Coinmama Review: Is It Suitable For Aussies?

Last Updated on February 1, 2024 by Kevin GrovesCoinmama is a cryptocurrency exchange founded in 2013, with the purpose to make it fast and easy to buy digital currency using fiat. They are a reputable Bitcoin and cryptocurrency broker that also offers support in 188 countries. The company has provided fast and reliable services to over 3 million customers internationally with over a decade in business. However, if you’re considering opening an account at Coinmama, read our comprehensive review below first as there are some things you need to know especially when it comes to fees…

Coinmama

Trading fees:

0.99% – 3.99%

Number of cryptos:

18

Deposit methods:

Credit/debit cards, Apply Pay, Google Pay, SEPA, Skrill

Supported countries:

Global (including Australia)

Promotion:

None available at this time.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick Overview

Here is a quick summary of Coinmama.

| Exchange Name | Coinmama |

| Supported Countries | Australia (and internationally) |

| Fiat Currencies Supported | AUD, USD, EUR, CAD, GBP |

| Deposit Methods | Credit/debit cards, Apply Pay, Google Pay, SEPA, Skrill |

| Supported Cryptocurrencies | BTC, ETH, XRP, USDT, UNI, LINK, USDC, DOGE, and 10 more. |

| Deposit Fee | None |

| Trading Fee | 0.99% – 3.99% commission fee (dependent on loyalty level) |

| Withdrawal Fee | None |

| Mobile App | Yes |

The Bottom Line

We were impressed by how easy it was to use the Coinmama platform, both on desktop and mobile app. Crypto buying and selling are highly suitable for the everyday investor, and the ability to send crypto directly to your external wallet will appeal to those worried about security.

Apart from that, there isn’t much else to entice investors to start their crypto portfolio with Coinmama. There are no other trading services or features such as Dollar-Cost-Averaging (DCA), only 18 currencies are supported, and the commission fees are very expensive. Simply put, there are a lot of better crypto exchanges for Australians.

What we liked:

- Non-custodial nature which means high asset security.

- Easy to understand and use platform.

What we didn’t like:

- Withdraw AUD requires sending crypto to another exchange.

- Fees ranging between 0.99% and 3.99%.

- Limited crypto to buy and sell.

What Does Coinmama Do?

Coinmama is a Dublin-based cryptocurrency exchange that was founded in 2013 by Nimrod Gruber and Lawrence Newman. Coinmama is a legitimate digital currency brokerage platform that is operated by Cmama Ltd. The company currently operates in 188 countries including Australia and has a customer base of over 3 million.

Coinmama was established to provide investors and traders with a simple way of buying and selling major coins and tokens such as Bitcoin and Ethereum. Coinmama is so simple that it could be considered basic and stripped back compared to other popular crypto exchanges such as Binance and Bybit. Instead of providing complex features, Coinmama is suited to everyday Aussies who want to quickly exchange their cash for popular crypto assets.

An important aspect of Coinmama is that it does not provide any crypto storage solutions. Instead, you will need to connect your external wallet when buying and selling assets due to the non-custodial nature of the platform. This isn’t so much of a problem since your assets are arguably more secure, however, you will need to have a good wallet to store your crypto.

Coinmama Pros & Cons

Pros:

Cons:

Coinmama’s Features Put To The Test

It’s designed for everyday people

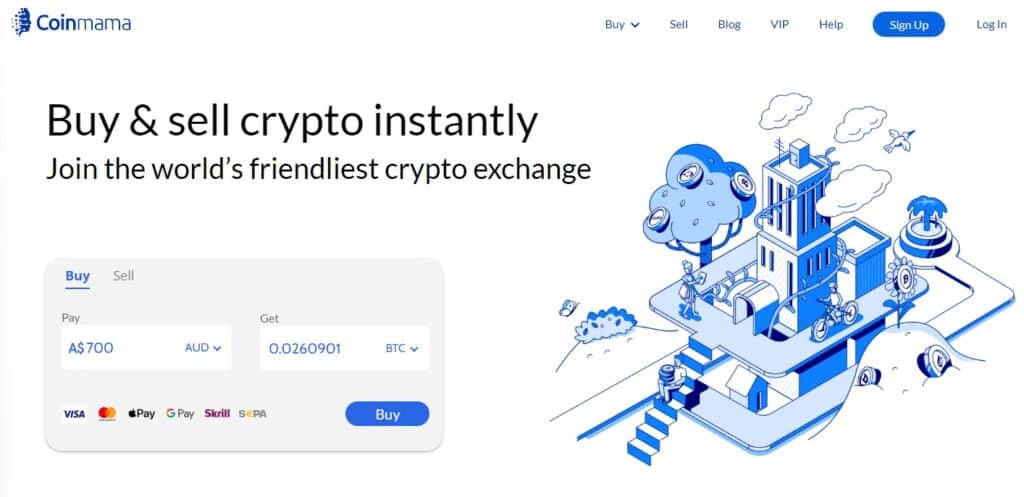

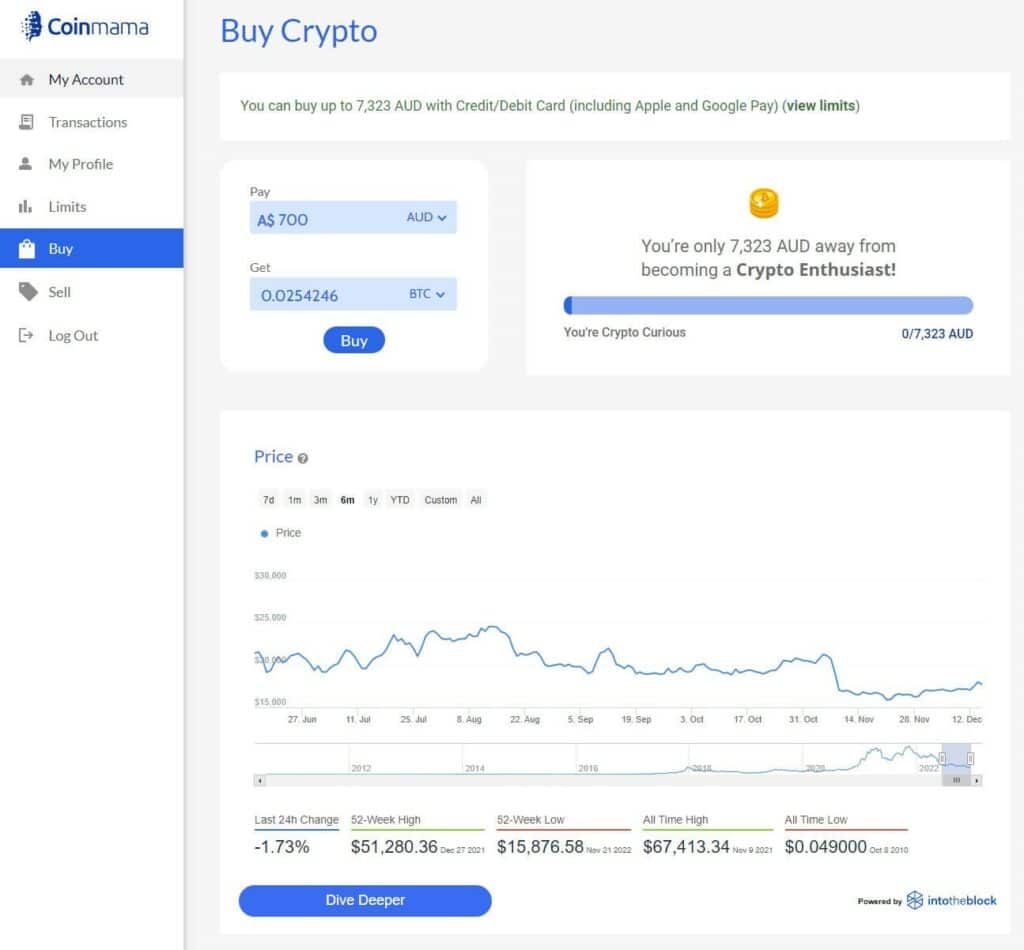

The Coinmama platform has been designed with everyday people in mind. To say that it’s an easy platform to use is an understatement with its basic and uncomplicated design. As presented in the below image, the interface has an uncluttered design where popular cryptocurrencies can be purchased in minutes.

Features that are typically found on crypto exchanges such as interest-earning and staking hubs, advanced trading interfaces and charts, as well as advanced markets are not offered. Coin-to-coin trades are also not permittable. Coinmama only allows you to buy and sell cryptocurrency using fiat currencies such as AUD and this results in an easy trading experience.

Non-custodial for security conscious investors

Coinmama is a highly secure trading platform in which to buy cryptocurrencies such as Bitcoin. This is due to its non-custodial nature as it doesn’t store any customer funds or digital assets.

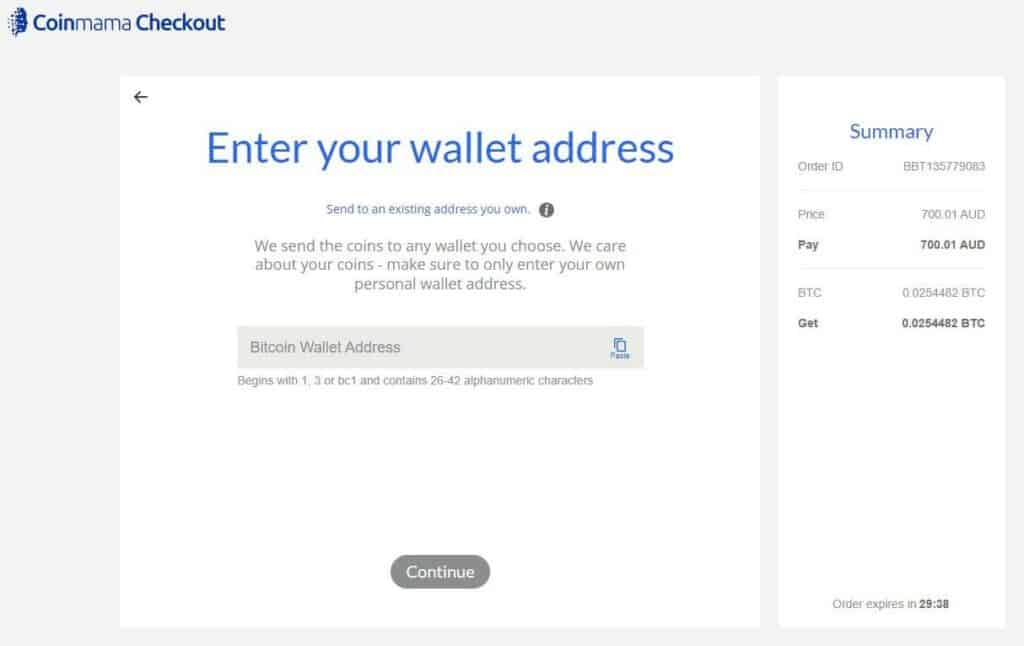

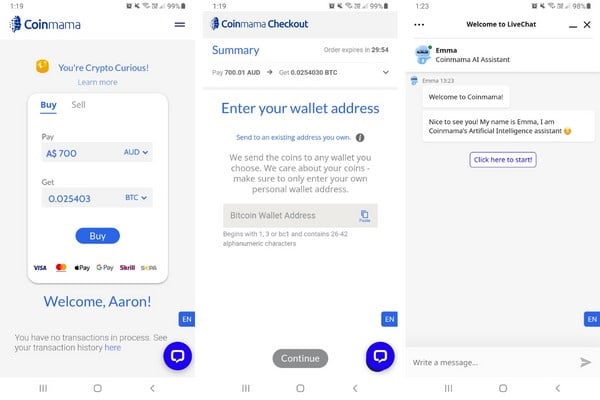

When you purchase Bitcoin, you need to enter the address of your digital or hardware wallet where it will be transferred through the blockchain. This process eliminates the potential for hackers to steal crypto assets that you would otherwise store on an exchange and will appeal to those who value peace of mind.

Why Are Coinmama’s Fees Expensive?

Coinmama charges zero fees for depositing fiat and digital currencies. The lack of fees to fund your account or transfer assets out is a common feature amongst crypto exchanges that offer services in Australia.

Coinmama charges a commission fee between 0.99% and 3.99% depending on your loyalty level. In comparison to other popular crypto exchanges, even the 0.99% fee is high. In Australia, competitive trading fees for a local crypto platform are in the vicinity of 0.5% – 0.6%. Examples of such platforms include Swyftx and Independent Reserve.

Verifying Your Coinmama Account

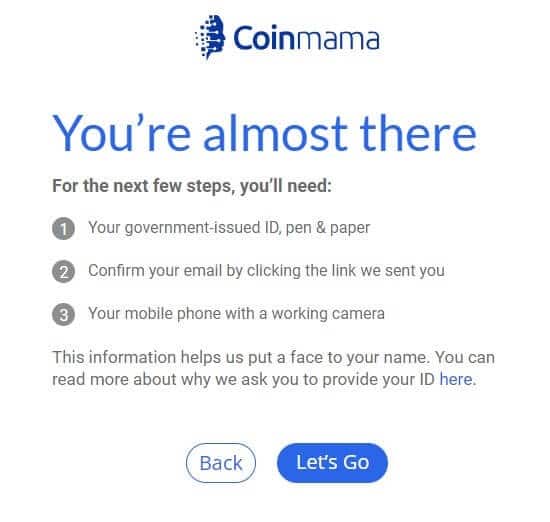

We found the account signup process on Coinmama to be surprisingly streamlined. A valid email address and strong will get the process started, followed by a series of short prompts where basic personal information will need to be entered. These include your full name, address, and country of residence (Australia).

Verifying your identity is a mandatory requirement that must be completed before you can deposit any funds. To satisfy KYC requirements, you will need a government-issued ID (passport or driver’s licence), a pen and paper, and your mobile device. Your mobile device will be needed to take a photo of your ID document as well as a selfie photo of you holding up your ID and a piece of paper showing the date of submission. This means that you cannot submit an existing photo of your passport or drivers licence.

Once we completed the process, an automated email was received stating that a wait of a couple of hours was required. The Know-Your-Customer (KYC) process on Coinmama is more involved than other exchanges and it takes a bit more time.

Deposit Methods & Limits

Although Coinmama offers a multitude of deposit methods to its global audience, Australians only have a few options to choose from including credit/debit cards, Apple Pay, and Google Pay. Transfers of cash from an Australian bank account, POLi, BPAY, cash deposits via Blueshyft, and PayID are not supported which is a major downside. If you prefer to use these methods then you can consider Swyftx or CoinSpot.

Although using credit/debit cards to buy crypto is a convenient method, the 4.99% fee that Coinmama will charge you is simply too much. When you first sign up, the base loyalty level will give you favourable daily and monthly limits of $7,293 and $21,878, respectively.

Our Thoughts on the Trading Experience

The only trading that you can do on Coinmama is the buying and selling of digital currencies using fiat cash. This means you can quickly exchange your AUD for Bitcoin and sell BTC for cash. Trading markets such as leveraged margin, futures, and options that are typically offered by large global exchanges are not offered. In addition, there is no way to swap one coin for another.

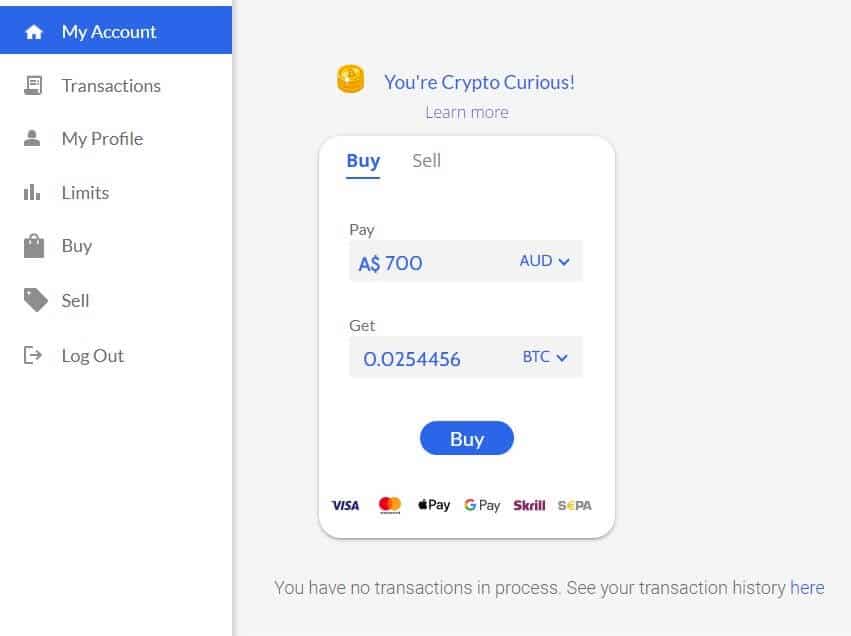

The trading experience that Coinmama facilitates is one of ease and simplicity. All buy and sell orders are fulfilled through a panel where you connect your hardware wallet. Enter in the amount of AUD to spend, enter your wallet address and progress the transaction.

Security Is Questionable

Coinmama does not store any of your cash funds or digital assets. Since cryptocurrencies that you buy and sell are directly transferred to and from your external hardware wallet, the potential for hackers to gain access to your assets is almost impossible. This is in contrast to exchanges that provide hot wallets for digital assets where they need to implement strong security measures to safeguard your funds and crypto.

In 2019, Coin Telegraph reported that Coinmama suffered a major security breach that affected approximately 450,000 customers. Coinmama outlined that the email addresses and hashed passwords of its customers were stolen and posted on a dark web registry. Coinmama was not alone in the breach as 24 other companies from the gaming, travel booking and streaming websites were also affected. Since the breach, Coinmama has taken measures to ensure its platform is resilient to such attacks.

We Tested The Mobile App

The Coinmama app is available for use on iOS and Android mobile devices. During our testing, we found the app to resemble the desktop version in terms of its layout. The buy and sell panels are clearly presented along with a summary of your crypto transactions. Since Coinmama is a very basic crypto trading platform, it is not surprising to see a very basic mobile app. One thing that we did notice, was that there was a bit of latency when navigating.

Customer Support Could Be Improved

Coinmama is an incredibly straightforward platform to use, however, the Help Centre provides some useful articles if you’re experiencing issues. There are not too many articles, however, Coinmama covers all the bases with topics outlining their various deposit methods and limits, how their loyalty program works, and general information on hardware wallets.

There are two ways of contacting the Coinmama customer support team including the submission of a ticket and through the live chatbot. During our testing of the live chatbot, were unimpressed by its usefulness. It was unable to understand queries such as “cash withdrawal” and ” withdrawal”, and we were not connected to a real person.

Where Coinmama Falls Short

High fees

Coinmama is generally well known for its high trading fees which are comparatively expensive to other crypto exchanges Australians have access to. Since the value for money is a key consideration for most Australians, you would be better off using a cheaper alternative such as Swyftx (0.6%), Binance Australia (0.1%), and even CoinSpot (1%).

Lack of supported cryptocurrencies

Coinmama only supports 18 digital currencies, albeit, they comprise all the major coins and tokens such as Bitcoin and Ethereum. The shortage of digital currencies that can be bought and sold, and the resulting lack of choice might be a determent for some investors.

If you prefer to buy altcoins for investment or trading purposes then consideration should be given to a crypto exchange or brokerage platform that lists over 300 assets. Examples include Swyftx (320+), Coinstash (410+), and KuCoin (700+)

Our Final Verdict

Coinmama is a global trading platform that provides a simplistic and stress-free way of buying and selling digital currencies. The barebone design of the interface exudes simplicity and beginners who know how to link their storage wallet will have no problems using the platform.

Whilst the security of assets is not an issue due to its non-custodial nature, the public image of Coinmama suffered in 2019 when the email addresses and hashed passwords of 450,000 customers were released on the dark web. Apart from this, Coinmama has some major downsides including a lack of supported cryptocurrencies, high transaction fees, and a lack of more features.

Coinmama is best suited to beginners who prefer an easy way of buying and selling currencies. But, it doesn’t take much to realise that there are plenty of alternative crypto exchanges that provide better services and cheaper trading fees.

Frequently Asked Questions

Coinmama is a legitimate and trustworthy cryptocurrency trading platform that was founded in 2013. The platform is highly secure since it doesn’t store your funds or digital assets. Instead, the crypto that you buy (and sell) is directly transferred to your external wallet for safekeeping. The company suffered from a hack where the email addresses and hashed passwords of 450,000 customers were stolen, however, security practices have been raised since.

Withdrawing cash from your Coinmama account into an Australian bank account is not able to be undertaken. Instead, you will need to transfer the crypto that you want to convert into AUD, to another crypto exchange such as Binance, and then sell it back to AUD.

Coinmama only offers the direct buying and selling of cryptocurrencies using cash and does not provide any financial services including a wallet to earn interest payments. For a list of the best wallets to earn crypto interest, you can read our article here.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.