Best Crypto Exchanges In Australia

Last Updated on January 31, 2024 by Kevin GrovesWith so many options to choose from, it can be difficult for you to decide on which Australian cryptocurrency exchange to put your money in. Exchanges are unique in the crypto products and services that they offer and it’s crucially important to select the right one that fits your investment and trading needs.

We have assessed and compared over 60 crypto exchanges and understand what makes a good and bad trading platform to buy and sell digital currencies such as Bitcoin. Our methodology is based on various factors that are important to Australians such as supported crypto assets, features and benefits, funding methods, trading fees, security, and customer support. In this article, we share our research and list the best cryptocurrency exchanges available to Australians.

The Best Crypto Exchanges Australia

We’ve reviewed crypto exchange platforms in Australia while considering important factors such as ease of use, fees, beginner-friendly, security, and customer support. Our list of the best exchanges for Australians are:

- Swyftx – Best Overall Crypto Exchange ($20 BTC bonus)

- Binance – Best Crypto Exchange for Altcoins

- Bybit – Top Platform for Aussie Margin Traders

- CoinSpot – Good Crypto Exchange for Everyday Aussies

- CoinJar – Best Crypto Debit Card

- eToro – Top Choice for Crypto Social Trading

- Independent Reserve – Trusted Option for Crypto SMSF Accounts

- Kraken Australia – Reliable Crypto Trading Platform

- Coinbase – Reliable Cryptocurrency Mobile App

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Best Crypto Exchanges In Australia: Our Top Picks

The section below provides an overview of each cryptocurrency exchange, its features, deposit methods, supported cryptos, trading fees and security. We also summarised each option with our reasoning for why we picked each one for this list.

1. Swyftx – Best Crypto Exchange Overall In Australia

Why we picked it: After testing and researching the most popular Australian crypto exchanges, we found Swyftx to be the best crypto exchange for people in Australia. With thousands of raving reviews from within the crypto community, low fees, high-level security and excellent customer support, Swyftx is undoubtedly the best crypto exchange.

- Rating: ★★★★★

- Number of crypto assets: 320+

- Trading fees: 0.6%

- Acceptable deposit methods: PayID, POLi, bank transfer, credit/debit card, cryptocurrency.

- Allows AUD deposits and withdrawals: Yes

- Our review: Swyftx review

In comparison to other crypto exchanges and platforms in Australia, we believe Swyftx is the best digital currency investment and trading option for the majority of Australians at the moment. Swyftx was founded to solve the major challenges Australians faced on other platforms including high fees, difficult to use interfaces provided by large exchanges, and poor customer service. The end product is a very straightforward to use platform that translates into an enjoyable trading experience.

Swyftx has accumulated an impressive customer base of over 660,000 Australians, which is partly due to the high quality of its services and features. The popular trading platform has continually improved the user experience where you can easily use Australian Dollars (AUD) to quickly buy over 320 cryptocurrencies. Buying and trading digital assets such as Bitcoin (BTC) and Ethereum (ETH) can be done in a number of ways.

Options are plenty when it comes to growing and managing your cryptocurrency portfolio. It is these options that make Swyftx suitable for a broad spectrum of users and investment strategies. The customisable dashboard is one of the best in Australia for understanding and tracking the digital currencies that you hold. Selling Bitcoin back to AUD and withdrawing it is a process that is more streamlined than other platforms.

Swyftx is registered and regulated by AUSTRAC, which is why you will need to verify your identity before being allowed to actively trade on the platform. The verification process is pretty straightforward and takes less than 4 minutes as long as you provide them with the correct information. Once your account is verified, you can deposit AUD funds using a variety of payment methods including bank transfer, POLi, credit/debit cards, PayID, and cryptocurrencies from your external wallet.

For a locally owned and operated cryptocurrency exchange, Swyftx provides great value for money. For starters, you can deposit and withdraw cash to and from your account for free. Its trading fee of 0.6% is on par with other local crypto platforms such as Digital Surge and Independent Reserve (both 0.5%).

Other Swyftx features that make it the best crypto exchange in Australia include:

- $20 worth of free BTC on signup using our Swyftx referral code.

- A free crypto demo account stocked with $10,000 of virtual cash so you can practice trading and explore the platform with zero risk.

- The ability to purchase multiple crypto in one transaction and saving on fees, known as crypto bundles.

- A local customer service team of over 30 individuals who can be reached via email, the 24/7 chat bot and even by phone.

- Outstanding customer feedback and reviews.

- Professional support for Self-Managed Super Fund (SMSF) investors.

- Set up recurring orders, otherwise known as Dollar-Cost-Averaging (DCA), to automate crypto purchases.

- Excellent security measures to ensure the protection of your cash and digital assets.

- Reporting tools to help you understand your crypto tax obligations.

Swyftx Pros:

Swyftx Cons:

Related: Swyftx vs CoinSpot, Swyftx vs Crypto.com, Swyftx vs. BTC Markets, Swyftx vs eToro, Swyftx vs Digital Surge

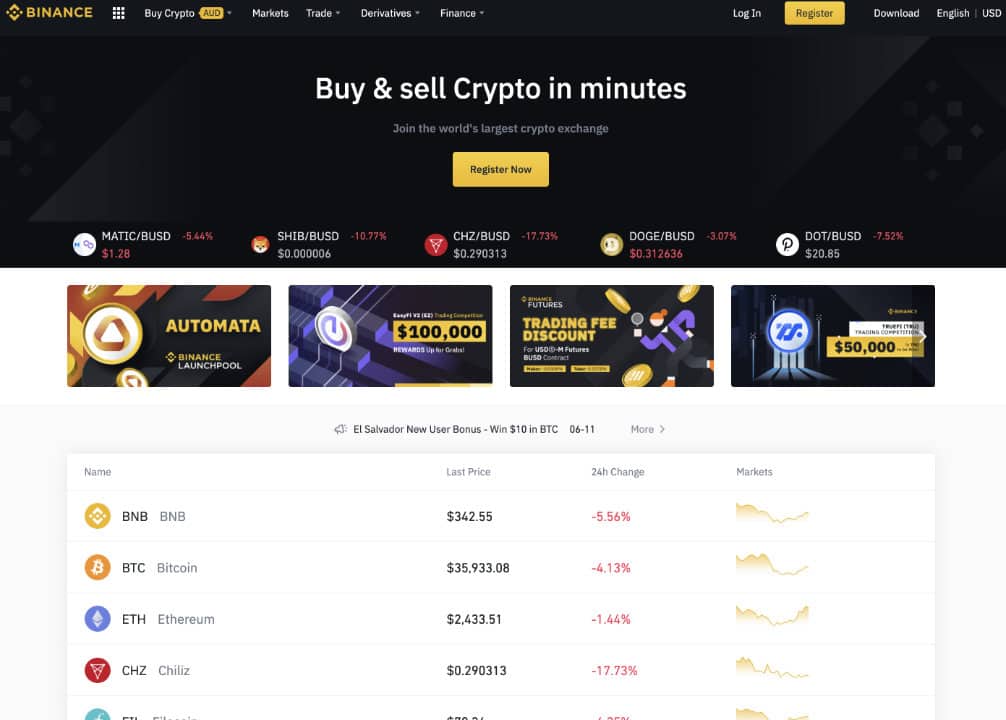

2. Binance – Best Crypto Exchange for Altcoins

- Rating: ★★★★★

- Number of crypto assets: 380+

- Trading fees: 0.1%

- Acceptable deposit methods: PayID, credit/debit card, bank transfers, cryptocurrency

- Allows AUD deposits and withdrawals: Yes

- Our review: Binance Australia Review

This platform is ranked 1st globally in terms of trading volume, according to CoinMarketCap. Even though it’s an international cryptocurrency exchange site, its Australian branch is fully compliant with the country’s laws and regulations. It’s one of the most reputable sites in the region and has a wide list of digital assets for investors to trade with.

Want to start trading? Claim 100 USDT with our Binance Australia referral code.

Binance also has complex trading and investing functionalities for professional traders, including cryptocurrency futures, margin trading, and leveraged trading. However, one of its most notable features is that it also offers decentralized finance services, staking, savings, and crypto-backed loans. You can also trade in various fiat currencies, a feature that few Australian exchanges have.

The identity verification process at Binance is pretty simple, and you only have to provide basic details such as government-issued ID verification, and phone and email verification.

Trading limits are based on a progressive trading model, which is determined by your level of verification and the market you’re trading in. For instance, fiat currency trades are limited to $5,000, while withdrawal limits start at 2BTC or its equivalent value in AUD.

Even though Binance was hacked in 2019, it still remains one of the most secure Australian exchange sites. They recently launched the Binance Coin, and all BNB token holders are offered massive discounts on their trades.

This platform also has a Binance visa card that allows you to use your Cryptocurrency for transactions. Currently, this card is accepted by more than 60 million merchants globally.

Binance Australia Pros:

Binance Australia Cons:

Related: Swyftx vs Binance, Coinspot vs Binance

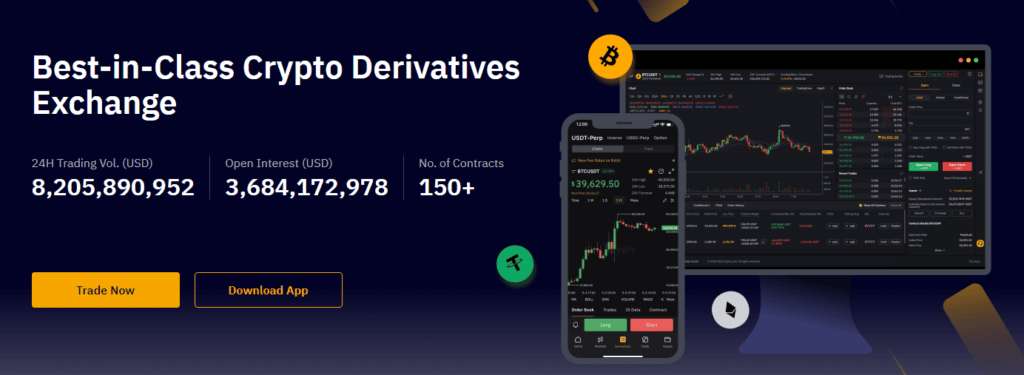

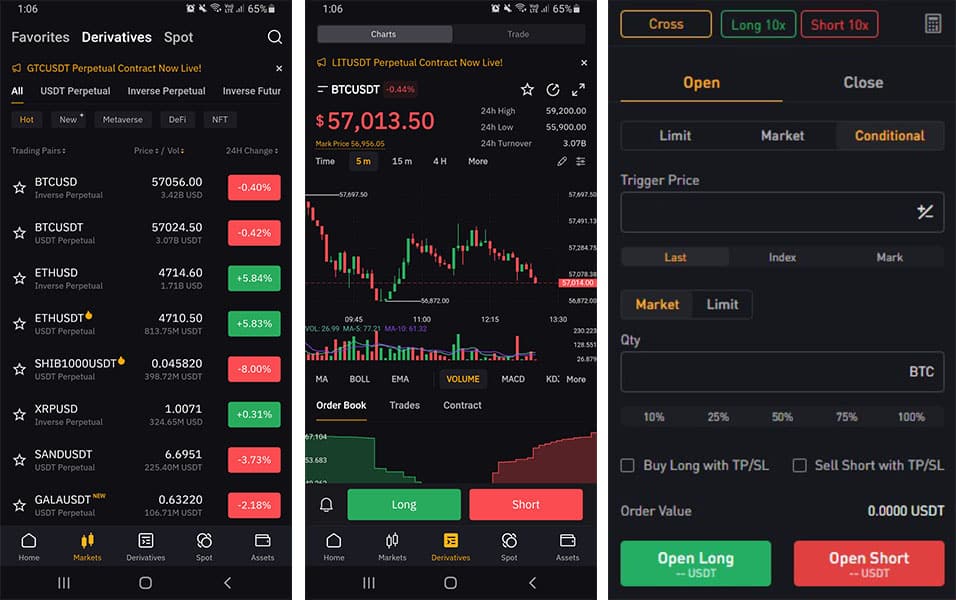

3. Bybit – Top Platform for Aussie Margin Traders

Why we picked it: After rigorously testing Bybit for the last 2 years, it is a premier crypto exchange for all levels. The robustness and richness of its margin and derivatives trading features are pros, all of which can be accessed with ease on the mobile app. The only downside to Bybit is the inability to direct deposit or transfer AUD into the account wallet.

- Rating: ★★★★★

- Number of crypto assets: 320+

- Trading fees: 0.01%/0.06% for derivative maker and takers, 0.1% (spot)

- Acceptable deposit methods: Crypto only

- Allows AUD deposits and withdrawals: No

- Our review: Bybit Australia Review

Bybit is a global crypto exchange that provides Australians with access to the leveraged margin where up to 100x can be applied to its spot, perpetual, and futures markets. With more than 3 million users, Bybit is an advanced platform for traders, however, retains a high degree of intuitiveness that enables almost anyone to find their way around.

Bybit stays relevant in the industry by continually evolving its crypto products and services over time. Besides its margin and derivatives trading features, you can put your digital assets to work in the Earn hub to passively generate crypto rewards, buy and sell NFTs, or just simply add to your portfolio using a credit card. If the world-class trading features and markets weren’t enough, you can perform your trades on its crisp and seamless mobile app.

The Bybit interface is world-class and offers a satisfying trading experience. Rather than having to focus on a small window, the powerful TradingView charting takes centre stage and is amply large enough to analyse the price action of cryptocurrencies using the suite of indicators and analytical tools. The order books and order panels are neatly laid out in a crisp and modern fashion that is visually pleasing and provides a high degree of functionality.

A key selling point for Bybit is its ultra-competitive trading fees. Maker and taker fees start at 0.01% and 0.06%, respectively, which puts it on par with the likes of OKX. Other features that complement the Bybit platform include its dual price mechanism and insurance policy. The dual price mechanism essentially protects you against significant market price fluctuations, and the insurance fund is there to decrease the potential for auto-deleveraging to occur.

Bybit Australia Pros:

Bybit Australia Cons:

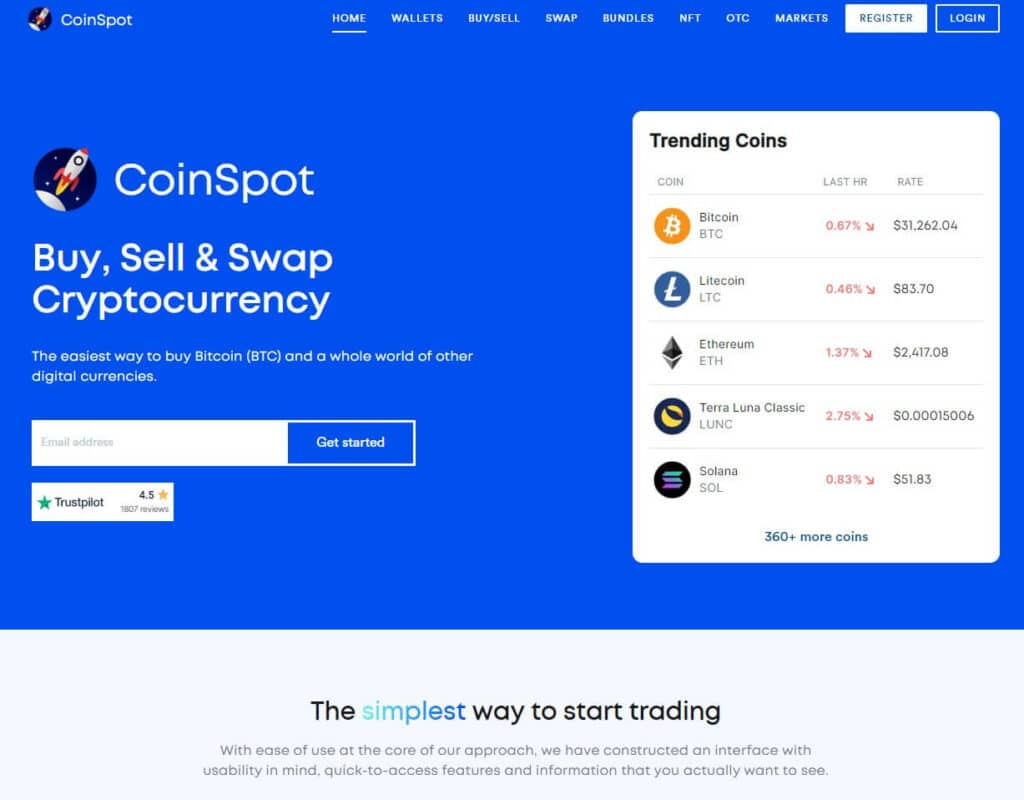

4. CoinSpot – Good Crypto Exchange for Everyday Aussies

Why we picked it: CoinSpot is one of our top picks due to its simplicity and ease of use that is tailored toward everyday Aussies. Investing in crypto doesn’t need to be complicated and CoinSpot offers a modern and streamlined exchange that supports over 370 coins. It is super easy to create an account, deposit AUD and convert cash into crypto. In addition, CoinSpot is commonly recognised as the safest crypto exchange in Australia due to its ISO 27001 accreditation.

- Rating: ★★★★★

- Number of crypto assets: 370+

- Trading fees: 1% for instant buy/sell, 0.1% for OTC and exchange orders

- Acceptable deposit methods: PayID, POLi, bank transfer, credit/debit card, BPAY, cryptocurrency

- Allows AUD deposits and withdrawals: Yes

- Our review: CoinSpot Review

Launched in 2013, CoinSpot has become one of the leading Australian exchanges. It has a simple-to-understand interface that’s easy to navigate and allows you to buy and sell cryptocurrency without feeling overwhelmed.

Since CoinSpot is Australian-based, it seamlessly integrates a suite of common deposit methods so you have the choice with how you decide to fund your account. Payment options include transfers from an Australian bank account, cash deposits, PayID, POLi, credit/debit card, BPAY, as well as cryptocurrencies. Deposit methods are generally free to use with minor fees for BPAY (0.9%) and cash deposits at supporting Blueshyft news agencies (2.5%)

CoinSpot is trusted by over 1 million Australian investors, traders, and crypto enthusiasts, and there are several reasons why this is the case. Firstly, its bank-grade security features have enabled it to keep an outstanding track record of no hacks since its establishment in 2013. Secondly, CoinSpot maintains the very best standards in information security by upholding the requirements of its internationally recognised ISO 27001 accreditation. Simply put, CoinSpot has been operating for a long time and has rightfully developed a strong reputation as a reliable crypto services provider.

Like Swyftx, CoinSpot offers a multi-token wallet where you can safely store your Bitcoin and other crypto.

With its ease of use as a major strength, CoinSpot falls in its fee structure. Users who don’t want to see or use complex-looking charts will prefer the simplicity of the Instant Buy/Sell feature. However, you should know that this carries a 1% which is expensive compared to most other Australian platforms. If you know how to place market orders on an exchange, then you can get better value for money on the exchange where the fees are 0.1%.

New users who sign up for an account with CoinSpot can get a free $10 bonus when using our CoinSpot referral link. The signup bonus is a limited-time promotion using this link.

CoinSpot Pros:

CoinSpot Cons:

Related: CoinSpot vs Digital Surge, CoinSpot vs Coinbase, CoinSpot vs CoinJar

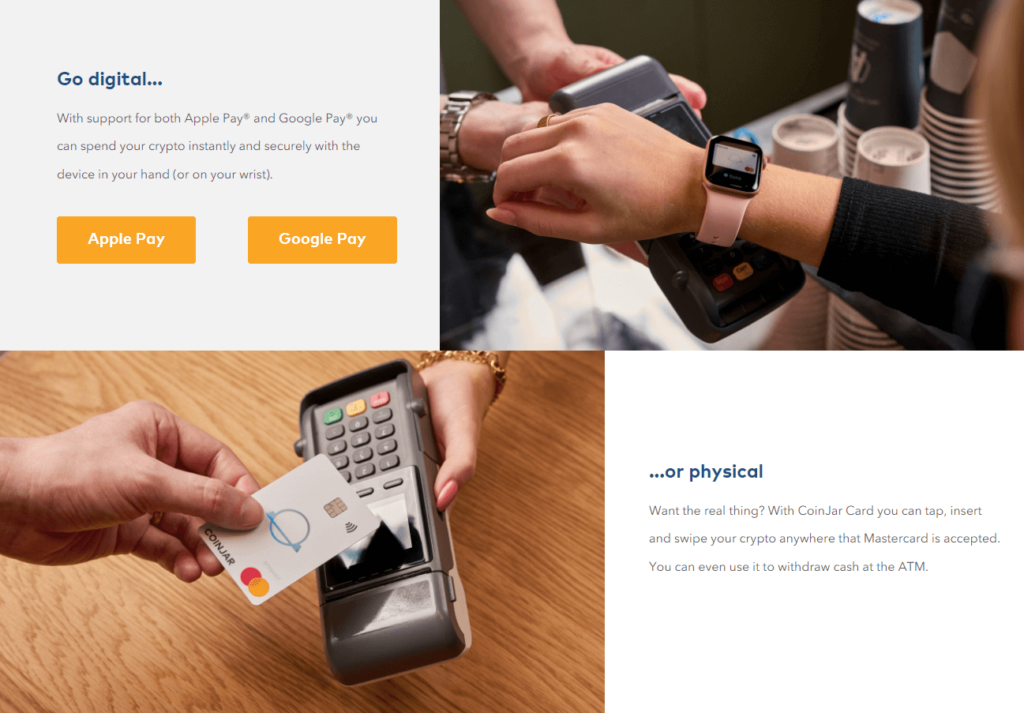

5. CoinJar – Best crypto debit card

- Rating: ★★★★★

- Number of crypto assets: 50+

- Trading fees: 1%

- Acceptable deposit methods: PayID, cash deposits, bank transfer, cryptocurrency

- Allows AUD deposits and withdrawals: Yes

- Our review: Coinjar Review

Founded in 2013, CoinJar is one of Australia’s oldest crypto platforms with more than 500,000 active users. The platform is more orientated towards the general public through its user-friendly interface, streamlined crypto purchasing processes and innovative features.

Some of Coinjar’s more prominent features include the ease at which you can buy the major coins and tokens with cash, crypto bundles, and a multi-token wallet to secure your crypto. However, the best feature by far is the CoinJar Card, a crypto debit card that can be used at online or in-store retailers that accept MasterCard. Not only are there no set-up or annual fees, but the card can be entirely managed using the CoinJar mobile app. Spending your crypto will even generate CoinJar reward points that you can redeem.

Adding crypto funds to your card can be done in a variety of ways. You can either exchange AUD cash for crypto using the Instant Buy/Sell function which carries a hefty fee of 1%, or by buying them through the Exchange which is much cheaper (0.1% trading fees). The combination of a well-designed mobile app and an innovative debit card makes for one of the better crypto debit cards available to Australians.

Aside from the CoinJar Card, if you’re looking for an exchange with a well-rounded suite of features, then CoinJar probably isn’t for you. Unlike some of the other crypto exchanges on this list such as Swyftx, CoinSpot, and Digital Surge, you can’t earn interest on your crypto.

Having said that, CoinJar is perfectly suited to everyday Australian crypto investors who prefer to buy and hold assets. Whilst the selection of crypto is comparatively poor, all the major coins and tokens are supported.

CoinJar Pros:

CoinJar Cons:

Related: Swyftx vs CoinJar.

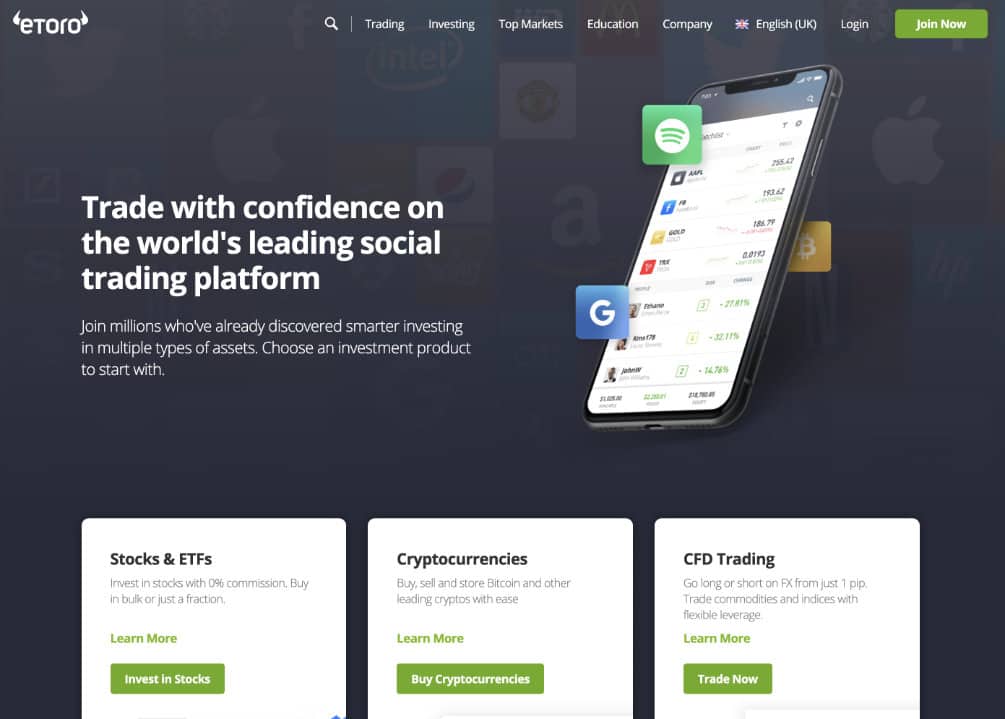

6. eToro – Top Choice for Social Crypto Trading

Why we picked it: After using eToro for a couple of months, we can certainly attest to eToro’s reputation as the premier social trading platform. Although the user interface takes on a unique design, we found it to be incredibly easy to use. Other global exchanges that offer the social trading experience are not as user-friendly as eToro due to their features and high level of development. However, one of the key cons for Australians will be the currency conversion fees.

- Rating: ★★★★★

- Number of crypto assets: 25+

- Trading fees: None (spread only)

- Acceptable deposit methods: Credit/debit card, PayPal, POLi

- Allows AUD deposits and withdrawals: No

- Our review: eToro Australia Review

eToro is Israeli-based and was founded in 2006. It’s a multi-asset trading & brokerage company that allows traders to invest in FCDs, Stocks, and Cryptocurrency. This platform has a highly intuitive and visual platform that is perfect for everyday people but also incorporates advanced trading options that traders would appreciate.

Perhaps one of the most notable features of eToro is its social and crypto-copy trading platform that’s basically a community where you can connect with other traders and replicate their trades. This allows you to share trading strategies & ideas, and most importantly, you can mirror trades from the best investors.

If you’re just starting at crypto trading, there’s a filter system on eToro that you can use to discover portfolios that fit criteria such as risk tolerance, investors that have copied that strategy, and return on investment. You can also limit your losses by setting up a stop loss level.

The trading fees on eToro vary based on the type of digital asset you’re trading and the current market conditions. This is often comparable to other exchange sites, which charge between 0.5% (Independent Reserve) to 4% per trade.

eToro also has a demo account feature that comes with $100,000 of virtual money. This allows you to become familiar with the site’s interface, features, and trading pairs before you start actively trading.

eToro Australia Pros:

eToro Australia Cons:

Related: eToro Australia vs CoinSpot

7. Independent Reserve – Trusted Option for Crypto SMSF Accounts

Why we picked it: Independent Reserve is a reputable cryptocurrency exchange that has provided over 200,000 Australians with reliable and stable services. Since its establishment in 2013, its premium support for SMSF investors has been its flagship service and currently holds over 8,000 accounts. Independent Reserve is a great choice for Aussies to start their cryptocurrency portfolio. However, if you’re considering a crypto SMSF, then Independent Reserve provides you with a secure environment and economical trading fees.

- Rating: ★★★★★

- Number of crypto assets: 30

- Trading fees: 0.5% (maximum)

- Acceptable deposit methods: Bank transfer (OSKO), PayID, SWIFT, Xfers (Singapore)

- Allows AUD deposits and withdrawals: Yes

- Our review: Independent Reserve Review

Established in 2013, Independent Reserve is a legitimate and well-regarded cryptocurrency trading platform that has amassed over 200,000 users and 8,000 SMSF accounts in Australia. Its reputation as a strong cryptocurrency service provider stems from the fact that it hasn’t suffered from any hacks or breaches.

It has also received a number of industry rewards and is a member of Blockchain Australia and the Australian Digital Commerce Association (ADCA). To top it off, Independent Reserve is one of a handful of Aussie exchanges that has attained the internationally recognised ISO 27001 accreditation that demonstrates its commitment to high-security standards.

Independent Reserve only offers 26 digital currencies that can be bought using AUD, SGP, USD, or NZD. However, all major coins and tokens are supported such as Bitcoin, Ether, Solana, Cardano, Tether, and DAI. If you’re an altcoin investor who is interested in the more exotic coins then you will need to find an alternative place to buy them.

The interface is simple and basic which allows you to easily use cash to purchase crypto. There are several ways you can fund your Independent Reserve account for free including bank transfers, however, OSKO and PayID will complete the transaction near-instantly. Although the interface is a bit outdated, it still performs and is highly functional.

The crypto buying process is streamlined and easy to understand. If you’re new to crypto then you shouldn’t have any issues. Despite leaving the interface design behind, Independent Reserve has kept up with the Aussie market by providing trading fees that start at 0.5%. If you’re trading volume meets certain criteria over 30 days then you can enjoy fee discounts as well. However, the trading volumes required for fee reductions aren’t as enticing as other crypto exchanges.

Independent Reserve offers you the ability to apply Dollar-Cost-Averaging (DCA) to your trades as well as being able to purchase bundles of crypto. Independent Reserve collectively markets these features as AutoTrader:

- AutoBuy: Let’s you automatically buy crypto whenever AUD are deposited into your account where the amount and desired price point are set by you.

- AutoBasket: This is Independent Reserve’s way of allowing you to buy crypto in bundles. Since multiple assets are purchased in a single transaction, it’s a great way of quickly diversifying your portfolio with minimal trading fees.

- AutoSchedule: Similar to AutoBuy except you can schedule the times when crypto is purchased. This is a commonly used tool to reduce purchasing risk during periods of price volatility as you don’t need to ‘time the market’.

Independent Reserve is widely known for its OTC and SMSF service offerings and has helped over 8,000 Australians use their SMSF to invest in cryptocurrencies. When it comes to building a long-term store of value for retirement purposes, low fees and a high degree of reliability are paramount. In this regard, you can benefit from the very competitive trading fees (0.5%), personalised customer support that you will receive, in-built tax reporting tools, and the ability to optimize trades using a variety of limit orders.

Independent Reserve Pros:

Independent Reserve Cons:

Related: Swyftx vs Independent Reserve

8. Kraken – Reliable Crypto Exchange For Traders

Why we picked it: Kraken provides Australians with easy access to over 190 digital currencies using an easy-to-use platform. It makes this list as it covers all the bases in terms of what Aussie investors and traders will be looking for in a reliable trading platform. The key advantage of Kraken, is the Kraken Pro exchange, where leverage margin of up to 5x can be applied to market orders. There are over 630 trading pairs for traders to trade in an economical fashion due to its competitive maker and taker fees of 0.16% and 0.26%, respectively.

- Rating: ★★★★★

- Number of crypto assets: 210+

- Trading fees: 0.16% (maker) and 0.26% (taker)

- Acceptable deposit methods: Bank transfer, credit card

- Allows AUD deposits and withdrawals: Yes

- Our review: Kraken Australia Review

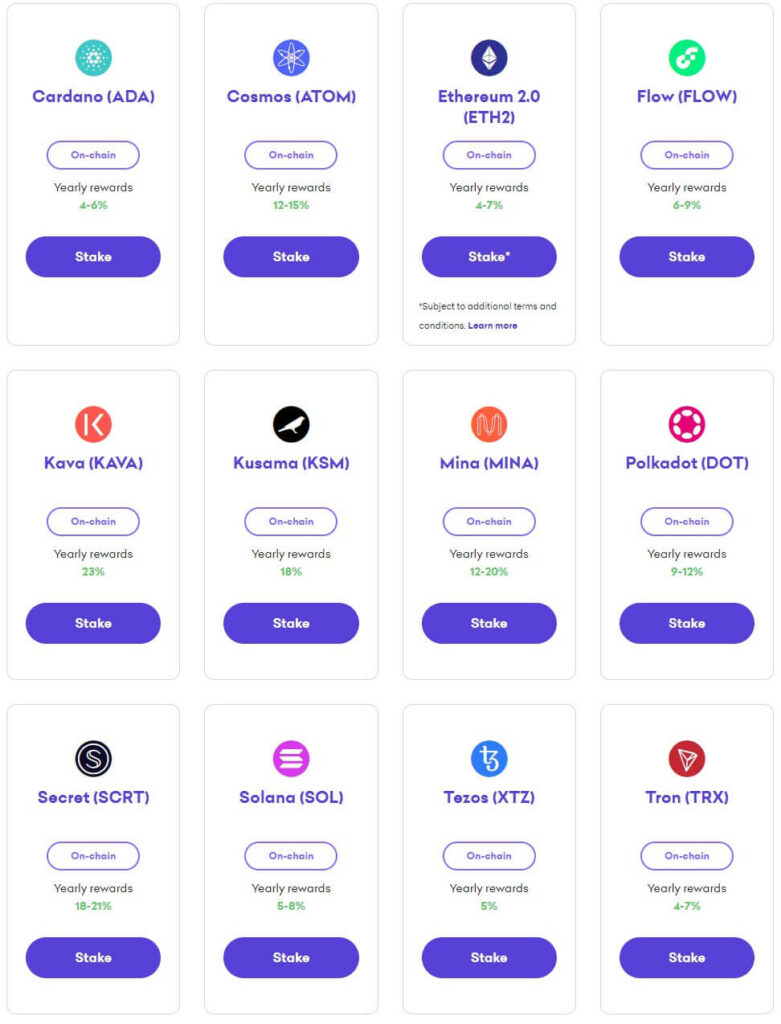

Established in 2011, Kraken is one of the longest-serving and largest cryptocurrency exchanges with over 9 million clients worldwide. Based in San Francisco, Kraken provides a rich assortment of premium products and services such as a professional crypto exchange and interface, SMSF support, and a top-rated staking platform where you can passively earn crypto rewards over time.

As an Australian, credit cards can be used as a payment method to buy over 210 digital currencies such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Ethereum Classic (ETC), Algorand (ALGO), and Monero (XMR). Not quite the selection compared to the likes of Swyftx and Binance, however, very serviceable nonetheless for a lot of people.

Kraken provides a number of features that are relatively common in the Australian market. These include support for Super Fund investors, a wealth of educational resources for users to expand their knowledge on, an easy user experience, and industry-leading security measures and regulatory compliance.

However, being a global crypto trading exchange, Kraken provides you with products and services that are not typically offered by local Australian exchanges. One of these features is the world-class trading interface on Kraken Pro where leverage margin and futures markets are available on over 610 trading pairs. The Kraken Pro exchange provides you with access to leveraged margin trading markets where up to 5x leverage can be placed on orders. Unfortunately, Australians are not eligible to speculate on the price of crypto in futures markets.

Traders will appreciate the advanced features of the interface, including an abundance of analytical tools, several real-time charting options to choose from, and an array of drawing tools. To further bolster its position as one of the best trading interfaces available to Australians, the maker and taker trading fees of 0.16% and 0.26% are relatively comparable to other exchanges like OKX.

Another feature that is not offered by local exchanges is Kraken’s support for Proof-of-Stake (PoS) coins and tokens. On-chain assets such as Kava, Polkadot, Solana, and Cosmos can be staked to earn up to 23% in interest payouts. Australians are not eligible to stake off-chain digital assets including Bitcoin.

Despite being a global crypto exchange, Kraken provides a simplistic and quick onboarding process that can be completed in minutes. There are three account tiers to choose from, however, you will be best served with the Intermediate tier since it allows you to transfer money from your Australian bank account.

To fund your account, cash can be deposited via bank transfers. Otherwise, you can use your credit card to purchase cryptocurrencies directly. Depositing cash or transferring digital assets (besides ETH) from an external wallet and into your Kraken wallet will incur zero fees.

Depending on your level of experience, you can choose the simple or advanced buying panel. The simple version will appeal to you if you’re a beginner, however, the advanced version provides you with order limits such as Limit, Market, Stop Loss, Take Profit, Stop Loss Limit, and Take Profit Limit.

If you run into any issues then Kraken goes one step further than most other global exchanges by providing a chatbot that connects you with a real member of the customer service team. Other avenues of assistance include phone support or submitting a ticket.

Kraken Pros:

Kraken Cons:

9. Coinbase – Reliable Crypto Mobile App

- Rating: ★★★★★

- Number of crypto assets: 220+

- Trading fees: 0.5% (maker) and 0.5% (taker)

- Acceptable deposit methods: Bank transfer, debit/credit card

- Allows AUD deposits and withdrawals: Yes

- Our review: Coinbase Australia Review

Cryptocurrency prices are extremely volatile, and mobile apps protect you from missing out on trades by allowing you to conveniently trade on the go. Coinbase was launched in 2014 and is one of the best crypto exchanges in Australia. Even though its headquarters are in Fransisco, it’s fully compliant with Australian rules and regulations.

Coinbase has a simple brokerage interface that allows you to easily swap, buy or sell crypto. It also has a Coinbase pro interface that is specifically designed for expert trades and has more advanced trading tools.

This site is highly secure, and it has never experienced a breach since its inception. Some of the security protocols it implants include 2FA and the storage of most funds in cold wallets. It also protects beginner traders from fraud by preventing them from sending coins to their blacklisted scam addresses.

Coinbase’s mobile app is accessible on both Android and iOS devices and is similar to the web version. This ensures your trading experience is streamlined irrespective of the device you’re using and is one of the best crypto apps in the market for investors and traders alike.

Coinbase Pros:

Coinbase Cons:

Related: Coinbase vs Swyftx

Top Factors To Consider When Choosing The Best Crypto Exchange Australia

Before you settle on the best bitcoin exchange in Australia, it’s important that you review various sites to ensure they meet your trading needs. Some of the factors you should look out for include;

1. Payment Methods Allowed

Exchange sites with multiple withdrawal and deposit methods are generally more convenient. You should, however, ensure that the options available work for you and are acceptable in Australia.

This is especially important if you choose to go with an international site. Don’t forget to check the fees associated with each method to ensure that they won’t eat a huge chunk of your profits.

2. Fees Charged

Every time you deposit, withdraw, and trade crypto, you incur fees. If the fees are too high, your profits will be reduced. Make sure you consider the currencies you intend on trading with, payment methods, and any discounts allowed.

3. Type of Trading

The best cryptocurrency exchange Australia often offers 3 types of trading;

- Crypto-to-crypto trading

- fiat-to-crypto trading

- Both fiat-to-crypto and crypto-to-crypto trading

Go for an exchange site that’s in alignment with your investment goals. For instance, if you’re planning on buying bitcoin using AUDs, you’ll have to choose a platform that allows deposits through credit cards and bank transfers.

4. User Interface and Available Trading Tools

If you’re just getting started with cryptocurrency trading, the entire process can be complex and overwhelming, which is why you should go for a site that’s beginner-friendly. Expert traders, on the other hand, are mostly drawn to platforms with advanced trading tools and multiple trading pairs.

5. Safety of Funds

Exchange sites are often targeted by malicious hackers due to the number of funds that are traded daily. There are also instances where unsuspecting traders fall victim to fraud, so you should look into the security features being offered.

Some of the aspects you should concentrate on include;

- 2-factor authentication

- Whether funds are stored on online or offline wallets.

- How well your private key is stored

- Constant account monitoring and data encryption.

You should also find out whether the exchange site has been hacked before and whether the affected traders were reimbursed.

6. Liquidity

Levels of liquidity determine how easily and swiftly you can complete trades. If an exchange site has high liquidity, it means that its trading volume is high, and you can complete trades quickly.

Low liquidity, on the other hand, often results in price fluctuations. Make sure you look at the order books before you create an account.

7. Customer Support

If you need help with your account, how quickly can you reach the customer support team? This is a very critical factor, but most traders overlook it and end up losing their investments. Consider aspects such as;

- How you can reach them; phone, email, live chat, telegram, etc.

- Hours that the support team is available

- How quickly they respond to queries

- Their library of resources on the most common FAQs

- Languages in which support is offered.

Don’t forget to check the platform’s reputation when it comes to providing helpful support. You can easily find this information on TrustPilot.

Other factors that you should consider include;

- Cryptocurrency selection: the site should have a wide range of altcoins and fiat currency listed, as this will enable you to diversify your portfolio.

- Trading limits: high trading limits allow you to place large trading orders, increasing your profitability.

- Regulations: exchange sites that comply with Australian laws and regulations are more secure.

- Processing times: go for a platform that processes your deposits and withdrawals swiftly.

What Are the Different Kinds of Cryptocurrency Exchanges?

There are various types of exchanges, based on your trading experience;

1. For beginner traders: you should go for cryptocurrency brokers. This will allow you to buy digital coins directly from the sellers, so the trades are quick and easy. An example of a cryptocurrency broker is Coinspot.

2. For intermediate traders: you should trade on cryptocurrency trading platforms. This will allow you to buy and sell digital coins at competitive prices on an open market. These trading platforms also have a wide selection of digital coins and have more features such as margin trading.

Crypto trading platforms are often more difficult to navigate than brokers, but there are some that are beginner-friendly. Swyftx is one of the best trading platforms.

3. For expert traders: if you’re a professional trader, you should go for cryptocurrency derivatives platforms. Instead of outrightly trading crypto, you’’ be trading in cryptocurrency derivatives.

These sites offer a wide range of trading features, high liquidity, high leverage, and trades are executed swiftly. Binance is a highly ranked derivative platform.

A Quick List of Cryptocurrency Exchanges

- The best Bitcoin exchanges: If you’re just looking to buy and sell bitcoin, you should go for exchange platforms that are easy, cheap & swift and offer a wide range of payment options. You don’t really need advanced trading tools, so focus on the payment options and how convenient they are. Coinjar is one of the best bitcoin exchanges.

- The best altcoin exchanges: You should go for a platform that has a wide selection of cryptocurrencies and has high liquidity across all trading pairs. You should also consider fiat payment options and low fees, but the digital coins available should be your main focus. CoinSwitch and Kucoin are great examples of altcoin exchanges that we have reviewed.

- The cheapest cryptocurrency exchanges: The exchange site with the lowest trading fees isn’t always the best, which is why you should also look at the spreads. Make sure the transaction fees are also reasonable. If you’re just trading bitcoin with Australian dollars, Coinjar is the best option. For altcoin trading with AUD, swifts should be your go-to site, while Binance is the cheapest for crypto-to-crypto trades.

- The largest cryptocurrency exchanges: The best way to measure how large an exchange platform is, is through its trading volume. High trading volume is a good indicator of how liquid and popular the site is. Currently, the largest site globally is Binance.

- The most popular cryptocurrency exchanges: Popularity is often an indicator of how reliable an exchange site is. It’s, however, difficult to measure because most exchange sites don’t disclose the number of active users that they have. All factors considered, the most popular sites are Coinbase and Binance.

- The best cryptocurrency trading platforms: The best crypto exchange sites in Australia are all rounded. They have a reasonable number of digital assets, have an easy interface, are secure, and have a good reputation. Swyftx is undoubtedly the best overall.

- The safest cryptocurrency exchanges: These sites have strict security protocols and have never been hacked. The most secure site right now is Coinspot.

- The best decentralized exchanges. These types of platforms do not have a middle-man and rely on liquidity pools to fulfill trades. Some of the best crypto DEXs to use in Australia are PancakeSwap and UniSwap.

- Cryptocurrency exchanges that don’t require ID: To trade on most Australian exchange sites, you need to have your identity verified. Some traders, however, consider this as a breach of their privacy. The only place you can trade without providing your ID id on peer-to-peer exchange sites.

- Cryptocurrency exchanges where you can pay with cash: One of the sites where you can buy Cryptocurrency using cash is Coinspot. There are also bitcoin ATMs in Australia that allow you to buy BTC conveniently.

Start Cryptocurrency Trading in Australia Today!

Cryptocurrency trading can be highly profitable, but the first step is choosing the right exchange platform. Ensure you consider factors such as security, customer support, trading fees, and cryptocurrency selection.

You should also go for a site that is in alignment with your trading expertise.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.