CEX.IO Review: Is It Worth It For Australians?

Last Updated on February 1, 2024 by Kevin GrovesCEX.IO is a global cryptocurrency exchange that allows buying, selling, borrowing, and earning crypto. The exchange offers diverse tradable assets. However, CEX.IO doesn’t support AUD deposits and withdrawals. Read our full CEX.IO review to see if it’s the exchange for you.

CEX.IO

Trading fees:

0.15% (maker) and 0.25% (taker)

Number of cryptos:

140+

Deposit methods:

Crypto, Debit/Credit Card, SWIFT, Google/Apple Pay

Supported countries:

Global (including Australia)

Promotion:

None available at this time

The Bottom Line

On CEX.io, Aussies have access to 140+ cryptocurrencies and tradable assets and 200+ trading pairs available in the spot and margin markets, which is relatively low compared to what’s available on other crypto exchanges for Australians. The exchange also has relatively high fees, so it may not be the best for crypto traders who want a low-cost exchange in Australia.

The CEX.io trading platform has a user-friendly interface and numerous advanced features, like crypto staking, borrowing, and margin trading. Crypto businesses are not left out; CEX.io PRIME allows institutional investors to access liquidity.

CEX.IO Pros:

- Crypto staking is available.

- Supports popular cryptocurrencies.

- Offers services to institutional investors.

- Mobile app available.

CEX.IO Cons:

- Its fees.

- Lower asset support compared to other global exchanges.

- Can be overwhelming for some users.

- No support for AUD trading pairs.

CEX.io Pros Explained

- Crypto staking is available: CEX.io users can access the platform’s crypto staking feature and lock up their funds for up to 30% interest annually.

- Supports popular cryptocurrencies: Though its asset support is limited compared to other exchanges, CEX.io supports popular crypto assets like Bitcoin and Ethereum.

- Offers services to institutional investors: Institutional investors can access enterprise-level investments on CEX.io via the CEX.io PRIME.

- Mobile App Available: Investors can instantly buy and sell crypto on the go via the user-friendly CEX.io mobile app.

CEX.io Cons Explained

- Fees: CEX.io fees are relatively higher than other popular exchanges like Binance Australia (0.1%).

- Lower asset support: Compared to other global exchanges, the supported digital assets on CEX.io are limited.

- Can be overwhelming for some users: The CEX.io platform might be overwhelming for some due to its trading features.

- No AUD support: The exchange doesn’t support direct AUD deposits and withdrawals.

Who Should and Shouldn’t Use CEX.io?

Everyone interested in Bitcoin and other popular cryptocurrencies can use CEX.io. The exchange supports retail and institutional investors across all levels who want access to popular crypto assets like Bitcoin, Ethereum, and Bitcoin Cash. However, Australian investors looking for an affordable exchange with vast assets and AUD support may opt for alternatives like Binance Australia and Crypto.com.

At A Glance

Here is a quick summary of CEX.io.

| Exchange Name | CEX.io |

| Supported Countries | 170+ countries including Australia |

| Fiat Currencies Supported | USD, GBP, EUR |

| Supported Cryptocurrencies | 140+ |

| Markets | Spot, margin with leverage (up to x100) |

| Deposit Methods | Crypto, Debit/Credit Card, SWIFT, Google/Apple Pay |

| Deposit Fees | None for crypto and SWIFT, credit/debit card – 2.99% – 3.99%, Google/Apple Pay – 2.99% – 3.99% |

| Trading Fees | 0.15% (maker) and 0.25% (taker) |

| Withdrawal Fees | SWIFT – 0.3% + $25, cards – up to 1.8% + commission |

| Crypto Growth Features | Yes, savings accounts and crypto staking |

| Mobile App | Yes (Android and iOS) |

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

What Is CEX.io and What Do They Do?

CEX.io is a regulated global exchange with its headquarters in the United Kingdom. The company was founded in 2013 as a Bitcoin mining service provider and hashing power network known as Ghash.io. In 2015, CEX.io stopped cloud mining and began offering crypto exchange services to its global customer base. CEX.io has become a reputable exchange with millions of users across 170+ countries including Australia.

In terms of liquidity, CEX.io isn’t among the biggest exchanges. On CoinMarketCap, the exchange typically ranks in the top 100 per total trading volume. CEX.io’s 24-hour trading volume as of February was over $4 million (equivalent to about 80 BTC), significantly lower than Binance’s $22 billion+ during the same period.

Here’s What We Think of Their Features…

CEX.io is popular because of its diverse crypto products and services for individuals and businesses. We highlight key products and services that make the exchange stand out from competitors.

CEX.io earn if you want to earn a little extra

The Earn feature on CEX.io is one of the platform’s biggest features. With this service, Australian customers can earn passive income by putting their crypto to use via staking and lending. The staking feature allows users to lock up their assets in a liquidity pool and earn up to 30% Annual Percentage Yield (APY). Alternatively, investors can lend their crypto via a CEX.io savings account for up to 5% interest.

During our CEX.io review, we discovered that the Earn feature is available to everyone, unlike Binance, which offers crypto staking on a first-come, first-serve basis. At the same time, the maximum 30% APY offered for crypto staking is competitive. For instance, Binance offers a maximum APY of 36.79%, and Coinbase offers a 6% APY. Overall, CEX.io makes for an attractive exchange to stake crypto.

A multi-token wallet for all your coins

Another notable feature of the CEX.io exchange is its crypto wallet. This hot wallet (or software wallet) is available to all customers, including Aussies, and it allows users to buy, sell, store, and manage their assets.

Moreover, the wallet is a multi-currency hot wallet that supports many assets. And although it is a custodial wallet, CEX.io claims that 98% of the assets are kept in cold storage. The CEX.io wallet provides an instant exchange feature to investors using the best exchange rates. Additionally, investors can earn crypto with the CEX.io wallet, making it another passive income product from the exchange. However, the wallet is in the Open Beta phase and won’t be available until testing is completed.

There’s a Visa debit card to spend your crypto

This feature is for investors looking to spend crypto holdings in their CEX.io wallet. CEX.io offers a crypto debit card that allows investors to spend their assets and earn up to 5% crypto asset cashback. The card is powered by payment giant Visa and is accepted at millions of online and offline stores worldwide.

One of the exciting things about the CEX.io crypto card is its high cashback rate on crypto spending. The 5% cashback offered is the exact figure offered by Crypto.com for its premium Obsidian Card, which requires users to stake $400,000 for six months (180 days) to earn the maximum cashback reward. However, like the CEX.io wallet, users have to join a waiting list to get the CEX.io Visa debit card.

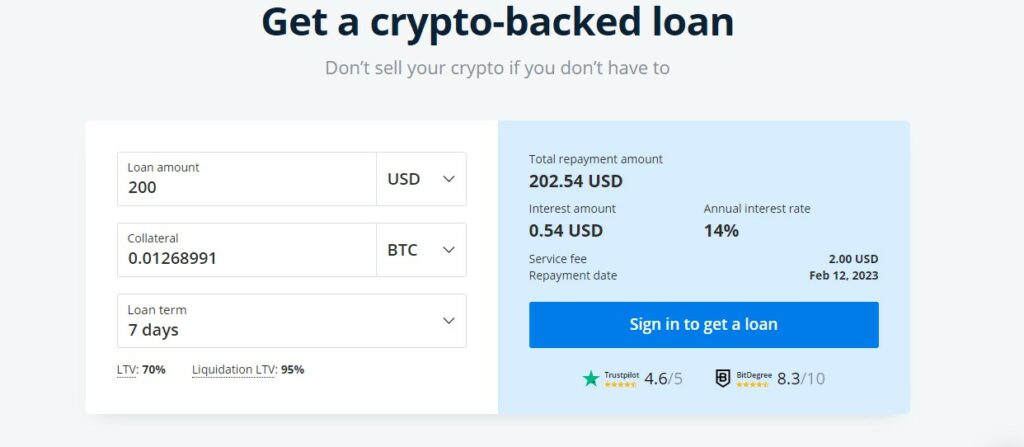

Need Cash? They have crypto-backed loans

Investors who want to short or long BTC and other crypto coins with margin in the CEX.io margin market can easily obtain crypto-backed loans from the exchange to execute their orders. The loan is offered within minutes and requires no credit scores or checks. The annual interest rate for crypto loans on CEX.io is 14%, which is lower than KuCoin’s loan interest rate of at least 30%. The 16% difference may be the reason Australian investors opt for platforms like KuCoin over CEX.io.

Copy trade the most profitable traders (on the platform)

CEX.io offers some copy-trading features, including futures copy-trading and the ability for users to create their bots and strategies. Similar to eToro Australia’s CopyTrader feature, although not as developed, you can copy the trades of successful traders or create and automate your trading strategies to increase profitability.

Alternatively, investors can leverage the CEX.io copy trading Application Programming Interface (API). This feature allows users to import and execute personal trading strategies to save time and effort and eliminate human errors by automating their trades.

Our Breakdown of CEX.IO Fees

In terms of fees, CEX.io is one of the pricey options on the Australian crypto market. As shown in the table below, CEX’s maker and taker fees are relatively competitive, however, the withdrawal fees are hefty.

| Fee Type | CEX.io | Binance Australia | Coinbase |

|---|---|---|---|

| Deposits | None | None | None |

| Trading | 0.15% (maker) and 0.25% (taker) | 0.10% (maker) and 0.10% (taker) | 0.40% (maker) and 0.60% (taker) |

| Withdrawals | SWIFT: 0.3% + $25 VISA: 3% + $1.20 Mastercard: 1.8% + $1.20 | None | None |

| Credit Card | 2.99% – 3.99% + commission | NA | 3.99% |

Deposit fees

Australians can transfer cryptocurrency to CEX.io without charges being incurred. Deposits of USD, GBP, and EUR made via SWIFT are also free. Purchasing digital currencies using a credit/debit card are subject to fees between 2.99% and 3.99%, whilst Google Pay and Apple Pay incur a fee of 2.99% – 3.99%.

Since CEX.io doesn’t support deposits of AUD, you will incur foreign currency conversion fees. This makes the exchange a slightly more expensive platform to use which is an added disadvantage on top of its lack of deposit options.

Trading fees

CEX.io uses a maker-taker fee model where trading fees start at 0.15% and 0.25% for maker and taker orders, respectively. Maker and taker fees can be reduced depending on your 30-day trading volume, which the exchange calculates daily at midnight.

Withdrawal fees

Withdrawal fees on CEX.io vary by the chosen payment method. SWIFT withdrawals attract an absorbent 0.3% + $25 fee which is likely to discourage potential users. In the same way as deposits, investors can only withdraw their funds in USD, BGP, or EUR. AUD withdrawals into bank accounts are not supported on the platform.

Withdrawals back to your VISA or Mastercard will attract high fees:

- VISA withdrawals attract up to 3% + $1.20 (plus a commission of up to $3.80).

- MasterCard withdrawals attract a fee of up to 1.8% + $1.20 (plus a commission of up to 1.2% + $3.80).

Like with deposits, conversion fees may apply to Australian investors since the platform doesn’t support direct AUD withdrawals. However, the Google and Apple Pay withdrawal fees aren’t stated on the website.

What Are The Supported Cryptocurrencies and Trading Pairs

CEX.io supports 140+ cryptocurrencies and 200+ crypto and fiat trading pairs. Though the number of cryptocurrencies supported on CEX.io is lower than Coinbase’s 8,800+ assets and Binance’s 350+ coins, investors will find popular cryptocurrencies and trading pairs on CEX.io, making the exchange perfect for traders across all levels.

However, a potential dealbreaker for Australian traders is the platform’s lack of support for AUD trading pairs. The lack of AUD support will likely discourage most Australian traders. Examples of reliable crypto exchanges that do provide AUD trading pairs include Binance Australia, Swyftx, and Kraken.

Some of the supported assets and trading pairs on CEX.io include the following:

- BTC

- USDT

- ETH

- BNB

- ADA

- DOGE

- DAI

- ATOM

- SHIB

- SOL

- BTC/USD

- ETH/USD

- UNI/USDT

- BTC/USDT

Getting Started On CEX.io

Verifying your account

After verifying the email address and logging in to the new CEX.io account, the exchange instantly requests you to undergo its mandatory identity verification or KYC process. After clicking “Verify Now,” you can fill in your personal information, phone number, and address details as requested.

You will have the choice of uploading photos of your Australian passport or driver’s licence, as well as a selfie photo of you holding up your nominated ID document. The ID verification for us was extremely fast as we only needed to wait 4 minutes before receiving confirmation.

How to fund your account

CEX.io offers several deposit methods including crypto transfers, SWIFT, Google Pay, and Apple Pay. Direct purchases of digital currencies using your credit/debit card are also possible. Alongside the lack of AUD support, common deposit methods in Australia such as POLi, BPAY, and PayID are not available.

The only supported fiat currencies for payments are USD, EUR, and GBP. As a result, Australian customers incur additional conversion fees. Additionally, bank wire transfers are unavailable on CEX.io, making it an inconvenient exchange choice for Aussie users.

How We Found Using CEX.IO

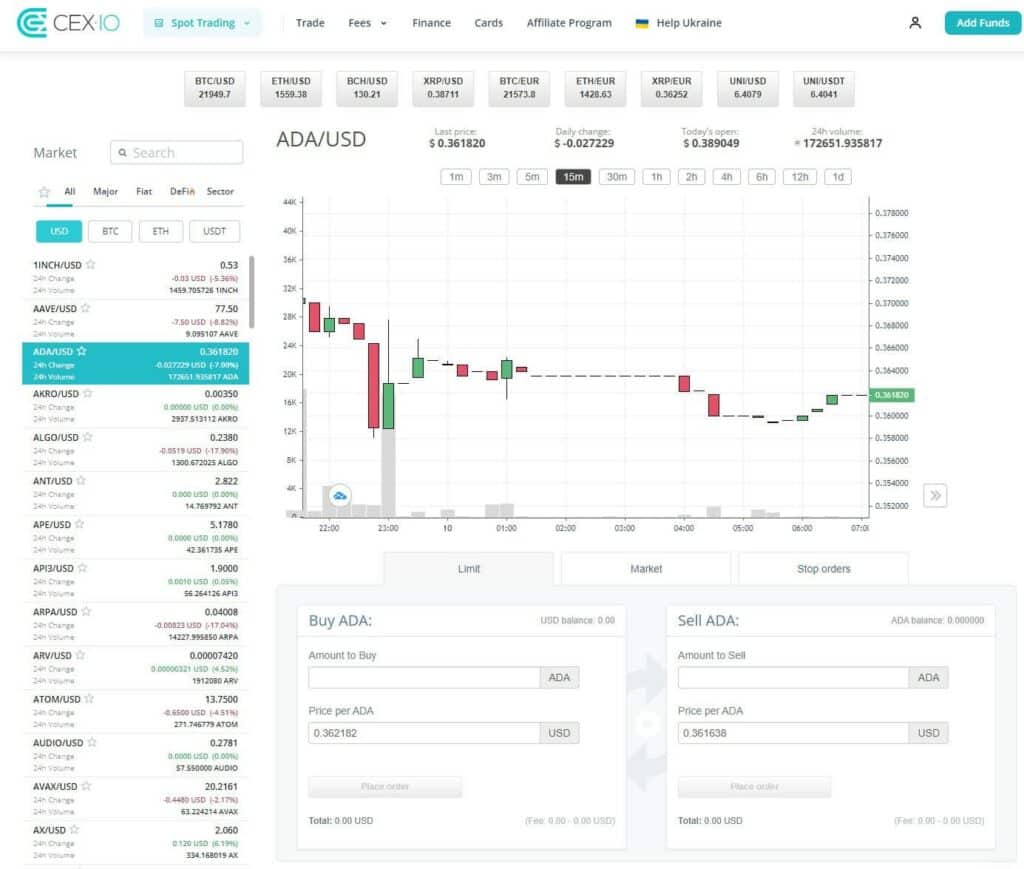

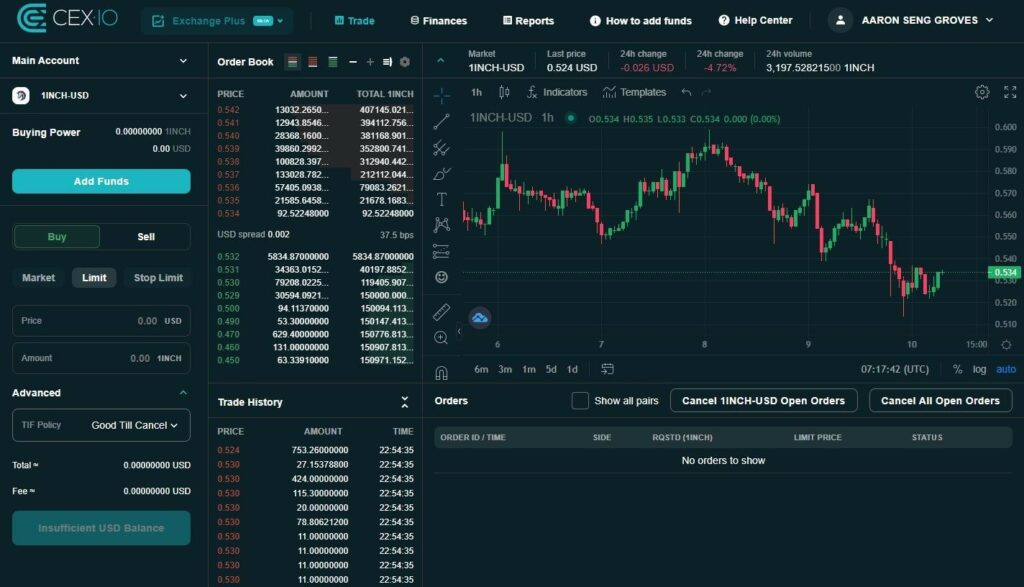

The trading experience on CEX.io can be challenging for new users because of the platform’s numerous interfaces. A separate trading interface is provided for its spot and margin trading markets. Additionally, CEX.io is currently trialling Exchange Plus which resembles a top-tier interface.

As seen in the image below, the spot market trading interface is rather basic and lacks the features of an advanced interface. The candlestick charting is on the basic side as the exquisite TradingView charts and the suite of advanced indicators and drawing tools that it comes with are not integrated. On The design and layout of the interface may suit a beginner but it felt too stripped back for our liking. On top of that, switching between trading pairs was slow and this feeds into the overall poor user experience.

The user experience on the Exchange Plus interface is much more slick and modern. It resembles an advanced trading interface that you would find on a major crypto exchange such as Bybit Australia or Kraken which are suited to experienced users.

Mobile App Does What It Needs To

CEX.io offers apps for Android and iOS mobile devices which we found to be user-friendly, relatively smooth, and highly responsive. The mobile app also has high interaction rates on the Apple Play and Google Play Store, getting respectable ratings of a 4.6/5.0 and 4.3/5.0 rating, respectively. Customers particularly love its accessibility, less congestion, and smooth verification experience.

The mobile app offers most of the features as the web platform, such as 140+ crypto assets and the Instant Buy option. Unfortunately, many other features like Earn, Loan and the learning academy on the website are not supported on mobile. Based on our experience using the app, mobile-first users will have no issues executing trades and managing their portfolios.

When the CEX.io card launches, the mobile app will come in handy for online and NFC purchases, which will be a major difference between the app and the website. However, the CEX.io app is designed for trading and price alerts.

Customer Support Just Passed Our Test

Like other exchanges, CEX.io offers various learning resources to its platform users who may find the exchange complicated or encounter challenges when using any of its products or services. These resources are available on the CEX.io University and blog. Also, customers can access customer support professionals available 24/7 to respond to their queries.

During our CEX.io review, we contacted the support team via the Live Chat feature. The bot was responsive and witty, but no agent joined the chat when a request to speak with an agent was sent despite waiting for 10 minutes. Instead, the exchange said it would review the issue and reach out via email “as soon as we can.” A bit of human interaction and an estimated timeframe would have been better here.

What Others Are Saying

Online reviews on Trustpilot suggest that CEX.io customers are thoroughly satisfied with the company’s services and support team. The exchange has an impressive rating of 4.7 out of 5.0, with 90% of the reviews being positive. Customers commend the platform’s excellent service and ease of use. The company is also known for responding to negative reviews within a few days, which is commendable.

However, we could not verify the claims about the platform’s excellent service, as a support agent didn’t connect to the live chat or reach out via email immediately after a ticket was opened.

Security Measures We Encountered

The security at CEX.io is quite basic, or at least information about their security measures is not detailed on their website. CEX.io secures a vast majority of customer funds in cold storage to protect them from cyber attacks or hacks — a standard security feature that is shared amongst all top crypto exchanges. However, unlike others, CEX.io isn’t transparent about how much of customers’ assets it stores in cold storage.

In addition, the exchange provides Two-Factor Authentication (2FA) for users’ protection. But from our experience, you need to enable the 2FA feature yourself. However, instant email notifications alert users of a successful login. It’s important to note that there are no reports of CEX.IO being hacked, making it a trusted exchange for Australians.

Final CEX.IO Verdict

CEX.io is one of the myriads of crypto exchanges available to Australian traders and investors. The exchange offers various crypto products and services to individuals and businesses, including crypto loans, staking, and margin trading. CEX.io is also reputable for its top-quality customer service that makes the overall user experience worthwhile.

While CEX.io is a solid exchange, it may not be the best for Australians because it has no direct AUD support for deposits and withdrawals. Moreover, there are no AUD/crypto trading pairs. Beginners may also find the platform complicated, while experienced investors may opt for CEX.io alternatives with more asset support, like Coinbase and Binance.

Frequently Asked Questions

CEX.io has lower trading fees than Coinbase. The former charges a maker-taker fee of 0.15%-0.25%, while the latter charges 0.40%-0.60%. However, Coinbase supports more digital assets than CEX.io and offers better-developed features for beginners.

Yes, CEX.io is available for Australians to use. The mid-tier exchange offers several features and trading markets that may interest Australian traders and investors. These include support for 140+ digital currencies such as Bitcoin and Ethereum, savings accounts, crypto staking, a multi-token wallet, and leverage margin trading (up to x100). One of the major downsides for Aussies is the lack of AUD support, both on deposits, withdrawals, and AUD trading pairs on the exchange.

The exchange holds regulatory licenses in the major countries it operates, including FinCEN in the US and FINTRAC in Canada. It also has a Gibraltar Financial Services Commission (GFSC) license that allows it to operate as a Distributed Ledger Technology (DLT) provider in Europe. However, it’s important to note that CEX.io doesn’t hold a regulation in Australia, which means there’s no investor protection for Australian customers.

CEX.io Alternatives

CEX.io is a mid-tier cryptocurrency exchange that has its advantages and limitations. For Australians, the limitations may outweigh the benefits and there are better alternatives.

- Swyftx: Swyftx is the premier cryptocurrency platform in Australia to buy and trade crypto with AUD. The Brisbane-based company provides a suite of features including over 320 digital assets, an advanced charting package, all on a uniquely designed interface. Swyftx is the best option for AUD deposits and withdrawals.

- CoinSpot: CoinSpot is a household name in the Australian cryptocurrency industry. The ISO 27001 accredited and AUSTRAC registered platform provides superior support for AUD compared to CEX.io as you can easily deposit money in a variety of convenient ways. You can quickly buy 370+ crypto assets and even cash out your money to your bank account.