How To Withdraw From Kucoin To Bank Account In Australia

Last Updated on July 14, 2023 by Kevin GrovesDespite being one of the top digital currency exchanges in the world, KuCoin still doesn’t allow the withdrawal of Australian Dollars (AUD) from its wallets. This poses a challenge for Australian investors and traders who have been using KuCoin and want to convert their crypto assets into cash with the intention of transferring it to their bank account.

The utilisation of a second crypto exchange to convert your crypto into cash before withdrawing it to your bank account is the missing piece of the puzzle. In this article, we show you how to do it as well as the common pitfalls to watch out for.

Withdrawing AUD From KuCoin To An Australian Bank Account

You can successfully withdraw assets from KuCoin by using another crypto exchange as a fiat currency off-ramp. Transfer your money into your bank account by following the steps below.

- Choose a top-tier Australian crypto exchange that allows you to convert your crypto AUD and withdrawals to a bank account.

- Create a new account on the desired crypto exchange and verify your identity.

- In the new exchange, copy the wallet address for the crypto that you intend on withdrawing from KuCoin and choose the network to facilitate the transaction.

- In KuCoin, find the “Withdraw” button for the crypto to withdraw under “Main Account”. Start the crypto transfer by pasting the wallet address of the destination exchange, entering the amount to send, and choosing the right network.

- After the deposit is complete, sell the crypto to AUD.

- Add your Australian bank account and withdraw your money.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Can You Withdraw AUD From KuCoin?

No, KuCoin does not allow the direct withdrawal of Australian Dollars into a bank account. Instead, you will need to transfer the crypto that you intend to withdraw to a second crypto exchange where it can be sold to AUD. From there, you can easily transfer your money to an Australian bank account.

To learn more about KuCoin’s withdrawal methods, limits and fees, read our review of KuCoin.

How to Withdraw Your KuCoin Money Into A Bank Account – Full Tutorial

The easiest way of converting your KuCoin-held crypto assets is by sending them to another exchange where they can be converted into Australian money. The steps to complete this are detailed in the following sections.

Step 1 – Choose a destination crypto exchange

If you’re looking to convert your KuCoin crypto assets with the intention of sending Australian Dollars (AUD) to your bank account, the first step is to choose a destination cryptocurrency exchange. Make sure that the exchange you pick allows you to sell Bitcoin and other digital currencies to AUD, and has low or no fees and an easy-to-use platform. And of course, the exchange must allow you to withdraw AUD to an Australian bank account.

Two of the top-rated local crypto exchanges that meet these criteria are Swyftx and Binance Australia. Both offer value-for-money trading fees and support withdrawals of cash to a bank account.

Step 2 – Create and verify a new account

Creating a Swyftx account can be completed in about 5 minutes from start to finish. As an added incentive, you can claim our $20 Bitcoin reward when you create a new account using our Swyftx referral code. This can only be claimed once per new account.

After your account has been created, you will need to verify your identity before receiving any crypto from KuCoin. Known as the Know-Your-Customer (KYC) process, this is to satisfy Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws in Australia. The KYC process can be completed by presenting either your Australian passport or driver’s licence. We completed the KYC process using the Swyftx mobile app which allows you to conveniently use your camera to take photos of your documentation.

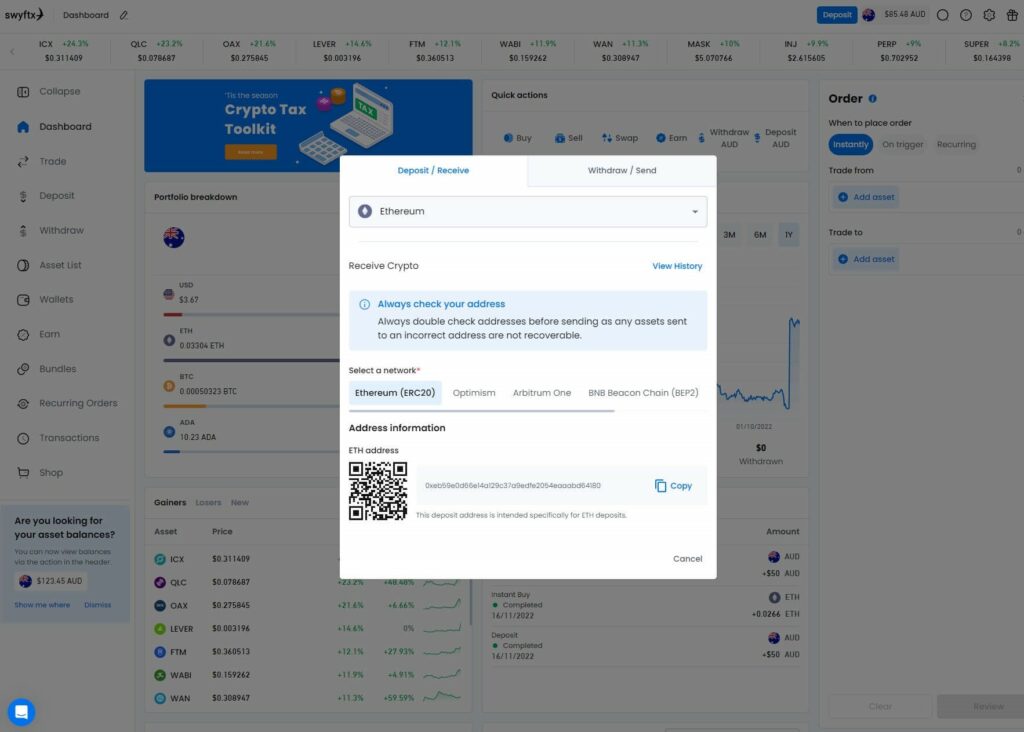

Step 3 – Copy your wallet address

Once you have selected the crypto to transfer, you will need to copy the wallet address so it can be pasted into Swyftx. This ensures that the crypto sent will go to the right place. The wallet address will be unique for each crypto asset.

You can find the wallet address by navigating from “Deposit” on the left-hand side of your Swyftx dashboard. Select the digital currency you want to ultimately convert into AUD and find its wallet address next to the QR code.

Click on the “Copy” icon to copy the address. It is important to note that Swyftx presents several blockchain networks for the transfer, so make sure that both exchanges support the network that you are choosing. Otherwise, you may lose your crypto in the transaction. The default blockchain is ERC20, but you can select another if you wish.

Step 4 – Withdraw your crypto from KuCoin

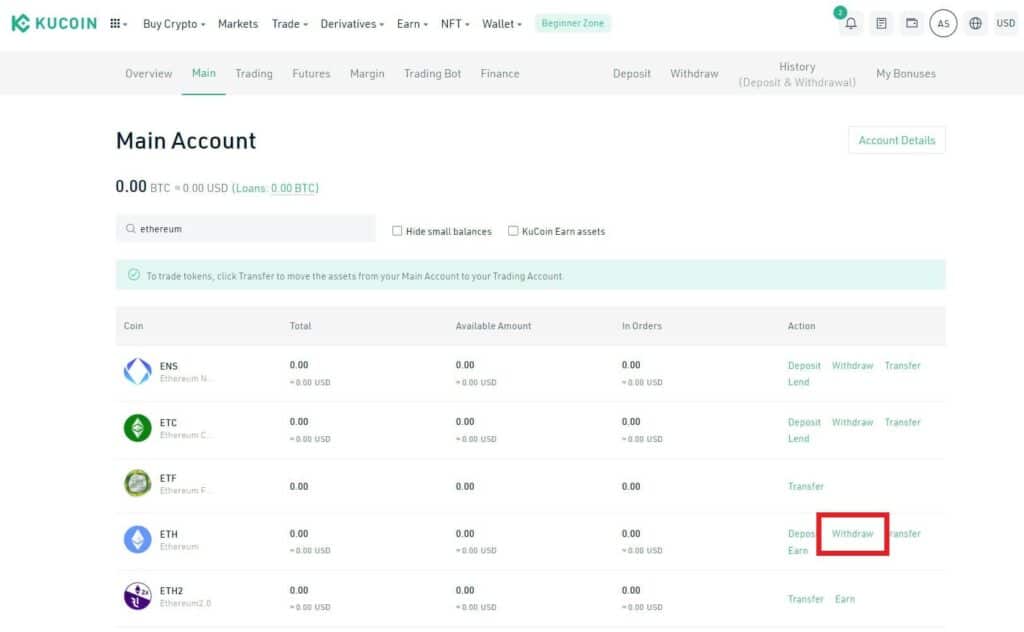

Once the wallet address for the crypto you intend on sending from KuCoin has been copied, the next step is about starting the crypto withdrawal process. In your KuCoin account, find your ‘Main Account’ under the wallet icon in the top right-hand corner of the dashboard.

Next, find the cryptocurrency that you wish to transfer to Swyftx using the search text box and click ‘Withdraw’. In this guide, we are using Ethereum as an example.

Before you can make any withdrawals on KuCoin, you will need to ensure you have successfully two security requirements:

- Activate 2-Factor Authentication (2FA) if you haven’t already done so. We prefer using the Google Authenticator app for all our 2FA needs.

- Set a trading password. This will be a unique 6-digit password to enable withdrawals.

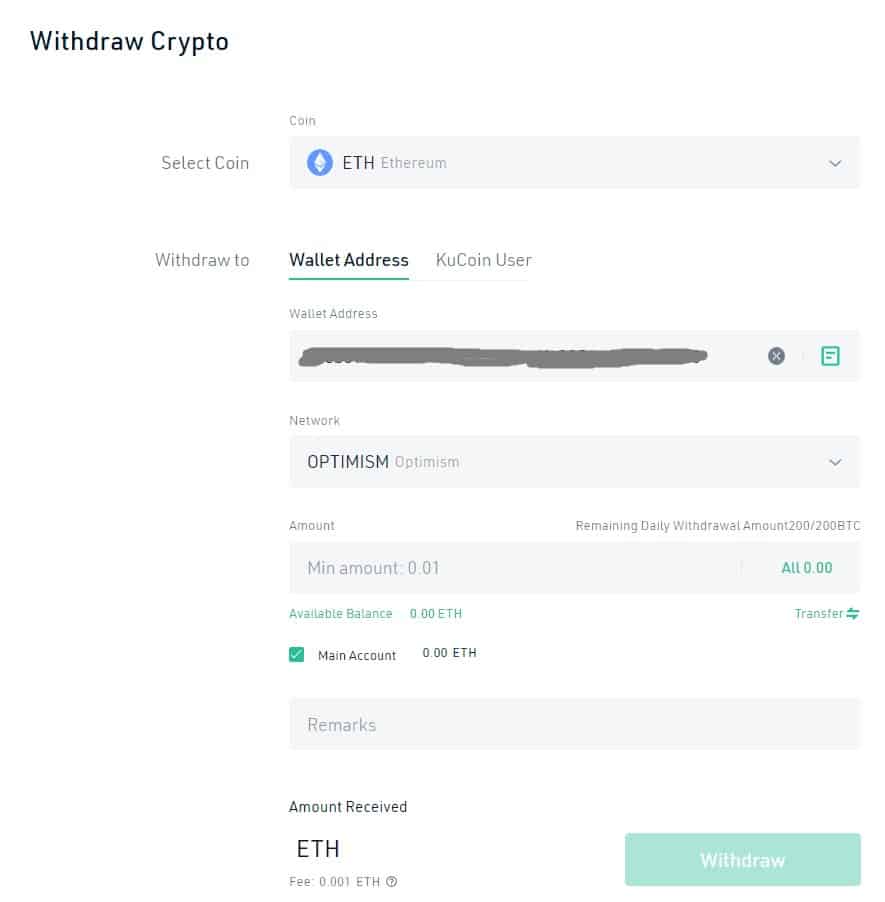

As shown in the image below, a window will appear asking you to enter the details of the crypto withdrawal. These include:

- The cryptocurrency you selected to be withdrawn from KuCoin.

- A text box where you paste in your Swyftx wallet address.

- Choosing the network (chain type), ensuring that it is the same as the one selected in Swyftx. In this case we selected the Optimism network since the gas fees ($1.62) were vastly cheaper than the ERC20 ($8.42) network.

- The amount of crypto to send.

Once you’re done, click on “Withdraw”.

To ensure security is upheld, KuCoin will prompt you to verify the transaction in a number of ways. Firstly, you will need to retrieve a code from your linked email account and provide it to KuCoin. Click on “Submit” to complete the withdrawal.

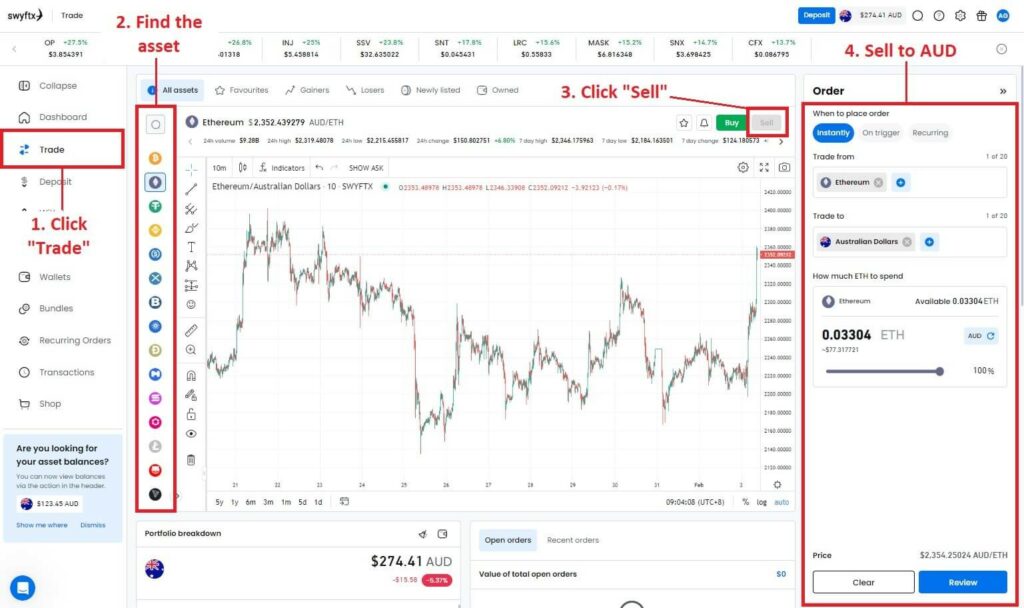

Step 5 – Convert your crypto to AUD

For Ethereum, we waited about 15 minutes for the assets to be seen in our Swyftx trade wallet as a ‘deposit’. To convert it to AUD, you need to sell it.

As shown in the image below, click on “Trade” and then find the asset to sell by searching for it or using the vertical scroll bar. The sell button can be found in the top right-hand corner above the TradingView charts.

The default currency will be Australian Dollars since Swyftx does not support other fiat currencies such as USD. Enter the amount of digital currency to sell and click “Review” to review the details. Once you confirm the liquidation of crypto to AUD, the cash will appear in your trade wallet.

Selling cryptocurrencies such as Bitcoin to AUD on Swyftx will incur a flat fee of 0.6%. Whilst this isn’t the cheapest rate available to Australians, it’s still highly competitive considering that some sell fees can be as high as 1%.

Step 6 – Withdraw cash to a bank account

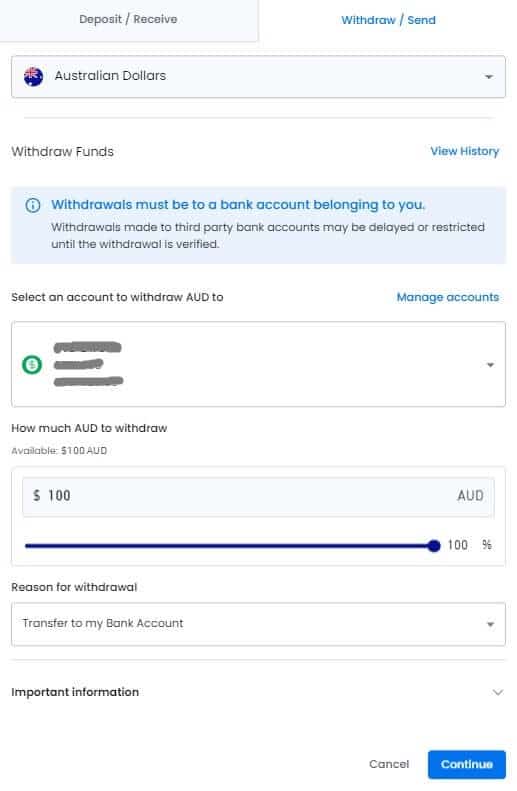

The withdrawal feature on Swyftx can be found under the slide menu on the left-hand side of your dashboard. Clicking on “Withdraw” will bring up a window where you can select AUD as the currency to withdraw to your bank account.

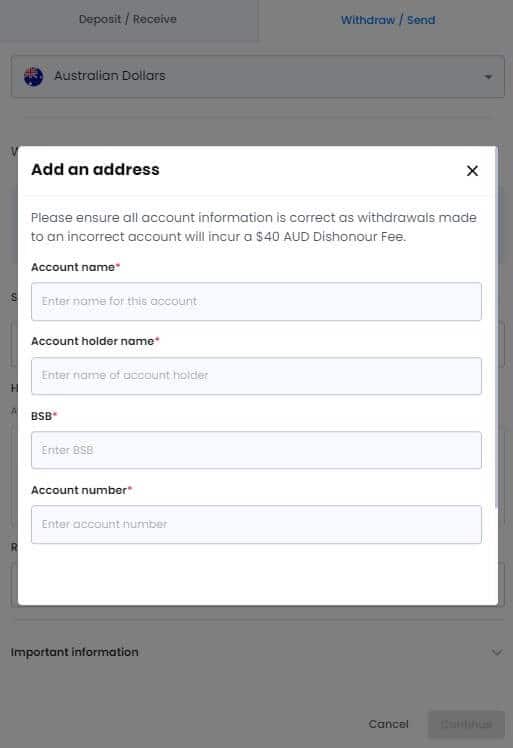

If you haven’t already done so, add your Australian bank account so Swyftx knows where to send the money. This is simple enough as your bank account details will need to be input.

After your Australian bank account is linked, you can easily cash out your AUD. Upon clicking “Continue”, you will be asked for withdrawal confirmation. Clicking on the withdrawal confirmation finalises the withdrawal process. You can then exit the withdrawal page and check your transaction history to confirm the successful transfer. You can also check the transaction details there should you need to revisit it for any reason.

Transfers of cash from Swyftx should be near-instant, however, allow a period of up to 24 hours if this is your first transfer.

The Fees To Transfer AUD From KuCoin To Your Bank Account

KuCoin doesn’t charge any fees to withdraw cryptocurrencies from its wallet. Instead, a minor network fee will apply for all transfers of digital currencies to an external wallet. The network fee will be dependent on the digital currency being withdrawn, network congestion, and the complexity of the transaction.

For example, gas fees to withdraw Ethereum (ETH) from KuCoin to another exchange where it will be converted to cash will typically range from $1.50 to $9.00. Using the ERC20 network will incur higher gas fees than networks such as Optimism.

How Long To Transfer AUD From KuCoin To Your Aussie Bank Account?

Transferring cryptocurrency from your KuCoin wallet to an Australian crypto exchange to be sold for AUD may take up to 20 minutes, depending on the cryptocurrency being transferred and the level of network congestion. Once the crypto is sold for AUD, the exchange can serve as a fiat currency off-ramp and the withdrawal of cash to your bank account should take an additional 30 minutes. Overall, the entire process of sending AUD from KuCoin to an Australian bank account could take up to one hour.

Are There Withdrawal Limits On KuCoin?

KuCoin allows you to make unlimited withdrawals of cryptocurrencies, however, there are some limits to consider. Firstly, there are limits on the minimum amount that can be transferred to an external wallet. Secondly, the total volume of any coin that can be withdrawn daily cannot exceed the equivalent of 200 BTC.

The minimum amounts of crypto that can be withdrawn are shown in the table below.

| Crypto | Minimum Limit For Withdrawals |

|---|---|

| Bitcoin (BTC) | 0.0005 BTC |

| Ethereum (ETH) | 0.0001 ETH |

| Ripple (XRP) | 20.5 XRP |

| EOS (EOS) | 1 EOS |

| Tether (USDT) | 1 USDT |

| Dogecoin (DOGE) | 40 |

| Polkadot (DOT) | 2 |

| Litecoin (LTC) | 0.02 |

| Stellar (XLM) | 10 |

Frequently Asked Questions

Can I withdraw from KuCoin to a bank account?

No, you cannot withdraw fiat currencies from KuCoin directly to your bank account. Instead, you will need to withdraw cryptocurrencies to another cryptocurrency exchange where they can be sold into money. Only after this can you transfer the cash to your bank account. Withdrawals of digital currencies such as Bitcoin and Ethereum can be performed free of charge.

Can Australians use KuCoin?

Yes, Australians can create an account with KuCoin to begin using its features. Despite having access to world-class cryptocurrency trading features and services, Australians are not able to deposit AUD since the popular exchange is not registered by AUSTRAC. On the other hand, since KuCoin is not regulated in Australia, you can start trading without the need to verify your identity through the KYC process.

Can I withdraw from KuCoin without KYC verification?

Yes, you can withdraw your cryptocurrency assets from KuCoin without needing to verify your identity through the KYC process. This is due to KuCoin not being regulated in Australia by AUSTRAC.

Conclusion

The inability to withdraw Australian money from KuCoin hasn’t stopped traders and investors from using the popular crypto exchange. To withdraw your cash from KuCoin, an intermediary crypto exchange is needed to act as a fiat off-ramp before transferring your cash to your bank account.

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.