Best Bybit Alternatives For 2024

Last Updated on January 31, 2024 by Kevin GrovesThe no-KYC crypto exchange, Bybit, has moved to impose KYC processes to be completed for users to access its trading services. Traders and investors who wanted the anonymity and convenience of not having to verify their identities now need to seek alternatives.

In this review, we cover the top crypto exchanges individuals can use instead of Bybit, which offer similar or unique services.

6 Crypto Exchanges To Use Instead Of Bybit

If you are looking for an alternative exchange to Bybit to trade digital currencies, then you might want to consider the options below. Each alternative trading platform offers a suite of products and services that might take your interest.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Top Crypto Exchanges To Use Instead of Bybit – Our Reviews

1. Binance – Best alternative for trading services and fees

Why We Picked It: The #1 ranked crypto exchange globally according to CoinMarketCap, Binance provides an innovative and robust ecosystem of well-designed products and services that open a gateway to just about every feature you can think of. The world-class exchange supports trading 386 digital assets across 1,699 markets including spot, margin, and futures. In addition to its cutting-edge financial management and blockchain-based products, Binance also offers highly competitive fees that are typically lower than most other exchanges.

- Rating: ★★★★★

- Number of crypto: 386

- Trading fees: 0.1% maker and 0.1% taker (spot)

- Acceptable deposit methods: Credit/debit card, POLi, bank transfer

- Allows fiat deposits and withdrawals: Yes

- Visit Website

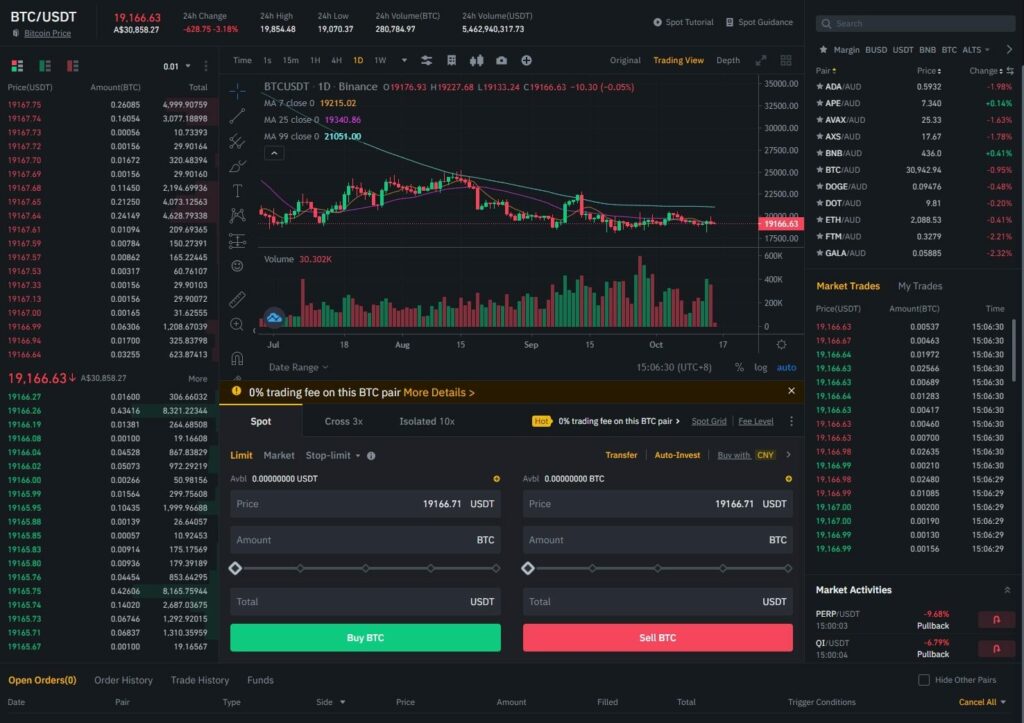

Binance has no shortage of cutting-edge features and is more or less on equal terms with Bybit. Both crypto exchanges offer spot, margin, and futures trading on an interface well-stocked with TradingView charting and an assortment of advanced technical tools. If you have used the trading interface on Bybit for a while, then you will quickly accustom yourself to Binance’s version since there are a lot of similarities.

Although the interest-earning wallets on Binance are more extensive than Bybit, the latter excels in its crypto-staking module. Nevertheless, the Binance Earn module is likely to appeal to the general public since it is straightforward to use.

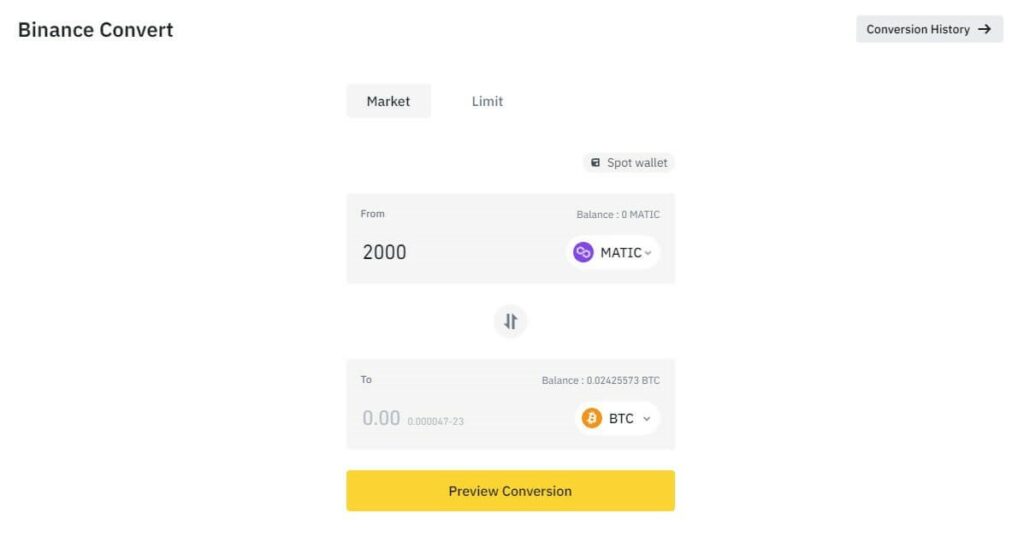

Notwithstanding Binance’s financial management products which include crypto lending, the highly liquid exchange complements its key selling points with a series of ancillary features that make it a one-stop shop for the majority of crypto traders and investors. These include its free crypto swapping service, Peer-to-Peer (P2P) marketplace, NFTs, trading bots, and a VISA debit card (unavailable to Australians).

In terms of fees, you aren’t missing out on much by switching to Binance. The crypto exchange has the same spot maker and taker fees as Bybit (0.1%) for all buy and sell orders. More information can be found in our Binance review.

The first key difference between Binance and Bybit that might sway you is its fiat gateway. To deposit fiat currencies such as AUD or USD on Bybit, third parties are used to make the conversion, and high fees are incurred. However, Binance lets you deposit cash via several ways including PayID and bank transfer with no fees charged. Moreover, Binance is one of the few large exchanges that lets you conveniently withdraw cash to a bank account.

The second differentiator is the Binance user experience which is smoother and more enjoyable than Bybit. For a large crypto exchange, Binance has done well to retain its visually intuitive interface to ensure that people are not totally discouraged.

Overall, Binance is a like-for-like swap plus a few distinct advantages it brings, making it one of the best Bybit alternatives. One thing to note is that it is necessary to complete KYC before any funds can be deposited.

Binance Pros:

Binance Cons:

2. Kraken – Best alternative for traders

Why We Picked It: Kraken is a suitable pick for traders who require a professional trading platform with decent fiat-to-crypto and crypto-to-crypto facilities. The trading engine and interface terminal are state-of-the-art and easily rival its biggest competitors with its TradingView charting, a full suite of indicators, overlays, and order types.

- Rating: ★★★★

- Number of crypto: 228

- Trading fees: 1.5% (instant), 0.16% (maker) & 0.25% (taker)

- Acceptable deposit methods: Crypto only

- Allows fiat deposits and withdrawals: No

- Visit Website

One of the most popular cryptocurrency exchanges is Kraken. Kraken, which launched in 2011, immediately gathered more than 7 million traders and investors across the globe due to its sophisticated and robust interface and infrastructure to firm itself as an advanced trading platform.

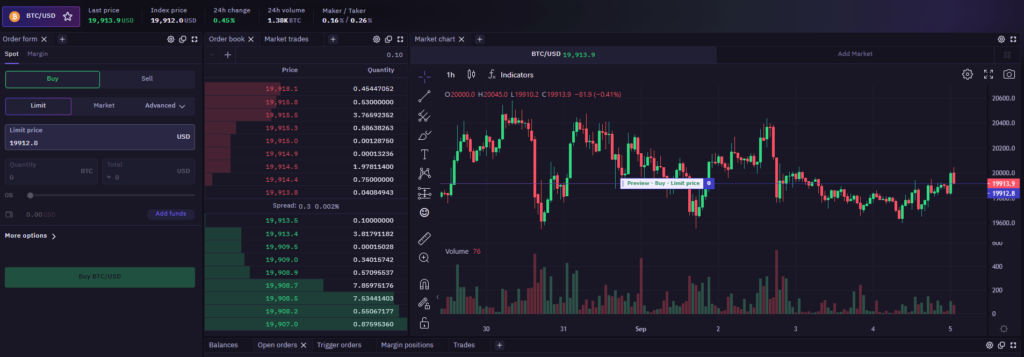

Since most of the local exchanges cater to the general public, Kraken targets traders who need access to execute complex strategies on its spot and margin markets with leverage. The cutting-edge TradingView charting and advanced order options are at your disposal on the Kraken Pro exchange, where its trading engine will execute trades rapidly.

The Kraken Pro interface can be customised to suit your needs and multiple markets can be opened to provide you better convenience. Despite being a well-equipped interface, Kraken has managed to maintain a level of simplicity by providing a range of straightforward order types to aid in risk management. The available order types include:

- Market

- Limit

- Stop loss

- Take profit

- Take profit limit

- Stop loss limit

- Settle position

One of the pros of using Kraken over Bybit is that its Pro exchange is available on its mobile app, giving traders even more flexibility and choice when it comes to managing their positions on the go.

You will need to remember that Kraken doesn’t have a suite of supported crypto assets than Bybit, with only 100 digital currencies that can be traded. Its spot trading fees are also slightly higher than Bybit’s 0.1%, where maker and taker orders start from 0.16% and 0.25%, respectively. Although Kraken is one of the better crypto staking exchanges in Australia, Bybit has more supported coins and more choices in terms of terms and other options.

Kraken does not have the bells and whistles that Bybit has. But as you will find out in our review of Kraken, choosing the exchange will primarily come down to its state-of-the-art trading interface and extremely high level of security – two things traders take notice of.

Kraken Pros:

Kraken Cons:

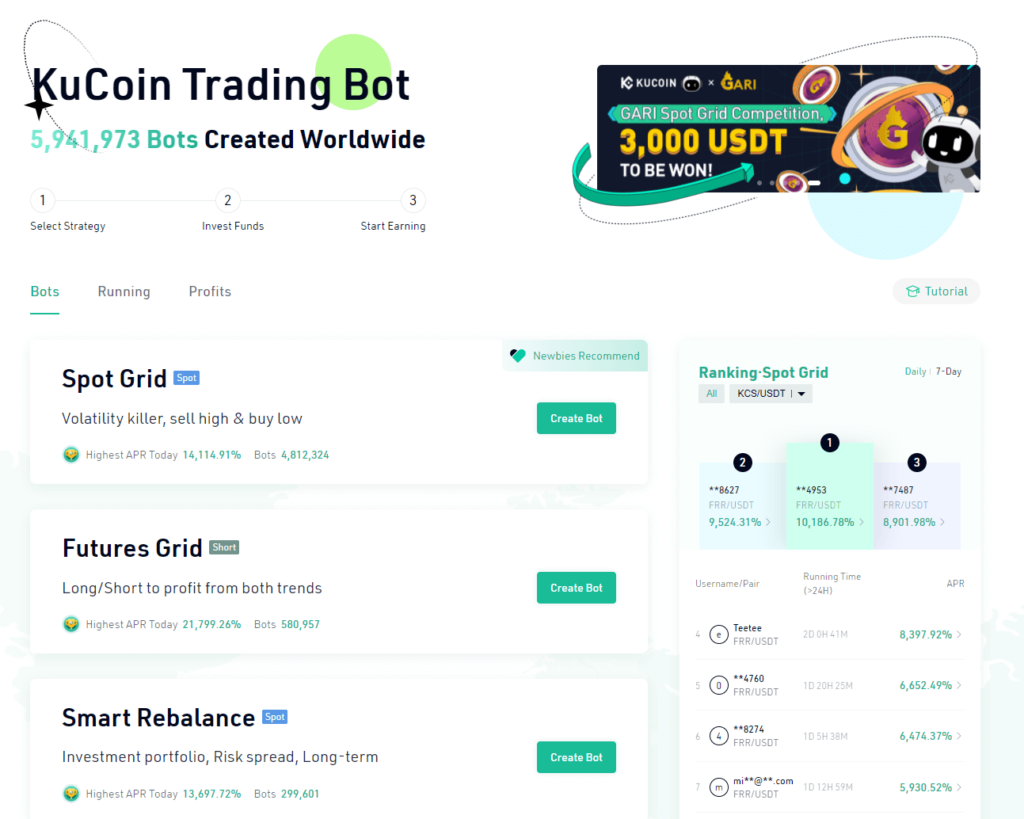

3. KuCoin – Best no-KYC alternative to Bybit

Why We Picked It: KuCoin is the crypto exchange with the most useful trading and investing features that don’t require KYC procedures to be completed to access them. You can place orders on its spot and margin markets with fees similar to Bybit, access its user-friendly trading bots, and withdraw a maximum of 1 BTC per day for unverified accounts.

- Rating: ★★★★

- Number of crypto: 862

- Trading fees: 0.1% (maker), 0.1% (taker)

- Acceptable deposit methods: Credit card, crypto, bank transfer (P2P only)

- Allows fiat deposits and withdrawals: Yes (deposit only)

- Visit Website

With over 20 million users worldwide, KuCoin is one of the best crypto exchanges to trade digital currencies without having to complete the KYC process. The digital asset platform supported more than 800 coins and tokens across over 1,400 markets, making it an ideal place to trade altcoins anonymously. Apart from its selection of assets, KuCoin offers a full-fledged ecosystem of products and services that rivals those on Bybit, including beginner-friendly trading bots, margin with up to 100x leverage, an earning hub, and low fees.

If you trade margin and derivatives then you don’t lose anything by switching to KuCoin. The cryptocurrency trading platform offers up to 100x leveraged futures trading on more than 100 coins. In addition to BTC, ETH, ADA, APE, and ATOM, more seasoned traders can also maintain long or short bets on a number of other well-known cryptocurrencies. The same advanced order options for margin trades may be utilised when purchasing and disposing of derivatives.

Since KuCoin is not registered with AUSTRAC, you can start depositing and trading cryptocurrencies without having to complete KYC. To unlock certain features including an increase to your withdrawal limit, placing leverage trades on the futures market, and accessing the P2P platform, KYC will need to be completed. Due to its no-KYC features, KuCoin is a viable option for buying altcoins anonymously because it supports more than 800 currencies and tokens across more than 1,400 markets.

Having access to KuCoin’s free trading bots is one of the pros of using an unverified account. Due to how simple it is to produce, copy, and deploy KuCoin, it becomes a real choice if you want to automate your daily trades.

Similar to Bybit, it charges 0.1% for maker and taker orders during spot trading. Maker and taker fees start at 0.02% and 0.06%, respectively, which is not too different from one another. When you take into account the substantial liquidity that the exchange offers, KuCoin becomes a very popular option for trading altcoins without requiring KYC.

The other benefit of using KuCoin is its Futures Lite hub which is more user-friendly than the main trading interface. The lite version removes many bells and whistles that might confuse traders and offers a sleek interface with a customisable chart. More information can be found by reading our KuCoin review.

KuCoin Pros:

KuCoin Cons:

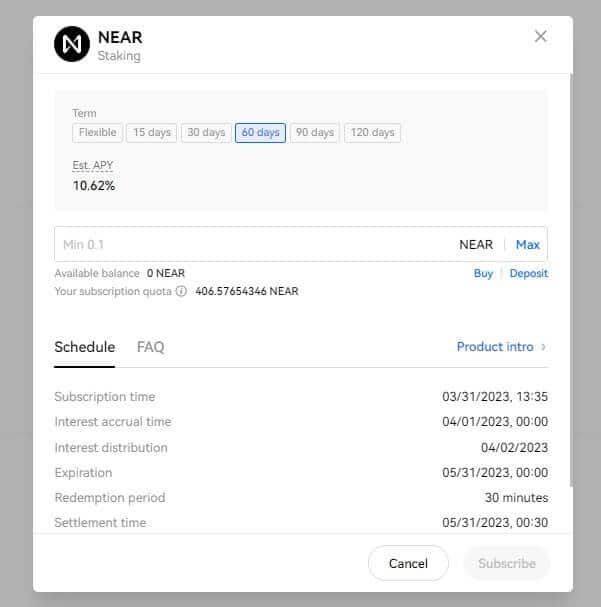

4. OKX – Best alternative for earning crypto

Why We Picked It: OKX offers a diverse range of Earn and staking products that easily rival Bybit. For its Simple Earn feature, there are 169 digital assets that can passively generate yields between 1% and 35.2% APY. 12 crypto assets including ETH 2.0 can be staked for interest returns up to 12% APY.

- Rating: ★★★★

- Number of crypto: 336

- Trading fees: 0.08% (maker) and 0.10% (taker)

- Acceptable deposit methods: Credit card, crypto

- Allows fiat deposits and withdrawals: No

- Visit Website

Formerly OKEx, OKX is a renowned digital currency exchange providing blockchain-based financial services across 100+ countries, including Australia. It offers a comprehensive ecosystem of innovative trading products and services built on robust blockchain technologies. With support for 359 coins and tokens across 802 markets, OKX serves as a one-stop shop for investors, traders, and crypto enthusiasts. Its offerings include spot, futures, contracts, margin trading, DeFi projects, and crypto lending/borrowing services.

OKX is one of the few crypto exchanges that provide an abundance of interest-earning options, both in terms of the number of coins supported but also the terms. At the time of writing, you can generate yields on 169 supported crypto assets to earn passive rewards up to 35.2%. This includes commonly traded stablecoins such as USDT (10%) and USDC (10%), Bitcoin (5%), and popular altcoins like Ethereum (5%), Shiba Inu (5%) and Apecoin (25%). Flexible term arrangements are available for almost all coins and tokens, but some have fixed terms that come with higher APYs.

As an alternative to Bybit, OKX certainly ticks a lot of boxes as the exchange provides just as many features. However, some features are lacking such as the inability to directly deposit or withdraw AUD. If this is important to you, then consider Binance for its AUD-friendly on-ramp options. For more information, read our full OKX review.

OKX Pros:

OKX Cons:

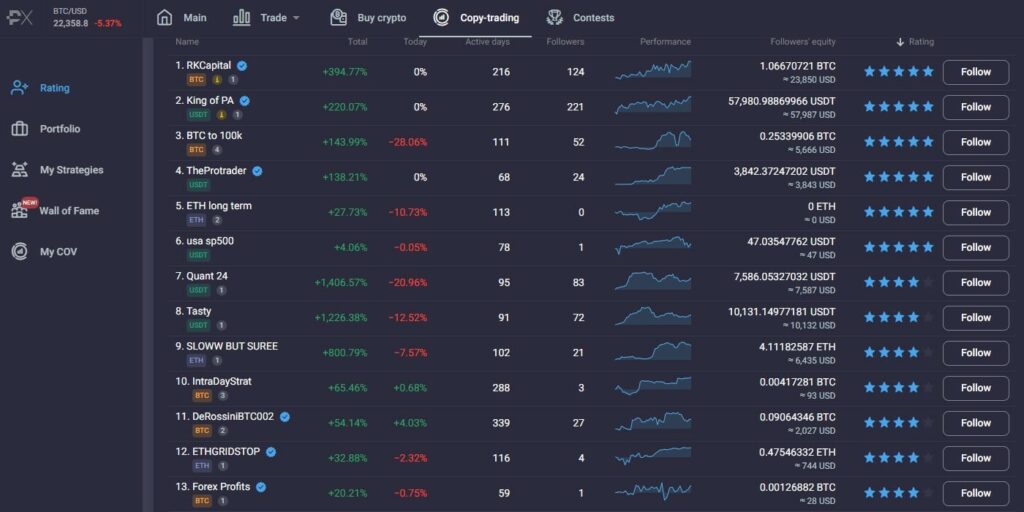

5. PrimeXBT – Best multi-asset trading platform

Why We Picked It: PrimeXBT is a reputable multi-asset trading platform that provides exposure to Forex, CFDs, and 34 digital currencies. Its two major cryptocurrency trading features are its copy-trading and margin markets which both benefit from its trading fees. The ability to apply up to 200x leverage on Bitcoin and Ethereum trading pairs sets PrimeXBT apart from its competitors.

- Rating: ★★★

- Number of crypto: 1,600+

- Copy trading fees: None

- Acceptable deposit methods: Bank transfer via PayID, credit card, crypto

- Allows AUD deposits and withdrawals: Yes

- Visit Website

PrimeXBT is an online multi-asset investing platform that was established in 2018 and has offices in Seychelles and St. Vincent and the Grenadines. PrimeXBT offers a variety of investment assets, including Contract for Difference (CFD), equities, forex, and commodities like crude oil. In 2019, it integrated virtual currencies like Bitcoin and Ethereum into its supported list of 34 digital currencies.

The platform enables users to trade 34 major cryptocurrencies across 39 pairs, mostly tied to the US dollar. While a few crypto-to-crypto pairs are available (LTC/BTC, ETH/BTC), AUD pairs are not supported. However, PrimeXBT has gained popularity due to its high leverage margin trading (up to 200x) and copy trading features. The 200x is higher than the maximum leverage that can be obtained on Bybit, based on our PrimeXBT review.

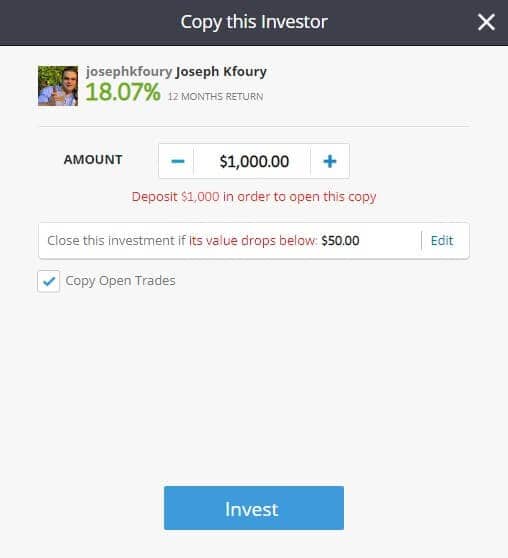

Similar to the social trading services provided on eToro, PrimeXBT’s take on copy-trading is just as viable and straightforward to use. Marketed as “Covesting”, beginner investors can copy the crypto trades undertaken by seasoned users who have demonstrated track records. Before a trade can be copied as one of your own, you have the option of browsing and viewing their strategy, making sure it (and the assets being traded) fits with your own.

There are specific requirements for copying a strategy: COV requires 101 units and 50.5 USDT/USDC, while BTC and ETH require 0.00101 BTC and 0.02525 ETH, respectively. Copiers also need to pay a high fixed 1% entry fee. After that, the 0.05% copy-trading fee is very reasonable.

Whilst the PrimeXBT user experience is very easy to wrap your head around, the capabilities of the multi-asset exchange platform are a far cry from what you get on Bybit. The exchange has a limited selection of cryptocurrencies and lacks AUD-friendly payment options. Credit card usage is costly, and there are no additional features like staking, NFTs, and futures trading. The only differentiator is exposure to alternative investment assets such as Forex and CFDs.

PrimeXBT Pros:

PrimeXBT Cons:

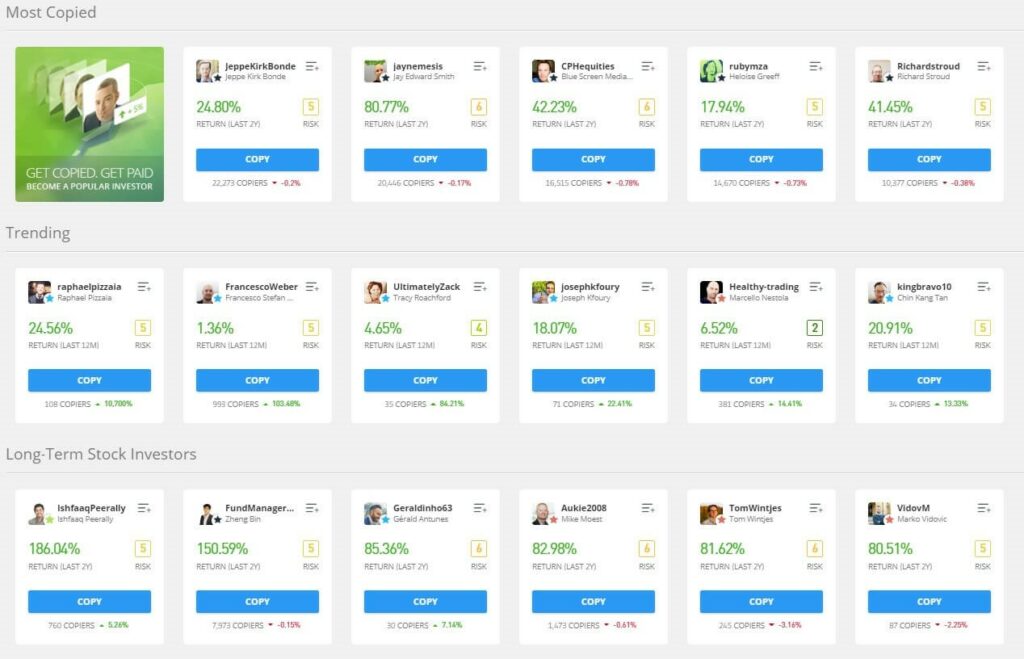

6. eToro – Top choice for copy-trading

Why We Picked It: eToro’s copy trading features are superior to Bybit’s equivalent in terms of its popularity, straightforward of use, variety of investment assets, and social community. The CopyTrader and SmartPortfolio features are delivered extremely well and are complemented by a strong community of like-minded individuals that fosters and promotes innovative investing strategies.

- Rating: ★★★★

- Number of crypto: 90+

- Trading fees: None (spread only)

- Acceptable deposit methods: Credit/debit card, POLi, bank transfer

- Allows fiat deposits and withdrawals: Yes

- Visit Website

eToro is a social trading platform for investors, offering users a wide range of assets including Forex, cryptocurrencies, commodities, stocks, and CFDs. Since its establishment in 2007, eToro has consistently expanded its features and markets, becoming a premier multi-asset platform.

The point of difference that eToro offers investors is its social trading feature. With the click of a few buttons, you can browse and sort through the pages of portfolios that investors are currently trading with. If the digital currencies and risk rating of a specific portfolio are compatible with your needs, then all you need to do is deposit funds to copy the trade.

One of the biggest differentiators eToro has that contributed to its success is its visually intuitive and appealing interface. The interface does not take the form of a traditional crypto exchange and takes some getting used to but the learning curve is short. Key management functions like depositing fiat currencies can be done swiftly. Although AUD can be deposited, the downside is that it will be automatically converted into USD resulting in currency conversion fees.

To further bolster its standing as a user-friendly copy-trading option, eToro provides a free crypto demo account so you can get accustomed to the platform. Stocked with $100,000, you have full access to the platform features where copying portfolios with no risk is highly beneficial in understanding how eToro works.

Based on our eToro review, the platform is an excellent choice for cryptocurrency investors seeking a holistic approach to portfolio growth. The platform’s community environment allows you to observe successful traders and is especially suited for those who enjoy this aspect.

eToro Pros:

eToro Cons:

Does Bybit Require KYC To Be Completed?

As of May 8, 2023, Bybit made its Know-Your-Customer (KYC) process to be mandatory for all users before any of its features could be used. The crypto exchange outlined that its purpose was to identify its customers and analyse their risk profiles with the overarching goal of mitigating the potential for money laundering and financing of illicit activities.

Which Crypto Exchanges Are Cheaper Than Bybit?

Bybit offers highly economical trading fees for its spot market that start at 0.1% and 0.1% for maker and taker orders, respectively. While these fees are commonly offered to crypto traders by many exchanges, there are a few trading platforms that are cheaper to use. For example, OKX maker and taker fees for its spot trading start at 0.08% and 0.10%, respectively. Orders that add liquidity to the market are marginally cheaper on OKX than Bybit.

Frequently Asked Questions

Binance, KuCoin, MEXC, and OKX are some of Bybit’s biggest competitors, each providing its own ecosystem of innovative crypto trading and financial management products. While each of these crypto exchanges shares similarities with Bybit, they have their own differentiators. KuCoin is known for its trading bots, Binance is a better platform to use, OKX equals Bybit for crypto generation products, and users can copy leverage margin trades on MEXC.

Binance is a superior cryptocurrency exchange to Bybit due to its smoother user experience, fiat gateway, and abundance of trading markets. While the two crypto exchanges have a similar number of supported digital assets, Binance has vastly more trading pairs and markets than Bybit. Binance caters to the global audience better than Bybit by integrating more fiat-to-crypto deposit options across more jurisdictions and countries.

KuCoin is a better digital asset trading platform than Bybit in terms of its supported coins, trading bots, and list of features that can be used without having to complete KYC. Although the user experiences are similar, some people may prefer the lighter and more aesthetic interface that KuCoin provides.

In terms of the number of digital assets available for buying and trading, Bybit and Bitget are relatively comparable with 400 and 558 cryptocurrencies, respectively. Regarding features and trading markets, Bybit, Phemex, and Bitget share a lot of similarities based on our reviews. This includes copy-trading, spot margin and futures trading, P2P marketplace, and interest-earning wallets.

Conclusion

Bybit does a lot right which is why it has become a world leader in cryptocurrency trading. Formerly a no-KYC trading platform, the mandatory requirement for KYC to be completed has been actioned and some traders and investors are seeking alternatives. Choosing the right alternative largely depends on what trading and investing activities you primarily partake in.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.