Anthony Pompliano’s Net Worth

Last Updated on December 24, 2023 by Kevin GrovesThis article explores the background of popular cryptocurrency figure, Anthony “Pomp” Pompliano, and his estimated wealth.

What Is The Net Worth Of Anthony Pompliano?

Anthony Pompliano’s net worth is estimated to be in the vicinity of $100 to 200 million, however, this is heavily dependent on the price of Bitcoin since 80% of his wealth is based on the digital asset being held. The remainder of his net worth comprises a multitude of wealth streams including private ventures and investments that are likely to include real estate, board membership and advisory roles, and his social media platforms.

Sources Of Anthony Pompliano’s Wealth

Anthony Pompliano has a diverse background ranging from technology to finance to social media. As such, the entrepreneur is known to have several sources of wealth that contribute to his overall net worth. The Bitcoin Anthony Pompliano holds accounts for more than 80% of his net worth, with the remaining 20% comprising real estate funds and assets, cash and funds from start-up investments and entrepreneurial ventures.

Entrepreneurial ventures

Throughout his career, Pompliano has been involved in various entrepreneurial ventures including the co-founding of companies in the cryptocurrency and blockchain industry. Some of his business endeavours include the following:

- Co-Founder and Partner at Full Tilt Capital between 2016 and 2018, a venture capital firm that focuses on investing in early-stage startups, particularly those involved in blockchain technology, cryptocurrencies, and decentralised finance. Full Tilt Capital was later acquired by his next company, Morgan Creek Digital.

- Co-Founder and Partner at Morgan Creek Digital between 2018 and 2020, an arm of Morgan Creek Capital Management, is a firm that focuses on and invests in new technologies in the blockchain, artificial intelligence, computer infrastructure and data space. In 2018, he invested $1 million of Morgan Creek Capital funds into Bitcoin.

- Board Member of Figure Technologies, a blockchain-based lending firm.

- Acts as an advisor to several blockchain-related companies in the crypto space including Lolli and Lunar.

Investments

As an active crypto influencer, Pompliano has made strategic investments in various start-ups, cryptocurrencies, and blockchain projects. His investment portfolio includes both early-stage and established companies that have the potential for substantial returns. He also holds a majority stake in several companies.

However, one of the key factors behind his net worth would be the early investment in Bitcoin and other cryptocurrencies where they have substantially appreciated in value over a long period of time. His early Bitcoin investment has propelled his net worth such that the digital asset accounts for over 80% of his wealth.

Anthony has also made multiple business investments in non-crypto-related ventures. In January 2022, Pompliano helped Athletic Greens raise $115 million to increase its nutrition brand across the globe. He has also invested in over 30 companies such as Wilder World, Assemble, Nelo, Eight Sleep, and Whalemap.

Podcasts and social media

Pompliano’s popular podcast, “The Pomp Podcast,” has grown in popularity and likely generates income through advertisements, sponsorships, and partnerships with other businesses. His media presence, including public speaking engagements and contributions to media outlets, may also be sources of income.

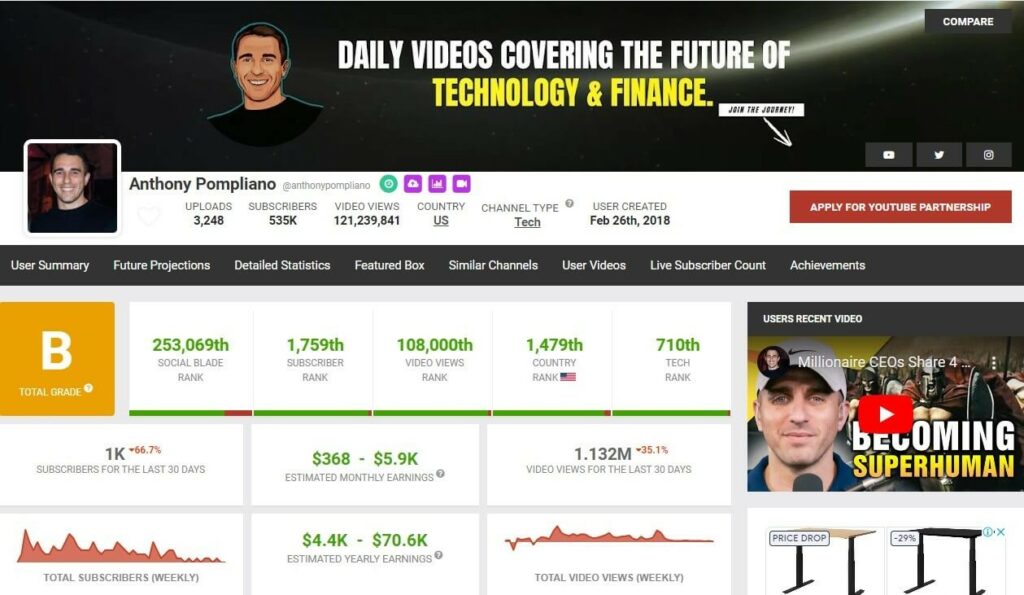

Pompliano’s YouTube channel has over 535,000 subscribers and he would be earning a semi-passive income through advertising and sponsorship deals. According to Social Blade, his annual income would be in the vicinity of $70,000, however, the channel itself could be valued at approximately $300,000.

Public speaking and consulting

Pompliano’s expertise in the cryptocurrency and blockchain space has made him a sought-after speaker at conferences and events. He may receive speaking fees and consulting fees for providing insights and advice to businesses and organisations. He has served the role of advisor to several blockchain-based companies such as Lolli and Lunar.

Anthony is also a frequent guest on several TV shows including CNBC, Fox and CNN where he discussed cryptocurrency-related issues, and the state and direction of the industry as a whole. Whether the entrepreneur receives payment for undertaking interviews is unknown.

Estimating Anthony Pompliano Net Worth

Pompliano has recently revealed that the majority of his net worth centres on the Bitcoin he purchased in its early days and still holds. The amount of Bitcoin the podcaster holds is unknown but is likely to be substantial. And given the rise of Bitcoin’s value since 2009, the digital asset is a major contributor to his wealth.

His involvement in start-ups and strategic investments has generated a lot of his wealth and his majority stakes in several blockchain-related companies are key contributors. However, his net worth was largely affected by the downfall of the crypto lending platform BlockFi where owned a majority stake.

A minor portion of his wealth comes from real estate and social media where he has accumulated a large follower base.

Pompliano’s net worth is predominantly built upon his entrepreneurial ventures and partnerships. However, his net worth would be affected by market outlook, investment performance, and his current business activities.

Is Anthony Pompliano A Billionaire?

Anthony Pompliano is unlikely to have been a billionaire during his career. His net worth is estimated to be in the vicinity of $100 to $200 million but likely reached $300 to $400 million during the 2019 and 2020 crypto bull market.

About Anthony Pompliano

Affectionately known as “Pomp”, Anthony Pompliano is an American entrepreneur, investor and public figure who is best known for his strong advocacy for Bitcoin and the use cases for blockchain technology. With a background in traditional finance and a keen interest in technology, Pomp was diverted to the world of cryptocurrencies where he was an early investor in Bitcoin.

With an educational background in economics and sociology, Pompliano took a keen interest in technology at a young age. This diverted his attention to the world of blockchain technology and cryptocurrencies, especially Bitcoin. Since then, he has successfully combined his advocacy for Bitcoin and other investment assets with his natural ability to convey complex topics and ideas in an accessible manner that has quickly earned him a reputation and following.

His reputation and expertise became apparent through his podcast, “The Pomp Podcast” where he frequently invites prominent figures in the financial and cryptocurrency space.

Pompliano’s bullish stance on cryptocurrencies, combined with his expertise, attracted attention from both seasoned investors and newcomers. He successfully transitioned from traditional finance to becoming a leading voice in the cryptocurrency industry.

| Name | Anthony Pompliano |

| Nationality | American |

| Date of birth | 2 April 1988 |

| Place of birth | North Carolina |

| Estimated net worth | $100 to $200 million |

| Source of wealth | Bitcoin, private ventures, majority corporate stakes, social media, partnerships |

| Education | Bachelor of Science in Economics and Sociology (Bucknell University) |

| Profession | Entrepreneur, investor |

Early life

Born in North Carolina on 2 April 1988, Pompliano graduated from Cardinal Gibbons High School. From a young age, he exhibited a keen interest in finance and technology from an early age which lead him to obtain a Bachelor of Science in Economics and Sociology from Bucknell University and then delved into the financial world gaining experience in asset management and growth strategies.

Between 2006 and 2012 he served as a Sergeant in the US Army which included two deployments as part of Iraqi Operation Freedom.

Career

Prior to the cryptocurrency space, Anthony was involved in social media where he founded Digaforce, a social media company that focussed on promoting unfiltered free speech. Later, he joined Facebook in San Fransisco as a Product Manager between 2014 and 2015 where he led the Growth Team for Snapchat.

Pompliano’s expertise in traditional finance combined with his interest in technology and visionary mindset led to him becoming a prominent figure in the cryptocurrency industry. His entrepreneurial journey began in 2016 when he co-founded Full Tilt Capital, a cryptocurrency investment firm that focuses on decentralised finance and blockchain technologies.

This was acquired by Morgan Creek Digital which he also co-founded. He was a Partner at the digital asset management firm for two years until 2018.

Frequently Asked Questions

How did Pomp make his money?

Anthony “Pomp” Pompliano has made his wealth from a variety of avenues including several corporate start-ups, private investments in over 30 companies, strategic ventures in the cryptocurrency space, and social media. His strong views and advocacy for Bitcoin and other digital currencies and their real-world use cases have been propelled by his podcast, “The Pomp Podcast,” as well as his active involvement in the community where he is a frequent guest on television shows.

Where did Anthony Pompliano go to college?

After graduating from Cardinal Gibbons High School in Fort Lauderdale, Florida, Anthony Pompliano obtained his Bachelor of Science in Economics and Sociology from Bucknell University.

Conclusion

Anthony Pompliano generated his wealth and achieved financial success through a combination of early investment into Bitcoin, and several business start-ups where he holds a majority ownership stake. His public profile and reputation as a defender of cryptocurrencies and their application in real-world use cases come off the back of his podcast and social media platforms as well as his participation in television interviews.

Related reading:

- Do Kwon’s Net Worth: Is He Still Wealthy?

- Anatoly Yakovenko Net Worth (Solana Founder)

- Jesse Powell net worth after founding Kraken

- Chamath Palihapitiya Net Worth

- What is the net wealth of Mike Novogratz?

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.