Where To Earn Interest On Crypto In Australia

Last Updated on January 31, 2024 by Kevin GrovesEarning interest payments on the cryptocurrencies that you currently hold is a great way of generating passive rewards, especially if you prefer to HODL. Interest-earning wallets are offered by some top-tier crypto exchanges in Australia and work in a similar fashion to a high-interest bank account where consistent and stable payments can be obtained.

With several options for you to choose from, knowing which place to invest your digital assets can be a difficult task. In this article, we break down the interest-earning wallets that are available to you in Australia by providing you with first-hand knowledge and experience of their features, fees, security, and interest yields.

Best 4 Aussie Platforms to Earn Crypto Interest

We have assessed over 20 cryptocurrency exchanges that offer interest-earning wallets that are available to Australians and have picked out the top 4. These are the 4 best crypto platforms to earn interest payments in Australia.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Top Crypto Interest-earning Wallets in Australia: 2023 Reviews

Here are our reviews of the best Australian wallets to passively earn interest on your crypto.

1. Swyftx – Best overall place to earn interest on crypto

- Rating: ★★★★★

- Supported Crypto: 10

- Fees: None

- Interest Rates: Up to 23% APY

- Terms: Flexible

- Visit Website

Swyftx is a Brisbane-based cryptocurrency exchange with a massive customer base of over 600,000 Australians. The AUSTRAC registered platform allows you to use AUD to buy, sell and trade more than 320 cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and more. One of Australia’s top crypto trading platforms to buy crypto, Swyftx has an easy-to-use user interface, a trading fee of 0.6%, and responsive customer support.

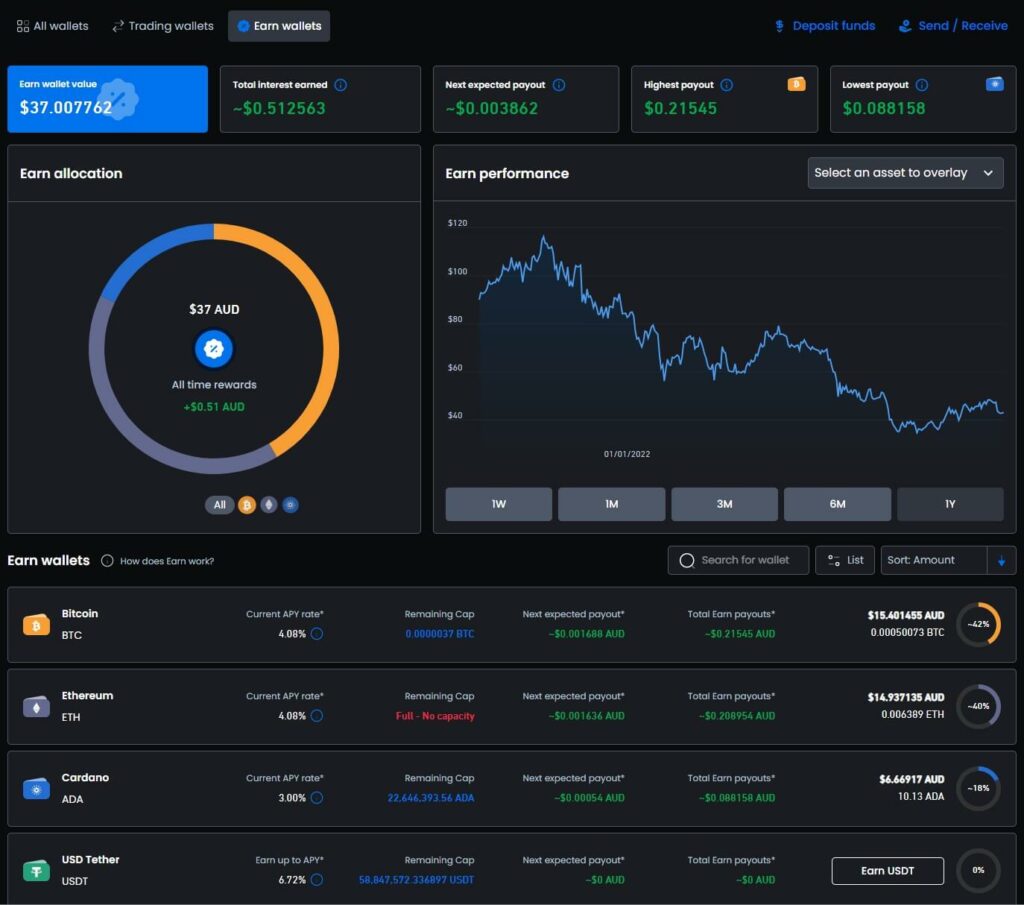

Swyftx allows you to earn interest payments on 10 digital currencies including Bitcoin, Ether, Tether (USDT), Cosmos (ATOM), and Algorand (ALGO). Interest rates for each asset are tiered, meaning that yields depend on the volume of crypto that you transfer into your Earn wallet. That is, the more you hold, the less interest on Earn – making Swyftx more suitable for holders with less capital.

The best interest returns are from Tier 1 where rates vary between 3.00% Annual Percentage Yield (APY) for Cardano (ADA) and 13.88% APY for Zilliqa (ZIL). For example, interest on Bitcoin is paid out as 4.08% which is quite comparable in the Australian market where yields typically range between 3% and 5%.

Interest that you generate is paid into your Trade wallet daily and there are no lock-in periods. You are free to move your crypto asset to the Earn wallet any time that you want. This is an advantage since most global crypto exchanges that offer interest-earning wallets will require you to lock your assets for periods typically ranging between 15 and 60 days.

Overall, Swyftx is a great cryptocurrency platform for earning interest on your cryptocurrency assets. On top of this, Swyftx is one of the very few local exchanges that allow you to earn interest on Bitcoin and Ethereum.

The Earn wallet is integrated into the newly designed Swyftx interface which is discussed more in our Swyftx review. Transferring your assets between the Trade and Earn wallets can be done in just a few clicks and tracking the performance of your portfolio has been easier with the new Earn dashboard. Moreover, Swyftx has an excellent crypto app that can also track interest accrued.

Some of the cons include the lack of supported crypto. During the 2022 market downturn, Swyftx reduced the number of supported crypto assets from 21 to 10. Although interest rates were slightly reduced across the board, Swyftx still remains competitive compared to other platforms available to Australians. Moreover, they even give new users $20 free Bitcoin using a Swyftx referral code.

Swyftx Pros

- Straightforward to use interface.

- Supports 10 of the most popular digital currencies including BTC and ETH.

- Easily manage your assets between the Trade and Earn wallets.

- Interest is paid out daily.

Swyftx Cons

- Stablecoins are not supported.

- Tiered interest rates mean lower returns for high-net investors.

Read our full Swyftx Review

2. CoinSpot (the most secure interest-earning wallet)

- Rating: ★★★★★

- Supported Crypto: 23

- Fees: None

- Interest Rates: Up to 78% APY

- Terms: Flexible

- Visit Website

Established in 2013, CoinSpot is one of the oldest and most reputable cryptocurrency exchanges in Australia. It sports the largest customer base of over 2.5 million Australians who have access to buying more than 350 cryptocurrencies such as Bitcoin, Ethereum, Cardano, as well as meme coins Dogecoin (DOGE) and Shiba Inu (SHIB). CoinSpot’s long-standing reputation as a safe and secure place to store cryptocurrencies stems from its strong track record and its internationally recognised ISO 27001 accreditation for information security.

CoinSpot provides interest payments on 23 digital currencies where interest returns range from 4.2% APY for FTM to 78% APY for AXS. All interest rates are offered as flat returns with the exception of Ethereum which is tiered.

You might have noticed that this is not a standard interest earning platform because instead of holding tokens in a wallet, you must leverage the “Earn” option on the platform’s multi-token wallet. Select the token and click on Earn to lock it. When you do, CoinSpot accepts them as loans, and you get interest payments as a reward. Simply put, you are the lender to the exchange, and you earn interest – think of it like reverse banking.

But it is easier said than done, as the interface is not the easiest to use. We had some difficulties understanding which of the 360 digital assets could earn interest and had to default to the Frequently Asked Questions (FQA) section to obtain the full list of supported assets.

If you want to earn interest on Bitcoin, then you’ll need to seek an alternative such as Swyftx. On the plus side, cryptos you can earn interest on don’t have any maximum or minimum limit. One thing to take note of, is that there is an “Earn Cap” for each coin and token. If the cap is reached for a particular token, it means that no more can be deposited to earn interest and you’ll need to wait until someone withdraws their assets first.

Overall, CoinSpot is a good crypto interest platform, especially for the security conscious with its secure crypto wallet for Australians. There are no fees to worry about and also no lock-in periods so you can freely transfer and manage your crypto as you please.

CoinSpot Pros

- Competitive interest rates on 23 digital coins and tokens including Ethereum.

- ISO 27001 certified and strong security track record.

CoinSpot Cons

- No interest accounts for Bitcoin.

- Not the easiest interface to use.

Read our full CoinSpot Review

3. Nexo (best interest yields for stablecoins)

- Rating: ★★★★

- Supported Crypto: 39

- Fees: None

- Interest Rates: Up to 16% APY

- Terms: Flexible and locked

- Visit Website

Nexo is a top-rated cryptocurrency platform that provides financial management services to over 4 million users across the world. The company is well known for its innovative crypto borrowing and lending services that include an interest-earning wallet. You can earn interest on 39 cryptocurrencies (which is a lot for a crypto interest platform), and it is also a beginner-friendly cryptocurrency exchange. As an Australian, you can also directly buy crypto using your credit card.

Security of customer assets is at the forefront of Nexo’s operating philosophy. In addition to its industry-leading security measures, it has a $775 million insurance fund to cover you in the event you lose your assets to hacking.

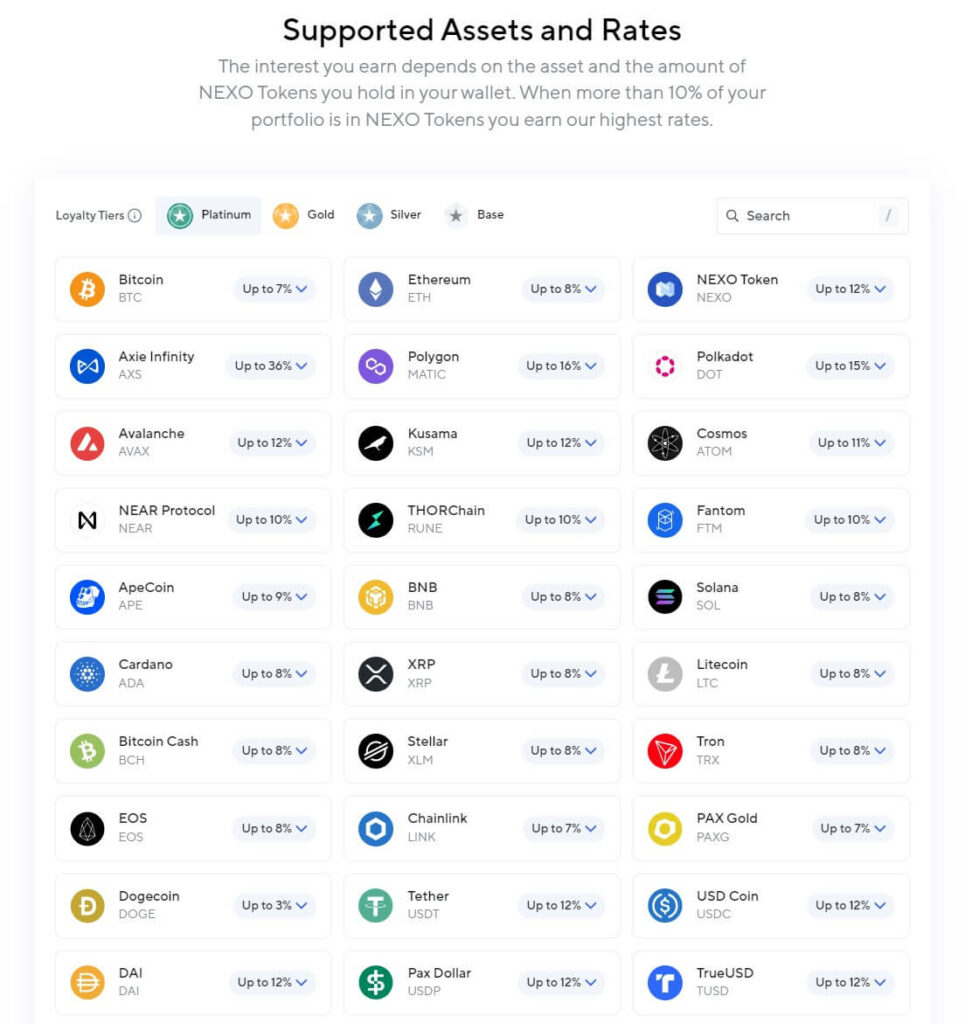

Nexo provides up to 16% Annual Percentage Rate (APR) on cryptocurrencies such as Bitcoin, Ethereum, Axie Infinity, Polygon, Polkadot, Avalanche, Cosmos, THORchain, Fantom, and others, to name a few. Additionally, Nexo is a popular platform for earning interest on stablecoins due to its high returns.

Nexo interest rates are tier-based with your tier determined by the amount of NEXO tokens you hold. The interest rates are relatively low if you don’t hold any NEXO tokens.

- Base: No NEXO tokens

- Silver Tier: 1% to 5% of your portfolio is NEXO tokens

- Gold Tier: 5% to 10% of your portfolio is NEXO tokens

- Platinum Tier: More than 10% of your portfolio is NEXO tokens

Being on the platinum tier will give you the highest interest rate, however, this means you need to buy NEXO tokens which is a sizeable investment by itself.

In terms of options, you can choose from the flexi term or lock your assets in for a fixed term where you cannot withdraw them. Locking your assets in will attract a better interest rate.

For Bitcoin and Ethereum, you’ll be able to earn a 7% and 8% interest rate, respectively. But if you choose to lock your stablecoins (i.e. USDT, DAI, USDC, TrueUSD) you’ll earn up to a 12% interest rate. Generally, an interest rate over 10% for stablecoins is attractive, making Nexo the best place to deposit stablecoins.

As a dedicated crypto borrowing and lending platform, the interface is specifically designed to deliver these services with ease. Whilst the interface is easy to understand and use, accessing interest rewards on your crypto has a few hurdles for Australians.

Firstly, the only way to buy crypto is with your credit card but at least there are no fees worry about (besides any from your credit card provider). Deposit methods commonly available to Australians such as BPAY, POLi, and PayID are not supported. Secondly, crypto can only be purchased in USD, EUR, or GBP, meaning that you will need convert AUD to USD and incur currency conversion fees. Not the most economical way to get started. Of course, you can still transfer your crypto from an external wallet and into the Nexo wallet.

If you’re looking for a crypto platform with a wide variety of supported assets then Nexo may be for you. The interest rates offered on stablecoins are simply the best Australians can achieve. A major downside is the need to buy and hold NEXO tokens if you want to obtain the best interest rates.

NEXO Pros

- 39 digital currencies to earn interest on.

- Versatile platform with a great user interface.

- Flexible and fixed terms available.

- The best interest rates on stablecoins.

NEXO Cons

- Must hold NEXO tokens to get higher interest rates.

- Will incur currency conversion fees to convert AUD to USD.

4. Hodlnaut (best for ease of use)

- Rating: ★★★

- Supported Crypto: 7

- Fees: None

- Interest Rates: Up to 7.25% APY

- Terms: Flexible and locked

- Visit Website

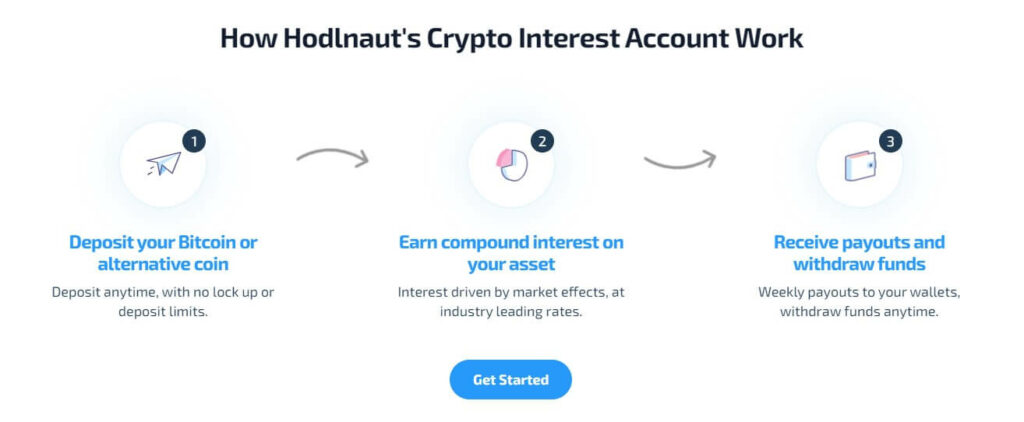

Holdnaut is a Singaporean-based crypto platform that offers interest-earning accounts to people who want to passively grow their portfolios. The company has a customer base of over 100,000 investors and holds in excess of $250 million worth of digital assets.

Update: Hodlnaut has currently suspended new accounts and withdrawals.

If you want to be flexible with your crypto assets then Hodlnaut may be the platform for you. There are no lock-in periods so you’re free to withdraw assets for other purposes at any time. On top of this, you can get started with as little as $1.

Currently, the list of assets that can earn interest pay-outs is very limited, with Hodlnaut only supporting 7 currencies. These include BTC, ETH, USDC, USDT, DAI, WBTC, and PAXG. Interest payments up to 7.25% APY can be obtained with payments made weekly. Interest compounds, making it suitable for large-scale crypto traders and a viable alternative to BlockFi. If you’re comfortable locking your crypto, you can also choose the fixed-term deposit to earn interest where terms range from 28 to 180 days.

Overall, Hodlnaut is a great crypto interest for Australians who are looking for weekly payouts. A fixed-term deposit and crypto savings account are available, which is good for both types of traders. While many find only seven cryptocurrencies lacking, you should know that all the cryptos listed are major assets.

Hodlnaut Pros

- Competitive interest rates.

- Fixed and flexible accounts are available.

- Interest is paid weekly.

- Can start earning crypto with just $1.

Hodlnaut Cons

- Only seven cryptocurrencies can earn interest.

Comparing Crypto Interest Accounts in Australia

Here is a comparison of our top 6 interest-earning wallets available to you. We have taken the ease of use into account, the platform’s security, the user count, the popularity, and whether they support AUD.

| Platform | Supported Assets | Bitcoin % APY | Ethereum % APY | Stablecoin % APY |

|---|---|---|---|---|

| Swyftx | 10 | Up to 4.08% APY | Up to 4.08% APY | Up to 6.72% APY |

| CoinSpot | 23 | Not supported | Not supported | Not supported |

| Nexo | 39 | Up to 7% APY | Up to 8% APY | Up to 12% APY |

| Hodlnaut | 7 | Up to 4.08% | Up to 4.60% | Up to 7.25% |

What to Look for in an Interest-earning Wallet

Before you pick any of the listed cryptocurrency interest platforms in Australia, it is important to understand these attributes:

- Supported assets: The range of supported digital assets that can earn interest should ideally fit your crypto portfolio. For instance, if you want to passively grow your Bitcoin portfolio, then Digital Surge isn’t an option as it doesn’t support Bitcoin.

- What are the interest rates: Always compare interest rates, their rate of payment and if they compound. Platforms like BlockFi accrue interest monthly instead of daily, which might be more suitable for beginner investors.

- Is the platform easy to use? The truth is, not every platform is easy to use. Different platforms have different user experiences. Are the deposit methods convenient for you? Are you able to swiftly transfer assets in and out of the Earn wallet? Swyftx and Digital Surge are examples of beginner-friendly platforms.

- What are the fees? The majority of interest-earning wallets available to Australians don’t charge any fees to earn interest on crypto. However, almost all platforms will support the purchasing of crypto which will carry trading fees.

- Security: Security is a critical factor to consider for every investor. If the platform isn’t secure, neither is your portfolio. Therefore, always find out how much care to secure the platform paid.

How to Earn Crypto Interest in Australia – Quick Guide

Earning interest on the cryptocurrencies that you currently hold is a surprisingly easy process that can be completed in just 4 steps.

- Create a crypto account with an AUSTRAC registered such as Swyftx.

- Complete the mandatory Know-Your-Customer (KYC) process by verifying your identity.

- Either fund your account with AUD using one of the supported deposit methods or transfer one of the supported cryptocurrencies from an external wallet.

- Transfer one of the supported assets from your Trade wallet and into the Earn wallet. Interest will start generating once the crypto is transferred.

Should You Earn Interest on Crypto?

Using an interest-earning wallet to passively generate crypto rewards over time is a popular way for investors to grow their portfolios. Rather than having digital currencies sit idle in your wallet, your crypto can see growth with next to no effort or input. Whilst interest rates are changed in response to market conditions, the crypto rewards that are generated are relatively consistent and stable. Overall, it is a safe and beginner-friendly way of making your crypto work for you.

What are the Risks of Earning Interest on Crypto?

While crypto interest platforms give you some protection from the market’s volatility, it is not risk-free. The higher APYs provided by many platforms always carry slightly higher risks due to their centralised nature. Think of Celsius. It was the platform that epitomized the term “Unbank” yourself. But the Terra crash and the subsequent Bitcoin dip caused its massive losses, and now, it has filed for Chapter 11 Bankruptcy. It means that whoever had their assets locked in Celsius is gone.

While many crypto lenders have established mitigation measures to deal with this issue in the future, there is no guarantee that they will work. Therefore, before holding your coin in centralized exchanges, research thoroughly.

Are Crypto Lending Platforms Regulated in Australia?

If you borrow money from traditional financial institutions, then up to $250,000 is insured in Australia. However, the cryptocurrency market is still new, and regulations are still being formulated – and that too sluggishly. So no, cryptocurrency lending platforms aren’t regulated by the Australian government – or any government for that matter. However, regulation could be coming to Australian crypto investments in the near future. That means that whenever you borrow crypto from a centralized lender or lend it to the crypto interest platform, you always carry the risk of losing your funds because of hacks.

Conclusion

Earning interest on crypto is a great way to passively grow your crypto portfolio, especially if you’re a beginner. The method requires very little effort, market knowledge, and capital to get started.

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.