Phemex Review: Is It Good For Aussies?

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Last Updated on December 24, 2023 by Kevin GrovesPhemex is known for its incredibly fast and reliable trading engine that executes derivatives trades rapidly. But the crypto exchange has made inroads to make its contract trading more accessible to newer traders. Read our full Phemex review to see if it’s the right exchange for you.

Phemex

Trading fees:

Spot: 0.1% maker / 0.1% taker

Number of cryptos:

189

Deposit methods:

Credit card, wire transfer, crypto

Supported countries:

Global (including Australia)

Promotion:

None available at this time

The Bottom Line

Phemex is a globally popular derivatives trading platform that has expanded its services to include financial management products as well as other ancillary services to rival its larger exchange counterparts. However, its derivatives (contracts) trading still remains its strength due to its low cost, 100x leverage, quick order execution, hundreds of trading pairs, and an unblemished security record.

Although experienced traders will see Phemex as a desirable platform for trading contracts, several additions to the platform’s features help it palatable for novices. Items such as the demo account, copy-trading, and visually intuitive interface go a long way to making the experience easier for traders starting out with derivatives. As a result, Phemex shapes up as an ideal derivatives platform for a broad range of experience levels.

What we liked:

- A simple, no-fuss design and layout.

- Highly competitive fees.

- Features to ease novices into derivatives trading.

What we didn’t like:

- No AUD trading pairs.

- The number of supported currencies is limited.

- A lack of deposit options.

At A Glance

Here is a quick summary of Phemex.

| Exchange Name | Phemex |

| Supported Countries | Global (including Australia) |

| Fiat Currencies Supported | EUR, GBP, AUD, USD, CHF, JPY, CAD |

| Supported Cryptocurrencies | 189 |

| Markets | Spot (with margin), derivatives (contracts) |

| Deposit Methods | Credit card, wire transfer, crypto |

| Deposit Fees | None (third party fees may apply) |

| Trading Fees | Spot: 0.1% maker and 0.1% taker Derivatives: 0.01% maker and 0.06% taker |

| Withdrawal Fees | None |

| Mobile App | Yes (Android, iOS) |

Can You Use Phemex In Australia?

Phemex can be used by Australians. The crypto exchange supports free AUD deposits from your bank account where it can be exchanged for 189 digital currencies such as Bitcoin and Ethereum. Australians have access to advanced spot, margin, and perpetual contracts trading.

Who Should Use Phemex?

Phemex is a low-cost and secure option for novices who want to delve into derivatives (contract) trading. The cryptocurrency exchange is astoundingly good for experienced traders but has continued to develop features to make it more appealing to newer traders. Features such as its copy-trading and demo account are there to assist newcomers to understand how contract trading works and the risks involved, and how to do it using Phemex. For astute traders, Phemex is certainly one of the top crypto exchanges that can execute trades with minimal price slippage, but there are no AUD trading pairs to work with.

Pros & Cons

Pros:

Cons:

Here’s What We Think of Phemex

Has a strong derivatives trading platform

Originally built as a derivatives trading platform, Phemex still retains this feature as one of its core strengths. Otherwise known as ‘contracts’ trading, Phemex provides experienced traders with USDT-M, USD-M, and COIN-M markets where USDT and USD can be used as margin, and BTC/ETH as collateral.

- USDT-M: 326 trading pairs with up to 100x leverage margin.

- USD-M: 14 trading pairs with up to 100x leverage margin.

- COIN-M: 2 trading pairs (BTC and ETH).

The Phemex trading engine is built upon a patent-protected raft protocol that has zero downtime. The high reliability is complemented by a transaction engine capable of executing 300,000 transactions per second with a response time of less than 1 millisecond. This more than accommodates Phemex’s significant trading volume and helps to mitigate against price slippage on your derivatives trades. There are few other crypto exchanges that come close to this level of performance, notably Bybit and Binance.

The Phemex trading interface comes stocked with the usual features you would expect from a premium derivatives trading platform. These include TradingView charting, live order books so you can assess the volume and spread of a trading pair, and a variety of order types such as market and limit orders for both long and short positions.

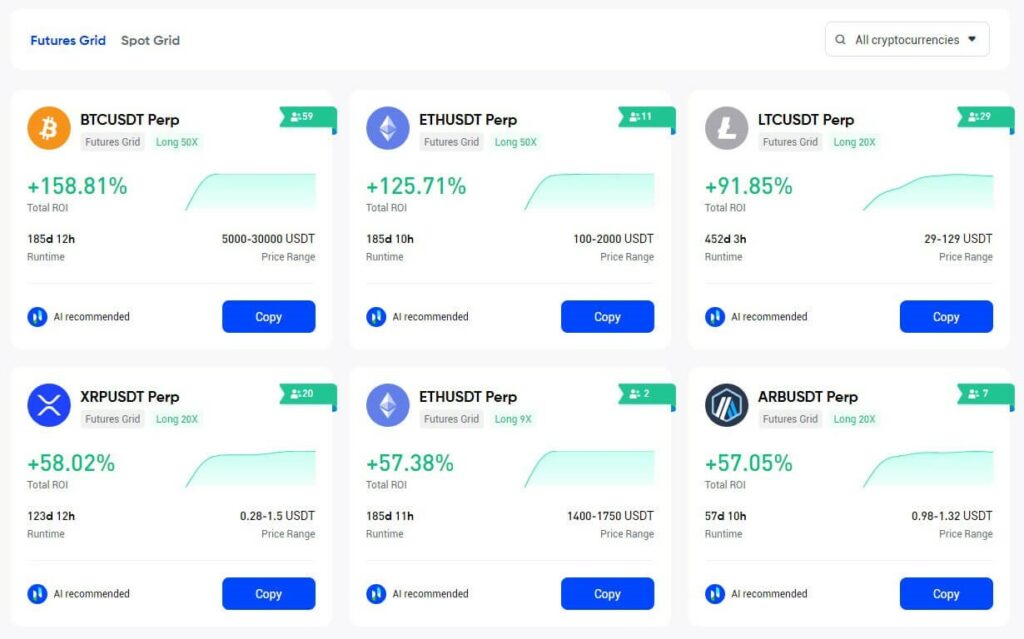

Easy-to-use trading bots are useful

Phemex allows you to automate your crypto trades using their suite of trading bots. Only available for its futures markets, you can browse the trading bot marketplace, find the bot for your trading pair, and then further customise the parameters (e.g. upper and lower grid limits) to ensure it fits your strategy. Additionally, they are completely free to use and your fees will be the same as your VIP level.

Implementing a trading bot is easy and can be done in two ways. Either copy one from the marketplace or toggle one on the contracts trading interface.

As a relatively new feature, Phemex’s trading bots are not as diverse as those found on the best trading bot platforms such as KuCoin based on our review. Popular trading bots such as infinity grid, smart rebalance and Dollar-Cost-Averaging (DCA) are not yet available.

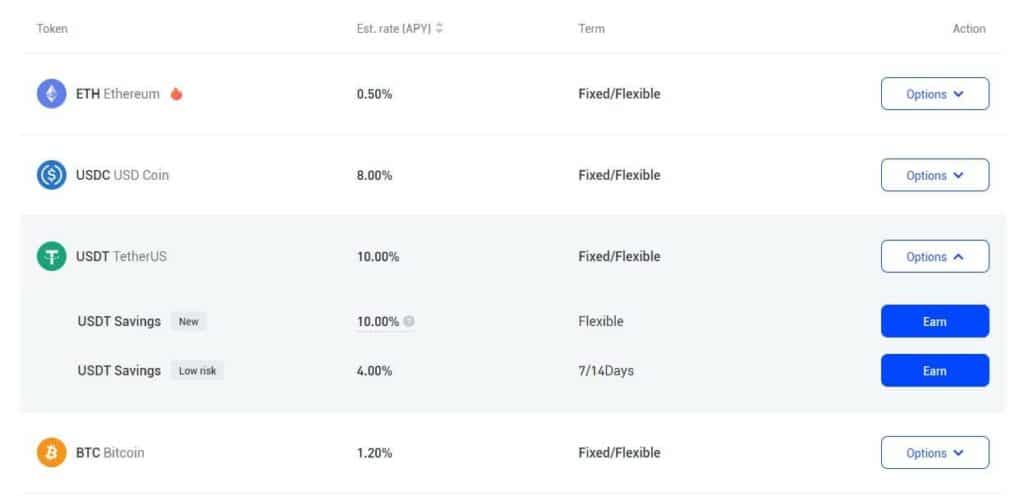

You can earn with their savings account

The interest-earning wallets on Phemex are relatively modest compared to other platforms that generate crypto interest in terms of the assets supported. There are only 13 digital assets that can be instantly deposited to passively generate yields over the fixed or flexible term selected. The list does not include coins and tokens you have never heard of but supports the major assets such as ETH, USDT, BTC, SOL, ADA, and NEAR.

In terms of yields, the Annual Percentage Yields (APY) that are on offer, are relatively competitive to other platforms. The most lucrative asset, Tether, can attract up to 10% APY on a flexible term which is rather nice.

Overall, it is clear that Phemex is not wasting its energy by providing savings accounts for obscure crypto assets that traders and investors are not likely to have in their wallets. Instead, they have built an interest-earning module that caters to the broader community.

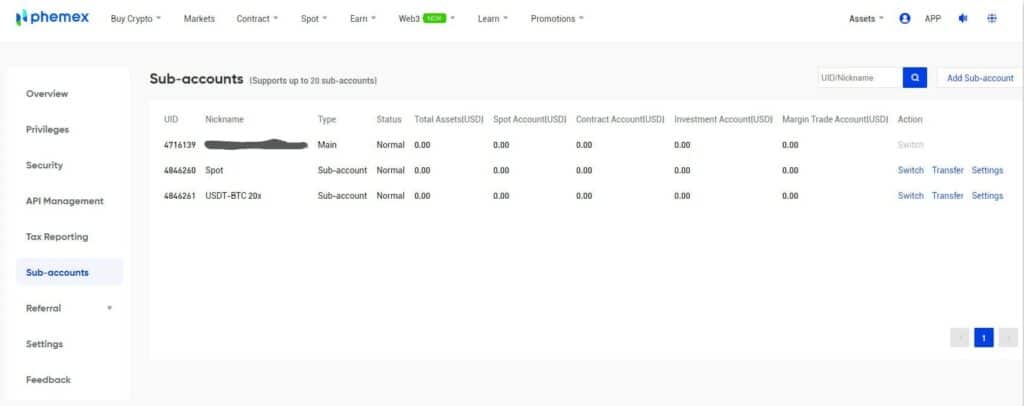

Create your own sub-accounts

A unique feature offered by Phemex is the ability to create up to 20 sub-accounts under your main trading account. What this does is allow you to segregate trading wallets as you see fit in order to heighten the level of control over your assets and activities. This is because each sub-account has its own wallet. So, if you want to separate crypto assets or fiat currencies used for spot trading versus derivatives trading then you can set these up in minutes.

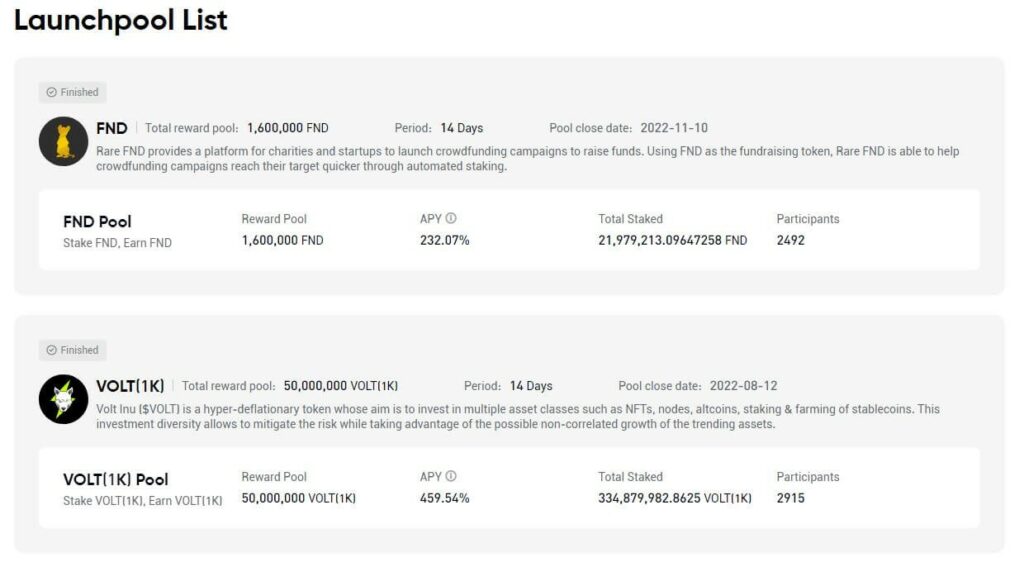

There’s a Launchpool to buy the latest coins

The Phemex Launchpool is where you stake several coins and tokens to reap lucrative rewards of up to 459%. The service is only applicable to new coins made available through its Initial Coin Offering (ICO) feature and is not the typical service you will find from a top-tier crypto staking platform.

The Launchpool does list some obscure coins that are only available temporarily. At the time of writing, there were only six projects listed so there are not a lot of options for investors who want to generate yields over some time. However, the high yields might appeal to those who have a bigger risk appetite.

Has a unique contracts copy-trading platform for leverage traders

To further bolster itself as a premium derivatives trading platform for Australians, Phemex has introduced a copy-trading platform for its contracts markets. There are hundreds of seasoned traders, dubbed “Top Traders”, whose contract trading activities can be copied and brought into your strategy. The portfolios of Top Traders can be sorted and browsed using basic filters such as total profit and loss and monthly ROI.

Copying a trader doesn’t mean that you need to apply their leverage to your copied trades. If you prefer less risk, then you easily set the leverage lower, as well as control the funds you want to allocate by entering your maximum investment amount.

Phemex’s copy-trading feature for derivatives trading is not a feature in the crypto market. However, the way Phemex has implemented it helps to bridge the gap between advanced contract traders and novices who are starting out gathering experience.

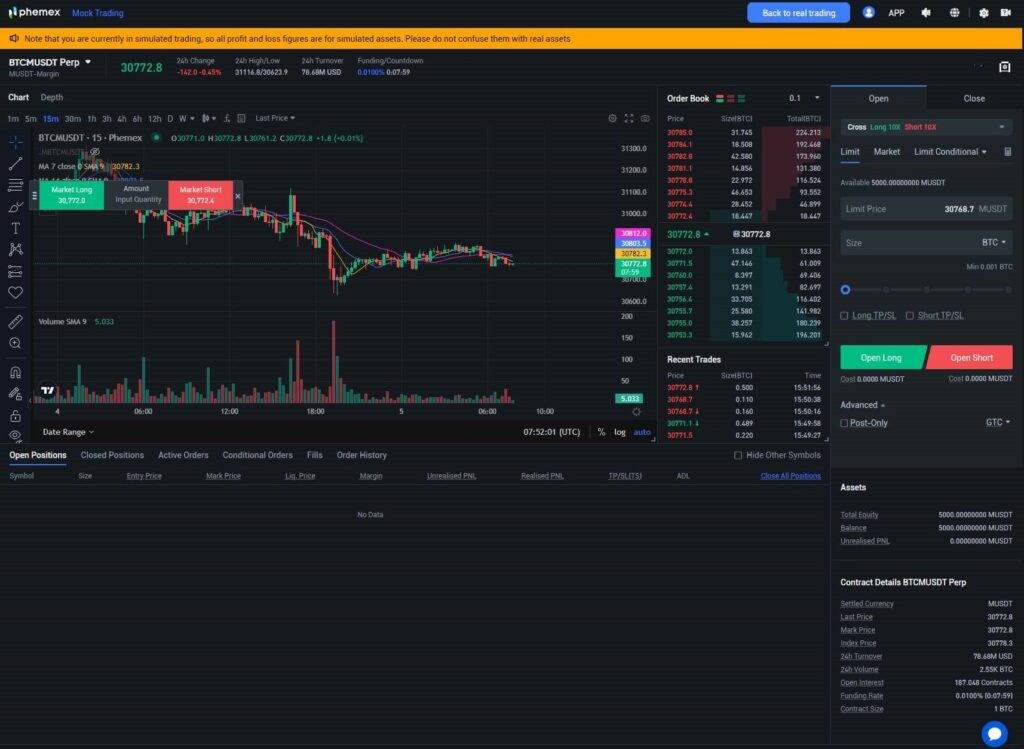

Comes with a free demo account for derivatives trading

Phemex acknowledges the complexities and riskiness of contract trading and has implemented a free-to-use demo account so Australians can practice their trades and familiarise themselves with the platform. The demo account comes equipped with 5,000 USDT and supports all the analytical tools and charting that are available on the live exchange.

The capabilities of the paper-trading account are discussed more in detail in our review of the best crypto demo accounts where Phemex ranks as the #1 account for contract trading.

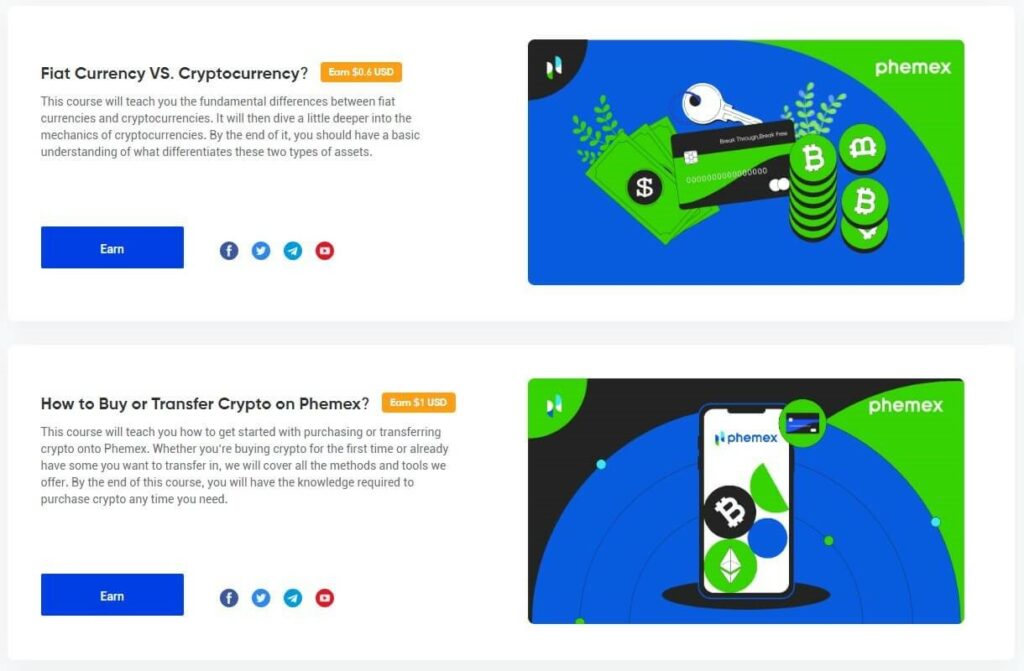

You can get get paid to learn crypto

Similar to the Coinbase Earn As You Learn feature, Phemex will pay you small amounts of USD for watching videos and completing online courses and quizzes. There are only a handful of beginner courses available but if you’re going to educate yourself then you might as well get paid for it.

What Are The Supported Crypto?

Phemex supports a moderate list of 189 digital assets that can be exchanged with 80+ fiat currencies including Australian Dollars (AUD). Whilst this is not the most exhaustive list of supported assets, all the major coins and tokens are available to Australians to be traded on its markets including BTC, USDT, ETH, NEO, UNI, DOGE, SOL, and SAND.

If you need a crypto trading platform with more altcoins to choose from then Phemex is not for you. Instead, look for an exchange that supports at least 300 crypto assets like Binance Australia (388), Swyftx (320), OKX (355), CoinSpot (370), or Gate.io (1,705) based on our reviews.

Are Phemex Fees Expensive?

Here’s a breakdown of the fees on the platform:

Deposit and withdrawal fees

Phemex charges zero fees to deposit any of its supported fiat currencies (EUR, GBP, AUD, USD, CHF, JPY, CAD) via wire transfer. Whilst no Phemex fees will be incurred, this does not include any potential third-party fees. Conversely, the same applies to cash withdrawals to a bank account.

Whilst you may need to wait between 1 and 2 days for the transaction to be processed, being able to fund your account using a bank transfer is convenient. Other popular deposit methods such as POLi, PayID, and BPAY are not available.

Trading fees

Phemex trading fees are competitively charged at 0.1% for maker and taker orders. As commonly seen on large crypto exchanges, Phemex fees can be reduced depending on your 30-day trading volume plus your hourly USD balance. For most, VIP 1, will be unattainable given that the requirement is to be trading over $1 million worth of assets.

However, contract trading is just as economical on Phemex as its spot markets where maker and taker fees start at 0.01% and 0.06%, respectively. Whilst being extremely cheap, the next tier of reduced trading fees is equally as hard to obtain for the everyday user.

Having said that, Phemex’s VIP 0 trading fees are more than competitive compared to other large crypto trading platforms such as Binance and Bybit.

| Exchange | Spot Trading Fees | Derivatives Trading Fees | Discounts Available |

|---|---|---|---|

| Phemex | 0.1% maker, 0.1% taker | 0.01% maker, 0.06% taker | Yes |

| Bybit | 0.1% maker, 0.1% taker | 0.01% maker, 0.06% taker | Yes |

| Kraken | 0.16% maker, 0.26% taker | 0.16% maker, 0.26% taker | Yes |

| KuCoin | 0.1% maker, 0.1% taker | 0.02% maker, 0.06% taker | Yes |

| Gate.io | 0.2% maker, 0.2% taker | 0.015% maker, 0.050% taker | Yes |

Here’s How To Get Started

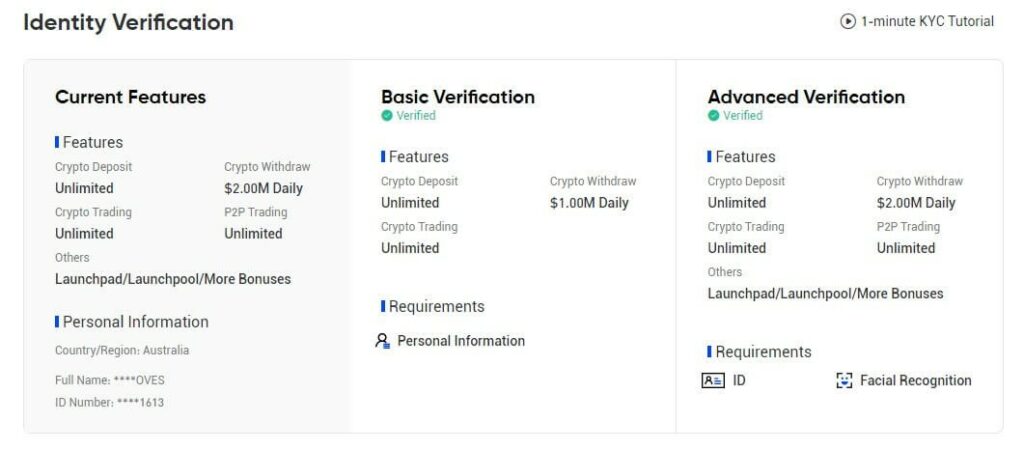

ID verification

Completing the Know-Your-Customer (KYC) process is not required before fiat funds can be deposited and traded on the Phemex website. The advanced verification level is easy to achieve compared to other crypto exchanges since it only requires your basic details, a copy of your ID document, and facial recognition. For the everyday Australian, the basic form of verification will likely be sufficient as you can still make unlimited deposits, conduct as much trading as you want, and withdraw up to $1 million. These traits make Phemex a fantastic no-KYC crypto exchange.

Deposit methods

Deposit methods on Phemex are very limited with wire transfers from a bank account the only way to fund your wallet. Popular payment methods such as POLi, BPAY, and PayID are not available. However, you can directly buy crypto using a credit card, a service supported by almost all Australian exchanges. Overall, Phemex is not a good choice if you prefer flexibility in how you want to fund your wallet. But at least it supports bank transfers, the most popular deposit method.

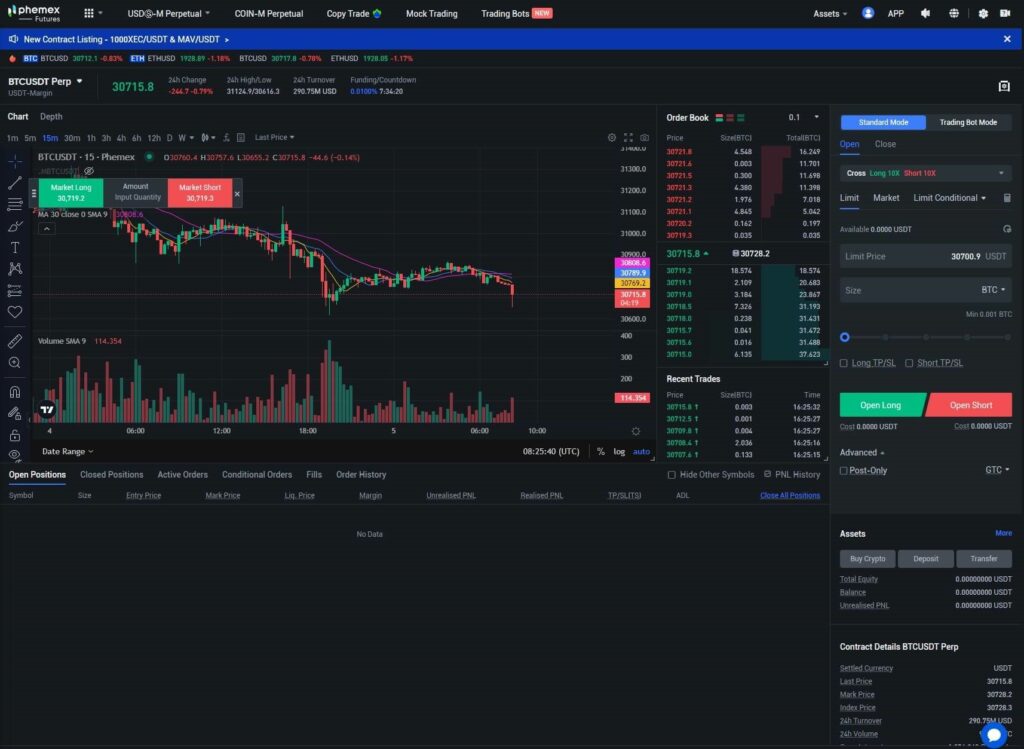

What Is Trading On Phemex Like?

Phemex is a popular derivatives trading platform across the globe as well as in Australia. The digital infrastructure on which the engine is built is world-class and is no wonder why it is a preferred choice. Initially designed to specifically deliver fast and responsive trading, Phemex continues this tradition by providing a cutting-edge interface.

From the get-go, the contracts (and spot) trading interfaces resemble those found on other platforms. TradingView charting and its assortment of analytical tools and indicators take centre stage whilst the live order books and order panel are placed on the right-hand side. Like most other platforms, you can easily change the layout of the interface.

Traders have access to market and limit orders that have a set of conditional variants. Additionally, you can switch over to its trading bot interface with the click of a button.

In a nutshell, Phemex does not go about reinventing the wheel. Instead, it sticks to the tried and tested formula that makes for a successful trading experience – reliability and speed.

Security Measures We Found

Based on our research, Phemex has not been hacked or experienced any significant security breaches. This can be attributed to the platform’s industry-leading security framework and controls. Given that Phemex was founded by former Morgan Stanley executives, its security standards are driven by their Wall Street risk control experience. Phemex wallets follow a Hierarchical Deterministic Cold Wallet System where each user is given their own unique cold wallet deposit address. The company uses offline signatures to periodically compile all the deposits into its multi-signature cold wallet.

Moreover, all customer funds are backed by reserves at a 1:1 ratio which should give Phemex users a great deal of consumer confidence. You can check your own assets by entering your hashed client ID which can be found on your Phemex dashboard. Other security control measures in place include network firewalls, 2FA, and whitelisting – all of which are relatively common in the crypto industry.

We Tested Their Customer Support

Avenues to Phemex customer support come in the form of its live bot chat and email. Emailing customer support is a relatively straightforward process. But the live chatbot was an interesting experience.

Using the virtual assistant will require you to state your name and confirm the email address that is associated with your Phemex account. Once you post your query, a real human will attend to it and provide a response in the chat with a copy sent to your email. During the testing of this process, our annoyance at having to confirm details after already being logged in was quickly dissipated by the very prompt response which was received in literally a couple of minutes.

One of the value adds to the Phemex customer support experience is the ability to upload videos. This means that you can record a walkthrough of your issue on your computer and attach it to complement your message. This will result in a better understanding of Phemex’s part and lead to a faster resolution. There are very few exchanges that allow this through their 24/7 chatbots.

Here’s What Other Traders Are Saying

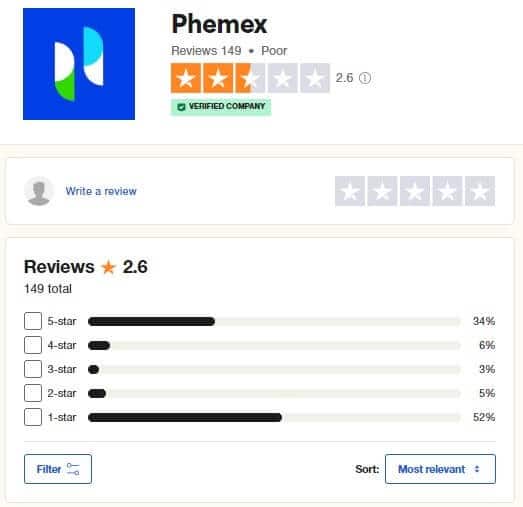

The sample size of existing customer reviews is not sufficient to gain an understanding of how the platform is seen. However, based on 149 Trustpilot reviews, Phemex has a mediocre rating of 2.6 out of 5.0.

Most of the positive reviews related to the simple design of its layout which results in an easy user experience. Some negative reviews appeared to be obscure and indicative of personal complaints rather than providing anything constructive. There was a recurring theme of funds being held and not being able to be withdrawn. From the responses that Phemex provided, it seems like these issues as well as others were associated with users not understanding how things work, for example, fluctuating mining fees.

Overall, it seems Phemex has a mixed response from its customer base. From our check of existing customer reviews, it’s hard to see the validity of some of the negative comments. For most, it was apparent that the root cause was beginners trying to use a platform that was too advanced for their level of knowledge and experience, or not being aware of the T&Cs.

The Mobile App Is Excellent

In contrast to the Trustpilot reviews (which we don’t consider to be representative), the mobile app has a stellar rating of 4.6 out of 5.0 from more than 12,000 reviews. The app has more than 1 million downloads from Google Store but is also available for iOS devices.

We found the Phemex mobile app to be very fast and slick just like the desktop version. Navigating from the homepage is easy due to the simple layout. From what we could see, all of the features offered on the Phemex platform were available on the app, even new applications such as the Soul Pass and Pre-mining airdrops.

TradingView charts and its suite of analytical tools are supported but the range of tools is limited compared to the website. One other downside is that you can’t retain a view of the charts whilst placing long or short orders. Assessing both requires you to toggle a button to switch between the two. Changing the layout so you can retain your chart analysis and drawings whilst placing orders would be an area for improvement.

Our Final Verdict

The Phemex trading platform is a reliable one that oozes all the features an advanced contracts user could ever want. Built on the pillar of a robust trading engine, Phemex has grown its products and services from its derivatives origins to a full-fledged crypto exchange that caters to a broader audience. Phemex users will quickly appreciate the speed at which transactions are executed and the advanced analytical tools at their disposal.

The products and services that Phemex has added to its shelves over time are not as well developed as those found on the larger crypto exchanges. They are generally limited in their scope but are delivered extremely well.

If you are new to derivatives trading or want to expose yourself more to it then Phemex is a great option. The Phemex platform offers all the traits that experienced traders want but also attempts to bridge the gap so that newer traders have an easier time adjusting.

Frequently Asked Questions

The Phemex exchange delivers a user-friendly and straightforward platform for beginners to learn the ropes of contract trading. The cryptocurrency exchange provides beginners and novices with features to help them get accustomed to the complexities and risks of derivatives trading such as a demo account and the ability to copy the contract trades of more experienced users.

Phemex is one of the cheapest exchanges for traders to use. With maker and taker fees starting at 0.01% and 0.06%, respectively, the cryptocurrency exchange offers a low-cost and reliable platform for derivatives or contract trading.

Phemex offers a free demo account where you can participate in paper trading. The Phemex demo account is equipped with $5,000 USD, users can practice their derivatives trading strategies without incurring any risk to their real assets.

Phemex charges zero fees for users to deposit fiat currencies into its wallet, no matter the payment method. Withdrawals of fiat currencies such as USD or AUD can also be done without incurring any fees.

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.