Best No KYC Crypto Exchanges For Australians

Last Updated on January 31, 2024 by Kevin GrovesThe Know-Your-Customer (KYC) process is often regarded as an inconvenience or an invasion of privacy by those who prefer to remain anonymous. If you want to start buying digital currencies in Australia but don’t want to verify your identity.

Top Australian Crypto Exchanges Without KYC

Here is our list of the better cryptocurrency exchanges in Australia that don’t require you to submit any personal information to start trading.

Australian Crypto Exchanges Without KYC Reviewed

The sections below provide an overview of the best Australian crypto exchanges that don’t require you to complete KYC. Our opinions for each exchange have been informed by our first-hand experience using each demo account.

1. Bybit Australia – Best crypto exchange with no KYC

Bybit is an Australian crypto exchange that offers margin and derivatives trading to local residents. Bybit has quickly become a popular choice for crypto traders, boasting over 3 million weekly visits and 2 million registered accounts.

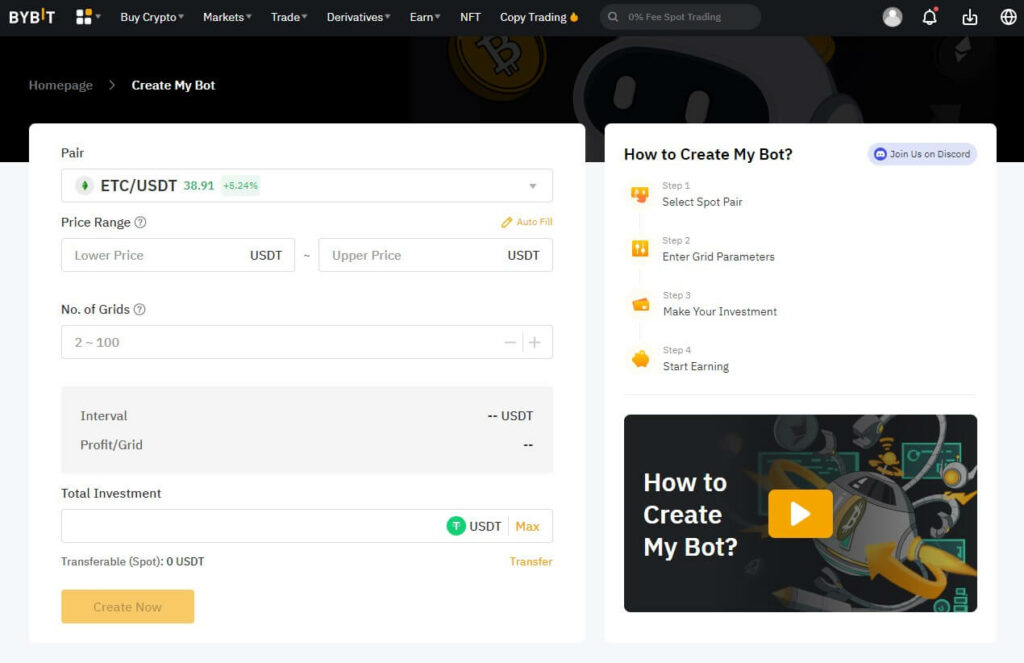

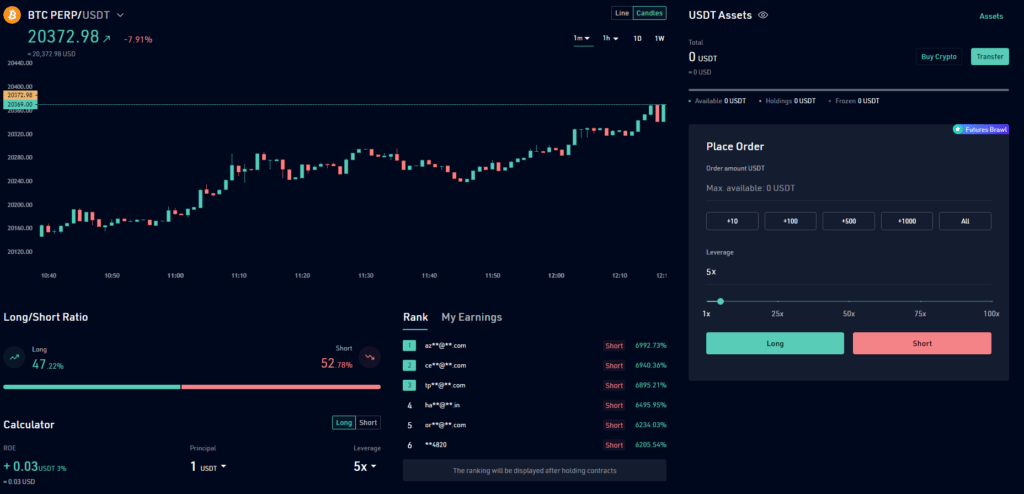

The Bybit Australia exchange offers a competitive advantage by providing low-cost derivatives and leveraging up to 100x on BTC and ETH trading pairs. You can easily engage in spot trading, leveraged tokens, perpetual contracts, copy trading, utilise trading bots, and take out crypto-backed loans without having to complete KYC.

In addition to the abundance of trading markets that are available without KYC, Bybit has trading fees for its spot and inverse perpetual and futures contracts that offer great value for money. For all spot trading pairs, maker and taker fees start at 0.1%. Maker and taker fees for its inverse perpetual and futures contract markets start at 0.06% and 0.01%, respectively. To put this into perspective, Bybit’s spot trading fees are the same as one of the other top crypto exchanges in Australia, Binance Australia. However, Binance is a bit cheaper for its derivatives markets.

To facilitate its trading markets, users can take advantage of its extremely fast and well-designed interface that comes equipped with TradingView charting. There is an in-built TradingView API so that you can customise charts to your liking with several indicators, stop losses and take profits can be easily arranged. You can also browse order book information and market depth in the interface.

Whilst you have unlimited deposits of crypto (AUD deposits are not possible), there are limits on withdrawals. The daily withdrawal limit for non-KYC accounts is $20,000 USDT or $100,000 USDT per month, both of which should be suitable for the majority of traders. One of the downsides to not completing your Bybit KYC is that you can’t buy digital currencies using a credit card or through the Peer-to-Peer (P2P) marketplace. This means that the only way of funding your no-KYC account is to transfer crypto from another wallet.

Apart from not being able to purchase cryptocurrencies, all of Bybit’s Earn products and its NFT marketplace are not available. Overall, nearly all of Bybit’s premium crypto services and features can be used without having to verify your identity. For more information, you can read our Bybit review.

Bybit Pros:

Bybit Cons:

2. KuCoin – Best no-KYC exchange for altcoin trading

KuCoin is a world-class crypto exchange that is an excellent alternative to Bybit, our number pick. Since KuCoin is not registered with AUSTRAC, you can start depositing and trading cryptocurrencies. However, you must complete the verification process to unlock certain features, including an increase to your withdrawal limit and futures trading leverage, as well as gaining access to the P2P platform.

Aside from the withdrawal limit and restriction on trading through the P2P marketplace, nearly all of KuCoin’s suite of innovative features are available for Australians to take advantage of. With more than 800 supported coins and tokens across over 1,400 markets, KuCoin is an ideal place to buy altcoins anonymously.

KuCoin’s list of altcoins can be traded on its spot (with up to 10x leverage) and margin trading interfaces, primarily against Bitcoin and USDT. Whilst there are only 9 fiat-crypto trading pairs (BRL, GBP, USD, and EUR only), there are no trading pairs with Australian Dollars.

As detailed in our KuCoin review, traders also have access to its perpetual and leveraged token contract trading. All the features of a top-tier trading interface are provided including TradingView charts, hundreds of indicators and drawing tools, market depth, an order book and your trading history summary.

You can trade crypto anonymously on KuCoin knowing that you are getting value for money. Similar to Bybit, its spot trading fees come in at 0.1% for maker and taker orders. Maker and taker fees are not too dissimilar where they start at 0.02% and 0.06%, respectively. Take into account the significant liquidity that the exchange provides and KuCoin becomes a viable place to trade altcoins with no KYC.

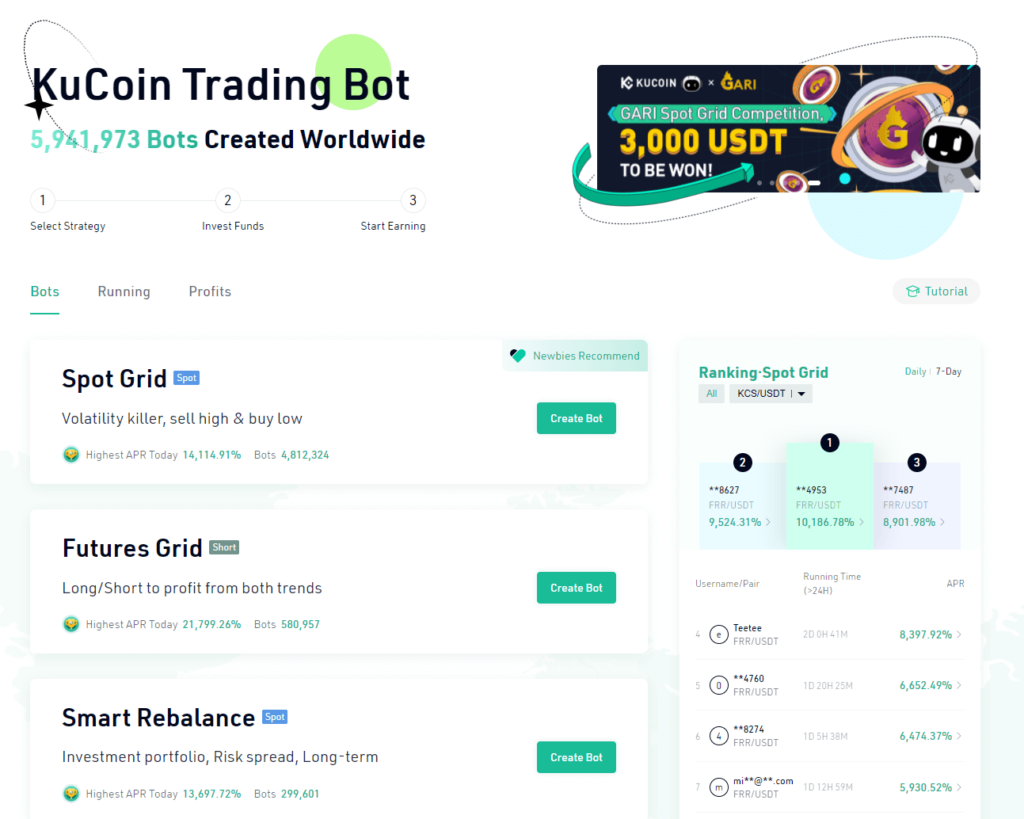

One of the pros of using an unverified KuCoin account is having access to its free trading bots. If you want to automate your day-to-day trades then KuCoin becomes a serious option due to how easily they can be created, copied, and deployed. The five most popular trading bots that you might want to consider implementing include the spot grid, futures grid, smart rebalance, Dollar-Cost-Averaging (DCA), and infinity grid.

Overall, KuCoin is a top choice for trading altcoins without KYC based on its superior support for an expansive list of digital currencies. In comparison to Bybit, there are enough user-friendly features that can be accessed without having to verify your identity.

KuCoin Pros:

KuCoin Cons:

3. Margex – Top no-KYC exchange for BTC and ETH margin trading

Margex is a Seychelles-based cryptocurrency exchange that was launched in 2020. The crypto exchange sets itself apart from other margin trading platforms due to its streamlined interface to entice beginner and novice traders.

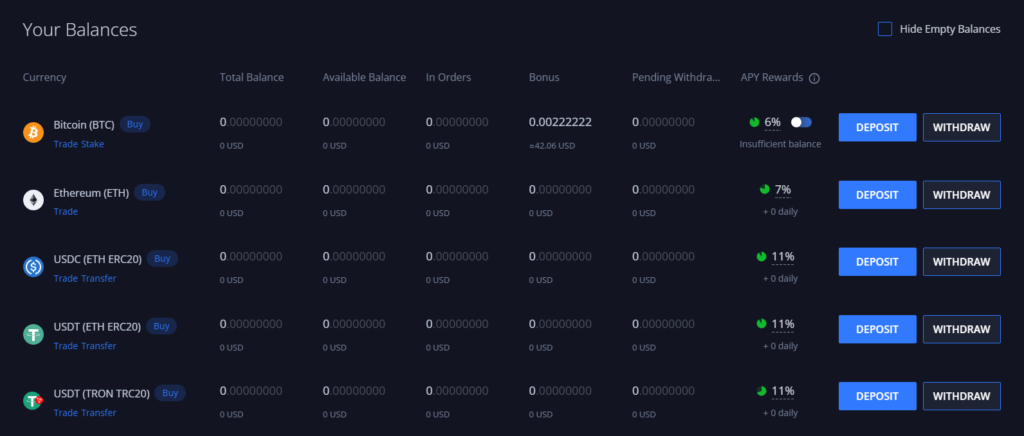

As seen in our Margex review, the platform can be said to be a dedicated margin trading platform as spot trading is not available. Despite this, unverified accounts can long or short positions with up to 100x leverage against 18 trading pairs. It is important to note that the minimum margin is 5x. All trading pairs are denominated against USD and there are no crypto-to-crypto pairs available. Nevertheless, all the popular pairs are supported including BTC/USD, ETH/USD, DOT/USD, and XRP/USD.

The key differentiator to other top margin trading platforms is Margex’s simplified interface. It is clean, uncluttered, and easy on the eye. Despite its simplicity, the interface still provides you with all the features that you need to analyse the price action of crypto. TradingView charting is integrated as well as a responsive order book. Limit, market, and stop-limit orders are also available as risk-management tools.

Although Margex doesn’t have the trading pairs or other features that the exchanges in this list provide, the advantage is that you can buy Bitcoin using a credit card. 10 digital currencies such as Bitcoin, Ethereum, Polygon, Tether, and Dai can be purchased, however, be prepared for the >3% fees.

You are not losing out when it comes to trading fees and charges either. Margex charges maker and taker fees of 0.019% and 0.06%, respectively.

Margex intends on providing a clear and simple margin trading experience and it executes it very well. If you don’t mind the lack of trading pairs and other value-add features such as NFTs, crypto-backed loans, and earn modules, then Margex may be for you.

Margex Pros:

Margex Cons:

4. MEXC – Most digital assets

MEXC is a global crypto exchange that allows you to buy crypto without having to complete KYC. Established in 2018 and with a customer base of over 10 million people around the world, MEXC aims to become a one-stop shop for digital asset trading and services.

If you choose to not complete ID verification, then your withdrawal limit is set to 20 BTC with no access to the P2P marketplace. However, almost all other trading services and features are available including crypto staking, margin and futures trading, leveraged Exchange Traded Funds (ETFs) and copy trading.

MEXC makes this list as a top no-KYC exchange due to its comprehensive list of 1,520 crypto assets that can be traded in the spot, margin and futures markets. There are 1,822 trading pairs with USDT as the main base asset which puts the reliable exchange on par with Binance, KuCoin, and Gate.io. Its perpetual futures markets using USDT (USDT-M) or crypto (COIN-M) as collateral can attract up to 200x leverage. If you’re not too confident with trading with your capital, then the free crypto demo account may be of interest.

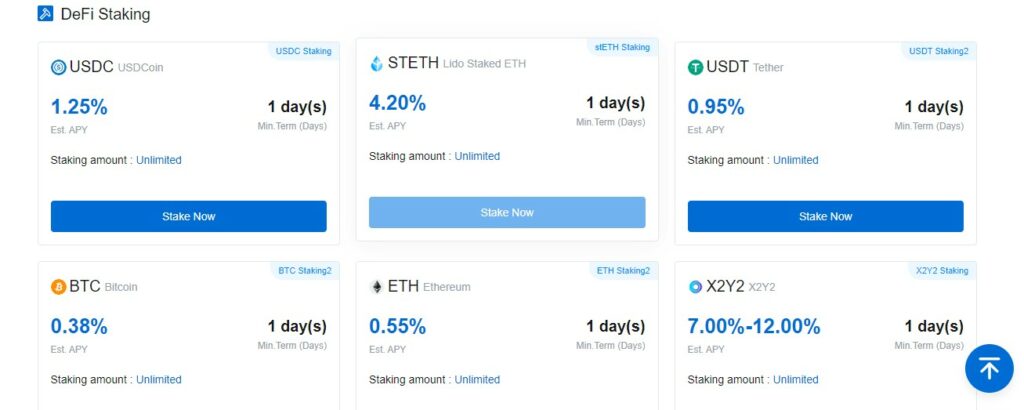

MEXC enables you to stake your crypto assets and gain up to 18% APY through either Flexible or Locked Staking. Flexible Staking grants you the freedom to withdraw your assets at any time, while Locked Staking offers you the option of setting a lock-up period of 1, 10, or 30 days.

The abundance of supported crypto assets spells benefits for its copy-trading feature. Similar to eToro Australia’s CopyTrader feature, MEXC provides a simple set-up where users can copy the trades of more experienced traders. Although it has its benefits, its copy trading is a little less refined than eToro as the search filter is extremely limited and hard to use.

Trading fees on the MEXC spot and futures trading exchange follow a maker-and-taker structure. For spot trading, maker and taker fees start at 0.0% and 0.1%, respectively. On the other hand, its futures trading fee is 0% for makers and 0.03% for takers. You can read more about its fees and charges in our MEXC review.

MEXC Pros:

MEXC Cons:

5. PrimeXBT – Best no KYC exchange for copy trading

PrimeXBT is an advanced multi-asset trading platform that provides you access to various investment assets such as Forex, CFDs, and digital currencies. It is accessible to Australians, and it offers copy trading and margin trading markets where up to 200x leverage can be applied to Bitcoin long and short positions.

PrimeXBT allows you to buy and sell 34 crypto assets across 39 trading pairs, most of which are denominated in the USD fiat currency. Crypto-to-crypto trading pairs such as LTC/BTC and ETH/BTC are offered, but unfortunately, AUD trading pairs are not supported since the exchange is not registered with AUSTRAC. Despite the limited assets, PrimeXBT makes up for it by providing up to 200x leverage for BTC and ETH trades.

If you are looking to margin trade without KYC then you should consider Bybit or Margex since PrimeXBT is unlikely to satisfy your needs. However, the strength of PrimeXBT as a no-KYC exchange lies in its copy trading. There are fewer trading portfolios to copy compared to the best copy trading platforms, but the interface is presented in such simplicity that results in a no-stress experience. All the key metrics that you would want to see from each trading portfolio can be seen with the click of a button. These include the traders’ Return on Investment (ROI) in real-time, how active they are, and their equity.

As discovered in our review of PrimeXBT, fiat currencies such as AUD and USD cannot be deposited or withdrawn. Instead, you will need to transfer any of the 34 supported cryptocurrencies from an external wallet. Once you do, the fees are quite economical. For every portfolio you copy, PrimeXBT will charge you a flat 0.05% fee. Whilst this is very competitive, you will need to complete KYC on a platform such as eToro to copy trade without any fees.

PrimeXBT Pros:

PrimeXBT Cons:

What Is Know-Your-Customer (KYC)?

The Know Your Customer (KYC) process is a mandatory process that Australian crypto exchanges need to complete in order to satisfy the provisions of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). This process must be completed before Australians can deposit or withdraw Australian Dollars to and from crypto exchanges that support fiat currencies.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) is the agency responsible for the enforcement of the AML/CTF Act. AUSTRAC is responsible for the detection, deterrence, and disruption of organised financial crimes.

The KYC process has been adopted by financial institutions for many years. With the recent regulation of the cryptocurrency industry, more and more crypto exchanges and brokerage platforms are implementing the KYC process to protect their business.

Can You Buy Crypto In Australia Without KYC?

Yes, you can buy crypto in Australia without KYC verification, however, the amount you can buy without KYC will depend on the exchange you are using. Some exchanges allow you to buy up to a certain amount without KYC, while others may require KYC verification for all purchases.

Typically, local Australian crypto exchanges will be registered with AUSTRAC and verifying your identity will be mandatory before any Australian cash can be used to buy digital assets. Examples of the best crypto exchanges that require KYC include Swyftx, CoinSpot, and Independent Reserve.

Pros & Cons Of Using A No-KYC Crypto Exchange

Non-KYC crypto exchange pros

- Start trading faster: Going through the process of verifying your identity (submission of basic personal information and copies of government-issued documents) takes some time. Depending on the crypto exchange you use, the wait times for your ID to be verified may vary from 10 minutes to two business days. Since no-KYC crypto exchanges don’t require this, you can start depositing funds and begin trading soon after you create an account.

- Increased privacy: One of the main benefits of using a no-KYC exchange is the anonymity behind it. No-KYC exchanges are ideal for those looking to keep their personal data and crypto asset transactions private. Since you don’t divulge any personal information, no-KYC exchanges offer users a much higher degree of anonymity than those that require KYC.

- Lower fees: Although no-KYC exchanges typically have lower fees compared to local Australian platforms that are registered with AUSTRAC, it isn’t because they don’t require ID verification. Instead, no-KYC crypto exchanges generally are the global companies that provide advanced trading markets such as margin and derivatives trading – activities that are not regulated in Australia. Given their global audience, no-KYC exchanges tend to have a larger trading volume and access to liquidity that enable them to offer lower fees.

- They can be more accessible: No-KYC exchanges are much more accessible than those that require KYC. This means that users from countries with strict KYC regulations can still access the same services as those in countries with more relaxed KYC regulations.

Non-KYC crypto exchange cons

- The risk of fraud is higher: Exchanges that don’t require KYC to be completed are at a higher risk of money laundering and fraud than KYC exchanges. This is due to the unknown identities of their customers.

- Vulnerable to hacking: Without KYC verification, it is easier for hackers to steal funds from an exchange as they cannot be easily traced.

- Limited use of features: Almost all no-KYC exchanges will allow the use of their crypto services and features, with the exception of those that require fiat currencies. Features that are often restricted for unverified accounts include the ability to deposit and withdraw fiat currencies, P2P marketplaces where fiat currencies may be exchanged for payment, earn wallets where interest payments can be obtained, and daily limits on the volume of crypto that can be withdrawn. Completing KYC will provide full access to the features and functionality of the exchange.

- Limited fiat payment methods: Non-KYC crypto exchanges won’t allow you to deposit cash into your wallet via POLi, PayID, BPAY or via bank transfer. The main method of account funding is crypto transfers from an external wallet. The use of credit cards may be an option on some non-KYC exchanges but the fees will be high.

Should I Use A No-KYC Crypto Exchange?

Whether you choose to use a non-KYC crypto exchange in Australia depends on your privacy values and level of convenience. Beginners are more likely to seek the convenience offered by KYC exchanges since Australian cash can be deposited in a number of ways. No-KYC crypto exchanges don’t often have fiat gateways and funding your wallet is usually undertaken by transferring digital assets across. As such, experienced and advanced traders are more likely to use crypto trading platforms with no KYC so they can remain anonymous.

Frequently Asked Questions

Yes, Australians can create a Bybit account and start trading cryptocurrencies without having to complete the KYC process. Unverified accounts have access to a range of trading markets such as spot, margin, leveraged tokens, and perpetual contracts, as well as copy trading, trading bots, and crypto-backed loans. However, unverified accounts have certain restrictions including no access to its P2P marketplace and a daily withdrawal limit of $20,000 USDT.

A no-KYC crypto exchange is an online platform that allows users to buy and sell cryptocurrencies without having to provide any personal or financial information. This means that users don’t need to verify their identity before depositing funds it making trades. No-KYC crypto exchanges typically impose reduced withdrawal limits and certain restrictions on features.

Conclusion

Demo accounts are fast becoming a popular way of exploring the features of crypto exchanges, understanding how they work, as well practising trading using real-time market conditions. Since all simulated accounts will come stocked with virtual fiat or digital currencies to start trading, there is zero risk to your actual investment assets.

However, there is a high degree of variability between demo accounts and the features they offer. At the end of the day, choosing the right demo account for you will largely come down to the type of trading you intend on performing with your real money.