CoinSpot vs. CoinJar: Which Is Better For Aussies?

Last Updated on December 24, 2023 by Kevin GrovesIf you’re reading this article, then you’re probably trying to decide between two of the best crypto exchanges to buy crypto in Australia, CoinSpot and CoinJar. Both were founded in 2013, however, they have taken different paths through the Australian crypto market. As such, the services and features that they offer differ. Do you know what they are?

In this review, we compare CoinSpot and CoinJar to see how they differ in their products, services, and features to assist you in your decision-making process.

The Bottom Line

CoinSpot and CoinJar are uniquely different in the features and services they offer to Australian crypto investors and traders. For most Australians, CoinSpot is the better option due to its feature that caters to a broad audience, especially those who prefer to buy and hold their assets over the long term. Beginners and experienced investors alike will benefit from its vast range of altcoins to buy, interest-earning wallets, NFTs, and the peace of mind that comes with its strong security track record.

However, if you’re after a world-class crypto debit card from a local exchange, then you can’t go wrong with the Coinjar Card. The low-fee card integrates nicely with the mobile app where you can spend your crypto at Mastercard retailers.

Winner: CoinSpot 🏆

Website: www.coinspot.com.au

Referral Code Get ($10 free): See the CoinSpot referral code instructions.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

CoinSpot vs CoinJar: Comparison Table

| ||

|---|---|---|

| Exchange | CoinSpot | CoinJar |

| Fiat currencies | AUD | AUD, GBP |

| Number of crypto | 370+ | 53 |

| Deposit methods | Bank transfer, POLi, PayID, BPAY, cash deposit, credit/debit cards | BPAY, PayID, NPP, bank transfer (OSKO), crypto |

| Deposit fees | Free except BPAY (0.9%), cash deposits (2.5%) | None |

| Maximum trading fees | 1% (flat) | 1% using cash, 2% using credit card |

| Withdrawal fees | None | None |

| Interest-earning wallet | Yes | No |

| Markets | Spot | Spot |

| Mobile app | Yes (iOS and Android) | Yes (iOS and Android) |

| Support | Live chat, email | |

| Verdict | ||

| Review | CoinSpot Review | CoinJar Review |

CoinSpot Overview

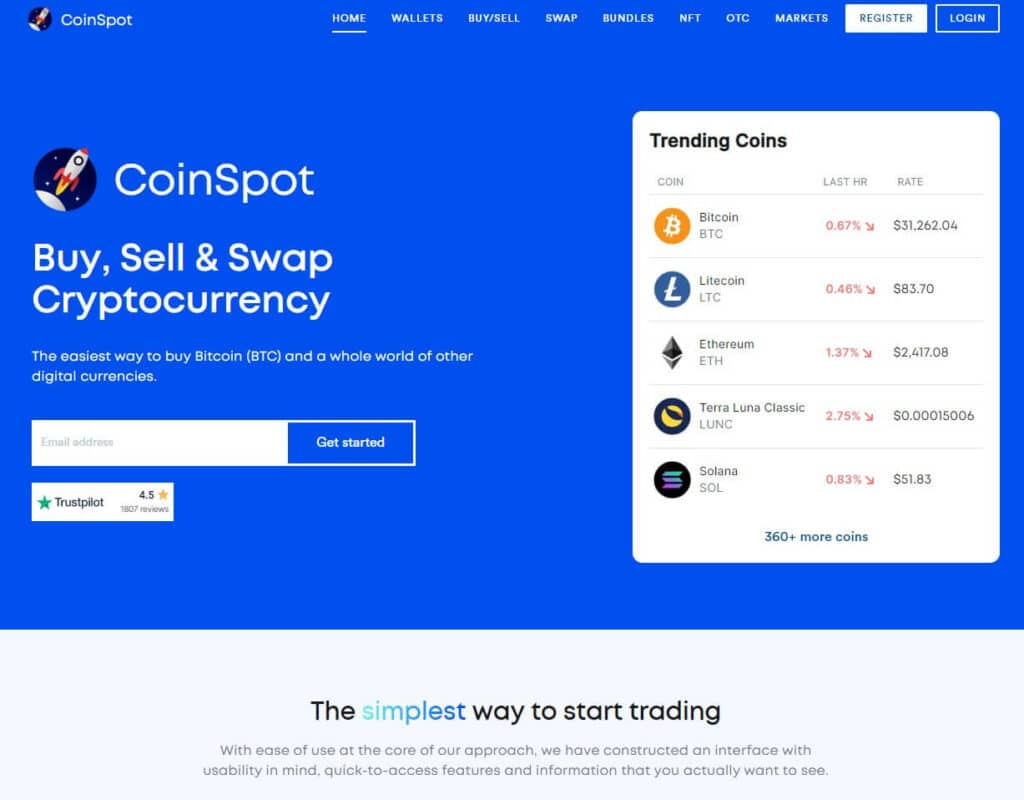

If you’re reading this article then chances are that you already know about CoinSpot. The Melbourne-based cryptocurrency platform was established in 2013, making it one of the oldest places to buy Bitcoin in Australia. Since then, over 1 million Australians have decided to invest in digital currencies with CoinSpot.

CoinSpot’s solid reputation as a reliable provider of cryptocurrency services precedes itself. It has a strong security track record and is compliant with the requirements of the internationally recognised ISO 27001 accreditation for information security management systems. The company’s emphasis on regulatory compliance and robust security has enabled it to gain trust in the crypto community.

CoinSpot provides an easy-to-use gateway to digital assets. With over 370 cryptos to buy, trade, and sell, the selection is one of the largest in Australia. Apart from convenient payment options, CoinSpot’s features cater to a crypto trading philosophy that is common in Australia, that is, buy and hold. You can buy crypto in a variety of ways that suit you and your trading strategy, but there are also features to passively grow your portfolio afterward.

CoinSpot Pros:

CoinSpot Cons:

CoinJar Overview

Established in the same year as CoinSpot, CoinJar has taken a different route with its products and services. Although CoinJar doesn’t have the commercial and public exposure that CoinSpot has, it has still managed to amass an impressive customer base of over 600,000 investors and traders who have easy access to 53 high-market-cap digital currencies including Bitcoin, Ethereum, and Cardano.

CoinJar has leveraged itself a unique position in the Australian market with its innovative crypto debit card. The CoinJar Card is one of the best Australian crypto debit cards available on the market and works simultaneously with the mobile app.

CoinJar Pros:

CoinJar Cons:

CoinSpot vs CoinJar: Deposit Methods

Simply put, CoinSpot provides more deposit options to fund your account with cash. These include payment methods are that commonly available in the Australian crypto market including bank transfers, POLi, BPAY, PayID, cash deposits to buy crypto via Blueshyft, and cryptocurrencies from an external wallet. Although not strictly an account funding method, CoinSpot also allows you to directly buy crypto with a credit card. This is an advantage as CoinJar does not support the use of credit cards, however, there are certain limitations which include a $200 limit.

CoinJar provides support for almost all of the methods that CoinSpot allows, with the exception of POLi and credit/debit cards. Despite having fewer account funding options, CoinJar’s selection should still suit the majority of Australians with bank transfers and BPAY.

| Deposit Method | CoinSpot | CoinJar |

|---|---|---|

| Bank transfer | Yes | Yes |

| POLi | Yes | No |

| BPAY | Yes | Yes |

| Cash deposit (Blueshyft) | Yes | Yes |

| Credit/debit cards | Yes | No |

| Cryptocurrency | Yes | Yes |

Winner: CoinSpot 🏆

CoinSpot supports almost all account funding methods available in Australia. There are five ways to deposit AUD and credit/debit cards are supported to make direct crypto purchases. On the other hand, Coinjar is slightly more restricted with the lack of support for POLi and credit/debit cards.

CoinSpot vs CoinJar: Products & Services

CoinSpot and Coinjar are quite different in their products and services which means they target differing audiences. The section below summarises the similarities and unique features of both platforms.

Range of cryptocurrencies

With 370+ supported digital currencies, CoinSpot has almost 7 times more crypto to buy and sell then CoinJar’s limited selection of 53 assets. Whilst almost all of CoinJar’s assets consist of popular and high market cap coins and tokens such as Bitcoin and Ethereum, you can find all of them on CoinSpot, plus78& more. Examples of altcoins available on CoinSpot and not on Coinjar include Near Protocol (NEAR), BItcoin Cash (BCH), ApeCoin (APE), Decentraland (MANA), Iota (MIOTA), PancakeSwap (CAKE), and Neo (NEO).

If you’re into unique or exotic altcoins then CoinJar simply isn’t for you.

Buy crypto in bundles

Both CoinSpot and CoinJar allow you to buy multiple digital currencies at a time through their crypto bundle features. CoinSpot offers 12 bundles to choose from compared to CoinJar’s 10, however, they are fairly similar. At the end of the day, we found no significant advantage from either platform. Both platforms don’t offer the ability to create your own bundle or customise the existing ones.

Support for crypto super funds

Like many Australian crypto exchanges, CoinSpot and CoinJar allow you to use your Self-Managed Super Fund (SMSF) to invest in crypto. The onboarding process appears to be relatively similar where you would need to submit information about the Trustees and members, Trust Deed, and commercial details of the Trust. Since CoinJar has higher trading fees, CoinSpot is the better option if you want value for money in building your retirement portfolio. In fact, it is one of the best places for crypto SMSFs in Australia.

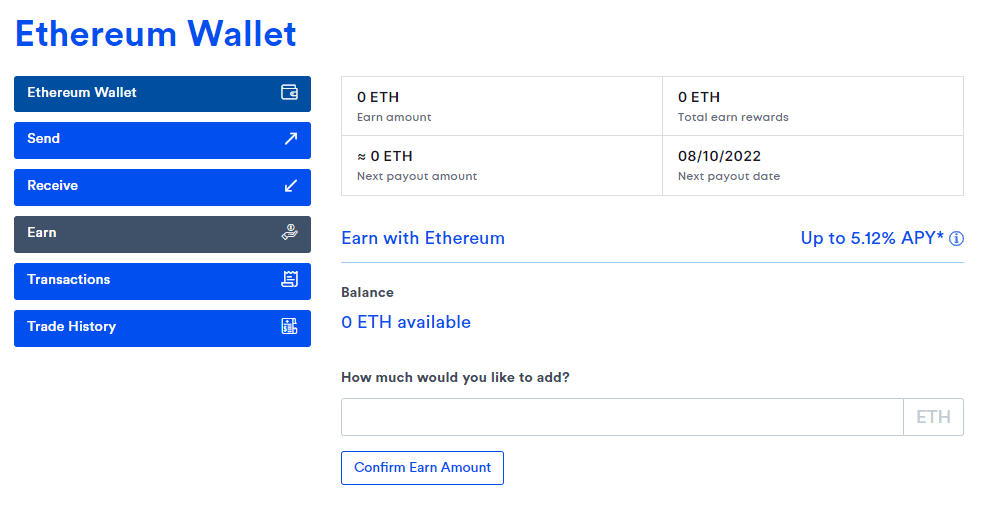

Earn crypto interest on CoinSpot

The key feature that CoinSpot has over CoinJar is its Earn function where you can earn interest on a selection of crypto of up to 78% Annual Percentage Yield (APY). At the time of writing, you can earn interest yields on 21 popular digital currencies including Bitcoin, Ethereum, Solana, Polygon, and Binance Coin. Rather than leave your crypto in your wallet waiting for its value to increase, you can place them into the Earn wallet to generate a passive income.

Although CoinSpot’s interest rates are quite similar to the likes of other interest-earning wallets such as Swyftx, navigating and using the Earn feature will be cumbersome to most. Instead of having a central location where you can deposit crypto to earn interest, CoinSpot has individual wallets for each supported coin, which proved to us as slightly annoying to use.

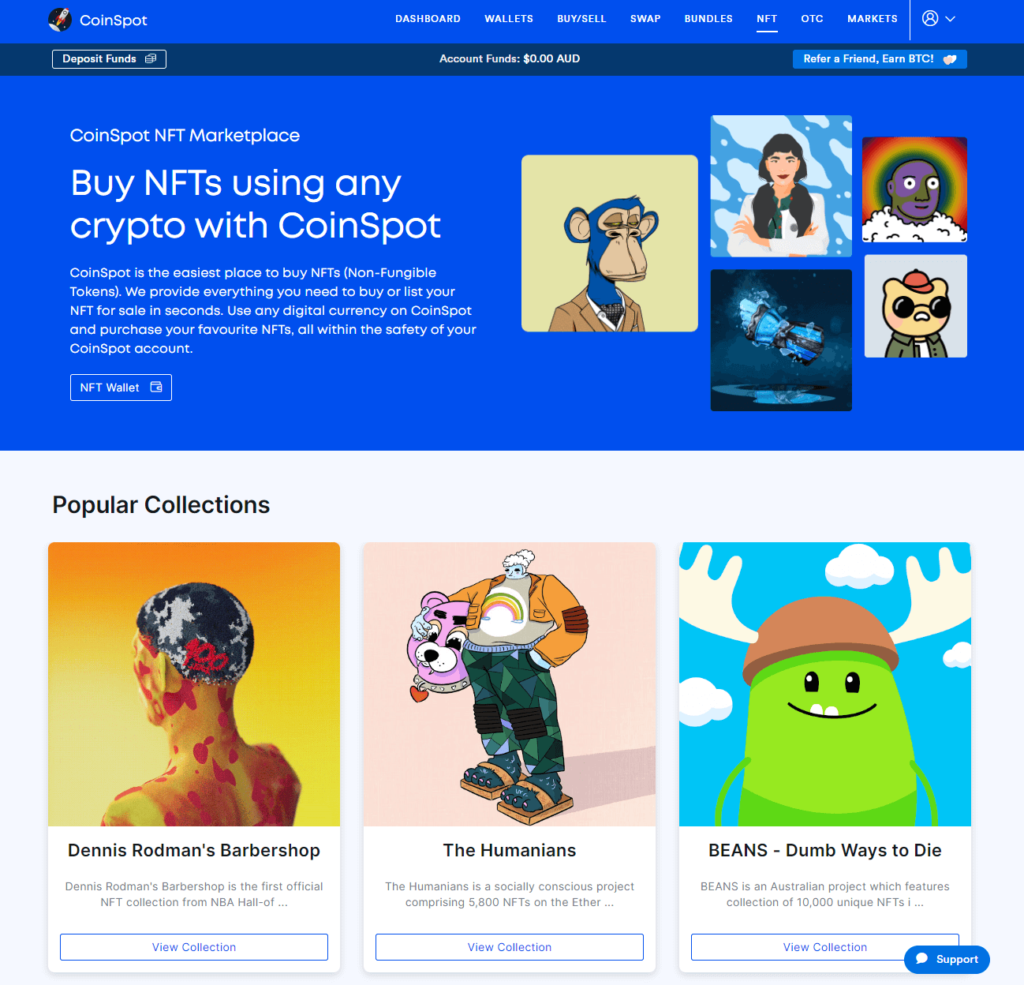

Buy NFTs on CoinSpot

If you’re into Non-Fungible Tokens (NFTs), then CoinSpot is your only option. You can buy or sell digital artworks and collectibles on the NFT marketplace which is steadily growing. However, the collection is not as exhaustive as the global exchanges that provide NFT marketplaces such as Bybit and Binance Australia.

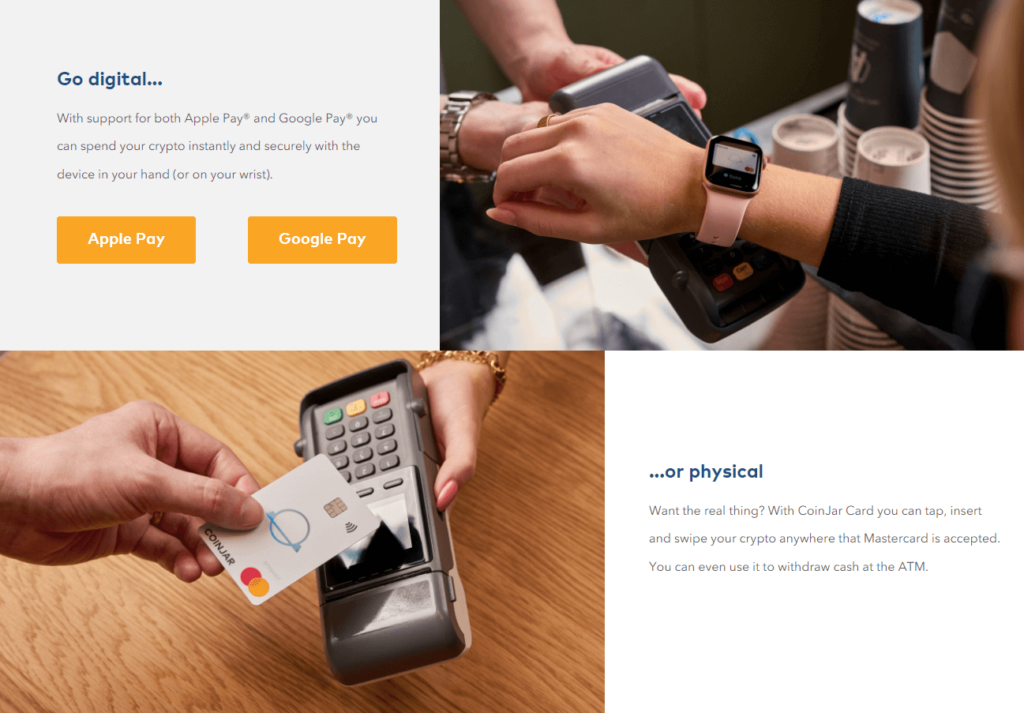

The CoinJar Card

The CoinJar Card is the differentiating factor between CoinJar and CoinSpot. This is not only because CoinSpot doesn’t have a crypto debit card, but the features that the CoinJar Card provides make it one of the best crypto debit cards on the market. So much so, that Australians are likely to use CoinJar simply for the CoinJar Card with an increasing number of merchants accepting Bitcoin in Australia.

It doesn’t cost much to use the CoinJar Card. It has no annual fees and it is completely free to set up. The card works by converting the crypto in your account wallet to enable purchases at in-store or online retailers that accept Mastercard.

Winner: CoinSpot 🏆

For everyday Australian investors or traders, CoinSpot has more diverse and superior features. This is because CoinSpot caters to a broader audience than CoinJar, especially those who prefer to buy and hold digital currencies. There are a lot more cryptocurrencies to buy, and you can grow your portfolio by earning interest payments.

Compared to CoinSpot, CoinJar’s features are more limited. However, if you’re looking for a debit card to spend crypto, then you should choose CoinJar.

CoinSpot vs CoinJar: Ease of Use

CoinSpot and CoinJar share similar user interfaces, which comes as no surprise since they were both established in 2013. Once you log in, both interfaces feel uncluttered with clear and concise buttons to navigate to each of their features and account management services.

Both CoinSpot and CoinJar take on the traditional user interface where each major function is separated on individual pages. You can get an overview of your portfolio on the ‘dashboard’ page and account funding methods are easy to find. Their respective mobile apps resemble desktop versions and are equally easy to use.

Winner: Tie

The user interfaces of the desktop and mobile apps of CoinSpot and CoinJar share a lot of design similarities, and hence are equally easy to use. Beginners with little or no experience buying cryptocurrencies with money should be able to quickly understand how each platform works.

CoinSpot vs CoinJar: Fees

CoinSpot will charge you minor fees to deposit AUD funds into your account depending on the method you choose. For BPAY and cash deposits made at a Blueshyft supporting news agency, expect to see a 0.9% and 2.5% fee, respectively. Deposits made using these methods on CoinJar are free. Fee similarities between the two platforms arise with bank and crypto transfers which are free.

At first glance, the fees to directly buy crypto using a credit card on CoinSpot (2.58%) and CoinJar (2.50%) may seem excessive, however, they are actually quite competitive in the Australian market.

| Deposit Method | CoinSpot Fee | CoinJar Fee |

|---|---|---|

| Bank transfer | None | None |

| POLi | Yes | Not supported |

| BPAY | 0.9% | None |

| Cash deposit (Blueshyft) | 2.50% | None |

| Credit/debit cards | 2.58% | 2% |

| Cryptocurrency | None | None |

In terms of trading fees, CoinSpot and CoinJar are both expensive if you use their respective Instant Buy/Sell features. They carry the same fee of 1% which is rather high compared to other popular platforms in Australia where you can get cheaper fees of around 0.5% to 0.6%.

If you are familiar with placing market orders on an exchange, then using either platform will not be more expensive than the other. CoinSpot and CoinJar offer similar maker and taker fees which are a maximum of 0.1%.

- CoinSpot: 0.1% (maker) and 0.1% (taker)

- CoinJar: 0.1% (maker) and 0.0% (taker).

With the exception of taker orders made on CoinJar (where a transaction is executed and removes liquidity from the exchange), trading fees are the same. However, if you’re a high-volume trader then CoinJar would be the better option due to its tiered structure. Depending on your 30-day trading volume, maker fees can reduce to as low as 0.04% if you trade more than $10 million.

Winner: CoinJar 🏆

Despite having a lot of similarities in their fees and charges, CoinJar is the more economical option. The combination of fewer fees or no fees to deposit AUD funds as well as the tiered structure of maker and taker fees on CoinJar Exchange presents slightly better value for money for beginner and experienced traders alike.

CoinSpot vs CoinJar: Markets & Trading

The trading interfaces for both CoinSpot and CoinJar are fairly similar and suited for beginners, yet contain a number of differences that you should be aware of.

Since CoinSpot and CoinJar are Australian digital asset platforms, only spot markets are supported due to government regulations. Advanced trading markets such as margin and derivatives are not available and you’ll need to use a global crypto exchange to access these markets.

With over 370+ digital currencies to buy on CoinSpot, there is simply more AUD trading pairs than CoinJar. Both platforms provide ‘Instant Buy/Sell’ features where you can quickly buy crypto in just a few clicks.

CoinSpot provides a simplistic interface that integrates with the powerful TradingView charting package and its suite of advanced analytical drawing tools and indicators. This means that you are able to learn the ropes of analysing the price action of cryptocurrencies against the Australian Dollar. A notable absence is the order books. Whilst you are unable to assess the trading volume or spread of a digital asset, it means that beginners are less likely to be confused by a feature that more experienced traders will use.

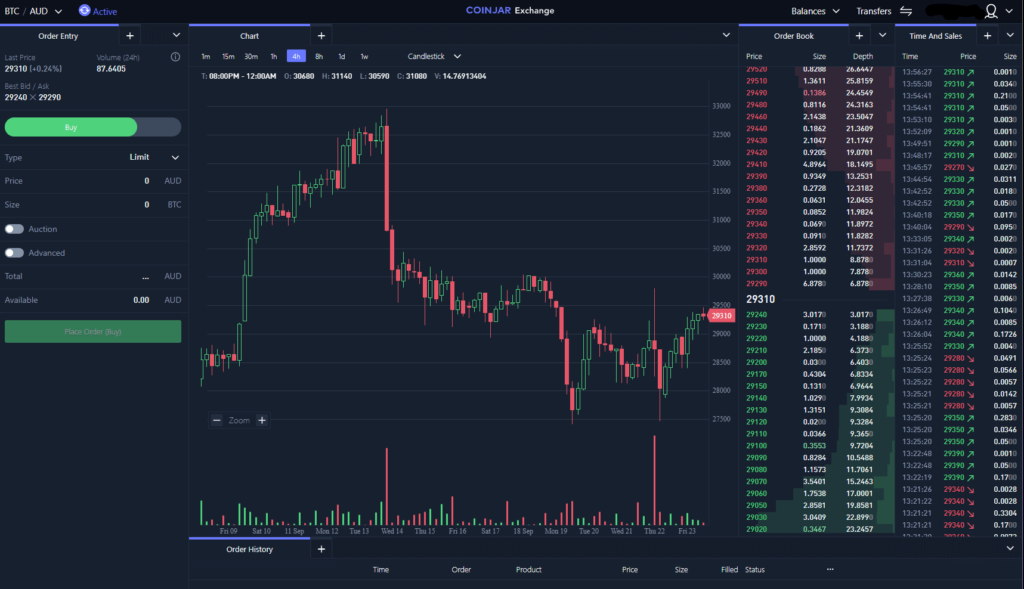

On the other hand, the interface of Coinjar Exchange resembles a trading interface of a global crypto exchange. But some elements have been simplified to cater to a broader range of traders. Unlike CoinSpot, TradingView charts are not provided and a simplified plot of the market price of crypto is presented. The order books are presented on the right side of the interface. One of the advantages that CoinJar Exchange has over CoinSpot is the ability to conduct coin-to-coin trades.

Winner: Tie

With so many differences between the trading features and experiences offered by CoinSpot and Coinjar, choosing between the two really comes down to what you’re looking for in an exchange. If you need the tools to identify suitable trades across a wide variety of AUD trading pairs then CoinSpot is your option, however, you can’t place orders to exchange one coin for another. If you don’t mind using a simplified charting package then CoinJar may be suitable.

CoinSpot vs CoinJar: Mobile Apps

During our testing, we found the CoinSpot and CoinJar apps for iOS and Android devices to be serviceable and functional. The apps aren’t the most refined compared to the best mobile apps for crypto that are typically provided by global exchanges, but they allow you to easily access all their respective features. One thing to note, is that the CoinJar mobile app is a necessity if you apply for the CoinJar Debit Card.

Winner: Tie

The mobile apps provided by CoinSpot and CoinJar allow you to access all of their respective features, services, and contact customer support. Both apps are clean and functional.

CoinSpot vs CoinJar: Customer Service

CoinSpot’s customer support is fairly impressive, although it doesn’t quite reach the heights of Swyftx. If the FAQ page doesn’t solve your query then you can reach them through support tickets or via the live chatbot on the website. The feature is only active between 9 am-6 pm on weekdays and 10 am-8 pm on the weekends, Melbourne time.

In comparison, reaching customer support on CoinJar can only be achieved using a ticketed email system during business hours on weekdays. There is no 24/7 live chatbot available on the website and phone assistance is not supported. It should be noted, that, unlike CoinSpot, the ticket system won’t provide a response on weekends.

Winner: CoinSpot 🏆

CoinSpot has a superior customer service experience where you get in touch with their local service team via the ticket system or through the live chatbot which is available for limited times on weekends. Avenues to customer support on CoinJar are limited to a ticket system.

CoinSpot vs CoinJar: Security

Based on our research, CoinSpot and Coinjar have not been hacked or reported any breaches in its security framework for nearly a decade.

At organisational level, CoinSpot and CoinJar share some similarities in how they protect your funds and digital assets from fraud and other financial crimes. These include the storage of 90% of all digital currencies at geographically isolated and offline locations. Coinjar has partnered with BitGo and Fireblocks to provide secure custodial services.

Other security features which are considered to be industry-standard, include:

- Multi-level data encryption.

- Regular external audits and penetration testing.

- Transport Layer Security (TLS) protocols.

- Multi-signature wallet withdrawals.

- 2-Factor Authentication (2FA) for desktop and mobile apps to provide an additional layer of account security.

A key difference, however, is the ISO 27001 accreditation for information security management systems that CoinSpot holds.

Winner: CoinSpot 🏆

Although there is no material difference between CoinSpot and CoinJar as both platforms have not been hacked since there inception, CoinSpot has ISO 27001 accreditation which means that it adheres to additional security measures to protect its data and sensitive information.

CoinSpot vs CoinJar: Comparison Outcomes

Based on our comparison review, CoinSpot is superior to CoinJar as its features cater to a broader audience. The popular platform provides a safe, regulatory-compliant, and easy-to-use way of obtaining a wider range of cryptocurrencies with AUD than you can with CoinJar, and the interest-earning opportunities it provides are very competitive. While CoinJar is an inferior alternative to CoinSpot, it still has an excellent choice of crypto if you want to HODL and grow your crypto.

| Comparison Criteria | Winner | Reason |

|---|---|---|

| Deposit Methods | CoinSpot | You have many more payment method options to fund your wallet with AUD. Credit cards are supported. |

| Products & Services | CoinSpot | Better overall features for the everyday crypto investor. |

| Ease of Use | Tie | The interfaces of both platforms are visually intuitive and easy to use. |

| Fees | CoinJar | Slightly cheaper exchange fees that can be reduced on trading volume. |

| Markets & Trading | Tie | Both have spot markets, but the trading interface depends on what you seek. |

| Mobile Apps | Tie | Both mobile apps are functional for their intended purposes. |

| Customer Service | CoinSpot | More ways of reaching customer support, including on weekends. |

| Security | CoinSpot | CoinSpot has international accreditations and world-class security systems in place. |

If you found this comparison between CoinSpot and CoinJar to be useful, here are other Australian crypto exchange comparisons to read next:

- Swyftx vs CoinSpot

- Coinspot vs Binance

- Coinbase vs CoinSpot

- CoinSpot vs Digital Surge

- CoinSpot vs eToro

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.