Gemini Australia Review: Features & Fees

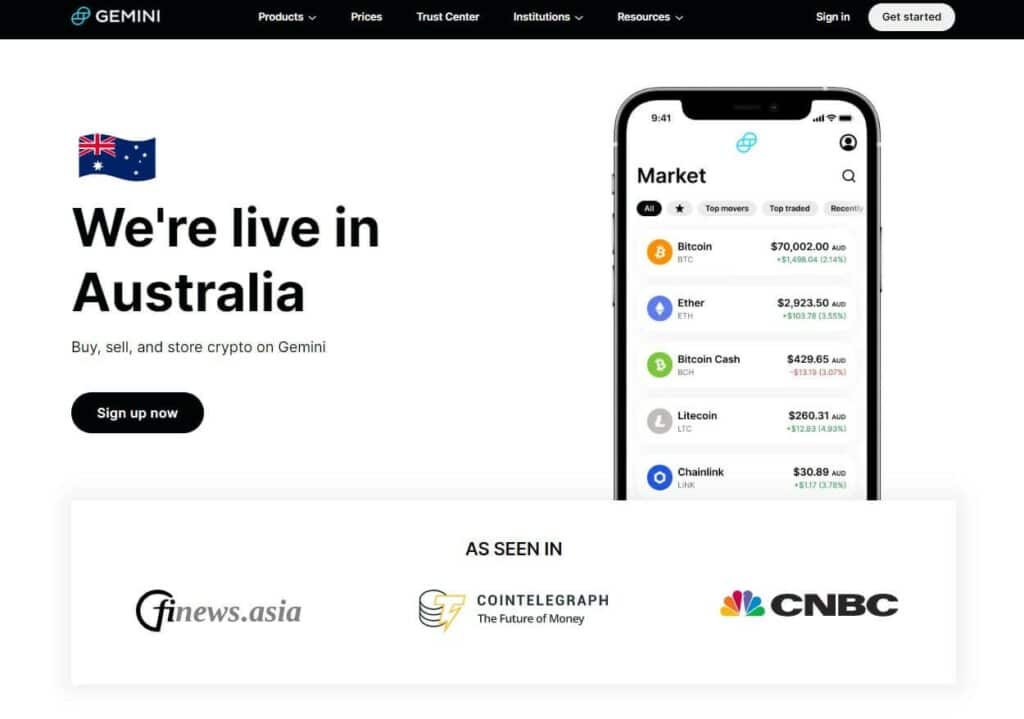

Last Updated on December 24, 2023 by Kevin GrovesGemini is a user-friendly crypto exchange suitable for crypto beginners and advanced investors. With support for AUD deposits and withdrawals, Gemini is a great option for investors in Australia. However, the exchange’s trading fees are higher than the industry average.

Read our full Gemini Australia review to see if it’s the crypto exchange for you.

Gemini

Trading fees:

0.2% maker & 0.4% taker

Number of cryptos:

100+

Deposit methods:

Credit card, bank transfer, crypto transfer

Supported countries:

Global (including Australia)

Promotion:

None available at this time

The Bottom Line

Gemini is a popular Australian cryptocurrency exchange that allows traders can purchase, sell, trade, and store Bitcoin, Ethereum, and a variety of ERC-20 tokens. Consistent with its global reputation, Gemini places a strong emphasis on security. It also adheres to Australian regulatory requirements.

Based on the features available in Australia, it is clear that Gemini is catering to beginners and novices who prefer a simple way of cryptocurrency trading and investing. Unlike other global exchanges, there is support for AUD deposits and withdrawals, all the major digital assets are available to trade, and the interface is clean and minimal. You also have the choice between two different trading interfaces; a basic version suitable for investors with little or no experience, and the more involved ActiveTrader interface which can be used by novices who know how to read real-time charting.

There are no advanced features or trading markets such as futures, margin, or options to entice advanced traders. However, when you consider the maker and taker fees that are on the low end of the market average, Gemini turns out to be a great option for new people to buy and hold crypto assets with peace of mind.

Gemini Pros:

- Available in Australia.

- Supports AUD deposits, withdrawals, and trading pairs.

- Beginner-friendly exchange.

- AUSTRAC-regulated.

Gemini Cons:

- High trading fees.

- Only 100+ coins available.

- Slow customer support.

Gemini Pros Explained

- Available in Australia: Gemini is a global exchange with operations in Australia, making it a good choice for Aussies.

- Supports AUD deposits and trading pairs: Gemini supports seven fiat currencies, including AUD for deposits and withdrawals. Users can also pair AUD with other assets for trades.

- Beginner-friendly exchange: Getting started on the Gemini platform is straightforward, making it ideal for crypto beginners.

- AUSTRAC-regulated: Gemini holds a regulatory licence from the Australian Transaction Report and Analysis Centre (AUSTRAC).

Gemini Cons Explained

- High trading fees: Gemini trading fees are typically higher than the industry average—depending on the transaction volume.

- Only 100+ coins available: Coin support on Gemini is limited to just a little over 100 cryptocurrencies, which is a potential downside for traders who want a diversified investment basket.

- Slow customer support: Gemini’s customer support is only available via email and it’s quite slow.

Who Should Use Gemini?

The Gemini exchange is a US-based trading platform that is available to traders in Australia. The reputable exchange provides a host of basic and minimalist features that are suitable for crypto beginners, however, they are delivered extremely well. With good support for AUD deposits, withdrawals to Australian bank accounts, all the major cryptocurrencies, and outstanding storage security, Gemini is a good option if you just want to buy and hold crypto.

Advanced traders, on the other hand, don’t have much to use. Trading is limited to the spot market and there is no advanced charting package integrated into the interface such as TradingView. There is also a lack of other features commonly seen on global exchanges such as Peer-to-Peer (P2P) marketplaces, margin, futures markets, and interest-earning wallets. The crypto staking features are very limited. Advanced traders are better off with a one-stop-shop exchange that provides a robust ecosystem of features such as Binance Australia, OKX, or Bybit.

Gemini At A Glance

Here is a quick summary of Gemini.

| Exchange Name | Gemini |

| Supported Countries | 60+ (including Australia) |

| Fiat Currencies Supported | USD, AUD, CAD, EUR, GBP, SGD, and HKD |

| Supported Cryptocurrencies | 100+ |

| Markets | Spot only |

| Deposit Methods | Credit card, bank transfer, crypto transfer |

| Deposit Fees | None for bank transfers, 3.49% for credit/debit cards |

| Trading Fees | Instant: $4.50 (<$250), 1.49% (>$250) Spot: 0.2% maker & 0.4% taker |

| Withdrawal Fees | None |

| Regulated | Yes |

| Mobile App | Yes (Android, iOS) |

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

What Is Gemini?

Gemini is a global cryptocurrency exchange and asset custodian offering numerous crypto services. The exchange was founded by the Winklevoss Brothers, Cameron and Tyler Winklevoss, in 2014 to provide individuals with financial independence and help them access various crypto industry opportunities.

Gemini has become one of the best exchanges worldwide that serves over 60 countries including Australia. According to CoinMarketCap, Gemini is among the top 15 exchanges in terms of liquidity. The exchange ranks above competitors like Gate.io and Crypto.com we have reviewed, with an average 24-hour trading volume of over $20 million (equivalent to 1,000+ BTC).

Gemini is one of the few global exchanges that are regulated by AUSTRAC. Gemini offers Australian-friendly payment methods, including local bank transfers and credit/debit cards. However, the AUD pairs on Gemini are only available on the basic trading platform for instant buy and sell orders. You won’t find them on Gemini’s advanced spot trading platform – the Gemini ActiveTrader.

Here’s Our Review of Gemini’s Features

It has simple and advanced trading platforms

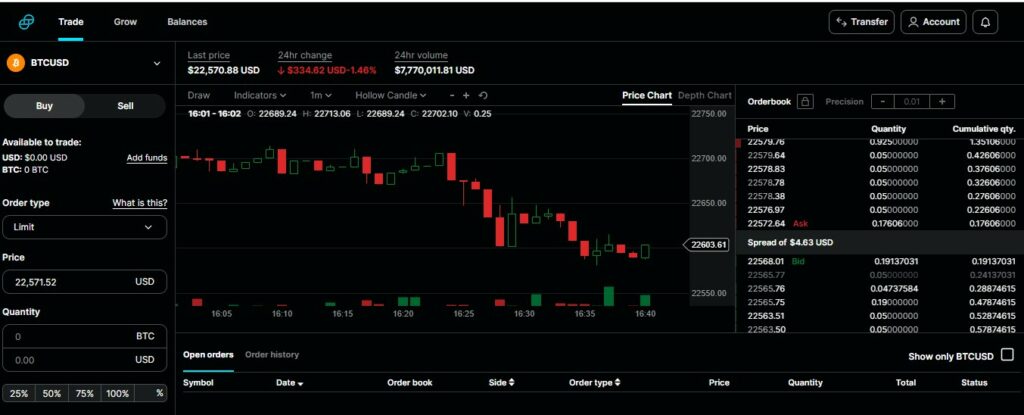

To cater to both beginners and intermediate traders, Gemini offers a simple trading interface and a slightly more advanced one called ActiveTrader. The basic Gemini platform is built for the instant buying, selling, and converting of cryptocurrencies. With its simple charting, this is suited to you if you don’t know or want to read real-time charting.

ActiveTrader is a more robust interface for traders who are more experienced than newbies, specifically those who want to learn or already know how to read real-time charting. It provides Gemini’s ActiveTrader is a simple trading interface with moderate features and lower fees. The platform also features advanced charting tools and different order types intermediate traders can leverage during trades. These include limit, stop-limit, fill-or-kill, and more.

However, compared to highly-advanced trading platforms offered by exchanges like Bybit and Binance Australia, Gemini ActiveTrader is lacking. For instance, the platform doesn’t support futures/derivatives trading. An important feature like TradingView integration is also missing, making ActiveTrader less refined than competitors.

Gemini Nifty Gateway to buy NFTs

Gemini caters to NFT enthusiasts in Australia via its sister company Nifty Gateway. Nifty Gateway is an NFT marketplace that provides an accessible way to buy, sell, and store exclusive NFTs. The digital collectibles hotspot is home to 10,000+ NFT collections from various artists, and like other products from Gemini, Nifty is secured with top-level security standards.

However, Nifty is a smaller NFT marketplace than a global platform like OpenSea. While Nifty houses about 10K worth of collections, OpenSea is home to about 100K collectibles. Nifty also charges 5% of the sale price plus 30 cents transaction charge. This is higher than the 1% fee charged on the Binance NFT marketplace and 2.5% on Opensea, which carries more inventory and is way more popular.

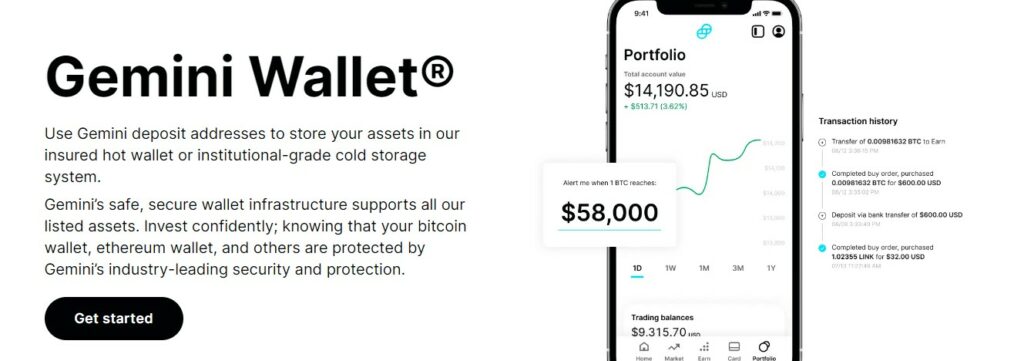

Gemini Wallet to store your purchased coins

The Gemini Wallet is the exchange’s secure crypto wallet structure. Gemini customers can store and manage 100+ cryptocurrencies available on the exchange.

However, this is a hot wallet, which means you’re not in charge of the wallet’s private keys. While this sort of wallet is standard with crypto exchanges, some platforms now feature a non-custodial option like Crypto.com DeFi Wallet and the standalone Coinbase Wallet. Self-custody wallets put the control of the assets in your hands, not in the hand of an exchange. They also allow you to store more digital assets, including NFTs and other Web3 solutions.

Gemini Custody for high net worth Australians

In addition to offering retail investors the ability to store their assets using the Gemini Wallet, Gemini offers institutional investors in Australia secure institutional-grade crypto storage via Gemini Custody. The solution is available to financial institutions, crypto service providers, and corporations looking to store their assets securely.

According to the website, Gemini Custody has $200 million in insurance coverage and is regulated by the State of New York. The custody also offers instant liquidity on trades and advanced security features, making it a reliable option for investors worldwide, including Australians. Gemini charges a fee for its custodial services. When you store an asset with Gemini, the platform charges whichever is greater between a 0.40% fee or $30/month per asset. There’s also an administrative withdrawal fee of $125.

Gemini Custody is similar in fashion to Coinbase Custody but it is quite limited in its features. For a start, it only supports about 100+ assets compared to Coinbase’s 360+ asset custody for institutional investors. It also lacks a staking feature for financial institutions to earn passive revenue from their secured digital assets which Coinbase Custody does. In summary, it focuses primarily on securing assets, offering little else.

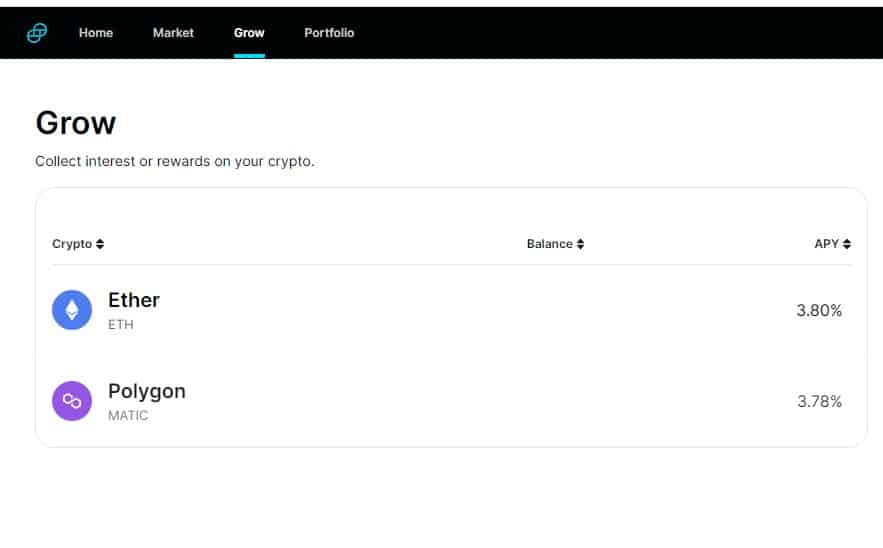

Stake tokens to earn a bit extra

Crypto staking is the primary option for Australian investors to earn passive income on the exchange. The staking program allows you to lock up your assets in the Gemini staking pool for periodic rewards.

To use this feature, you must purchase any of the supported coins for staking and transfer them to your Gemini staking account. On Gemini, there is no minimum amount of crypto required for staking. In addition, the exchange doesn’t charge any fees for the transfer or redemption of crypto staked.

The downside with this service is that Gemini only supports two cryptocurrencies – ETH and MATIC – which certainly doesn’t put it amongst the best places to stake crypto. Similarly, the maximum Annual Percentage Yield (APY) for staking on Gemini is 3.80%. Coin support for its staking feature and relatively small APY compared to competitors make Gemini staking less desirable for local investors.

Gemini Clearing to make P2P trades

Gemini Clearing is another impressive solution on the exchange. With Gemini Clearing, two traders can carry out peer-to-peer (P2P) trades on the exchange without using the order book. But Gemini confirms and settles all transactions between them as a third-party agent to mitigate risks. In addition, both parties carrying out the transaction must be fully verified on Gemini for more security.

This feature is suitable for AU traders who want to execute anonymous transactions that will not be published in the order book. It also facilitates speed and safety, as both parties must already be fully funded before transactions happen. Though this is similar to the Binance P2P, it offers additional anonymity that is unavailable on such a platform.

What Are Gemini Fees?

Gemini is transparent with its charges, but the trading fees are slightly higher than the charges on Binance. Funding your account with your local debit card is also more affordable on Gemini than Coinbase, making the overall fee structure competitive compared to the industry average. However, the fact that the Gemini fees are relatively higher than Binance’s could be a dealbreaker especially when you consider the number of features you’ll be missing by sticking with Gemini.

Deposit fees

On Gemini, you can fund your account using AUD as well as USD, CAD, EUR, GBP, HKD, SDG. Transfers of AUD from an Australian bank account are supported and free. However, if you fund your Gemini account with a debit card, you’ll incur a 3.49% charge. Alternatively, you can fund your account by transferring crypto to your Gemini trading wallet. Crypto deposits are free. Some of the crypto deposit options include BTC, ETH, BCH, LTC, and MANA.

Trading fees

The transaction fee for instant orders via the Gemini mobile app and website range from $1.50 to $4.50 for transactions up to $250. However, transactions above $250 attract a hefty 1.49% fee of the total order value. These fees are excessive in the Australian crypto market and you can get much better value from exchanges like Swyftx where the trading fees are 0.6%.

For ActiveTrader users, the trading fees follow a maker-and-taker system which is determined by your 30-day trading volume. You will be charged a maximum of 0.20% and 0.40% for maker and taker fees, respectively, but these can be reduced if your trading volume increases.

Withdrawal fees

Gemini supports both crypto and fiat withdrawals. AUD withdrawals are free via bank transfer. For crypto withdrawals of Ethereum and ERC-20 tokens, Gemini charges network fees called “Dynamic Fees,” which are based on Ethereum gas fees. At the same time, Gemini charges a flat transaction fee for digital assets outside the Ethereum ecosystem, but this varies per coin being withdrawn.

Which Cryptocurrencies Can You Trade?

As stated earlier, Gemini supports 100+ crypto assets including all the popular ones including BTC, ETH, GUSD, DOGE, ADA, and SOL. Some lesser-known coins such as SAMO, FIL, XTZ, and AAVE are available. While this number is little compared to competitor exchanges, it’s about enough for beginners to trade major crypto assets and popular altcoins. Traders seeking a more robust crypto library may prefer alternatives like Coinbase and KuCoin.

Gemini also supports various trading pairs on its simple trading interface, including AUD pairs. However, AUD pairs are not supported on the ActiveTrader platform. This will likely force users to change their default currency from AUD to USD in order to access this more advanced trading terminal. While it incurs no fee, the fiat change may be impractical for a lot of Australian investors. Some of the fiat and crypto trading pairs on Gemini ActiveTrader are:

- BTC/USD

- ETH/USD

- GUSD/USD

- BCH/BTC

- LINK/BTC, and more.

This is How To Get Started On Gemini

The Gemini exchange offers a seamless experience to users that starts at account creation. After creating an account on the website or mobile app using a valid email address, you are required to undergo the Know-Your-Customer (KYC) process before you can fund your account and start trading.

Verifying your account

The identity verification process on Gemini is mandatory. In other words, you are entirely limited from trading and engaging in other activities on Gemini without completing it.

Gemini recommends using a mobile device for the verification process. To complete the process, you’re required to submit an ID (for instance, an Australian passport) and take a photo of the ID using a smartphone. All of these requirements are put together in only one KYC level, so you can get your account fully verified once and for all.

Upon submission, Gemini will review the documents and provide an update. During this review, the verification process took about 20 minutes, which is a bit slow.

How to fund your Gemini wallet

You can add fiat currency funds to your Gemini account via bank transfers or from your credit/debit card. Deposits of cryptocurrencies from an external wallet are also supported. Popular Australian deposit methods such as POLi, BPAY, and PayID are not supported.

Bank transfers are free but they may take up to 5 days to process. Debit card deposits would cost 3.49% per transaction but are instant. Gemini’s fees for the use of credit cards are within the range of fees in the Australian market but are certainly not the cheapest when you can find better fees of around 2%.

So, What’s The Trading Platform Like To Use?

Our experience on Gemini was user-friendly and extremely smooth. From the account creation process to verification, the exchange prioritises ease which makes it ideal for beginners. Gemini also provides a basic “Gemini” platform for beginners to trade crypto, crypto-to-crypto, and crypto-to-fiat trading pairs. Gemini’s Buy and Sell feature will suit beginners.

On the other hand, experienced traders will typically prefer Gemini ActiveTrader, which offers higher performance and speed than the primary Gemini Exchange. This makes the advanced platform ideal for active traders looking to execute trades in microseconds with access to deeper order book visibility and lower fees. The platform also offers multiple order types namely:

- Limit Order: an instruction to set the minimum price you want to receive for an asset as a seller and the maximum price you want to pay as a buyer.

- Stop-Limit: an instruction to buy or sell a coin when it reaches a certain limit price you’ve set.

- Maker-or-Cancel (MOC): used to buy or sell an asset at a market/limit price by staying on the order book until the order is filled or by cancelling any unfilled fraction.

- Immediate-or-Cancel (IOC): used to execute a buy or sell order for an asset immediately and cancel any unfilled order portion.

- Fill-or-Kill (FOK): to execute a buy or sell order immediately in its entirety or cancel the entire order without partial executions if conditions are not met.

The in-house charting on ActiveTrader is quite limited and the indicators and drawing tools were a bit cumbersome to use. The lack of TradingView support means that advanced traders will likely look elsewhere since the interface is nowhere near as refined as the interfaces found on serious platforms like Binance Australia and Bybit.

However, intermediate traders who want to learn how to read live trading charts can take advantage of the ActiveTrader platform to get a head start before switching to platforms with more advanced charting setups. A significant downside is the absence of AUD trading pairs for local traders. Aussie traders have to convert their AUD currencies to supported fiat currencies on the platform.

Regardless of the trading interface chosen, Gemini is still relatively easy to use. However, Australian investors may find it difficult to use Gemini because of the absence of AUD trading pairs on the advanced Gemini ActiveTrader platform. Due to regulatory reasons, the platform also lacks advanced trading markets such as margin, futures, and options.

Mobile App To Buy on the Move

The Gemini mobile app is available on Android and iOS devices for mobile-first customers to trade and manage their accounts on the go. Like the website, the mobile app features a clean interface and aids easy trade execution.

However, the mobile app has fewer features than the website, which could be a deal breaker for some. For instance, most educational resources on the website are unavailable on the mobile app. The ActiveTrader exchange is also unavailable on the mobile app.

The 4.4/5.0 user rating on the Google Play Store and the 3.4/5.0 rating on the Apple App Store indicate the mobile app’s moderate efficiency and performance. There are positive comments about the platform’s simple design and intuitive user interface. But there are a few complaints about the app’s UI lagging, which we also experienced when trying to place trades during our Gemini review.

Customer Support Could Be Improved

To support its customers, Gemini has an online library of diverse learning materials that you can turn to when you get stuck using the platform. Gemini also engages a dedicated team of customer service professionals available via email 24/7.

However, during our Gemini review, we discovered that the exchange only has a live chat feature on its desktop platform. The chat feature is a chatbot that can help you locate answers from the Help Center. For a human touch, you have to email Gemini to get responses to your queries. In our experience, we received a response from a test inquiry about 6 hours after we sent it which is really slow.

Customer Reviews Are Excellent

Going by online Gemini reviews on Trustpilot, the exchange is sub-par in terms of customer satisfaction. Gemini has a poor rating of 1.1/5.0, with 94% of the 856 reviews being negative.

Common complaints among users include the unjust blocking of accounts with funds in them and the low yield on crypto staking. Furthermore, Gemini failed to respond to customers’ poor reviews or provide solutions to their concerns. We personally feel that such reviews and Gemini’s silence can damage the exchange’s reputation and deter potential customers.

Security Measures We Observed

Gemini is one of the most secure cryptocurrency exchanges. The company has a mandatory KYC process for all users to combat fraud. It also uses the industry-standard Two-Factor Authentication (2FA) on mobile and desktop devices. In addition, Gemini supports hardware security keys like Yubikey and addresses allow whitelisting.

The exchange is also known for its strong internal controls. For instance, multi-sig keys are required to transfer funds out of the platform, eliminating a single point of failure. Furthermore, the company claims its CEO and President, Tyler, and Cameron Winklevoss, cannot transfer customer funds from the online or cold storage systems themselves.

Gemini takes compliance quite seriously in all markets where it operates. The platform is registered with AUSTRAC and is notably one of the first crypto custodians to complete the SOC 1 and SOC 2 Type 2 exams and earn ISO 27001 certification – a global reporting standard regarding information and data security. The exchange has never breached or experienced any form of intrusion since it launched in 2014.

Our Final Gemini Verdict

Gemini offers a seamless trading experience to beginners and mid-level traders across two trading platforms. For a global crypto exchange, Gemini provides a decent level of support for Australians including the ability to deposit and withdraw AUD to and from bank accounts. In addition, the exchange’s security architecture and strong internal controls make it one of the most secure crypto trading hubs available to Aussie traders.

However, Gemini has relatively high fees to instantly buy and sell crypto, questionable customer support, and there is a lack of features for advanced traders. The platform offers no AUD trading pairs on ActiveTrader which will discourage some prospective traders.

Frequently Asked Questions

Gemini is a reputable exchange licenced in the US and Australia. The popular trading exchange is well-known for its strong emphasis on security. In Australia, the exchange is registered with AUSTRAC, the government financial intelligence body responsible for the prevention and detection of money laundering and terrorism financing.

The Gemini wallet is one of the safest Bitcoin wallets available. Gemini is a secure and compliant platform, SOC 2-certified and offering FDIC insurance for U.S. dollar deposits up to $250,000 and digital asset insurance for funds held in its hot wallet. Gemini also holds the internationally recognised ISO 27001 accreditation. This demonstrates the platform’s commitment to safety and security.

While Gemini and Coinbase offer user-friendly and highly secure trading platforms to customers, Coinbase supports more cryptocurrencies and has lower fees than Gemini.

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.