If you’re looking to buy cryptocurrency in Australia, this step-by-step guide is perfect for you. You’ll discover everything you need to know and what you need to get started.

Buying cryptocurrencies like Bitcoin and altcoins might sound overwhelming, particularly if you haven’t done it before. Where is the safest and easiest place to buy crypto and how do you do it? The first step is to find a reputable Australian crypto exchange.

How To Buy Crypto In Australia: A Quick Overview

Australians can easily purchase digital currencies from a cryptocurrency exchange. With convenience, security, and value for money in mind, here’s a quick summary of how you can buy crypto in 5 steps.

- Create an account with an AUSTRAC-registered Australian exchange or brokerage platform that accepts Australian Dollars (AUD) as payment for crypto. A trusted and local trading platform is Swyftx.

- Satisfy Know-Your-Customer (KYC) requirements by verifying your identity. You can either choose to submit a photo of your Australian passport or driver’s licence. of your passport or driver’s licence. This is a mandatory process that exchanges are legally required to complete before you can fund your account.

- Using one of the supported methods, fund your account by depositing Australian Dollars. Popular payment methods include bank transfers, POLi, BPAY, PayID, cash deposits (via Blueshyft), and credit/debit cards.

- Enter the details of the crypto purchase. Under the ‘Trade’ menu, select the digital asset you wish to buy, then select ‘Buy’. Enter the amount of crypto to buy and press ‘Review’.

- Review the details and confirm the purchase. Swyftx will present a summary of the transaction including Go to “Trade” on the Swyftx dashboard, select the crypto or crypto bundle to buy and confirm the transaction. The purchased crypto will be near-instantly transferred into your Swyftx wallet.

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

How To Buy Crypto In Australia: Full Tutorial

Step 1: Create an account with an exchange

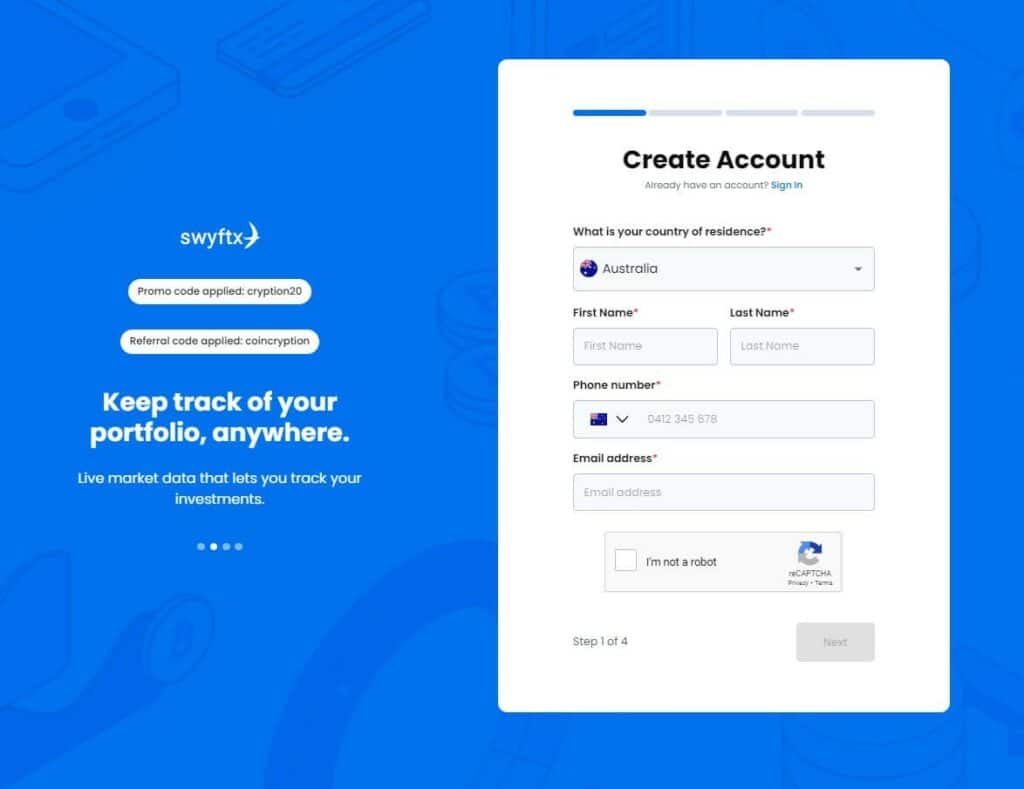

Visit the Swyftx website and click on the “Sign Up” button. This will redirect you to the registration page where an email address, password, and phone number will be required to be provided. As shown in the below image, our referral code “CoinCryption” will be presented as well as our promotional code “Cryption20” where you will receive $20 of free Bitcoin. For more information on how this works, you can read about our Swyftx referral link.

Once the details are entered, accept the terms and conditions and click on “Create Account”.

For more information, you can our comprehensive Swyftx review that covers its features, account financing options, fees, and more.

Step 2: Verify your identity

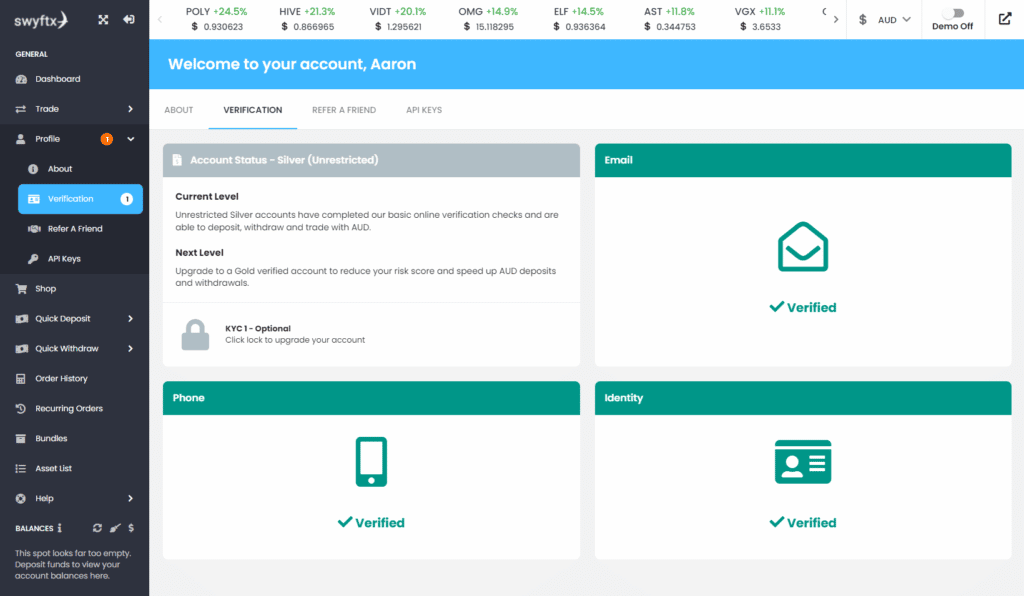

Log into your new Swyftx account to commence the ID verification process. Under your profile, click on ‘Verification’. This is a mandatory process that all Australian crypto exchanges and brokerages are legally required to satisfy the provisions of the Anti-Money Laundering and Counter-Terrorism Financing Act 2006.

Your role in this is essentially proving your identity. On Swyftx, you can choose to upload a photo of your Australian passport or driver’s licence for Swyftx to verify. Overall, the process is efficient and streamlined. If you’re using a desktop computer, Swyftx will prompt you to use your mobile device and scan the QR code provided. You can then take a photo of your documentation and submit them online. Of course, this entire process is also able to be completed using the Swyftx mobile app.

Providing basic personal details and uploading your ID documentation is required before any AUD funds can be deposited. However, it should only take 3 or 4 minutes to complete. In our experience, we waited about an hour (on a weekday) before we received email confirmation that our identity has been successfully verified.

Step 3: Fund your account with AUD

Swyftx is one of the better crypto exchanges when it comes to account financing options. If you like having flexibility on how you finance your account, then you can also consider CoinSpot with its multitude of supported methods.

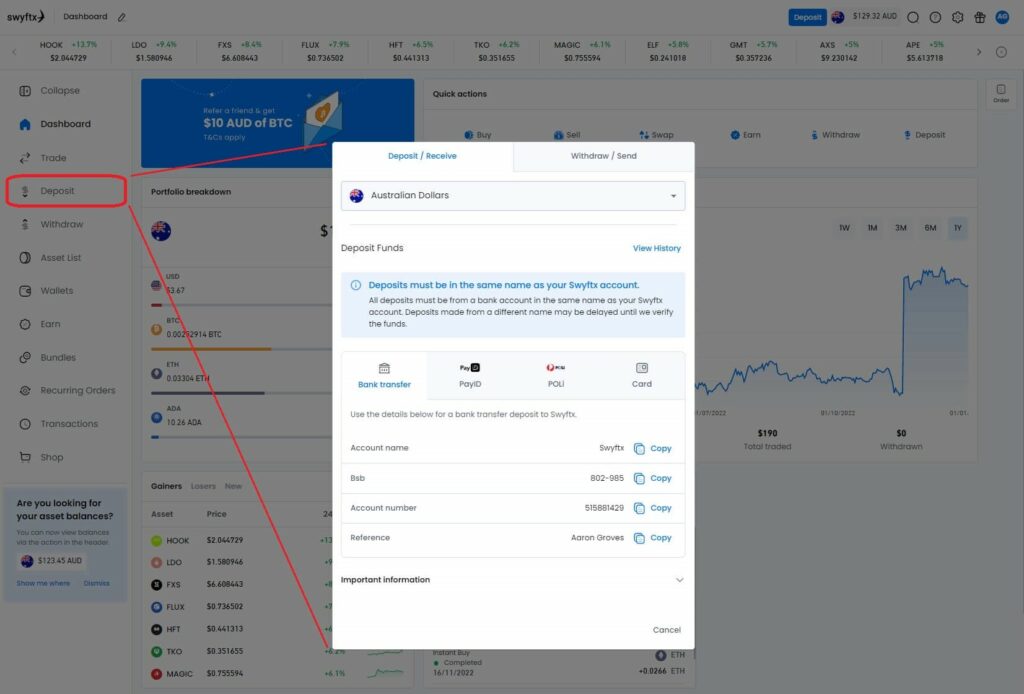

Swyftx allows you to fund your wallet using a variety of methods to buy crypto including transfers from an Australian bank account, PayID, POLi, and credit/debit cards. Most major banks are supported, so you can buy crypto with Commbank and other banking apps. To begin the process, select ‘Deposit’ on the left-hand navigation panel. This will bring up a window (as shown in the image below) where Australian Dollars can be chosen as the asset to deposit.

For this guide, we opted for bank transfers since they are near-instant. It should be noted that all wallet funding methods carry a $30 minimum limit which shouldn’t inconvenience many users. The exception lies with purchases from a credit/debit card where a $75 minimum applies.

After a couple of minutes, the money that you transferred will be seen as a ‘deposit’ in your Swyftx wallet. Now you can begin buying digital currencies.

Step 4: Select the crypto to buy

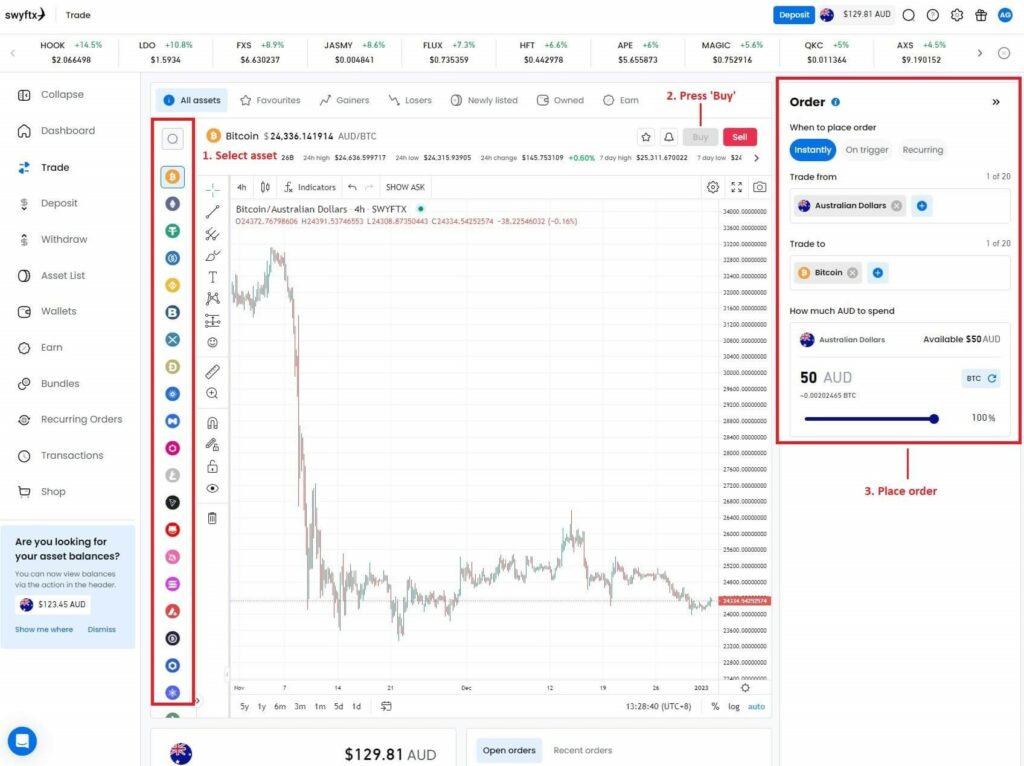

Once you’re Swyftx wallet has been funded, select the ‘Trade’ button on the left-hand navigation panel. This is where you can buy and sell over 320 cryptocurrencies. Next, select the cryptocurrency that you wish to buy with AUD buy by using the text box or scrolling through the list of supported assets.

For each crypto that you select, Swyftx will present the real-time pricing chart as well as a suite of advanced drawing tools and indicators if you’re able to analyse the price action. To buy the asset, click on the green ‘Buy’ in the top right-hand corner. After doing so, a buying panel will appear where you enter how much AUD you wish to spend.

At this point, you have some options on how you want to buy your crypto. You can make an instant purchase, set up a trigger order, or implement recurring purchases.

- Instant Buy: Exchanges your AUD for the desired crypto with the assets near-instantly transferred into your wallet.

- Trigger Orders: Enter a price point where you want Swyftx to automatically purchase the crypto at. If the real-time market price equals the indicated price then the transaction will be executed.

- Recurring Orders: Otherwise known as Dollar Cost Averaging, this will automatically use your money to buy crypto at set amounts and at regular timeframes (e.g. daily, monthly). This is a beginner-friendly way slowly accumulating crypto whilst minimising the effects of price volatility.

For most people, instant orders and DCA are the easiest ways of buying crypto in Australia. Applying trigger orders requires some knowledge of market price trends. Once you’re happy with the amount of money to spend, click on ‘Review’.

Step 5: Review and confirm the purchase

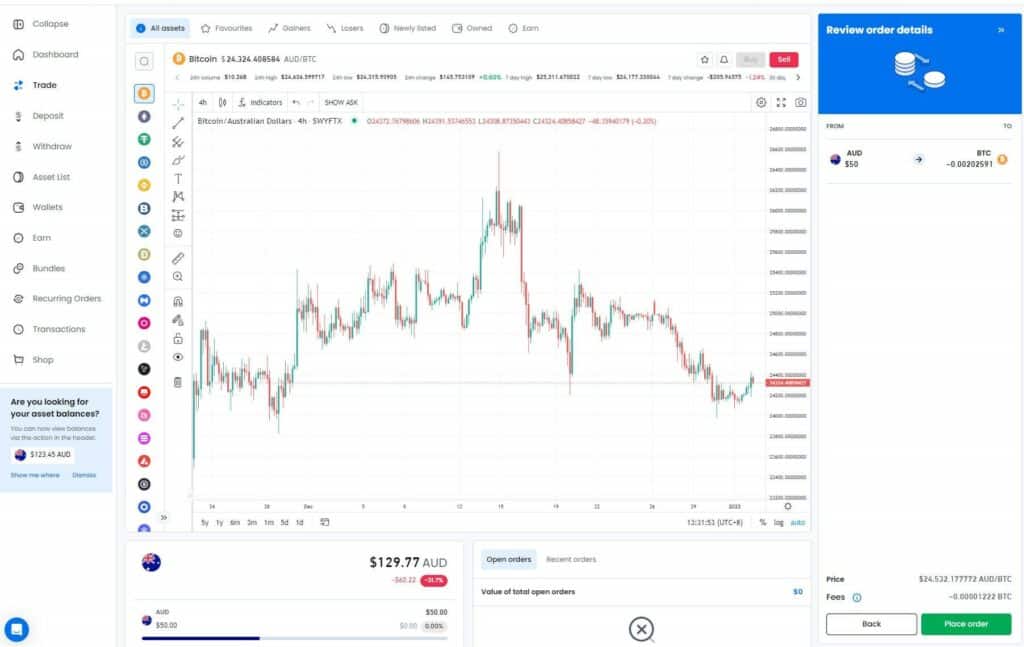

The fifth and final step of buying crypto on Swyftx is to review the details of the transaction. The details to look at include the amount of AUD being spent, the asset being purchased, and the trading fees being incurred.

For all buy and sell orders, Swyftx charges a flat fee of 0.6%. Compared to other popular crypto exchanges and brokerage platforms such as CoinSpot and CoinJar, this is very competitive. Whilst the Swyftx trading fee is more expensive than Binance (0.1%), the downside to Binance Australia is that you need to be fairly experienced with using an exchange. Swyftx offers value for money on top of an easy-to-use and streamlined interface.

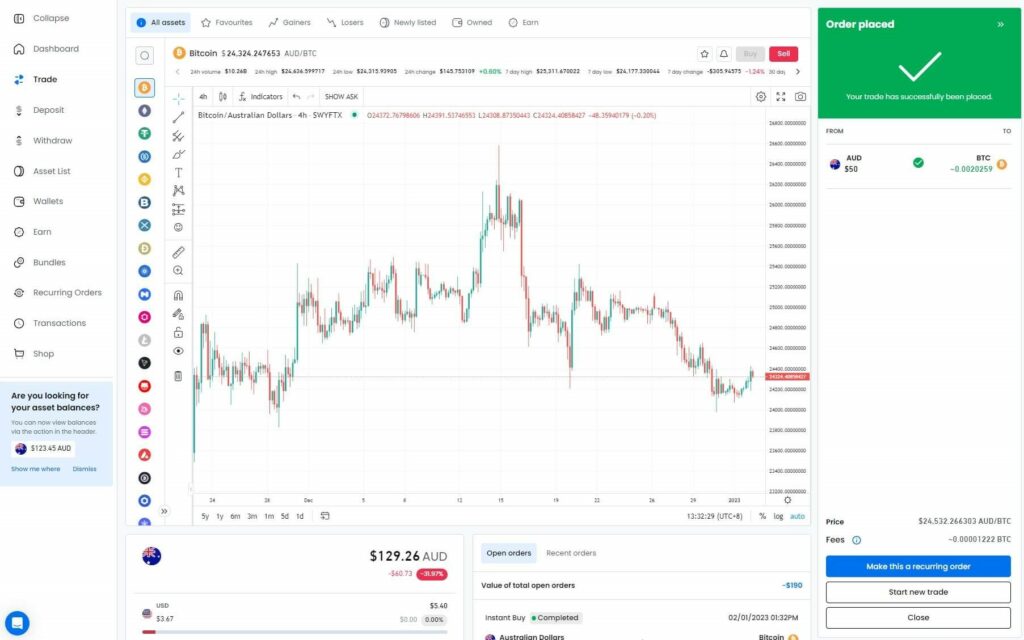

If you’re happy that the details are correct, then clicking on ‘Place order’ will execute the transaction. The purchased digital currencies will be near-instantly transferred into your Swyftx wallet. Clicking on ‘Wallets’ using the left-hand navigational panel will present you with a breakdown of the assets you hold in your portfolio.

What Is Cryptocurrency?

Cryptocurrency is a form of digital currency that utilizes encryption techniques to regulate the generation of currency units, verify transactions, and provide security. There are two categories of cryptocurrencies: Fiat-backed and Non-fiat backed. They are both created without the need for a central bank or any regulatory authority which makes them decentralized.

How Does Cryptocurrency Work?

Cryptocurrencies use cryptography to secure transactions and control the generation of new coins. A cryptocurrency is difficult to counterfeit because it is based on cryptography. Cryptography can also be used to create new coins – this process is called mining.

Should You Buy Crypto?

Whether or not you should buy crypto depends on your individual financial situation, investment goals, and risk tolerance. Cryptocurrencies such as Bitcoin and Ethereum are a volatile asset class and are often regarded as high-risk investments. Before investing in crypto, it’s important to conduct your own research and understand the potential risks involved. If you do plan on buying digital currencies then a good rule of thumb is to only invest the amount of money that you are ok losing.

Cryptocurrency Ownership In Australia

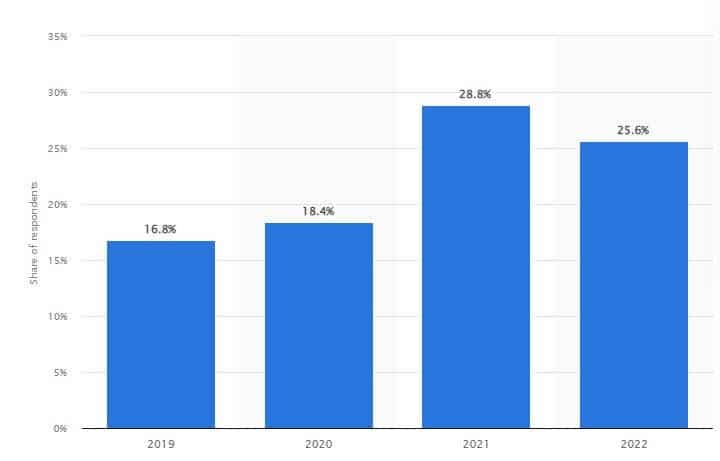

In recent years, digital currencies have fast become a popular investment asset for many Australians. According to a study conducted by Statista, cryptocurrency ownership generally increased from 2019 to 2022 when 25.6% of Australians possessed crypto assets.

Similarly, a 2022 study by Roy Morgan discovered that the dominant demographic who incorporated cryptocurrencies as part of their investment portfolio were males under the age of 35. Whilst their numbers were comparatively lower, Australians over the age of 50 possessed the largest investments with an average value of $56,200. In comparison, the average portfolio size for Australians aged between 18 and 24 was only $2,600.

The Benefits Of Investing In Cryptocurrencies

Higher than average returns

The market value performance of cryptocurrencies, especially Bitcoin and Ethereum, has generally surpassed the growth of traditional investment assets such as stocks and ETFs. Despite their high volatility, digital currencies such as Bitcoin have emerged as the better performers over the past decade. In fact, traditional investment vehicles such as the S&P 500 have been outperformed by crypto assets in 7 of those 10 years.

Diversify your portfolio

Diverse investment portfolios are attractive and financially smart since you don’t have all your eggs in one basket. Investing in digital currencies can be a great way to diversify an investment portfolio. Despite being a relatively new asset class that comes with a high degree of volatility, cryptocurrencies still present Australians with exposure to a potentially high-yielding asset.

For beginners and the risk-averse, slowly buying the crypto with the largest market capitalisation is the best way forward. This is opposed to purchasing a range of altcoins where their value of time has been questionable unless you know what you’re doing.

When investing in crypto, it is important to do extensive research and create a diversified portfolio to ensure that any potential losses are minimized. It is also important to remember that the performance of cryptocurrency investments is highly speculative and there is no guarantee of success. With the right research, however, crypto can be a great way to diversify an investment portfolio.

Stores of appreciating value

In Australia, cryptocurrencies are not regarded by the ATO as forms of traditional currency. Instead, they are considered assets or property that can be accumulated in the hope that they slowly appreciate in value over the long term. Bitcoin, the cryptocurrency with the largest market capitalisation, is often regarded as an asset with a long-term store of value.

The everyday utility is increasing

Rather than just being investment assets, the level of cryptocurrency adoption and use cases in everyday life is increasing. In recent years, the number of Australian merchants that are accepting Bitcoin as payment for goods and services has increased since 2019. The food and beverage industry, in particular, has quickly incorporated crypto as a payment class. Nowadays, there are numerous bars and restaurants in Australia where you can pay with crypto.

One of the original intentions of cryptocurrency was to provide an alternative to the traditional financial system. Today, crypto can be used to securely send and receive payments across the world, all without the need for an intermediatory third party such as a bank or financial institution.

Overall, the increasing number of applications that crypto can be used for ultimately means good things for its value. This, therefore, represents a benefit for those who choose to buy digital currencies.

Opportunities for growth

Almost all digital currency exchanges offer some sort of financial management products where you can passively grow your crypto holdings. For those who prefer to HODL, interest-earning wallets and crypto staking will generate interest over a period of time, however, their mechanisms are different.

An interest-earning wallet works similarly to a bank account where you deposit funds and earn interest over time. You deposit your crypto into a wallet and thereby lend it to the exchange, and you are rewarded with interest payments in return. The Annual Percentage Yield (APY) will depend on the crypto asset you deposit and the term duration. In some cases, yields can be higher than the interest rates offered by banks on your money. For example, APYs on popular stablecoins USDT and DAI can be as high as 8% APY.

On the other hand, cryptocurrency staking is the process of designating your coins to a blockchain network to assist in its development or take part in network governance. The best crypto staking platforms in Australia all comprise global exchanges since local companies are regulated to provide these services.

What Is The Best Australian Exchange To Buy Crypto?

Swyftx is the best Australian crypto exchange to buy digital assets such as Bitcoin with AUD. The AUSTRAC-registered brokerage offers competitive trading fees with low spreads, supports over 320 coins, a free demo mode, and TradingView charting. All of these features are integrated into a visually intuitive and simply designed interface that is highly suitable for beginners.

Is Buying Crypto Safe In Australia?

Buying cryptocurrency in Australia is safe since all exchanges and platforms that accept AUD as a payment method need to be registered with AUSTRAC. However, not all exchanges and platforms are regulated. Although exchanges implement bank-like security measures in place such as 2-Factor Authentication (2FA), whitelisting, and encryption techniques, it is also prudent to keep your digital assets in a secure crypto storage wallet.

Which Crypto Should I Buy?

With the vast multitude of cryptocurrencies and blockchain projects available, as well as the influence of social media platforms, knowing which assets to buy as long-term investment options can quickly become confusing. If you’re not an astute and experienced trader then sticking to popular coins that have high market capitalisations is always a safe bet.

The articles below provide step-by-step instructions on how to use your money to buy some of the world’s most popular cryptocurrencies.

- Bitcoin (BTC)

- Ethereum (ETH)

- Decentraland (MANA)

- Solana (SOL)

- Cardano (ADA)

- Shiba Inu (SHIB)

- Dogecoin (DOGE)

Factors To Consider When Buying Cryptocurrencies

Although buying cryptocurrencies with your hard-earned money can be a simple task, there are a few things you need to consider to ensure that you’re getting the best deal.

Fees that offer value for money

Australians want value for money, and the fees that exchanges charge are one of the first things to consider. Most Australian crypto exchanges will let you deposit and withdraw fiat (i.e. AUD) and digital currencies for free. There are some exceptions where some payment methods might incur a minor fee. A popular example is CoinSpot where BPAY deposits will incur an annoying 0.9% fee. Luckily, CoinSpot offers several free deposit methods. For the most part, choose an exchange that charges zero fees to fund your account.

The differences between exchanges lie in their fee structures for buying, swapping. and selling cryptocurrencies. As a general rule, trading fees for locally owned and operated Australian exchanges range between 0.5% and 1%. Anything around 0.5% to 0.6% is considered to be highly competitive. Examples of value-for-money platforms include Independent Reserve (0.5%) and Swyftx (0.6%). For global crypto exchanges with large trading volumes and liquidity, trading fees that are a maximum of 0.1% can be considered as value for money.

If you prefer the convenience of using a credit or debit card to purchase cryptocurrencies for your portfolio then use an exchange that carries fees of around 2%. In Australia, credit/debit card fees typically range between 2% and 4%.

Convenient deposit methods

Before you can buy cryptocurrencies, you must first fund your account wallet. In Australia, commonly available deposit methods include bank transfers, POLi, PayID, BPAY, and cash deposit. Credit/debit cards can be used to directly buy crypto.

The payment method you choose will depend on your personal situation and what you consider to be convenient. One important thing to remember is that some exchanges provide more than a few methods, whilst others are limited to one or two. The more free deposits to choose from the better.

Deposit methods such as bank transfers (OSKO), POLi, PayID, and BPAY will transfer your money into your wallet in a matter of minutes. Moreover, depending on the method you choose, there will be a minimum amount you can deposit. In Australia, minimum deposits generally range from $30 to $50 which shouldn’t inconvenience most investors.

Frequently Asked Questions

Is buying crypto legal in Australia?

Using AUD to buy cryptocurrency is legal in Australia, but it is not regulated. This means that there are no laws or regulations in place to protect investors. Australia has a number of agencies that are looking into the regulation of cryptocurrencies. They are considering the introduction of rules and regulations for cryptocurrency exchanges, ICOs, and cryptocurrency wallets.

Do I pay tax on crypto?

Yes, you do need to pay tax on crypto. You will pay tax on any profit or income that you derive from your cryptocurrency transactions. If you do not derive any profit or income then you will not need to pay tax on your cryptocurrency transactions. You can read all about crypto tax in Australia and also find out which tax platforms are good for crypto.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.