Plus500 Australia Review: Suitable For Crypto?

Last Updated on December 24, 2023 by Kevin GrovesAre you on the lookout for ways to invest your hard-earned money into things that might help preserve your net worth during an inflationary period? Or perhaps you would rather try your luck on a crypto trading platform with the hopes of doubling or tripling your gains.

There are several online crypto platforms in Australia where you’ll be able to do any of the stuff we just mentioned. Still, we feel that a standalone Plus500 review is merited, for it’s touted as one of the most prominent among them.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

What is Plus500?

Plus500 is, at the time of writing, one of the most renowned global brands for CFDs (Contracts for Difference). The platform allows users to invest in shares, forex (FX), options, ETFs, indices, commodities, and a wide array of cryptocurrencies to buy such as Bitcoin, Litecoin, Ethereum, Neo, Monero, Tron, XRP, and Cardano (availability is subject to local regulations).

This fintech giant, founded in 2008 in Israel, is currently operative in 50+ countries and has an extensive list of strict rules devised to shield the clients’ interests.

As for the platform itself, it features a wide collection of charting tools for trading experts. You may be able to utilize these services via Plus500’s mobile app or its own “web trader” via a regular browser.

How Does Plus500 Work?

Plus500 acts basically as a CFD brokerage firm, an intermediary between an investor or trader and the market.

To understand further how Plus500 works, we need to delve into some basic concepts to get the reader acquainted with the types of services that the platform provides.

What Is A CFD?

A contract for difference (CFD) is a contract by virtue of which a buyer and a seller speculate on the price movement of an asset over a determined span of time, with the goal of profiting from the differences in value after opening a position.

In a CFD, it must be stressed that you don’t actually own said asset or market. You’re simply taking advantage of price behaviour without having the underlying asset delivered to your door.

In the traditional stock market, you, as a trader, would go over to your broker to get the financial instruments (such as shares of a company) directly from NASDAQ or a similar market. The shares would be yours and you may be able to find them in your portfolio, as well as their value (in real-time on many occasions).

To illustrate, if you bought 1 share of a company at $90, and the price for each share reached $93 in a week, you would be earning $3, but you can decide to keep the asset and the value of your portfolio would still reflect that gain (which would be deemed as an unrealized gain until you decide to sell).

In the event that you need liquidity, you can sell your share of the company for cash, in which case you’ll possibly have to pay fees to your broker or lose some money due to market spreads (more on this later).

Now, Let’s Illustrate How It Works With CFDs.

If you decide to invest in a Google share via CFD, you are asking the broker (in this case, Plus500) to buy this share in a parallel market with the expectation that the price fluctuates in your favour.

Within this trading model, the share will not be credited as yours. You’ll only have an open position.

As Google increases its market value, you can instruct the broker to sell the share by closing your position, and that positive difference between the purchase and selling prices will be reflected in your account, This is traditionally called a “long position”,

To illustrate with another asset class, you can have the broker borrow oil and sell it at market price so that it can be bought back later at a lower rate for profit. This is called “short-selling” and it effectively involves betting against the market based on certain events, such as the discovery of alternative fuel or energy sources, the rise in popularity of electric cars, and geopolitical factors signalling a price drop.

In each case, you’d be essentially speculating on the price of the underlying asset, whether it be shares of a given company, commodities (gold, silver, crops, etc.), cryptocurrencies, among other asset classes.

Is CFD Trading Risky?

We would lie if we said that CFDs are easy instruments to manage and trade. These are complex products that should not be treated lightly. You could lose copious amounts of money if things go awry.

It may not look that way when considering how prices fluctuate in the traditional stock market (especially when compared with the high volatility you’ll find in modern cryptocurrency markets). But, in most instances, traders will use “leverage”, which basically means that they would borrow money to increase the size of the position for much more substantial gains. It’s very possible to have your funds liquidated if a leveraged CFD trade doesn’t go your way.

How Do We Start Using Plus500?

Back to our Plus500 review, let’s go over the procedure you need to follow in order to start using the platform.

Registration

To open an account, you ought to follow these steps:

- Visit the Plus500 website and click on either “Start Trading Now” or “Try Free Demo”, depending on if you’d like to start with real money straight away or just with a demo account.

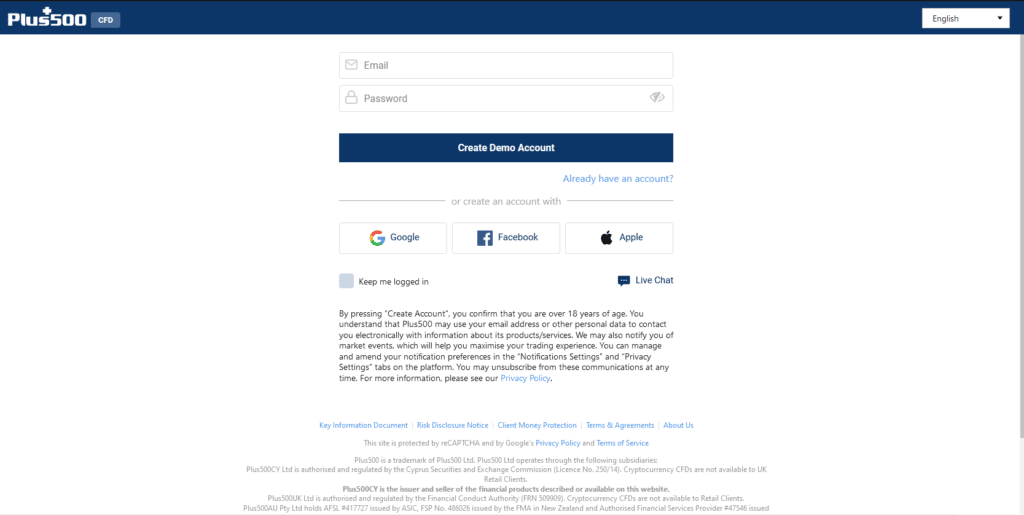

- You will then be directed to the registration form. Enter your “Email” and “Password” in the respective fields.

- Once that’s done, click on “Create Account”.

Creating the account is the easiest part. It can get a bit trickier when you get into the verification phase. You would have to go through a KYC (Know-Your-Client) process wherein you’ll be asked to provide data related to your country of residence, address, trading knowledge, and employment status.

The verification process could take longer than usual. In some countries, a verification letter is sent to the postal address that appears on your trading account. You would additionally be asked to send proof of address via a photo or scan of a utility bill or bank statement.

After verification is done, you can start depositing funds into your account. You may try the “demo account” feature to get the gist of how CFD trading works before using real money.

If you create a demo account, you don’t need to go through this verification process, because you won’t be using any real money. Of course, you’ll still need to do it later, once you start trading with real money!

Deposits

To start depositing your funds into your Plus500 account, you need to do the following:

- Log into your Plus500 trading account.

- Go over to the menu and click on “Deposit”.

- You’ll be asked to choose your preferred deposit method from a list. Some accepted methods include PayPal, Skrill, Credit/Debit Card, Bank Transfer, and BPAY. Each of these methods has specific processing times and limitations.

- Enter the amount you want to deposit.

- Click on “Make A Deposit”.

The deposited amount will appear in your account’s funds and you may start opening positions.

Is Plus500 Easy to Use?

Throughout the length of this Plus500 review, we’ve laid out all the basic info regarding what Plus500 is, how it works, and how we start using it. Now, we turn our attention to user experience, which is possibly one of the most important traits of any broker platform.

We must begin by saying that the web trader is incredibly smooth, intuitive, and well distributed. You won’t find an overly cluttered or unresponsive UI.

The charts are also fully endowed with all kinds of tools for more advanced traders, such as Fibonacci retracements (the lines indicating possible price support and resistance levels), horizontal, rectangles, drawing lines, arrows, and many more.

If you are a relatively experienced trader, you’ll be also capable of looking at various indicators such as Relative Strength Index (RSI), Bollinger Bands, Simple Moving Averages, and more.

However, you won’t be able to sync your web charts with the mobile app, a feature that is readily available on many other trading platforms

Also, some of the most professional traders may miss a number of other features, such as those included in MT4 or MT5 trading platforms. Notwithstanding, if you’re only getting started with trading, you can possibly do well without these for the time being.

Another weak point of the platform is the lack of thorough research material. Technical analysis is virtually non-existent, while the fundamental analysis is decent, though not exactly a trendsetter. By technical analysis, we mean the interpretation of the data seen on the chart to ascertain whether we are on a market uptrend or downtrend, possible reversal signals or divergences, etc.

Lastly, Plus500 provides a Trader’s Guide section with a bunch of articles and educational videos. Most of them only explain how to utilize the platform and don’t offer substantial content when compared to other trading brokers

With regards to security, Plus500 includes 2FA (dual-factor authentication) to protect users against unauthorized withdrawals or access to your account. For this purpose, you should:

- Install the Google Authenticator app (Android or IOS).

- Go to Security Settings under “Account”.

- Click “Edit”.

- Enter the PIN code generated by the 2FA to confirm the setup.

How To Start CFD Trading with Plus500?

Opening or closing a position on Plus500 is relatively straightforward. For example, if you want to trade with crypto, go over the respective crypto pair and click on either “Buy” or “Sell”. This will prompt a “New Order” box. You’re then able to see the price, amount of contracts (relative to the trade size) the position, and the required margin for opening.

There are also options for automatically closing the position. You would be allowed to choose whether to close at profit or at loss, and the limits for each. These would be set to avoid total liquidations due to extreme volatility. Some traders set up these limits for security purposes, but others will use them scarcely because they feel they can probably manage through these volatile moments in the market.

As far as leverage options go, the maximum leverage available for retail clients is 1:30 (meaning that the broker can trade for $30 for every $1 deposited by the trader), For cryptocurrency CFDs, the maximum leverage is 1:2, meaning that investors will only obtain 2x gains at most.

When it comes to cryptocurrencies, there are 9 cryptocurrencies available for trading against the USD pair.

What Fees Does Plus500 Charge?

Most of the services offered by the platform are free of charge (including deposits and withdrawals) because the platform takes advantage of the market spread, namely, the difference between what the asset costs and what you pay for it.

Nonetheless, Plus500 users will pay a monthly $10 fee after three months of inactivity. There are also “overnight funding fees” which are added or extracted from the account when a position is held after a determined amount of time (the percentage varies according to the tradeable asset.)

Finally, Plus500 charges a currency conversion fee of up to 0.7% of the trade’s profit or loss.

What Are The Pros and Cons Of Plus500?

At this point in our Plus500 review, we may be able to summarize the stronger and weaker points of this broker:

Pros:

- Plus500 is a highly regulated broker known for its safety and compliance-based approach.

- The web-based platform is very user-friendly and features a very solid charting toolkit. Same with the mobile app.

- The spreads are relatively reasonable and close to the industry average on most forex pairs (forex or FX relates to the national currencies market).

- The broker offers lots of discounts for active traders.

- There is an ample catalog, with roughly 2,000 tradeable symbols, including cryptocurrencies.

- Despite not having as many features as some of the most advanced cryptocurrency exchanges, you may be able to diversify your portfolio with cryptos and regular stocks, or seamlessly switch back and forth between them.

- It has a broader cryptocurrency offering than what you usually find in most brokers.

Cons:

- There is a lack of educational material for new users.

- It lacks some of the features present in more advanced trading platforms.

- It doesn’t have a lot of content in relation to market updates or analysis. It also lacks news headlines.

Plus500 Review Wrap Up

In this Plus500 review, we’ve shown how this fintech company has earned its fame as one of the most reliable and low-risk trading platforms on the internet.

While not devoid of drawbacks and disadvantages, Plus500 can hold its own and excel in many areas, including its ability to offer cryptocurrencies within its vast number of tradeable assets. If you’re looking for an alternative to Plus500, there’s also eToro and Easy Crypto which are both brokers. Read our full review on eToro Australia and Easy Crypto review for more information.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.