Best CoinSpot Alternatives: 5 Cheaper Exchanges Like CoinSpot

Last Updated on January 31, 2024 by Kevin GrovesOver the past decade, CoinSpot has established itself as one of the undisputed pillars of the Australian crypto industry. The AUSTRAC registered trading platform has accumulated over 2.5 million customers, mostly due to its range of Australian-centric features that are hosted on a user-friendly platform.

Although CoinSpot offers so many benefits, it doesn’t sport the cheapest trading fees in Australia. It’s 1% fee to instantly buy and sell digital currencies is quite expensive and should be avoided since it does not offer value for money.

In this article, we pick from Australia’s popular crypto exchanges to identify which can be the top contenders of CoinSpot. The key focus was to look for trading platforms that are cheaper to use but still provide great reliability and features.

Best Alternatives To CoinSpot

Looking for a cheaper crypto exchange than CoinSpot? These are our five picks if you want similar features but lower costs.

- Swyftx – Best alternative to CoinSpot for Australians

- Binance Australia – Cheaper fees and superior features

- eToro Australia – Choose it for copy-trading

- Cointree – A similar trading experience except with lower fees

- Independent Reserve – A better SMSF option

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Is CoinSpot Expensive?

CoinSpot is expensive to buy and sell cryptocurrencies if you use its Instant Buy/Sell feature. Here, trading fees are a hefty 1% which is expensive in the Australian market considering that fees typically range from 0.1% to 1%. Better value for money can be obtained from the CoinSpot Exchange where market orders will incur a much cheaper fee of 0.1%. The downside is that not everyone will have the expertise or knowledge to place orders and customers are more likely to use the Instant Buy/Sell feature.

Best Crypto Platforms Like CoinSpot: 2023 Reviews

Here are our reviews of the best Australian crypto exchanges to use instead of CoinSpot.

1. Swyftx – Best alternative to CoinSpot for Australians

Why we picked it: The trading fees to buy and sell crypto on Swyftx (0.6%) are 0.4% cheaper than on CoinSpot (1%). So for every $100 you spend buying crypto, you will save $0.40 on Swyftx. All of Swyftx’s AUD deposit methods can be used for free as an added pro. In comparison, CoinSpot will charge minor fees of 0.9% and 2.5% for depositing AUD into its wallet via BPAY and cash deposits, respectively. There is also a $20 Swyftx referral code for creating a new account.

- Rating: ★★★★★

- Supported Crypto: 320+

- Deposit Fees: None

- Trading Fees: 0.6% (flat)

- Beginner-friendly: Yes

- Allows AUD deposits and withdrawals: Yes

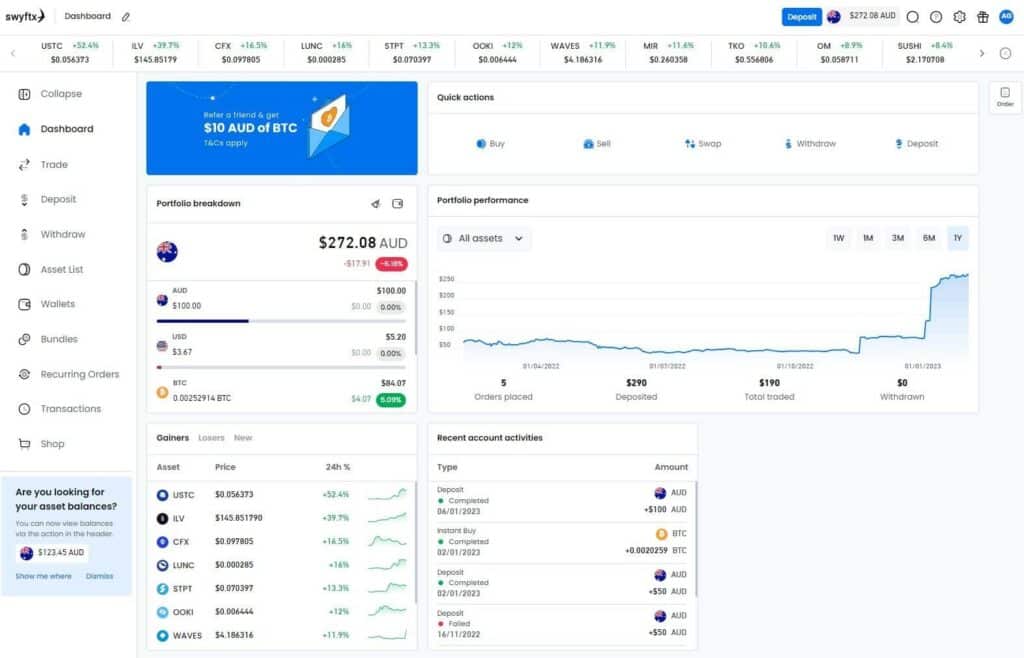

Swyftx is a Brisbane-based cryptocurrency brokerage platform that has been providing Australians with first-rate products and services since 2019. Initially established as a solution to common issues seen in the crypto industry, Swyftx has amassed a customer base of over 660,000 Australians on the back of strong consumer trust and reliability.

Swyftx has similar crypto features to CoinSpot, which is of no surprise since both target everyday Australians, particularly beginners. On Swyftx, you can easily and quickly exchange your money for 320+ coins and tokens such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Solana (SOL), Cardano (ADA), and many more. Not quite the expansive list that CoinSpot supports but very comparable for all intents and purposes and a very good place to trade altcoins.

The user experience is also similar between the two AUSTRAC-registered exchanges. Both allow you to seamlessly deposit AUD into your account wallet, however, it can be said that the Swyftx experience is more enjoyable. You can read more in our Swyftx vs CoinSpot review, but this is the direct result of Swyftx having a modern and aesthetically pleasing user interface. You can toggle the dark mode, switch to the free demo mode (that comes equipped with $10,000 of virtual AUD), or customise the dashboard to suit your needs. This means you can take control of how you want to track and manage your crypto portfolio.

Other notable Swyftx features include a built-in crypto tax calculator, Dollar-Cost-Averaging (DCA) tools, real-time portfolio tracking, and the TradingView charting package that is integrated into the trading interface.

Similar to CoinSpot, Swyftx has not been hacked since its inception and this should give you peace of mind. Its unblemished track record can be attributed to its industry-leading security measures which include ISO 27001 accreditation.

One of the cons to switching to Swyftx from CoinSpot is the slightly less-developed features. Specifically, this comprises a debit card to spend crypto. Swyftx also does not have a crypto debit card whereas CoinSpot has recently released their CoinSpot Card that can be used at in-store or online retailers that accept Mastercard.

Overall, Swyftx is the top crypto exchange in Australia. Although CoinSpot has a few more features, Swyftx is far easier on the wallet due to its cheaper trading fees. This will resonate with beginners looking to start their crypto portfolios.

Swyftx Pros:

Swyftx Cons:

Read our full Swyftx review

2. Binance Australia – Cheaper fees and superior features

Why we picked it: With trading fees of 0.1% and 0.1% for maker and taker orders, Binance Australia is one of the cheapest alternatives to CoinSpot. Moreover, trading fees can be reduced depending on your 30-day trading volume. Due to its significant trading volume and above-average liquidity, you will get far tighter spreads on Binance which means less price slippage. Binance Australia also provides a much more robust product and service ecosystem than CoinSpot.

- Rating: ★★★★★

- Supported Crypto: 380+

- Deposit Fees: None

- Trading Fees: 0.1% maker and 0.1% taker

- Beginner-friendly: Yes

- Allows AUD deposits and withdrawals: Yes

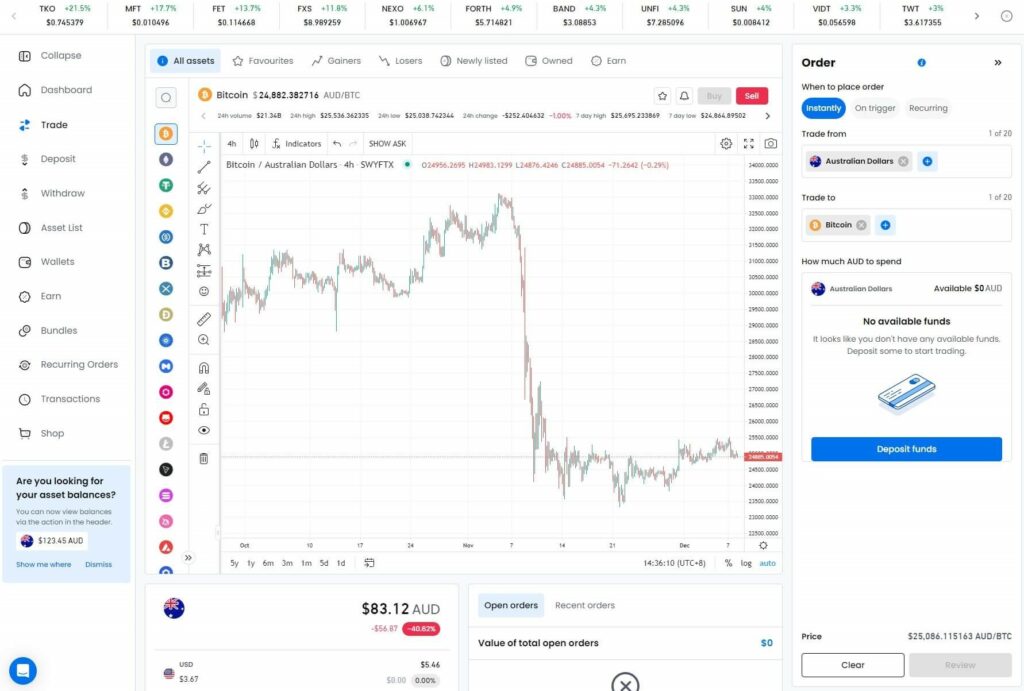

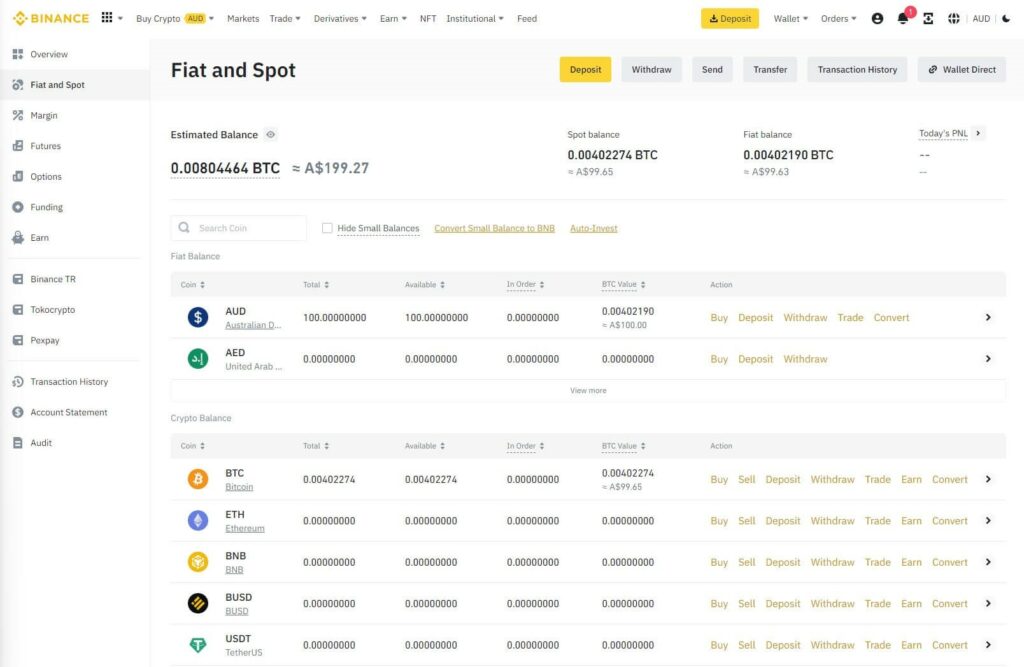

Binance Australia is the premier digital asset exchange in the world. In Australia, the Binance brand gives you access to 380+ digital currencies which is on par with CoinSpot. However, Binance is simply superior in almost every other regard including value for money as we revealed in our Binance vs Coinspot comparison.

Binance Australia is tailored to people of all experience levels, including beginners and frequent traders. Whilst there is something for everyone, it can be said that advanced traders and investors will appreciate the platform more. Binance Australia is packed with advanced features, tools, and trading markets such as spot, margin, leveraged tokens, contracts and futures. On top of that, AUD receives strong support where there are 19 AUD/crypto trading pairs available on the spot market.

Binance Futures offers the following markets:

- USDS-M Futures: Perpetual or Quarterly Contracts settled in USDT or BUSD.

- Coin-M Futures: Perpetual or Quarterly Contracts settled in Cryptocurrency.

- Leveraged Tokens: Trade with leverage without the need to put up collateral, maintain and margin level, or worry about the risk of liquidation.

- Options: Cash-settled contracts where the options can be exercised before the time expires.

Apart from being about 90% cheaper than CoinSpot, Binance Australia is a great exchange to stake crypto. Digital assets such as Litecoin (1.4%), XRP (1.39%), BUSD (3.5%), and ETH 2.0 can be staked on the Proof-of-Stake (PoS) consensus protocol to earn passive rewards. This is a feature that CoinSpot does not offer due to regulatory reasons.

Binance Australia provides a robust and feature-rich platform with a wealth of trading markets that other exchanges can only aspire to. For most, Binance Australia should provide all the crypto features to equip experienced investors and traders with the tools they need, as well as capture their interest as new products are always been released. In addition, there is a 100 USDT bonus using a referral code for Binance Australia.

Binance Australia Pros:

Binance Australia Cons:

Read our full Binance Australia review

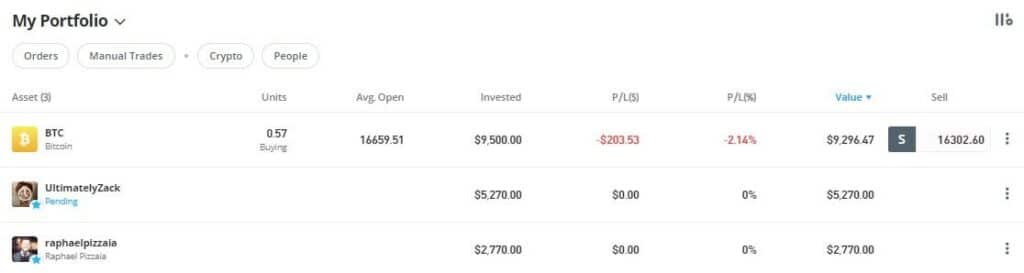

3. eToro Australia – Choose it for copy-trading

Why we picked it: eToro Australia offers the same 1% trading fee to buy digital currencies as CoinSpot, however, the major benefit is its world-renowned copy-trading features, CopyTrader and SmartPortfolio. You can also get involved with the active community and engage with like-minded individuals. Since the other aspects of eToro are a bit lacking compared to CoinSpot, if you’re going to make the switch then the copy-trading features are a strong enough reason to do so.

- Rating: ★★★★

- Supported Crypto: 90+

- Deposit Fees: None

- Trading Fees: 1%

- Beginner-friendly: Yes

- Allows AUD deposits and withdrawals: Yes

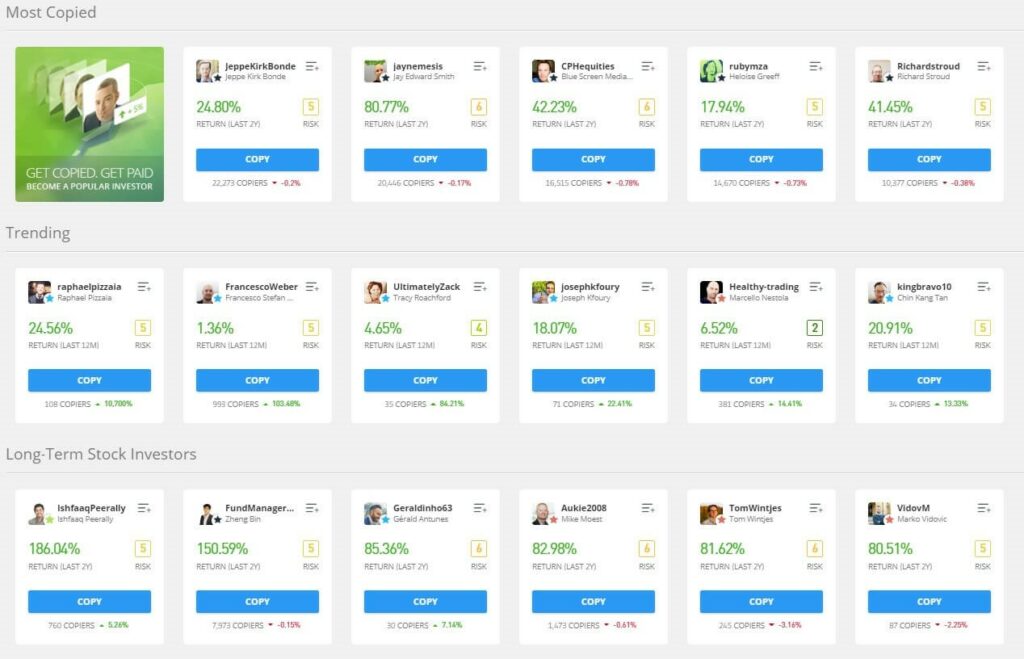

eToro is a leading social trading platform that enables investors to trade a variety of assets, including Forex, cryptocurrencies, commodities, stocks, and CFDs. Established in 2007, eToro has added more features and markets and become a world-class multi-asset platform. With over 20 million customers worldwide, eToro is one of the best Australian crypto exchanges for social trading.

The CopyTrader feature is renowned for its ability to let beginners copy the trades of experienced and successful traders. By browsing portfolios of other traders, you can use various categories and filters and sort by eToro’s risk scores. Though there are other cryptocurrency trading platforms such as KuCoin and Bybit that offer a social trading marketplace, eToro stands out with its user-friendly interface that caters to investors. All you need to do is enter the number of funds you want to spend and confirm the order.

eToro Australia offers a straightforward, free, and convenient demo account for crypto trading. With just a click of a button, you can activate or deactivate this feature. Additionally, you’ll have access to virtual $100,000 USD to explore the platform and practice your trading strategies risk-free. We found that the vast majority of eToro’s features are available for use in demo mode. The only exception we encountered was that you can’t view the make-up of portfolios copied through the CopyTrader feature.

As detailed in our CoinSpot vs eToro Australia review, the latter has few but major strengths over CoinSpot. The pros of its copy-trading features and how easily they can be used may be enough to entice you despite the limitations of the platform in other areas. One of these limitations is that you can’t use AUD to buy crypto. Whilst you can deposit AUD via POLi, bank transfers, or credit cards, the AUD will be converted into USD by eToro. This results in currency conversion fees and reduces eToro’s value for money.

eToro Pros:

eToro Cons:

Read our full eToro Australia review

4. Cointree – A similar trading experience except with lower fees

Why we picked it: The trading fees to buy and sell crypto on Swyftx (0.6%) are 0.4% cheaper than on CoinSpot (1%). So for every $100 you spend buying crypto, you will save $0.40 on Swyftx. All of Swyftx’s AUD deposit methods can be used for free as an added benefit. In comparison, CoinSpot will charge minor fees of 0.9% and 2.5% for depositing AUD into its wallet via BPAY and cash deposits, respectively.

- Rating: ★★★

- Supported Crypto: 250+

- Deposit Fees: None

- Trading Fees: 0.9% (spot), 0.25% (coin-to-coin)

- Beginner-friendly: Yes

- Allows AUD deposits and withdrawals: Yes

Cointree is a well-established cryptocurrency exchange based in Melbourne, Australia that has been providing a simple, safe, and quick way to buy and sell over 250+ cryptocurrencies since 2013. The platform is tailored to the general public, featuring a free demo version to simulate trading before committing, a refreshing interface design with intuitive tooltips, and no distracting charts.

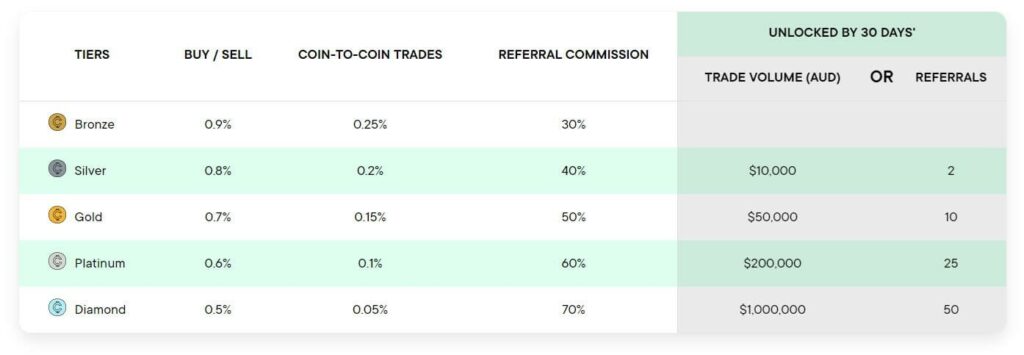

Furthermore, Cointree offers trading fees starting at 0.9% for AUD purchases, and 0.25% for coin-to-coin trades, which is cheaper than CoinSpot’s 1% fee. All trading fees on Cointree can be reduced by either your 30-day trading volume or the number of new referrals you bring in for that month.

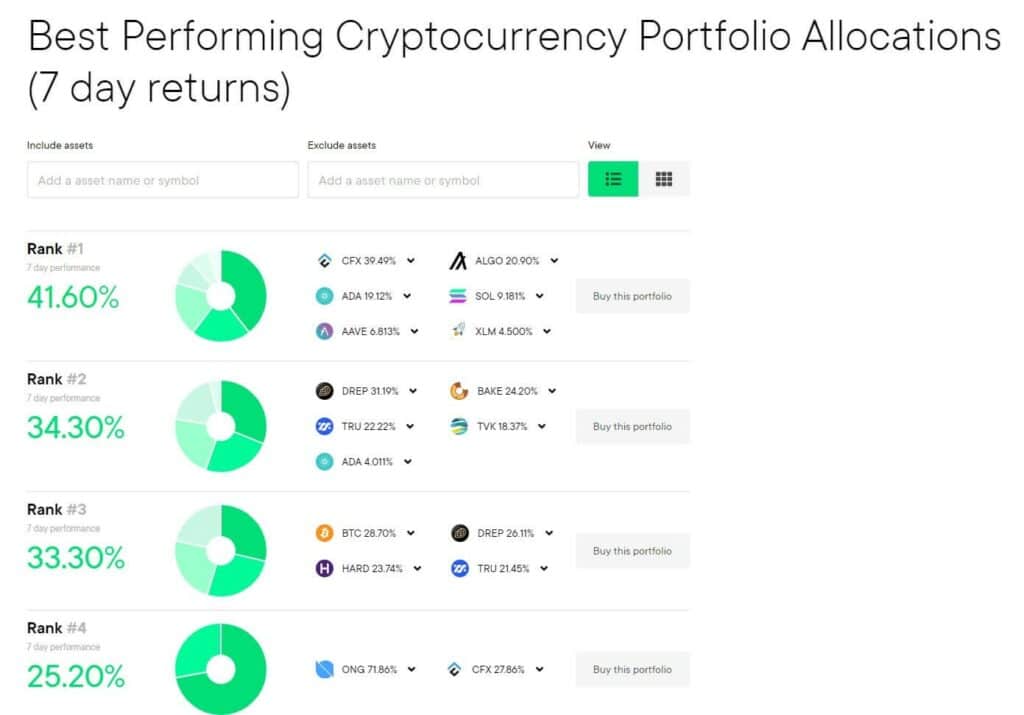

Cointree offers an impressive selection of 100 pre-set crypto bundles that have been determined based on their 7-day performance. This goes one step further than CoinSpot’s limited selection of 10 bundles where their performance is largely unknown unless you do the research yourself.

Whether you’re looking for a portfolio filled with altcoins or one that excludes a specific coin, you can easily narrow down your options with their simple filtering features. Although you can’t customise crypto bundles like you can on Swyftx, the filtering options combined with the huge choice provide you with a great deal of flexibility. This is another advantage over CoinSpot as the bundles are fixed. After you’ve selected the bundle, all you need to do is enter the amount of AUD to spend and the digital assets will be deposited into your wallet.

Cointree Pros:

Cointree Cons:

Read our full Cointree review.

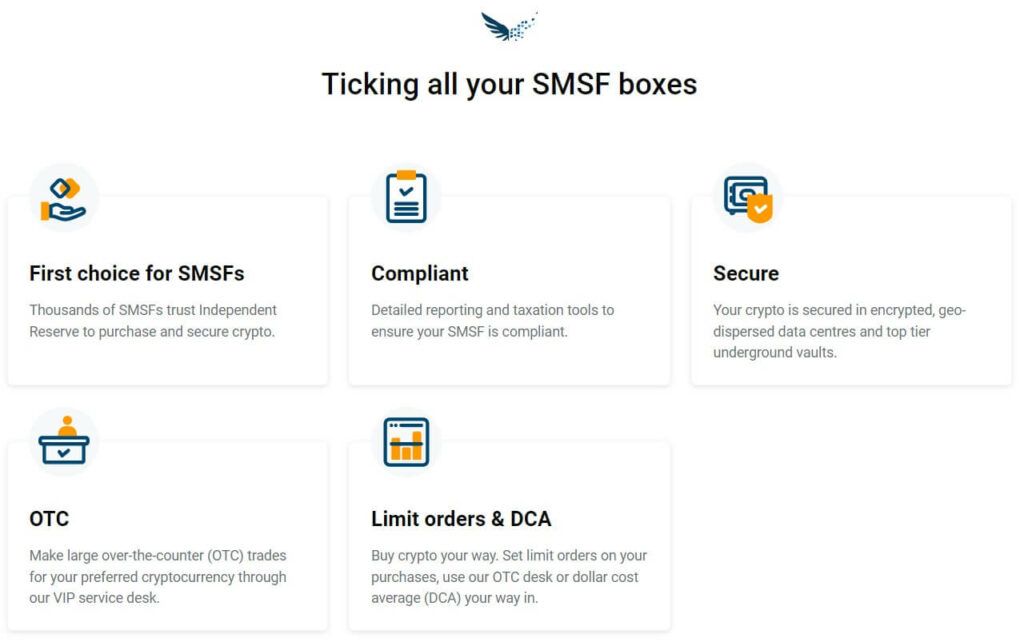

5. Independent Reserve – A better SMSF option

Why we picked it: Independent Reserve’s long-standing reputation as a trusted provider of Self-Managed Super Fund (SMSF) services precedes itself. Although CoinSpot provides SMSF services as well, Independent Reserve has better features to offer Australian investors with more choices, more flexibility, and fewer fees.

- Rating: ★★★

- Supported Crypto: 30

- Deposit Fees: None

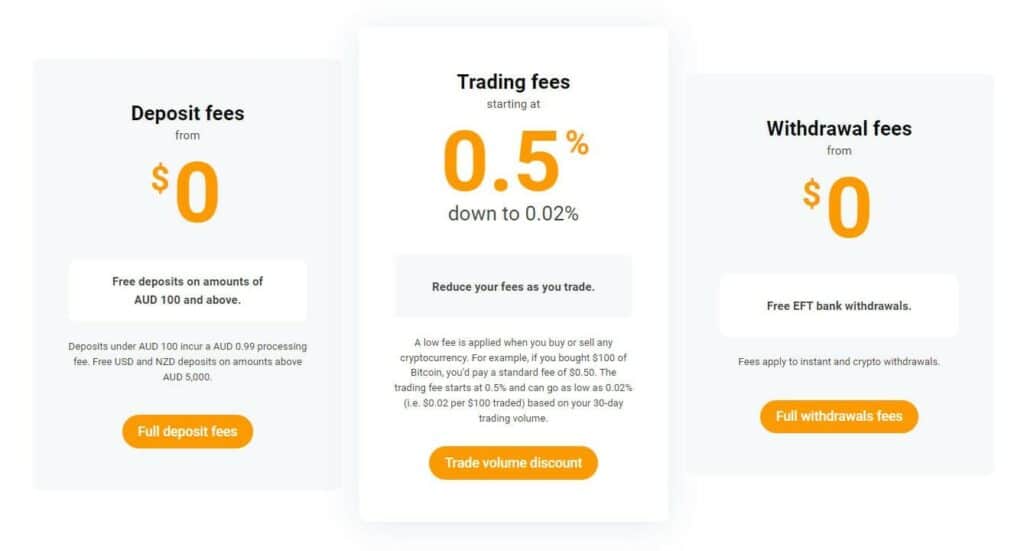

- Trading Fees: 0.5%

- Beginner-friendly: Yes

- Allows AUD deposits and withdrawals: Yes

In 2013, Adam Tepper and Adrian Przelozny founded Independent Reserve to provide Australians with a secure and regulated platform to trade Bitcoin and other cryptocurrencies. The company has since seen its customer base grow to over 250,000 investors and traders across Australia, Singapore, and New Zealand. It holds more than 8,000 Self-Managed Super Funds (SMSFs) and $1 billion worth of digital assets in its secure vaults.

Independent Reserve is committed to being one of Australia’s most reliable and trusted places to buy crypto with AUD and has achieved the ISO 27001 accreditation and implemented top-tier security standards to demonstrate its commitment. It has also partnered with industry players and associations such as Blockchain Australia to bring value to its customers.

Independent Reserve offers a comprehensive crypto SMSF service, making it one of the best in Australia. You get personalized advice on your investments, can utilize limit orders and Dollar-Cost-Averaging (DCA) to reduce your risk in volatile markets, and enjoy the value from competitive trading fees starting from 0.5%.

Furthermore, with quick access to tax reports to assist you with your legal obligations, as well as the Over-The-Counter (OTC) desk, your trading experience is made easier. Although the Independent Reserve interface is easy to use, it lacks a bit of polish compared to more modern exchanges such as Swyftx.

It is 50% cheaper to instantly buy crypto on Independent Reserve than it is on CoinSpot. Here, trading fees start at a maximum of 0.5% and can be reduced to as low as 0.02% depending on what your 30-day trading volume is.

The only downside to choosing Independent Reserve as a place to use your super fund to invest in crypto assets is its limited selection of cryptocurrencies (30) that can be bought with AUD. However, this shouldn’t be much of a factor for the majority of Australians since Bitcoin and Ethereum are the most popular assets to HODL.

Independent Reserve Pros:

Independent Reserve Cons:

Read our full Independent Reserve review

Conclusion

CoinSpot has been a mainstay of the Australian crypto community for a long time, and rightfully so. The ever-so-reliable and trusted brokerage platform has forged itself as a major player on the back of easy-to-understand and use features that are tailor-made for the everyday Aussie.

Just like its outdated interface, its high fees to trade Bitcoin and altcoins crypto using it’s Instant Buy/Sell have remained the same. With the vast array of other crypto exchanges now on the market, each with their own unique suite of products and services, you have a lot more choices of platforms to use that also carry lower fees.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.