CoinSpot vs. Digital Surge: Which Should You Pick?

Last Updated on December 24, 2023 by Kevin GrovesCoinSpot and Digital Surge are two of the most popular crypto exchanges in Australia. Whilst CoinSpot is the older and more established of the two, Digital Surge is an up-and-coming brokerage platform with a focus on simplicity.

In this review, we compare CoinSpot and Digital Surge to see how they differ in their products, services, and features to assist you in your decision-making process.

The Bottom Line

The crypto features that CoinSpot provides Australians are more robust and mature compared to Digital Surge. A lot of CoinSpot’s features are similar to Digital Surge but are slightly more advanced. An example is the interest-earning wallets where the interest rates are similar but CoinSpot supports more coins and tokens.

Other benefits of CoinSpot include its outstanding security track record and improved customer support. One of the downsides to CoinSpot is that it’s Instant Buy/Sell function will incur you a 1% fee which is 50% more expensive than Digital Surge. However, these can be avoided if you know how to place market orders on the exchange where the fees are highly competitive at 0.1%.

Winner: CoinSpot 🏆

Website: https://www.coinspot.com.au/

Referral Code ($10 free BTC): See our CoinSpot referral code instructions

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

CoinSpot vs Digital Surge: Comparison Table

| Exchange | CoinSpot | Digital Surge |

|---|---|---|

| Fiat Currencies | AUD | AUD, NZD |

| Number of Crypto | 360+ | 330+ |

| Deposit Methods | POLi, PayID, BPAY, cash deposit | PayID, OSKO, POLi |

| Deposit Fees | BPAY (0.9%), cash deposit (2.5%), credit/debit card (2.58%) | POLi ($2 – $3.30) |

| Maximum Trading Fees | 1% | 0.5% |

| Withdrawal Fees | None | None |

| Interest-earning Wallet | Yes | Yes |

| Markets | Spot | Spot |

| Mobile App | Yes (iOS and Android) | Yes (iOS and Android) |

| Support | Live chat, email | Live chat, email |

| Verdict | ||

| Our Review | CoinSpot Review | Digital Surge Review |

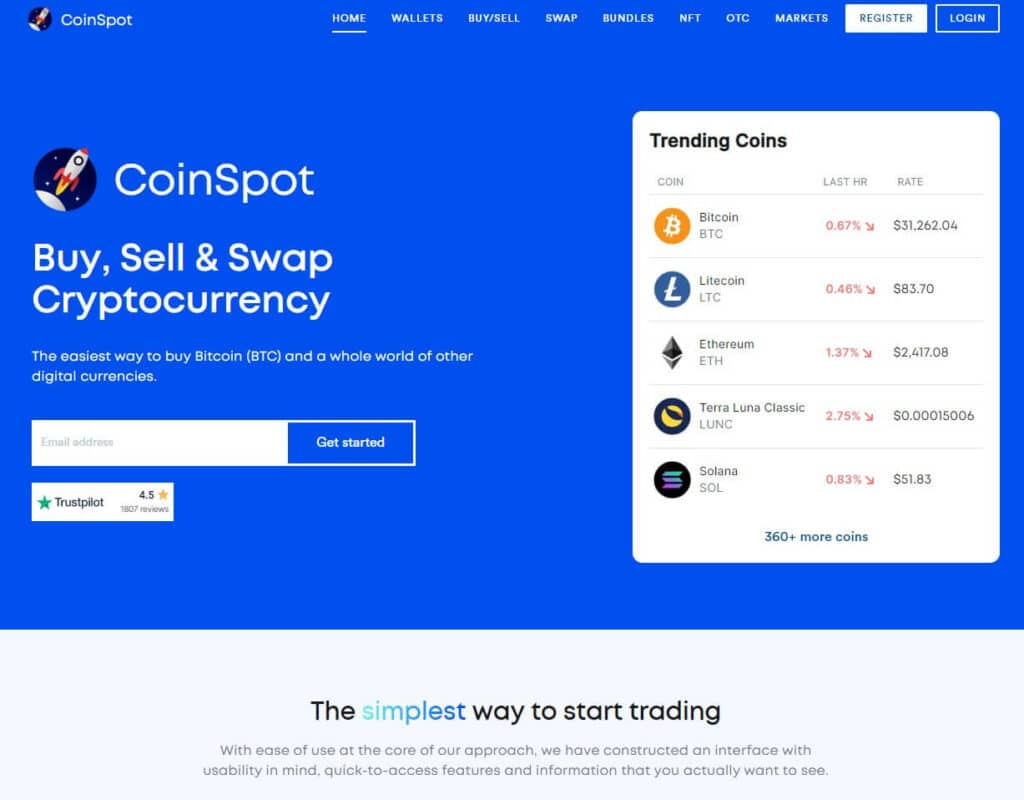

CoinSpot Overview

CoinSpot is a highly reputable trading platform that has been providing reliable crypto products and services to the Australian community since 2013. Since its establishment, the popular platform has accumulated over 1 million customers and become partners with major sporting teams and companies.

The Melbourne-based crypto platform is best known for its immense range of digital currencies that can be bought with Australian Dollars (AUD) and easy-to-use interface. However, its reputation is founded on a strong focus on security and digital integrity. This is highlighted by its internationally ISO 27001 accreditation which means that CoinSpot’s security framework is cutting-edge and world-class.

Although CoinSpot’s sterling reputation comes from its commitment to providing a safe place for Australians to buy digital currencies, it is also known for its beginner-friendly features. These include crypto bundles where you can use your money to buy multiple assets in a single transaction, an Non-Fungible Token (NFT) marketplace, and interest-earning wallets to generate consistent rewards.

CoinSpot Pros:

CoinSpot Cons:

Read the full review on CoinSpot.

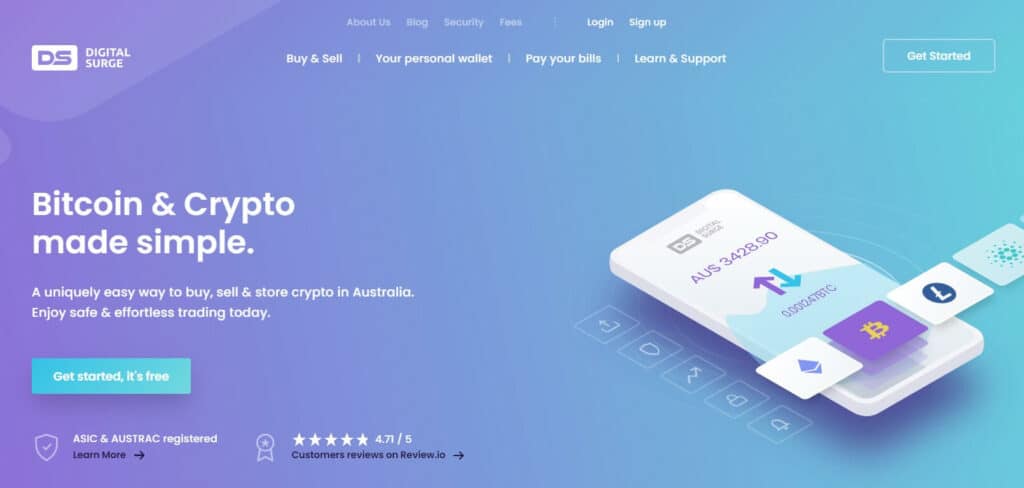

Digital Surge Overview

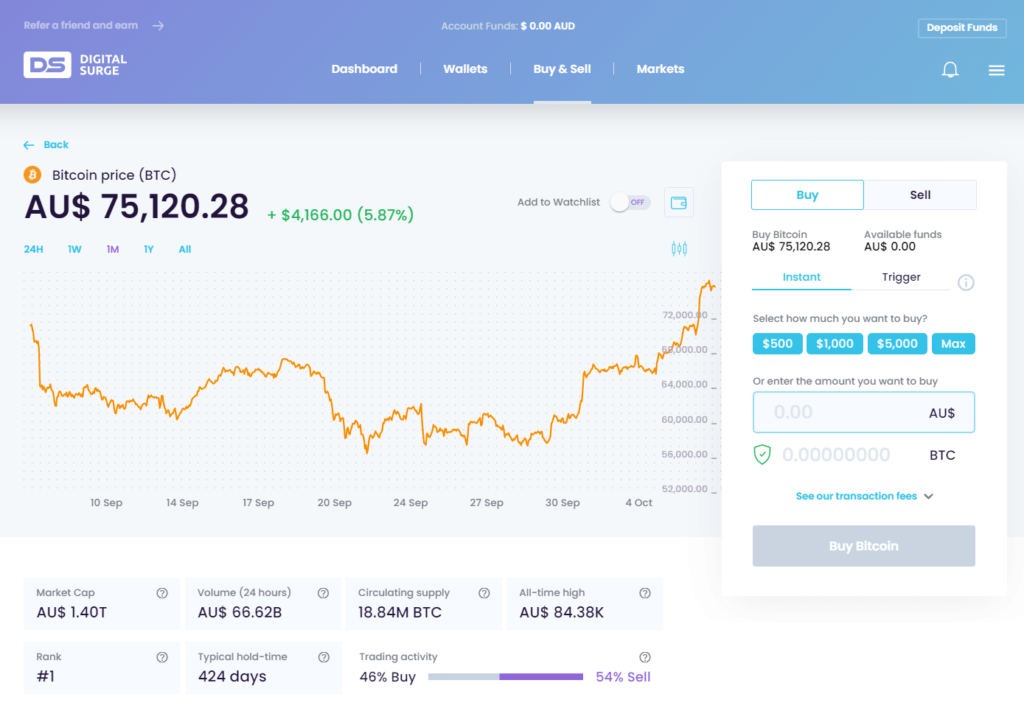

In contrast to CoinSpot, Digital Surge is a newer cryptocurrency brokerage platform that was founded in 2019. The Brisbane-based company focuses on simplifying cryptocurrencies for beginners where cash can be used to buy crypto. Everything Digital Surge offers has been specifically designed for beginners and even people who have never bought crypto before.

The user interface is probably the feature that benefits beginners the most. It is modern, visually intuitive, and enjoyable to use which makes for a short learning curve. Getting started by funding your account, buying crypto, and tracking the performance of your portfolio is about as easy as it gets. On top of this, there are no confusing price charts or complicated-looking tools to get in the way.

Like all other Australian crypto trading platforms that allow you to buy crypto with AUD, Digital Surge is registered with AUSTRAC. It also implement security controls and processes that are standard in the industry.

Some of Digital Surge’s best features include its beginner-friendly interface, low trading of 0.5%, support for Super Fund investors, the ability to pay your bills with Bitcoin, and in-built crypto tax reporting tools.

Digital Surge Pros:

Digital Surge Cons:

Read the full review on Digital Surge.

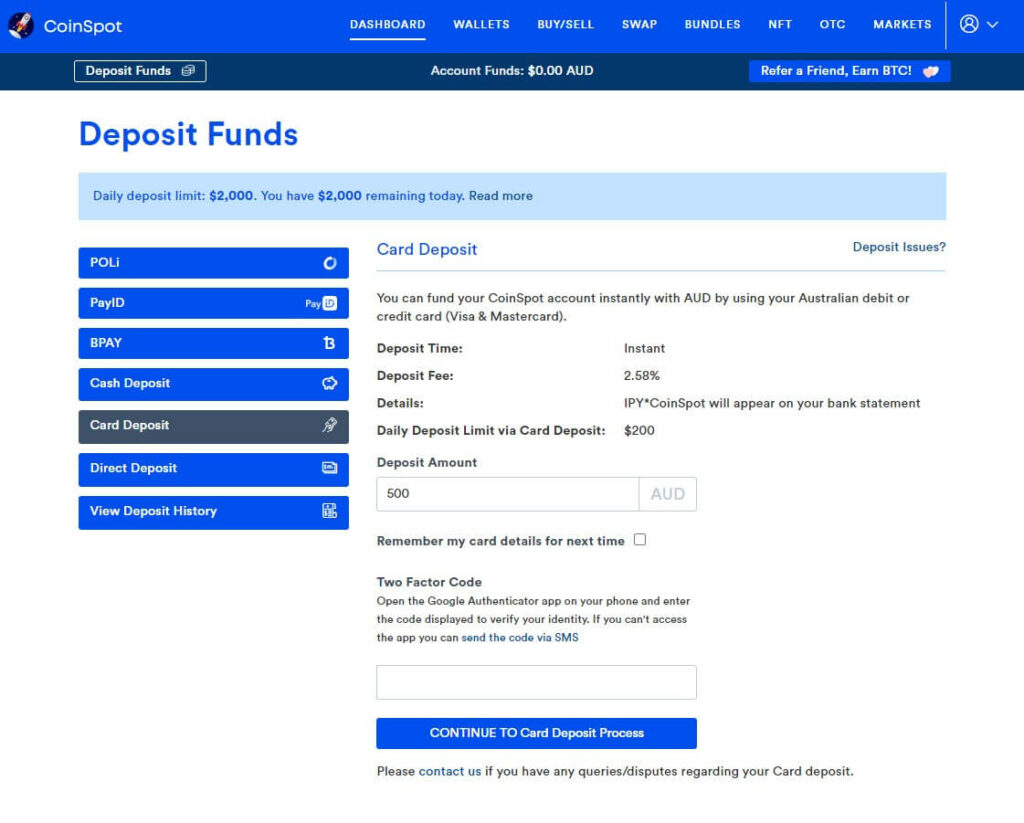

CoinSpot vs Digital Surge: Deposit Methods

Funding your CoinSpot account wallet can be done using a variety of ways that are commonplace in the Australian crypto market. These include near-instant methods POLi, PayID, OSKO, cash deposit, credit/debit cards, as well as BPAY which may take up to 2 business days to process. The inclusion of credit/debit cards to buy crypto shows that CoinSpot is trying to stay in touch with the Australian market.

Depending on your bank or financial institution, your first PayID deposit may take 1 day to complete, however, subsequent deposits will be near-instant. Although credit and debit cards are probably the most convenient ways of funding your wallet, their use will incur a 2.58% fee and the maximum limit is $200, making it only worthwhile for small amounts.

In comparison, Digital Surge only allows you to transfer cash into your account wallet using PayID, OSKO, and BPAY. Deposit methods such as credit and debit cards, as well as cash deposits, are not supported which makes it less flexible than CoinSpot. Like CoinSpot, Digital Surge is not without minor fees where POLi payments will incur $3.30. However, you are able to deposit a lot more with Digital Surge with maximum AUD limits ranging between $8,000 and $10,000.

Winner: CoinSpot 🏆

With 6 ways of funding your account with Australian Dollars, CoinSpot offers more flexibility than Digital Surge. Both platforms share the ability to transfer cash from an Australian bank account or use PayID for free. Minor charges apply for POLi, credit/debit cards, cash deposits, and BPAY.

CoinSpot vs Digital Surge: Products and Services

When it comes to their products and services, CoinSpot and Digital Surge share a lot of similarities. The section below summarises the similarities and unique features of both platforms.

Range of cryptocurrencies

For local Australian crypto platforms, CoinSpot and Digital Surge offer you two of the largest selections of cryptocurrencies to buy and sell back to AUD. CoinSpot currently offers more cryptocurrencies with over 360 assets on offer compared to Digital Surge’s 320.

Whilst the range of digital assets slightly differs, both platforms are great options to purchase Bitcoin, stablecoins, meme coins, and several exotic altcoins.

Earn interest on crypto

CoinSpot and Digital Surge are two of the best Aussie platforms to earn interest on crypto. At the time of writing, you can earn interest payments up to 23% Annual Percentage Yield (APY) on 13 digital assets on Digital Surge. As seen in the table, interest rates for CoinSpot and Digital Surge are almost the same with minimal differences in rewards for Algorand, Flow, Kusama, Polkadot, Solana, and Tron. On top of this, CoinSpot and Digital Surge don’t charge fees to earn interest, there are no lock-in periods, and interest compounds daily.

| Crypto | CoinSpot Interest Rate | Digital Surge Interest Rate |

|---|---|---|

| Algorand (ALGO) | 8.5% | 1% – 4% |

| Flow (FLOW) | 6.5% | 6% – 9% |

| Kusama (KSM) | 18.5% | 18% |

| Polkadot (DOT) | 12.5% | 9% – 12% |

| Solana (SOL) | 6.6% | 5% – 8% |

| Tron (TRX) | 5.9% | 4% – 7% |

So where do the differences lie? CoinSpot supports more coins and tokens that can earn interest payments with unique examples including ETH (up to 5.12%), BNB (5%), AXS (78%), AVAX (6.9%), FTM (4.2%). Additionally, although interest compounds daily for both Earn modules, payments are made to your wallet daily for CoinSpot compared to Digital Surge where they become available on the first day of each month.

SMSF support

CoinSpot and Digital Surge support Australians who want to use their Self-Managed Super Fund (SMSF) to invest in cryptocurrencies such as Bitcoin and Ethereum. The Australian Tax Office (ATO) recognises digital assets to be a form of investment for retirement funds, however, there are certain criteria that must be met including the separation of super fund and personal accounts.

CoinSpot has partnered with New Brighton Capital, an Australian super fund specialist, to provide SMSF services. The specialist provider behind Digital Surge is unknown. In any case, the documents that you will need to provide include the Trust Deed, SMSF name and ABN, and trustee information.

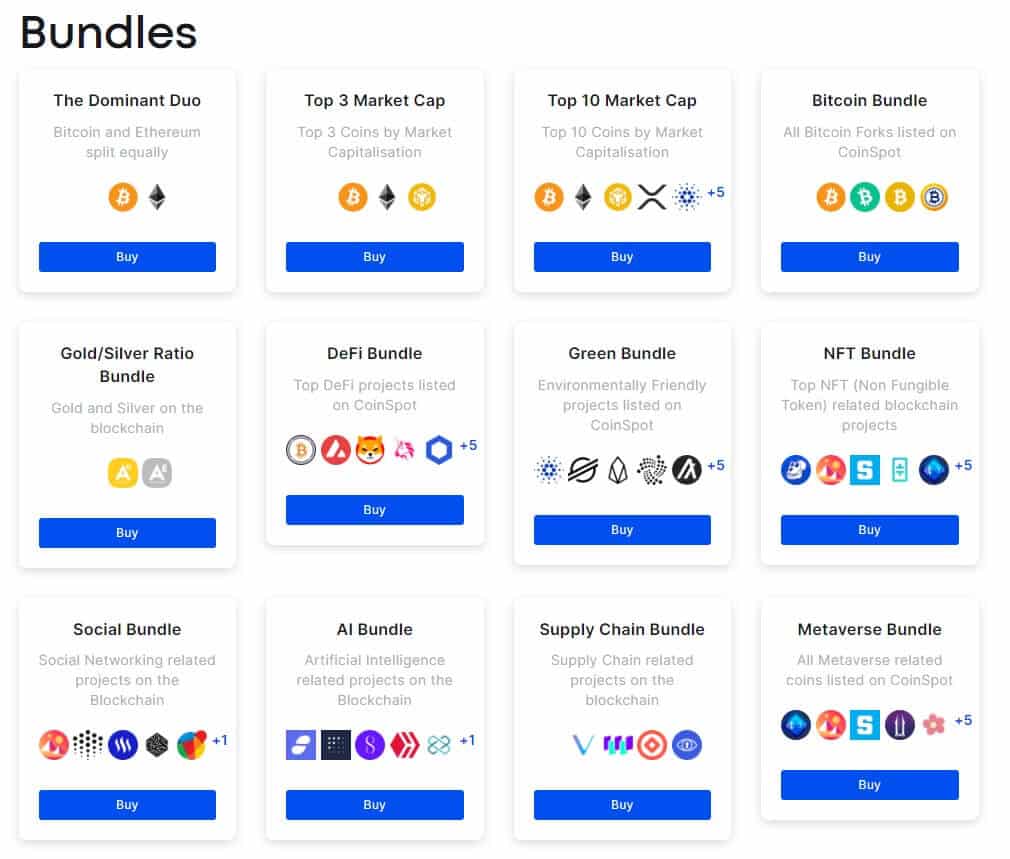

Features unique to CoinSpot

CoinSpot offers you several unique features which cater to the everyday Australian. As a CoinSpot customer, you can benefit from these features that Digital Surge does not offer.

- A growing NFT marketplace where you can use any digital currency available in your wallet to buy digital artworks and collectibles from over 30 collections.

- An assortment of cryptocurrency bundles to purchase to quickly diversify your portfolio with fewer fees.

Features unique to Digital Surge

A summary of features that are unique to Digital Surge is provided below.

- In-built crypto tax estimators where you can easily produce a detailed summary of your trading activities for End of Financial Year (EOFY) reporting. Digital Surge has partnered with Koinly to provide these services.

- The ability to pay any Australian bill or credit card using Bitcoin – as long as the bill has the BPAY biller code for Bitcoin.

Winner: CoinSpot 🏆

In terms of their crypto services and features, CoinSpot comes out on top over Digital Surge. The reputable platform provides a greater number of supported digital assets to buy with AUD, you can earn decent interest payments on more crypto assets that compound daily, and there is also the NFT marketplace and crypto bundles. Whilst the features offered by Digital Surge are good, they are mainly suited to those who prefer to HODL their crypto.

CoinSpot vs Digital Surge: Ease of Use

The user interfaces of CoinSpot and Digital Surge were designed for beginners in mind. In fact, they share a lot of similarities in terms of their structure. Both have dashboards that provide you with an overview of your crypto portfolio, a wallet section that presents a breakdown of your portfolio, and streamlined crypto buying processes for Australians.

With that in mind, it could be said that the Digital Surge interface is slightly more modern – not surprising as it’s a newer platform. Since CoinSpot is the older and more established of the two, its platform seems slightly outdated where features have been added on rather than being seamlessly integrated.

For example, we found it challenging to know which coins and tokens could earn interest and there isn’t a dedicated section allocated for this feature. Instead, interest-earning wallets are inside the wallets of individual coins and tokens meaning that you will need to explore each asset to discover if interest can be earned and the % APY. Frustratingly, we found a list of supported Earn assets and their interest rates in the FAQ section, however, this list may not be updated on a regular basis.

Despite this, the CoinSpot interface is still very easy to use where key functions such as account funding and withdrawing AUD are clearly identifiable. The Digital Surge interface is visually stunning, modern, and enjoyable to use.

Winner: Tie 🏆

Overall, we found that the CoinSpot and Digital Surge interfaces to be intuitive and simple which should make the learning curve for beginners a short one.

CoinSpot vs Digital Surge: Fees

CoinSpot and Digital Surge will both charge you minor fees for depositing cash into your wallet, however, it depends on the deposit method. For CoinSpot, fees will apply for cash deposits (2.5%), credit/debit cards (2.58%), and BPAY (0.9%). Overall, the credit/debit card fee of 2.58% is quite reasonable but there is a $200 limit which is inconvenient. The BPAY fee of 0.9% is a bit out of the ordinary as other Australian crypto platforms typically don’t charge fees for BPAY deposits. Funding your Digital Surge account using POLi will result in a minor fee of $3.30.

| Method | CoinSpot Fee | Digital Surge Fee |

| Bank transfer (OSKO) | None | None |

| POLi | None | $3.30 |

| PayID | None | None |

| Cash deposit | 2.5% | Not supported |

| Credit/debit cards | 2.58% | Not supported |

| BPAY | 0.9% | None |

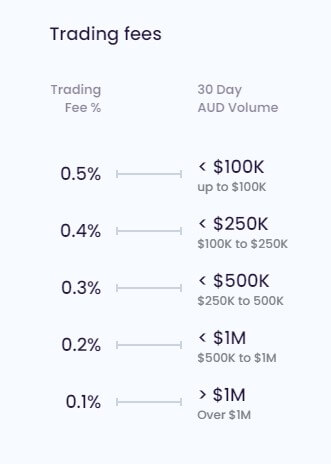

The real difference between the fee structures of CoinSpot and Digital Surge arises when you buy, trade, or sell digital currencies. If you use the Instant Buy/Sell feature to buy digital assets on CoinSpot, then a hefty fee of 1% will be charged for every transaction. The 1% fee is simply too expensive when compared to Digital Surge and other Australian crypto platforms.

If you’re familiar with placing market orders, then you can get a cheaper trading fee of 0.1% by using CoinSpot Exchange. This is one of the downsides to CoinSpot since the Instant Buy/Sell feature, which is 10 times more expensive, is centrally promoted on the website where most people are likely to see it. Moreover, beginners may be discouraged by the complicated-looking buying panel on the Exchange.

Digital Surge’s fees are simpler as a flat fee of 0.5% will apply when you buy and sell crypto. This is 50% cheaper than the 1% fee incurred by using CoinSpot’s Instant Buy/Sell feature. Depending on your trading volume over 30 days, you may even be entitled to receive discounts on your trading fees. This is due to Digital Surge’s tiered fee structure. For example, if you trade between $100,000 and $250,000 over 30 days then your fee is reduced by 20% to 0.4%.

Winner: Digital Surge 🏆

If you’re a beginner with little or no experience buying crypto then Digital Surge is the cheaper option and by a long way. It’s maximum fee of 0.5% to buy crypto is 50% cheaper than the 1% you will be charged by CoinSpot for using its Instant Buy/Sell feature. Although lower fees of 0.1% can be obtained by using the CoinSpot Exchange, the majority of beginners are not likely to understand how to place market orders. Simply put, Digital Surge’s fees are easier to understand and offer better value for money for the majority of Australians.

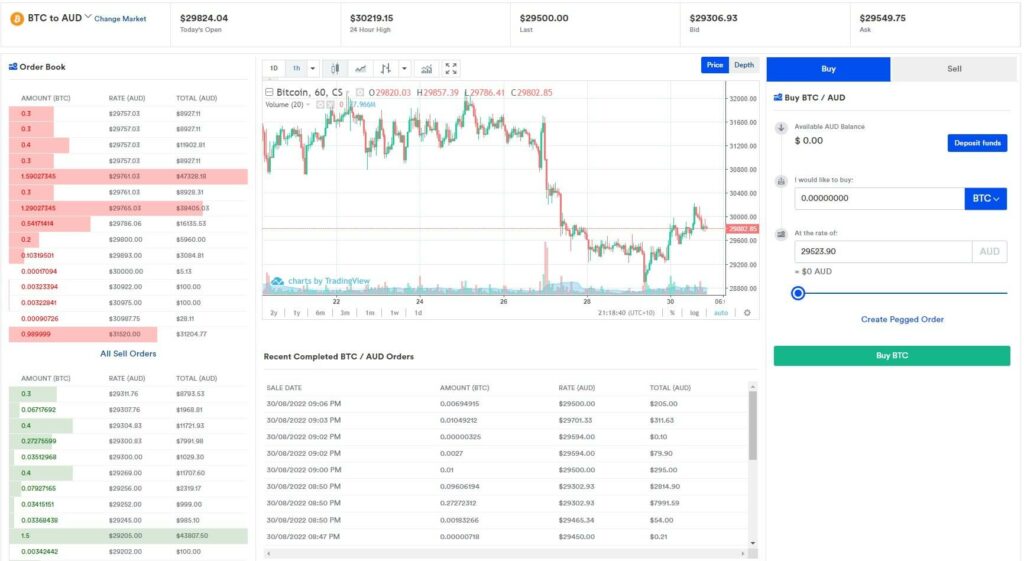

CoinSpot vs Digital Surge: Markets & Trading

CoinSpot and Digital Surge only support spot trading markets, that is, where AUD is directly exchanged for cryptocurrency and delivery is immediate. Advanced markets such as margin and derivatives are not supported. Given the vast multitude of digital assets that CoinSpot and Digital Surge support, it means that both platforms are suitable for you if you want to buy crypto with the intention of HODLing.

The similarities don’t end there with CoinSpot and Digital Surge offering more experienced traders with TradingView charting and the full suite of advanced analytical tools and indicators. However, CoinSpot provides a more robust trading experience with the inclusion of orders books. These enable you to assess the spread and trading volume for any given cryptocurrency.

Digital Surge also provides TradingView charting but there are no order books. Additionally, basic trigger orders can be set up to automatically purchase crypto when the desired price meets the market price.

Overall, CoinSpot provides a trading interface that is more reminiscent of an advanced crypto exchange.

Winner: CoinSpot 🏆

CoinSpot and Digital Surge only support spot markets where you can directly buy crypto with cash. Cryptocurrency products and services such as leveraged margin, futures and perpetual markets are not supported. With the inclusion of orders, the trading interface on CoinSpot is a bit more robust and suits experienced traders.

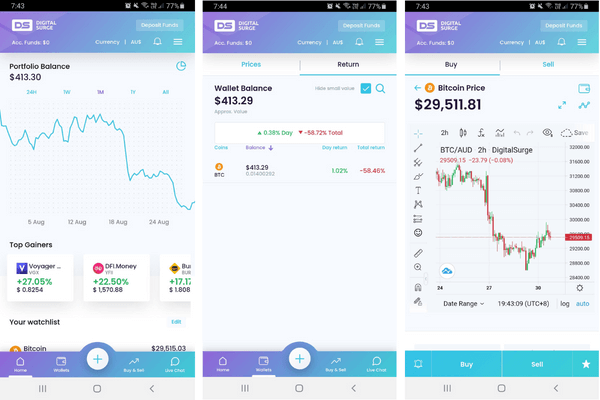

CoinSpot vs Digital Surge: Mobile Apps

Buying cryptocurrencies and reviewing your portfolio on the go can be done on CoinSpot and Digital Surge as both provide apps for iOS and Android mobile devices. The mobile apps provide you access to all of the desktop features including the TradingView charting interfaces. The CoinSpot mobile app for Android devices appears to have received positive feedback from its customers. Based on over 6,000 reviews, the app has a very good rating of 4.6/5.0 which suggests that the product is well delivered.

Just like its desktop website, the Digital Surge mobile app is clean and modern. If you’re worried about safety, then you can also set up a biometric login (either facial recognition or retina scan) to provide another layer of account security. Biometric log-ins are an increasingly popular feature on the best mobile trading apps for crypto.

Winner: Tie 🏆

CoinSpot and Digital Surge provide apps for mobile devices that are as easy to use as their respective desktop websites. The apps provide access to all of their products and services as well as are more than suitable for managing your crypto portfolio.

CoinSpot vs Digital Surge: Customer Service

In terms of reaching out to the CoinSpot customer service team, you can choose from using the live chatbot or submitting a ticket to the Help Desk and waiting for a response. In our experience, submitting a ticket returned an email response in 3 hours which is quite fast. It is worth noting that both the live chatbot and Help Desk are active 24/7.

In comparison, Digital Surge appears to have removed its ticket system with all queries to customer support needing to be conducted through the 24/7 chatbot. Although you get to talk to a real person, the feature is understandably only active during business hours.

Winner: CoinSpot 🏆

CoinSpot appears to have improved its customer service efforts by providing 24/7 assistance for its customers. Digital Surge offers the same avenues to customer support, however, only during business hours.

CoinSpot vs Digital Surge: Security

Public awareness of the safety and security aspects surrounding cryptocurrencies has increased in recent times. In response, Australian crypto exchanges implement bank-like security measures to safeguard your assets and money against internal and external threats.

CoinSpot is one of the leading Aussie crypto platforms in the security space. On top of its security controls including the storage of the majority of held assets at highly secure offline locations, withdrawal restrictions, geo-lock logins, and 2FA, CoinSpot was the first in Australia to obtain the internationally recognised ISO 27001 accreditation. This means that CoinSpot adheres to strict processes relating to information security, asset storage, and more. Although Digital Surge implements the same security measures as CoinSpot, it does not currently possess ISO 27001 accreditation.

Based on our research, neither CoinSpot nor Digital Surge have been hacked since their establishments in 2013 and 2019, respectively.

Winner: CoinSpot🏆

Although Digital Surge and CoinSpot have not experienced any security breaches, CoinSpot has attained a much higher level of security requirements.

CoinSpot vs Digital Surge: Comparison Outcome

Based on our comparison review, CoinSpot is the superior crypto exchange over Digital Surge. The established crypto platform has cemented its reputation as a reliable provider of crypto services, most notably its beginner-friendly interface and features. CoinSpot also offers good value for money provided that you know how to place market orders on the exchange interface. Whilst Digital Surge is a worthy CoinSpot alternative and does a good job of providing features that suit the Aussie market, CoinSpot’s features are more mature.

| Comparison Criteria | Winner | Reason |

|---|---|---|

| Deposit Methods | CoinSpot | More deposit methods to choose from. |

| Products & Services | CoinSpot | More robust features including interest-earning wallets and NFTs. |

| Ease of Use | Tie | Both platforms are easy to use and understand. |

| Fees | Digital Surge | Digital Surge’s fee of 0.5% is 50% cheaper than CoinSpot’s Instant Buy/Sell feature. |

| Markets & Trading | CoinSpot | CoinSpot offers a slightly more robust trading interface. |

| Mobile Apps | Tie | The mobile apps for both platforms are easy to use and highly rated. |

| Customer Service | CoinSpot | 24/7 access to the CoinSpot customer support team. |

| Security | CoinSpot | Possesses ISO 27001 accreditation. |

If you found this comparison between CoinSpot and Digital Surge useful, here are other Australian crypto exchange comparisons to read next:

- Swyftx vs CoinSpot

- Swyftx vs Digital Surge

- Coinbase vs CoinSpot

- Coinspot vs Binance

- CoinSpot vs CoinJar

- CoinSpot vs eToro

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.