Crypto.com Review For Australians: Is It A Good App?

Last Updated on December 24, 2023 by Kevin GrovesCrypto.com is a crypto hub that supports trading, investing, staking, and NFTs. It helps crypto traders earn passive income. And while the fees are low, most of its benefits are targeted at customers who stake the platform’s native token. Our full Crypto.com review for Australians will help you decide if it’s the right exchange for you.

Crypto.com

Trading fees:

0.075% maker & 0.075% taker

Number of cryptos:

229

Deposit methods:

Debit/credit card, crypto, Google Pay

Supported countries:

Global (including Australia)

Promotion:

None are available at this time

The Bottom Line

Crypto.com operates a simplified and comprehensive ecosystem for crypto-related products that cut across trading, lending, and staking. The top Australian digital currency exchange is known for its innovative products, namely the Visa debit card, that provide investors with levels of utility and everyday use that other crypto exchanges can only aspire to. For users of the Crypto.com Exchange, the maker and taker fees are highly economical and will cater to those who want value for money in their spot trading.

Despite its benefits, Crypto.com lacks sophisticated trading options for advanced investors as margin, futures, and perpetual trading markets are not supported. Support for AUD deposits, withdrawals, and trading pairs is mediocre at best. But the real advantages come to Crypto.com customers who have the capital to invest and use the platform’s native token, CRO.

Crypto.com Pros:

- Supports 229 cryptocurrencies.

- Staking is available.

- Supports AUD deposits and withdrawals.

- Trading fee discounts are available.

- Prepaid crypto debit cards with cashback rewards.

Crypto.com Cons:

- High trading fees for non-CRO stakers.

- Cashback rewards are paid in CRO.

- Poor customer reviews.

- No futures, perpetual markets for Australians.

Crypto.com Pros Explained

- Supports a wide range of cryptocurrencies: Crypto.com supports 229 crypto assets, offering investors easy access to top cryptocurrencies and trading pairs for more trading options and flexibility.

- Crypto staking available: You can stake CRO or put over 33 untraded assets to use for annual interest rates of up to 8%.

- Supports AUD deposits and withdrawals: Australian investors on Crypto.com can easily deposit and withdraw AUD on Crypto.com via bank transfers, credit/debit cards, PayID, and BPAY.

- Discounts available for high-volume traders: High-volume traders with investments from $10 million can pay low trading fees (0% for makers and 0.050% for takers) on Crypto.com once trading fee discounts are applied.

- Crypto card available with cashback: On Crypto.com, you’ll find a cryptocurrency prepaid debit card to spend your crypto holdings online and offline. The card offers crypto cashback of up to 5% of the total amount spent and several other perks.

Crypto.com Cons Explained

- High trading fees for non-stakers: Fees are increased for non-stakers of CRO and customers with a low trading volume.

- Cashback and rewards are paid in CRO only: The cashback from the Crypto.com Visa card spending is only paid in CRO. This is a less valuable coin compared to Bitcoin or Ethereum.

- Poor customer reviews: Online reviews indicate that Crypto.com customer support is poor and customers are unsatisfied.

- No futures, perpetual for Australians: The exchange only provides spot trading, and margin, futures, and perpetual are unavailable.

Who Should and Shouldn’t Use Crypto.com?

Crypto.com is best suited for investors keen on accessing more services than regular buying and selling of cryptocurrencies. Since the best benefits such as reduced trading fees, higher yields, and better cashback rewards on its range of crypto debit cards, are only obtainable by investing in CRO, Crypto.com is best suited to those who are willing to use the platform on a long-term basis.

At A Glance

Here is a quick summary of Crypto.com.

| Exchange Name | Crypto.com |

| Supported Countries | Australia (and internationally) |

| Fiat Currencies Supported | USD, GBP, AUD, CAD, EUR, and 15+ more |

| Supported Cryptocurrencies | BTC, ETH, XRP, LTC, MATIC, DOGE, UNI, LIMK, MANA, and 220 more |

| Markets | Spot only |

| Deposit Methods | Debit/credit card, crypto, Google Pay |

| Deposit Fees | None (third-party fees may apply) |

| Trading Fees | 0.075% maker and 0.075% taker |

| Withdrawal Fees | None |

| Crypto Staking | Yes |

| Mobile App | Yes (Android, iOS) |

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Crypto.com Overview

Crypto.com was established in Singapore in 2016 by Bobby Bao Gary and Kris Marszalek Rafael Melo, making it one of the oldest and most reputable names in the crypto space. The exchange was created to enhance the world’s adoption of cryptocurrencies and give traders more control over their money, data, and identity. The exchange is home to over 80 million customers across different countries including Australia. The comprehensive trading and financial management platform offers a wide range of services including crypto payments, custodial services, and NFT trading support.

Crypto.com is a high-liquidity exchange, making it a good choice for seasoned investors who want to minimise their price slippage and mitigate volatility. The Crypto.com Exchange is among the top 15 world’s largest exchanges in terms of trading volume. As of January 2023, Crypto.com had a 24-hour spot trading volume of over $500 million (equivalent to about 20,000 BTC) and a total value of over $3 billion.

Here’s What We Thought About The Features

Crypto.com is a comprehensive cryptocurrency exchange with numerous products and services. In this section of our Crypto.com review, we examine the top features that make the exchange stand out.

Crypto.com Visa debit card is a nice touch

The Crypto.com cryptocurrency debit card is one of its best features. As a cash-back Visa card, it allows you to automatically convert your crypto assets to fiat when making purchases at online or in-store merchants. You can also spend them at millions of stores supported by the Visa network as you would a standard credit or debit card. The card offers up to 5% cashback on all spending. Customers can only request the Visa debit card via the Crypto.com app and there are no monthly, annual, or ATM withdrawal fees.

The Crypto.com Card comes in five different tiers where the volume of CRO is the key threshold for obtaining a better cashback rate.

- Midnight Blue: The most basic and accessible card with no staking requirements.

- Ruby Steel: With a $400 (approx. $564 AUD) CRO staking requirement and 1% cashback.

- Royal Indigo & Jade Green: A $4,000 (approx. $5,649 AUD) CRO staking requirement and 2% cashback.

- Frosted Rose Cold & Icy White: A $40,000 (approx. $56,495 AUD) CRO staking requirement and 3% cashback.

- Obsidian: A $400,000 (approx. $564,959 AUD) CRO staking requirement and 5% cashback.

The Crypto.com debit card is available to everyone, but only customers who stake CRO are eligible for cashback and rewards. Staking amounts are locked up for 180 days. As a result, you enjoy an additional interest of up to 8% per annum on staked amounts. Meanwhile, Australians also have to pay a 1% admin fee when the Crypto.com card is topped up with a credit card.

Overall, the Crypto.com Visa card is strong enough to entice new customers on its own, especially since there aren’t a lot of good crypto debit cards to choose from. But it may be difficult for average users to afford.

Crypto.com Pay to pay your bills

Crypto.com Pay allows you to pay and get paid in crypto via its mobile app. The feature supports crypto payments using 30+ cryptocurrency tokens including CRO, BTC, DOGE, ETH, and DOT. Settlements are near instant, there are no gas fees, and you may be eligible for up to 10% cashback in CRO.

Investors can use this feature to shop or pay for gift cards, book flight tickets, recharge mobile airtime, or send crypto to friends for free. They can buy NFT collectibles on the Crypto.com NFT marketplace, among other things. All of these can be done for free on Crypto.com Pay. The Crypto.com Pay feature is similar to the version offered by Binance Australia further to our review.

Put tokens to work with staking

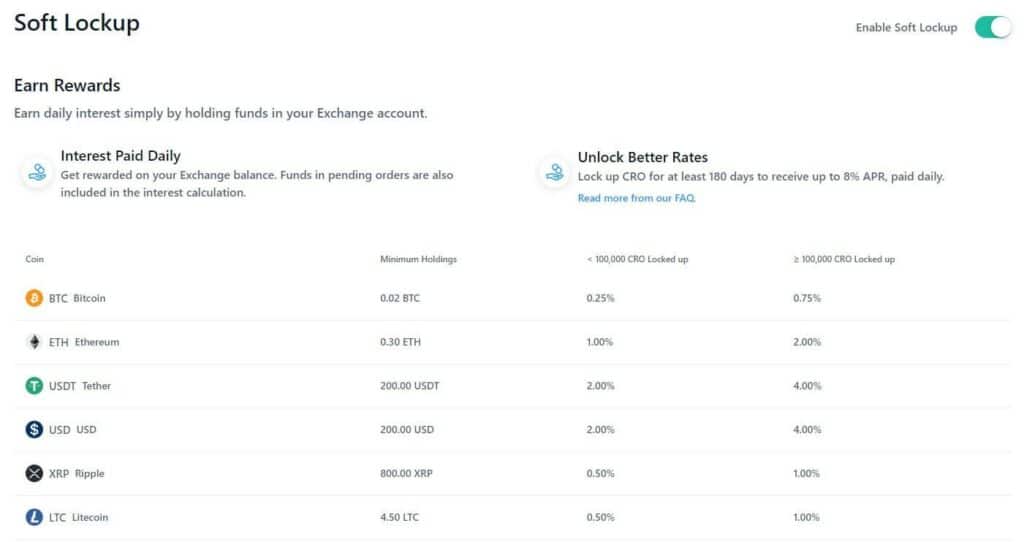

Crypto.com offers its users an alternative way to earn passive income via its Soft Lockup feature that is accessible through the Exchange (desktop only). The platform’s soft staking feature allows you to earn between 0.25% to 4% from 33+ crypto assets. The CRO token plays a principal role here as well. If you stake over 100,000 units, you can earn the maximum APR on the platform while interest is paid daily.

Crypto Earn to earn little extra interest

The Crypto Earn service is a bit different. The service is intrinsically tied to the CRO token and the Card Services. You can earn as much as 14.5% on supported assets when you link a prepaid crypto card. The mobile earning service offers more tweaks as you can switch your lockup period between a week to three months. Longer lockup periods tend to pay more. There are two drawbacks to this service on the Crypto.com app. You can only earn from 20+ digital currencies and rewards are paid weekly rather than daily.

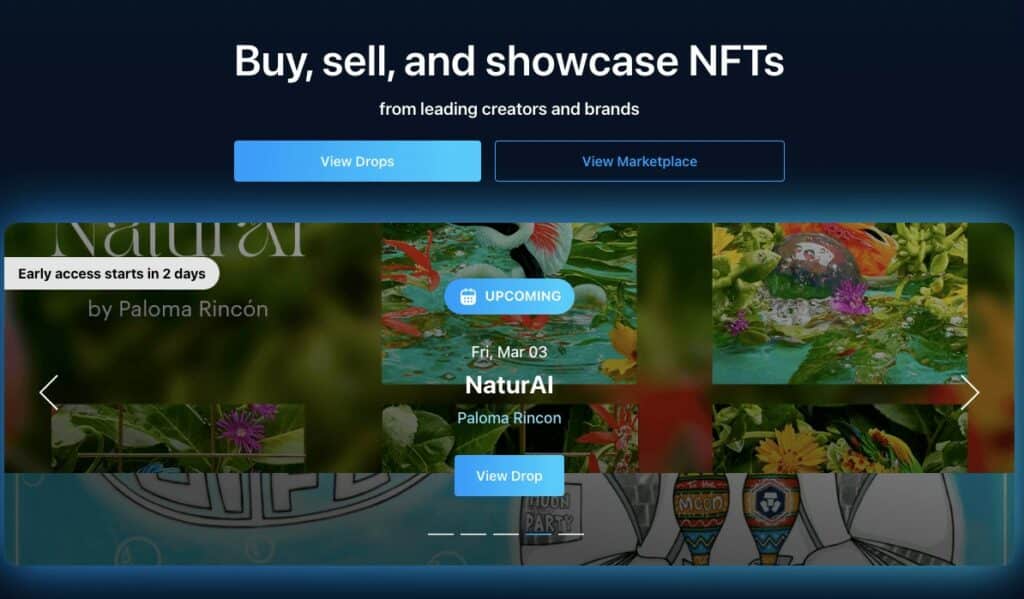

Marketplace with popular NFTs

The NFT marketplace is one of Crypto.com’s newest projects. Like other popular NFT marketplaces (OpenSea, and Binance NFT Marketplace), Crypto.com users can mint, buy, sell, and showcase NFTs in various forms without a third-party platform.

The platform offers access to top-ranking NFT creators, brands, and collections. It also offers detailed insights into the earning history of top collections and creators. There is a live auction page that allows you to bid for upcoming digital collectibles in real-time.

However, using Crypto.com’s NFT marketplace isn’t cheap as there is a fixed fee of 1.99% per transaction to buy and sell NFTs. While Crypto.com’s fee is higher than the 1% cost of trading on the Binance NFT marketplace, it’s still less than the 5% charges on Gemini’s Nifty Gateway.

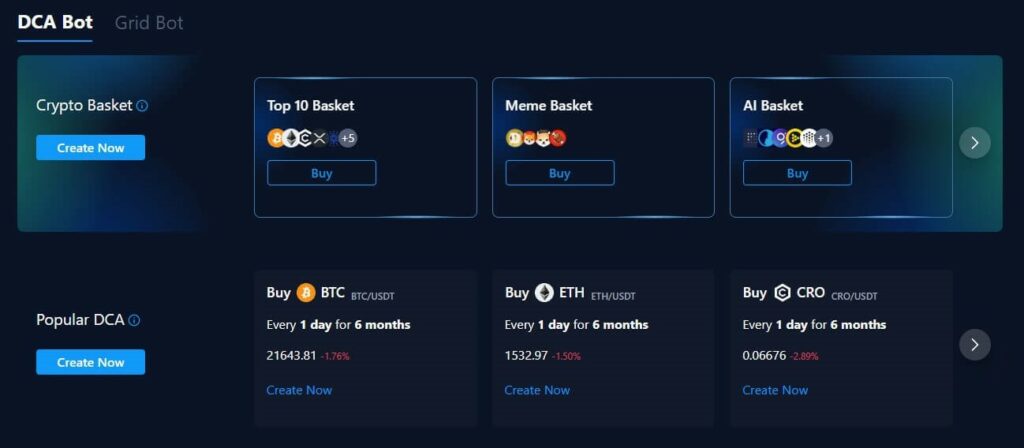

Bots for automated crypto trading

Another major feature is the ‘Bots’ service offered on the Crypto.com exchange. This feature allows you to automate your trading experience on the platform. The Crypto.com Bots service is split into Dollar Cost Averaging (DCA) bot and the Grid bot, both of which are popular crypto trading bots amongst beginners. Both options are further divided into Auto and Advanced.

- Auto DCA bot: This option functions as a recurring buy purchase. You can create an automated ‘buy’ order for a single coin at particular time intervals.

- Advanced DCA bot: This allows you to buy or sell different trading pairs. Similar to the Auto option, you can set a timeframe for when these actions should be taken. It also offers ‘market’ and ‘limit’ order options, allowing you to set a price limit on your orders. In addition, you can set a ‘stop-loss’ and ‘take-profit’ price before the bot executes these commands.

For the platform’s Grid bot, the Auto and Advanced options are also available. The Auto option allows you to buy a crypto asset at particular price points in an arithmetic order. While the Advanced option offers both arithmetic and geometric orders. You can set lower and upper prices and also set up stop-loss and take-profit positions for the bot to execute.

OTC trading for big traders

For high-volume and institutional investors, Crypto.com offers an Over-The-Counter (OTC) service. This basically allows them to buy large volumes of crypto assets separate from the exchange’s order books. This way, the large orders will not impact the price of the underlying asset. Institutional investors are provided custom quotes, and all trades are executed instantly.

To access this service, you must place a minimum order of 50,000 USDT or its equivalent. The maximum threshold is set at 5 million USDT or its equivalent. Supported trading pairs include BTC/USDT, ETH/USDT, and others.

Crypto.com’s OTC service is unique compared to many other popular crypto exchanges. For instance, the Binance and Coinbase exchanges do not offer this feature to their retail customers, making Crypto.com’s operations unique. According to the Singapore-based platform, there is no additional fee besides the quoted average on the checkout page.

DeFi earning wallet for exotic tokens

Apart from crypto trading and investing, Crypto.com also offers asset custodial services to its customers via its DeFi (Decentralised Finance) wallet. The self-custodial crypto wallet allows you to send, receive, and store crypto and private keys. Currently, it supports the storage of 1000+ cryptocurrencies across 30 blockchain networks, including Cronos, Crypto.org, and Ethereum. It also facilitates access to all Crypto.com DeFi services, including earn/staking, lending, decentralised apps (DApps), and more.

In addition, the Crypto.com DeFi Wallet allows you to earn rebates on your spending using 25+ coins. Some of these tokens include VVS, ATOM, TONIC, and the platform’s CRO native token. You can also earn up to 50.46% interest yearly or swap over 1,000+ cryptocurrencies. This can be done across multiple blockchains like Ethereum, Cosmos, Yearn protocol, and more.

However, while the popular Binance wallet is free, Crypto.com charges a transaction fee based on the on-chain realities at transaction time.

What Are Crypto.com Fees Like?

Deposit fees

Crypto.com allows users to deposit 250+ cryptocurrencies and fiat options like AUD, EUR, and GBP. There are no deposit fees for fiat and crypto deposits on the mobile app. You can only deposit crypto on the exchange and they’re free.

Trading fees

Crypto.com trading fees start at 0.075% and 0.075% and follow a maker-taker model where discounts can be obtained depending on your 30-day trading volume or the volume of CRO you stake. VIP trading fees are fixed at 0% for makers, while takers are charged between 0.025% and 0.040%, depending on their 30-day volume.

On the other hand, discounts for stakers depend on the amount of CRO staked. For instance, investors who stake up to 10,000 CRO get 8% off maker/taker fees.

| Trading Volume | Maker Fee | Taker Fee |

|---|---|---|

| 250,000 USD and below | 0.0750% | 0.0750% |

| Up to 250,000 USD and above | 0.0700% | 0.0720% |

| Up to 1,000,000 USD and above | 0.0650% | 0.0690% |

| Up to 5,000,000 USD and above | 0.0600% | 0.0650% |

| Up to 10,000,000 USD and above | 0% | 0.0500% |

Compared to the industry average, Crypto.com fees are very competitive. For example, Binance charges 0.10% per transaction, while Coinbase charges maker-taker fees from 0.40% to 0.60%. These are higher than Crypto.com’s 0.075% maker-taker fee. Moreover, stakers on Crypto.com enjoy the lowest fees.

Withdrawal fees

Fees are not charged by Crypto.com when you transfer crypto assets to an external wallet. Mining fees to facilitate withdrawals of digital currencies will apply. For instance, the BTC withdrawal fee on Crypto.com is 0.0005 BTC, while ETH withdrawal is 0.004 ETH for all ERC-20 tokens.

Other fees

Crypto.com charges a 50 USDC administration fee for every transaction reversal of a wrong on-chain withdrawal. The fee for withdrawing from a USDC wallet is 25 USDC. This fee is not levied on other global exchanges like Binance and Coinbase.

How Many Cryptocurrencies and Trading Pairs Are There?

Crypto.com supports 229 cryptocurrencies, including Bitcoin and hundreds of altcoins such as Ethereum (ETH), Tether (USDT, Dogecoin (DOGE), Polkadot (DOT), Chainlink (LINK), Ripple (XRP), and Polygon (MATIC) across 518 markets. BTC/USD, CRO/USD, BTC/USDT, and ETH/USD are the most popular trading pairs.

Though the coins listed on the exchange are fewer than its competitors such as Binance Australia (350+), Swyftx (320+), and CoinSpot (370+) based on our reviews, they should be enough for you to diversify your investment portfolio.

Getting Started On Crypto.com

Creating a Crypto.com account is straightforward on the website and on the Crypto.com app. After creating a new account, the following steps should be taken to finish the account registration process.

Verifying your account

As part of its Know-Your-Customer (KYC) and Anti-Money Laundering (AML) protocols, Crypto.com requires identity verification to be completed. You cannot access the platform or any of its features without verification. To verify your account, you must:

- Confirm your personal information entered during the registration.

- Upload a government-issued ID document (like a driver’s licence, passport, or any other acceptable document) and

- Take a selfie photo.

After submitting the documents, Crypto.com will review them and provide an update. In our experience, this took less than 10 minutes which is about industry standard.

Wallet funding

Crypto.com supports crypto and direct purchases of digital assets via credit and debit cards. Transfers of fiat currencies from your Australian bank account are not supported which might prove to be a barrier to entry for some.

Our Experience Using The App

Most of Crypto.com’s features are primarily accessed through its premium crypto mobile app. If you’re interested in applying for the Visa debit card then downloading and installing the beginner-friendly mobile app is a must. The app is also the home of the NFT marketplace, and all wallet management tools, as well as provide an overview of your portfolio.

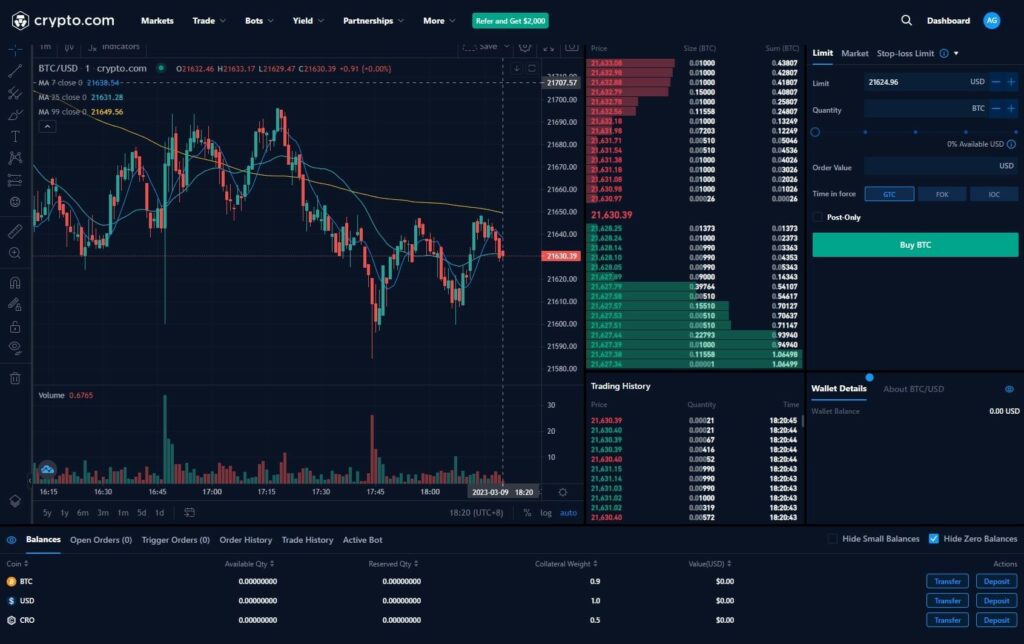

The Crypto.com Exchange, which is only accessible on desktop, is the gateway to all the serious trading features including the spot trading interface, soft staking, trading bots, affiliate management portal, and lending features.

Another feature we verified was the additional trading chart from TradingView, which is renowned for its strong backtesting capability. This integration comes with multiple advanced indicators as well as different timeframes. There is also a ‘Depth’ option which helps you learn the trading volume of the digital asset in real-time.

Despite its slightly enhanced trading features, like the live market charts and market highlights, beginners can still navigate the platform. Buying and selling crypto can be accessed on the exchange via the ‘Trade’ button. From there, you’re presented with a comprehensive overview of the underlying asset, including a live chart, order books, and trading history.

You can access order books and view the cryptocurrency’s trading history. Due to its sole support for spot trading, Crypto.com is significantly less attractive than competitors like Binance and Coinbase Pro. The obvious lack of futures and derivatives trading is also a huge drawback. This makes the exchange an unsuitable destination for advanced Aussie investors.

There’s nothing fancy or advanced here besides selecting the order type. Multiple order types like market, limit and stop-loss limits ensure control over trades.

The Crypto.com spot market still requires new crypto investors to undergo a basic learning curve, despite its lack of advanced trading options. In contrast, not having to deal with advanced products like margins and futures means you can’t use leverage or capitalise on other sophisticated features like shorting Bitcoin.

The Mobile App Is Top Class

The Crypto.com app is a simple but robust and brilliantly designed trading channel. The app is available for Android and iOS devices. You can also buy and sell NFTs, earn crypto, store assets using the in-house crypto wallet, and make payments offline using the Crypto.com prepaid debit cards.

The mobile app is home to the Crypto.com Card and the Pay service. You can use the Crypto.com debit card at millions of Visa outlets as you would a standard credit or debit card. In contrast, the Pay service enables the purchase of gift cards, airtime, and also the ability to send money to your contacts.

Spot trading isn’t available on the mobile app. You can only buy and sell individual cryptocurrencies on the app. To trade in the Spot market, you’ll have to head back to the Exchange platform – which is only available on desktop. Also, the mobile app features a standalone wallet for storing any form of fiat currency besides the regular in-built crypto wallet. We noticed the obvious absence of the ‘Soft Staking’ feature in the Crypto.com app.

Overall, the Crypto.com app is a consummate mobile service experience and is aimed at newbie traders who simply want to buy and sell individual crypto assets, earn passive income and send digital payments.

Customer Support Could Be Improved

Looking for help concerning how the platform works? Look no further than Crypto.com’s Help Center with its hundreds of educational resources. The exchange also offers a 24/7 customer support team to assist customers with any issues they might have while using the platform. The support team can be accessed via live chat and email.

The live chat feature is primarily a chatbot that pre-selects queries and directs users to articles from the Help centre. For instance, you can only choose from 5 primary topics when connected to the chatbot. However, if you have a pressing issue, follow the prompts until the last step and request to speak to an agent. The process is tedious, but you should be connected with a human agent within five to ten minutes. Many exchanges use chatbots like MEXC, but we feel Crypto.com does a great job of getting customers the help they need.

What Others Are Saying About Crypto.com

While we feel Crypto.com’s customer support is fairly standard, many of its existing customers disagree. Online customer service reviews suggest that Crypto.com’s customer service is below average. The exchange has a 2.0-star rating from a possible five on Trustpilot, with many complaints about poor customer support. Several customers complained about lost funds and the inability to receive funds sent to their crypto wallets.

This is a concern given Crypto.com’s industry reputation. There were also a few complaints about customers having difficulties sending their funds to their bank accounts. The exchange seems to have a poor image that is slowly damaging its reputation.

The Crypto.com mobile app has a high interaction rate with a Google Play Store rating of 4.6 stars and another 4.5 stars on the Apple App Store from a possible five. Users particularly love its relatively simple and intuitive interface. The company also responded to both positive and negative reviews.

However, during our Crypto.com review, we found some raised eyebrows concerning poor fiat and crypto withdrawal policies, restrictive management options for the wallet, and poor purchase order execution. We couldn’t verify the countries where these customers live, but it seems Crypto.com might have a fiat withdrawal issue in some regions.

Security Measures We Found

Crypto.com deploys various security measures to safeguard customers and funds. The exchange encourages Multi-Factor Authentication (MFA) for login access. The broker claims to store 100% of users’ crypto assets in offline cold storage through its partnership with crypto hardware powerhouse Ledger. This means all customers’ holdings are offline and immune to cyberattacks. In addition, it offers proof of reserves to verify the maintenance of a 1:1 asset backing.

The cryptocurrency exchange is one of the world’s first crypto exchanges with multiple International Organization for Standardization (ISO) Level 1 compliance. Crypto.com also boasts the highest NIST Cybersecurity and Privacy Frameworks level. This indicates that it follows the industry’s best cybersecurity practices.

Further enhancing security, Crypto.com holds an Insurance Fund worth $750 million. The insurance program is one of the industry’s largest – right behind Binance’s SAFU (worth $1 billion). Crypto.com’s $750M insurance setup offers customers guaranteed funds retrieval in the case of hacks or theft by malicious actors.

However, the exchange was hacked in 2022, with reports of $30 million stolen by the perpetrators. This casts a little doubt on the efficiency of the platform’s security measures.

Our Final Crypto.com Verdict

With Crypto.com, you have a comprehensive exchange for all your trading and investment needs. The exchange offers a wide range of services, including crypto staking, crypto debit cards, an NFT marketplace, and DeFi lending and borrowing, to mention a few.

However, despite all these features, the exchange is not an ideal destination for elite traders. Most of its features target beginner traders or risk-averse investors chasing passive crypto income. Some of its flagship products, like the staking feature, offer one of the highest rewards in the industry, but the requirements could be challenging to meet. The staking program requires a high commitment of CRO tokens for six months to enjoy the maximum interest rate. This could be a potential deal breaker for many investors.

Frequently Asked Questions

Crypto.com holds an Australian Financial Services Licence (AFSL), and the exchange is one of the most reputable in terms of security. However, Crypto.com has been hacked in the past.

Trading cryptocurrencies on Crypto.com is legal in Australia. The exchange is licensed as a financial services provider under the Australian Financial Services License (AFSL).

Users can withdraw crypto and fiat currencies from Crypto.com whenever they like. Aussies can also withdraw AUD via PayID and BPAY.

Crypto.com has a secure insurance fund worth $750 million to protect its customers. The insurance also covers Australian customers on the crypto platform.

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.