eToro Review For Australians: What We Didn’t Like

Last Updated on December 24, 2023 by Kevin GrovesYou might know eToro Australia for being a popular social trading platform but other features might interest you. As always, there are some pretty big limitations that you should be aware of. In this detailed review, we dissect eToro Australia as a crypto trading platform and break down what products and services are available to Australians, if the fees are cost-effective, and how secure the platform is.

eToro Australia

Trading fees:

Spread only (variable)

Number of cryptos:

90+

Deposit methods:

Credit/debit card, POLi, bank transfer

Supported countries:

Global (including Australia)

Promotion:

None available at this time.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick Overview

A quick summary of eToro Australia is provided in the table below.

| Exchange Name | eToro Australia |

| Supported Countries | Australia (and internationally) |

| Fiat Currencies Supported | 14 including AUD, USD, EUR and GBP |

| Deposit Methods | Credit/debit card, POLi, bank transfer |

| Supported Cryptocurrencies | 90+ |

| Deposit Fees | None for USD. Currency conversion applies for non-USD currencies including AUD. |

| Trading Fees | None, spread only. |

| Withdrawal Fees | None for USD. $5 and currency conversion fee for non-USD withdrawals. |

| Mobile App | Yes (iOS and Android) |

The Bottom Line

After exploring the eToro platform, we were impressed by its CopyTrader and SmartPortfolio features, not only for their quality but for also how easy they were to use. These world-class features are built upon a unique interface that promotes an investor’s way of thinking where you can connect with like-minded individuals to learn and grow.

The strength of eToro is without a doubt its social trading features but it does fall over in other aspects. Products and services that are typically offered by other cryptocurrency platforms are either absent or inferior in quality. A recurring theme was the lack of high-quality customer support and popular review websites were plagued with negative feedback from existing customers.

What we liked:

- Outstanding social trading features that are beginner-friendly.

- The community feel and social aspect.

- Unique but simple to use interface.

What we didn’t like:

- A currency conversion fee will apply for AUD deposits and withdrawals.

- A poor reputation for inferior customer service.

- A lack of crypto features apart from social trading.

What Is eToro Australia?

eToro is the world’s leading social trading platform that lets investors trade in multiple assets such as Forex, cryptocurrencies, commodities, stocks, and Contract for Differences (CFDs). Originally founded in 2007, eToro has continually added new features and markets to its service offerings, gradually transforming it into a world-class multi-asset platform. eToro now sports a customer base of over 20 million people around the world and is regarded as one of the best Australian crypto exchanges for social trading.

eToro Australia is the Australian company of the global eToro brand and is headquartered in Sydney. Trading under eToro AUS Capital Limited (ACN 612 791 803), eToro Australia is licenced by the Australian Securities and Investments Commission (ASIC) as a Digital Services Provider under Australian Financial Services License 491139.

Pros & Cons

Pros:

Cons:

Here’s What We Think of Etoro’s Features

Supported cryptocurrencies are a bit lacking

At the time of writing, eToro Australia supports over 90 popular coins and tokens such as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). All of its supported assets can be bought using any of eToro’s fiat currencies including AUD. However, it should be noted that any other traditional currency besides USD will be automatically converted by eToro into USD and you will be charged a currency conversion fee.

Whilst eToro Australia provides you with access to the major digital currencies, it isn’t a viable platform to invest in altcoins since its primary focus is social trading. If altcoins are of interest to you then you should seek a local crypto exchange that supports at least 300+ digital assets like Swyftx (320+) or CoinSpot (370+).

Related: eToro vs CoinSpot: Which is better in Australia?

Social trading at its finest

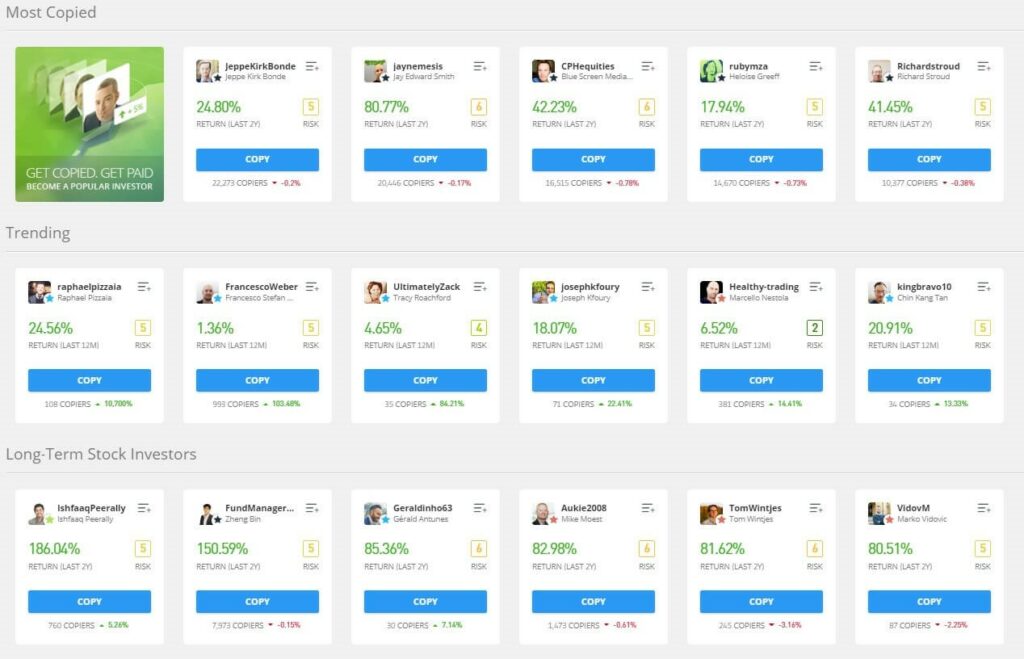

eToro’s CopyTrader feature is renowned across the world for its ability to let beginners copy the exact trades of experienced and successful traders. Sometimes referred to as social trading, you can browse the portfolios of other traders using a variety of categories and filters, as well as sort by eToro’s risk scores that are designated to each strategy.

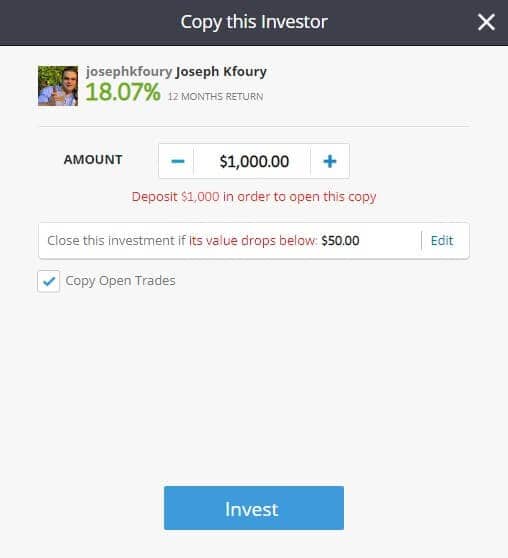

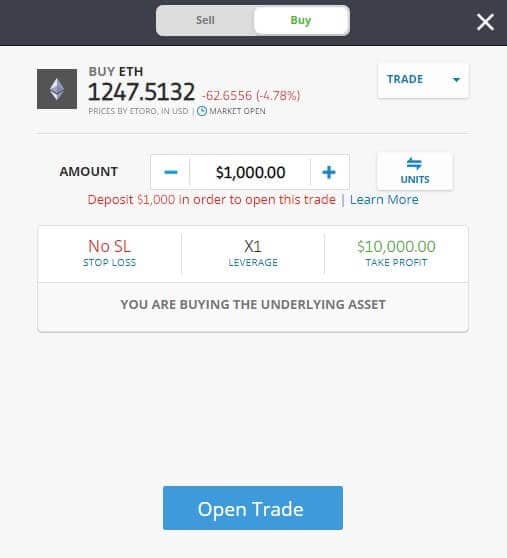

There are several cryptocurrency trading platforms such as KuCoin and Bybit that offer a social trading marketplace, however, the point of difference with eToro is that it’s really easy to use. This is no surprise as eToro Australia targets beginners and novices. Once you find a trader’s strategy that fits yours, you can quickly purchase the same in a matter of clicks. As shown in the image below, all you need to do is enter the amount of funds to spend and confirm the order.

Investment portfolios for beginners

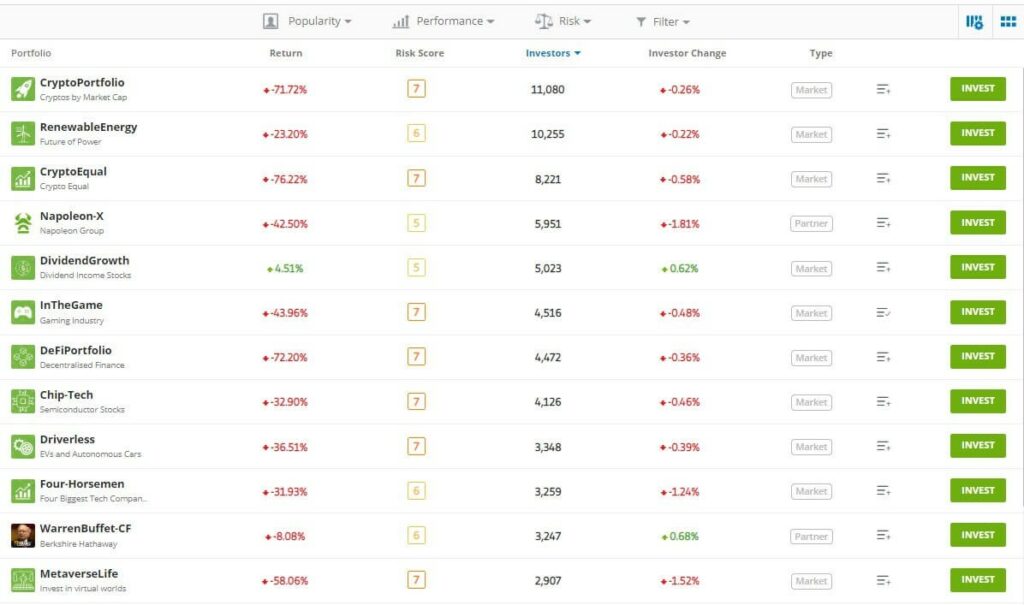

Due to being a multi-asset trading platform, you have exposure to stocks, CFDs, and cryptocurrencies. The SmartPortfolio feature works in the same way as CopyTrader and it is as easy to use.

By choosing a suggested portfolio, you will automatically obtain a copy of multiple markets or traders based on a predetermined investment strategy of their choosing. This is an incredibly easy way to build a diverse portfolio without knowing much about the specific investments, helping beginner investors to minimize their risk and obtain a top-performing portfolio.

You can trade risk-free with the demo account

eToro Australia provides an easy-to-use and free demo account for crypto trading that can be toggled on or off with the click of a button. The demo mode comes well-equipped with $100,000 USD to explore the platform and practice trading.

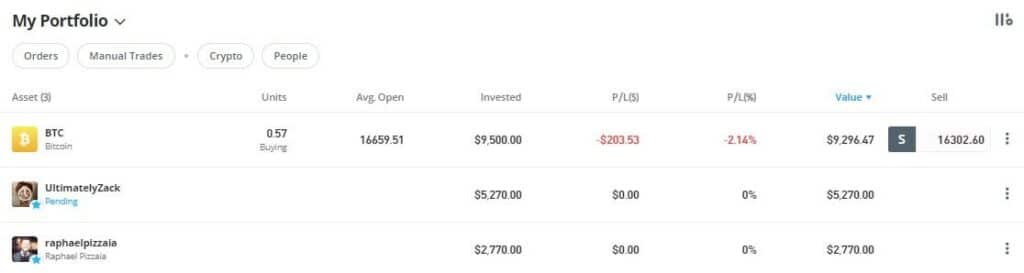

From our testing, we noted that almost all of eToro’s trading features could be used which is a plus considering that demo accounts only provide limited services. One minor but understandable limitation was that we were unable to see the constituents of portfolios (refer to the image below) copied using the CopyTrader feature.

Overall, we were impressed by the freedom eToro gives with its $100k worth of virtual funds and the lack of limitations when it came to exploring the features of the platform. This, and the ability to trade risk-free, makes eToro one of the best crypto demo accounts available to Australians.

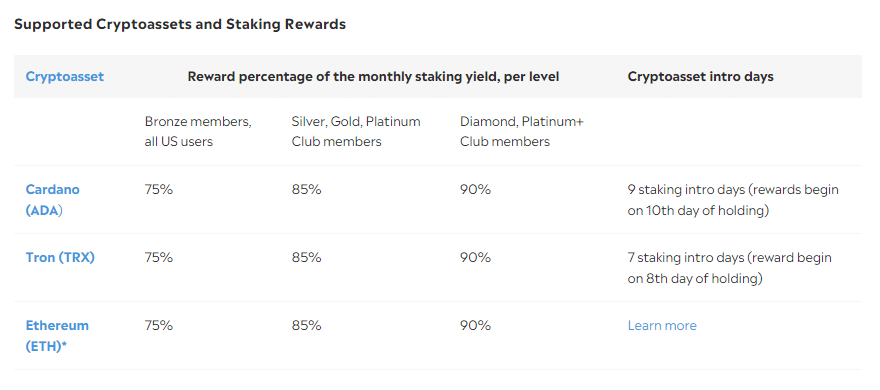

Crypto staking is available (but limited)

The cryptocurrency staking feature on eToro can be described as lackluster at best. At the time of writing, only three digital assets can be staked comprising Cardano (ADA), Tron (TRX), and Ethereum (ETH). Depending on your membership level, staking rewards are capped between 75% and 90%. For example, Bronze members only receive 75% of the monthly staking yields (we couldn’t find information on what the yields are either). Moreover, staking rewards only start generating if you stake crypto for no less than 7 days.

If you want to stake your digital assets to passively generate crypto yields over time then eToro should be avoided. There is simply not enough there to make it enticing. For a list of Australian crypto-staking exchanges that support the Proof-of-Stake consensus protocol, you can read our ranked reviews here.

Do We Think eToro Is Safe To Use?

Based on our research, yes, eToro Australia appears to be a safe and secure cryptocurrency brokerage platform. Apart from the lack of previously reported hacks, eToro is a major multi-asset trading platform that implements world-class security measures such as SSL encryption and firewalls. In addition to being licenced by ASIC as a Digital Services provider, the trusted company is regulated by AUSTRAC and must adhere to strict requirements set by the Australian government.

So, Is eToro Australia Legit?

Yes, eToro Australia is a legitimate cryptocurrency exchange that is operated by eToro AUS Capital Limited (ACN 612 791 803). eToro is licenced by the Australian Securities and Investments Commission (ASIC) as a Digital Services Provider under Australian Financial Services License 491139. eToro Australia is headquartered in Sydney, New South Wales.

Fees & Charges on eToro Are Not The Cheapest

Deposit and withdrawal fees

Although AUD is a supported fiat currency, eToro will automatically convert it to USD when you deposit your cash and trigger currency conversion fees. This is highly undesirable for the everyday investor or trader since it diminishes the value you are getting for your money. As an alternative, you can deposit USD without any fees incurred.

If you’re a Silver or Gold eToro member then withdrawing cash from eToro is an expensive exercise as a flat $5 fee applies on top of the USD to AUD conversion fee. However, Platinum, Platinum+ and Diamond members won’t be charged any withdrawal fees for non-USD currencies.

Trading fees

Whilst funding your account with AUD and withdrawing cash from your eToro wallet is expensive, its fees to trade crypto offer some reprieve. eToro doesn’t actually charge any flat or tiered trading fee to buy, trade, and sell digital currencies. Instead, a spread will apply to all transactions. The spread is the difference between the sell and buy price and may vary depending on market conditions as well as the liquidity of the trading pair.

Other fees

If you don’t login into your account for over a year, then eToro will take a monthly $10 fee from your account as long as there is a balance remaining, or open positions closed to cover the fee.

Verifying Your Account

Since eToro is regulated by AUSTRAC, all new members are required to complete the mandatory Know-Your-Customer (KYC) process. This must be completed before any funds can be deposited into your account wallet. To verify your identity, you can use your valid passport, photo ID, and a form of a utility bill to meet the stipulated criteria. The eToro mobile app has a feature where you can easily scan these documents for upload. eToro will go over the documents uploaded and update you on your verification status via the registered email.

Overall, we found the process to be fairly standard and it took about 6 minutes to complete.

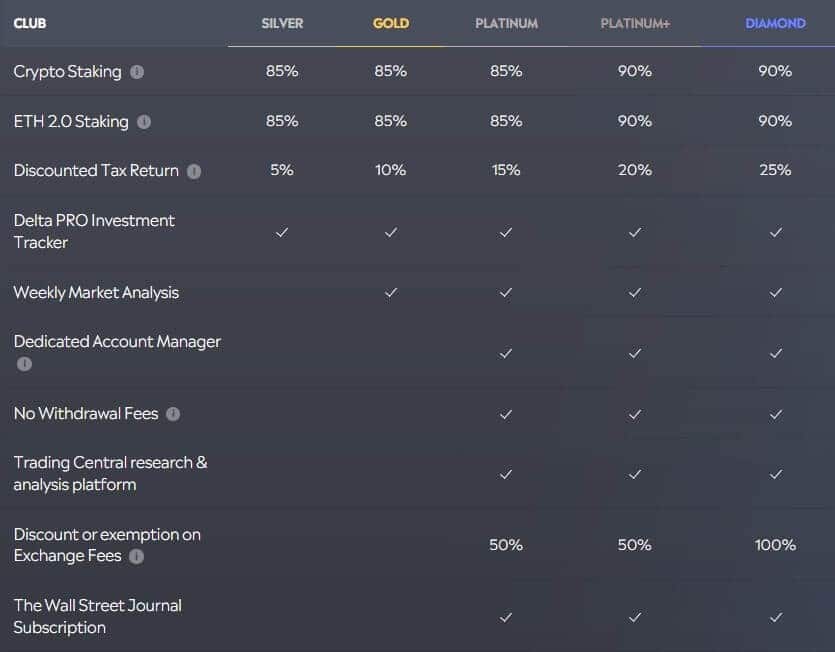

Membership Levels Explained

When you first sign up for eToro, you will automatically be registered as a Bronze member, however, there are additional memberships that come with increased benefits. However increasing your membership is not like other crypto exchanges where you provide further details to verify your identity or place of residence. Your membership level will be determined depending on your equity level. For example, you will automatically go up to Gold if you’re equity is between $5,000 and $10,000. To have the best benefits such as decreased trading fees (50% to 100%), no withdrawal fees on non-USD currencies, and a dedicated account manager, your equity needs to be at least $25,000.

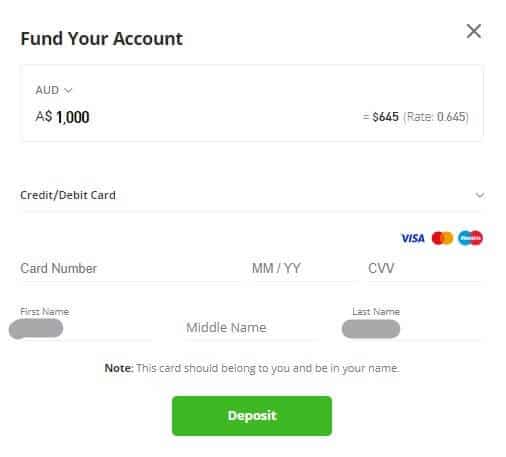

Funding Your Wallet Is Easy

eToro offers Australians a modest list of support deposit options including bank transfers, POLi, PayPal, and credit/debit cards. Other popular deposit methods such as BPAY and cash deposits are not supported. Nevertheless, the options that eToro provides should cater to most people.

There are some subtleties existing for each of the deposit methods. One of the most notable ones is that you cannot transfer AUD into your eToro wallet via bank transfers. On top of that, the AUD that you deposit using any of the methods will be automatically converted by eToro into USD and therefore currency conversion fees will be incurred. This alone may discourage regular investors. Apart from that, most account methods are instant and have favourable limits that should cater to most people.

| Deposit Method | Fiat | Speed | Limit | Withdraw? |

|---|---|---|---|---|

| Credit/debit card | AUD, USD, EUR, GBP | Instant | $40,000 | Yes |

| PayPal | AUD, USD, EUR, GBP | Instant | $10,000 | Yes |

| Bank transfer | USD, GBP, EUR | 4 – 7 days | No limit | Yes |

| POLi | AUD | Instant | $10,000 | Yes |

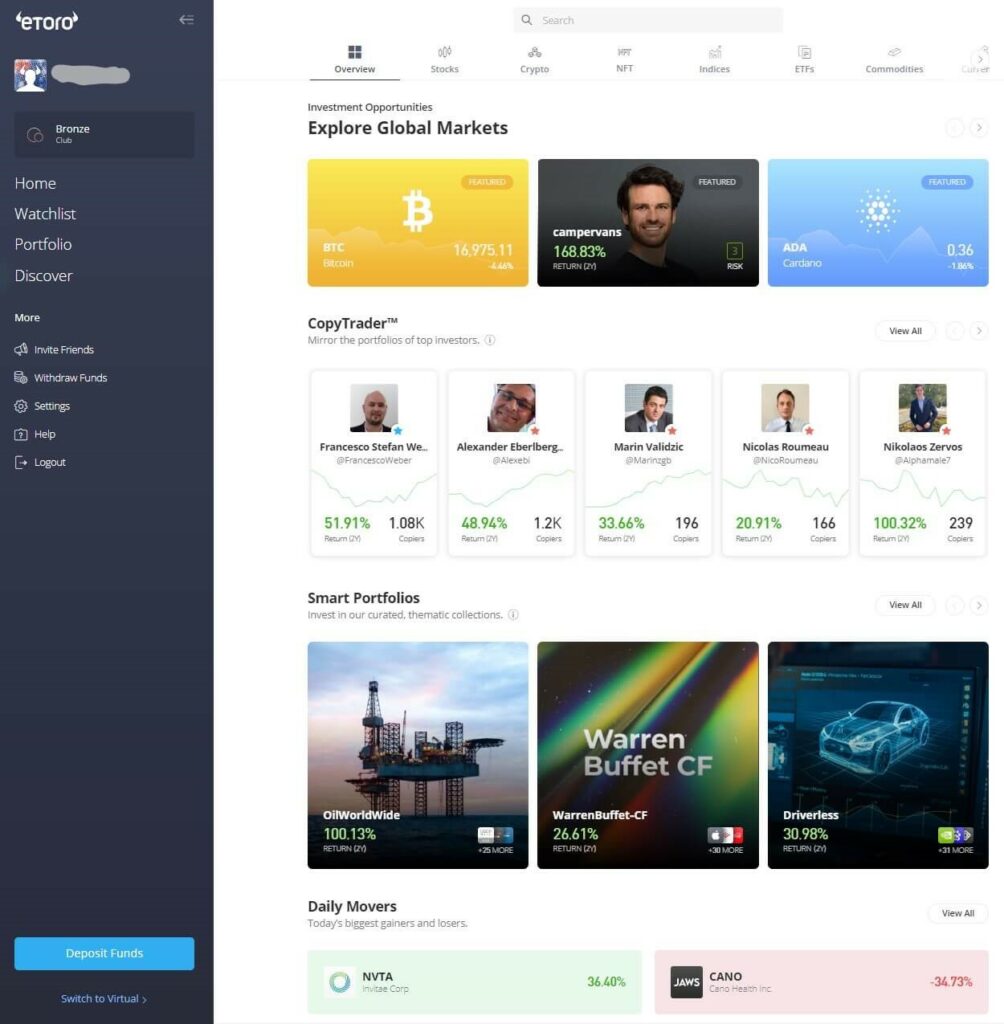

Our eToro Australia Experience After Using It

Account management is simple

The eToro Australia interface takes on a design that is unique compared to other crypto brokerage platforms. Since the focus lies on social trading for beginners, the interface has been compartmentalised into easy-to-understand sections that promote investing in general and a sense of community amongst other investors. Major account functions such as depositing and withdrawing funds have been streamlined to result in an incredibly easy experience.

If you’ve been using other crypto exchanges then the eToro Australia interface may take some getting used to. Having the free demo mode to use will help in this cause. But once you are familiar with it, the experience is quite enjoyable in a way that other platforms can’t seem to replicate well.

Trading is very intuitive and visual

Setting the CopyTrader feature aside, eToro still provides you with the ability to directly purchase Bitcoin and other digital currencies. At first, it may seem a bit more confusing if you’re a beginner due to the addition of order types such as stop loss and take profit. But it still functions as the typical ‘quick buy/sell’ feature that almost all crypto exchanges offer. The only thing to remember is that all prices are in USD.

To further substantiate itself as a beginner-friendly platform, eToro provides a simple in-house charting interface rather than the power TradingView package. Despite being a simplified charting interface, you still have access to a variety of analytical tools and indicators to enable price action analysis. There are no order books that might overwhelm beginners but the disadvantage is that you cannot assess the trading volume for a trading pair nor assess the spread.

As seen in the image below, the eToro trading interface is minimalist, clean, and simple. This should suit a wide variety of users between beginners learning how to use charts to intermediate traders.

What Customers Are Saying

The global eToro brand appears to have a good reputation with the majority of its customers. This is indicated on the popular review website TrustPilot where it has an overall score of 4.3 out of 5.0 (based on 17,600+ reviews).

However, the opposite may be said for eToro Australia. Australian review website Product Review has eToro at a poor score of 1.6 out of 5.0. Although the sample size of just over 100 reviews is too small to rely upon, the worrying issue is that 82% of customer feedback returned ratings of 1 or 2 stars. A key theme amongst negative reviews revolved around the withdrawal process as well as poor customer service.

Customer Support Is Limited

Customer support on eToro is available 24 hours from Monday to Friday through a ticketing system and live chat. Although direct phone support is not offered, eToro is a multi-lingual platform that offers assistance in English, French, Spanish, and Italian to name a few.

Phone support could be added to provide Australians with easier assistance. based on customer feedback reviews on Product Review, it appears that the quality of customer service provided by eToro is lacklustre, to say the least.

What Can eToro Improve On?

If you are a high-value trader, eToro is not for you. The platform has maximum trade limitations and charges through spreads, making large transactions very costly. The $5 fee for withdrawing non-USD fiat currencies is simply too much considering that other exchanges typically won’t charge anything for cashing money out.

eToro could also improve its customer support and include more avenues such as phone support and Telegram. Even though they have limited crypto coins, eToro has multiple assets that you can use to diversify your portfolio.

Our Verdict On eToro Australia

eToro is regarded as the world leader when it comes to social trading and it’s easy to see why. There are similar features offered by other global crypto exchanges, however, eToro’s CopyTrader and SmartPortfolio features are delivered so well that it’s night and day. Both of these features are nicely complemented by the unique design of the interface which helps to promote an investor’s way of thinking, as well as connect users to other users.

However, apart from its flagship social trading features and providing access to other assets such as stocks, ETFs, and commodities, there isn’t much else to entice cryptocurrency investors and traders. One of the biggest drawbacks is that eToro will convert the AUD that you deposit into USD meaning that you will incur currency conversion fees. Withdrawing money out of eToro is expensive for non-USD currencies and there seem to be a lot of existing customers experiencing technical issues cashing out.

Despite its shortcomings, eToro Australia is a particularly good option for beginners who prefer a holistic way of growing their cryptocurrency portfolios. If you enjoy seeing what successful traders are doing with their portfolios then the community environment that eToro provides will be ideal.

Frequently Asked Questions

The point of difference that eToro Australia has that makes it ideal for beginner and novice investors is its social trading feature. Its CopyTrader feature allows beginners to see the performance of other portfolios and invest their own money into the same portfolio. The unique design of the platform helps to promote a social community where investors can learn from each other. Add in the ease at which the platform can be understood, and eToro becomes a great place for beginner investors to start their investment portfolios.

At this stage, eToro Australia does not provide a wallet where you can earn interest payments on your digital assets. If you want to passively grow your portfolio by earning interest then you will need to seek an alternative platform such as Swyftx or CoinSpot.

eToro Australia allows you to withdraw AUD from your wallet, however, note that cash will be returned in the same fashion as it was deposited. For example, if you transferred money from an Australian bank account then eToro will return the money to the nominated bank account upon withdrawal. For all non-USD withdrawals, a flat $5 fee will apply as well as the USD-AUD conversion fee.

eToro Australia Alternatives & Comparisons

eToro is a top performer for cryptocurrency social trading, however, it does lack in other features that crypto exchanges typically offer. If you’re still considering your options after this review, then you may be interested in reading about these exchanges which offer similar services.

- Swyftx: Swyftx is the leading cryptocurrency platform in Australia to directly buy and trade crypto with Australian Dollars. The trusted platform has a lot of advantages over eToro including a massive list of supported crypto (320+), a wallet to earn crypto interest, an excellent charting package, and responsive customer support from a local team. For more information, read our Swyftx vs eToro Australia comparison.

- CoinSpot: CoinSpot is a trusted name in the Aussie crypto market and has earned a stellar reputation since its inception in 2013. The AUSTRAC registered platform has over 370+ digital currencies to buy and trade with AUD, a debit card to spend your crypto, a Non-Fungible Token (NFT) marketplace, and an interest-earning wallet to grow your portfolio. Read our full comparison on eToro and CoinSpot next.

- Bybit: An outstanding crypto exchange for spot and margin (up to 100x) traders. Bybit offers great fees for its spot and margin trading markets, all of which can be accessed on its state-of-the-art mobile app. Since the exchange is not regulated in Australia, you don’t need to complete KYC procedures.

Related:

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.