6 Best Crypto Staking Platforms In Australia

Last Updated on January 31, 2024 by Kevin GrovesDue to Australian government regulations, there aren’t many top-tier crypto platforms that support the Proof-of-Staking (PoS) consensus protocol. However, there are still some staking platforms available in Australia to stake your digital assets to obtain a passive income.

In this article, we identify which cryptocurrency exchanges are regulated to provide the staking of digital currencies for Australians and bring you our best-rated places to stake your crypto. Our assessment is based on the breadth of staking services provided, how easy their services are to use, any associated fees, and several other factors.

Best Staking Platforms In Australia

These are the six crypto staking platforms in Australia for interest yields.

- Binance Australia – The best overall exchange to stake crypto in Australia

- Bybit – Best yields under flexible terms

- Crypto.com – Excellent staking option for active traders

- Kraken – Great option for high returns

- OKX – Most crypto staking options

- eToro – Good staking platform

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Top Platforms To Stake Crypto In Australia: Reviews

Here are our reviews of the best Australian crypto exchanges to stake your wallets to passively earn interest on your crypto.

1. Binance – Overall best Australian staking platform

- Rating: ★★★★★

- Supported Crypto: 325 including ETH 2.0

- Staking Fees: None

- Stablecoin APY %: Up to 13.30%

- Non-stablecoin APY %: Up to 52.90% APY

- Terms: Flexible, 21, 30, 60, 90, 120 days

Binance is a premium global cryptocurrency exchange that provides a wide range of cutting-edge products, trading markets, and blockchain-based financial services including staking. In Australia, the brand is independently operated by Binance Australia Pty Ltd and offers a stripped-back suite of services. Binance Australia offers its staking services through two modules on Binance Earn – Locked Staking, and DeFi staking.

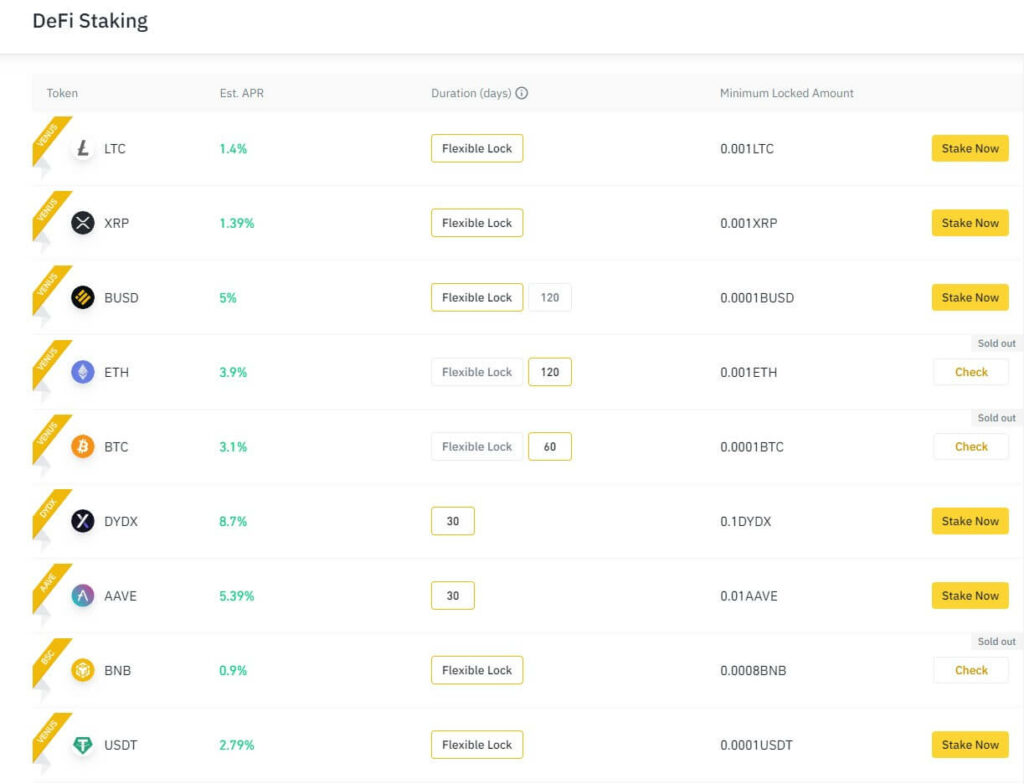

Binance Australia’s Decentralised Finance (DeFi) staking services are offered through smart contracts on the Binance Earn module. There are various DeFi projects that are available to provide you with higher annualised earnings depending on the cryptocurrency. The DeFi staking features on Binance Australia come with no gas fees as your funds are deposited into smart contracts by the company. Its staking services are also very easy to use and you don’t need an on-chain wallet to obtain online crypto rewards.

The Locked Staking feature allows you to easily deposit your crypto into any one of the 310 available projects to earn Annual Percentage Yields (APY) of up to 52.90%. The Returns on Investment (ROI) are higher with the locked staking since you cannot redeem your assets once they are transferred. Having said that, you still have a lot of choices when it comes to how long you want to leave your assets with terms ranging from 21 to 120 days. Flexible durations are available but come with lower interest rates.

At the time of writing, there were 15 DeFi staking projects available where you can earn up to 8.70% Annual Percentage Yield (APY) on currencies such as Litecoin (LTC), Bitcoin (BTC), Binance Coin (BNB), Ripple (XRP), Chainlink (LINK) and many more. Binance Australia also supports reasonable Returns on Investment (ROI) on stablecoins Dai (DAI) and Tether (USDT) where you can earn 1.19% and 2.79%, respectively. Unfortunately, it doesn’t support all tokens such as staking AXS. However, it still has a comprehensive list compared to alternatives in this list.

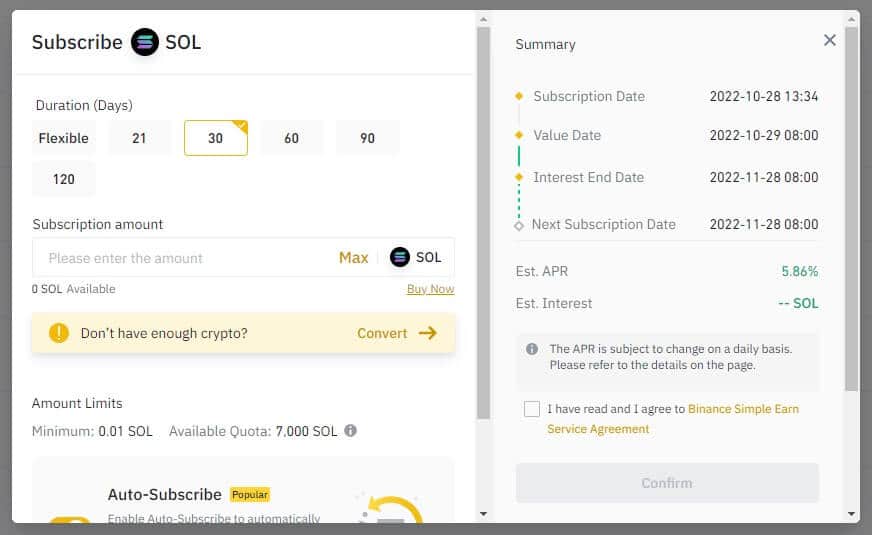

The process of staking your cryptocurrencies with Binance Australia has been made easy due to its well-designed interface. All you essentially need to do is choose the term, enter the amount of crypto to stake, review the arrangement and confirm. Once confirmed, Binance will automatically transfer the selected assets from your wallet and into the Binance Earn wallet.

Interest rewards that you passively generate over the term are paid out into your wallet daily. Overall, Binance Australia’s staking services are one of the most accessible and easiest to use in the Australian market. With the service being completely free to use, it is also one of the cheapest. However, the most significant pros of using Binance lie in its incredibly large number of DeFi staking projects as well as the very attractive interest payouts.

Pros:

Cons:

Read our full Binance Australia review

2. Bybit – Best yields under flexible terms

- Rating: ★★★★★

- Supported Crypto: 27

- Staking Fees: None

- Stablecoin APY %: Up to 5.50%

- Non-stablecoin APY %: Up to 30% APY

- Terms: Flexible, 30, 60 days

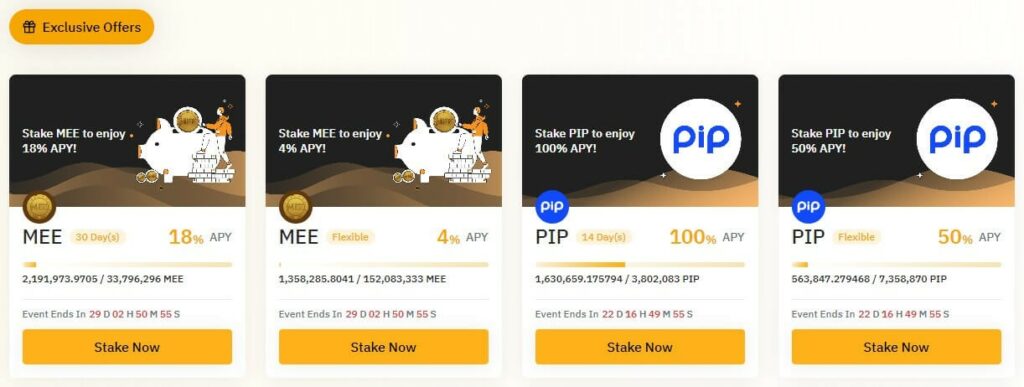

Bybit is a popular no-KYC crypto exchange in Australia where you don’t need to verify your identity in order to access its products and features. Aside from its world-class ecosystem of spot and derivatives trading, and blockchain-based features, Bybit allows you to deposit 27 digital assets to earn staking rewards.

The availability of staking options is dependent on the current capacity of the staking pool for each asset. Although several term arrangements can be selected, the most common include flexible, 30 days, and 60 days. For most crypto staking platforms, higher staking rewards come when you lock crypto up for longer time periods. But this is not the case with Bybit. For example, staking ETH on a flexible arrangement will get you a slightly higher interest rate of 2.5% compared to the 60-day rate of 1.8%.

The interest yields for flexible-term arrangements are calculated based on the type and number of coins staked, as well as market conditions. Fixed-term arrangements, where your crypto is locked in, have more certainty around yield returns where they are automatically distributed into your wallet when the period ends. Despite this, you can still get favourable interest rates on flexible terms for most coins and tokens. This makes Bybit a great crypto exchange for casual investors to earn passive income.

Interest yields are also non-compounding and the yields obtained won’t be reinvested to gain additional yield. This means that for fixed terms, you will need to deposit a new amount of crypto to start generating yields, that are paid out at the cessation of the term.

In terms of options and yield generation, Bybit is a mid-tier option for staking crypto. It supports all the major Proof-of-Stake (PoF) coins and tokens but it doesn’t have the options that the best Australian platforms to stake crypto offer. Take, for example, OKX. OKX supports vastly more crypto to stake as well as more terms to choose from.

Pros:

Cons:

Read our full Bybit review

3. Crypto.com – Excellent staking platform for active traders

- Rating: ★★★★★

- Supported Crypto: 32

- Staking Fees: None

- Stablecoin APY %: Up to 4%

- Non-stablecoin APY %: Up to 4%

- Terms: Not applicable

Crypto.com is a global cryptocurrency exchange that is well-known for its exquisite mobile app where almost all of its features can be accessed. The Hong Kong-based exchange has several offices around the world including in Australia. Crypto.com offers its products and services through a desktop version as well as the Crypto.com App.

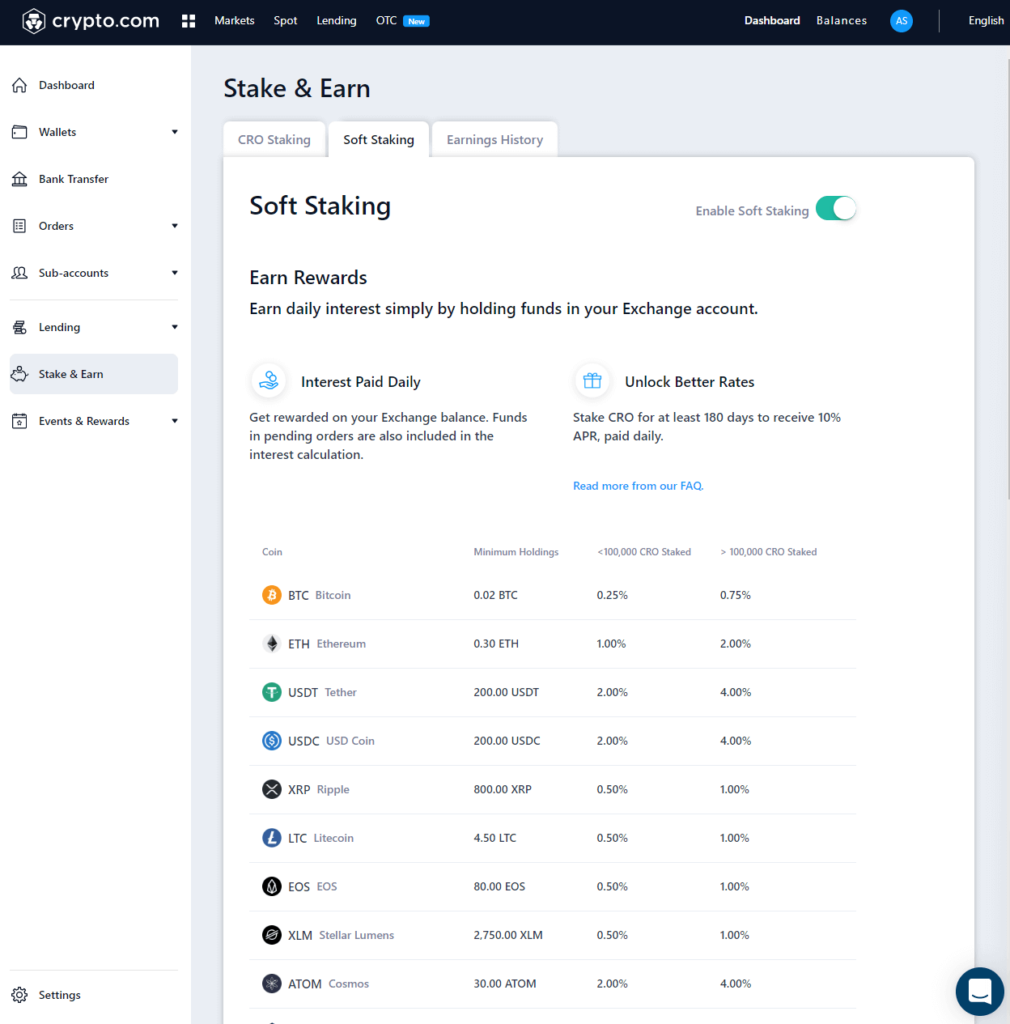

Crypto.com’s Soft Staking feature is accessible on the Exchange, not the Crypto.com App. Once you log in, you will find the “Soft Staking” feature under Stake & Earn. As the feature is turned off for new users, you will need to turn it on by clicking on the “Enable Soft Staking” button.

Crypto.com offers a modest selection of 32 digital currencies that can be staked through the Exchange. Supported cryptocurrencies include Bitcoin, Ethereum, Tether, Ripple, Cardano, Tezos, Polkadot, and many more coins and tokens that are commonly traded.

We mention commonly traded because the Soft Staking feature works in conjunction with the Crypto.com Exchange. Rather than transfer crypto from your trade wallet to a staking wallet on alternative platforms, you earn passive rewards by simply holding any of the supported assets in your trade wallet. There is no need to transfer anything, anywhere. The other benefit to this is that you freely trade your crypto as you please as it won’t be locked away for a set amount of time.

The interest pay-outs you receive daily are based on the sum of crypto held in your wallet and any crypto that you have in trade orders pending on the Exchange. Overall, Crypto.com’s Soft Staking feature can be seen as a very nice perk for people who actively trade on the Exchange.

As with many of Crypto.com’s features, the greatest benefits are realised when you hold its native token, CRO. In the case of staking, you can get better interest rates (up to 8% APR) by staking CRO for at least 180 days. However, the amount of CRO staked also matters as better rates can also be achieved by staking more than 100,000 CRO tokens. Anything less than that and the ROI is reduced. For example, if you stake less CRO then the interest return for Tether is 2%. Stake more than 100,000 CRO and the ROI is increased to 4%, and a similar approach applies to all supported assets.

Overall, Crypto.com’s Soft Staking feature on its Exchange is a handy little addition for existing traders but is unlikely to attract new users. This is due to the relatively low-interest rates (even after staking CRO) compared to other staking platforms. If you’re trading on the Crypto.com Exchange then this is simply a must-have.

Pros:

Cons:

Read our full Crypto.com review.

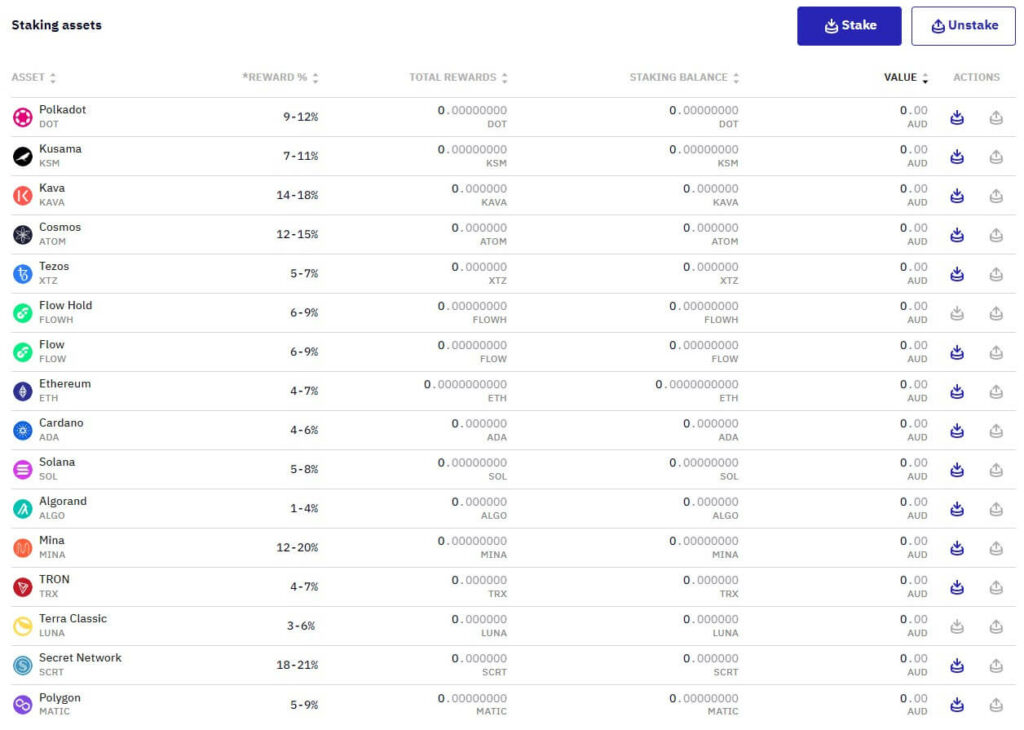

4. Kraken Australia – Great option for high returns

- Rating: ★★★★

- Supported Crypto: 16

- Staking Fees: None

- Stablecoin APY %: None

- Non-stablecoin APY %: Up to 21%

- Terms: Flexible

Kraken is a global provider of innovative crypto products and services across 190 countries including Australia. The USA-based exchange allows investors and traders to easily purchase all the major coins and tokens using its professional and modern trading features and markets.

Kraken supports the on-chain staking of 16 popular cryptocurrencies on the PoS protocol including ETH, DOT, KSM, ATOM, ADA, SOL, ALGO, and MATIC. With interest rewards as high as 21% APY, Kraken is a fantastic option for getting solid returns on your crypto. Unlike other staking platforms where interest is typically paid out daily, Kraken will automatically send your interest rewards to your wallet twice a week.

Although the number of on-chain cryptocurrencies is particularly small compared to the likes of Binance Australia and even Crypto.com, the interest rates offered are highly competitive. Since you can un-stake and redeem your digital assets at any time and without incurring any fees, Kraken is a viable alternative to Binance Australia.

Kraken is an ideal choice for staking Ethereum (ETH) due to its attractive ROI as rates range between 4% and 7%, the latter of which is a standout in the Australian market.

Pros:

Cons:

Read our full Kraken review.

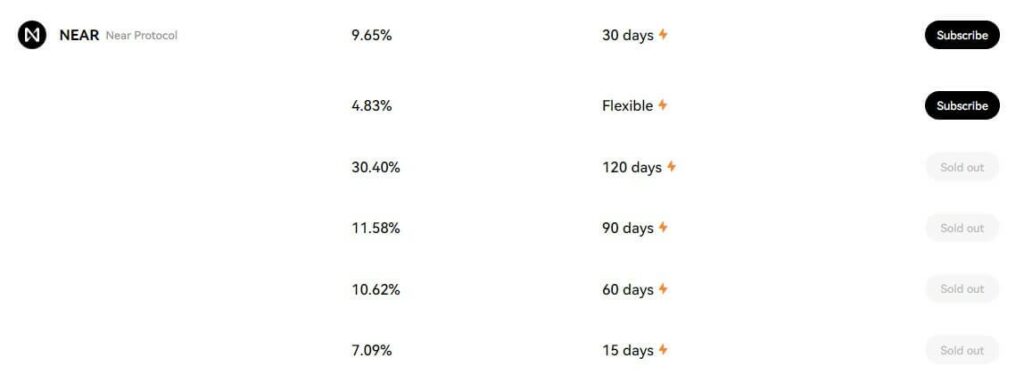

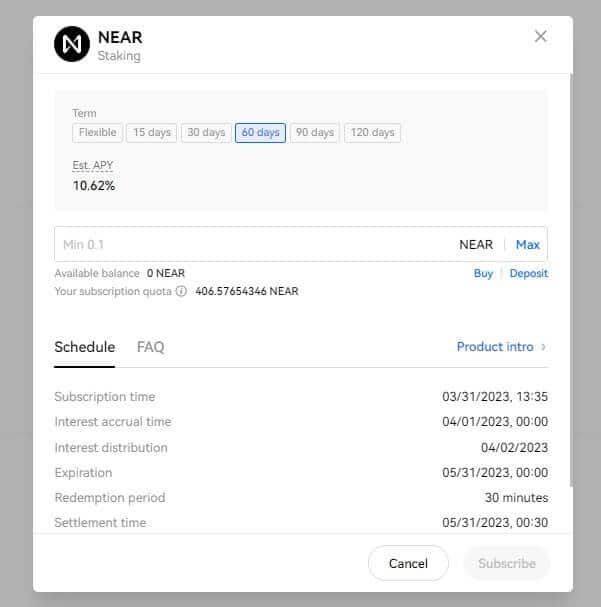

5. OKX – Most crypto staking options

- Rating: ★★★★

- Supported Crypto: 80

- Staking Fees: None

- Stablecoin APY %: None

- Non-stablecoin APY %: Up to 72%

- Terms: Flexible, 15, 30, 60, 90 days

OKX is one of the few crypto exchanges that provide an abundance of crypto staking options, both in terms of the number of coins supported but also the terms. As a leading crypto staking platform, you can stake any of its 80 supported crypto assets to earn passive rewards up to 72% Annual Percentage Yield (APY).

Almost every supported crypto asset can be staked under a variety of terms which gives you a superior choice. Terms range from flexible, where you can take back your crypto at any time for other purposes, to a maximum of 120 days. The respective maximum terms for each digital asset will attract the highest interest yields. In comparison, the lowest yields arise by subscribing crypto into a flexible arrangement since you have the convenience of withdrawing them.

As long as you have the crypto assets in your OKX wallet, then staking them can be completed in a matter of minutes. If you don’t, then the staking panel allows you to purchase them beforehand using a credit card. If you must, the 1.99% credit card fee to purchase Bitcoin and other currencies may be a deterrent but this is actually quite competitive in the Australian crypto industry. An alternative would be to buy crypto with AUD on a local platform such as Swyftx or CoinSpot and transfer them to your OKX wallet.

Overall, OKX has far more crypto staking options than most other platforms, both in terms of the number of supported assets but also the term options. Supported assets include popular coins such as ETH 2.0, AVAX, NEAR, ONE, FLOW, and DOT. More exotic and low-market capitalisation coins are also available including ICX, LUNA, and FLR.

Pros:

Cons:

Read our full OKX review.

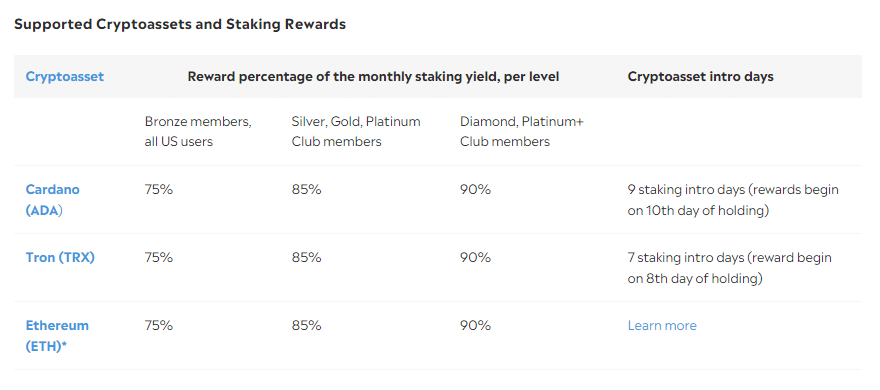

6. eToro Australia

- Rating: ★★★

- Supported Crypto: 3 (ADA, TRN and ETH 2.0)

- Staking Fees: None

- Stablecoin APY %: None

- Non-stablecoin APY %: Capped at 75%, 85% and 90% yields

- Terms: Minimum of 9 days

eToro is a global multi-asset trading platform that is most known for its social trading features and community. The trusted platform sports a customer base of over 25 million investors and traders in around 100 countries including Australia. eToro Australia is a locally operated that is registered with AUSTRAC and licenced with ASIC. Its social trading features are the flagship offerings but there is a limited staking module available as well.

Cardano (ADA), Tron (TRN), and Ethereum 2.0 can be staked with the rewards generated depending on your membership level. The maximum interest yields are not specified on the eToro website, however, we know that your pay-outs will be capped at 75% for Bronze users, 85% for Silver/Gold/Platinum members, and 90% for Diamond/Platinum+ members. With minimal staking options and capped rewards, eToro should be avoided as a viable staking platform.

To be eligible for crypto rewards, you need to stake one of the three supported crypto assets for a period of no less than 9 days. Although interest is calculated daily, you will receive the generated interest in your wallet on a monthly basis. So in order to get some benefit, you need to keep your assets locked in which isn’t very flexible.

Pros:

Cons:

Read our full eToro Australia review

What Is Crypto Staking?

Staking cryptocurrencies is the process of designating digital currencies such as Solana (SOL) or Cardano (ADA) to a staking pool to assist in improving blockchain-related activities and functions. These may include the validation of transactions made on a Proof-of-Stake network, or participating in the governance of the network in some way.

For example, each time a new block is added to the blockchain, the newly minted coin or token is distributed to the validators as reward. In that sense, staking digital currencies is a great way of passively generating cryptocurrencies over a period of time.

What Is A Staking Pool?

A staking pool is a blockchain-enabled feature that allows several crypto holders to pool their coins and tokens. The operator of the staking pool then obtains validator status and distributes small amounts of crypto to validators as a reward. By staking crypto in pools, the combined efforts of the computational process increase the chance of being rewarded.

Can I Stake Crypto In Australia?

You can stake cryptocurrencies in Australia as long as the exchange supports the Proof-of-Stake consensus protocol for the coin or token in question. Due to regulatory restrictions, local AUSTRAC-registered exchanges are not permitted to provide staking services. However, unregulated exchanges such as Binance Australia offer this service. Ethereum 2.0 (ETH), Cardano (ADA), Solana (SOL), and Litecoin (LTC) are popular digital currencies that can be staked to generate passive crypto rewards.

The Benefits of Staking Crypto

Some of the benefits of crypto staking include the following.

- The potential to earn more tokens. Though this is not assured, it is possible to earn extra tokens on your holdings. The interest rates are often quite generous since you can earn between 10-20% per year. All you need to begin earning is a crypto that utilizes proof of stake and a good exchange platform like swyftx. The longer you choose to stake coins, the greater the potential rewards due to compound interest.

- You support the blockchain. Staking crypto also enables you to support the blockchain you invest in. Since cryptocurrencies depend on investors to verify transactions, engaging in this ensures that things run efficiently.

- It consumes fewer resources. Unlike crypto mining, crypto staking is environmentally friendly since it consumes fewer resources. Crypto staking limits the supply of tokens and services to the ecosystem. You also don’t require any equipment for you to engage in crypto staking.

The Risks of Staking Crypto

Though crypto staking can help you earn some passive income, it is not risk-free. The following are some of the risks you should beware of before engaging in crypto staking.

- Volatility. Crypto staking is volatile due to price swings that are quite common. Sometimes, the coin you stake may fall. If the assets that you stake experience a significant price drop, you may not earn any interest in return. Before you start crypto staking, you should therefore assess whether you are ready for such risks. Due to the volatile nature of crypto staking, it is not always the best option for everyone.

- Lock-up periods. We mentioned crypto staking involves locking up some funds for a certain duration. It could be months or years. During this duration, you may not be able to access your holdings to trade them. If you don’t have plans to trade soon, you can stake Crypto.

- Possible fees. Not every exchange that allows crypto staking is free. Some of them charge certain fees, which are often a percentage of your rewards. If you want to avoid such, consider signing up with swyftx since it does not charge crypto traders fees for staking.

How To Choose An Exchange To Stake Crypto

Before you pick any of the listed cryptocurrency staking platforms in Australia, it is important to understand these attributes:

- Supported assets: The range of supported digital assets that can be staked should be considered. If you want to maximise the level of passive earning opportunities then exchange with a vast array of PoS-supported assets will be ideal. Currently, Binance Australia supports the most comprehensive list of crypto staked in Australia (325).

- What are the staking returns: When you stake your cryptocurrencies in a staking pool, the rewards are not always guaranteed. However, the advertised Annual Percentage Yields (APY) will provide a good indication of the potential returns. Some exchanges provide higher ROI compared to others.

- Is the platform easy to use? Different crypto exchanges have different ways of offering and delivering staking features. The vast majority will allow you to transfer crypto from your trading wallet to a staking wallet with the click of a few buttons. Some advanced exchanges may be a bit more complicated or have other features that may confuse beginners.

- Staking fees? Most cryptocurrency exchanges that allow you to stake crypto will not charge any specific staking fees. However, there will be fees to conduct other related activities such as depositing AUD into your account and trading crypto.

Frequently Asked Questions

Since the staking of cryptocurrencies generally results in a net increase in value over a period of time (assuming its market value holds or increases), then a capital gains event may be triggered. In such a case, the crypto rewards may be subject to Capital Gains Tax (CGT) as required by the Australian Tax Office (ATO). For more information regarding the taxation of cryptocurrencies in Australia, you can read our guide.

Due to regulatory reasons, Swyftx removed its cryptocurrency staking services in May 2022 and no longer supported the Proof-of-Stake protocol. Instead, the popular exchange provides an Earn module where you can lend your crypto and receive interest payments in return. At the time of writing, Swyftx supports a modest range of 21 cryptos such as Cardano, Ethereum, and Cosmos with APYs up to 10.52%. For more information, read our full review on Swyftx.

No, CoinSpot customers can no longer stake their cryptocurrencies on the Proof-of-Stake protocol. Its staking services were removed mid-2022 and replaced with CoinSpot Earn, an interest-earning wallet that supports 21 digital assets including Polygon (MATIC), Binance Coin (BNB), and Ethereum (ETH). In return for lending your crypto to CoinSpot, you can obtain interest payments of up to 78% APY. Learn more about the exchange and its features in our Coinspot review.

Though anyone can engage in this, it is not always the best option for every. If you are an experienced investor used to volatility, it might be the right option for you.

Staking and interest-earning wallets are similar in that you passively generate crypto rewards over a period of time. However, the mechanisms in which they work are inherently different. The crypto that you get from staking DeFi tokens in a staking pool is distributed from a validator as a reward for contributing to the development of the network. However, interest-earning wallets can be thought of as high-interest accounts at a bank. You lend your digital assets to an exchange or trading platform by depositing them into an interest-earning wallet. In return for lending your crypto, the exchange will pay you interest on top of the principal. For more information about the best wallets to earn crypto interest in Australia, you can read our guide.

Conclusion

The number of Australian cryptocurrency exchanges that support staking on the PoS consensus protocol is limited. Due to regulatory reasons, local exchanges are not permitted to offer this service and may provide an interest-earning wallet instead.

However, global crypto exchanges that provide their services in Australia offer crypto staking. For the vast majority of investors, Binance Australia will be the best option due to its extensive list of supported digital assets, attractive interest yields, and flexible term arrangements.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.