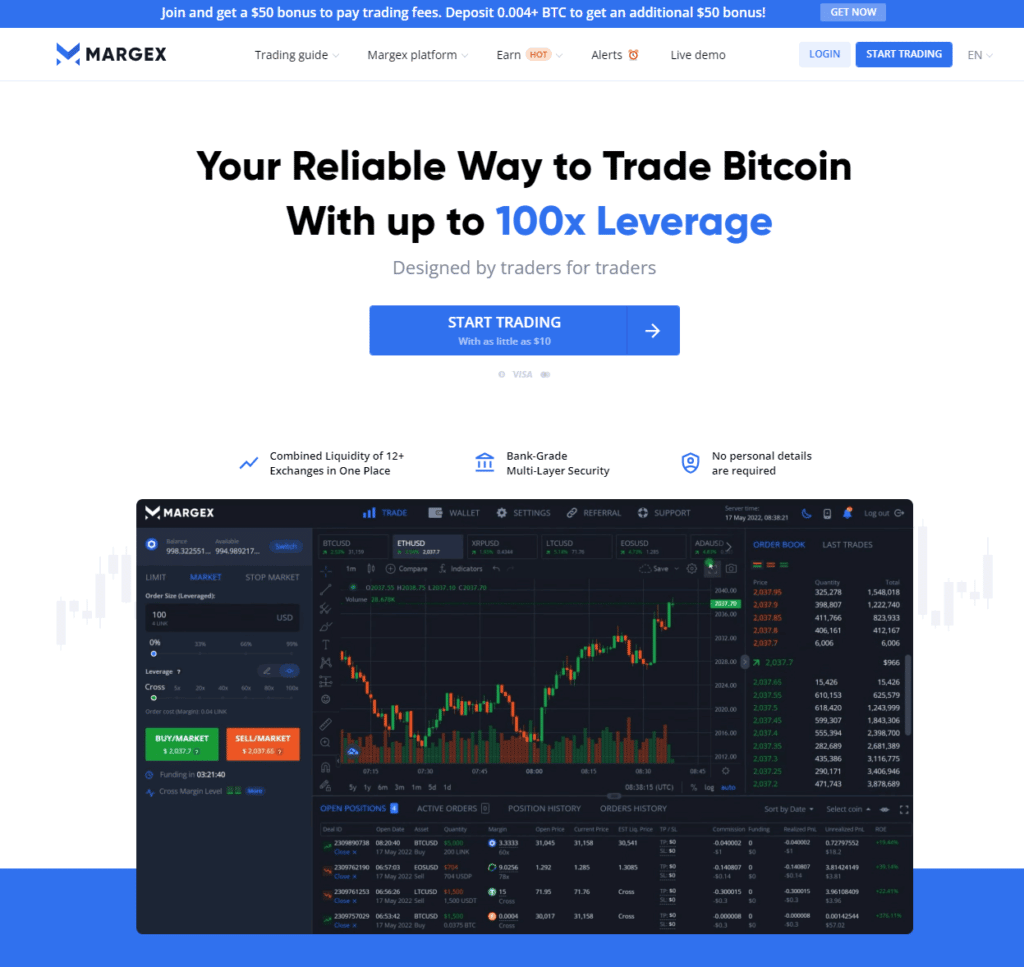

Margex Review: Should Australians Use It?

Last Updated on December 24, 2023 by Kevin GrovesMargex is a newcomer to the cryptocurrency scene, intending to compete with big players like OKX and ByBit. You can trade Bitcoin and other trading pairs with up to 100x leverage on the platform. This review investigates how Margex compares against the well-established Australian crypto trading platforms by analysing its features, fees, supported currencies, and ease of use.

Margex

Trading fees:

0.019% (maker) / 0.06% (taker)

Number of cryptos:

20

Deposit methods:

Visa/MasterCard, cryptocurrency transfer

Supported countries:

Australia, New Zealand, UK, Singapore

Promotion:

None

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick Overview

Here is a quick summary of Margex for Australians.

| Exchange name | Margex |

| Supported countries | Australia, New Zealand, UK, Singapore |

| Fiat currencies supported | AUD, NZD, GBP, SGD |

| Deposit methods | Visa, MasterCard, Cryptocurrency transfer |

| Supported cryptocurrencies | BTC, ETH, XRP, LTC, EOS, ADA, SOL, UNI |

| Deposit fee | None |

| Trading fee | 0.019% (maker) / 0.06% (taker) |

| Withdrawal fee | Varies depending on standard network fee |

| Margin | Up to 100x |

| Mobile app | Yes (iOS and Android) |

The Bottom Line

Margex is a relatively new cryptocurrency exchange but has quickly built a positive reputation among traders. The platform boasts one of the sleekest and easy-to-use trading interfaces of any derivatives exchange, decluttering what can be an overwhelming experience for those new to futures and margin trading.

The exchange doesn’t support fiat deposits (including AUD), which may present a roadblock for some Australian investors that want to buy crypto. In addition, the platform is very light on features and supported cryptocurrencies. However, Margex is intended to be a simple, clean way to trade a few popular digital currencies – and it does this very well.

What we liked:

- One of the most aesthetic and sleek user experiences on the market.

- Competitive trading fees.

- You can trade with up to 100x leverage.

- Integrated TradingView charting and tools.

What we didn’t like:

- Minimal support for fiat currencies.

- Derivatives trading isn’t ideal for beginners.

- Only five tokens supported for staking.

What is Margex and Is It Registered In Austalia?

Margex is a cryptocurrency exchange based in Seychelles that was founded in 2020. It is a direct competitor to other top crypto derivatives exchanges established around the same timeframe. The Margex platform has one key goal to set itself apart from the rest – to provide a simple way to trade futures and margins on the most important cryptocurrencies. Margex does away with clunky trading interfaces and features overload to present traders with a no-frills experience.

Margex is not registered with the Australian regulatory body AUSTRAC and cannot offer fiat currency deposits to its customers. To compensate, the exchange has partnered with third-party payment gateways Changelly and ChangeNOW to directly purchase BTC and other digital assets with a debit/credit card.

Margex is intended for experienced and intermediate crypto investors looking to expand into the world of derivatives trading. You can go long or short on eight trading pairs with up to 100x leverage, and use over 15 tokens as collateral. Margex offers top-of-the-range liquidity by piggybacking off the liquidity of 12 providers.

Pros & Cons

Pros:

Cons:

Here’s What We Thought of the Features

Derivatives and margin trading are limited

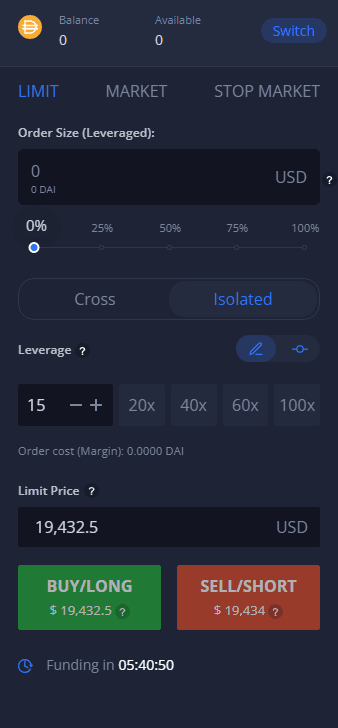

Margex offers you the ability to trade futures contracts on eight trading pairs with up to 100x leverage. The platform intends to reduce the skill gap required for investors to trade futures and has stripped back the number of options available.

Investors can go long or short and set three types of orders – limit, market and stop market. You can also choose between cross and isolated margin types. This customisability is substantially limited compared to other advanced trading platforms like Bybit. However, that is by design. Suppose you’re a trader who wants to cut back the clutter found on most other trading-focused exchanges. In that case, Margex’s interface and streamlined features are a perfect alternative.

You can use approximately twenty different digital currencies to execute orders on the Margex trading hub. This includes popular options like BTC and ETH, as well as some stablecoins (DAI, USDC). It’s worth noting that you cannot place an order under 5x leverage – so every trade made will have to utilise a margin.

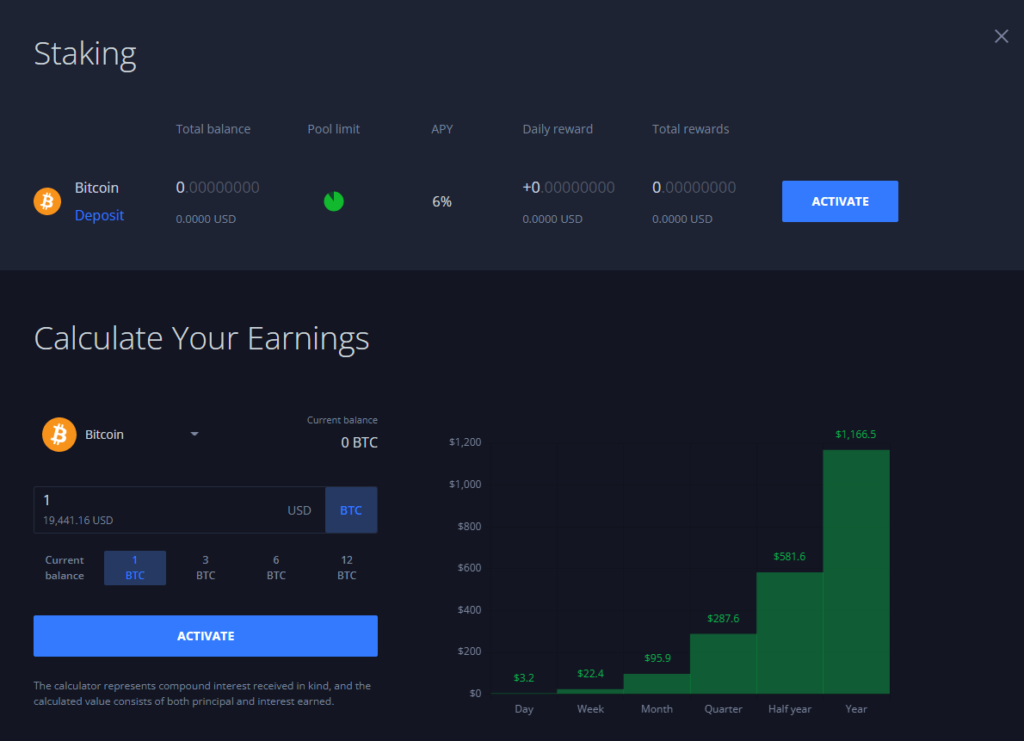

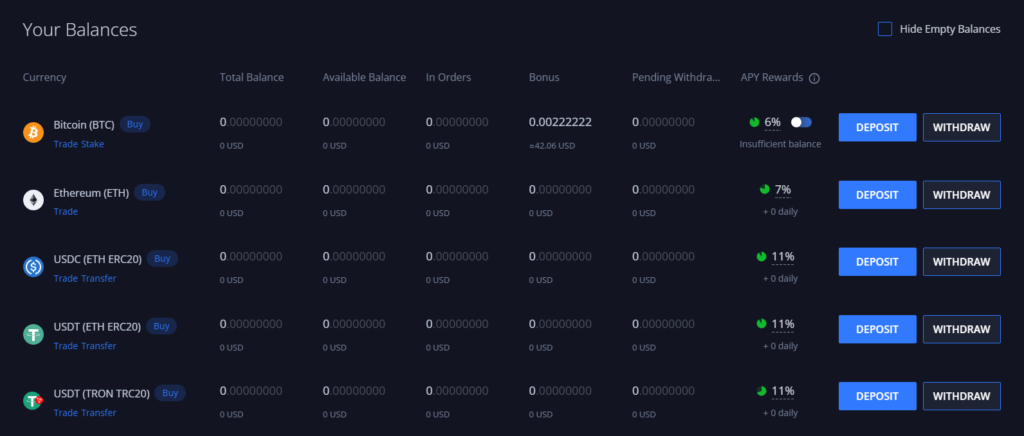

Stake coins for a little extra

Margex doesn’t have a comprehensive earning hub available. While more feature-rich competitors offer liquidity mining, cloud mining, on-chain staking and yield farming, Margex only supports a soft staking protocol.

You can stake five cryptocurrencies (Bitcoin, Ethereum, USDC, USDT and USDT Tron) to earn passive income. The reward rates on offer are quite impressive and somewhat make up for the lack of supported assets. For example, stablecoins currently boast a rate of 11%, while Bitcoin’s 6% and Ethereum’s 7% are above the industry standard.

In addition, the staking program is very flexible. There are no minimum/maximum limits or lock-up periods for your tokens. Yields are paid into your Margex wallet every day. However, Margex doesn’t stack up too well against some of the best staking platforms in Australia as per our comparisons.

Margex manages to offer such high APYs due to its unique earning mechanism. They essentially employ a yield farming strategy. By loaning out your coins to multiple decentralized and centralized finance products, they can capitalize on the best reward rates in the industry and siphon them back to you.

Although Margex’s earning hub is a little lacking compared to other exchanges, we were still quite impressed. The high rewards rates and extremely simple user interface make it a viable option for those wanting to earn passively on a few major cryptocurrencies.

Website states deep liquidity but this isn’t really the case

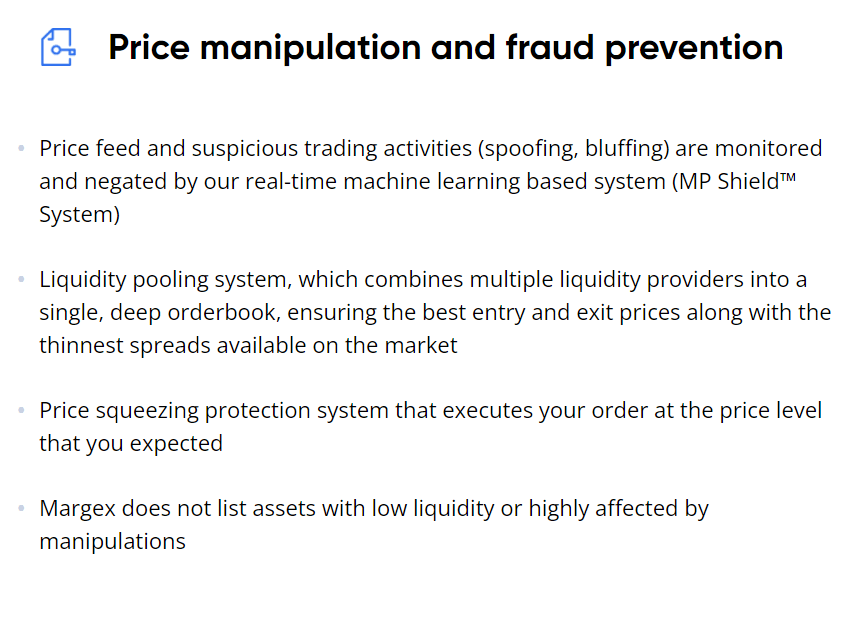

Margex is unique for a centralized exchange in the way it addresses illiquidity. Illiquidity is an issue that occasionally rears its head in margin and derivatives exchanges. Low liquidity can have all sorts of effects on trading efficacy. Slippage – a difference in the price of a cryptocurrency between the time an order is placed and executed – is common in low-liquidity marketplaces. This can result in heavy dents in trading profits. In addition, exchanges with poor liquidity are also prone to price manipulation by very few sell orders.

Margex has a multi-pronged strategy for providing deep liquidity. The platform only supports the most popular digital currencies that typically have deep liquidity. The team constantly monitors trading pairs to avoid price manipulation. Their Price Manipulation Shield System employs algorithms from 12 different liquidity providers to ensure trading on the exchange remains uncompromised.

The multi-token wallet is useful but shouldn’t be relied on

The Margex exchange supports a native multi-token wallet where you can store 19+ digital currencies. Cryptocurrencies like Bitcoin, Ethereum, USDC, USDT, Solana and DAI can all be held safely in the industry-standard wallet. This makes it easy to trade on the Margex platform without constantly transferring assets in and out of your trading account.

Although native wallets on exchanges are a convenient way to store your crypto funds, it’s always a good idea to consider a third-party wallet. Non-custodial wallets give you complete control over your cryptocurrencies, whereas holding crypto on an exchange like Margex means the company owns your private wallet keys. The best solution for serious crypto investors is a non-custodial hardware wallet, which you should use in tandem with an exchange wallet. Check out our review of the best wallets for Australians.

Mobile app is poorly rated

Margex offers a smartphone application on both the Google Play and iOS App Store. The apps are relatively new compared to the exchange and don’t have many customer reviews available. The Margex app has a 3.9/5-star rating on Android, which is solid without being great.

Overall, the Margex app is clean and intuitive, reflecting the exchange’s philosophy of providing advanced trading for beginners. You can find all the features accessible via the desktop platform on the mobile app. In all, it’s a great way for active investors to manage their portfolios and trade derivatives while on the move. You can check out the best mobile apps for crypto investors in our guide.

Margex Has A Limited Number of Cryptocurrencies

Margex only supports eight cryptocurrencies that can be traded against United States Dollars (USD), comprising Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Cardano (ADA), Solana (SOL), EOS.io (EOS), and Uniswap (UNI).

The limited support for cryptocurrencies is both a good and bad thing. On the positive side, only offering the most popular crypto ensures the Margex exchange maintains deep liquidity and avoids price manipulation. In addition, it removes some of the complexity from margin trading that can be overwhelming on other platforms. As a derivatives exchange intended for newcomers to futures trading, it makes sense to simplify the assets available.

On the other hand, more advanced traders may feel underwhelmed by the supported trading pairs. Considering that competitors like Binance, Huobi and ByBit have hundreds of derivatives trading pairs, it’s easy to see why some investors may pass on Margex. Ultimately, your opinion on the lack of supported cryptocurrencies will largely depend on your personal investment goals and experience.

You can fund Margex trades with up to 19 different cryptocurrencies, each of which can be stored in the exchange’s native wallet. This includes prominent digital currencies like BTC, ETH and SOL, as well as stablecoins such as USDT, USDC and DAI.

So, What Are The Fees?

There are no fees or costs associated with creating or holding a Margex account. Similarly, storing crypto in the platform’s native wallet is free.

Deposit fees

Margex does not support depositing fiat currency, including AUD, onto their platform. Therefore, no deposit fees are charged. Alternatively, you can fund your account with Bitcoin using a credit/debit card and a third-party payment gateway. The costs for this will vary depending on which payment provider you choose, however, are typically quite expensive (3%+).

Depositing cryptocurrency to your Margex account wallet doesn’t incur any fees.

Withdrawal fees

Margex does not charge any fees on their side for cryptocurrency withdrawal to a wallet. However, standard network transfer fees will apply. These fees vary from blockchain to blockchain and depend on network congestion at the transaction time.

You cannot withdraw fiat currency from the Margex exchange.

Trading fees

Margex trading fees follow a maker-and-taker structure. Maker trades will incur a 0.019% fee, while taker trades incur a 0.06% fee. These rates are right about industry-standard for a margin/derivatives exchange and are relatively cost-effective.

However, it’s worth noting that Margex does not support a tiered fee structure, unlike many alternatives. For example, some platforms will lower your trading fees when you hold a certain amount of a utility token. There are also often reductions in costs for high-volume traders, which Margex does not offer.

Do We Think Margex Is Safe?

Not really, Margex is a relatively new exchange and therefore doesn’t have enough historical data to make a definitive call on its safety. However, the platform has never experienced a hack or other compromising event. To prevent an attack, Margex employs a multi-layered security system. 2 Factor Authentication (2FA) is available for every account and it is recommended that you enable this as soon as you sign up. In addition, the company keeps 100% of digital assets secure in a multi-signature cold (offline) wallet. This makes it much harder for hackers to access than if they used a hot (online) wallet.

In addition, withdrawals can only be processed once daily and must be confirmed via email. Based on their stringent security measures, Margex is doing everything right to ensure the safety of its platform and its customers.

That said, Margex does not support fiat currency deposit/withdrawals and is not registered with most government regulatory bodies, including AUSTRAC. Some investors may prefer to use an exchange with oversight from the Australian government to ensure they comply with KYC and AML regulations.

This Is How To Get Started On Margex

Opening an account on Margex is easy. To get started, simply select “Start Trading” from the Margex home page. You will then be prompted to enter your email address and a password to register your account. Once you’ve verified your email address, you’re ready to start using Margex.

As Margex isn’t registered with government regulatory bodies, there are no KYC requirements to start trading. Once your account is set up, you can immediately begin trading derivatives on eight trading pairs. However, you will need some cryptocurrency in a wallet to fund your account. Alternatively, you can purchase Bitcoin through one of Margex’s payment providers using a debit/credit card.

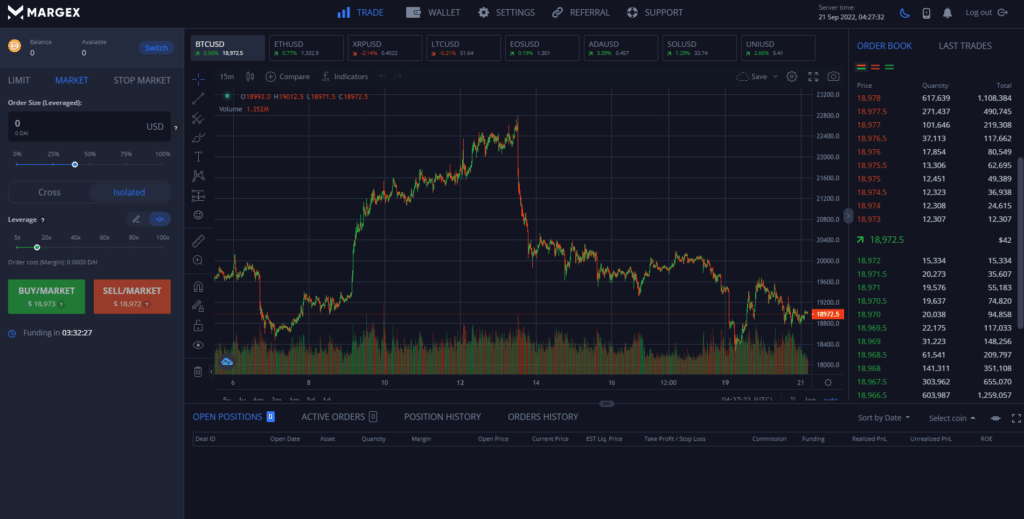

What Is Trading On Margex Like?

Margex’s trading interface has a clear goal – to provide advanced trading options in a clean, de-cluttered manner. We were impressed by how smoothly the Margex trading hub’s design reflected these goals. It is one of the sleekest and easiest to use designs on the market and takes a lot of the stress out of trading derivatives with leverage. Every customisable feature, different trading pair, and order type are visually accessible. Navigating the various functions of the trading interface is a breeze.

On the left pane, you can easily adjust the specifics of your order. You can choose between 15+ cryptocurrencies to fund your trades and then decide if you’d like to set a Limit, Market or Stop-Limit order. These order types are relatively limited compared to other trading-centric exchanges, which sometimes have more than five different order types. However, the three provided are useful for beginner-intermediate traders and should suit most users.

It’s also extremely easy to switch between margin types (Cross or Isolated) and adjust the leverage depending on your personal risk appetite. The minimum margin for a trade is 5x, which may be off-putting for some newer traders who might prefer to trade at 2x leverage.

You can switch between the eight provided trading pairs directly above the live chart feed. All you have to do is click on the box to see the orderbook and current price of a digital currency.

The customisable chart comes with all the features a trader would want. It is flush with hundreds of adjustable indicators, drawing tools and volume signals. You can also switch between dark and light modes depending on your preference by clicking the sun or moon icon in the top-right of the interface.

We Tested The Customer Support (and it didn’t work)

Margex is a platform designed to bridge the gap between beginner and advanced traders, and its customer support is a great representation of this. We were very satisfied by the wealth of articles, videos and how-to guides available on nearly every facet of the exchange. Another bonus is how easy it is to navigate Margex’s Help Centre articles. They are segmented into relevant sections, or you can type what you’re after to find a helpful article.

Whether you want to learn the basics of trading futures contracts, understand more about the blockchain or figure out how to deposit crypto to your account, Margex likely has you covered.

For more pressing inquiries, Margex has a live chat. Margex claims that this chat is available 24/7, however when we visited the exchange we were unable to load this feature outside of active support hours. (This may have just been a short-term issue.) In this situation, you can email Margex directly via their customer support email. While the help centre and live chat aren’t perfect, Margex provides more than enough help and contact options for the vast majority of investors.

Our Final Verdict

Margex is a new fish in the crypto pond that serves a clear purpose – providing traders of all experience levels a streamlined way to exchange derivatives. This does come with a few limitations. Margex isn’t full of features the way some alternative platforms are, although depending on your goals this may actually be an advantage. There is no support for fiat currencies, which may impact Australians wishing to use AUD.

However, Margex has one of the cleanest trading interfaces on the market. It is incredibly simple to use, and navigating the platform is an overall satisfying experience. Although the exchange is not registered with AUSTRAC, the company puts a lot of emphasis on security and customer support. Having a 24/7 live chat is an added bonus that we feel most exchanges, if possible, should offer. The majority of Margex users should feel comfortable using the exchange for trading futures contracts.

Margex’s fees are more than competitive, and its deep liquidity ensures you will get the best prices on your trades. Overall, we recommend Margex for those wanting to start trading derivatives with leverage, but want to avoid the complexity of other platforms in this space.

Frequently Asked Questions

Is Margex trustworthy?

Margex has only been around since 2020 which makes it hard to conclude how trustworthy the exchange is. However the management team have put a lot of effort and resources into ensuring the platform is safe from hacks and glitches. The customer support offered is thorough, and to date, no compromises have been publicly recorded.

Does Margex require KYC?

No, new users can begin trading cryptocurrency derivatives without passing Know Your Customer (KYC) verification.

Is Margex regulated?

No, Margex is not regulated by AUSTRAC or any other Australian financial body. The company is headquartered in Seychelles.

How do you withdraw from Margex?

Margex users can withdraw cryptocurrency to a third-party wallet address. The platform does not support the withdrawal of fiat currency, so users wishing to withdraw AUD must convert their funds elsewhere.

Is Margex allowed in Australia?

Australians can utilise the cryptocurrency services that Margex offers including futures and margin trading, low fees, and a beginner-friendly interface. However, Margex is not currently registered with AUSTRAC, and you can’t deposit Australian Dollars to fund your wallet. Instead, you can begin trading by funding your account with digital currencies such as BTC, ETH, XRP, LTC, EOS, ADA, SOL, UNI.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.