Independent Reserve Review

Last Updated on December 24, 2023 by Kevin GrovesThe Australian cryptocurrency market is rapidly growing, and there are several exchange platforms to choose from. Some of them are beginner-friendly, while some are geared towards expert investors. There’s a very high chance that you’ve come across Independent Reserve Review in your search for reputable Australian crypto exchanges. This Australian platform was launched in 2013, and it was founded on one main goal; to do things the right way.

If you’re wondering whether it’s the right fit for you, here’s a detailed review of the Independent Reserve to get you started.

Independent Reserve

Trading fees:

0.5%

Number of cryptos:

30+

Deposit methods:

Bank transfer, PayID, Osko, SWIFT, crypto

Supported countries:

Australia, New Zealand, Singapore

Promotion:

None available at this time.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick Overview

Here is a quick summary of Independent Reserve:

| Exchange name | Independent Reserve |

| Supported countries | Australia, New Zealand |

| Fiat currencies supported | AUD, USD, NZD & SGD |

| Deposit methods | PayID, OSKO, SWIFT, TT, EFT, FAST, cryptocurrency |

| Supported cryptocurrencies | 30 |

| Deposit fees | $0.99 processing fee if under $100 AUD |

| Trading fees | 0.5% |

| Withdrawal fees | None |

| Mobile app | Yes (Android, iOS) |

The Bottom Line

Independent Reserve is a robust and reliable trading platform for beginners and experienced crypto traders in Australia. The exchange has economical fees starting at 0.5% per trade, excellent support for SMSF investors, and a responsive mobile app for 24/7 trading. However, we felt that the user experience was dated and could be improved to streamline the overall buying and selling process.

What we liked:

- Compliant and AUSTRAC licenced exchange.

- Supports the major cryptocurrency pairs.

- Competitive 0.5% trading fees that reduce with trading volume.

What we didn’t like:

- No TradingView charting.

- Does not offer broader features like staking, margin trading or earning crypto interest.

- Limited number of cryptos.

What Is Independent Reserve?

Independent Reserve was founded in 2013 by Adam Tepper and Adrian Przelozny to provide Australians with a robust, secure, and regulated exchange to trade Bitcoin and other cryptocurrencies. Since then, the trusted platform has grown to a customer base of over 250,000 investors and traders spanning across Australia, Singapore, and New Zealand. Additionally, it holds over 8,000 Self-Managed Super Funds (SMSFs) and about $1 billion worth of digital assets in its secure vaults.

As a testament to its vision of being one of Australia’s most reliable and trusted places to buy crypto, Independent Reserve has achieved the coveted ISO 27001 accreditation whilst implementing top-tier security standards. It has also partnered with industry players and associations such as Blockchain Australia to bring value to its customers.

Pros & Cons

Pros:

Cons:

Our Review Of The Top Features (What We Found)

It’s beginner-friendly

Independent Reserve has a basic interface that’s easy on the eye and geared towards both novice and expert investors. Navigating the site is easy as all information is well distributed and processes to manage your account and buy crypto are generally streamlined. Although the interface will be seen as fashioned for most and needs an update, it still provides a stress-free experience.

You can instantly buy the major digital currencies

Independent Reserve only supports 30+ digital assets which is quite limited compared to other popular trading platforms such as Swyftx, Digital Surge, and Binance Australia where 300+ is commonplace. However, rather than list low market cap coins and tokens, Independent Reserve supports most of the major crypto assets. You can exchange multiple fiat currencies (AUD, SGD, USD, and NZD) for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Polygon (MATIC), Cardano (ADA), and Tether (USDT).

With the limited number of digital assets supported, Independent Reserve is not ideal if you’re interested in investing in altcoins. For example, meme coin Shiba Inu (SHIB) is not listed.

AutoTrader so you can buy crypto slowly

If you’re familiar with how Dollar-Cost-Averaging (DCA) works then you might be interested in AutoTrader. This is Independent Reserve’s take on DCA and other popular trading strategies. You can choose from 3 modes.

- AutoBuy: Purchase cryptocurrencies at your desired price whenever a deposit hits your account. This is particularly useful if you want to only buy assets at a price that you deem economical.

- AutoBasket: Akin to ‘crypto bundles’ offered by other trading exchanges, this automatically uses your funds to purchase multiple cryptocurrencies at a time. You can set the proportion of assets in a bundle, for example, 60% BTC, 20% ETH, and 20% ADA.

- AutoSchedule: Essentially DCA, AutoSchedule automatically buys your desired crypto at regular intervals so you don’t need to ‘time’ the market.

Overall, we can see the value that the AutoTrader features offer to beginners and novices. Rather than place advanced limit orders on a complex crypto exchange, these are marketed in a way that provides more simplicity and is easy to understand.

Retirees can invest with their SMSF

If you’re thinking about rolling over your existing super fund or creating a new SMSF to invest in cryptocurrencies, then Independent Reserve will surely tick all your boxes. Whilst newer crypto platforms are starting to incorporate SMSF support into their services, Independent Reserve has been doing this for a long time. As such, its suite of features are well placed to benefit retirement investors.

One of the key benefits that Independent Reserve brings for its SMSF service is its strong track record when it comes to security and regulatory compliance. The platform has not been hacked and it maintains strict requirements for its ISO 27001 accreditation. This is all on top of the bank-like security measures it implements to give SMSF investors peace of mind.

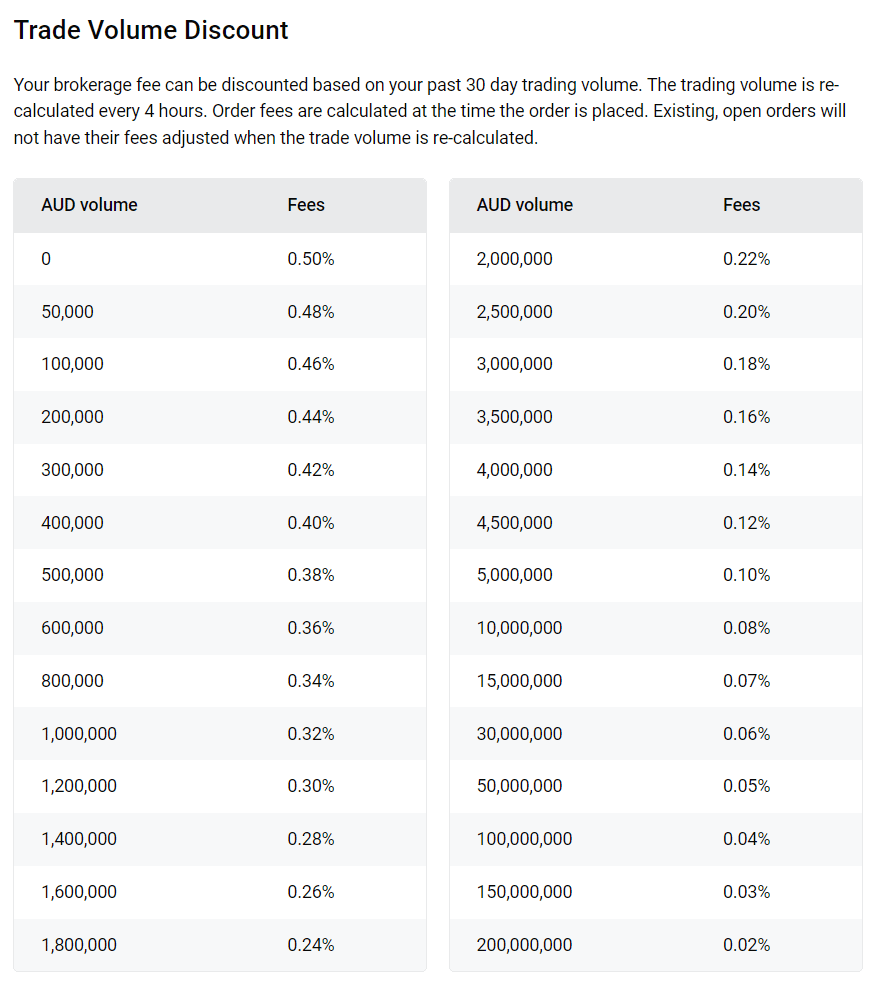

The structure of Independent Reserve’s trading fees will suit SMSF investors who prefer to trade large volumes. The maximum trading fee of 0.5% is already competitive in the Australian market, however, high-net traders using the Over-The-Counter (OTC) service can reduce their fees to as low as 0.02%.

The other feature that makes Independent Reserve an ideal place to invest in crypto as part of your SMSF, is the ability to apply DCA and a range of limit orders. This is something that is fairly unique to Independent Reserve.

Crypto tax calculators to help with ATO lodgement

Cryptocurrency trades are taxable under Australian law. Every time a net financial gain is made, a capital gains tax event is triggered. The Australian Tax Office (ATO) considers cryptocurrency as property or an asset that is subject to Capital Gains Tax (CGT), and must be reported.

Independent Reserve has a KPMG tax calculator that allows you to estimate your tax obligations. It works by exporting a .csv file of all the transactions you made during the financial year and estimates the amount of CGT you need to pay.

So, Do We Think Independent Reserve Is Safe?

Yes, Independent Reserve appears to be one of the most secure exchanges in Australia as it has never been hacked or compromised. The company has partnered with Cobalt to provide network security, and penetration testing to identify any vulnerabilities. The majority of funds are held in cold storage to eliminate unauthorised access.

Should You Trust Independent Reserve?

Independent Reserve is a legitimate cryptocurrency exchange that trades under Independent Reserve Pty Ltd (ABN 46 164 257 069). Based in Sydney, the platform is regulated in the financial sector by ASIC and AUSTRAC to ensure it abides to government requirements. Independent Reserve is regularly audited by third parties, is a Gold Member of Blockchain Australia, and has partnerships with prominent players in the Fintech industry.

Independent Reserve was one of the first crypto exchanges to be licenced with the Monetary Authority of Singapore under the Payment Services Act. This means that the platform is allowed to act as a Digital Payment Token (DPT) provider where users can obtain crypto with Singaporean Dollars (SGD).

Fees Breakdown and Explanation

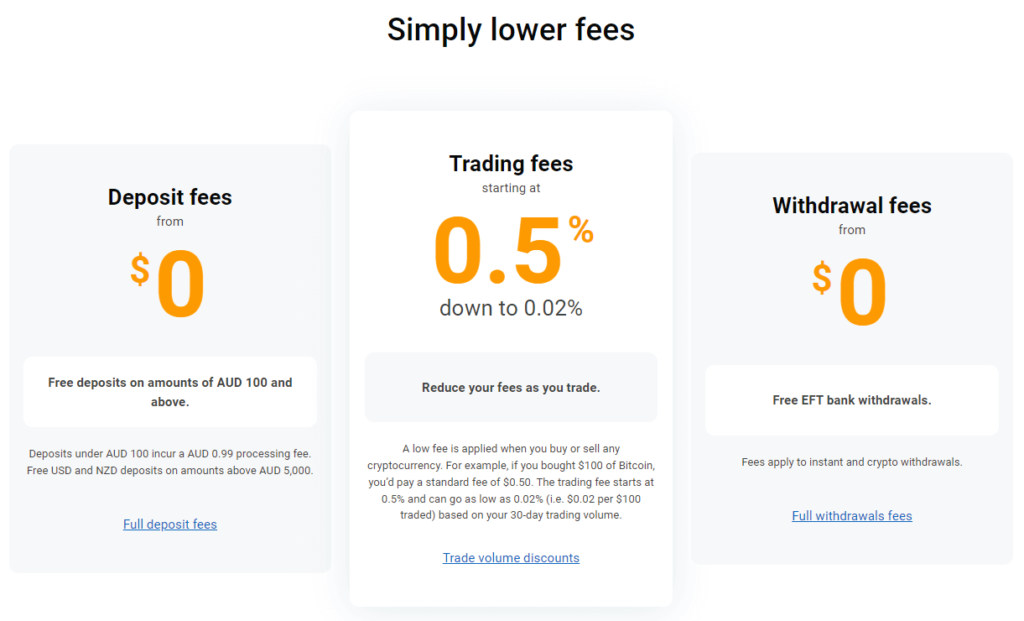

Deposit and withdrawal fees

You can fund your account using any one of the supported methods for free, as long as the deposit amount is greater than $100 otherwise a $0.99 processing fee will apply for Australians. Although minor, the processing fee of $0.99 is not much to worry about since most users are likely to deposit more than $100 at a time. Cash withdrawals using EFT are also free.

Fees to buy and sell crypto

Independent Reserve has some of the lowest crypto trading fees in Australia. Their trading fees are based on a tiered structure that starts from 0.5%. As seen below, depending on your 30-day trading volume, these can reduce to as much as 0.02%. The more you trade, the less you are charged.

Despite being an older exchange, Independent Reserve has managed to maintain value for money with its competitive trading fees. In Australia, trading fees to buy and sell crypto typically range between 0.1% and 1%, depending on if you go with a local or global exchange. This makes Independent Reserve quite attractive as a local crypto exchange. The below table compares Independent Reserve’s trading fees against other commonly used platforms.

| Crypto Exchange | Starting Trading Fee |

|---|---|

| Independent Reserve | 0.5% |

| Swyftx | 0.6% |

| Digital Surge | 0.5% |

| CoinSpot | 1% |

| CoinJar | 1% |

| BTC Markets | 0.85% |

| Binance Australia | 0.1% |

Tax calculator fees

Independent Reserve has partnered with KPMG to offer crypto tax summaries for End of Financial Year reporting. Fees to use the service range from $4.95 to $199.95, depending on how many crypto trades you executed during the financial year.

| Number of Crypto Trades | Fee |

|---|---|

| < 20 trades | $4.95 |

| < 200 trades | $29.95 |

| < 1,000 trades | $59.95 |

| > 1,000 trades | $199.95 |

Creating & Funding Your Account

The account creation process is pretty straightforward. Since Independent Reserve is registered with AUSTRAC, it means that you will need to verify your identity so that they comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. We were able to complete the Know-Your-Customer (KYC) process in 6 minutes by submitting a photo our drivers licence.

Independent Reserve supports some of the most popular deposit and withdrawal methods. You can make deposits using bank transfer, SWIFT, Xfers, and PayID, all of which have varying charges depending on your country of residence.

For Australians, you can deposit AUD funds into your account for free as long as the amount is more than $100. Anything less and a $0.99 processing fee will apply. PayID and OSKO deposits take less than 24 hours to be processed and come with a daily limit of $20,000. Bank deposits are processed within 1 – 2 business days, while SWIFT deposits could take up to 3 days to be reflected in your account. If you’d like to increase your deposit limits, you can put in a request with the support team.

Withdrawals can be made using Xfers, bank accounts, NPP Instant AUD, and cryptocurrencies.

The Crypto Trading Experience (This is what we noticed)

First-time users can easily buy Ethereum with AUD thanks to the Buy/Sell feature at the top of the page. Digital assets that you buy are near-instantly transferred into your multi-token wallet for safekeeping.

However, that’s where the convenience and innovation stops.

Independent Reserve provides a basic trading interface that is suitable for beginners or those who are starting to read real-time charts and order books. Even in its basic state, the design of it gives it a cumbersome feel with a lack of functionality. For example, the order books, simple price chart, and market depth charts are presented separately and in a manner that requires to scroll down to see them. Of course, at least the order books are there so you can assess the spread and volume of a trading pair – some local exchanges do not provide this.

The area where Independent Reserve falls over the most is the lack of a modern charting package. The price action of crypto trading pairs are plotted on a simple graph and can be shown as candlesticks. There are no analytical indicators or drawing tools to analyse the price action further. Newer crypto platforms such as Swyftx and Digital Surge provide TradingView charting and its full suite of tools. The latter provides the option of using a basic or advanced (TradingView) charting interface.

Under the ‘Trade’ page, you can utilise several limit orders to your crypto purchasing, including:

- Market Buy

- Market Sell

- Limit Buy

- Limit Sell

- Stop Limit Buy

- Stop Limit Sell

You can also see all market orders irrespective of the fiat currency they are listed with.

Customer Support Could Be Improved

The customer support structure at Independent Reserve could use an upgrade. To help you with the most common question, they have an FAQ section that tackles the majority of issues. You can, however, reach the team via email only. There is no 24/7 live chat bot to help with immediate queries, nor is there any phone support.

Are There Independent Reserve Alternatives?

Independent Reserve was one of the first platforms to start offering cryptocurrency exchange services to the Australian markets. It currently has more than 200,000 users and has now grown to accommodate global investors.

This platform has a variety of impressive features to invest in crypto, but it may not be the best for expert traders. It’s, however, very safe and has the most popular cryptocurrencies.

If after reading this Independent Reserve Review you feel it doesn’t meet your investment needs, we recommend that you check our reviews on Swyftx, Digital Surge, CoinSpot and CoinJar. If you’re looking for an exchange with a massive list of crypto, then check out our review on CoinStash too.

We even did a comparison on Independent Reserve and Swyftx, which is a popular choice for Australians that want to get started with crypto.

Our Final Verdict

Independent Reserve has established itself as one of the most reliable and trusted crypto trading platforms available to Australians. And it is easy to see why. The company has placed a strong emphasis on being a legitimate exchange that adheres to all regulations. This includes its approach to security and safeguarding customer assets and funds.

In terms of features, Independent Reserve offers the basics but experienced investors and crypto-savvy enthusiasts will feel left out. The platform is suitable if you want to buy and hold Bitcoin and other major currencies, but there is no interest-earning features to grow your portfolio. Despite its shortcomings, Independent Reserve really shines when it comes to crypto SMSF accounts and high-volume trading.

Frequently Asked Questions

Margin trading on Independent Reserve is not supported. Instead, you can perform spot trades with over 30 cryptocurrencies such as BTC and ETH with AUD, USD, NZD, and USD as the base fiat currencies. If you want to trade crypto with leverage, then you will need to seek a top-rated margin exchange that is available to Australians.

Over its 9 years of providing crypto services, Independent Reserve has demonstrated itself to be a trustworthy and reliable exchange to buy and sell cryptocurrencies in Australia. The legitimate platform has not been hacked or reported any security breaches. This can be attributed to its bank-like security controls and ISO 27001 accreditation. Independent Reserve is trusted by over 250,000 investors and traders and holds 8,000 SMSF accounts.

Independent Reserve offers basic apps for Android and iOS mobile devices which support most of the desktop features. These include buying and selling 30+ digital currencies using AUD, USD, SGD, and NZD. However, some features such as viewing simple charting are not supported.

For more information about the best Australian mobile apps for crypto, you can read our detailed review.

Best Independent Reserve Alternatives & Comparisons

If after reading this Independent Reserve Review you feel it doesn’t meet your investment needs, we recommend that you check our reviews on Swyftx, Digital Surge, CoinSpot, Coinstash, and CoinJar. These crypto exchanges and platforms are local, and provide similar features.

You can also check out our Independent Reserve comparisons below:

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.