CoinSpot vs eToro: A Detailed Comparison

Last Updated on December 24, 2023 by Kevin GrovesIn this comparison, we compared two of Australia’s best crypto platforms, CoinSpot and eToro to see which is better to use. This assessment will compare their key features, AUD payment methods, user experience, trading fees, and customer service.

The Bottom Line

CoinSpot will satisfy the needs of most Australian investors and traders with its range of features and services that have been tailored to the Aussie crypto market. As a reliable trading platform, CoinSpot has many advantages over eToro for people who simply want to buy digital currencies with their money. People who are new to crypto investing should know that they have all the tools they need to quickly and safely buy and store crypto.

The social trading features of eToro and the simplicity with which they are delivered are the major strengths of the platform. However, there is a lack of other features that would benefit Aussies or even more experienced traders. eToro also seems to have a poor reputation in terms of its customer service and mobile app. If social trading is for you or you want to have exposure to non-crypto markets then eToro should be in strong consideration.

Winner: CoinSpot 🏆

Website: www.coinspot.com.au

Referral Code ($10 free BTC): Refer to this guide for entering the Coinspot referral code.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

CoinSpot vs eToro Australia: Comparison Table

| ||

|---|---|---|

| Exchange | CoinSpot | eToro Australia |

| Fiat Currencies | AUD | 14 including AUD, USD, EUR and GBP |

| Number of Crypto | 370+ | 90+ |

| Deposit Methods | Bank transfer, POLi, PayID, BPAY, cash deposit, credit/debit cards | Credit/debit card, POLi, bank transfer |

| Deposit Fees | None | None |

| Maximum Trading Fees | 1% | None, spread only. |

| Withdrawal Fees | None | None for USD. $5 and currency conversion fee for non-USD withdrawals. |

| Social trading | No | Yes |

| Interest-earning Wallet | Yes | No |

| Markets | Spot | Spot |

| Mobile App | Yes (iOS and Android) | Yes (iOS and Android) |

| Support | Live chat, email | Live chat, email |

| Verdict | ||

| Review | CoinSpot Review | eToro Australia Review |

| Website | Visit the CoinSpot website | Visit the eToro website |

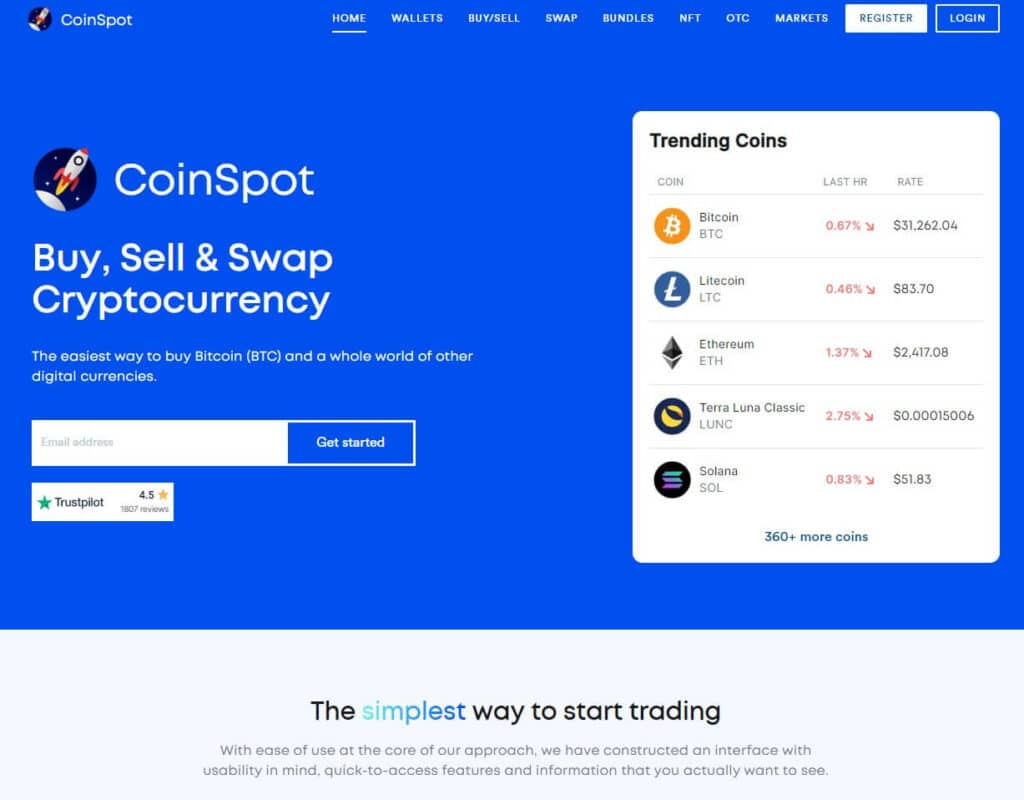

CoinSpot Overview

Established in 2013, CoinSpot is a leader in the Australian cryptocurrency market. The Melbourne-based brokerage platform is well-known for its reputation as a secure and reliable place to buy a wealth of digital assets directly with Australian Dollars (AUD). With over 370 crypto coins and tokens to choose from, CoinSpot becomes a favourable place to trade and invest in altcoins.

CoinSpot has an unblemished track record in security and this can be partly attributed to its internationally recognised ISO 27001 accreditation. The Australian-based company emphasises regulatory compliance as well as robust security measures to provide consumer confidence among its user base of over 1 million Australians.

All of CoinSpot’s features are tailored towards the needs of Australian investors and traders, in particular beginners and everyday users. The platform has an easy-to-use interface, streamlined account management processes, and features that allow users to grow their crypto wealth.

CoinSpot Pros:

CoinSpot Cons:

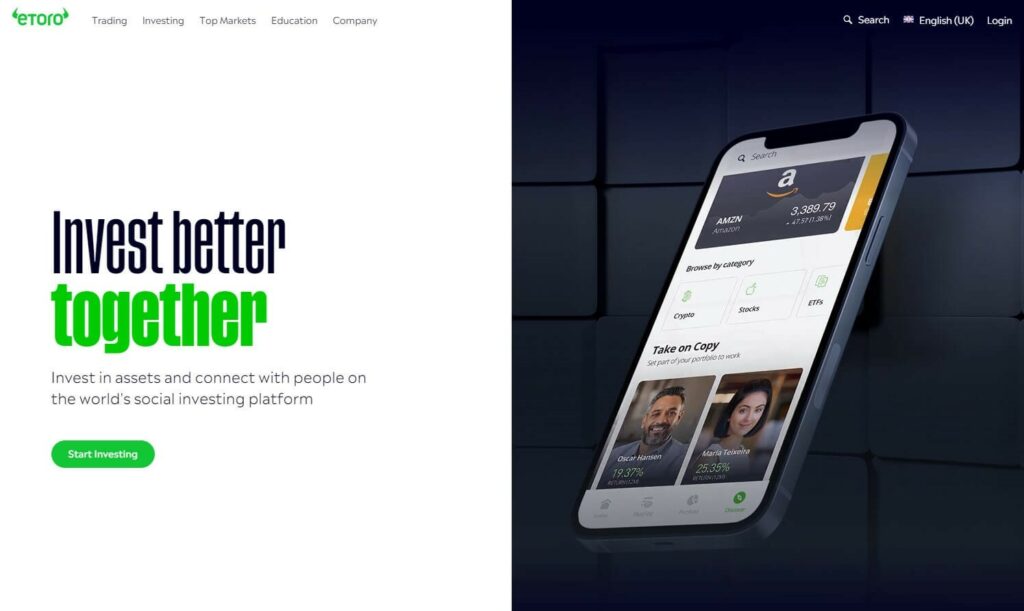

eToro Australia Overview

eToro Australia is an independently operated company (eToro AUS Capital Limited) of the global eToro brand. Originating from its global market, Australians have easy access to a variety of investment markets such as Forex, stocks, commodities, and Contract for Differences (CFDs).

Licenced by ASIC as a Digital Services Provider (DSP), eToro is the leading provider of social trading markets and features in Australia and is frequently cited as a beginner-friendly platform.

eToro Australia Pros:

eToro Australia Cons:

CoinSpot vs eToro Australia: Deposit Methods

CoinSpot provides more ways to deposit AUD into your account over eToro. Currently, you can fund your CoinSpot wallet through bank transfers, POLi, BPAY, cash deposit crypto purchases via Blueshyft, and credit/debit cards. eToro also supports the transfer of money from an Australian bank account, POLi, and purchases using credit/debit cards. As seen in the table below, popular deposit methods that are supported by CoinSpot and not eToro include BPAY and cash deposits.

| Deposit Method | CoinSpot | eToro |

|---|---|---|

| Bank transfer | Yes | Yes |

| POLi | Yes | Yes |

| BPAY | Yes | No |

| Cash deposit (Blueshyft) | Yes | No |

| Credit/debit cards | Yes | Yes |

Winner: CoinSpot 🏆

CoinSpot provides more flexibility and choice when it comes to funding your account with cash. Moreover, the AUD that you deposit on eToro will be automatically converted into USD since all trading activities are done in USD.

CoinSpot vs eToro Australia: Products & Services

CoinSpot has been providing robust cryptocurrency services for over a decade. During that time, its features have evolved to match the needs of Australian investors and traders. To be specific, CoinSpot’s target audience is the general public with experience levels ranging from beginner to experienced. In comparison, eToro Australia is an extension of the global eToro social trading brand.

Supported Cryptocurrencies

If you value the range of cryptocurrencies that are offered by a crypto exchange, then eToro is not for you. For context, CoinSpot has over 370 digital currencies that can be directly bought with AUD, and sets the Australian benchmark as an ideal place to invest in altcoins. eToro’s selection is rather meek with only 90+ assets that can be acquired. The reason for this is that eToro is not built to act like a typical cryptocurrency exchange, whereas CoinSpot is.

Low market capitalisation and/or exotic coins and tokens are likely to be found and supported by CoinSpot rather than eToro. With new digital currencies being added to the list regularly, CoinSpot continues to lead the Australian crypto market.

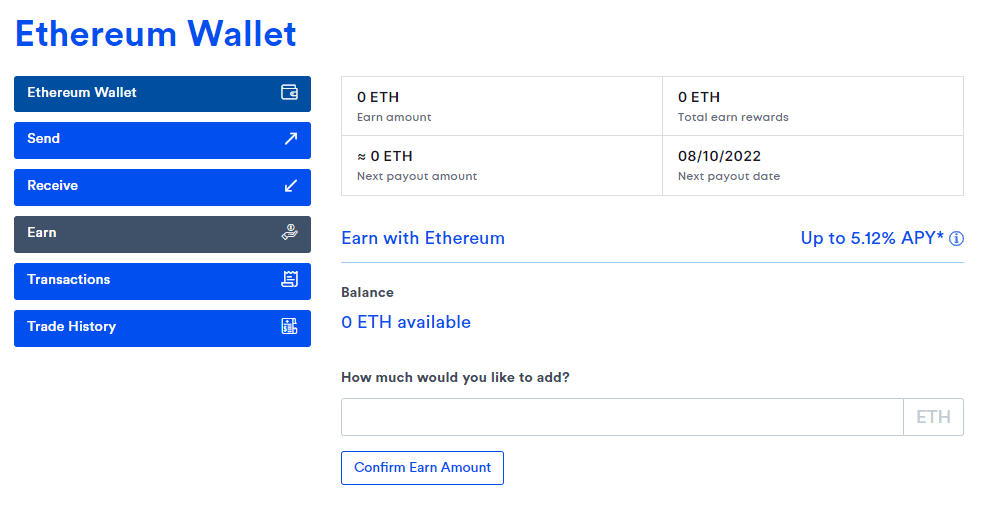

Features to earn crypto rewards

When it comes to financial management services that allow you to grow your crypto holdings, CoinSpot’s Earn feature is vastly superior to eToro’s crypto staking.

As part of your multi-token wallet, CoinSpot allows you to earn up to 78% Annual Percentage Yield (APY) on 21 popular digital currencies that most investors are likely to hold. These include Ethereum, Bitcoin, Cardano, Solana, Polygon, and Binance Coin. The wide variety of options at your disposal on CoinSpot makes it one of the best places to earn crypto interest in Australia. There are no fees associated with using the feature and you can withdraw your assets out of the Earn wallet and into your Trade wallet at any time.

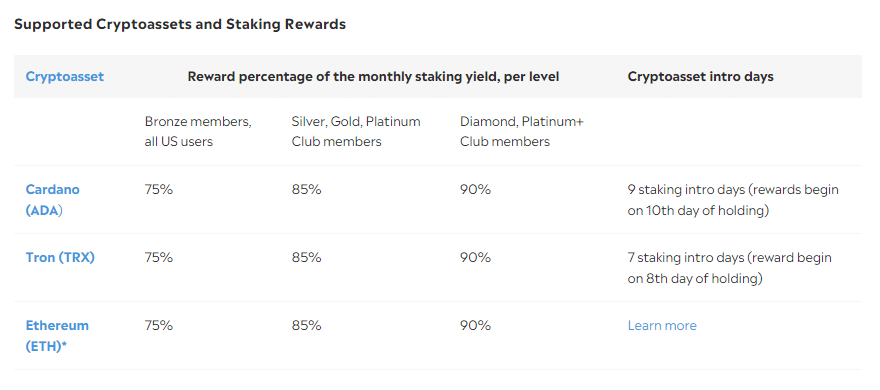

Although eToro supports the staking of crypto on the Proof-of-Stake (PoS) consensus protocol, its features could be considered as lacklustre. You can only stake Cardano (ADA), Tron (TRX), and Ethereum (ETH), and the yields are capped depending on what level of membership you hold. If these limitations weren’t enough, you have to stake Tron and Cardano for a period of no less than 7 and 9 days, respectively, before you started earning your capped rewards.

Overall, CoinSpot has an excellent crypto-earning program with a wider range of products than eToro offers. On top of that, it’s far easier to implement and the rewards are more lucrative. than eToro’s staking feature. There are plenty of alternatives to stake your cryptocurrencies. For more information on where to stake crypto in Australia, you can read our detailed guide.

SMSF support

Simply put, eToro does not allow Australians to allocate a portion of their Self-managed Super Fund (SMSF) to invest in digital currencies such as Bitcoin. CoinSpot does offer this service and its delivered through a partnership with New Brighton Capital, an Australian-based SMSF specialist.

The CoinSpot onboarding process for new SMSF accounts appears to be relatively streamlined. As regulatory requirements go, you will need to submit relevant information about the Trustees and members, the Trust Deed, and commercial details of the Trust.

CoinSpot is one of the best crypto platforms for SMSF accounts due to its outstanding security record, highly economical exchange fees, and regulatory compliance.

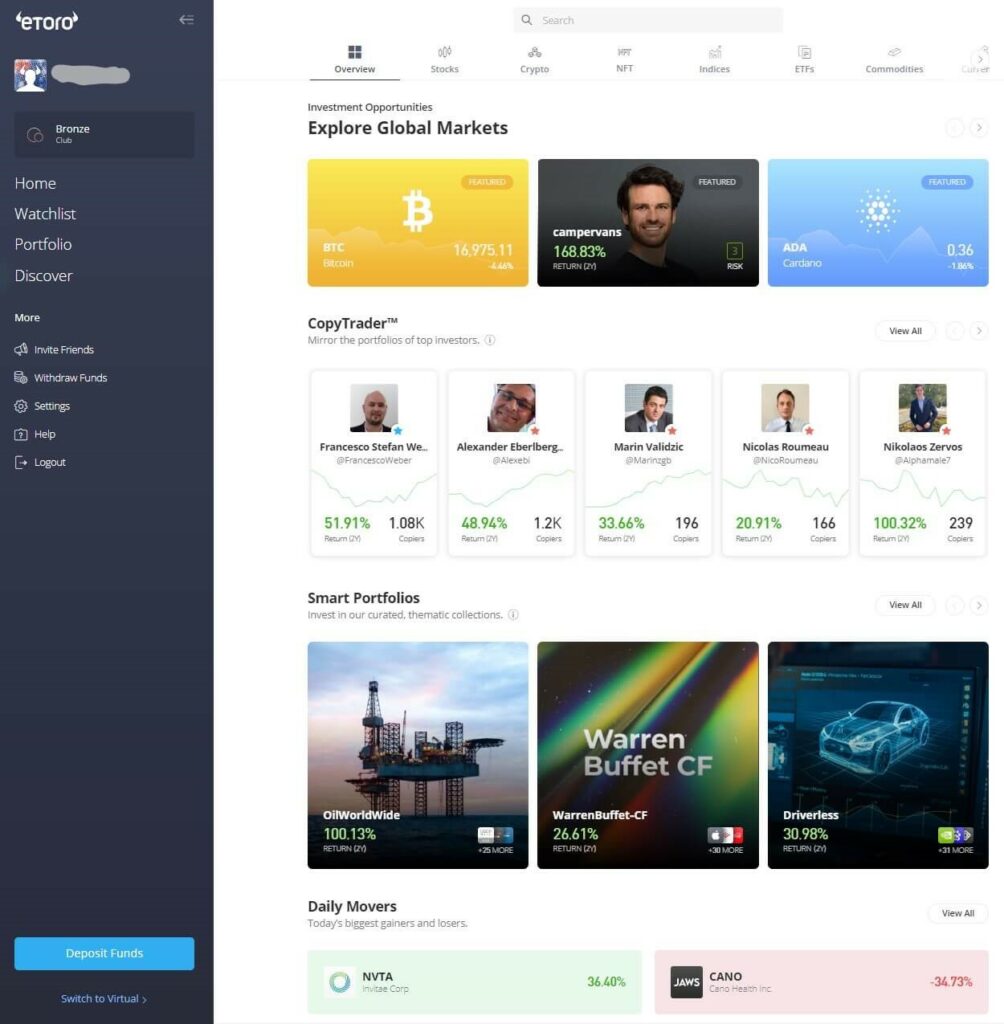

eToro is for social trading

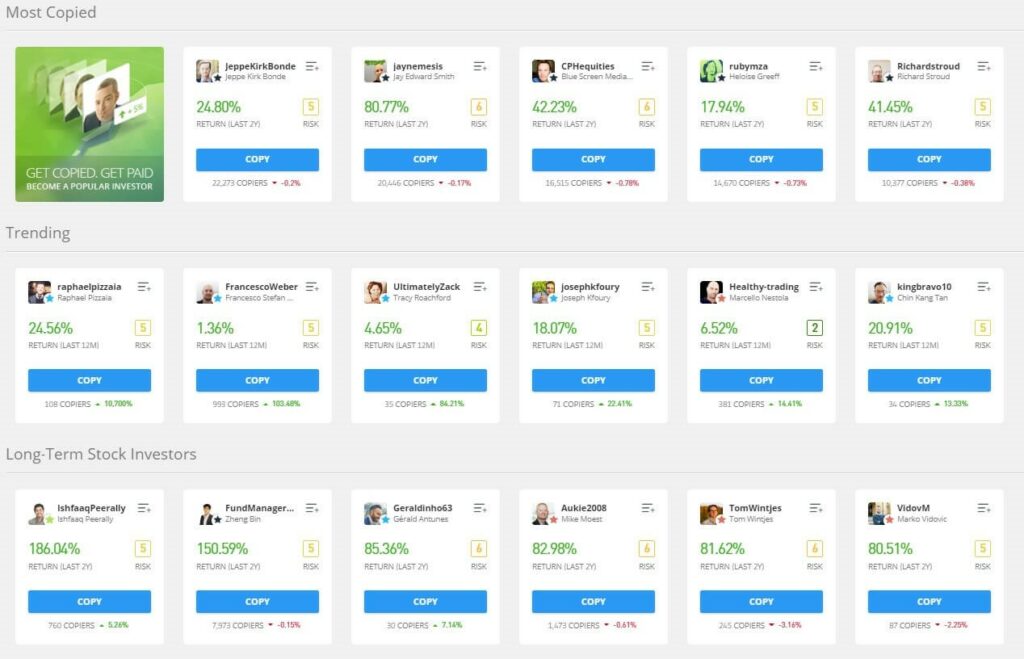

In our opinion, the sole reason for choosing eToro over CoinSpot is due to its world-class social trading features. Rather than purchase individual assets, eToro’s Australia’s CopyTrader and SmartPortfolio feature essentially let you browse, choose, and copy the investment portfolios that other eToro investors have taken. And since the entirety of the eToro platform has been designed with beginners in mind, its social trading features allow inexperienced investors to get a step ahead.

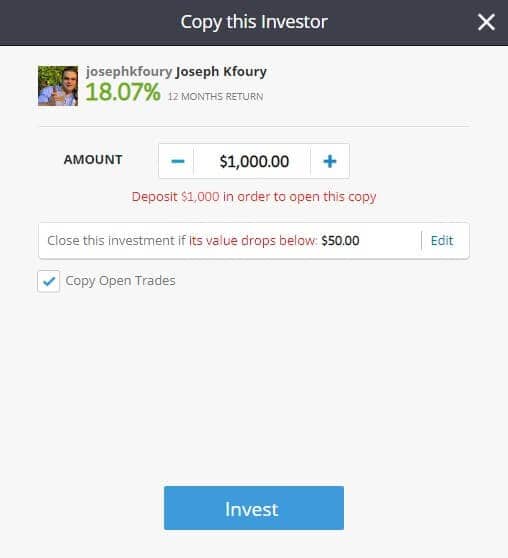

You might be more familiar with the CopyTrader feature (refer to the image below). eToro’s CopyTrader feature is more robust and easier to use than other social trading alternatives. There are various tools and filters that can be used to find an investor portfolio that best suits your strategy. In addition to the Return on Investment (ROI) that is presented, eToro also displays a risk ranking to help beginners get an understanding of their potential liabilities.

Once you find a portfolio to copy, simply click on it and enter the amount of USD (eToro automatically converts your AUD into USD when you deposit it) to spend. The portfolio and the individual assets it contains will be shown on your dashboard.

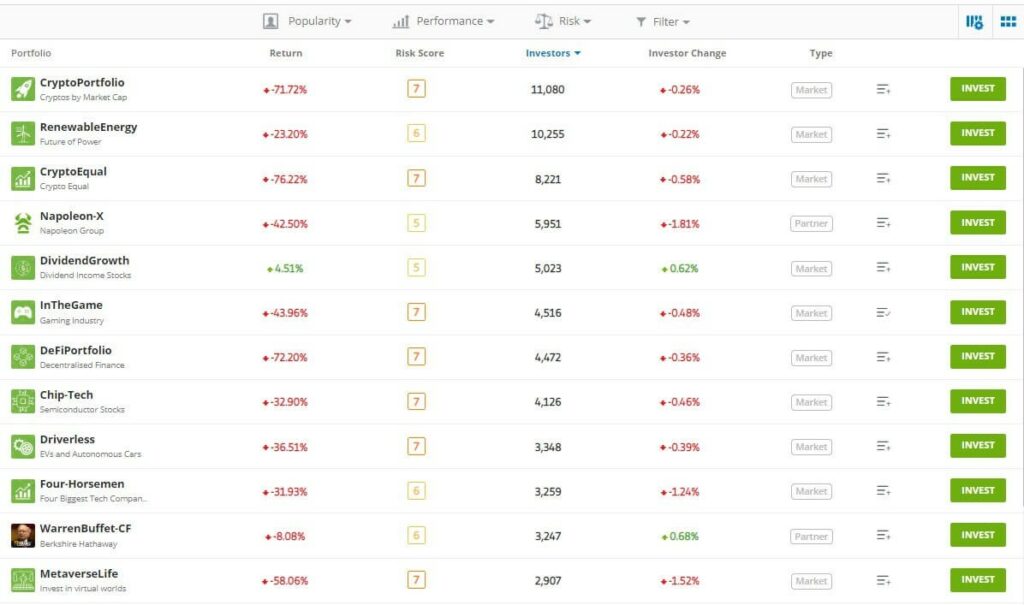

The SmartPortfolio feature follows a similar vein to CopyTrader, except you can browse and copy portfolios that contain cryptocurrencies, stocks, commodities, and CFDs. The same beginner-friendly nature and functionality are there but you have the added benefit of being exposed to a wider variety of investment markets. CoinSpot is limited to digital currencies. This will appeal to newcomers who want to minimise their long-term risks by investing in multiple assets rather than just one.

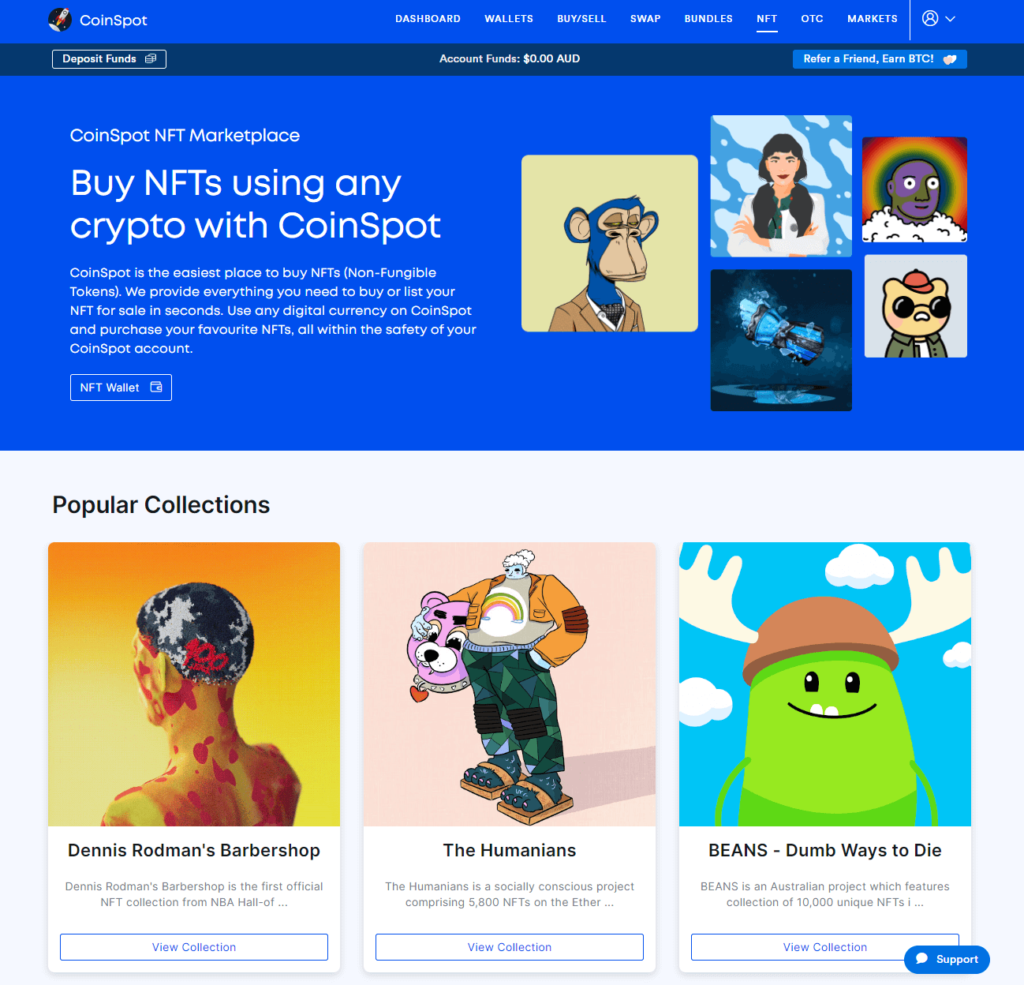

Buy NFTs on CoinSpot

Another feature that you can access on CoinSpot and not eToro is a marketplace to buy and trade Non-Fungible Tokens (NFTs). Although the CoinSpot NFT collection is not as diverse as some, it is still one of the better local marketplaces to trade NFTs.

Spend your crypto with CoinSpot

CoinSpot has recently entered the crypto debit card market with its new CoinSpot Mastercard. Although CoinSpot has not yet released a rewards or cashback program, the card is still one of the leading debit cards in Australia to spend crypto. This is due to a number of features:

- Spend any of CoinSpot’s supported cryptocurrencies (maximum of 5 at a time) at online or in-store retailers that accept Mastercard.

- Free to use and has no monthly or annual fees.

- Compatible with Apple Pay and Google Pay.

- Managed using the CoinSpot mobile app.

Winner: CoinSpot 🏆

CoinSpot is built for the exchanging of AUD for a massive range of cryptocurrencies. To do this, the platform has a suite of features that allow Australians to get started with crypto, suitably manage them, and grow their assets. Innovative features such as the CoinSpot Mastercard, NFT marketplace, Earn wallet, and SMSF support help to round out its services to allow you to get the most out of your cryptocurrencies.

However, eToro centres itself on the acquisition of entire portfolios or trading strategies as a whole. Although its social trading features are the best of the best (and should be used if that’s what you’re after), there is a lack of supporting features to entice new investors.

CoinSpot vs eToro Australia: Ease of Use

Although the user interfaces of CoinSpot and eToro differ, their ease of use are similar in that they are beginner-friendly. The differences in how their platforms are a result of their services.

Since CoinSpot is built for the trading of digital currencies, its user interface takes on a traditional design that most people would be familiar with. Although not as slick as Swyftx or outdated as Independent Reserve, CoinSpot has done a good job of maintaining a balance between functionality and ease of use.

On the other hand, the design of eToro’s interface may take some getting used to. eToro places a central focus on its social trading and promoting a community of like-minded individuals. Having said that, once you understand where to find the CopyTrader and SmartPortfolio features are located, then everything falls into place.

Winner: Tie

The user interfaces of CoinSpot and eToro are strikingly different, however, they are still very easy to use. This comes as no surprise since both trading platforms have the same target audience, that is, beginners and everyday investors. Whilst CoinSpot offers a lot of functionality, the eToro experience can be described as simplistic and enjoyable.

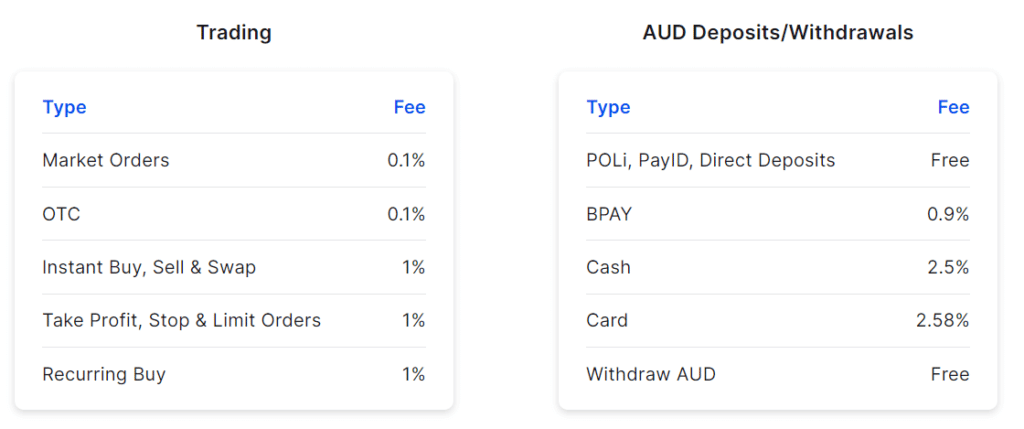

CoinSpot vs eToro Australia: Fees & Charges

Fee for deposits & withdrawals

Despite being a popular option, CoinSpot is not the cheapest cryptocurrency exchange in Australia to deposit AUD funds. Although there are no fees for POLi, PayID, and transfers of cash from a bank account, minor fees apply for BPAY (0.9%) and cash deposits via Blueshyft (2.5%). Its 2.58% fee for the use of credit or debit cards is quite reasonable in the Australian crypto market.

Whilst there are no fees when you withdraw fiat or digital currencies from your CoinSpot wallet, a minor network fee will apply. This fee will be paid out in the same crypto that you withdraw and is not paid to CoinSpot. The amount will depend on the asset being transferred out and the level of congestion on the blockchain network.

In comparison, eToro does not charge any fees for depositing AUD funds. However, a currency conversion fee will be every time AUD is deposited since eToro will automatically convert it to USD. This is likely to be a barrier to entry for new investors. With CoinSpot, currency conversion fees are not an issue. You just have to avoid BPAY and cash deposits to escape the fees.

eToro’s currency conversion fees also apply when you withdraw AUD from your account. Not only do you need to pay for this, but a $5 fee is also added on top for non-USD withdrawals including AUD. Overall, depositing and withdrawing AUD from your eToro account will be an expensive exercise over time and is something that CoinSpot users don’t need to worry about.

Trading fees

There are stark differences in the trading fees between CoinSpot and eToro. Beginners who might find the convenience of CoinSpot’s Instant Buy/Sell feature to be appealing will be paying an expensive fee of 1% for buy and sell orders. This is excessive in the Australian crypto market and should be avoided. At the same time, placing recurring orders (sometimes referred to as Dollar Cost Averaging) to regularly and automatically purchase crypto incurs a hefty 1% fee which is disappointing.

Better value for money on CoinSpot can be obtained from buying and selling digital assets using market orders on the exchange. Market orders placed on the CoinSpot exchange incur a very attractive fee of 0.1% which is great value for money. However, not all beginners would know how to use market orders.

Buying cryptocurrencies on eToro doesn’t incur any trading fees and instead, a spread applies. The spread is the difference between the buy and sell price of a digital asset and varies depending on the asset and its liquidity.

Winner: CoinSpot 🏆

With the exception of BPAY and cash deposits via Blueshyft, CoinSpot does not charge any fees to deposit or withdraw AUD or crypto. The currency conversion fees that eToro users will incur when depositing AUD into their accounts will be discouraging at best.

For trading, CoinSpot is a more economical option than eToro if you’re able to place market orders (0.1% fee). Although eToro only charges a spread, they aren’t overly transparent with what they are.

CoinSpot vs eToro Australia: Markets & Trading

The trading experience and the markets on offer are quite different between CoinSpot and eToro. CoinSpot only offers spot trading markets where you directly exchange AUD for crypto. Advanced trading markets such as margin and futures are not supported due to government regulations and you’ll need to seek alternatives to Coinspot such as OKX or Bybit. You can read our reviews of the best margin trading platforms for more information.

CoinSpot provides beginners with all the tools they need to start trading cryptocurrencies on the exchange. The trading interface comes equipped with TradingView charting and a series of advanced analytical tools and indicators. The downside for some might be the lack of order books in which to assess the trading volume and spread for a given digital currency. But their absence will suit new traders who don’t want to be overwhelmed with a cluttered interface.

eToro does not offer any real-time charting package as the platform is all about its CopyTrader and SmartPortfolio features. Rather than analysing the price action of a specific cryptocurrency, you can quickly browse the portfolios that other eToro investors are currently undertaking and purchase them for yourself. This makes the trading experience more akin to investing in index funds rather buying individual shares.

If you’re not sure or confident enough to use the features that eToro has to offer then you can use the free demo mode. The cryptocurrency demo account is one of the best versions available as the limitations on what you can do are minimal. This is one of the advantages that eToro has over CoinSpot.

The social trading experience on eToro is simply exquisite. Unlike other social trading features that are provided by global crypto exchanges such as KuCoin, eToro delivers a visually pleasing and simplistic interface that allows for an enjoyable experience. In our opinion, there is not much that could be considered as overwhelming.

Winner: CoinSpot 🏆

Choosing between CoinSpot and eToro depends on what your investment intentions and strategy are. CoinSpot has the tools and features for you to build and grow a cryptocurrency portfolio with ease. The design of the trading platform strikes a nice balance between simplicity and providing adequate features to support investors and traders who are more experienced. CoinSpot will suit more Australians than eToro.

However, if the social trading aspect of eToro appeals then this is a no-brainer. The ability to copy the investing moves of successful traders is a feature that is executed to perfection on eToro.

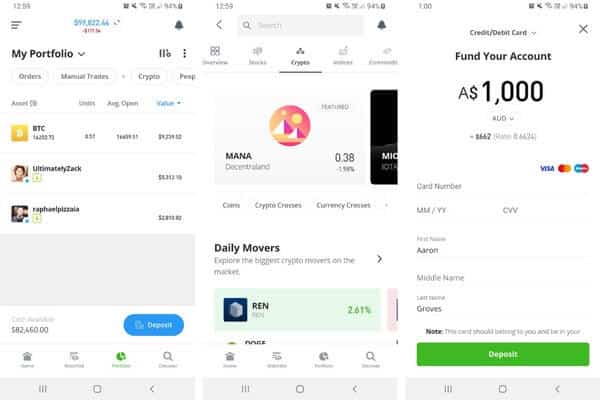

CoinSpot vs eToro Australia: Mobile Apps

Based on over 6,000 reviews from existing CoinSpot customers on Google Play, the CoinSpot mobile app has a very good rating of 4.7 out of 5.0. The app is regularly updated to fix bugs and add features such as the recently introduced CoinSpot Mastercard. From a review of the negative feedback, there appeared to be several posts about the news page freezing. Overall, the app is highly functional, clean, and relatively responsive.

In contrast, the eToro mobile app appears to suffer from more negative customer feedback reviews than CoinSpot. From 122,000 reviews, the eToro mobile app has a mediocre score of 3.8 out of 5.0 which is not a good reflection of its quality. A lot of negative comments related to technical issues surrounding the app’s inability to reach certain digital asset pages.

If it counts, the technical issues that others said to have occurred were not experienced during our testing. Nevertheless, the CoinSpot mobile app is a lot better than eToro’s version and is up there as one of the best crypto apps available to Australians.

Winner: CoinSpot 🏆

The CoinSpot mobile app is not the slickest app going around but it certainly does the job well. it is clean, simple, and fairly responsive which adds value to the user experience. All of the features that are available on the desktop can be accessed on the go. As a testament to its quality, CoinSpot’s app has received outstanding feedback from its users which should provide confidence to new customers.

On the other hand, the amount of poor reviews and mediocre ratings for eToro’s mobile app doesn’t instill a great deal of confidence. Although we found the app to be visually pleasing and functional, it is hard to ignore the wealth of negative feedback.

CoinSpot vs eToro Australia: Customer Service

The quality of CoinSpot’s customer service is superior to eToro by a long way. This is evident when we compare feedback and scores on popular review websites such as TrustPilot and Product Review. A staggering 82% of feedback from existing eToro customers was negative, with common issues revolving around the withdrawal process and a lack of attentiveness from its customer support team.

CoinSpot and eToro allow you to get in touch with their respective customer service teams in the same ways, that is, via an email ticket system and by the live chatbots. One of the advantages of eToro’s customer service team is that it supports a wide variety of languages.

Winner: CoinSpot 🏆

The CoinSpot and eToro customer service teams can be reached via an email ticket system and the live chatbot. Whilst the methods are the same, their reputations differ greatly.

CoinSpot’s local customer support team has a reputation for being accessible and providing good quality service. This is overwhelmingly positive feedback on popular review websites that point to a positive experience in finding solutions. However, the same can’t be said for eToro. The platform seems to suffer from a reputation for having poor customer service.

CoinSpot vs eToro Australia: Security

Based on our research, neither CoinSpot nor eToro Australia has been previously hacked and appears to have intact security track records. This is a welcome sight and should provide good consumer confidence. In addition, both trading platforms implement industry-standard security measures to safeguard the integrity of customer funds and digital assets. These include encryption techniques, third-party penetration testing, 2FA, and cold wallet storage.

Having said that, CoinSpot has the advantage over eToro due to its ISO 27001 accreditation. This means that CoinSpot adheres to a higher standard of security on its information systems and processes.

Winner: CoinSpot 🏆

Both CoinSpot and eToro implement similar security features such as SSL encryption techniques, 2FA, firewalls, and the storage of digital assets in hot and cold wallets. But CoinSpot needs to adhere to strict regulations in order to maintain its ISO 27001 accreditation and this should provide consumers with greater confidence.

CoinSpot vs eToro Australia: Comparison Outcome

Simply put, more Australian investors and traders will benefit from CoinSpot than eToro. The features that CoinSpot provides are tailored to the Australian crypto market and particularly to beginners who are starting with their portfolios. These include one of the widest selections of crypto in Australia (370+), wallets to earn crypto rewards, SMSF support, crypto bundles, NFTs, a feature-rich charting package, and tax reporting tools.

This is not to say that the suite of features offered by eToro is inferior – it’s just that there is a lack of them. The CopyTrader and SmartPortfolio features are simply world-class in their ability to allow beginners to easily start and manage portfolios, but also to connect with other investors in a community setting. Beyond its social trading features, there is not much else to entice the everyday investor.

The other key difference between CoinSpot and eToro is their reputations. Being an Australian-owned and operated company, CoinSpot has forged a solid reputation as a reliable and trustworthy place to trade digital currencies for over a decade. It hasn’t been hacked and it still endeavours to provide high-quality customer service to its user base. On the other hand, eToro is plagued with negative feedback and reviews from existing customers which paints a poor image of the platform.

| Comparison Criteria | Winner | Reason |

|---|---|---|

| Deposit Methods | CoinSpot | CoinSpot offers more methods to deposit AUD then eToro. |

| Products & Services | CoinSpot | CoinSpot offers features that will suit more Australians then eToro. |

| Ease of Use | Tie | Although different in design, CoinSpot and eToro are easy to use and suitable for beginners. |

| Fees | CoinSpot | CoinSpot has competitive fees and free deposits/withdrawals for most methods. eToro is too expensive to deposit and withdraw funds. |

| Markets & Trading | Tie | The more traditional trading features of CoinSpot will cater to more Australians than eToro’s social trading features. |

| Mobile Apps | CoinSpot | The CoinSpot app is satisfactory but the eToro app has a lot of poor reviews and feedback. |

| Customer Service | CoinSpot | eToro’s customer service has overwhelming negative feedback. |

| Security | CoinSpot | CoinSpot has ISO 27001 accreditation. |

If you found this comparison between CoinSpot and eToro to be useful, here are other Australian crypto exchange comparisons to read next:

- Swyftx vs CoinSpot

- Coinspot vs Binance

- Coinbase vs CoinSpot

- CoinSpot vs Digital Surge

- CoinSpot vs Coinjar

- Swyftx vs eToro

- eToro vs Stake

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.