BlockFi Review For Australians

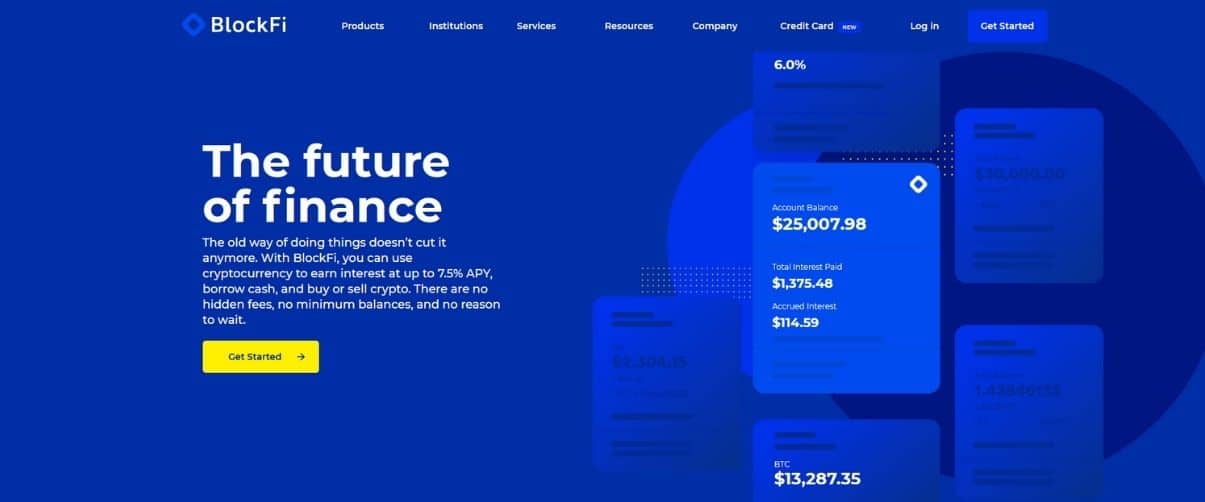

Last Updated on December 24, 2023 by Kevin GrovesIn this BlockFi review, we will explore whether it is worth using, how safe it is, and the benefits & risks involved in investing your money with them. The name BlockFi is making rounds in cryptocurrency circles, and if you’re not sure what it is, you’re not alone.

Traditionally, investors store and trade their digital assets on hardware wallets and crypto exchange sites for safekeeping. While this method is generally safe, it doesn’t build up your portfolio. This negates the whole point of investing because investors do it to make a profit. But what if you can deposit your digital assets in a high-interest savings account that earns you passive income? It will be as if your cryptocurrency is working for you without you having to do any of the heavy lifting. That’s the main concept of BlockFi.

What Is BlockFI?

BlockFi is a cryptocurrency lending and borrowing platform that was launched in 2017. It is New York-based and is backed by innovative global partners such as Fidelity, Arrington XRP Capital, CMT Digital, Coinbase Ventures, Galaxy Digital, etc. This platform works the same way as traditional banking systems, only that it’s designed for cryptocurrency and offers better interest rates.

The cryptocurrency industry is highly dynamic, and new altcoins are constantly being released. Investors then buy the new coins with the hope that they will make a tidy profit selling them when their prices increase. For a long time, this was the only way investors could make money off their cryptocurrency; by actively trading it.

BlockFi is revolutionizing the market by allowing investors to earn passive income by lending their digital sets to other crypto players. This eliminates the risks of crypto trading while still allowing you to make a healthy profit. According to the BlockFi website, you can earn up to 8.6% interest every year. This is crazy high, especially when you compare these rates to those of traditional banking systems.

In addition to earning passive income, you can also use block fi to;

- Get cash loans against your digital coins.

- Make crypto to crypto trades.

- Earn bitcoin rewards every time you make purchases using the BlockFi Credit Card.

Simply put, BlockFi is like a crypto bank that you can access all the time and has great interest rates on savings.

A Quick Overview of the BlockFI Team

BlockFi is led by a team with vast experience in the banking sector and traditional financial systems. Its two founders, Zac Prince (the CEO) and Flori Marquez (VP of growth), have held leadership roles in multiple tech companies and have practised portfolio management in highly successful institutions, e.g. Goldman Sachs. Zac was the head of business development teams at Orchard before he founded BlockFi.

Marquez, on the other hand, is more experienced in alternative lending product management and was the head of portfolio management at Bond Street, where she helped grow a $125MM portfolio. BlockFi claims that it will take a conservative approach so that it can position itself for sustainable expansion and long-term growth.

What Makes BlockFI Unique From Other Exchange Platforms?

There are multiple players in the cryptocurrency market and BlockFi is the first bitcoin lending platform that offers its users compound interest on crypto deposits. There’s no other platform of its kind, and the most exciting part is that they abolished the minimum balance required for users to earn compound monthly interest.

Compounded interest means that all the interest you earn every month is added back to our initial capital, allowing you to increase your earnings over time.

This platform also doesn’t offer native tokens, so you don’t have to hold BlockFi based tokens to earn high interest or use their services.

Core Products of BlockFI

BlockFi offers cutting edge financial services, and its 3 core products are;

1. BlockFi Interest Account (BIA)

This product allows you to earn up to 8.6% APY on your crypto without incurring any hidden charges and fees. This interest starts accruing immediately after you make a deposit and is compounded monthly.

2. Crypto-Backed Loans

You can lend or borrow crypt on BlockFi by leveraging your digital assets (1). For instance, you can borrow fiat currency to buy more crypto or for day-to-day spending.

3. Crypto-to-crypto Trading

BlockFi allows you to trade cryptocurrency by speculating on the market while still earning interest even after you place the trade.

1. BlockFi Interest Account (BIA)

The BIA allows you to deposit or transfer your crypto investments like Bitcoin into the platform and earn interest. BlockFi generates this interest by lending your digital assets to corporate borrowers and trusted institutions, who are then charged interest for the loan.

Their interest rates are higher than the market average, and they vary based on the digital asset stored. Here’s a quick chart of their APYs.

| Cryptocurrency | Interest % |

| Bitcoin | Up to 1BTC: 6%

1-20 BTC: 2% Over 20 BTC: 0.5% |

| Ethereum | Up to 100 ETH: 5.25%

100 -1000 ETH: 2% Above 1000 ETH: 0.5% |

| Litecoin | 5.5% |

| GUSD | 8.6% |

| USDC | 8.6% |

| USDT | 9.3% |

You start earning interest immediately after you deposit your funds into BlockFi’s interest and savings account. The returns are paid out at every start of the calendar month, and this interest is combined with your initial capital, which means that you earn compound interest.

BlockFi also has an interesting feature that allows you to earn your interest in a different cryptocurrency than the one stored in your crypto savings account. For example, you can make deposits in ETH, BTC and LTC but choose to have your money paid out in BTC. This allows you to diversify your portfolio without having to spend money.

Eligibility for this account is only based on your ability to deposit, transfer or hold funds in a BlockFi account. There are no minimum or maximum deposits, which means you can learn as much as your investment allows. This feature also makes BlockFi ideal for beginners that only have limited digital coins.

Please note that you’re only allowed one free withdrawal every month and will be charged fiat withdrawals. These fees are often subtracted from the withdrawable amount.

2. Crypto-Backed Loans

When you borrow from traditional financial systems, most of the time, you trigger a taxable event. With BlockFi’s crypto-backed loans, you get fiat money deposited directly into your account and use your digital assets as collateral. This allows you to access cash without incurring taxes. Some of the coins you can use to apply for a loan include Ethereum, Bitcoin and Litecoin.

Here’s how you can apply for a crypto-backed loan on BlockFi;

- Create an account with BlockFi.

- Search for the new loan button on the navigation bar at the top.

- Identify your cryptocurrency collateral, the amount you wish to obtain, and calculate the loan offer.

- Verify that the collateral amount, interest rates, and LVR are correct, and then click on proceed.

- Confirm all the details on your loan offer before signing the loan agreement.

- Deposit your cryptocurrency collateral in BlockFi’s storage wallet.

- Receive the loan in the form of crypto into your wallet or as fiat money into your bank account.

- Make monthly interest-only payments either in USD or BTC, LTC and ETH.

- Refinance the loan at the current interest rate or pay the entire principal amount at the end of the loan period.

The amount of interest that you pay is dependent on the loan to value ratio that you choose. This ratio is determined by how much collateral you need to store with BlockFi so that they can grant you a loan. For example, if you take a $25,000 loan with an LVR of 50%, the interest rate will be 12.5%.

BlockFi’s crypto-backed loans are more appealing to long-term investors that are looking to hold their investment until their value rises significantly. You can also borrow loans in fiat currency and use them to pay off your debts or diversify your investment.

3. Crypto-to-crypto Trading

BlockFi also has a trading exchange that allows you to trade between different cryptos. To enjoy this service, you only need to register an account with them, and the most exciting part is that you still get to earn compound interest!

Here’s a quick guide on how to sign up for this account;

- Visit the registration page on BlockFi’s website.

- Fill in the required details and complete the email verification process.

- Sign in to your account and deposit funds through your dashboard.

- Find the trade button on the navigation panel at the top.

- Select the digital coin that you’d like to trade.

- Enter the number of coins that you’d like to buy.

- Verify that all the information is correct, and then tap on the submit trade button to finalize the process.

While this feature is a great addition to the platform to swap between digital assets, there isn’t an option to deposit fiat currency directly. This means Australians that do not own any digital assets will need to use a crypto exchange and transfer the assets across to the lending platform. A list of our recommended exchanges in Australia can be found here.

Does BlockFi Have Withdrawal Limits?

BlockFi has placed restrictions on the amount of funds that you can withdraw from the platform. For instance, the maximum withdrawal limit for bitcoin is 100 BTC that is charged a 0.0025 BTC fee. While this is sufficient for average investors, it’s a major concern for large-scale traders.

Other withdrawals limits include;

- Ethereum: 5,000 ETH with a withdrawal fee of 0.0015 ETH

- Litecoin: 10,000 LTC with a withdrawal fee of 0.0025 LTC

- Stablecoin: 1,000,000 with a withdrawal fee of $0.25 USD

- PAXG: 500 with a withdrawal fee of 0.0025 PAXG

There are also withdrawable minimums of 0.056 ETH and 0.003 BTC, and if your account has a lesser balance, the transaction will be processed in 30 days.

Is BlockFI Safe?

Yes. Only 5% of the assets are stored in hot storage, and to enhance security, they are insured by AON. The rest are stored in cold storage to eliminate breaches.

BlockFi also recently received SOC2 compliance from Deloitte and is regulated by the NYDFS.

Some of the security measures that they use to keep your accounts safe are;

- Encryption of all sensitive information and account details.

- 2FA for all withdrawals and login activity.

- Withdrawals are limited to whitelisted addresses only.

Pros and Cons of BlockFI

Let’s take a quick look at the pros and cons of BlockFi:

Pros

Cons

The Conclusion of our BlockFi Review

Our BlockFi review has shown that it is legitimate and backed by highly reputable investors and well-established institutions. It’s also safe as all funds are stored by the Gemini, their primary custodian.

If you have a significant portfolio size and are looking for a way of earning passive income, you should give them a try. Their interest rates are pretty impressive and way better than those of traditional finance systems.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.