FTX Review for Australians 2023: Features & Advantages

Last Updated on December 5, 2023 by Kevin GrovesFTX is one of Australia’s best-rated leverage exchanges, renowned for its broad range of trading features, such as derivatives, advanced orders, up to 20x leverage, and a competitive fee structure. FTX Australia pays attention to the blockchain sector’s development and is constantly looking for ways to improve its products. They have introduced an earning hub, listed new cryptocurrencies for trade and run occasional trading competitions.

This review will dive into the FTX exchange and identify the features, fees and security measures that may make it a suitable platform for your crypto investment needs.

UPDATE 10.01.2023 – FTX has entered into administration and is no longer available to use.

FTX Australia

Trading fees:

0.02% maker / 0.07% taker

Number of cryptos:

320+

Deposit methods:

Credit/debit card, crypto

Supported countries:

Global (including Australia)

Promotion:

5% discount on trading fees

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick overview

Here is a quick summary of the exchange information.

| Exchange name | FTX |

| Supported countries | Australia (and internationally) |

| Fiat currencies supported | AUD, EUR, GBP, USD, and 5+ more |

| Deposit methods | Credit/debit card, crypto |

| Supported cryptocurrencies | BTC, ETH, SOL, USDT, BNB, LTC and 320+ more |

| Trading fee | 0.02% (maker) and 0.07% (taker) |

| Deposit fee | None |

| Withdrawal fee | None |

| Mobile app | Yes (iOS and Android) |

| Leverage | Spot (10x), futures (20x), tokens (3x) |

The Bottom Line

FTX Australia is one of the best exchanges for experienced traders. Whether you want to trade derivatives, or like me, set up advanced spot orders, navigating the interface is a seamless experience. FTX is always adding new coins and features to its services, and trading on the exchange is extremely cost-efficient. I found the earning and staking program to be a little lacking, although the FTX team will likely improve this going forward.

What we liked:

- Low fees, excellent for day traders

- Lots of unique crypto trading pairs like tokenized stocks

- Great mobile app for trading on-the-go

What we didn’t like:

- Not a great option for beginners

- Minimal AUD trading pairs

- Only four tokens available for staking

Limited Promotion – 5% discount on trading fees.

What is FTX Australia?

FTX is an advanced trading platform offering Australians derivatives and margin trading. The exchange was founded in 2019 by young billionaire and influential crypto figure Sam Bankman-Fried, alongside Gary Wang. Since then, FTX has blossomed into one of the most popular trading platforms for digital currencies. The exchange regularly averages over $10 billion USD in daily trading volume and generated more than a billion dollars in revenue in 2021.

FTX is headquartered in the Bahamas, but in 2022 the team received an Australian Financial License and registered with the national regulatory body AUSTRAC. This significantly expanded the potential services FTX could offer Australians, including greater support for AUD. FTX is opening up a Sydney-based office to take care of Australian-based products and rival the top crypto exchanges in the country.

FTX is well known for offering a broad range of trading options to its userbase. For starters, you can trade derivatives and margins with up to 20x leverage using USD or USDT as collateral. The platform provides access to over 290 trading pairs and niche products like tokenised equity (cryptocurrencies based on stocks such as AAPL or TSLA). Experienced traders can buy options or set stop-loss/take-profit orders with ease.

FTX Australia is foremost intended for advanced traders, and the platform is across all the cutting-edge trading technology. The exchange also offers other blockchain-based features, such as an NFT marketplace, an earning hub and a native token (FTT) that can be staked. However, compared to alternatives like Binance that we have reviewed, these elements of the FTX exchange are a little less-developed.

FTX Australia Pros & Cons

Pros:

Cons:

Our Review of the Top Features on FTX Australia

Supported cryptocurrencies

FTX has a very comprehensive list of supported cryptocurrencies, boasting over 275. However, this number is smaller than some competitors like Swyftx and Binance. Its large range of perpetual contracts and other derivatives is where the platform makes up ground. Hundreds of trading pairs are available on the exchange, with representation for most major digital currencies.

It is worth noting there aren’t many AUD-based trading pairs available on the spot market. This means you may have to convert your Australian fiat to USD or Tether (USDT) before trading on FTX. Luckily, the conversion process is free and can be done through your exchange wallet.

For more information on how to buy altcoins in Australia, read our guide.

Derivatives and margin trading

It doesn’t take long to see that FTX is easily one of the world’s best crypto leverage trading platforms . But before you can access any advanced margin and derivatives tools, you must complete a 10-minute quiz. This “client suitability test” will ask you about your financial situation, as well as questions about CFDs and your trading strategies.

Once the quiz has been passed, you can browse the hundreds of perpetual contracts available and trade them with leverage – including most major tokens like BTC, ETH, LTC and so on. A unique offering is Indexed futures, where you can trade perpetual contracts for “baskets” of multiple coins in specific sectors. Examples include DeFi (SOL, RUNE, MKR, SUSHI, etc.) and Memecoins (DOGE, SHIB, etc.).

Margin trading on FTX comes with a whole range of options. You can choose from applying leverage to spot markets (a max of 10x), futures (20x) and specific tokens (3x), while using USD or Tether (USDT) as collateral.

Not all of FTX’s derivatives are available for Australians. Notably, regulators don’t allow the sale of prediction-based tokens (such as Trump 2024) or MOVE contracts.

It’s vital to remember that trading with leverage or derivatives contracts is not recommended for beginners. Margin trading is one of the easiest ways for inexperienced traders to lose all their money very quickly.

Earn products

FTX’s main trading platform – accessed via desktop – supports the staking of four different tokens. You can lock up your SRM, SOL, RAY or FTT in exchange for a reward paid out in kind. These staking offerings are performed on-chain (directly on the blockchain network). The reward rates vary between 4% and 20%, however, are subject to change.

Related: Where can I stake crypto in Australia?

A unique benefit of FTX is margin lending, where you can loan various assets to other traders on the exchange. You get to predetermine an interest rate, and if a borrower accepts the loan, they will need to repay you with interest. If the borrower defaults, FTX will use their collateral to reinstate your loaned funds.

This option somewhat compensates for the platform’s lack of traditional earn products, but still has downsides. For starters, borrowers aren’t guaranteed to use your loan. Secondly, you will need to keep re-lending your assets once they’ve been repaid, unlike other yield programs which automatically compound your investment.

However, another option is the FTX App. FTX’s App merged with well-known earning company Blockfolio to offer their customers yield on 20+ cryptocurrencies, including Bitcoin and Ethereum. This product is separate from FTX’s main exchange and will require you to create a new account. The process is a little inconvenient, especially when some competitors already offer advanced trading tools on top of a comprehensive earning platform.

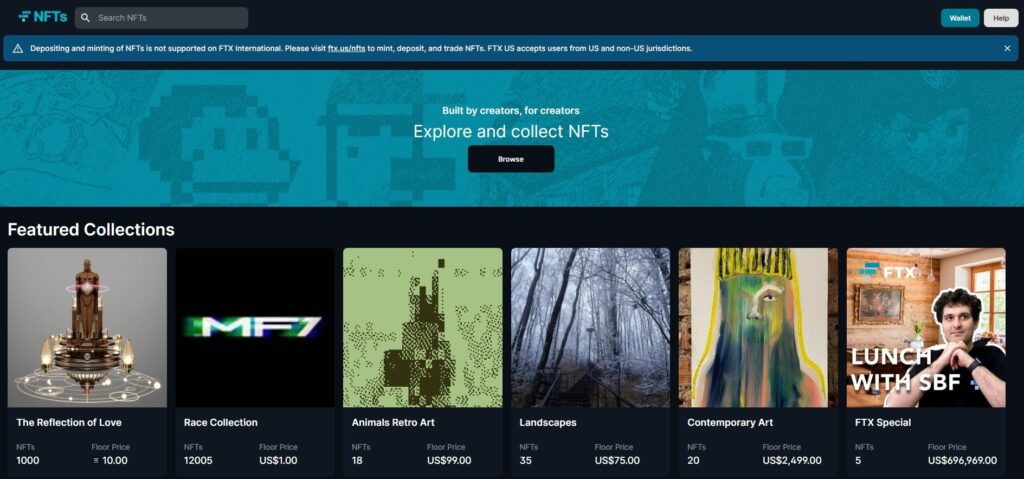

NFT marketplace

Fully utilising the NFT marketplace on FTX will require two separate accounts. On the Australian version of FTX, you can browse artwork, purchase special events (like lunch with FTX’s CEO), and bid on valuable NFTs.

The breadth of content is thinner on FTX than on specialised NFT marketplaces, such as OpenSea. There aren’t many blue-chip offerings or popular collections available.

However, if you navigate to FTX.US (which supports Australian accounts), you can browse a much larger number of NFTs. You can also deposit and mint your digital tokens on this exchange version.

FTT utility token

FTX introduced its native utility token FTT, following in the footsteps of major exchanges like Binance and KuCoin (read our KuCoin review here). The FTT token can be staked, but instead of generating on-chain yield, it comes with a glut of other benefits. The main advantage of staking FTT is for high-volume traders, who can offset trading fees by up to 60%. The highest tier (7) of rewards requires you to hold $5m USD worth of FTT.

Staking FTT comes with a variety of other benefits too. You will get bonus votes in polls and governance, a greater chance of receiving airdrops, free NFTs, free ERC-20/ETH withdrawals and an extra free fiat withdrawal every week.

Rewards and promotions

FTX offers several rewards and promotions outside of staking FTT.

The exchange has a comprehensive referral program, where you can sign up family and friends using a special link. Every time the new account makes a trade, you will receive 25% of any fees they pay. This figure can be increased up to 40% by staking FTT. This is a very competitive rate. The fees earned can quickly add up if your referees are prolific crypto traders. Best of all, those you refer receive 5% off their own trading fees – forever.

FTX also occasionally runs trading competitions, however the last one promoted on the website’s international version was in 2020.

Mobile app

FTX has two separate mobile applications, and using both in tandem will require two different accounts. The app intended for serious traders that mirrors most of the desktop platform’s features is called FTX.Pro. This app version has an impressive 5.0-star rating on Google Play, with reviewers commending its ease of use and stylish trading interface. We were impressed with the app’s overall performance and can confidently call it one of the best crypto apps for Australians.

The alternative FTX app (simply called “FTX”) is a merger with Blockfolio geared towards novice crypto investors. This app lets you trade around 20 digital currencies, as well as generate yield on seven different tokens, including Bitcoin (BTC), Ethereum (ETH) and Dogecoin (DOGE). Those looking for the majority of FTX’s advanced trading benefits will want to ensure they download the Pro version of the application. That said, the FTX App is not a terrible option for newcomers to the industry wanting to get their feet wet.

Tokenised stocks

FTX is one of the few centralised exchanges offering support for tokenised stocks. These assets essentially track the value of underlying equity – for example, the share price of Netflix. However, instead of being restricted to typical trading hours and incurring high brokerage fees, they have been minted as ERC-20 (Ethereum network) tokens. To ensure the price stays stable, a branch of FTX will own the actual shares they are tokenising.

You can buy, sell and swap tokenised stocks on the FTX platform with leverage. Certain assets even have futures contracts that you can purchase. There are easily over 50 different trading pairs and derivatives available. You can learn more about tokenised stocks via the FTX Help Centre.

To get started trading tokenised stocks, you will have to pass multiple rounds of KYC, both from the international FTX exchange as well as the Swiss version of the platform.

Charity

FTX has pledged to donate 1% of its fee revenue to the FTX Foundation. This Foundation is a non-profit setup by Sam Bankman-Fried. It supports charities focussing on animal rights, human welfare, healthcare and pandemic prevention. Those in the FTX community get a say in which charities the proceeds are spread across.

FTX Australia Fees

Deposit fees

FTX does not typically charge any deposit fees if you fund your account with AUD. That said, depending on the provider, you may encounter fees on your bank’s side.

The ability to deposit AUD via debit or credit card for free is an impressive advantage of the FTX exchange, as most alternatives charge a 3% (or higher) fee for this deposit method. This makes it an economical way to buy crypto with a credit card in Australia.

Depositing cryptocurrency is typically free too, although you may incur some network charges depending on the coin being used. FTX will cover these blockchain fees for all crypto deposits, except for ETH/ERC-20 tokens.

Withdrawal fees

Withdrawing AUD from FTX to your bank account is completely free. This is a benefit Australians have over other exchange users, as withdrawal fees for other fiat currencies can be very high (higher than $100 AUD).

Cryptocurrency withdrawals are also typically free. However, you will be charged a fee if you withdraw ETH, an ERC-20 token, or a small amount of Bitcoin. These fees are variable and depend on blockchain congestion. Essentially, you are paying the “gas fee” for withdrawals of this type. High-volume users of FTX may want to stake FTT to get one (or more) free ERC-20 withdrawals daily.

Trading fees

We found trading fees on FTX to be some of the best value for traders on the market. At a base level, their maker fee is 0.02%, and taker fee is 0.07%. Already, these rates are impressive and beat out most Australian competitors in this space. However, there is a slightly cheaper alternatives Bybit and Margex based on our review, which is also a popular margin exchange.

Those that use FTX for day or high-frequency trading can receive additional discounts on their fees. Both staking FTT and high monthly trading volume can substantially improve the FTX platform’s cost-effectiveness. Trading fees can be reduced to completely free for makers, and those staking FTT will even receive a rebate on their maker fees. The lowest possible taker fee is 0.015%.

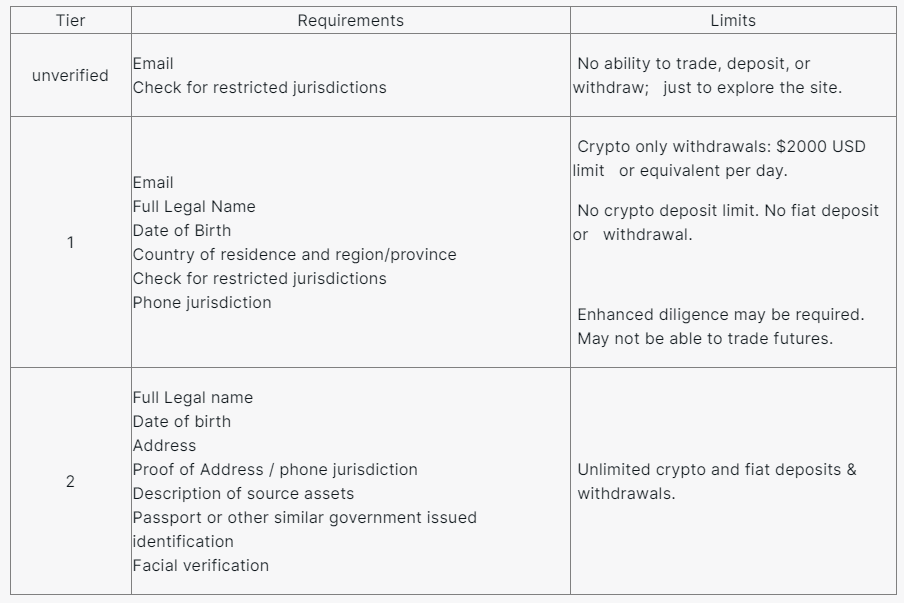

How To Get Started with FTX

Getting started on FTX is easy, although there are a few hoops you must jump through to unlock the exchange’s full potential. You can easily register for an account using your email or Apple/Google accounts. You will also need to provide a working mobile number to enable 2-Factor Authentication (2FA). To begin trading, you must at least pass level 1 KYC requirements. This includes basic information like date of birth and location. Achieving level 2 KYC involves providing proof of address, a selfie and a photo of government-issued documentation.

Finally, Australians must pass a quick survey to unlock most margin and derivatives trading options. In this quiz, you will answer questions about your financial position and need to demonstrate an understanding of how CFDs/derivatives trading works.

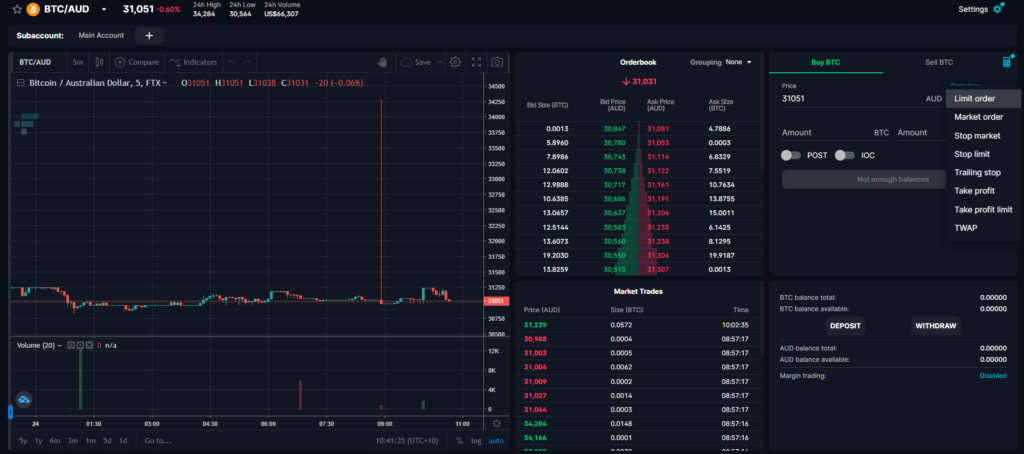

The FTX Trading Experience

Complete cryptocurrency beginners can use the FTX homepage to easily build their portfolios. This trading method is incredibly simple and ideal for new users.

Although FTX does have some benefits for new crypto investors (in particular its low fees), to get the most out of FTX, you’ll need to be quite experienced. Newcomers will likely be overwhelmed by the FTX trading interface. In contrast, advanced traders will love its suite of options and customability.

Trading on FTX comes with all the bells and whistles you’d expect from a modern trading platform. There is an adjustable charting feature, which includes indicators and volume. The order book is easy to navigate, and you can even review your past orders.

The trading interface supports eight different order types, which is perfect for advanced traders. You can choose between the basics – limit order, market order, stop limit or take profit. However, you can also set up niche order types like trailing stop, TWAP and take profit limit.

Customer Support

FTX is a cutting-edge exchange led by one of the biggest names in the blockchain industry – Sam Bankman-Fried. Sam is extremely active in the community and is known to respond to suggestions or help inquiries via Twitter.

Unfortunately, FTX does not have a live chatbot or live customer support, which many modern exchanges are implementing. However, they have an extensive FAQ/Help Centre that should answer most basic questions. If not, you can head over to the “Support” page and lodge a ticket, which the customer support team should respond to within the day.

Our Verdict

While navigating the comprehensive and sleek world of FTX, it quickly becomes clear that it’s the best option for Australians wanting to trade derivatives. Admittedly, some alternatives have better-developed features outside of trading, such as NFT marketplaces and earning hubs. However, if you’re looking to trade crypto with with an advanced charting interface with low fees, FTX is arguably the best on the market. The exchange hosts hundreds of trading pairs, has state-of-the-art security (and never experienced a hack) and is licensed by Australian regulatory bodies.

If you’re a beginner looking to slowly build a cryptocurrency portfolio, there are probably some better options out there. However, professional traders, institutional investors or those with experience in the industry will be hard-fought to find an exchange superior to FTX for trading.

Limited Promotion – 5% discount on trading fees.

Frequently Asked Questions

Is FTX available in Australia?

Yes, FTX’s international platform has been available for Australians since its release. However, the exchange also received a license from Australian regulatory bodies in 2022 to offer residents their derivatives and margin trading services. In response, FTX has opened an office in Sydney to watch over the Australian exchange.

Can FTX be trusted?

Yes, FTX is one of the market’s most reputable crypto trading platforms. It has never experienced a hack and has implemented state-of-the-art security features. The founder and CEO, Sam Bankman-Fried, is extremely active in the crypto community and constantly looking for ways to improve the customer experience.

Who owns FTX?

FTX is owned by Sam Bankman-Fried, who co-found the crypto exchange with Gary Wang.

Is FTX better than Coinbase?

For Australians, we recommend FTX over Coinbase. This is largely because FTX is registered in Australia, whereas Coinbase cannot offer AUD withdrawals, the sale of cryptocurrency and has substantially higher trading fees. However, Coinbase is still a platform worth considering due to its beginner-friendly interface.

Is FTX good for day trading?

FTX is one of the best exchanges on the market for trading cryptocurrency. Its low fees, large number of trading pairs and suite of advanced financial instruments like derivatives make it perfect for day traders.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.