CoinSpot Review: Features, Fees & Safety

Last Updated on February 1, 2024 by Kevin GrovesIf you’re looking for a great Australian crypto exchange, then you’ve definitely come across CoinSpot. It’s one of the top platforms in the region and is preferred by many traders. We’ve compiled all the relevant information including safety, ease of use, and supported currencies, to give you a clear picture of what it’s all about. Should you start buying and selling cryptocurrency on CoinSpot?

CoinSpot

Trading fees:

1%

Number of cryptos:

370+

Deposit methods:

Bank transfer, POLI, PayID, BPAY, cash deposit, credit/debit card

Supported countries:

Australia

Promotion:

$10 Free Bitcoin

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick Overview

Here is a quick summary of CoinSpot’s exchange information.

| Exchange Name | CoinSpot |

| Supported countries | Australia |

| Available fiat currency | AUD |

| Deposit methods | Bank transfer, POLi, PayID, BPAY, cash deposit, credit/debit cards |

| Number of cryptocurrencies | 370+ |

| Deposit Fee | BPAY: 0.9%, cash deposits: 2.5%, credit card: 2.58% |

| Trading fee | 1% for instant buy & sell, 0.1% for OTC/market orders |

| Withdrawal Fee | None |

| Mobile App | Yes (Android and iOS) |

The Bottom Line

After using CoinSpot, we can understand why so many Aussie crypto investors use the platform. For the most part, the CoinSpot interface is very easy to use when it comes to account creation, funding, and adding cryptocurrencies to your portfolio. We were impressed by its features that cater to the Australian crypto market including the ability to earn interest, crypto bundles, tax reporting tools, and the staggering list of supported assets. There is even a Coinspot referral code to get $10 worth of BTC for free.

However, some of the deposit and trading fees are relatively high when compared to other crypto platforms that also provide a user-friendly experience. This is an area for improvement for CoinSpot.

What we liked:

- Stable and reliable trading platform with outstanding security

- Good range of support crypto

- Attractive interest rates on crypto

What we didn’t like:

- Fees to instantly buy crypto

- Poorly integrated interface and features

What Is CoinSpot?

CoinSpot is one of Australia’s first bitcoin exchange companies that has managed to maintain a stellar reputation for almost a decade. It has a simple user interface that’s designed for everyday investors. Buying and selling digital currencies only takes a few minutes, and they’ve implemented strict security measures to ensure the highest security standards. This includes the internationally recognised ISO 27001 accreditation for digital information systems.

CoinSpot offers a secure environment for Australians to invest in over 370 digital assets such as Bitcoin, stablecoins and numerous altcoins to buy. There is an instant buy feature that allows you to buy and sell cryptocurrency without using the exchange. As a whole, the user experience is simple and streamlined with almost all deposit methods supported to fund accounts.

Pros & Cons

Pros:

Cons:

Here’s What We Think of CoinSpot

It has a streamlined interface

Crypto trading can be fairly complicated, but CoinSpot has made digital currency portfolio management quite easy. They have invested in a simplistic website design that’s very easy to navigate to buy and sell crypto. Moreover, their mobile crypto app is world-class and is available for both Android and iOS. This is why the platform is favoured by both novice and expert investors. The signup process is also instantaneous.

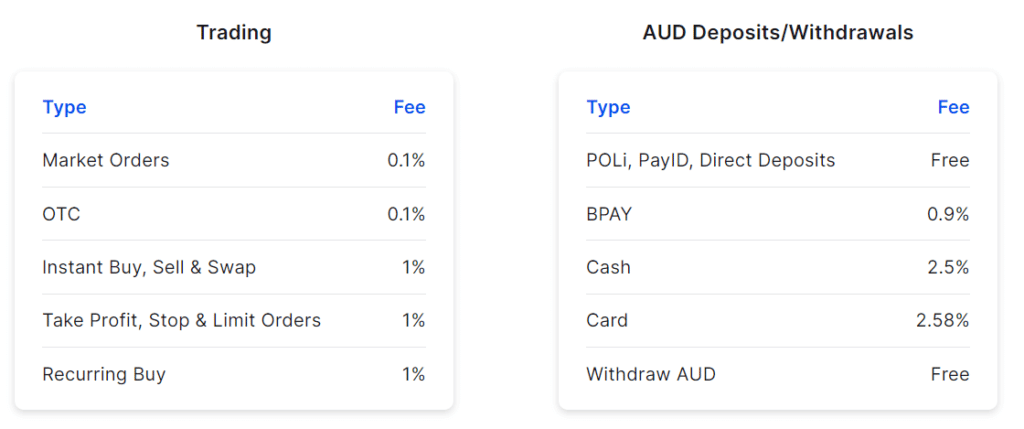

An expansive list of cryptocurrencies

Currently, CoinSpot supports more than 360 cryptocurrencies, making it ideal for everyday traders that prefer having a diversified portfolio. The vast list of supported crypto assets allows you to buy Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC) and some of the less known ones like Tael (WABI), Monaco (MCO), and FunFair (FUN). Meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB) can also be bought with cash.

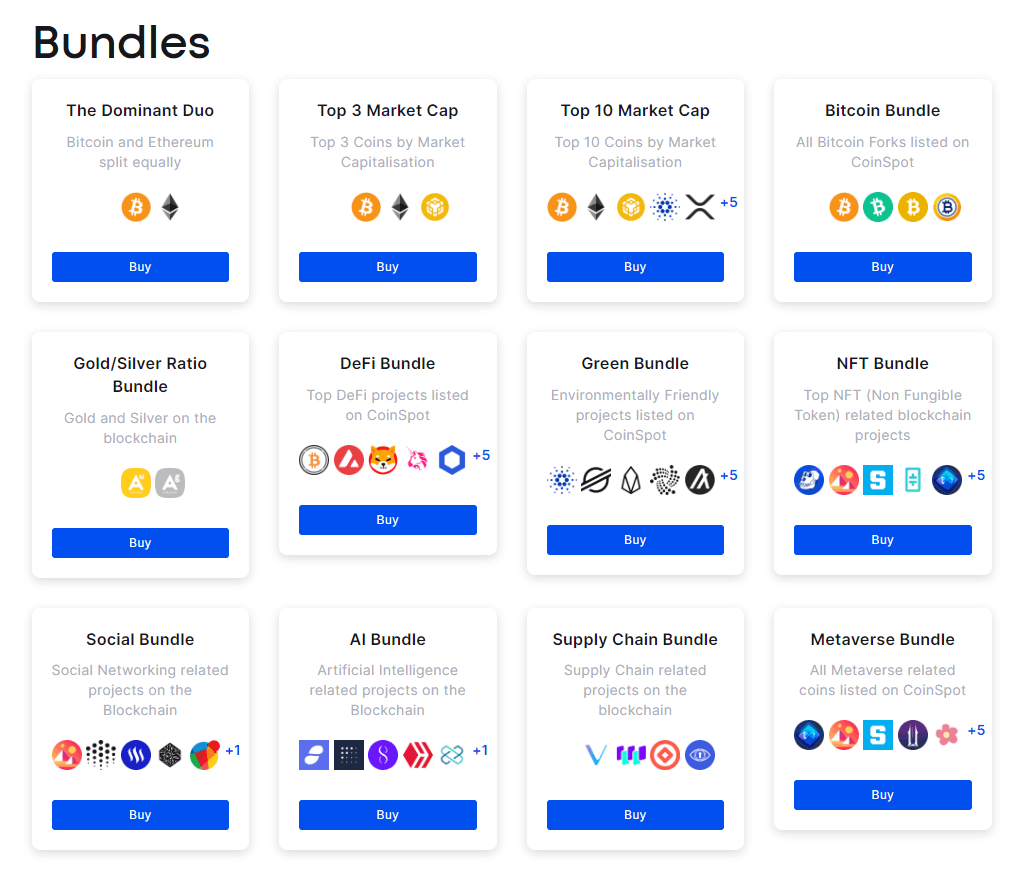

Buy crypto in bundles (cheaper as well)

If you want to quickly diversify your crypto whilst incurring fewer trading fees, then you can use your money to purchase the crypto bundles offered by CoinSpot. At the time of writing, you can choose from 12 bundles where each has been prepared by CoinSpot based on different factors including the market capitalisation of each asset, their type, and blockchain utility. Once purchased, the digital assets will be near-instantly transferred into your account wallet.

Although crypto bundles are a fairly common feature in the Australian market, CoinSpot’s offering is not as flexible as other platforms we’ve reviewed such as Coinjar where you can make up your own bundle. Moreover, there is no ability to implement Dollar-Cost-Averaging for the purchase of bundles which means that you will need to manually conduct transactions. Another downside is that a 1% fee applies for every bundle purchase.

CoinSpot Mastercard to spend your crypto

The recently released CoinSpot Mastercard is a prepaid debit card that allows you to spend your digital assets at in-store or online retailers that accept Mastercard. The entire list of CoinSpot’s supported assets can be spent on goods and services but you can only select up to five digital currencies in your wallet at any one time. This will be particularly useful if you have a few crypto in mind that can be used for spending. The card works by automatically converting your nominated crypto into AUD using the best rates at the time the transaction takes place.

Although CoinSpot has not yet developed a rewards or cashback program, the functionality of the CoinSpot Mastercard has been improved with the addition of Apply Pay and Google Pay compatibility. This means you can complete contactless payments in a safe and secure manner which adds a lot of convenience.

To be eligible, your CoinSpot account needs to be fully verified including the enabling of 2-Factor Authentication (2FA). There are no fees to get started as well as no monthly or annual maintenance fees.

The CoinSpot Mastercard is our leading crypto debit card in Australia. It provides a great deal of flexibility with payment options, doesn’t cost anything, and is a product provided by a highly reputable Australian company.

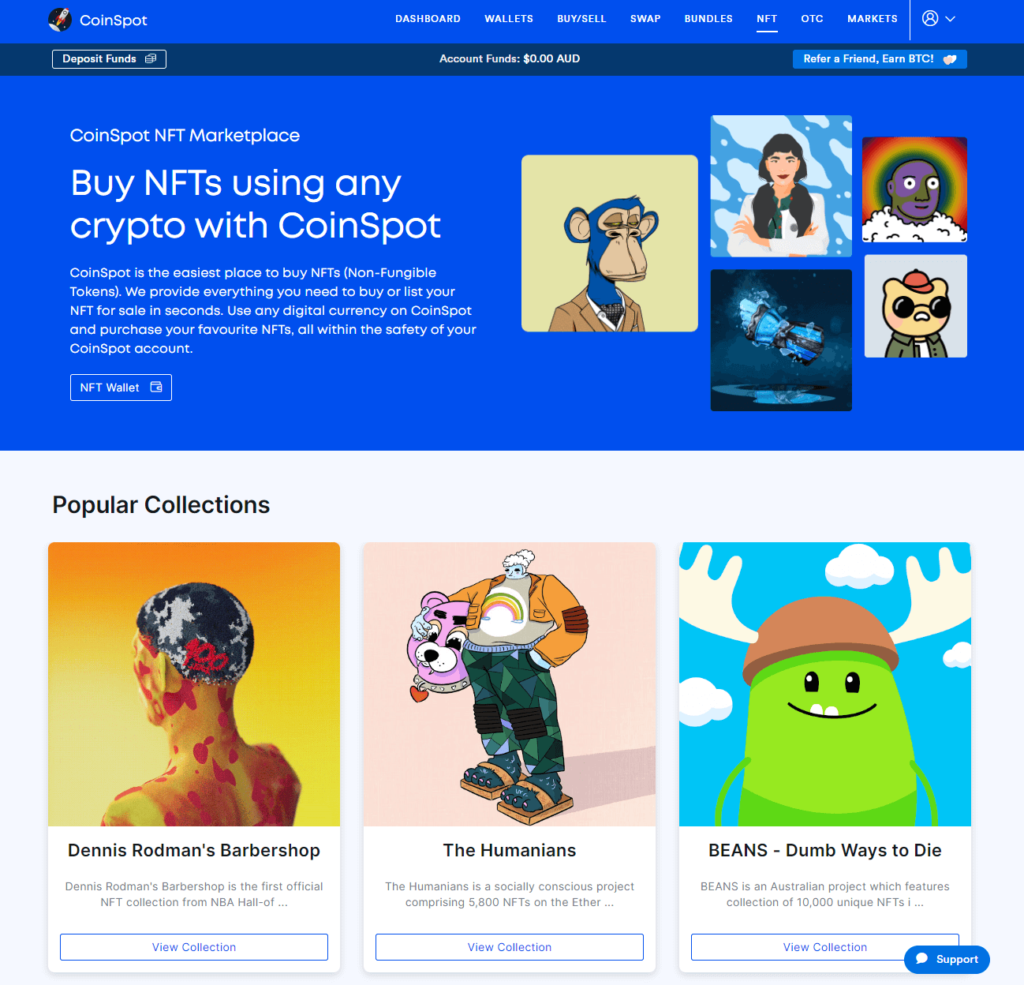

An emerging NFT marketplace

CoinSpot now offers a Non-Fungible Token NFT marketplace where collectibles and digital artworks can be bought using any cryptocurrency that is supported on the platform. Although the collection is growing, it is not as exhaustive as some of the global crypto exchanges that offer NFTs to Australians such as Binance Australia and KuCoin.

SMSF investors are allowed

Like many other Australian crypto platforms, CoinSpot offers support for investors who want to build up a cryptocurrency Self-Managed Super Fund (SMSF) with Bitcoin, Ethereum, or other assets. To deliver this service, which is highly regulated by government authorities, CoinSpot has partnered with New Brighton Capital which is a super fund specialist in Australia.

The onboarding process with CoinSpot is streamlined whereby you will need to produce a copy of the Trust Deed, details of the Trust (name, address, and ABN), and information about the beneficiaries. Once the documents and information are approved, you can start investing in Bitcoin as part of your long-term super fund.

In our opinion, CoinSpot is a top crypto SMSF platform given its strong security record, level of reliability and trustworthiness, portfolio tracking tools and its Over-The-Counter (OTC) where high-volume trades can be placed. However, one of the biggest advantages for SMSF investors are the low fees of 0.1% for buying digital assets through the Exchange or OTC service. These fees are exceptional in the Australian market and will go a long way to providing value for money for your retirement investment.

Tools for crypto tax reporting

If you’re an existing CoinSpot customer or thinking of joining CoinSpot, then the tax tools will make life easier during the End of Financial Year (EOFY) reporting. Currently, CoinSpot has partnered with Koinly, CoinLedger, CryptoTaxCalculator, and Accounting.com, to simplify tax reporting for cryptocurrencies in Australia.

There are two ways for you to export your CoinSpot crypto transactions to one of the four reporting tools. You can do this via an Application Programming Interface (API) or by downloading your .csv file and uploading it into the tools.

Referral program to refer your friends

After you sign up with CoinSpot, you will have access to a CoinSpot referral link that you can share with family and friends. If they create their accounts and buy crypto, then you will receive up to 30% of their trading fees as an ongoing reward for 3 years. Commissions start at 30%, however, decrease to 15% after 24 months, and to 5% after 36 months.

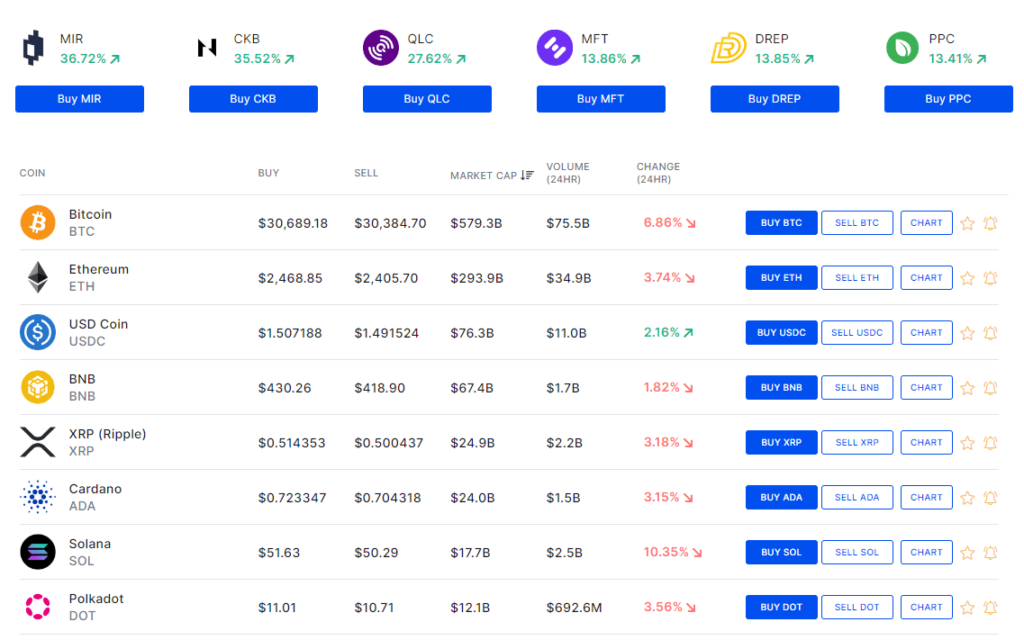

What Are The Fees on CoinSpot?

Deposit & withdrawal fees

You can fund your CoinSpot for free using POLi, PayID, or direct deposits. Depositing AUD into your account using BPAY and cash deposits at participating news agencies will incur minor fees of 0.9% and 2.5%, respectively. The fee for using BPAY as a deposit is a bit annoying since other popular platforms like Swyftx don’t charge any fees. Having said that, you can easily avoid these by depositing AUD via POLi or PayID, which are two of the most commonly used deposit methods amongst Australians.

The use of a credit card will incur a fee of 2.58% of the transaction volume. This, and the $200 maximum limit, is not ideal since you can buy cryptocurrencies with a credit card on Swyftx for no charge.

As for withdrawal fees, CoinSpot does not charge a fee for withdrawing cryptocurrencies. For example, there is no transaction cost to transfer crypto from CoinSpot to Metamask or another external wallet. There is a standard blockchain network fee, but this is determined by the network.

Trading fees

On the whole, CoinSpot’s fees to buy, swap, and sell digital currencies with AUD are generally higher than most Aussie platforms. If you prefer to use the Instant Buy/Sell/Swap feature, then be prepared for the hefty 1% fee. There are cheaper alternatives such as Swyftx and Digital Surge where the trading fees are 0.6% and 0.5%, respectively, where the buying process is still similar.

Where CoinSpot fails to provide value for money via the Instant Buy/Sell/Swap feature, it makes for in the Exchange. Here, market orders will incur fees that are 10 times cheaper at 0.1%. This is provided you actually know how to execute market orders in the first place, an aspect that may not account for all beginners who are starting out.

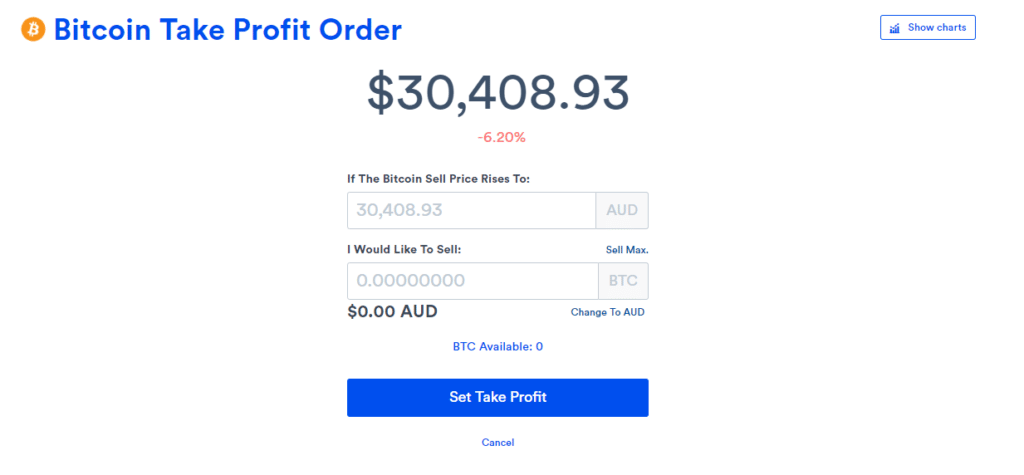

Disappointingly, the 1% fees resurface if you decide to apply take profit, stop/limit orders, as well as DCA to purchase crypto on the Exchange. In terms of cost, CoinSpot is perfectly fine for Aussies who don’t mind paying a bit more for the convenience that the Instant Buy/Sell/Swap feature offers. However, if you want value for money, then you should consider a more economical crypto platform such as Binance where the fees range between 0.1% and 0.5%. Find out more in this comparison on Coinspot vs Binance.

Do We Think CoinSpot Is Safe?

When it comes to crypto trading, security is one of the features that you should never compromise on, and CoinSpot knows this all too well. To safeguard your digital currency portfolio, CoinSpot has bank-like security measures such as 2 Factor Authentication (2FA) to keep your information secure, cold wallet storage and SSL encryption.

To date, CoinSpot has not been hacked or experienced security breaches for nearly a decade. This is especially impressive because some of the top exchange sites have experienced major hacks that have resulted in the loss of data and customer assets.

CoinSpot also has strict identity verification rules that factor in all payment methods so as to prevent fraud. Most of the customer data is stored in a secure offline location as a security measure, while the information that’s stored online is encrypted.

All factors considered, CoinSpot is a safe and trustworthy place to buy cryptocurrencies. The platform has built a strong reputation for its reliability and is also one of the few Australian crypto exchanges that have attained the internationally recognised ISO 27001 accreditation.

Here’s How To Get Started With CoinSpot

Creating & verifying your account

Account creation was pretty straightforward and only took us a few minutes to complete. The signup process begins at the registration page, which you can easily find at the top of the home page.

The identity verification process to satisfy mandatory Know-Your-Customer (KYC) protocols were similar to other trading platforms where a full name, date of birth, Australian phone number, street address, and a form of photo verification was required. You can either provide a picture of your utility bill (to verify your address), driver’s card, or Australian passport. Verification takes at most 48 hours, but ours went through in less than 60 minutes.

The next step was setting up the 2-Factor Authentication (2FA) that verifies your identity using an email address or phone number before logging in. While this is not a mandatory step, it goes a long way to protect your account from unauthorised access.

How to fund your CoinSpot account

CoinSpot supports several common methods to deposit AUD funds into your account wallet. These include direct bank transfers (OSKO), POLi, PayID, BPAY, credit/debit cards, cash deposits at participating news agencies that support Blueshyft. POLi, PayID, and OSKO are the recommended methods given that funds are transferred almost instantly and they do not incur any deposit fees.

| Method | Speed | Fees | Limits |

|---|---|---|---|

| POLi | Instant | None | $2,000 daily maximum |

| PayID | Instant | None | $1 minimum |

| BPAY | 0 – 2 business days | 0.90% | $2,000 daily maximum |

| Bank transfer (OSKO) | Instant | None | $2,000 daily maximum |

| Credit/debit card | 2.58% | $200 daily maximum | |

| Cash deposit (Blueshyft) | Instant | 2.50% | $2,000 daily maximum |

What Is Trading Like On CoinSpot?

We found the CoinSpot interface straightforward to use. This is due to its relatively uncluttered dashboard and features that can be navigated to the top of the page. Key portfolio management tools including funding your account using one of the supported methods, entering your bank details for AUD withdrawals, and obtaining a summary of your trading history are all easily obtainable. CoinSpot allows you to monitor your portfolio’s overall performance using visual charts with percentages of the coin holdings.

In terms of buying cryptocurrencies with AUD, you can either use purchase them using the Instant Buy/Sell/Swap feature, or place market orders on the Exchange. Whilst the Instant feature is akin to the Instant Buy features offered by other platforms, we found the Exchange interface to be a bit cumbersome.

The powerful TradingView charting package is available to use by clicking on “Advanced Charts”, however, we noted that the order books have been removed. This means that you are not able to assess the trading volume or spread for any given asset and is a downside for experienced traders who would want to know this information.

Buying assets such as Ethereum is relatively straightforward, however, you need to keep navigating on buttons to access the limit orders (and place them). The limit order page is similar to the Instant Buy feature where a simple panel is presented in its isolation. This means that any technical analysis or drawing you have done on the TradingView charts is not able to be viewed concurrently when you buy crypto.

The lack of order books and the seemingly poor structure of the CoinSpot interface will be suitable for beginners who don’t want to be confused or overwhelmed with information. However, this will be frustrating for experienced traders.

In our exploration of the CoinSpot platform, we also discovered that your wallet consists of individual wallets for the coins and tokens you possess. Although the dashboard presents a holistic and useful overview of your portfolio, there is no overarching wallet for assets that can earn interest payments. Instead, every time you purchase a digital asset, a new wallet will be created for that asset.

This means that there are no overarching wallets or central locations to store assets, or even earn interest. In fact, we had challenges seeing which digital currencies could earn interest payments, and rather than clicking them individually, we found the list of supported assets in the Help Centre.

Generally, the majority of CoinSpot’s interface is simple to use and navigate and results in an average user experience. But there are some areas where information is hard to find or the level of functionality is considered to be low. As such, CoinSpot should improve the structure of the interface, or find better ways to integrate the features.

Customer Support Is Responsive

CoinSpot’s customer support is fairly impressive, and you can reach them through support tickets or via the live chatbot on the website. The feature is only active between 9 am-6 pm on weekdays and 10 am-8 pm on the weekends, Melbourne time. CoinSpot could, however, use an upgrade as they don’t provide phone support, which is one of the most effective and fastest information channels.

Comparisons You Might Be Interested In

If after this guide you’re still reviewing other options, here are our top CoinSpot alternatives and comparisons:

- CoinJar Review (offers a debit card)

- CoinStash Review (cheaper trading fees)

- Cointree Review (great for beginners and SMSF)

- CoinSpot vs Digital Surge

- CoinSpot vs Coinbase

- CoinSpot vs CoinJar

- CoinSpot vs eToro Australia

Our Final Verdict

CoinSpot is an ever-reliable trading exchange that has been providing crypto products and services to Australians since 2013. Its rise in popularity is partly due to its long-standing establishment in the industry but also due to its ongoing commitment to regulation and security. The user-friendly nature and appeal of the platform have also been a large factor in the accrual of its user base of over 1 million Australian investors and traders.

The key strengths of CoinSpot are founded on its low barriers to entry, specifically, the rapid start-up process, account funding, and crypto buying processes. The vast range of supported assets is one of the largest in Australia and makes CoinSpot an attractive option for altcoin investors.

Despite its strengths, CoinSpot falls behind in its fees and charges. The Instant Buy/Sell/Swap feature, which is squarely promoted on the website, will incur high fees of 1% for buy and sell orders. Cheaper fees of 0.1% can be obtained on the Exchange but this requires placing market orders, something that not be suitable for newcomers to the crypto world. Simply put, there are cheaper alternatives in the Australian crypto market such as Swyftx.

Frequently Asked Questions

CoinSpot is only available to Australian citizens, which means that you can’t withdraw into a non-Australian bank account. To cash out, you have to notify the platform of the account that you’d like them to transfer your money.

Navigate to the ‘Account’ button on your dashboard, click on ‘Bank Details’, and finally, fill out the account number of your preferred account. Withdrawals can only be made in AUD.

Withdrawals take at most 48 hours, and if you put in your request before midday, the funds will reflect in your account the next day. The withdrawal requests are processed immediately, but there are factors that determine the waiting time, including network congestion.

CoinSpot has a send option that allows you to send digital currency to anyone on the globe. To do this, navigate to the top menu and click on Wallets. Select the wallet that you wish to transfer funds from and click the send button. This will prompt you to input the number of coins you’d like to send and the address.

Ensure you verify that you’ve input the right details as any slight error could result in loss of funds. If you’ve involved 2-factor authentication, you’ll be required to put in the code sent to your phone, after which you can approve the transaction by email. This process may seem lengthy, but it’s been put in place to discourage unauthorized parties from accessing your account.

This platform doesn’t have mobile and desktop wallets, but it does have an online wallet where you can store all your digital currencies. You’ll be able to access it every time you log in and can easily send and receive coins from other exchanges. It’s a great way of keeping your assets safe, especially for beginners, and is easy to use.

Offline wallets are the safest options, so it’s recommended that you refrain from storing large amounts on online wallets.

Yes, the 1% fee to use CoinSpot’s Instant Buy/Sell/Swap feature to purchase crypto are high considering that other popular Australian crypto platforms like Binance and Swyftx have fees between 0.1% and 0.6%. The 1% fee also applies to take profit, stop and limit orders, as well as recurring orders.

Frustratingly, there are also minor fees to deposit cash into your account if you use BPAY (0.9%), credit/debit cards (2.58%), and cash deposits (2.5%).

Related reading:

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.