Best Crypto Tax Software In Australia

Last Updated on January 31, 2024 by Kevin GrovesThe End of the Financial Year (EOFY) is an important yet challenging time when it comes to understanding your cryptocurrency obligations. With the multitude of crypto tax tools out there, it is understandably difficult to know which one best suits your needs.

In this article, we identify the most popular ones and break them down to reveal their capabilities, limitations, and features.

Best Australian Tax Software For Crypto

How digital currencies are taxed in Australia is similar to other asset classes such as property. After careful consideration of numerous crypto exchanges and platforms, these are some of the best tax reporting tools for cryptocurrency in Australia.

- Koinly – Best overall crypto tax tool

- CoinLedger – The most user-friendly crypto tax software

- CryptoTaxCalculator – Best for producing ATO-compliant reports

- CoinTracking – Crypto tax tool with the best free version

- TokenTax – Best support for exchanges and wallets

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Cryptocurrency Tax Filing Software Reviews

Here are our reviews of the best Australian software to assess and report crypto tax estimates.

1. Koinly – Best overall crypto tax tool

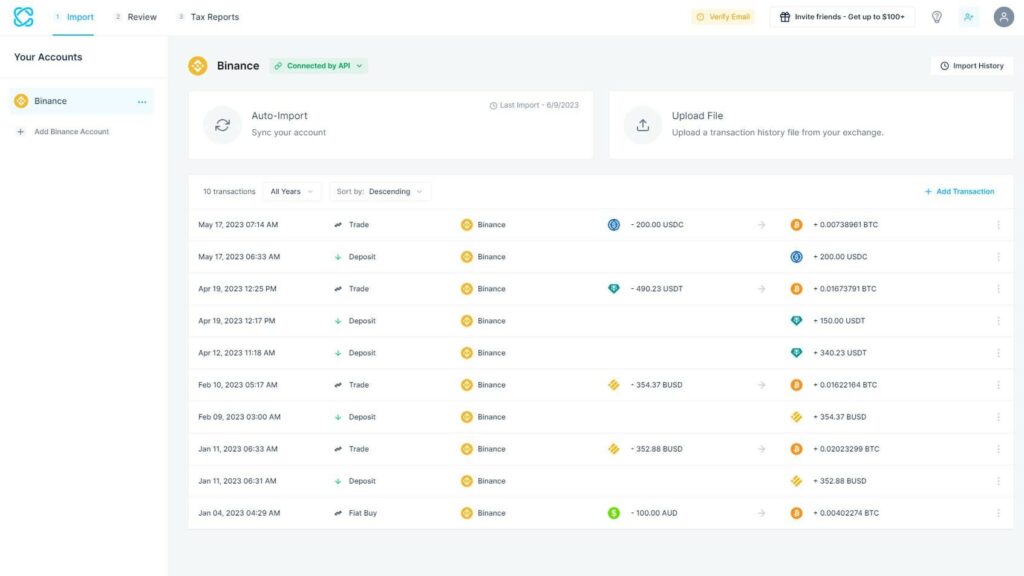

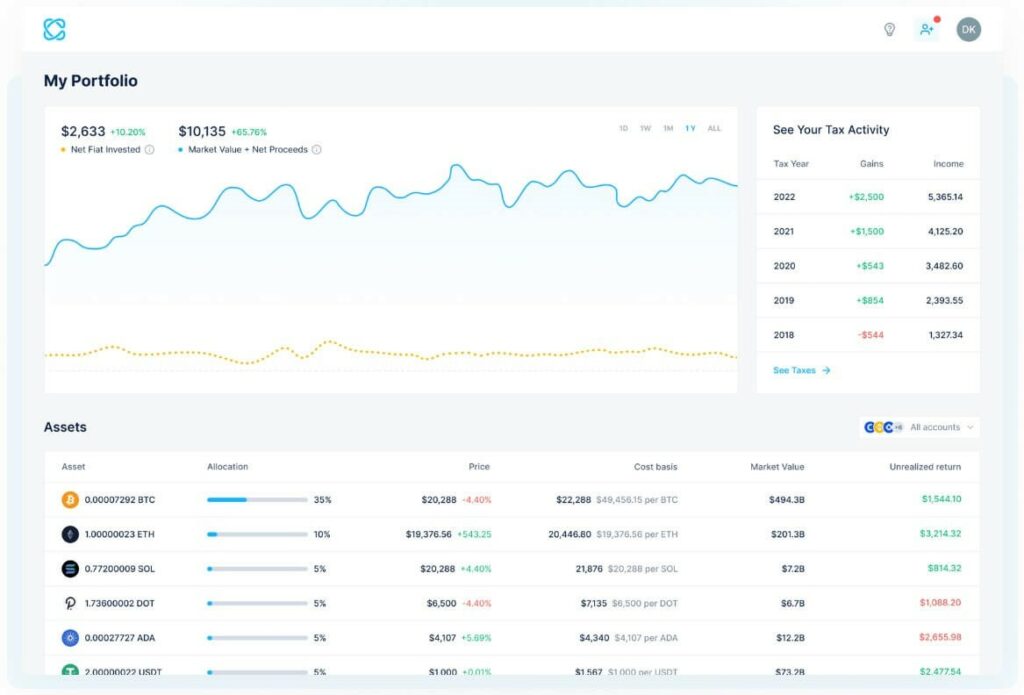

Koinly is an Australian cryptocurrency tax software and portfolio tracker that is designed to help individuals and businesses manage their cryptocurrency transactions, calculate tax liabilities, and generate tax reports. Like CoinLedger, Koinly is compliant with Australian tax regulations.

Koinly aims to simplify the process of cryptocurrency tax reporting, ensuring compliance and reducing the complexity of managing cryptocurrency portfolios for tax purposes. Because of this, Koinly is integrated into several of the leading Australian crypto exchanges.

Koinly supports 23,000+ cryptocurrencies and integrates with over 600 popular cryptocurrency exchanges, wallets, and other platforms to automatically import your transaction data. You can organise your transaction data into categories, track cost basis, and calculate capital gains or losses to give a good destination before it is submitted to your accountant.

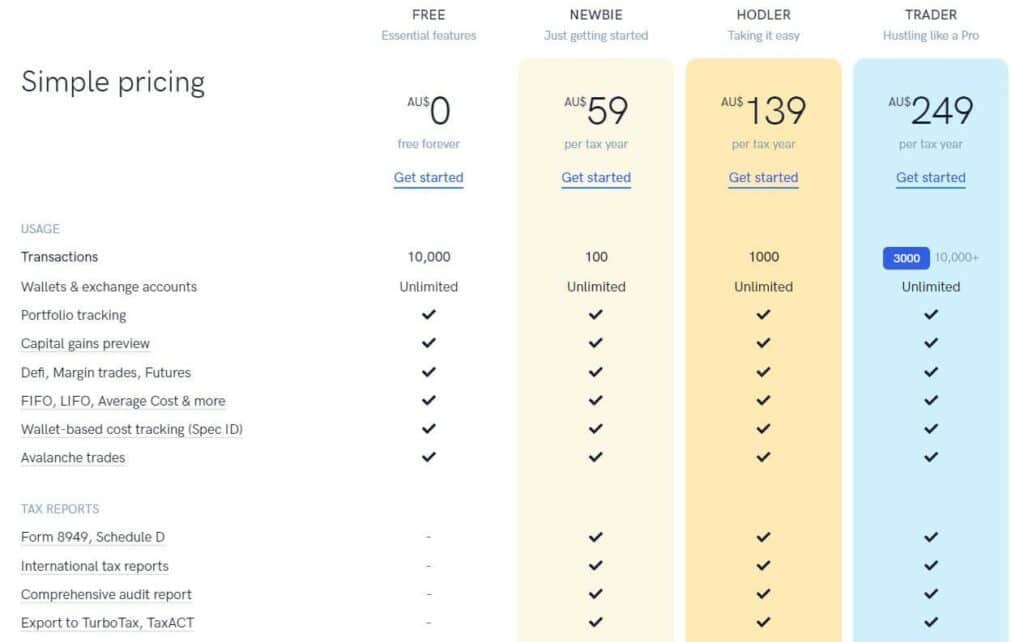

Koinly is slightly more expensive than CoinLedger. But unlike other crypto tax tools, the major pro is that there is still a free version available. You won’t be able to produce any tax reports but at least all the other features are available such as portfolio tracking, a capital gains preview, and support for spot, margin, futures, mining, staking, lending, and airdrops. The priced packages start at $59 per financial year with the ‘Newbie’ to $249 for the ‘Trader’.

With the simplicity with which Koinly’s features can be used by the everyday crypto investor and trader, it is no surprise that it has become one of the best crypto tax software in Australia.

Koinly Pros:

Koinly Cons:

2. CoinLedger – The most user-friendly crypto tax software

Formerly known as CryptoTrader.Tax, CoinLedger was founded by David Kemmerer, Lucas Wyland, and Mitchel Cookson in 2018. Essentially, CoinLedger was established to provide a quick and easy solution following their personal challenges and frustrations when it came to tax reporting time.

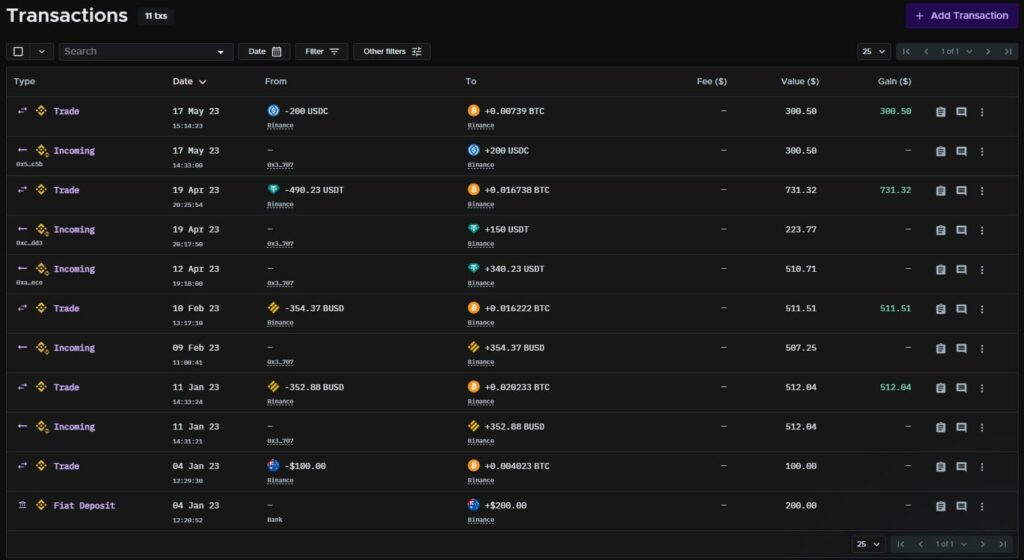

CoinLedger is an all-inclusive tax reporting tool that integrates with over 300 cryptocurrency exchanges and wallets. In addition to being compliant with Australian tax regulations, the product allows you to track your portfolio. The ability to report profit and loss outcomes for crypto transactions during the year also extends to the trading of digital art on NFT marketplaces.

CoinLedger works by importing transaction data associated with the crypto exchanges and or software wallets that you use to trade. As part of the easy set-up process, CoinLedger will prompt you to select the crypto exchanges and software wallets such as MetaMask that you use. APIs are then used to provide visibility of your crypto transactions to CoinLedger, all of which can be viewed on the interface. The ease at which this can be done is a major plus and a differentiator compared to other reporting tools.

In terms of the pricing of its four packages, CoinLedger is an affordable option that doesn’t sacrifice features the higher you go. For the everyday investor and trader, all subscriptions including the free version include portfolio tracking, connectivity to unlimited exchanges and wallets, support for over 20,000 cryptocurrencies, capital gains overview, and even DeFi support and NFTs.

Despite having all of the functionality that the paid subscriptions offer, the free version requires you to pay for each tax report. Nevertheless, this is still great value for money. If you have multiple portfolios then you may consider the Hobbyist ($49), Investor ($99) or Unlimited ($199+) since you can export all the reports you want.

CoinLedger Pros:

CoinLedger Cons:

3. CryptoTaxCalculator – Best for producing ATO-compliant reports

Originating from Coffs Harbour, CryptoTaxCalculator is an Australian web-based platform that is designed to help individuals and businesses calculate and manage their crypto taxes. Built for integration with Web3, the crypto tax calculator produces detailed and accurate reports that are compliant with the ATO’s reporting requirements. This provides an advantage since your accountant will have an easier time digesting it, resulting in less back-and-forth communication.

CryptoTaxCalculator offers features that are tailor-made for the Australian market, including:

- Transaction Import: You can import your cryptocurrency transactions via API from popular exchanges, wallets, and CSV files to automate the process of data entry.

- Tax Calculations: The platform calculates capital gains, losses, and tax liabilities based on the imported transaction data. It considers factors such as the cost basis, holding period, and applicable tax regulations.

- Support for NFT trading: If you are buying NFTs then CryptoTaxCalculator will track the potential capital gains associated with it.

- Tax Reports: Generate comprehensive tax reports that are consistent with the requirements of the ATO. These tax reports can be sent to your accountant.

- DEX support: Decentralised crypto exchanges and platforms such as Uniswap, Pancakeswap, Sushiswap, Quickswap, TraderJoe, Curve, Balancer, Osmosis, 1inch, GMX can be connected via API keys.

There is no free version available and the subscription fees for the four plans are comparatively higher than other crypto tax software on our list. Priced at $49, the ‘Rookie’ plan is suitable if you buy a few crypto assets here and there. But seasoned traders will likely need the ‘Trader’ plan with its hefty $399 cost.

CryptoTaxCalculator Pros:

CryptoTaxCalculator Cons:

4. CoinTracking – Crypto tax tool with the best free version

CoinTracking is one of the top crypto tax software that offers several features that specifically benefit Australians in managing their cryptocurrency investments and tax reporting.

Firstly, CoinTracking allows you to use it in conjunction with popular Australian cryptocurrency exchanges. Linking your transaction data is not a problem at all which makes portfolio tracking automatic.

Secondly, CoinTracking provides comprehensive tax reporting features tailored to Australian tax regulations. It generates tax reports that are compliant with the ATO’s requirements including capital gains and losses calculations, tax summaries, and other relevant documentation to aid in EOFY reporting.

Furthermore, CoinTracking offers real-time and historical price tracking for a wide range of cryptocurrencies such as Bitcoin and Ethereum. This feature allows you to monitor the current value of your holdings accurately and track price movements over time.

However, the feature that makes CoinTracking so valuable is its free version. Although you are restricted to up to 200 transactions per year, it is one of the few tax software where you can generate reports for free. If you go over the 200 transactions, then you will need to select one of the paid plans that start from $12.99 USD per month. Although you can get a 5% discount by paying its fees in Bitcoin, the accumulating monthly charges won’t make it worthwhile compared to local alternatives such as Koinly.

Wirex Card Pros:

Wirex Card Cons:

5. TokenTax – Best support for exchanges and wallets

TokenTax is a global crypto tax software with a comprehensive set of tools and features. Although TokenTax primarily focuses on US tax regulations, it also supports users from other countries including Australia.

For Australian users, TokenTax allows the import of cryptocurrency transaction data from Australian exchanges, wallets, and platforms we’ve reviewed such as Swyftx and CoinSpot. It takes into account the specific tax rules and regulations applicable in Australia when calculating capital gains, losses, and tax liabilities. The platform generates tax forms and reports that are relevant for ATO filings.

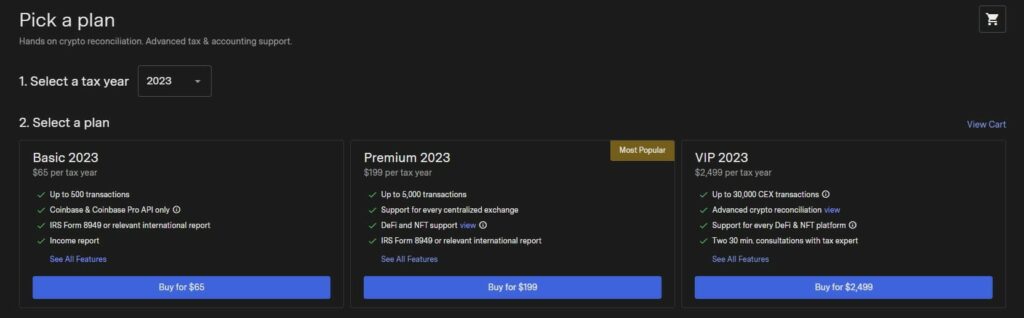

However, the lack of a free version as well as the comparatively lower supported number of transactions is the downside. Depending on the plan you select, be prepared to pay between $65 and $2,499 per financial year, where the Basic plan only supports up to 500 transactions. On top of this, extra features are separate purchases that are simply not worth it. For example, having the ability to track and assess margin and futures trades will cost an additional $399.

Wirex Card Pros:

Wirex Card Cons:

What Is A Crypto Tax Reporting Tool?

Crypto tax reporting tools are software or online services that assist individuals and businesses in calculating and reporting their cryptocurrency-related tax obligations. Since activities such as the trading of Ethereum may trigger a capital gains event, they will be subject to taxation and must be reported to the ATO.

Crypto tax reporting tools typically integrate with popular cryptocurrency exchanges and wallets. They are linked via APIs where data associated with crypto transactions is imported into the tool. They then analyse this data to generate reports, calculate capital gains or losses, and determine tax obligations.

Why Use A Crypto Tax Software Tool?

Using crypto software such as Koinly to report taxation offers several significant benefits.

Accurate and reliable tax reports

One of the primary advantages is the accuracy it provides in calculating crypto taxes. Cryptocurrency trades made during the financial year can be complex, involving factors such as capital gains, losses, cost basis, and holding periods. Instead of manually calculating these, where human error will likely be a factor, crypto software automates the process and ensures precise and reliable summaries to inform tax documents.

It saves time and effort

Another key advantage of using the best crypto tax software is the time and effort it saves. With the use of APIs, you can easily import transaction data from numerous crypto exchanges at the same time. The software then consolidates the data, analyses it, and generates comprehensive crypto tax reports. The automated nature of the process saves time and a lot of headaches, allowing you to focus on other aspects of your financial management.

Portfolio tracking

Crypto software also offers comprehensive tracking capabilities, which is highly beneficial when dealing with cryptocurrencies. Keeping track of your crypto activities across multiple wallets, exchanges, and tokens can be challenging. However, with crypto software like Koinly, you can conveniently monitor your transactions, track gains and losses, and identify taxable events. By providing a centralised location for all your crypto data, the software offers a comprehensive overview of your portfolio. This simplifies the tax reporting process by ensuring that no transactions or taxable events go unnoticed.

Minimise your tax liabilities

The best crypto tax tools include features to help optimise your tax liabilities. These features can provide valuable insights and strategies to minimize your overall tax burden. For example, the software can identify tax-efficient strategies like tax-loss harvesting. This involves selling assets at a loss to offset capital gains and reduce your taxable income. By leveraging such optimizations, you can potentially save money on your crypto taxes and enhance your overall tax planning.

ATO compliant reports

Most crypto tax tools, especially the local Australian ones, produce reports that satisfy the reporting requirements of the ATO. The best crypto tax tools generate accurate tax reports in a format that is easily shared with the ATO. This improves the level of transparency and accountability in your tax reporting, reducing the likelihood of an audit.

What Features To Look For In Crypto Tax Software?

When choosing a crypto tax reporting tool, beginners should focus on key features that make the experience user-friendly and accurate. An intuitive interface is essential, with clear instructions and simplified data entry options like CSV imports or API syncing.

Accurate tax calculations are a must-have. Ideally, look for crypto tax software that reliably calculates capital gains, losses, and cost basis calculations, accommodating different tax calculation methods and holding periods. Comprehensive reporting features are vital, including detailed tax reports, export options in common formats, and clear breakdowns of taxable events and income categories.

Data security and privacy are paramount. Look for strong security measures like encryption and two-factor authentication, along with compliance with privacy regulations. Transparent data handling practices and access to customer support channels, comprehensive documentation, and community forums contribute to a positive user experience.

By considering these features, you can select a crypto tax reporting tool that streamlines the process, provides accurate calculations, and offers user-friendly support, enabling you to meet your tax obligations effectively.

Frequently Asked Questions

Koinly is the best calculator to assess your crypto trades and report taxation estimates. The easy-to-use software allows you to generate ATO-compliant tax reports in as little as 20 minutes and supports data imports and syncing with hundreds of digital currency exchanges and storage wallets.

Koinly has a free version where you can import your crypto transaction data and have it calculate tax estimates to inform EOFY reporting. However, Australians will need to purchase one of the paid plans to prepare and export a crypto tax report.

CoinTracker is a bit more limited than Koinly in terms of blockchain integrations. Koinly supports the importing of over 23,000 digital assets from over 600 crypto exchanges and wallets. Although Koinly is much easier to use than CoinTracker, the free version of the latter allows you to produce tax reports (with limitations).

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.