Bybit Review for Australians: It’s Not All That Great

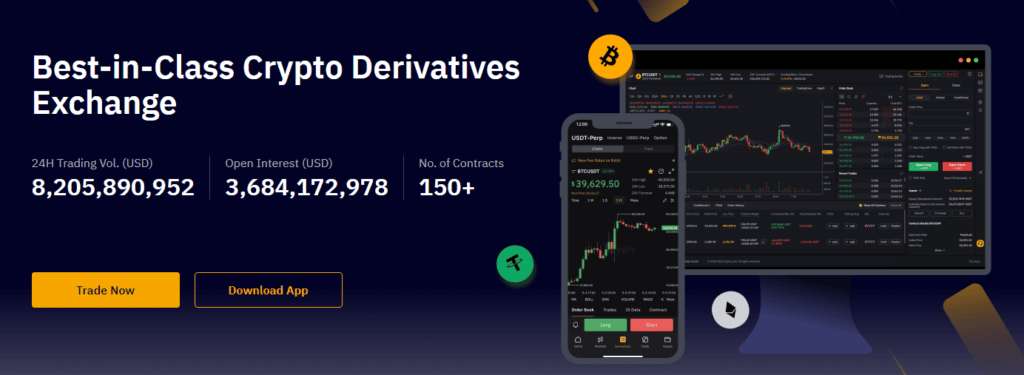

Last Updated on December 24, 2023 by Kevin GrovesBybit has grown into one of the best cryptocurrency margin exchanges to use in Australia. The platform hangs its hat on cost-effective margin trading, where investors can trade BTC/USD and ETH/USD pairs with up to 100x leverage. Bybit remains up-to-date with the latest innovations in crypto technology, supporting derivatives, an earning hub, a copy trading platform and an NFT marketplace.

This review will explore the ins and outs of Bybit for Australians to help you understand if the platform’s fees, features and security measures will meet your crypto investment goals.

Bybit

Trading fees:

0.06% / 0.01% (margin), 0.1% (spot)

Number of cryptos:

81+

Deposit methods:

Crypto, 3rd party fiat gateway

Supported countries:

Global (including Australia)

Promotion:

Deposit bonus up to $3,000

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick Overview

Here is a quick summary of Bybit.

| Exchange Name | Bybit |

| Supported Countries | Australia (and internationally) |

| Fiat Currencies Supported | None (fiat currencies can be converted to crypto through third-party payment gateways) |

| Deposit Methods | Cryptocurrency wallet transfer |

| Supported Cryptocurrencies | BTC, ETH, XRP, EOS, USDT, BIT, DOGE, DOT, LTC, XLM, AAVE, COMP, LINK, MKR, SUSHI, UNI, YFI +150 more |

| Trading Fees | Spot trades: 0.1%, Derivatives trades: 0.01%/0.06% (makers/takers) |

| Deposit Fees | None |

| Withdrawal Fees | None. Variable network fee that depends on cryptocurrency |

| Mobile App | Yes (Android and iOS) |

The Bottom Line

After using Bybit for the best part of 2 years, the trading experience for buying crypto on the spot exchange or with margin is superb. The modern and innovative mobile app is second to none and coupled with a vast range of coins to trade and low fees, Bybit is all-class. However, there were some minor delays with my ID verification which took quite a while to pass.

What we liked:

- Stable and reliable trading platform with TradingView charts.

- Good range of support crypto pairs.

- Modern mobile app for 24/7 use.

What we didn’t like:

- Can’t deposit or withdraw AUD from Bybit.

- ID verification can be lengthy.

- It may be complicated for beginners.

Limited Promotion – Deposit bonus up to $3,000

What is Bybit And Why Choose Them?

Bybit is one of the few cryptocurrency exchanges currently offering margin and derivatives trading to Australian residents. The platform came to life in 2018 at the hands of Ben Zhou, who previously worked at a large CFD and forex brokerage company. Bybit averages over 3 million weekly visits and boasts more than 2 million registered accounts. The business operates out of Singapore (and Dubai) but is registered in the British Virgin Islands.

The Bybit exchange’s primary point of difference is its support for low-fee derivatives and margin trading. If you’re an experienced trader, you can seamlessly swap perpetual contracts and receive up to 100x leverage on BTC and ETH trading pairs. Although these services are intended for advanced crypto investors, the platform’s user interface is quite intuitive and can be used by anyone.

Bybit stays relevant in the industry by constantly evolving its suite of features. You can browse and build a portfolio at the NFT marketplace, passively earn digital currencies through the earn hub, or keep an eye on the platform’s top traders on the Copy Trading program.

So, Can You Use Bybit In Australia?

Yes, Australians can create an account with Bybit and begin margin trading. While Bybit is not fully regulated in Australia, it is 100% legal to trade crypto with leverage on Bybit. It should be noted that Bybit does not allow direct AUD deposits, however, traders can purchase crypto through a third party using a credit or debit card. This will incur additional payment fees which is not ideal. If you want to buy and sell with AUD, you will need to find an alternative to Bybit in Australia.

Pros & Cons

Pros:

Cons:

This Is What We Think After Using Bybit

Great platform for derivatives and margin trading

It was quite apparent that ByBit is one of the top derivatives and margin trading cryptocurrency exchanges globally. The platform supports high liquidity on perpetual, Futures, and Options contracts. Stablecoins pegged to the US dollar are typically used as collateral for derivatives trading, particularly USD Coin (USDC) and Tether (USDT). There are over 150+ contracts for you to choose between.

You can trade 15 different leveraged tokens long or short, including Solana, Ripple, Ethereum and Bitcoin. For margin traders, there isn’t a huge range of supported cryptocurrencies. However, you can trade BTC and Ethereum against USD for up to 100x leverage. This leverage is higher than most competitors, which tend to cap borrowing power at 5-10x.

It’s worth remembering that margin and derivatives trading are only recommended for experienced investors. Returns are amplified when trading with leverage – but so too are losses. If you are new to trading cryptocurrency, it is generally best to stick with spot trading.

Copy trading will suit beginners

Copy Trading (also known as social trading) is a relatively uncommon feature in cryptocurrency exchanges. The concept was pioneered by eToro over a decade ago, and allows users to observe and copy other “Principal traders” with more experience or capital.

You can choose between some of the best-performing portfolios on the Bybit platform and automatically copy crypto trades they make. Most of these Principal traders are working with tens of thousands of dollars per transaction, which might be out of reach for casual investors. Instead, you can follow a Principal Trader’s moves using a smaller proportion of money. You can constantly update this amount depending on your risk appetite.

Marketplace for your favourite NFTs

Bybit supports a growing NFT marketplace where you can buy, sell and swap various non-fungible tokens. Users cannot sell their own NFT mints without directly contacting the Bybit support team. As of now, there aren’t many “blue chip”, high profile NFT collections for sale on the market compared to alternatives like OpenSea.

That said, the platform occasionally has live collection drops, where you can pick up new NFTs at a heavily discounted price. Considering all of Bybit’s other features, their NFT marketplace is a decent landing point if you want to begin building a portfolio of digital collectibles.

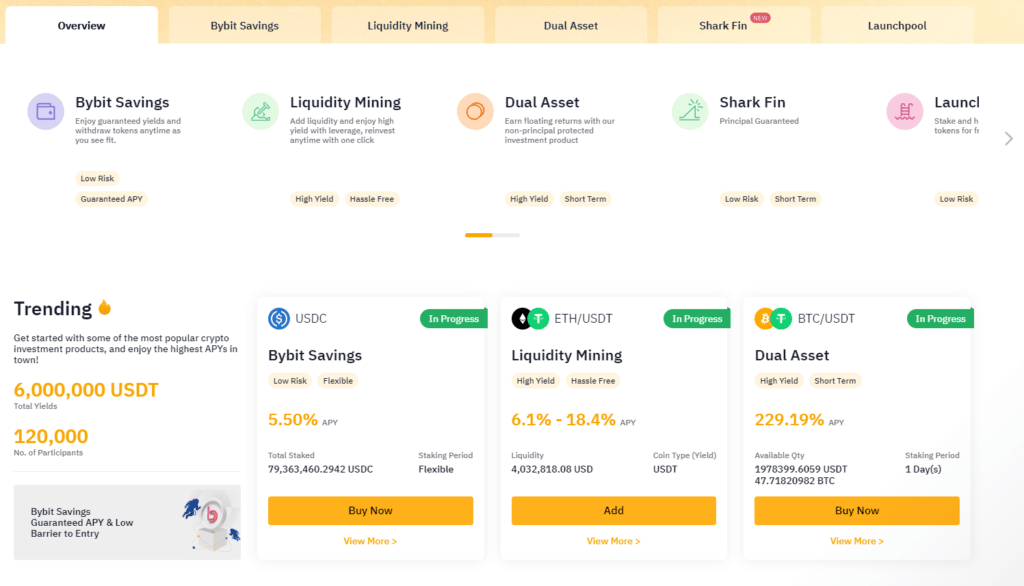

Earn products if you want to earn a little extra

Bybit’s earn program has been running for a few years and has returned $6m in yields for its investors. There are five different types of earnings available:

- Savings account (lending)

- Liquidity mining

- Dual asset (a bit like investing in futures)

- Shark fin (low risk, principal guaranteed)

Bybit doesn’t have many tokens available for earning, especially compared to competitors like Binance. The savings account supports yield for 21 different digital currencies, with APYs of up to 5.5%. The potential APY for liquidity mining and dual asset earning programs dwarfs the savings account, but these methods also come with greater risk.

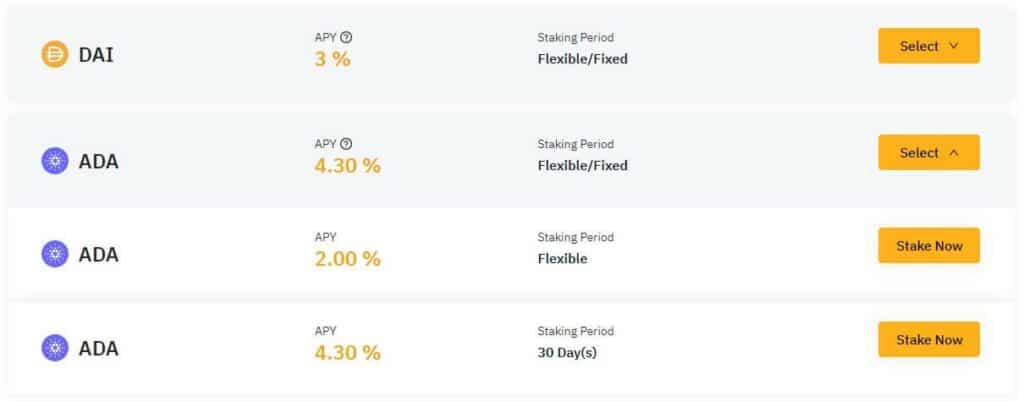

Crypto staking for savvy investors

Bybit allows you to stake 27 cryptocurrencies such as SHIB, SOL, XRP, and ETH for passive interest yields. However, in order to do so, you need to complete KYC level 1 which will require you to verify your identity.

The availability of staking options is dependent on the current capacity of the staking pool for each asset. Although several term arrangements can be selected, the most common include flexible, 30 days, and 60 days. Usually, the longer the term the higher the yields. But this is not the case with Bybit. For example, staking ETH on a flexible arrangement will get you a slightly higher interest rate of 2.5% compared to the 60-day rate of 1.8%.

How your interest yields are calculated depends on if you choose a flexible or fixed term. For flexible staking arrangements, the daily yield is based on the number and type of tokens staked and is subject to market conditions. Fixed-term arrangements offer a more guaranteed approach where the principal and yield will be automatically distributed into your wallet when the period ends.

Interest yields are also non-compounding and the yields obtained won’t be reinvested to gain additional yield. This means that for fixed terms, you will need to deposit a new amount of crypto to start generating yields, that are paid out at the cessation of the term.

Rewards and promotions to keep you trading

Bybit offers a Rewards Hub where you can earn up to $1,230 by completing tasks on the exchange. These tasks include making an account, reaching certain trading volumes and participating in various features.

The platform also offers various promotions for signing up, trading specific digital currencies, or locking up tokens in an earning program. Many of these promos are region-locked, so you should always read the terms and conditions before participating.

Bybit features a referral and affiliate program. Every time someone uses your referral link, you will be paid 30% of any fees they accumulate through trades. For more information on the Bybit referral code and how to get one, read this article or you can learn more in this Bybit article in the Canberra Times.

Bybit also runs frequent trading competitions, where experienced investors can compete with one another for a share of a prize pool.

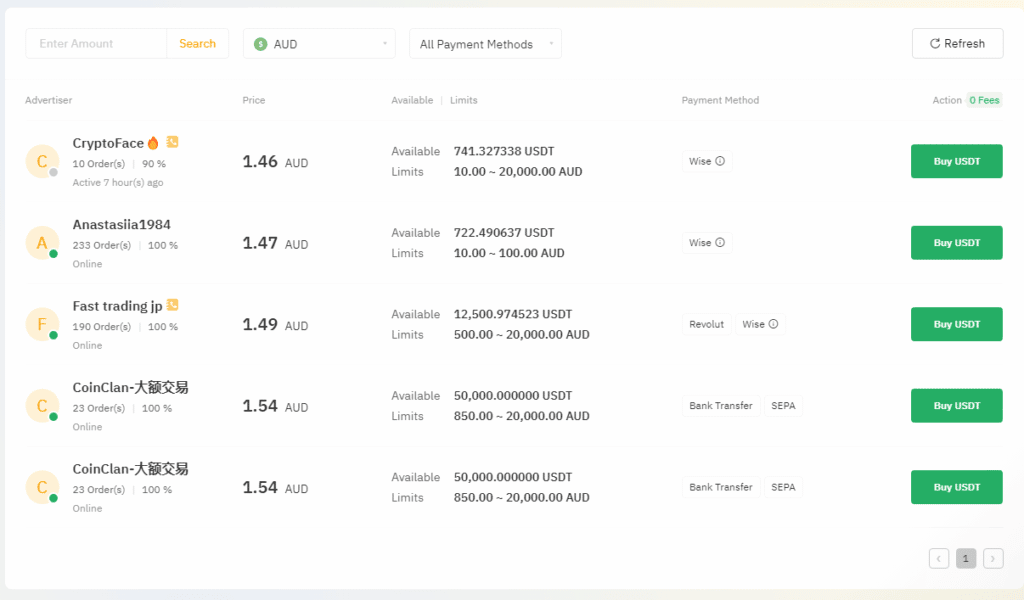

P2P Exchange that has zero fees

Bybit launched its native P2P exchange in January 2022. Here, you can trade coins and tokens directly with other users on the Bybit platform. The P2P platform charges zero fees and supports direct fiat purchases through payment methods like Bank Transfer, Credit Card and Wise. So far, the P2P exchange supports USDT, BTC and ETH.

Unfortunately, there’s no way to filter sellers other than through payment methods and fiat currency. This won’t present a huge issue for Australians though, as there aren’t too many sellers that support AUD. But it is possible to find a seller or buying that is willing to trade with AUD as shown below:

Advanced orders to execute trades to your strategy

Advanced order types are an important element of any well-structured trading strategy. Applying Stop Losses or Take Profit to your orders is a great way to mitigate the risk of trading CFDs or with leverage. By using an SL or TP, traders can set a “trigger price” where they automatically exit their position on a digital currency. This gives Bybit a major advantage over other derivatives exchanges available to Australians that do not offer these risk management options.

Insurance fund (DYOR)

Bybit maintains a significant reserve that it uses as an insurance fund. The company reported the fund being worth over $200m AUD as of August 2022. The fund is used in situations where margin traders are forced to close their positions at lower than the bankruptcy price. In this circumstance, the trader will have already lost more than their initial margin, so the insurance fund makes up the deficit.

In general, Bybit’s insurance fund is used to prevent deleveraging, high amounts of negative equity and as a backup in case of liquidation. You can read Bybit’s in-depth guide for more detail on the fund.

Mobile app is lightning fast to use

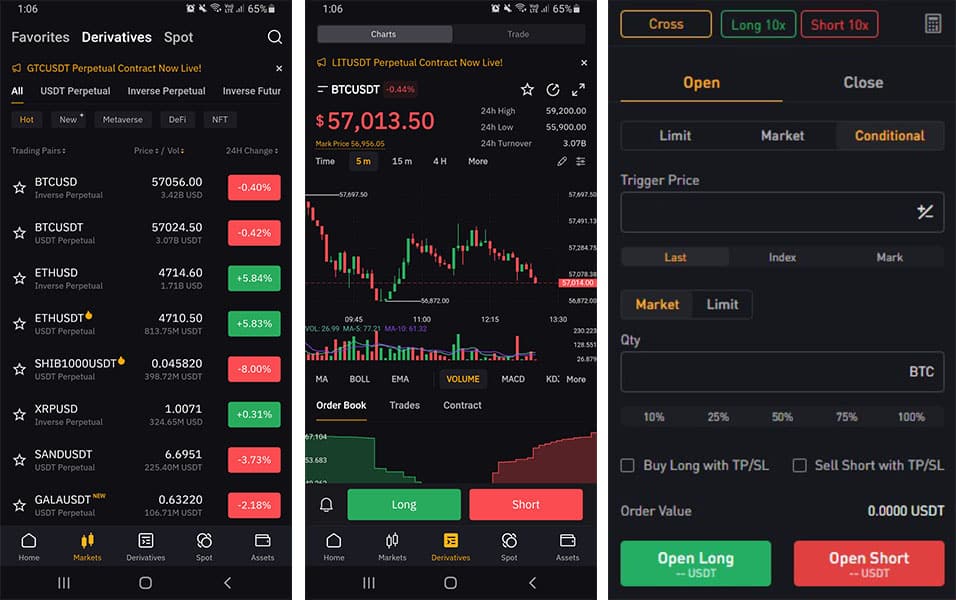

Bybit has a sophisticated mobile app that supports on-the-go derivatives and margin trading. The app is easy to use, responsive and mirrors all of the desktop version’s main features. Using the app to perform spot or margin trades is smooth and simple to navigate through the options. The smartphone application is available on Google Play (4.4 / 5 stars) and iOS App Store (3.9 / 5 stars). We were extremely satisfied with the performance of the app and is undoubtedly one of the best crypto apps for trading.

What Crypto can you trade?

Bybit’s main trading platform does not support most fiat currencies, including AUD. Instead, users will need to transfer their local currency into crypto through Bybit or a different crypto exchange in Australia. Bybit has native support for “express” trading seventeen different cryptocurrencies: USDT, BTC, ETH, USDC, XRP, EOS, ADA, SOL, DOGE, DOT, DAI, TRX, AVAX, MATIC, LINK, ATOM and ETC.

Those looking to trade derivatives or on the spot market can access more than 81 cryptocurrencies that are available in 100 or more trading pairs, including popular tokens like APE, CAKE, GMT and ONE. You cannot deposit tokens from the Binance Smart Chain (BSC) onto the Bybit platform.

What Are The Fees on Bybit?

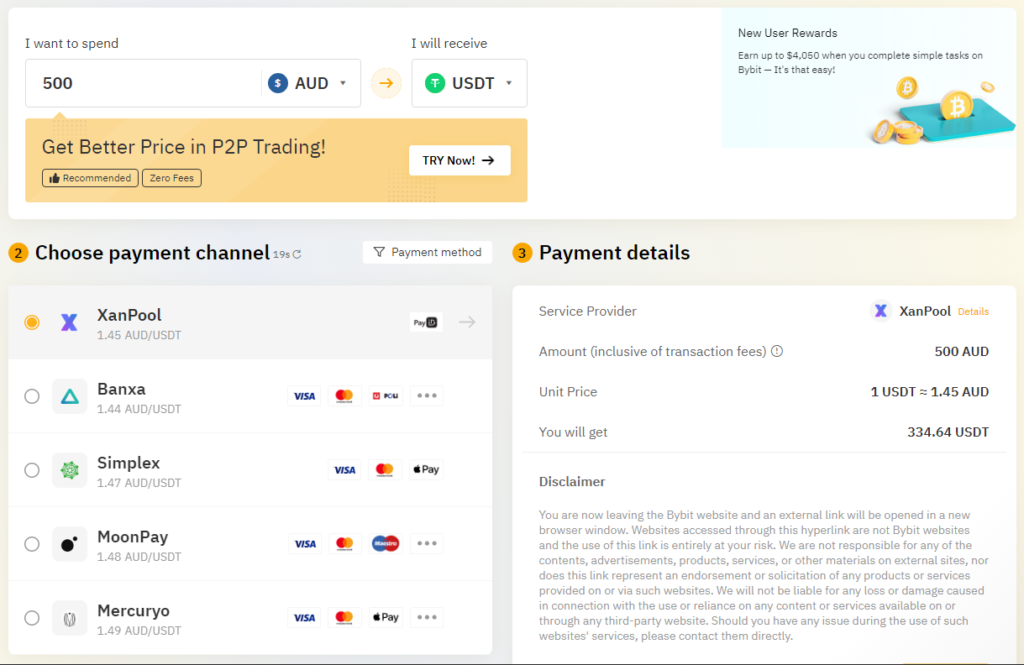

Deposit fees

If you are using a third-party gateway to convert your fiat to cryptocurrency on Bybit to deposit AUD, you will incur a variable fee. This isn’t great for buying crypto in Australia. Moreover, these fees can be quite high, so it is better to deposit digital currency directly such as Bitcoin or Ethereum, if possible. Deposits of cryptocurrency onto Bybit do not incur any fees and there are no minimums.

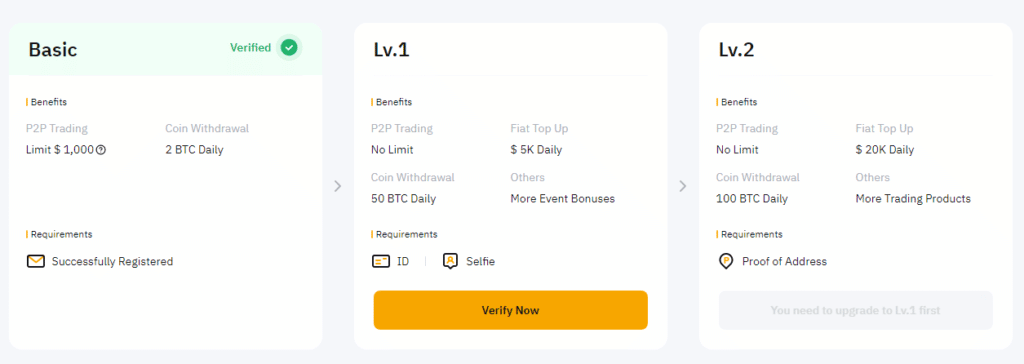

Withdrawal fees

As Bybit is largely unregulated, it does not support AUD withdrawals. You can withdraw up to 2 BTC (or equivalent) per day without any level of KYC completed. This figure jumps to 100 BTC for those with level 2 KYC verification. Each cryptocurrency has a minimum withdrawal figure, usually around $20 USD.

Withdrawal fees are variable and depend on which token is being transferred. For example, Dogecoin withdrawals will incur a 5 DOGE fee, and USDT withdrawals incur a 10 USDT fee. You can see a full list of withdrawal fees here.

Trading fees

Bybit has some of the best trading fees on the market. Their spot trading fee is only 0.1%, comparable to other large exchanges in Australia that we have reviewed such as Binance.

Regarding derivatives, Bybit will charge a varying fee depending on whether you’re a maker or taker, and your monthly trading volume. The base level fee is 0.01% for market makers and 0.06% for market takers. High-capital investors with a Pro 3 account can have their maker fees waived entirely on both spot and derivatives trades, which makes it cheaper than the likes of Margex for example.

Swaps from one digital currency to another on Bybit incur a 0.1% fee which is reasonable but not the cheapest in the industry. Platforms such as Binance have zero-fee crypto swaps.

How To Get Started On Bybit?

Opening an account with Bybit is easy. Each new member must provide an email address and password to start. Users can even sign up using their Google accounts without providing additional information. As Bybit isn’t regulated in Australia, you don’t need to verify your account or pass KYC protocols to begin trading. However, some restrictions on withdrawals and deposits are put in place. Even so, ByBit is one of the top crypto exchanges without KYC for traders that want to remain anonymous.

To verify your account fully, you must configure SMS authentication for 2FA and pass identity verification. Level 1 KYC requires you to post a selfie of yourself along with a form of government-issued identification. Level 2 KYC requires proof of address through a bank or utility statement.

What Is Trading On Bybit Like?

Novices can use Bybit’s “express” trading feature to quickly and easily transact fiat to 17 different cryptocurrencies. This method involves a third-party payment gateway and can rack up costs quite quickly, but it can be a good way to get started on the platform.

We found Bybit’s main trading interface is a little complex and will be quite overwhelming for beginners. The crypto exchange is intended for experienced, high-volume traders who wish to move derivatives – and the trading hub reflects this.

Those a little more advanced in their crypto trading journey will find Bybit’s trading interface quite useful. It comes with an in-built TradingView API so that you can customise charts to your liking with indicators. It’s easy enough to set stop losses/take profits via the order tab on the right of the page. You can also browse order book information and market depth in the interface.

Customer Support Is Questionable

Bybit provides its users with a comprehensive FAQ section that will answer the most basic and some more in-depth questions. There are guides for depositing and withdrawing crypto, as well as articles on derivatives trading and many other features offered on the exchange.

If the help centre doesn’t answer your question, Bybit runs a live chatbot service through ZenDesk. This chat is available 24/7 and has multi-lingual support. Alternatively, you can submit a case query through the help centre, or contact Bybit officials via social media such as Twitter, Telegram, or email.

Our Final Verdict

Bybit is one of the world’s top exchanges for trading derivatives. The platform offers lightning-fast transaction times, low fees, up-to-date price feeds, and various advanced trading instruments. Beyond Bybit’s trading benefits, the development team keeps informed and relevant with cryptocurrency’s latest trends and innovations. The platform offers an NFT marketplace, an earning hub, and customisable charts. This helps set Bybit apart from many of its competitors within the Australian market that we have reviewed.

Bybit’s lack of regulation and complex trading interface may ward off some potential users. If you’re new to cryptocurrency trading in Australia, we recommend avoiding Bybit and leveraged/derivatives products. A good alternative would be Swyftx, Digital Surge or CoinSpot, as each of these exchanges is licensed with AUSTRAC and headquartered in Australia. However, if you’re an experienced investor looking for derivatives, Bybit is one of the best options out there.

Limited Promotion – Deposit bonus up to $3,000

Frequently Asked Questions

It is unclear exactly which countries Bybit is registered with outside of the British Virgin Islands. In general, Bybit operates in a grey area outside most regulatory jurisdictions. This means they are not registered with AUSTRAC, therefore limiting the use of AUD on the platform. In addition, Bybit’s lack of regulation allows them to offer greater leverage on margin trades compared to other exchanges with greater government oversight. This lack of regulation is why Bybit cannot provide its services to US customers. Just because Bybit isn’t regulated in Australia doesn’t mean it isn’t trustworthy. The platform has a history of security, decent customer support, and millions of customers. However, you should always proceed with caution when using an unregulated exchange.

Bybit is a safe and trustworthy crypto exchange that has millions of customers worldwide. While it isn’t 100% regulated in Australia, Bybit has bank-like security measures such as two-factor authentication (2FA) and uses 20% of its annual budget to ensure the exchange’s security. The Bybit team also uses a hot/cold wallet combination to hold some of their digital assets offline while delivering a fast and seamless trading experience.

Yes, Bybit is a good option for day traders. The platform’s high scalability is of great benefit to high-frequency traders (HFT). Additionally, Bybit’s support for a wide range of future and perpetual contracts, paired with low trading fees, makes it a logical choice for many day traders.

Bybit does offer a “Launchpool”, where token developers can list their new cryptocurrencies to be staked. However, the most popular staking coins (ETH, SOL etc.) cannot be staked for yield using Bybit.

Yes, Bybit offers its premium cryptocurrency services in Australia. Since Bybit is unregulated in Australia, you don’t need to verify your identity or pass KYC procedures. Moreover, it does not provide a gateway to deposit fiat currencies including AUD. Instead, Australians can deposit over 80 digital currencies to begin trading. Bybit offers several unique crypto services to Aussies including derivatives and margin trading, copy-trading, an NFT marketplace, and excellent earn products.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.