Best Crypto Debit Card Australia

Last Updated on January 31, 2024 by Kevin GrovesChoosing a crypto debit card can be a difficult task, but picking the right card is a smart way of relinquishing your digital currencies in exchange for everyday goods and services. With debit and credit cards for crypto becoming more mainstream, there are plenty of options for Australians to select from.

In this article, we pick out some of the top crypto debit cards that Australians have access to and rate them in terms of their value and performance. Our assessment is based on a detailed review of their features, maintenance fees, how easy they are to use, and whether their reward programs bring value for money.

Best Crypto Debit Cards In Australia

We have assessed over 20 cryptocurrency debit cards that are available to Australians and have picked out the top 4. These are the best cryptocurrency debit cards in Australia.

- CoinSpot Mastercard – Overall best crypto debit card for Australians

- Crypto.com Visa Card – Best crypto debit card for rewards

- CoinJar Card – Versatile local card with no annual fees

- Wirex Visa Card – Best crypto debit card for travellers

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Our Reviews Of The Top Debit Cards In Australia

Here are our reviews of the best Australian debit cards to get in Australia. All of these crypto cards allow you to spend your digital currencies, such as Bitcoin, at in-store and online retailers that support Visa and Mastercard.

1. CoinSpot Card – Best overall crypto debit card for Australia

- Rating: ★★★★★

- Supported Crypto: 360+

- Type: Prepaid Mastercard

- Mobile App Integration: Yes

- Rewards Program: No

- Annual Fees: None

In October 2022, CoinSpot released its new crypto debit card, the CoinSpot Card. Being a prepaid debit card, you need to ensure it is topped with the 360+ cryptocurrencies that are supported by the CoinSpot platform. One of the biggest pros is that CoinSpot is a top Australian cryptocurrency exchange that carries a reputation as a reliable, secure, and trusted provider of crypto services.

Activating the card can be done by logging into your CoinSpot account. Although any of CoinSpot’s 360+ assets are supported, you can only spend up to five assets at a time by selecting them in your multi-token wallet. The asset that you select first will be spent first as payments. If the balance runs out then the asset selected second will then be spent, and so on and so forth. When you make a transaction, the CoinSpot Card automatically makes an instant conversion to Australian Dollars (AUD) to pay for the item or service.

Based on our review of CoinSpot, we thought that the multi-token wallet was a bit clunky in design. However, navigating through the selected wallets to manage how your card is funded shouldn’t be much of a problem if you’re only using one or two digital currencies as payment.

The CoinSpot Card allows you to spend your crypto at in-store or online merchants in Australia that support Mastercard. Any one of CoinSpot’s 360+ supported digital currencies can be used as payment for goods and services including Bitcoin (BTC) and Ethereum (ETH). This feature will be useful to you if you have a diverse altcoin portfolio with CoinSpot as it gives you a supreme choice in which coin you want to relinquish.

CoinSpot has really rounded out its debit card by integrating it with Apply Pay and Google Pay. Depending on whether you have an iOS or Android mobile device, you can download Apple Pay or Google Pay onto your device to help ensure safe, secure, and contactless payments. Simply swipe your mobile device at the terminal and the transaction will take place (assuming your crypto funds are topped up).

CoinSpot customers who have successfully verified their accounts and enabled 2-Factor Authentication (2FA) are eligible for a CoinSpot Card. There are zero start-up fees and no annual fees to speak of which makes it incredibly economical and cheap.

However, you should be aware that topping up your card can get expensive if you’re using CoinSpot Instant Buy/Sell feature. This carries a hefty 1% fee per transaction and should be avoided by using the exchange (0.1% fee) or transferring crypto from an external wallet.

Despite being potentially cumbersome to manage four or five digital assets serving as payment choices, the card is fully integrated with the reliable CoinSpot mobile app. In addition to the lack of fees, the flexibility and choice that the CoinSpot Card gives make it our #1 debit card for crypto in Australia.

CoinSpot Card Pros:

CoinSpot Card Pros:

Read our full CoinSpot review

2. Crypto.com – Best crypto debit card for rewards

- Rating: ★★★★★

- Supported Crypto: 250

- Type: VISA prepaid

- Mobile App integration: Yes

- Rewards Program: Yes

- Annual Fees: None

Crypto.com offers one of the best and most popular crypto prepaid cards. Crypto.com is a global cryptocurrency exchange that is well-known for its suite of innovative products and services that are delivered through its cutting-edge mobile app.

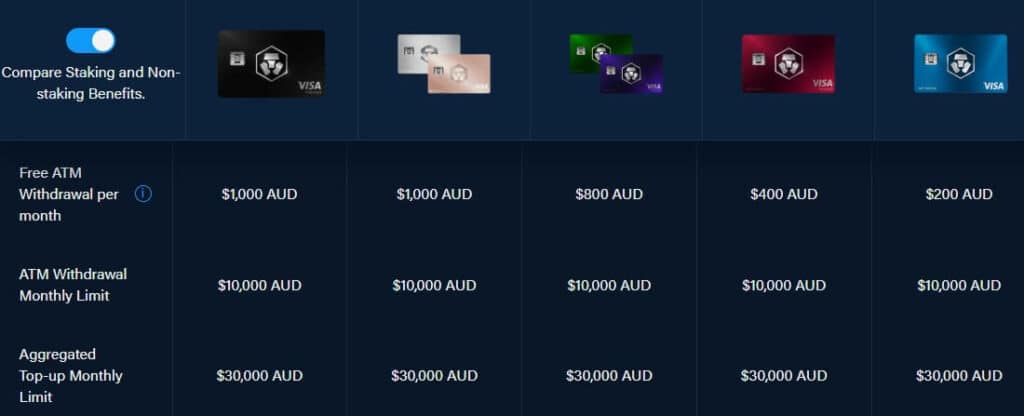

Rather than just offering one card to spend your crypto, Crypto.com allows you to choose from 5 card tiers depending on what your needs are. The entry-level card is the Midnight Blue where you don’t need to stake the platform’s native token, CRO, to obtain the best benefits.

However, the higher-level cards require you to stake CRO tokens for a minimum period of 6 months. For example, the third-tier cards, Royal Indigo and Jade Green (the same card but you can choose the colour), require you to stake $5,000 worth of CRO tokens to be eligible. This is quite the upfront investment and is a barrier to entry for beginners.

Despite the increased CRO staking costs with the higher-tiered cards, the rewards that you can obtain from them also increase. For a crypto debit card with no annual fees, the Crypto.com Visa card is certainly a top choice for its benefits. For example, you can get cashback rewards on every purchase you make. For a modest amount of $500 CRO tokens staked, you can earn 1% cashback with the Ruby Steel card and up to 5% with the Obsidian.

In addition to the cashback rewards, you can also get subscriptions to Spotify, Netflix, and Amazon Prime to name a few. However, the best pros come from the fourth and highest card tiers where you need to invest at least $50,000 in staking CRO tokens. To further add to the limitations, the second and third-tier cards have cashback limits of $25 and $50 USD, respectively.

The Crypto.com VISA card can be used to make purchases at online or in-store retailers that accept VISA. The card can be topped up using a fiat currency or by purchasing crypto through the Crypto.com mobile app, noting that fees will be charged for credit card purchases.

Overall, the Crypto.com VISA Card is a viable crypto debit card for Australians who want to be more flexible with their digital currencies. The card is fully integrated with the high-class mobile app that provides easy access to 250+ digital assets. Above all, Australian Dollars (AUD) are supported as a fiat currency so you don’t need to worry about currency conversion fees.

Crypto.com Card Pros:

Crypto.com Card Cons:

Read our full Crypto.com review.

3. CoinJar Card – Versatile local card with no annual fees

- Rating: ★★★★

- Supported Crypto: 50+

- Type: Prepaid Mastercard

- Mobile App Integration: None

- Rewards Program: Yes

- Annual Fees: None

If the CoinSpot Mastercard doesn’t satisfy you then the CoinJar Card is a great alternative. CoinJar is an Australian-owned and operated cryptocurrency trading platform that has been providing high-quality services since 2013. This means that Coinjar is registered with and regulated by AUSTRAC so you know that the platform does things by the book. CoinJar supports a rather modest list of 50+ digital currencies, however, all the major coins and tokens are supported including Bitcoin (BTC) and Ethereum (ETH).

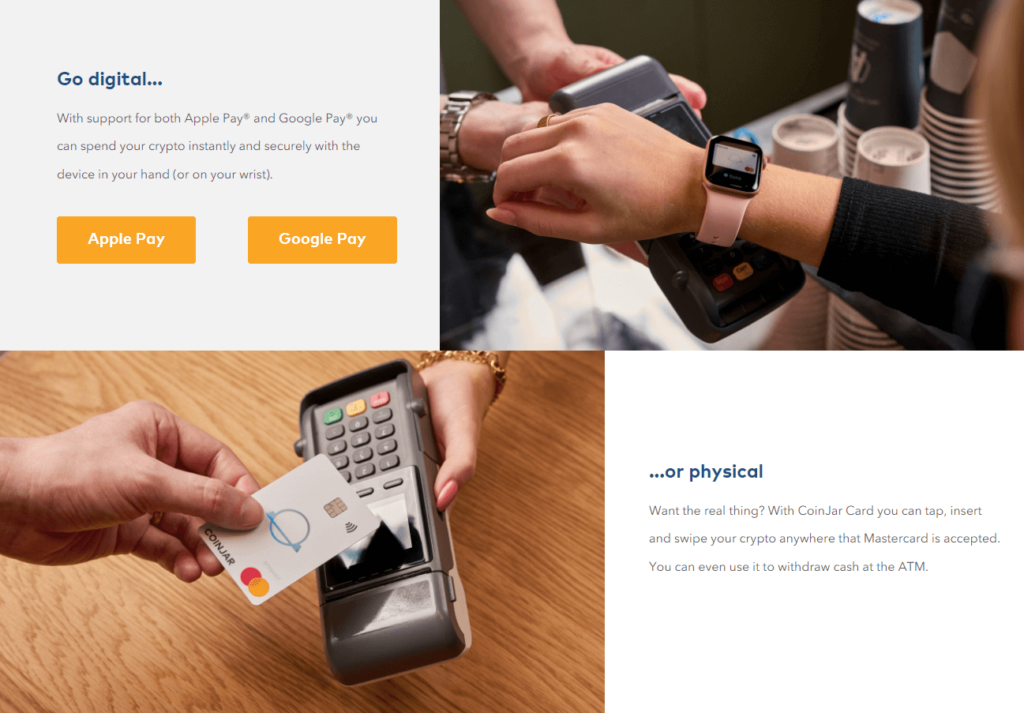

The Coinjar Card has been around for a long time and is one of the better debit cards to spend crypto. You can spend the digital assets that are being held in your Coinjar wallet at in-store or online retailers that accept Mastercard as payment. When you swipe your card (either physically or electronically through a device), Coinjar will automatically and instantly convert your crypto into Australian Dollars (AUD) using the best rates available. The major pro of using a local card that supports AUD is that there is no need to worry about currency conversion fees.

Like most other crypto debit cards, Apple Pay and Google Pay are supported. If you prefer to use a physical card rather than your mobile device, then you can request one free of charge. However, using the card through your mobile device is the best option due to its highly well-designed integration. You can immediately fund your card through the CoinJar mobile app, view previous transactions, and spending history, and change the PIN.

The fee structure for using the CoinJar Card is equally attractive. There are zero costs involved in setting up or requesting a physical card, and there are no monthly or annual fees. The fees that do apply include a 1% transaction fee that is returned through the rewards program, a respectable 2.99% for foreign transactions, and a 1% fee for using a physical card to withdraw AUD from an ATM.

All in all, the only fee worth considering is the 1% transaction fee as foreign transaction fees won’t apply unless you are overseas, and you can avoid the withdrawal costs by using the desktop platform.

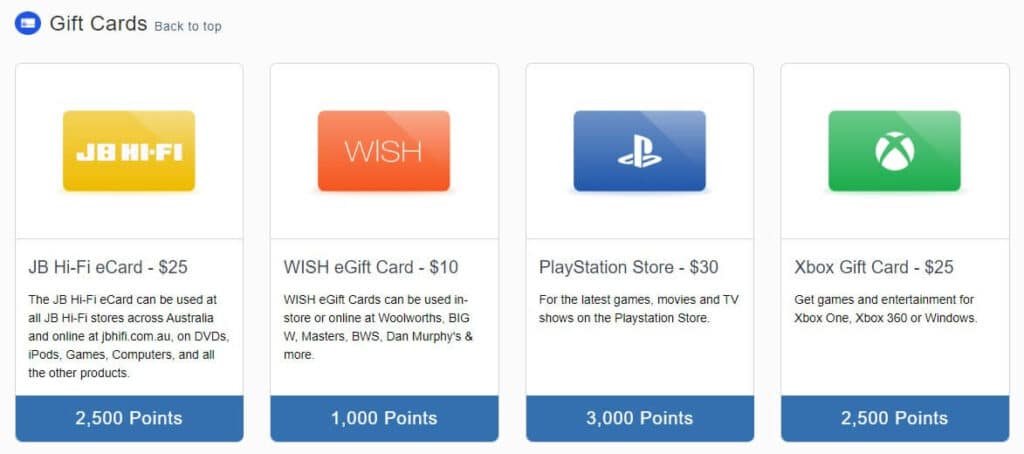

Coinjar has made their 1% transaction fee a bit more palatable by offsetting them with their in-house loyalty program. As you spend your crypto, you generate points that can be redeemed for a variety of rewards such as gift cards to buy BTC and ETH, discounts for popular crypto tax reporting software, and gift cards to popular Australian retail brands.

CoinJar Card Pros:

CoinJar Card Cons:

Read our full Coinjar review.

4. Wirex Card – Best crypto debit card for travellers

- Rating: ★★★

- Supported Crypto: 150+

- Type: VISA and Mastercard

- Mobile App Integration: Yes

- Rewards Program: Yes

- Annual Fees: None

The Wirex Card is a highly flexible multicurrency card that allows you to spend both cryptocurrencies and fiat currencies at retailers that accept VISA and Mastercard. The Wirex Card is used by over 4.5+ million crypto enthusiasts across 130 countries, and supports 150+ traditional and digital currencies, making it ideal for active travellers.

Some of the key features of the Wirex Card include real-time conversions during transactions which instantly translate into crypto rewards through its Cryptoback system. For every purchase at an online or in-store retailer, you will receive 2% in Wirex’s native token, the WXT. The credited WXT tokens are instantly transferred to your wallet. The Cryptoback program is a great way of passively earning crypto, however, we note that the program previously rewarded Bitcoin.

Although the Wirex Card is the first debit card on our list that supports VISA and Mastercard, the advantages don’t stop there. Using the modern and streamlined mobile app, you can instantly switch between fiat and digital currencies as the mode of payment, giving you top choice and flexibility. And since rates are based on their Over-The-Counter (OTC) service as well as interbank rates, there are no fees with advertised savings of up to 3%.

There are no charges for ATM withdrawals of cash, and although there is a $400 limit, this is moderately better than Crypto.com’s limit of $200. Similar to the rest of the debit cards on this list, there are no monthly maintenance fees.

If you’re a regular traveller then the flexibility offered by the Wirex Card should be highly appealing. With the wealth of fiat and digital currencies supported as payment options, the abundance of accepted countries, and the ability to make purchases in the local traditional currency without any exchange fees are the points of difference.

Wirex Card Pros:

Wirex Card Cons:

How Does A Crypto Debit Card Work?

Crypto debit cards allow you to spend your digital assets at in-store or online retailers on goods and services. They work by automatically converting your crypto into the local fiat currency, e.g. AUD, at the time a transaction is made. Most debit cards can be used at payment terminals that accept VISA and Mastercard.

Pros & Cons Of Using Australian Crypto Debit Cards

Advantages:

Disadvantages:

How To Pick A Crypto Debit Card

Selecting the right crypto debit card for you can be difficult due to the wide variety of options available in Australia. Before you pick a crypto prepaid cards, you should consider these important factors.

- Low or no fees: A crypto debit card with no monthly or annual maintenance fees is ideal. Luckily, most crypto prepaid cards available in Australia don’t come with these charges. However, ATM withdrawal fees (and low limits) are more common. A local crypto debit card such as the CoinSpot Mastercard is best for you if you want to avoid foreign currency conversion fees as AUD will be a supported fiat currency.

- Cashback and redeemable rewards: Some crypto debit cards come with a rewards program where cashback is the most common type of reward. When you make a transaction, you will receive a percentage (usually 1% – 3%) back in a type of digital asset that goes straight into your wallet. Others will return points that can be redeemed later for a wide variety of goods and services such as coupons, discounts, and gift vouchers. Rewards programs offered by debit card providers vary a lot and some rewards may not be appealing or useful at all.

- Card funding: Whilst most crypto debit cards have little or no monthly or annual fees, the trading fees to top up your card can get expensive. This is where local Australian crypto exchanges have the advantage as AUD is always a supported fiat currency and conversion fees don’t apply. In addition, the global crypto exchanges may only bank transfers or credit card purchases of crypto that come with hefty fees. Since you have more options to buy digital assets from a local provider, the trading fees are generally lower.

- Supported digital currencies: The choice you have in deciding which of your digital assets you want to spend for goods and services will be influenced by the crypto that the debit card supports. Spending Bitcoin alone may not be favourable since most investors would want to see its value appreciate over time. Does the card support all the coins and tokens that you currently buy and invest in? And are you able to switch between the assets you want to spend?

- Is AUD a supported fiat currency: Australian Dollars (AUD) as a supported fiat currency is simply a must-have. If it isn’t, then you will be paying unnecessary currency conversion fees.

Frequently Asked Questions

Deciding to apply for a crypto debit card will depend on your investment strategy, how the card is funded, and whether the fees will be worth absorbing. Rather than selling Bitcoin for AUD, spending it can be a useful way of easily relinquishing it in exchange for goods and services.

The Australian Tax Office (ATO) regards cryptocurrencies as assets or property. When digital assets such as Bitcoin are sold or exchanged for goods and services, a capital gains event is triggered. This is a taxable transaction that must be reported. Having said that, all gains and losses from the use of your debit card should be included in your tax return.

For more information regarding the taxation of cryptocurrencies in Australia, you can read our guide.

The Australian Tax Office (ATO) is unable to track the individual transactions you make using your crypto debit card. Since the selling of crypto for goods and services may trigger a capital gains event, transactions may be subject to Capital Gains Tax (CGT). All transactions made should be reported to the ATO.

Whilst the ATO will be unaware of crypto debit card purchases prior to tax reporting, they will be aware of cryptocurrency transactions you make on exchanges, brokerage platforms, third-party payment providers, and other crypto-related businesses. This is due to a data-matching program that was launched in April 2019 between the ATO and Australian-based Designed Service Providers (DSPs). As such, the ATO can compare this data against the information lodged in your tax reporting.

Yes, in October 2022 CoinSpot released its new CoinSpot Card. The debit card allows you to spend your crypto at any in-store or online retailers that accept Mastercard. Any of CoinSpot’s 360+ supported assets can be used as payment, however, you can only select five in your wallet at a time. There are no annual fees and it’s completely free to set up for verified users.

Conclusion

Choosing a debit card to spend on cryptocurrencies in Australia can be a difficult task as you’ll need to find one that suits your investment strategy and everyday spending needs. Prepaid crypto cards are becoming more mainstream and readily available.

However, you should be aware of the value that each debit card brings as well as its limitations. Generally, local Australian debit card providers will provide lower barriers to entry in terms of trading fees and ease of use. But global providers typically offer better ancillary features.

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.