MEXC Review For Australians: How Does It Stack Up?

Last Updated on December 24, 2023 by Kevin GrovesMEXC is one of the few centralized exchanges (CEXs) that require no KYC for sign-ups. The exchange boasts the lowest fees but has no AUD withdrawal support. Read our full MEXC exchange review to learn if it’s the exchange for you.

mexc.com

MEXC Global

Trading fees:

0.0% maker & 0.1% taker

Number of cryptos:

1,520

Deposit methods:

Credit card, crypto, bank transfer (P2P only)

Supported countries:

Global (including Australia)

Promotion:

None available at this time

The Bottom Line

MEXC is a premium cryptocurrency exchange that offers various crypto-related products and services in Australia including one of the widest selections of altcoins and trading markets (spot, margin, leveraged Exchange-Traded Funds (ETFs), and futures. Its strong suit is easily its range of passive earning opportunities, including locked staking, flexible staking, and trade mining.

Overall, MECX is a great option for mid-level and advanced traders who want to trade in advanced crypto products. The exchange is not suited for crypto novices as it does not offer a truly simplified trading experience. Australians should look elsewhere given its lack of support for the Australian Dollar there are no AUD trading pairs and you can’t withdraw cash to your bank account.

MEXC Pros:

- Extensive crypto support.

- Low trading fees.

- Supports AUD purchases.

- Advanced trading features are available.

- Competitive staking yields.

MEXC Cons:

- Slow verification process.

- Only a few cryptocurrencies are available on Quick Buy/Sell.

- No AUD withdrawal.

- No AUD trading pairs.

MEXC Pros Explained

- Extensive crypto support: MEXC supports 1,520 cryptocurrencies that investors can buy, sell, and trade in the spot and derivatives markets.

- Low trading fees: The exchange offers 0.0% and 0.1% maker and taker fees that are unrivaled.

- Supports AUD purchases: Limited but viable AUD deposits via credit card.

- Advanced trading features available: Seasoned investors have access to advanced markets like the margin, futures, and ETFs markets on MEXC coupled with impressive leverages.

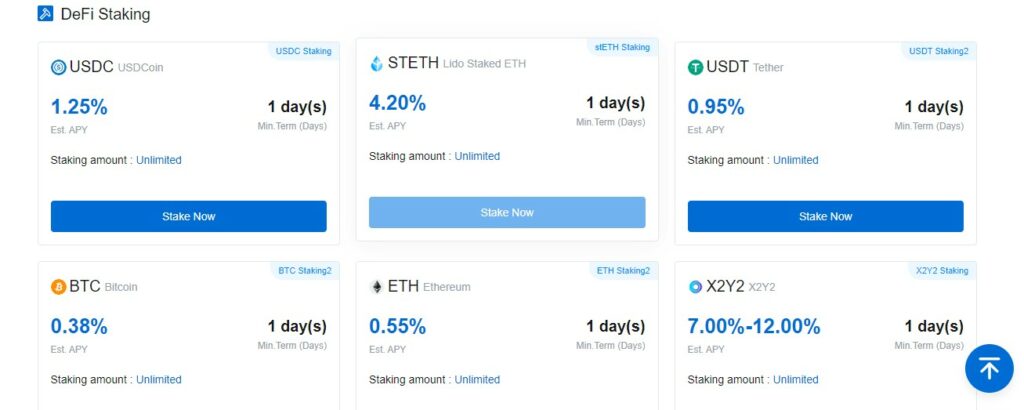

- Competitive staking APY: MEXC offers crypto staking with up to 18% APY.

MEXC Cons Explained

- Slow verification: MEXC’s verification feedback takes longer than competitor exchanges like Coinbase.

- Only a few cryptocurrencies are available on Quick Buy/Sell: The instant buy and sell feature on MEXC supports only 9 cryptocurrencies for AUD purchases.

- No AUD withdrawal: Does not support AUD withdrawals.

- No AUD trading pairs: No AUD trading pairs across all the available markets.

Who Should (and Shouldn’t) Use MEXC?

MEXC is a robust cryptocurrency exchange suitable for you if you want to trade crypto and earn passive income on the side. Australians who have been trading for a while and prefer trading with USD and USDT will appreciate the exchange’s high-quality products and trading markets.

MEXC At A Glance

Here is a quick summary of MEXC.

| Exchange Name | MEXC |

| Supported Countries | Global including Australia |

| Fiat Currencies Supported | EUR, GBP, USD, AUD, VND, RUD, KRW, JPY, HKD, EGP, and 18 more. |

| Supported Cryptocurrencies | 1,520 |

| Markets | Spot, futures |

| Deposit Methods | Credit card, crypto, bank transfer (P2P only) |

| Deposit Fees | None (third-party fees apply for credit cards) |

| Trading Fees | Spot: 0.0% maker & 0.1% taker Futures: 0.00% maker & 0.03% taker |

| Withdrawal Fees | None |

| Crypto Staking | Yes |

| Mobile App | Yes (Android, iOS) |

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

So, What Do We Think of MEXC?

With numerous features packed on the MEXC exchange, we review the top options that make the platform stand out among its competitors.

Has good staking rewards for popular tokens

Like most popular cryptocurrency exchanges, staking is a core feature offered on MEXC. Staking is a simple way to earn passive income on the platform in return for securing a Proof-of-Stake (PoS) blockchain network. MEXC allows you to securely lock up your untraded crypto assets and earn periodic rewards of up to 18% Annual Percentage Yield (APY).

You can choose between two staking options – “Flexible Staking” and “Locked Staking.” Flexible staking allows you to withdraw your staked assets at any time without penalties, while locked staking has a fixed lock-up period of a day, 10, and 30 days.

Interestingly, MEXC supports 40+ assets that you can lock in and earn yield from. Some of these include popular PoS coins like Polkadot, Hydra, EOS, USDT, and USDC, amongst others. Though the number of coins supported for staking on MEXC is smaller than Binance’s 60+, MEXC is a great place to stake crypto.

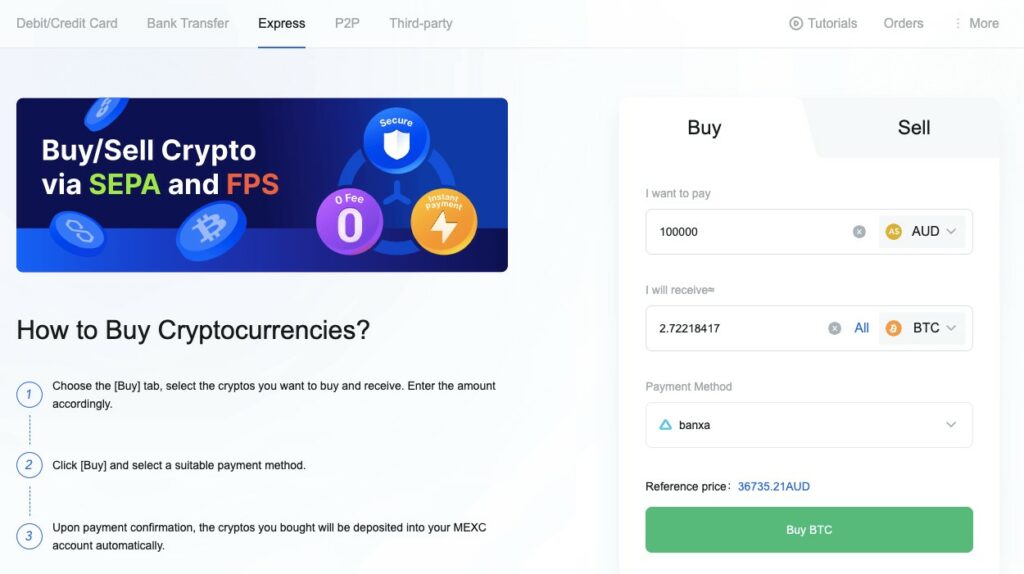

You can instantly buy and sell crypto assets

The ‘Express’ feature allows you to instantly purchase and sell crypto. For Australians, there are only 28 cryptocurrencies that can be traded against fiat currencies in this manner but it should provide beginners and intermediates with all they need. Payment methods can be credit cards or through MEXC’s third-party payment providers Mercuryo, Moonpay, and Banxa. Although the service is free to use and MEXC won’t charge any fees, third-party fees might be incurred.

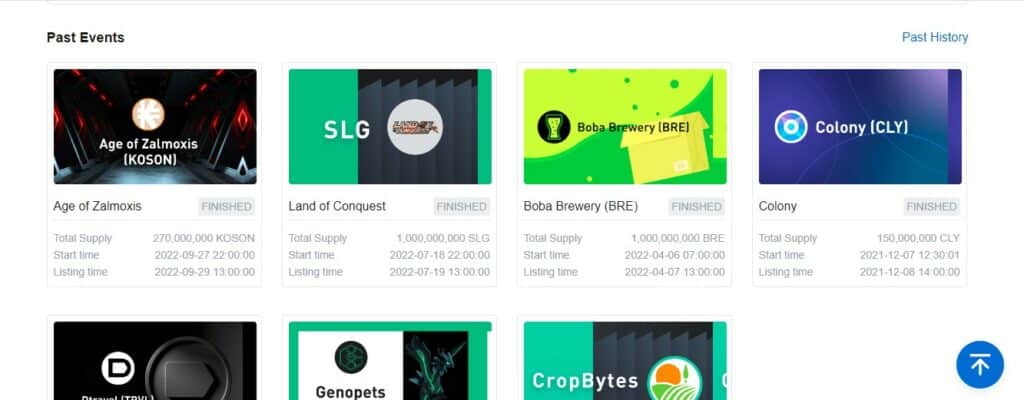

MEXC Launchpad so you can buy new coins

MEXC has a Launchpad feature that lists new crypto projects and tokens investors can back. Acting as another of MEXC’s services where you can earn crypto, holders of the listed tokens on MEXC Launchpad also get airdrops from Initial Exchange Offerings (IEO). A recently concluded Launchpad project is DeHeroGame which is a blockchain-powered NFT game. The crypto game sold off all its 1 million tokens allocated for the event.

However, unlike the Binance Launchpad, the MEXC Launchpad also has only a few projects on its Launchpad program. While this earning opportunity can be a viable option for early-bird investors, Launchpad enthusiasts are generally required to hold the platform’s MX tokens in order to participate in these events. This is not unusual as the Binance exchange also requires customers to hold BNB.

Margin trading is good for experienced traders

Experienced investors looking to trade in the advanced cryptocurrency markets can leverage MEXC Margin. With margin trading, you can borrow assets from MEXC and go short or long on Bitcoin and other cryptocurrencies to maximise your profits (and losses).

MEXC offers up to 10X leverage across 70+ trading pairs, including BTC/USDT, ETH/USDT, and MX/USDT. All these pairs can be traded using cross and isolated margins. There’s also additional TradingView support for a more detailed analytical experience. However, Australian investors should be aware of the absence of AUD trading pairs in the margin market. The 10x leverage offered is also lower than the 20x maximum leverage on Binance and the 100x leverage available on ByBit.

However, the platform has a minimum of 100 USDT to open a trade and charges 0.00146% hourly. When compared to competitor exchanges like Binance, which charge a variable fee of 0.041% daily, it is quite competitive in its margin section. You should consider MEXC for trading with leverage margin if you have no problems converting to USDT.

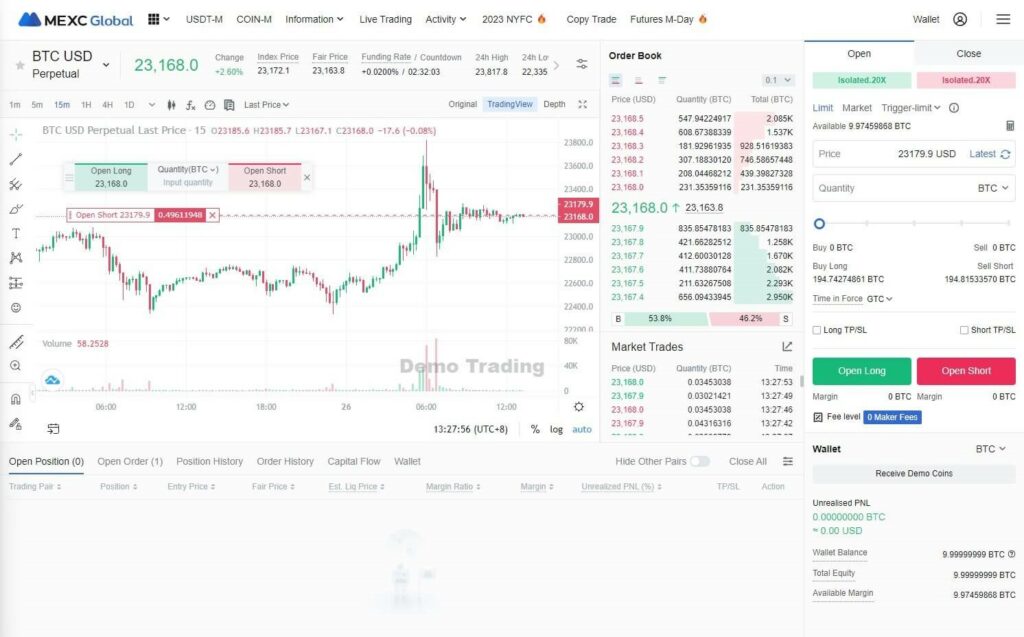

Futures trading has high leverage options (experts only)

Another advanced trading feature that active traders will enjoy on MEXC is futures trading. With MEXC Futures, you can enjoy up to 200x leverage to trade Coin-Margined (Coin-M) and USDT-Margined (USDT-M) futures. The exchange also offers various tools like copy trading to mirror trades of successful traders, crypto demo trading to paper trade, and a wide range of crypto-derivative tools.

During our review, we also discovered that MEXC Futures offers both cross and isolated margins. Traders can also use limit, market, and trigger-limit orders to mitigate risks, which is similar to competitors. The TradingView support is also a great addition. However, MEXC’s 0.03% futures trading fee is lower than KuCoin’s 0.1% but on par with Binance’s 0.012% and 0.030%, which is a major consideration for investors.

The fact that MEXC offers 0% in maker fees for its futures trading makes it an even better option than exchanges like Kraken with a 0.02% fee structure.

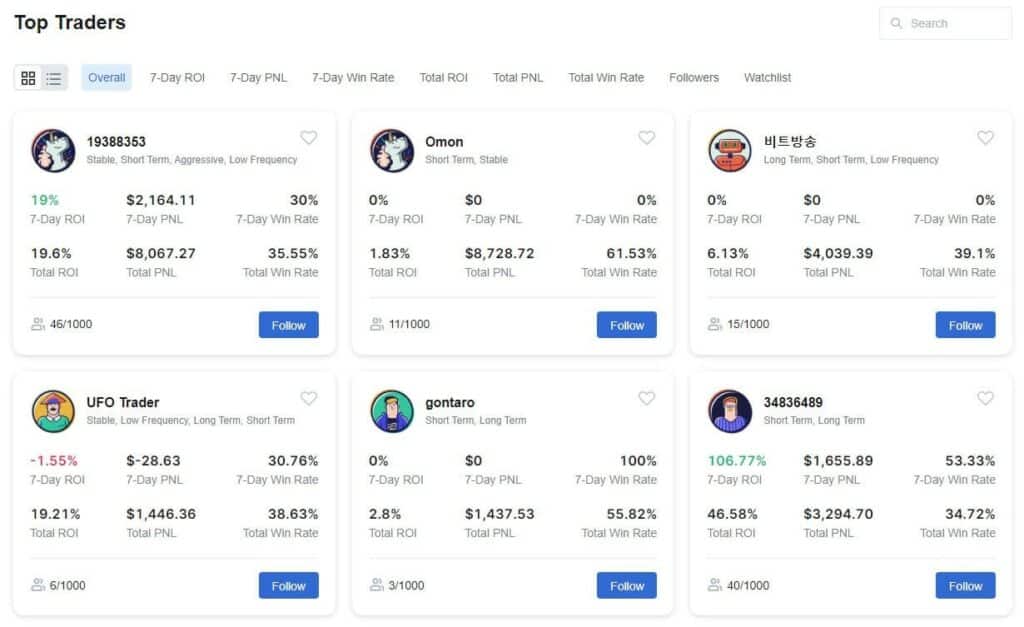

Copy-trading for beginners to follow the best on the platform

MEXC is a sound option for beginners who prefer the copy-trading route. You can copy the moves of other investors on the platform but unlike high-end copy trading platforms we’ve reviewed like eToro, Phemex, and ByBit, the MEXC copy trading setup is quite basic.

In the first place, there are no links to the top traders’ websites or social media profiles. Instead, MEXC’s traders use aliases. There’s no way to identify the traders or their antecedents trading cryptocurrencies beyond their statistics on the platform. Secondly, the search filter is extremely limited and hard to use.

Before following their trades, you can view some important details about the top traders. For instance, you can view and filter traders based on their win rate and total profit and loss earned or lost. Copiers can also view the trading pairs before deciding to follow a trader.

To initiate copy trading, you must first select a preferred trader and fill in the copy trading details. The copy trading details would include the trade amount and a variable figure/ratio to use for subsequent orders, take-profit/stop-loss ratio and then submit the orders.

The traders earn a share of every successful copied trade on MEXC. While this feature is quite interesting, MEXC seems to lack the volume of top traders available compared to other copy trading crypto platforms. In terms of structure, ease of use, and full control of trades and customization parameters, the exchange is also far behind eToro.

Unique leveraged ETFs offering is not for everyone

Another advanced trading feature on MEXC is leveraged Exchange-Traded Funds (ETFs) trading. This trading model combines derivatives trading with leverage (debt) to trade ETFs and amplify returns on an underlying leveraged token.

MEXC allows you to trade leveraged ETFs on the spot market with no liquidation risk and also enjoy compound interest on your trades. You do not have to worry about liquidation as the trading feature does not have a periodic settlement time. The prices on leveraged ETFs theoretically cannot hit the zero peg hence why there is no liquidation risk.

You can also long or short the ETFs and enjoy a basket of derivative positions and choose options from 2x ETF to 5x ETF collateral to boost your profits. MEXC outshines KuCoin with its better collateral margin, as the latter is limited to 3x collateral. This makes MEXC Leveraged ETFs trading more considerable.

Leveraged ETFs are charged at 0.2%. This is quite expensive but the platform is only one of a few exchanges that offer this trading feature. The leveraged ETFs are quite impressive and provide even more trading opportunities for advanced Australian investors.

Powerful quantitative trading bots if you know how to use them

Angling towards the era of automation, MEXC Global offers a systematic trading experience through Quantitative Trading. This service is similar to automated crypto bots and it allows you to create trading strategies and execute them based on preset commands.

MEXC is limited in that it only provides automated crypto trading via its Spot Grid. You can lay out instructions like the price to open or close a position, the number of orders to place and the amount to invest from their exchange balance. You can also select the digital asset via which the trade will be settled when it finally ends. This allows you to participate in other activities while the bots execute trades on your behalf.

MEXC’s singular trading bot is quite limited compared to offerings from similar exchanges like KuCoin, which offers up to five different bots. We also observed a lack of possible percentage gain from using the trading bot, a feature most exchanges highlight. Another missing item is the lack of a transparent fee for this service as the exchange stated users will find out when they utilise the tool. Nonetheless, this is a pretty useful tool that comes in handy for trading cryptocurrencies on the platform.

MEXC Fees Explained

Deposit fees

Deposits of fiat and cryptocurrencies are free on MEXC Global. Customers can also fund their accounts using AUD and 27 other fiat currencies. Deposits come in the form of credit cards or through MEXC’s third-party partners which provide quotes for you to choose from.

Trading fees

Trading fees on the MEXC spot and futures trading exchange follow a maker-and-taker structure. For spot trading, maker and taker fees start at 0.0% and 0.1%, respectively. On the other hand, futures trading fee on MEXC is 0% for makers and 0.03% for takers.

Customers who hold the MX token enjoy a 10% discount on the aforementioned trading fees. That means the taker fees for spot trading will reduce to 0.09%, and futures trading will reduce to 0.027%. Overall, trading fees on MEXC are highly attractive for intermediate and advanced traders and offer great value for money.

Withdrawal fees

The MEXC platform offers only crypto-based withdrawals as fiat transfers to an Australian bank account are not supported. Transfers of digital currencies to an external wallet can be done for free which is consistent with most other crypto exchanges.

Cryptocurrency withdrawal fees are dynamically calculated using the blockchain network status at the withdrawal time. Other factors that influence the network fee include congestion and the complexity of the transaction. There are withdrawal minimums. For example, BTC withdrawals are pegged to a minimum of 0.002 BTC and a minimum withdrawal fee of 0.0003 BTC.

What Can You Trade on MEXC?

MEXC supports 1,520 digital assets that you can trade in the spot, margin, and futures markets such as Bitcoin, Ethereum, Cardano, Solana, Litecoin, and USD Coin. The exchange also supports 1,807 trading pairs across its spot, margin, and futures market with USDT as the primary base asset.

In terms of asset support, MEXC does a great job and outshines competitors like Binance and Crypto.com. Looking for an intuitive platform to invest in a wide range of crypto assets, MEXC is an ideal solution.

Getting Started On MEXC

Creating a MEXC account is seamless on the website and mobile app. After signing up for the exchange, follow the steps below to complete your account creation process.

Verifying your account

Though you can buy and trade crypto on MEXC without completing KYC, the exchange recommends that customers undergo the verification process to access all its features. Unverified accounts have no access to the P2P marketplace but have a daily withdrawal limit of 20BTC which is one of the highest for a non KYC crypto exchange.

There are two KYC Levels on MEXC, each with its requirements. We highlight them below.

| KYC Level | Requirements | Limitations |

|---|---|---|

| Primary KYC | Personal Information (full name, nationality, ID information, date of birth) and ID document upload | 24-hour withdrawal limit of 80 BTC |

| Advanced KYC | Personal Information and Facial Recognition | 24-hour withdrawal limit of 200 BTC |

The verification process on MEXC is pretty straightforward and takes only a few clicks. During our review, we submitted KYC documents, and the verification feedback was sent after an hour, which is longer compared to other competitors like Binance and Crypto.com, which takes minutes. Despite the slow process, we were able to fund our account in the meantime.

How to fund your wallet

As stated earlier, you can fund your MEXC account while you await verification. However, the exchange offers limited payment options to Australians comprising credit/debit cards, bank transfers (only available through the P2P marketplace), or through third-party payment integrators Mercuryo, MoonPay, and Banxa.

Though MEXC offers direct credit/debit card deposits and bank transfers, these options are limited to EUR, USD, and GBP. All in all, the limited AUD deposit options make MEXC less attractive to Australian customers.

Alternatively, you can fund your MEXC account using cryptocurrencies. This is also commission-free, and funds will arrive in your account within 5 minutes. So, Australians can directly transfer to their MEXC exchange wallet for instant deposits.

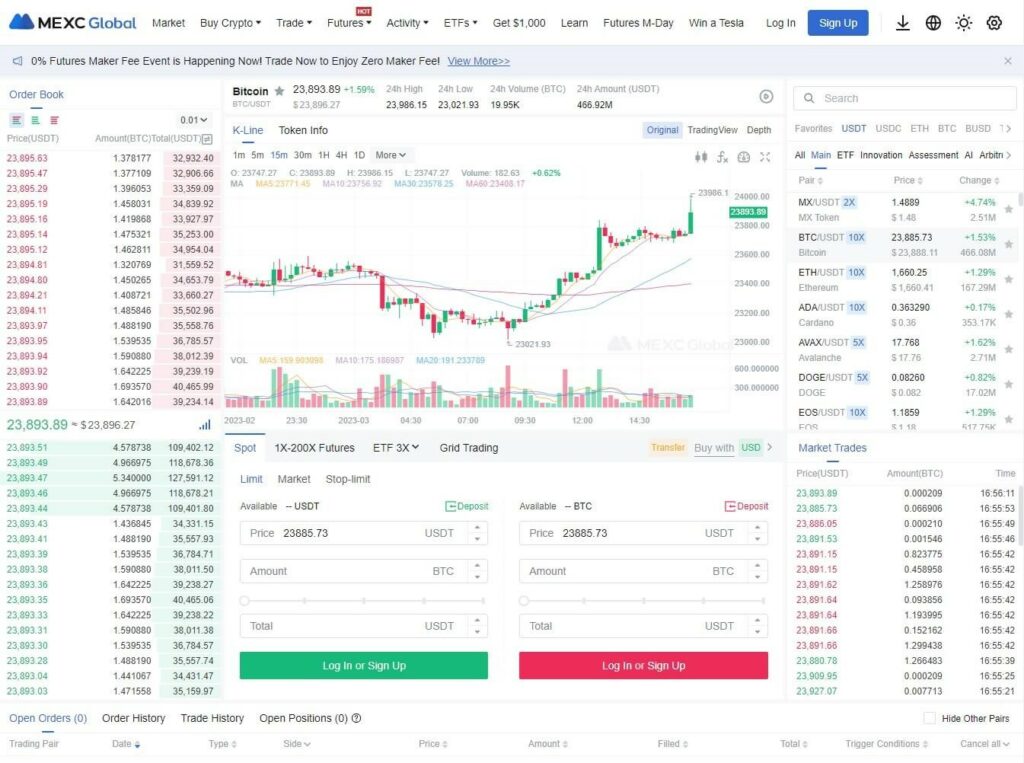

This Is What We Thought When Trading

MEXC Global offers a simple and intuitive trading platform on its website and mobile app. The entire account creation, deposit, and trading features were easy to access and use. The process of adding funds to your MEXC account through any supported third-party platform is also seamless. Once the website redirects you to the chosen payment provider, you can easily deposit funds and have them reflected in your account within the stipulated period.

We found minimal latency issues when using the trading interface such as switching between trading pairs. The exchange uses high-performance mega transaction technology to facilitate efficient trading.

Experienced traders will fancy the additional TradingView charting and depth features that offer additional analysis tools and indicators. There is also a dark mode that can be toggled.

Another amazing touch is the inclusion of a Live Chat option on the trading desk. This is a great touch and it’s not a feature that you see every day. From the Live Chat option, you can read the news and type in your questions to find instant answers to your queries. This feature has the advantage of not interfering with the user experience. So, if you find an article in the Help box, you can read it from the Help box without leaving the trading terminal.

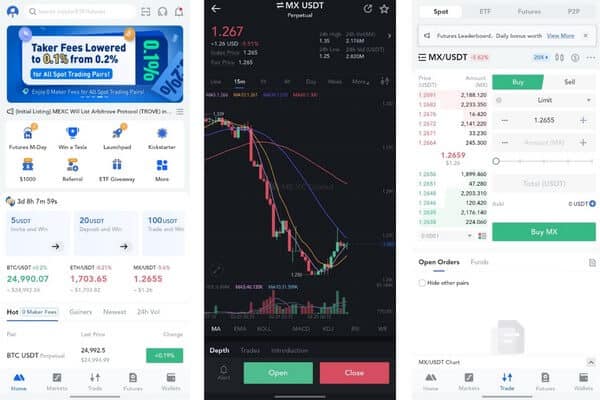

MEXC Has A Good Mobile App

The MEXC Global app is available on Android and iOS devices. Like the website, logging in to an account on the app is fast and efficient in command execution. It also has similar features to the desktop platform. So, you should expect to see features like copy trading, spot, margin, and futures markets on the app.

However, additional features like X-Game, Futures M-Day, ETF Treasure, and ETF Giveaway are absent on the MEXC website. In summary, the mobile app is packed with more features, including basic features for buying and selling crypto and the account wallet.

Interestingly, when trading on the mobile app, you get the option to toggle between viewing live charts or only the order book. This offers additional convenience and is similar to the Binance mobile app.

In addition, the MEXC mobile app has an excellent online rating. The mobile app has a 4.2-star rating on Google Play Store and a 3.8-star rating on the Apple App Store. According to users, the high interaction rate is due to the app’s optimized trading and excellent user interface. However, there were a few complaints including slow loading times. To this end, the MEXC team responded with directions on how to connect with the development team to solve their query.

Customer Support Is Responsive

MEXC offers various resources to educate users about the platform and provide answers to common issues like payments and verification. The extensive “MEXC Learn” does a good job of providing crypto tutorials and tips. In addition, the exchange has a dedicated team of customer support professionals that users can reach if self-service fails. The support team is available 24/7 via live chat and email which is standard in the crypto industry. There’s also a community of users across social media platforms like Telegram, YouTube, Twitter, and more.

During our review, we tested the Live Chat feature and discovered that MEXC offers customer support in 8 different languages including English, Turkish, and Dutch. Additionally, we sent a message and were connected to an agent within seconds, which is quite impressive. If you read our Gate.io review, you’ll see why having a responsive customer support team is such a big deal.

Here’s What Other Customer Had To Say

Though MEXC appears to thrive with its excellent support, online reviews suggest that the exchange can be better in this regard. According to customer reviews on Trustpilot, MEXC has a 2.6-star rating from a possible 5, which is just average. 59% of the reviews are poor, with many fraudulent reports from the majority.

We also discovered that no MEXC support agent responded to the negative comments. This would have been a better outlook for bystanders considering the platform. In other words, it’s best to test the platform with a small amount before fully onboarding on the exchange.

Security Measure We Noticed

To protect its customers and their assets, MEXC employs various security measures on the company and user end. The exchange has law enforcement guidelines like the standard KYC verification to combat scams and money laundering. The platform also institutes anti-phishing code to protect its servers from cyber-attacks and employs 2FA via Google Authenticator or email verification for sign-ins.

In addition, MEXC has an investor protection fund that provides customers with insurance coverage. However, there’s no verifiable information about the figure on their platform. We also couldn’t find many details on how MEXC stores customers’ funds.

MEXC’s registration with AUSTRAC is also a plus because it offers a reasonable level of assurance to Australian customers. Notably, there have been no reports of any MEXC hacks since the company started operations in 2018. This is an upside because popular exchanges like Binance and Coinbase have been hacked in the past.

Our Final MEXC Verdict

MEXC Global is a reputable cryptocurrency platform with high liquidity and an array of smartly-designed crypto products. The exchange offers simplified crypto trading and investing to Australians with access to 1,807 assets and some of the lowest fees.

However, the MEXC global exchange is lacking in many areas. This includes limited deposit methods for Australians, no fiat withdrawal, no NFT support, and no interest-earning wallet, to mention a few. Despite its similarities to Binance, the platform does not have the necessary setup to compete at the highest level.

Frequently Asked Questions

MEXC has its headquarters in Seychelles. However, it is a global entity operating in 170+ countries worldwide.

You can create an account and deposit funds on the MEXC global exchange without KYC. However, you need to be verified to access the platform’s promotions and services like P2P trading.

MEXC Global initially started its operations in China. However, the company has moved out of China to Seychelles due to regulatory issues.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.