How To Buy Crypto With A Credit Card In Australia

Last Updated on July 14, 2023 by Kevin GrovesCredit cards have received increasingly more support from the most popular crypto exchanges in Australia as a means to quickly buy cryptos. They offer a fast, simple, and convenient way to add assets to your portfolio whilst avoiding lengthy transaction approval times by banks.

In the tutorial below, we show you how to use a credit card to buy digital currencies from a top Australian crypto exchange, Swyftx.

Using A Credit Card To Buy Crypto In Australia

The use of credit cards to purchase digital currencies such as Bitcoin and Ethereum can be done in five easy steps, which are summarised below.

- Create an account with a trustworthy Australian crypto exchange that accepts credit card payments such as Swyftx.

- Verify your identity by submitting a copy of your passport or driver’s licence. The Know Your Customer (KYC) process is is a mandatory requirement for Australian exchanges to ensure compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) requirements.

- Fund your account with cash by clicking on “Deposit/Receive”. Select “Australian Dollars”, then “Card” as the payment option. Enter the amount of AUD to deposit into your account and click “Continue”. This will take you to Swyftx’s payment provider, Banxa.

- Enter your credit card details and confirm the transaction on the Banxa interface. If this is your first time then Banxa will need to verify your ID (driver’s licence/passport and facial recognition).

- Buy crypto on Swyftx. Go to “Trade” on the Swyftx dashboard, select the crypto or crypto bundle to buy and confirm the transaction. The purchased crypto will be near-instantly transferred into your Swyftx wallet.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Guide On Buying Crypto With A Credit Card In Australia

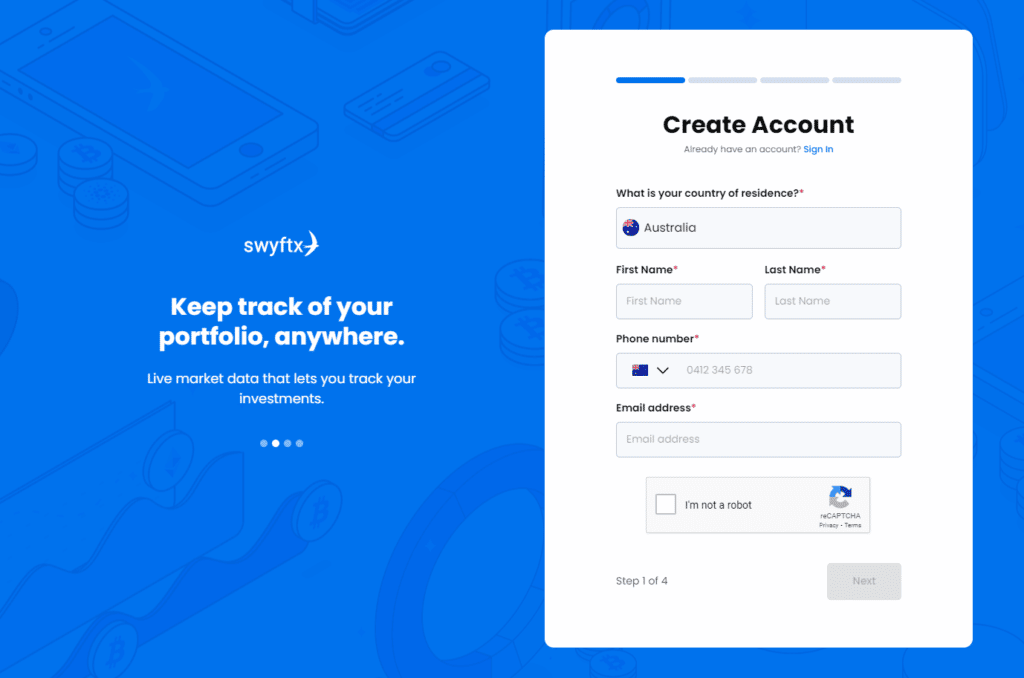

Step 1: Create an account with a crypto exchange

Using our Swyftx referral link to collect $20 of free Bitcoin, go to the Swyftx website and click on the “Sign Up” button. This will redirect you to the registration page where an email address, password, and phone number will be required to be provided. Once the details are entered, accept the terms and conditions and click on “Create Account”.

For more information, you can our comprehensive Swyftx review that covers its features, account financing options, fees, and more.

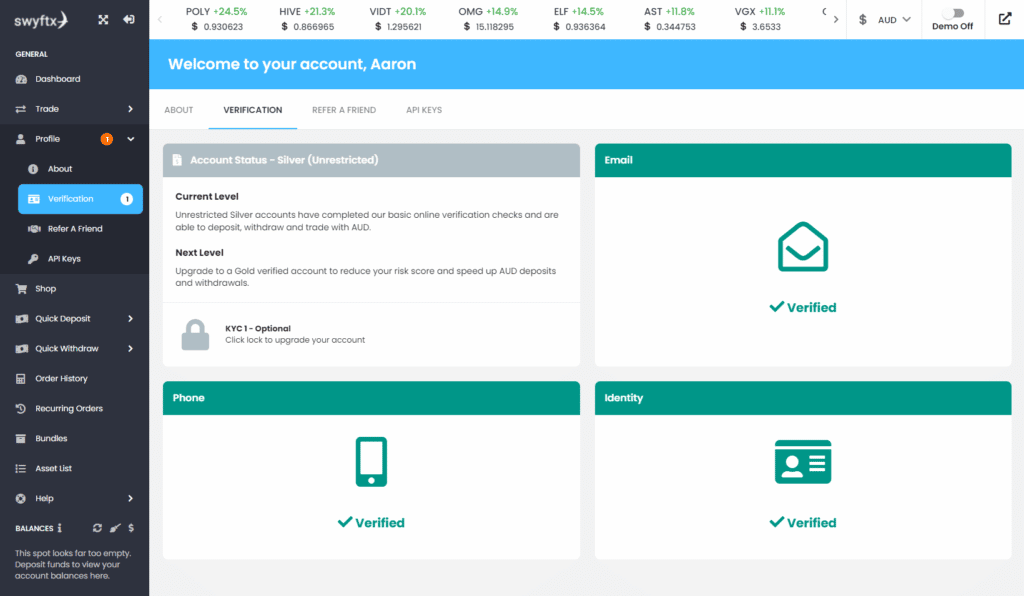

Step 2: Verify your identity

Using the new login details, login into the Swyftx account to commence the ID verification process. Since Swyftx is registered with AUSTRAC, it is legally required under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 to obtain customer details and verify identities. This process is known as Know Your Customer (PYC) and it needs to be completed before money can be deposited into your account wallet.

To verify your identity, you can choose from electronically submitting your Australian passport or driver’s licence, and the whole can process can be completed in 3 minutes.

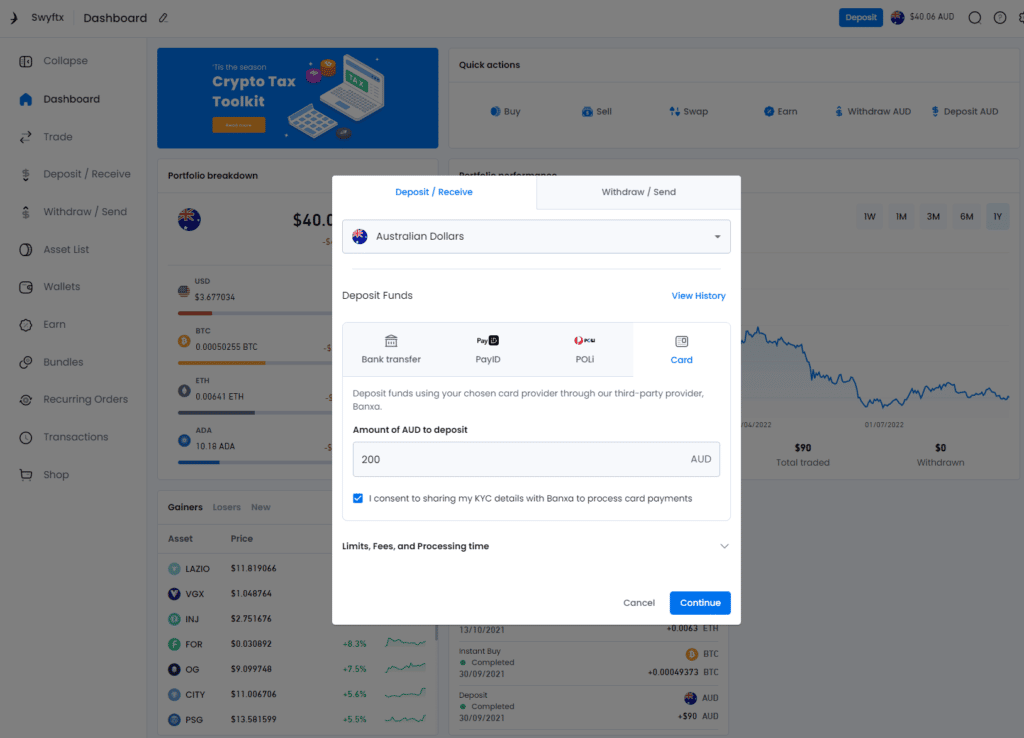

Step 3: Deposit money into your account

On Swyftx, you cannot directly purchase crypto with a credit card. Instead, you will need to use your Visa or Mastercard to deposit cash into your account before buying digital currencies.

To do this, find and select “Deposit/Receive” on your dashboard. A panel will appear where you can select Australian Dollars (AUD) as the asset to deposit, and “Card” as the payment option. Enter the amount of money to transfer, noting that the minimum and maximum daily limits are $75 and $15,000, respectively. A total limit of $60,000 applies per month.

Clicking “Continue” will take you to Banxa, Swyftx payment provider partner.

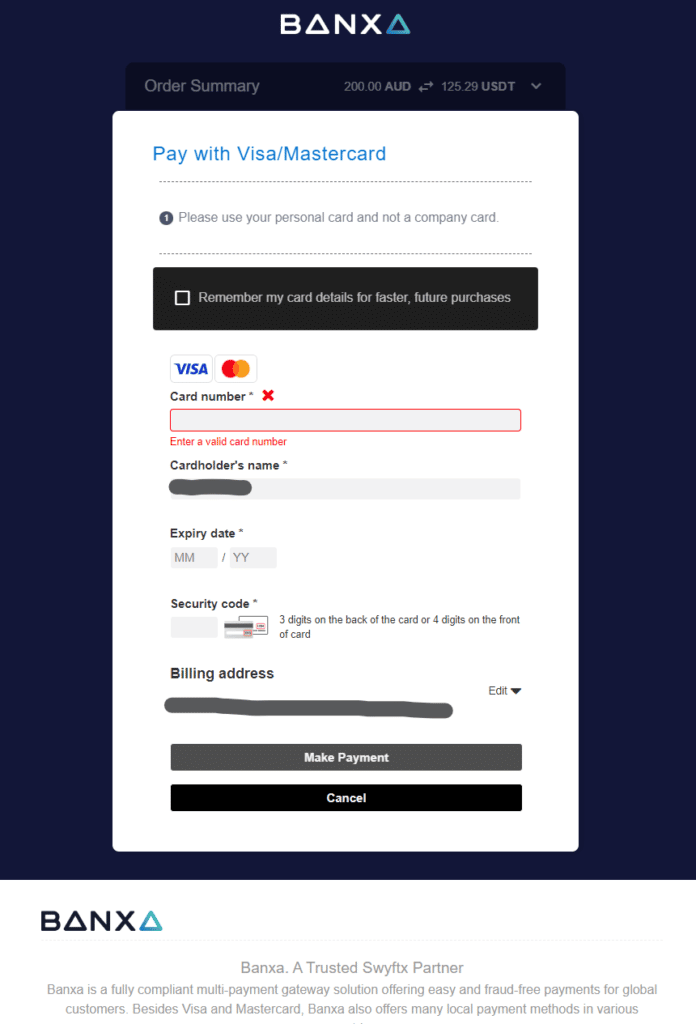

Step 4: Enter the transaction on Banxa

Once you arrive at the Banxa interface, you can enter your Visa or Mastercard details. If this is your first time using purchasing crypto with a credit card on Swyftx, then expect to see Banxa ask to verify your identity. Similar to the Swyftx account set up process, you can submit your driver’s licence or passport. A facial recognition check will be required that can be completed using your desktop or laptop camera, or your mobile device.

Before proceeding, review the transaction details including the fees (3.6% plus a spread of up to 4%) and the amount of crypto that will be received.

Step 5: Buy crypto

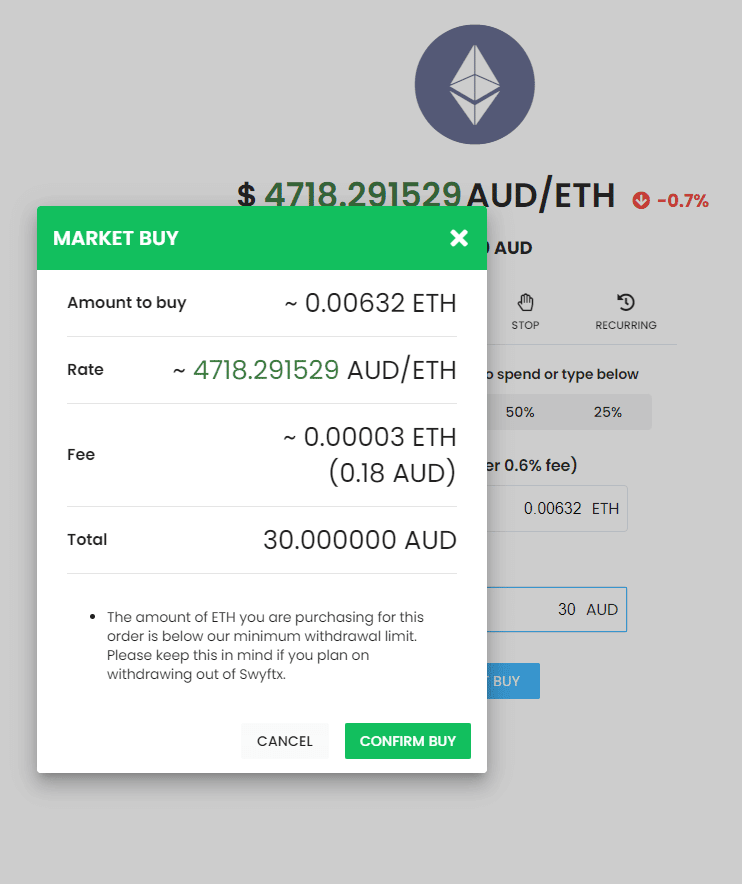

On the Swyftx dashboard, navigate to the “Trade” window and find the digital currency you wish to buy using the deposited funds. Enter in the amount of AUD to spend, review the transaction details and confirm if you want to proceed. Once you complete the transaction, the digital assets that you bought will be near-instantly transferred into your Swyftx wallet it can be tracked and managed as part of your crypto portfolio.

If you have any problems during the credit card deposit just contact Swyftx’s excellent customer support team via the 24/7 chatbot, email or by phone.

Can I Buy Crypto With A Credit Card?

Yes, some Australian crypto exchanges and brokerage platforms support credit cards as a way of funding your account to buy crypto or directly purchasing them. Of the exchanges that let you use credit cards, their fees will be typically higher than other commonly used payment methods since the service is facilitated through a third-party payment provider such as Banxa. Secure and reliable Australian exchanges that we have reviewed where you can buy crypto with credit cards include Swyftx, Binance Australia, CEX.IO, and Coinbase.

Is It Safe To Buy Crypto Via Credit Card?

Credit cards are not immune to fraudulent activity and internet scams. Using a credit card to buy cryptocurrencies will carry some risks since you are providing sensitive information including credit card details. However, this can be mitigated by using an AUSTRAC-registered crypto exchange that has a strong security track record. You should be sure that you are participating on the official website of the crypto exchange.

What Are The Fees To Buy Crypto With A Credit Card?

The fees to buy digital currencies using a credit card are highly variable depending on the trading exchange you are using. In Australia, credit card fees to buy crypto generally range from 1% to 4% and don’t include spreads or any additional fees incurred by your credit card provider.

As seen in the table below, you might incur foreign currency conversion fees as some exchanges charge their fees in USD. The fees may even depend on if your credit card is Visa or Mastercard. On top of this, you should check with your credit card provider if the purchase of crypto is treated as a cash advance as this might attract a higher interest rate.

| Crypto Exchange | Credit Card Fees |

|---|---|

| Swyftx (via Banxa) | 3.6% plus a 4% spread |

| Binance Australia (via SWIFT) | $15 USD |

| CoinJar | 2% |

| Crypto.com | 1% – 4% |

| eToro Australia | None |

| Bybit | 2.70% (Mastercard), 3.05% (Visa) |

| CoinSpot | 2.58% |

Pros & Cons Of Using A Credit Card To Buy Crypto

Using a credit card to buy crypto from an exchange is a fast and convenient way of adding assets to your portfolio. However, the benefits the payment method provides do come with several disadvantages and limitations.

Pros:

Cons:

Frequently Asked Questions

Can I use credit cards on CoinSpot?

Yes, you can use a credit or debit card to quickly buy cryptocurrencies on CoinSpot. At the time of writing, CoinSpot currently charges a fee of 2.58% for you to deposit cash with your Visa or Mastercard. You can then use the funds to near-instantly buy a range of cryptocurrencies such as Bitcoin and Ethereum. A $200 daily limit applies.

Is it legal to buy crypto with a credit card?

Yes, it is legal to use your Visa or Mastercard to purchase cryptocurrencies in Australia. Several Aussie crypto exchanges support the use of credit cards to either fund your account or directly make crypto purchases.

Can you sell crypto back to a credit card?

A lot of cryptocurrency exchanges support the withdrawal of AUD into an Australian bank account. However, selling crypto back into a credit card is not currently supported.

Can I buy Bitcoin with a credit card?

Yes, buying Bitcoin with a credit card is possible on many Australian crypto exchanges such as Swyftx and CoinSpot.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.