Best Decentralised Crypto Exchanges (DEX) In Australia

Last Updated on January 31, 2024 by Kevin GrovesIf you’re looking for a way to purchase crypto, Decentralized Exchanges (DEXs) provide a lot of help and have many incentives such as yield farming and access to decentralized apps (dApps). They are essentially an online community platform where traders can facilitate trades, provide liquidity to earn interest, and swap their cryptocurrencies. While they are a great way to trade crypto, not all crypto DEXs are safe and easy to use.

This article covers some of the best crypto DEX in Australia in 2024 as an alternative to crypto exchanges. The DEXs we list and compare is packed with features, have community-driven approaches to solving issues, and make investing more streamlined.

Top 7 Crypto DEX In Australia

You should consider multiple factors before choosing a crypto DEX in Australia. The user experience, historical security breaches or hacks, and slippage rates are examples. We have taken those points into consideration and came out with the best DEX for Australian traders:

- UniSwap – Overall best DEX for Australians

- PancakeSwap – Best DEX for security-conscious Australians

- dYdX – DEX with no gas fees on certain assets

- Serum – Best DEX for cross-chain trading

- Curve – A DEX that doubles as a series of asset pools

- 1inch – Best for trading across multiple markets

- Dodo – A DEX powered by a proactive market maker

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Best Crypto Decentralized Exchanges in Australia: Our Reviews

1. Uniswap – Overall best DEX for Australians

UniSwap is the largest DEX in the world, being the first DEX to get the most traction in the market. UniSwap is an automated market maker that provides a crypto trading pool using liquidity pools. A liquidity pool is referred to as a community-powered pool where you can lock your tokens to contribute to UniSwap’s liquidity. Because of this feature, UniSwap also provides a crypto staking platform to earn rewards on PoS tokens.

UniSwap is a robust decentralized exchange, with a trading volume of upwards of $1.1 trillion. More than 108 million trades have been performed on this platform, powered by more than 4,400 community delegates.

Since it is one of the earliest decentralized exchanges in the crypto market, UniSwap allows you to swap ERC-20 (Ethereum-based) tokens. Therefore, it has become one of the favoured DEXs by many upcoming ETH-based cryptocurrencies.

When it comes to the user experience, UniSwap is surprisingly user-friendly. It is not necessarily minimalistic, but all the options are available to you right from the get-go. All you need to do is to go to the official website, click on the launch app and start swapping your crypto.

With liquidity mining, you can earn a passive income from this platform. And since UniSwap is one of the most liquid decentralized exchanges in the world, having Total Value Locked (TVL) of $5.64 billion, according to DeFiLlama, you won’t face difficulty earning crypto through mining.

UniSwap is also a great development platform for decentralized applications (dapps). UniSwap has integrated more than 300 dapps including TrustWallet, Rotki, Universal Finance, Flipside Crypto, Burner Wallet, Argent, Felato, Furucombo, and Sorbet, to name a few. UniSwap provides all the tools you need to build their own dapps.

Some of the cons of UniSwap include the gas fees since it mostly supports ETH-based tokens. So until the merge upgrade is complete, you can expect gas fees to remain high. Secondly, since it is a decentralized exchange, it doesn’t accept fiat payments. The impermanent loss – losing the value of the crypto when withdrawing from UniSwap is also a major issue. Finally, lacking Know-Your-Customer (KYC) processes can potentially invite malicious elements to use the platform.

Overall, UniSwap is a great DEX cryptocurrency exchange given its robust nature and minimalist interface that results in a superb user experience. The wide range of cryptocurrencies that can be swapped is a plus. However, the high gas fees and impermanent loss don’t make this P2P exchange palatable for novice investors.

Pros:

Cons:

2. PancakeSwap – Best DEX for security-conscious Australians

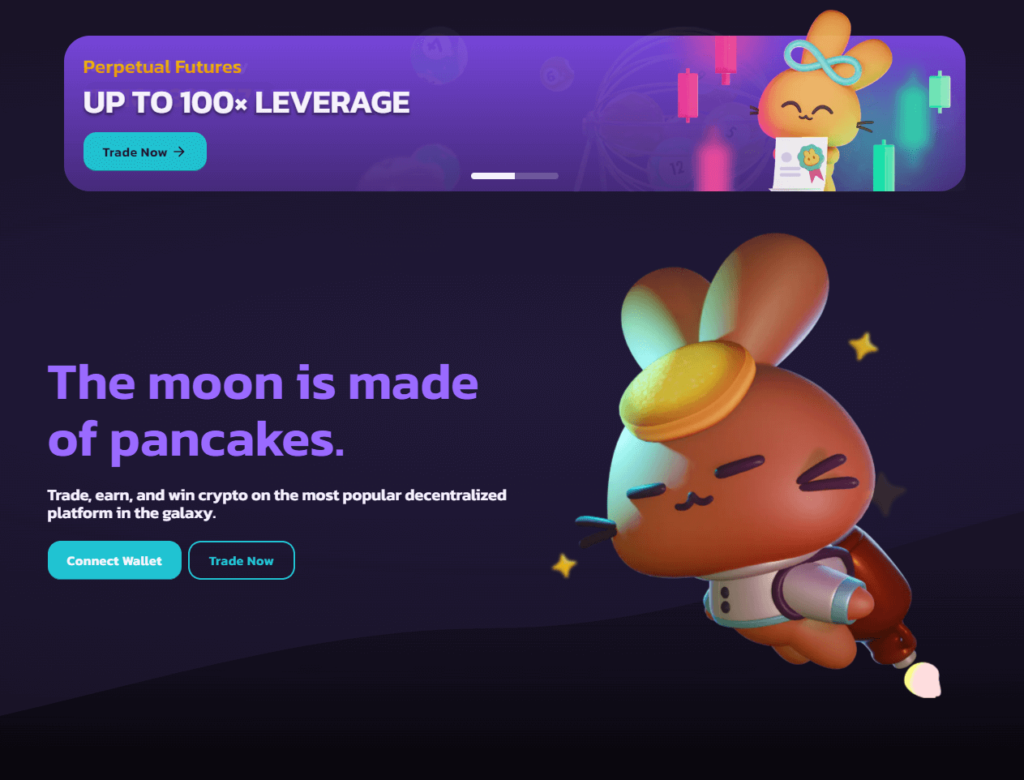

The second DEX on the list is the PancakeSwap. Launched in 2020, this cryptocurrency exchange was built on the Binance Smart Chain. PancakeSwap is similar to UniSwap in many instances, however, there are some unique features on PancakeSwap that will appeal to investors.

In August 2022 alone, PancakeSwap acquired 1.9 million new users and has completed over 23 million trades in the last 30 days. It is also used for staking with over $4 billion in TVL.

Built on the Binance Smart Chain, PancakeSwap is extremely fast. Much like UniSwap, PancakeSwap also takes a simpler approach to trade, with no registration or KYC requirement. However, the user interface of this platform is a bit more nuanced.

In addition to presenting a simple swapping tool to users, PancakeSwap also offers a basic price chart. You can use this chart to take a peek at the trends and decide on your crypto investments. The exchange also has a liquidity option that allows you to add liquidity to the platform. Recently, PancakeSwap also launched trading for perpetual futures for up to 100x leverage. PancakeSwap also supports a bridge to perform cross-chain swaps, like Serum, another DEX on this list.

Perpetual futures shows complete trading charts of the listed perpetual futures and contracts that look similar to centralized exchanges. Examples of trading pairs that can be traded in the perpetual futures markets include:

- BTC/USDT

- ETH/USDT

- ADA/USDT

- DOGE/USDT

- SOL/USDT

- XRP/USDT

- DOT/USDT

- SAND/USDT

- NEAR/USDT, and many more.

But that’s not all, as this utility also offers daily rewards, 20 APX tokens per day. To earn it, you need to have completed a trading task the previous day.

The PancakeSwap Earn program allows you to stake liquidity pool tokens to earn Annual Percentage Returns up to as 99.06% APR. The staking rewards are given for BUSD, USDT, BNB, and ETH trading pairs. Staking the CAKE/BUSD pairs (CAKE is the native crypto of the PancakeSwap ecosystem) will reward 42.22% APR. The interest rates are subject to how many tokens are there in the liquidity pool of this platform. The earn program also has Syrup pools that offer Annual Percentage Yield (APY) rewards of up to 33.50%.

In addition to staking pools and DEX features, PancakeSwap also organizes trading competitions ranging from prediction to Pottery. It also organizes a PancakeSwap lottery for which you must buy tickets using CAKE to enter. PancakeSwap also has an NFT marketplace which is built on the Binance Smart Chain.

When it comes to security, PancakeSwap is one of the most secure decentralized exchanges on the list, with no reports of hacks since its inception.

On the negative side, an impermanent loss is possible on PancakeSwap. Furthermore, prediction and lottery features have come under fire because they can cause loss of funds rather quickly. And since the platform’s rise in popularity, network congestion has increased.

Overall, PancakeSwap is a good fit for security-conscious Australian traders. The PancakeSwap user interface is robust, and the earning options are great. It is also a great place to find good NFTs. That said, the impermanent loss of funds is still a major issue.

Pros:

Cons:

3. dYdX – DEX with no gas fees on certain assets

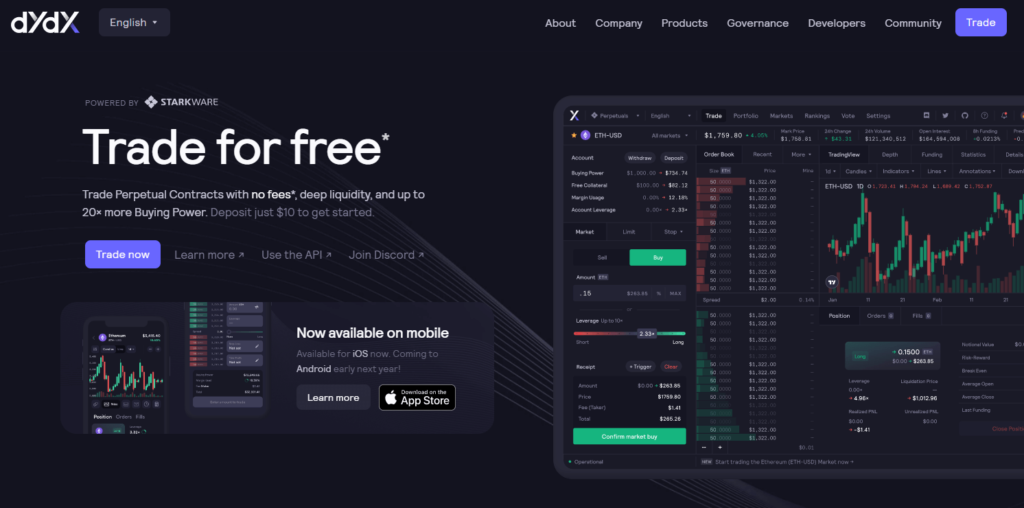

dYdX is a decentralized exchange that has exploded in popularity since it entered the market in 2019. dYdX does accept fiat payments on the platform and its trading interface for trading perpetual pairs is similar to most DEXs. The platform also provides a robust TradingView charting package to enable you to analyse the price action of digital assets.

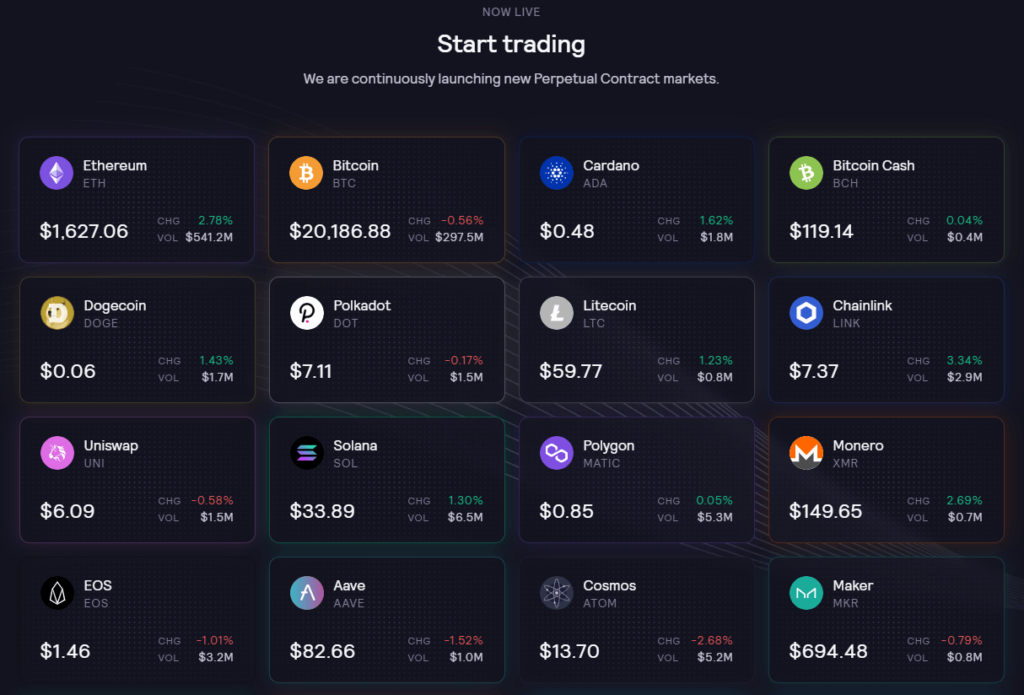

So far, DYDX supports 36 cryptocurrencies, which is far less than PancakeSwap and UniSwap. These include Maker, Compound, Ethereum, Avalanche, 1inch, Ox, Algorand, Bitcoin, Cardano, Polkadot, and even meme coins like Dogecoin.

Like PancakeSwap, you can margin trade on dYdX with up to 20x leverage. The user-friendly nature of dYdX makes the platform an ideal choice for traders seeking a suitable margin and perpetual trading DEX. Many users have called the perpetual trading feature the best attribute of dYdX, and rightly so. It provides all the perks of a centralized exchange without asking for identification details.

For other margin trading platforms to consider, we have reviewed Australia’s best margin exchanges for leverage trading in this article.

However, the most noteworthy feature of this platform is the removal of gas fees for most transactions. As a layer 2 solutions provider, dYdX doesn’t charge gas fees for most transactions. Other notable benefits of this platform include:

- Fast transactions: Most trades are executed and confirmed instantly.

- Fast withdrawals: You won’t need to wait for fund withdrawals to be processed.

- High security: dYdX is powered by StarkWare’s Layer 2 solutions that use zero-knowledge rollups to increase the security of the platform.

Whilst there is no mobile app, dYdX has a robust and mobile-friendly interface. In addition, dYdX has its very own NFT collection known as the Hedgies. It is a collection of 4,200 3D hedgehogs with various trades. The mint date of these NFTs has ended, but you’re likely to find them on OpenSea.

dYdX also offers staking and governance opportunities where you can put their dYdX tokens into the liquidity pool and earn 0.18 DYDX per $1k daily. There is also a safety pool that awards up to 14.63% APR.

In summary, dYdX is a good DEX option for crypto traders in Australia. The biggest pro is the absence of gas fees for most cryptos, and the trading opportunities are many. On the flip side, the number of cryptos available on this platform is limited compared to other popular DEXs.

Pros:

Cons:

4. Serum – Best DEX for cross-chain trading

Serum is a DEX developed by the team that built the centralised exchange FTX. It is one of the few DEXs that support multiple chains, wrapped coins, stablecoins, and order books.

While other decentralized exchanges have some centralized features, Serum truly is decentralized. For instance, while UniSwap is decentralized, Uniswap Labs, the foundation behind the DEX, uses a centralized user interface and do an almost one-sided promotion of the platform and its interface.

The transactions on Serum are cheap, fast, and secure. Here are some of the notable features of Serum.

- Cross-chain swaps are possible: While DeFi relies heavily on trust, Serum’s implementation of cross-chain swaps is completely trustless.

- SRM token: SRM token is the native token of the Serum ecosystem that allows you to earn discounts when trading. It also doubles as a governance token – letting you have a say about the future of this ecosystem.

- SerumBTC: SerumBTC is a model that Serum uses to create tokens using ERC-20standard. It helps it tokenize Bitcoin on Serum’s parent blockchain, Solana. SerumUSD is another feature that allows the platform to develop crypto stablecoins.

- Cross-chain contract is physically settled: Contracts power the margin position of those who regularly invest in DeFi. Since Serum has the support of FTX, a leading derivatives exchange, it has both advanced and simple margin trading features, which makes it suitable for both new and old traders.

- Decentralized order book: Serum is not an automated market maker. Instead, it implements a decentralized order book, which matches the traders on-chain, and traders have full control. And since Serum is built on the Solana blockchain, decentralized order-book implementation here is much faster.

When it comes to fees, you can reduce them by up to 60% by holding Serum tokens. To trade on Serum, you must first create a Solana (SOL) wallet and fill it with SOL that can be bought from any other DEX or CEX. SOL can then be swapped for other cryptos. To date, Serum hasn’t been hacked.

One of the limitations of Serum is its limited list of supported digital currencies where only 15 are available across 30 trading pairs. These include Solana, Bitcoin, Ethereum, Chainlink, and Yearn.Finance.

Serum is a viable platform with its cross-chain functionality as one of the major pros. It is one of the latest DEX with a lot to prove. The lack of supported cryptocurrencies is something you should factor in.

Pros:

Cons:

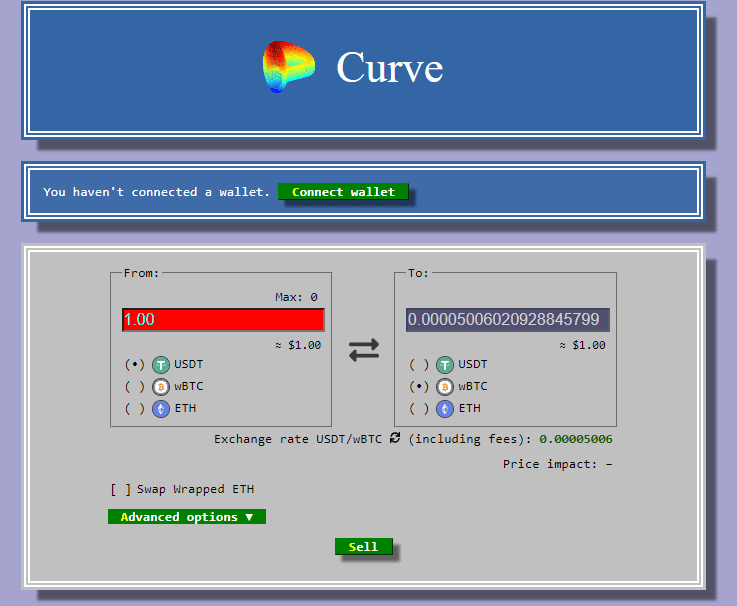

5. Curve – A DEX that doubles as a series of asset pools

Curve Finance is one of the latest crypto decentralized exchanges that climbed up the crypto charts quickly after entering the scene. Created by Russian Physicist Micheal Egorov, Curve Finance powers the DeFi aggregator, Yearn.Finance.

Curve Finance is a DEX built on the Ethereum blockchain. Specifically designed to offer an efficient trading experience for trading crypto of the same value, Curve provides high interest returns on crypto. Furthermore, after the release of its native token, Curve has evolved into more than a simple DEX – it is not a Decentralized Autonomous Organization (DAO).

Curve Finance can be thought of as a series of digital asset pools, each containing crypto assets of the same value. These pools offer extremely high-interest rates on deposited funds, going as high as 300%.

One of the different features of this platform is its retro look. There is a level of simplicity, however, some of it might be too complex for some investors.

Curve Finance is upfront about the potential risks of using its platform because even after three years of development, many factors of this platform are still new. That is why bug bounties are offered to those who find issues with the platform.

When it comes to the fees of this platform, swapping stablecoins is very cheap. You only need to pay a small transaction fee and rebalancing fee, around 0.04%, and the exchange rates are also reasonable. The platform charges no deposit fee. However, you must pay 50% of their trading fee to withdraw crypto.

To earn passive income, you can choose from 30 different pools presented on the platform. You can select among the StableSwap Pools or the Yearn Algorithm and yPools.

For the security-conscious, the smart contracts of Curve Finance are regularly audited by Trail of Bits and Quantstamp to ensure the integrity of its framework.

Overall, Curve is a unique DEX choice for experienced traders in Australia. Much of the UI may come across as a little complicated, so it is not suited for novices.

Pros:

Cons:

6. 1inch – Best for trading across multiple markets

1inch is a DEX suitable for Australian investors who want to trade cryptocurrencies across multiple markets. You can use the simple mode for traders or a limit order to schedule a swap at the best prices. And there is also an option that allows you to conduct a Peer-to-Peer (P2P) exchange for certain cryptocurrencies.

One of the best features of 1inch is the Pathfinder which allows you to trade your cryptos across multiple markets. Pathfinder is an aggregation information service that acts as a discovery and routing algorithm. It doesn’t cost you any extra fees to use. Examples of the markets that can be accessed include Ethereum, BNB chain, Polygon, Optimism, Gnosis, Arbitrum, Avalanche, and Fantom, to name a few.

1inche’s UI is highly versatile. You are free to choose between the simple mode or the classic mode. The simple mode will give you a standard swapping interface but the classic mode has TradingView charting and other features.

The 1inch Earn Program offers good APYs for providing liquidity. 1inch has a total of 279 liquidity sources, has a trading volume of more than $236 billion, has connected to over 3.3 million wallets, and has conducted more than 21.5 million trades.

To pay transaction costs, you need to use Chi Gastoken. It is similar to the GasToken token prevalent on the Ethereum blockchain, but it is an improved version of it. Pegged to Ethereum’s Gas price, Chi experiences low prices when the gas prices are low.

To pay these fees, you can use the 1inch DeFi wallet to top up with crypto using their bank cards via 1inch’s gateway provider.

The entire DEX is governed by the Dao, which in turn, is powered by the 1inch token. And when it comes to safety, the smart contracts of 1inch are audited by multiple bodies, including Scott Bigelow, OpenZeppelin, Chainsulting, SlowMist, Haechi Labs, Consensys diligence, Certrik, Coinfabrik, Hacken, and Mix Bytes.

1inch is one of the most versatile DEX on this list and is suitable for both veteran and novice traders. With P2P trading, you can try to beat the market’s volatility to trade crypto. And since it is a DeFi aggregator platform, you can trade across multiple markets. That said, you can only fund the DeFi wallet with cryptocurrency.

Pros:

Cons:

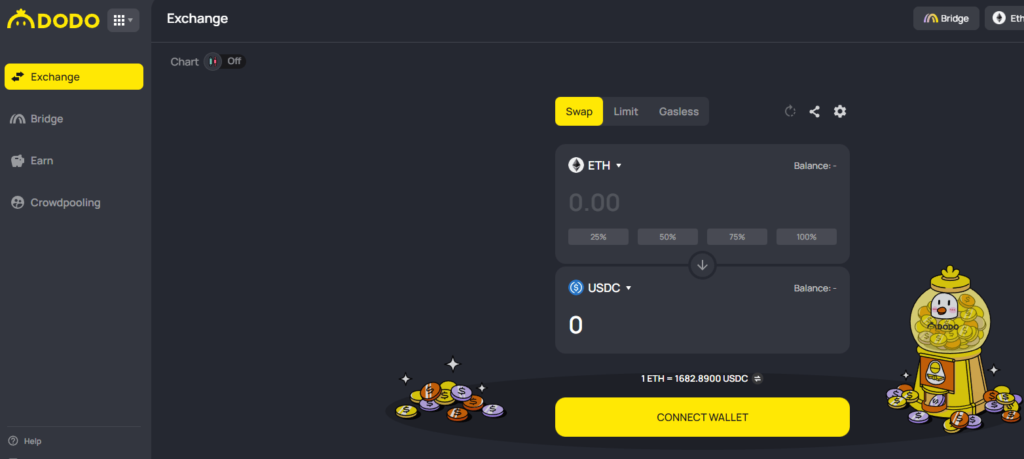

7. Dodo – A DEX powered by a pro-active market maker

Dodo is the decentralized trading protocol for web3 with an all-time trading volume of $83.62 billion, over 15.31 million transactions, and currently supports upwards of 1.7 million users.

Dodo fashions itself as one of the best DEXs in the market, even going as far as comparing itself to UniSwap, saying it provides more returns to those supporting the liquidity pools of the platform.

One of the unique features of Dodo is that it is a proactive market maker or PMM. This algorithm helps liquidity providers and market makers to focus their assets to provide strong liquidity without high capital requirements.

The Proactive Market Maker also factors in slippage issues that are common on most DEXs. High slippage and impermanent loss can deter small investors. Through the Proactive Market Maker, Dodo provides you with real-time and automatic pricing information. After determining the ideal market, Dodo quickly removes the liquidity from the market price – reducing the arbitrage abilities and impermanent loss and slippage.

Dodo is known for its high capital efficiency, lying at 63.27% at the time of writing. The trading volume of the past seven days has been $16.2 million, and the capital locked over the past week has been $74.3 million.

In addition to offering standard DEX features, Dodo also allows you to create your custom tokens without needing any code. Your can also generate liquidity markets (Dodo Vending Machine) free of charge and boost their earnings by fractionalizing their NFTs via the Dodo NFT vault.

Overall, Dodo is a multifaceted cryptocurrency exchange with many advantages. Implementing a unique Proactive Market Maker ensures that the slippage and impermanent loss are reduced. However, it also removes arbitrage opportunities. So, it would be a bit difficult if you want to buy crypto quickly from Dodo and sell it on another for major gains. That said, Dodo has implemented many bridges to let you trade crypto of different chains.

Pros:

Cons:

What Are The Benefits Of Trading On A DEX In Australia?

- No need to provide KYC details. Decentralized exchanges are completely trustless, meaning that all the security features depend on the underlying code, making it more secure than most CEX. So, you don’t need to provide their personal details to access trading utilities on DEXs.

- There is no risk of counterparty. The absence of any centralized body makes it possible for you to trade the tokens directly. DEXs are also difficult to hack and make it harder for scammers to manipulate the price.

- Most DEXs support a lot of digital assets. You can trade almost all types of cryptos on DEXs, not just those making positive rounds in the market. If a new cryptocurrency has arrived, chances are high that you will see it on a DEX.

What Are The Risks Of Trading On DEXs?

- Lost tokens cannot be recovered. Centralized exchanges are private companies with employees you can hold accountable if you lose your tokens. You can’t do the same with a Decentralized Exchange. And because there is no KYC done, there is no way to salvage compromised user details or a private key, which makes token recovery nearly impossible.

- Most DEX has low liquidity. DEXs are powered by their users as they contribute to the liquidity pool. On the other hand, centralized exchanges have the financial backing of major venture capitalists and, therefore, have deeper liquidity.

Conclusion

Decentralized Exchanges provide freedom to trade crypto since there are no KYC requirements. And their typically simple interfaces let you swap crypto on the fly. However, the low liquidity and the lack of ability to recover lost tokens is something traders need to be mindful of.

Frequently Asked Questions

Which DEX platform is the best for crypto in Australia?

Australian traders have many options for cryptocurrency exchanges. If you want to choose a decentralized exchange, Uniswap is still the best due to its high liquidity and attractive features.

Can you buy crypto on DEX?

Yes, you can buy crypto on DEX, but it would require swapping one crypto for another. Other reliable platforms where you can buy crypto in Australia include Swyftx, Binance Australia, and Digital Surge.

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.