Binance vs CoinSpot: Which Is Better?

Last Updated on December 24, 2023 by Kevin GrovesBinance Australia and CoinSpot may seem like two different cryptocurrency trading platforms but they are similar in a lot of ways. Does the global brand too generic in its trading experience or is the local platform come through with its Australian-centric features?

In this article, we compare Binance Australia and CoinSpot, two Australian crypto exchanges on the market so you can understand which one may suit your needs better.

The Bottom Line

Binance Australia is a superior crypto exchange to CoinSpot as it provides better features, more markets, and cheaper trading fees that offer great value for money. Whilst CoinSpot has unique features that cater to the Australian market such as SMSF support and crypto tax reporting tools, more Australians will benefit from Binance’s robust ecosystem of features.

Although the learning curve to get accustomed to the Binance interface is slightly longer than on CoinSpot, the interface is so well designed that even beginners should be able to navigate their way around with ease. The only downside to Binance is that CoinSpot’s customer service is more responsive.

Winner: Binance Australia 🏆

Website: www.binance.com

Referral Code (get 100 USDT free): See our Binance Australia referral code instructions

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Binance Australia vs CoinSpot: Comparison Table

| Exchange | Binance Australia | CoinSpot |

|---|---|---|

| Fiat currencies | 27 | AUD |

| Number of crypto | 380+ | 370+ |

| Deposit methods | Credit card, PayID, OSKO, crypto (BTC, ETH, USDT, BNB, BUSD) | Bank transfer, POLi, PayID, BPAY, cash deposit, credit/debit cards |

| Deposit fees | None | Free except BPAY (0.9%), cash deposits (2.5%) |

| Maximum trading fees | 0.1% | 1% (flat) |

| Withdrawal fees | None | None |

| Interest-earning wallet | Earn, staking | Earn only |

| Markets | Spot | Spot |

| Mobile app | Yes (iOS and Android) | Yes (iOS and Android) |

| Support | Live chat, email | Live chat, email |

| Verdict | ||

| Review | Binance Australia Review | CoinSpot Review |

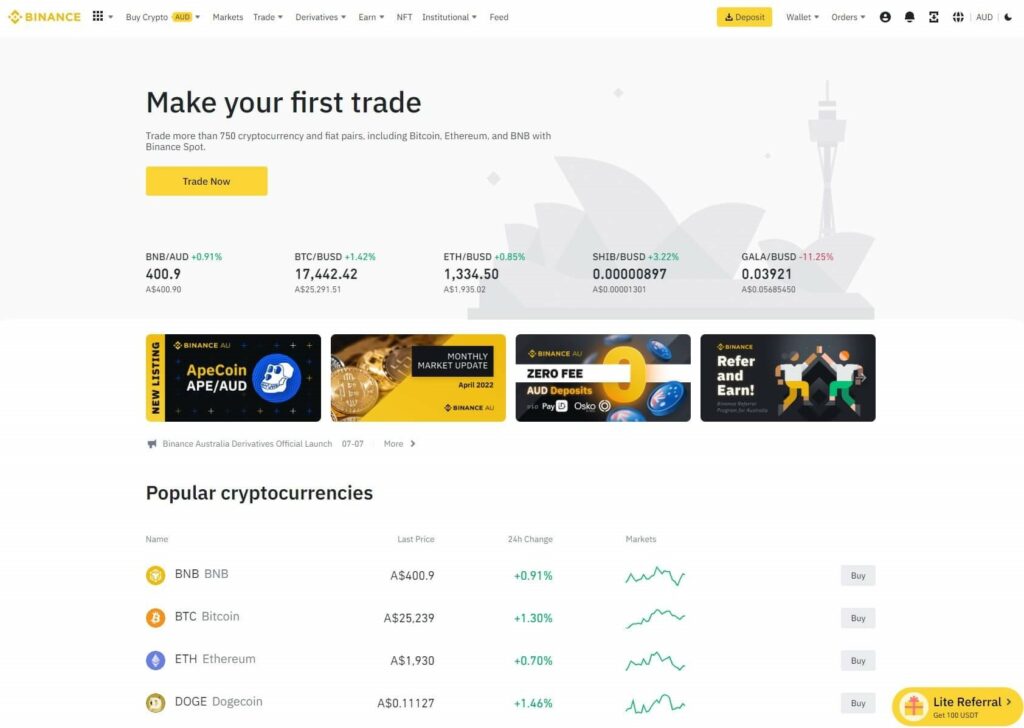

Binance Australia Overview

Binance Australia is a world-class crypto trading platform that offers Australian investors, traders, and crypto enthusiasts cutting-edge products and services. Launched in July 2020, Binance Australia has quickly become a popular choice with over 385 crypto assets to buy with Australian Dollars (AUD) and 1,636 trading pairs. The platform’s daily trading volume has exceeded $23 billion, making it the world’s #1 crypto exchange (at the time of writing) according to CoinMarketCap.

With maker and taker fees starting at a maximum of 0.1%, Australians have access to advanced markets like spot, margin, and futures trading, as well as innovative financial management products where you can leverage your crypto assets for your benefit. Binance’s extensive range of features and tools makes it ideal for serious and frequent traders.

Binance Australia Pros:

Binance Australia Cons:

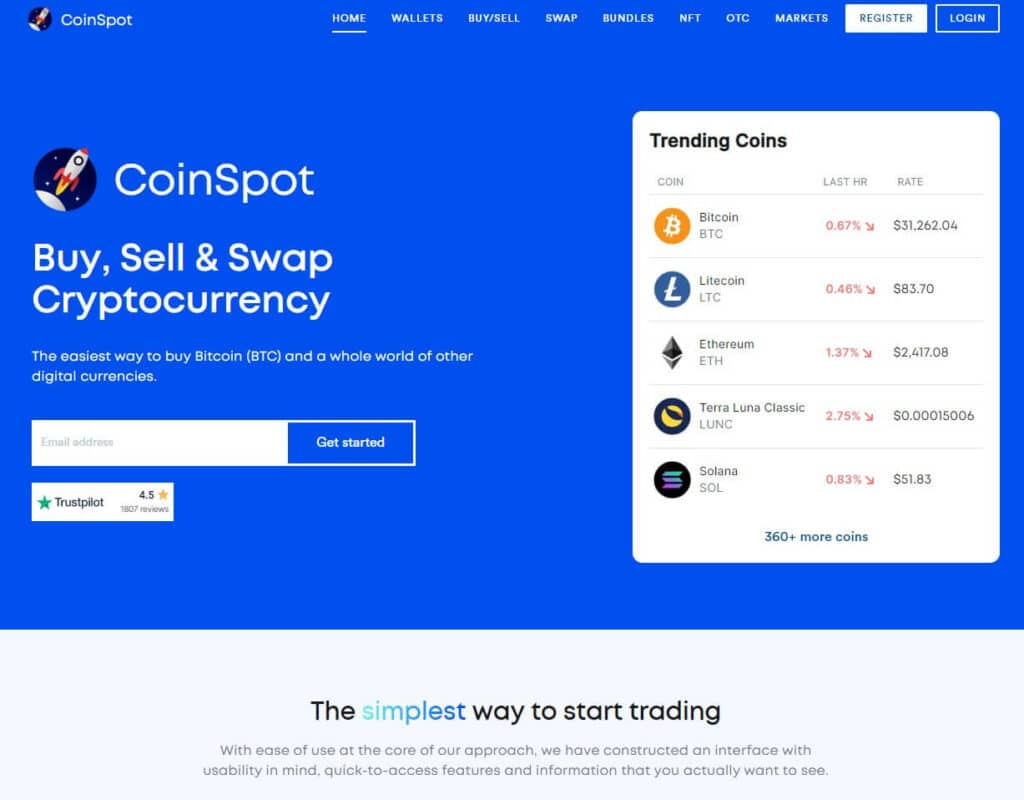

CoinSpot Overview

CoinSpot is an established, highly-regarded cryptocurrency exchange in Australia, having earned a solid reputation since its launch nearly a decade ago. The Brisbane-based company provides a user-friendly interface that is suitable for both novices and experienced investors, with the ability to buy and sell digital currencies in minutes. You can purchase over 370 digital assets such as Bitcoin, stablecoins, and altcoins quickly and securely, with all major deposit methods supported. The entire process is designed to be fast and straightforward, making it an ideal choice for anyone looking to invest in digital currencies.

To ensure maximum security, CoinSpot employs strict safety measures, including the attainment of the internationally recognised ISO 27001 accreditation for digital information systems. Its emphasis on security and customer-centric approach amongst its 2.5 million strong user base has led to the company’s exposure across multiple markets. For example, CoinSpot is a major sponsor of the Western Bulldogs Football Club and is now in partnership with Australian Bathurst.

CoinSpot Pros:

CoinSpot Cons:

Binance vs CoinSpot: Deposit Methods

When it comes to depositing options, CoinSpot provides more flexibility and choice than Binance Australia. CoinSpot supports nearly all AUD payment methods available in Australia including bank transfers, POLi, PayID, BPAY, cash deposits, and credit/debit cards. In comparison, Binance Australia only shares three of these methods comprising transfers from an Australian bank account, PayID, and credit/debit cards.

Like most cryptocurrency exchanges, Binance Australia and CoinSpot allow you to transfer digital assets from an external wallet. Any of the supported crypto assets on either platform can be deposited for free.

| Deposit Method | Binance Australia | CoinSpot |

|---|---|---|

| Bank transfer | Yes | Yes |

| POLi | No | Yes |

| PayID | Yes | Yes |

| BPAY | No | Yes |

| Cash deposit (Blueshyft) | No | Yes |

| Credit/debit cards | Yes | Yes |

| Cryptocurrency | Yes | Yes |

Although not recognised as a fiat currency payment method, Binance Australia has the added advantage of offering a Peer-to-Peer (P2P) marketplace which provides another avenue to trading digital assets.

Winner: CoinSpot 🏆

CoinSpot offers a broad range of account-funding methods available in Australia, such as five ways to deposit AUD and the option to purchase crypto with credit/debit cards. Binance Australia, on the other hand, is more limited in its methods, not accepting POLi, BPAY, or cash deposits.

Binance Australia vs CoinSpot: Products & Services

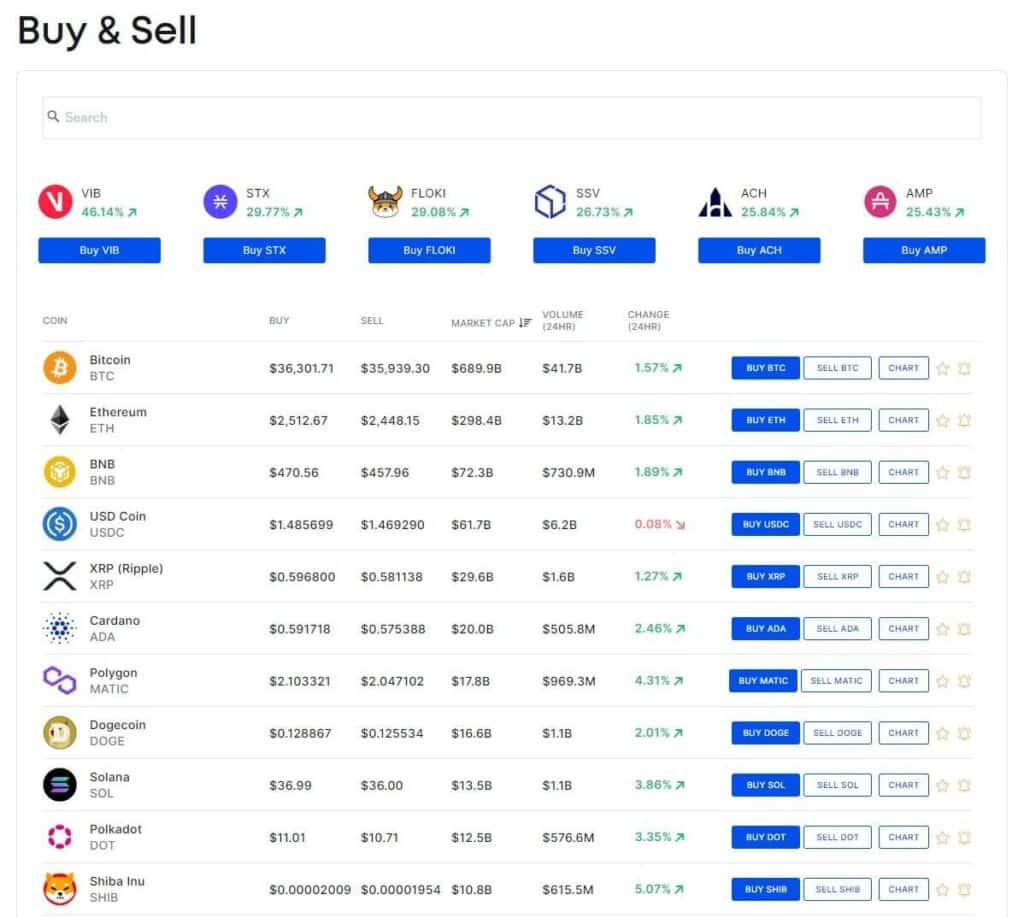

Supported cryptocurrencies and trading pairs

In terms of the number of supported cryptocurrencies, there is little difference between Binance Australia and CoinSpot, where they allow you to trade 380+ and 370+ assets, respectively. The vastness of their digital asset lists allows both beginners and experienced traders to invest in Bitcoin and the major altcoins including Ethereum, Solana, and Cardano. Although their asset lists are not as exhaustive as Gate.io or KuCoin, there is a lot for altcoin traders to work with.

Although the number of supported crypto is the same between the two platforms, Binance Australia has a significant advantage in its trading pairs. With the exception of BTC/USDT, crypto trading on CoinSpot is limited to the use of AUD as the fiat currency. There are no trading pairs with other fiat currencies or digital currencies as the base asset. Whilst this may not bother you if all you want to do is buy and sell crypto with AUD, CoinSpot is not a viable option if you’re a seasoned trader.

This is where the strength of Binance Australia’s diverse markets comes in. On the spot market alone, you have access to hundreds of fiat/crypto and crypto/crypto trading pairs where margin up to 5x can be applied to some:

- 15 fiat currencies including AUD, EUR, and GBP. There are 18 AUD/crypto trading pairs including the ever-popular BTC/AUD, DOT/AUD, DOGE/AUD, ETH/AUD, MATIC/AUD, SHIB/AUD, SOL/AUD, and ADA/AUD.

- 8 digital currencies can be traded as the base currency including BTC, USDT, BUSD, BNB, ETH, XRP, TRX, DOT, and DOGE.

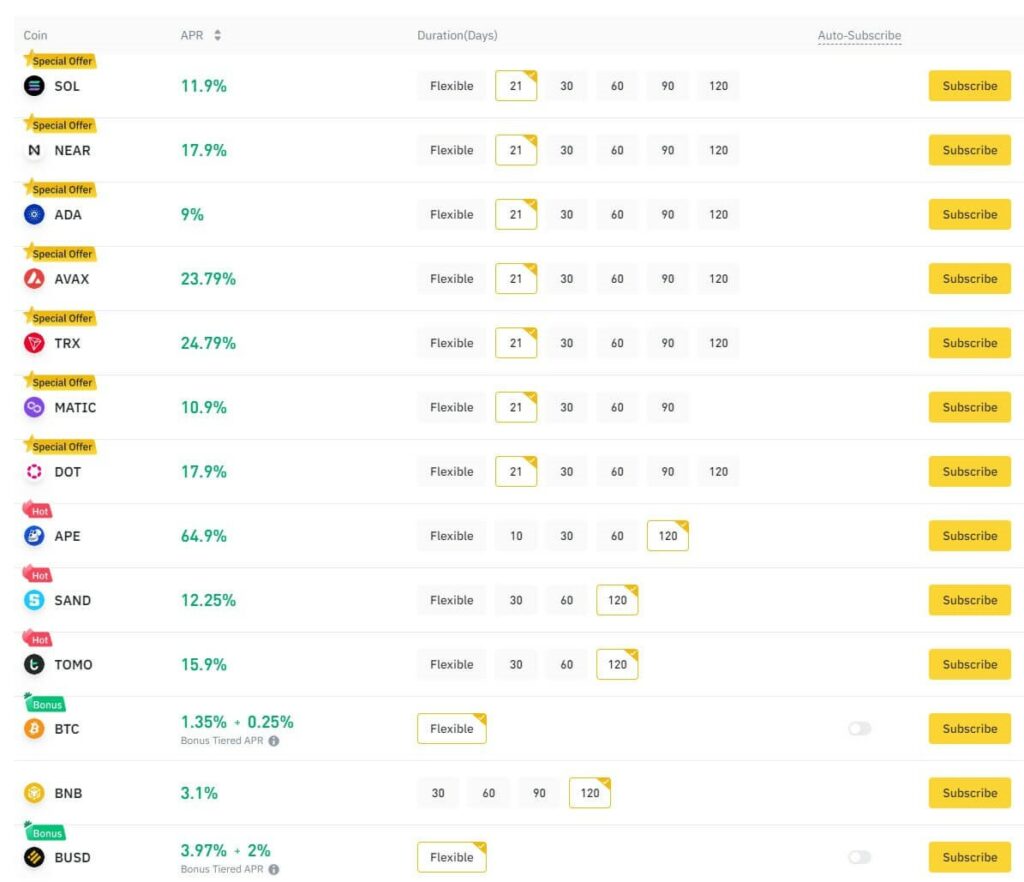

Binance has better financial management products

Simply put, Binance Australia has a better-developed interest-earning wallet than CoinSpot in terms of choice as well as Returns on Investment (ROI). The Simple Earn module allows you to deposit 30 digital assets to attract yields that are generally higher than CoinSpot’s Earn feature. As seen in the table below, CoinSpot supports seven fewer crypto assets to earn interest on and the rewards are noticeably smaller than Binance.

Popular cryptocurrencies that most investors would possess such as Solana (SOL) and Cardano (ADA) have their highest Annual Percentage Yields (APY) under the fixed term of 21 days where the yields are more than double those offered by CoinSpot.

| Earn Features | Binance Australia | CoinSpot |

|---|---|---|

| Supported crypto | 30 | 23 |

| Terms | Flexible, 15, 30, 60, 90, and 120 days | Flexible only |

| BTC | Up to 1.35% | Not available |

| SOL | Up to 11.9% | Up to 4.5% |

| ADA | Up to 9% | Up to 3.3% |

| MATIC | Up to 10.9% | Up to 7% |

| DOT | Up to 17.9% | Up to 9.5% |

| AVAX | Up to 23.79% | Up to 4.9% |

Besides the better service offerings and returns that Binance provides, financial management products such as SImple Earn are a lot easier to use than its CoinSpot counterpart. Although both platforms keep their interest-earning wallet for each crypto separate, CoinSpot’s Earn wallets are located within the wallet of each supported coin. Unlike Binance Australia, CoinSpot’s earn wallets are not kept in a central location where navigation and even finding coins that are eligible to earn interest is a cumbersome experience.

As an added benefit, you can also stake ETH 2.0 on Binance Australia for interest rewards of 4.29%. The staking of cryptocurrencies is not supported on CoinSpot.

Crypto spenders will favour CoinSpot

If you’re an active crypto user or want the option of spending your crypto in the future then CoinSpot should be your choice. Australians who use Binance don’t have access to its globally used Visa card to spend crypto. But CoinSpot customers can with its new Mastercard.

The recently released CoinSpot Mastercard is an incredibly convenient prepaid debit card that allows you to easily spend your digital assets on goods and services at in-store or online retailers that accept Mastercard. You can select up to five digital currencies in your wallet at any one time to be the payment asset, making it the perfect card for those who have a few favourite cryptos in mind. As an added bonus, the card automatically converts your nominated crypto into AUD at the best rates available when you make a purchase.

Contactless payments are a reality with its integration with Apple Pay and Google Pay, however, one of the downsides is that there is currently no rewards or cash-back program.

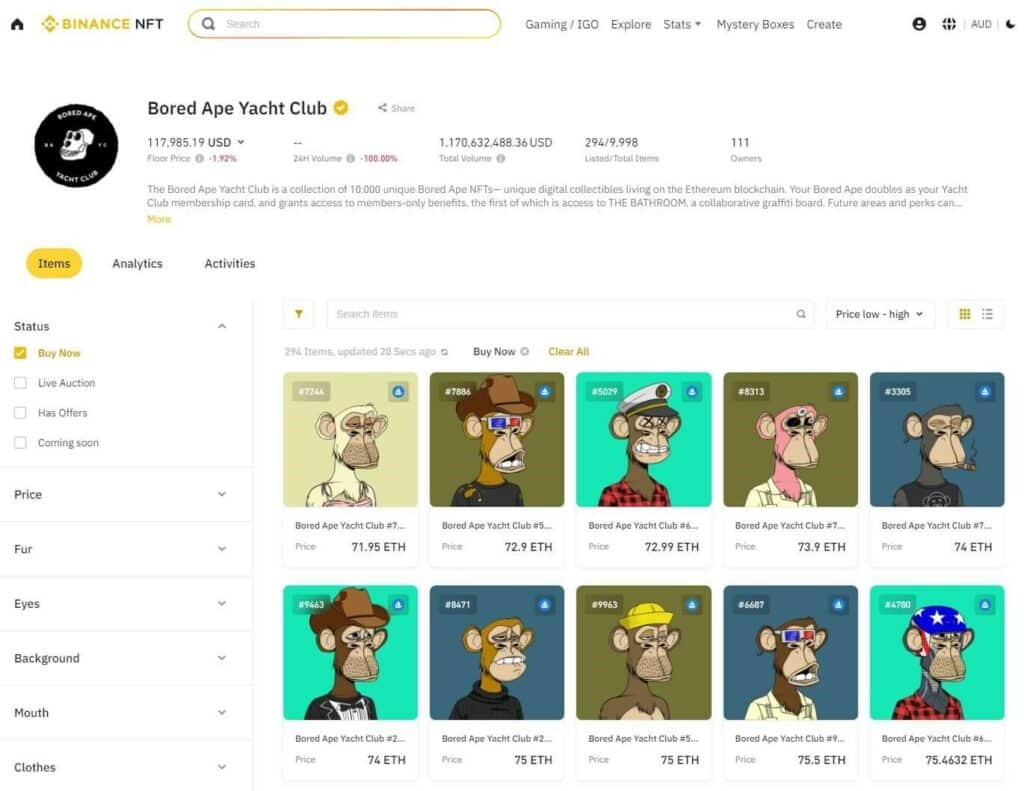

Buying and trading NFTs

CoinSpot has continually improved its growing NFT marketplace by slowly adding new collections of digital artworks and collectibles over time. Although one of the best NFT marketplaces in the Australian market, it pales in comparison to the NFT marketplace that Binance provides. As it stands, there are 30 NFT collections on CoinSpot compared to the hundreds on Binance.

CoinSpot has tailor-made features for Australians

One of the biggest advantages of choosing CoinSpot is that you have access to a range of small but useful features that suit the Australian market. These and unique to CoinSpot and include:

- Support for Self-Managed Super Fund (SMSF) investors. Australians can create an SMSF account where they can invest in Bitcoin and Ethereum as long-term stores of value.

- In-built tax reporting tools to make your End of Financial Year reporting easier. You can obtain an understanding of your obligations by using the Application Programming Interface (API) or by downloading your .csv file and uploading them into the tools.

Winner: Binance Australia 🏆

Binance Australia and CoinSpot provide the same staple features that you would come to expect from reputable crypto exchanges. Both provide good AUD support where cash can be used to trade in a multitude of crypto assets, as well as interest-earning wallets to passively obtain yields.

However, the sheer robustness of Binance’s features outweighs the benefits you can get from CoinSpot, including the small but useful features that the latter offers such as SMSF and crypto tax reporting tools. The crypto features on Binance are so well-developed that they provide much more choice, flexibility and better returns than CoinSpot.

Binance vs CoinSpot: Ease of Use

The beginner-friendly CoinSpot interface is relatively easy to use. This comes as no surprise since the popular crypto trading platform has been catering to everyday Australians for nearly a decade. Its straightforward dashboard makes navigating the platform simple. Crucial portfolio management tools such as funding your account, setting up AUD withdrawals to your bank account, and getting a summary of your trading history can all be done with a few clicks.

The Binance Australia interface offers a similar user experience to CoinSpot but more time is needed to get acquainted with it. If you’ve come from another large cryptocurrency exchange such as OKX or Bybit then the Binance Australia interface will feel familiar. However, the extra time that is needed for beginners to learn how it operates doesn’t necessarily mean it is hard to use. In fact, it could be said that the design of the Binance interface is a lot better than the outdated CoinSpot interface, even despite the more features and markets it has.

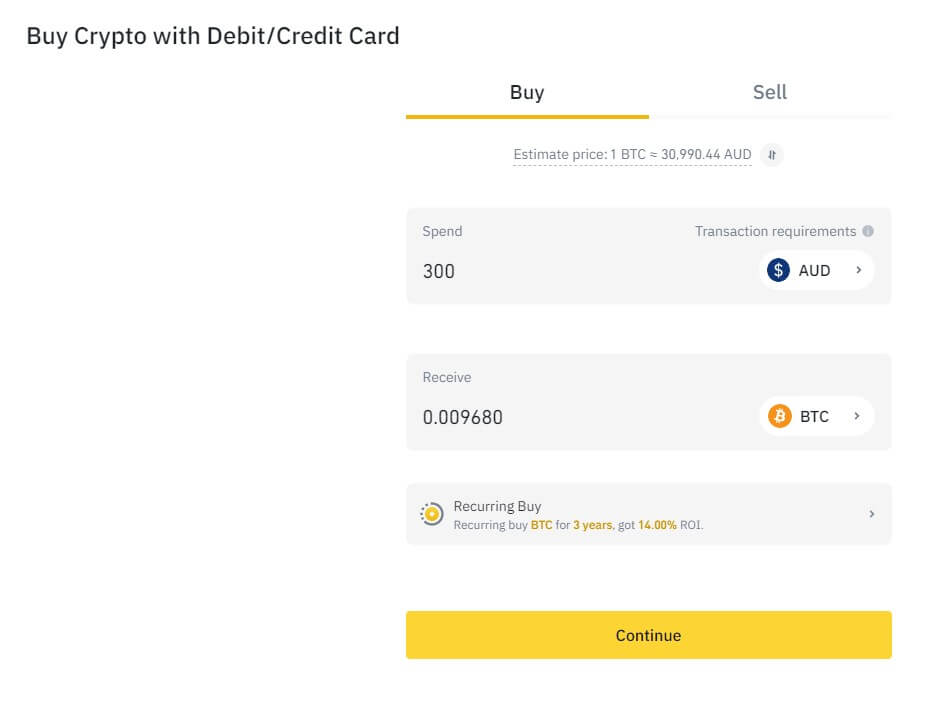

If you’re a beginning crypto investor looking to purchase digital assets in AUD, you have multiple options with Binance Australia. You can fund your account with cash via PayID or transfer funds from an Australian bank account, or purchase them directly with a credit card. For those who want to avoid trading fees, the P2P marketplace might be the ideal choice. Third-party payment providers may also be employed, but fees are usually higher.

Binance stands out as a world-class crypto service provider, providing a vast array of ways to buy digital assets. All methods are delivered on an advanced platform, simplifying the process for all newcomers.

Winner: Binance Australia 🏆

Binance Australia and CoinSpot provide easy-to-use interfaces that most traders and investors should get accustomed to fairly quickly. But with the vastness of Binance’s features, the learning curve will take a bit longer if you’re totally new to crypto exchanges. Despite this, the Binance user experience is seamless and indicative of a premium crypto exchange with premium features.

On the other hand, the CoinSpot interface hasn’t changed much since 2013 and is very outdated. Although simple in operation, the interface could do with a lot of improvements to its design and layout to heighten the quality of life

Binance vs CoinSpot: Fees

Binance Australia is a cheaper crypto exchange than CoinSpot in terms of its deposit and trading fees. There are zero fees to deposit AUD into your Binance wallet via bank transfer or PayID. Whilst this is the same for CoinSpot, minor and annoying fees are associated with BPAY (0.9%) and cash deposits (2.5%), which should be avoided. Moreover, fees to buy crypto with a credit/debit card are cheaper on Binance than they are on CoinSpot by 0.58%.

| Deposit Method | CoinSpot Fee | Binance Australia Fee |

|---|---|---|

| Bank transfer | None | None |

| POLi | Yes | Not supported |

| BPAY | 0.9% | None |

| Cash deposit (Blueshyft) | 2.50% | None |

| Credit/debit cards | 2.58% | 2% |

| Cryptocurrency | None | None |

Binance Australia also has the upper hand over CoinSpot in trading fees. Firstly, there are zero fees on Binance to instantly buy cryptocurrencies using AUD via bank transfer. Compare this with the astoundingly high 1% fee from CoinSpot’s Instant Buy/Sell feature and the choice between the two platforms is easy.

Trading fees for both exchanges start at 0.1%, noting that Binance fees follow a maker-and-taker structure. However, high-volume traders should be using Binance due to the fee discounts that can be derived given their 30-day trading volume. Other aspects that equate to a better value comprise Binance’s high liquidity which means that the price slippage on trading pairs will be reduced.

Although market orders on CoinSpot attract a fair fee of 0.1%, take profit, stop/limit orders, and recurring buys all incur hefty costs of 1%. For advanced traders or even novice traders who want to apply a level of control to their orders, CoinSpot is not a value-for-money platform to trade crypto.

Winner: Binance Australia 🏆

Despite having a lot of similarities in their fees and charges, CoinJar is the more economical option. The combination of fewer fees or no fees to deposit AUD funds as well as the tiered structure of maker and taker fees on CoinJar Exchange presents slightly better value for money for beginner and experienced traders alike.

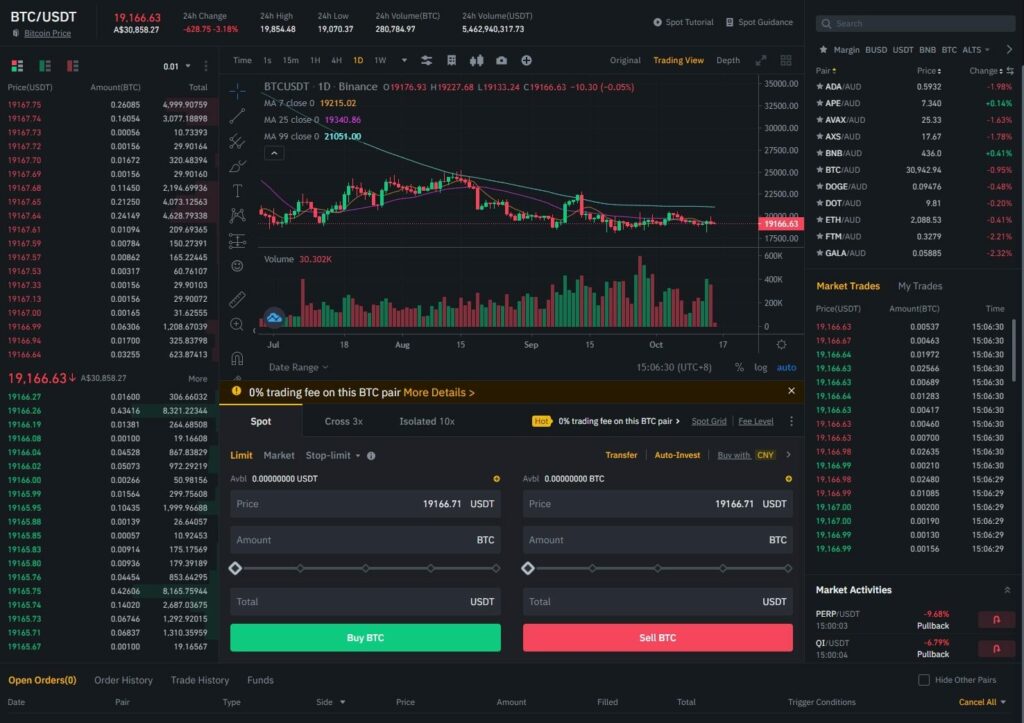

Binance Australia vs CoinSpot: Markets & Trading

CoinSpot limits crypto trading to the pairing of BTC/USDT and AUD, so it may not be the most suitable choice for experienced traders. Furthermore, there are no trading pairs with other fiat or digital currencies as the base asset, limiting the options of those who want to purchase and sell digital currencies with AUD.

In addition to the direct purchasing of crypto with AUD and crypto/AUD pairs, Binance Australia provides superior trading markets that will entice experienced traders. Binance Futures offers the following markets:

- USDS-M Futures: Perpetual or Quarterly Contracts that are settled in USDT or BUSD.

- Coin-M Futures: Perpetual or Quarterly Contracts settled in Cryptocurrency.

- Leveraged Tokens: Trade with leverage without the need to put up collateral, maintain and margin level, or worry about the risk of liquidation.

- Options: Cash-settled contracts where the options can be exercised before the time expires.

Binance’s margin and futures markets on their state-of-the-art trading platform are unrivalled, with only top margin trading platforms such as KuCoin and Bybit coming close. You benefit from deep liquidity, a comprehensive charting interface, powerful tools, and some of the lowest market and taker fees available. With all these features, Binance is the perfect Australian platform for margin trading.

Winner: Binance Australia 🏆

Binance Australia has a superior range of markets and trading features than CoinSpot. In comparison to CoinSpot ‘s limitation to AUD-only trading, Binance offers spot, margin, futures, leveraged tokens, and options markets that will satisfy seasoned traders. The #1 crypto exchange in the world also allows multi-fiat currency trading and has an impressive number of crypto/crypto trading pairs.

Binance Australia vs CoinSpot: Mobile Apps

Binance Australia and CoinSpot have apps for Android and iOS mobile devices. These apps have been designed to offer the same experience as the web version, including the features. The trading interfaces on the Binance app are particularly nice and feel very streamlined and responsive. Both crypto trading apps implement 2-Factor Authentication (2FA) measures to ensure that the apps are secure places to buy, sell, and store digital assets.

Winner: Tie

CoinSpot and Binance Australia provide functional and easy-to-use mobile apps. In terms of their ease of use and how they integrate their respective crypto products and services, we found no significant difference.

Binance Australia vs CoinSpot: Customer Service

The customer service team at CoinSpot are very accessible. You can reach them through support tickets or via the live chatbot on the website. The feature is only active between 9 am-6 pm on weekdays and 10 am-8 pm on the weekends, Melbourne time.

In comparison, the FAQ section that Binance provides is extremely well-built and detailed and can be considered the industry’s best version of a help centre. Although Binance Australia provides the same avenues to customer service as CoinSpot (email and live chat), the responsiveness is lacking. If you send a ticket to Binance then expect to wait around 24 hours for a response.

Winner: CoinSpot 🏆

CoinSpot provides superior customer service due to their local and devoted team, who are renowned for their speedy responses. In comparison, Binance Australia offers support via live chat and email, but their replies can take a while due to their worldwide clientele.

Binance Australia vs CoinSpot: Security

CoinSpot is an incredibly reliable and secure platform, equipped with cutting-edge security features to protect your funds. Every user is subject to KYC rules, meaning you must go through a quick verification process to start trading. 2FA is required upon sign-up to further protect your account from potential hacks. Regular account monitoring is conducted and the platform is integrated with Auth0 to ensure the utmost security of user wallets. CoinSpot has not been hacked since its inception in 2013.

CoinSpot is a reputable and secure platform for purchasing cryptocurrencies. It has earned a stellar reputation due to its dependability and is one of the few Australian crypto exchanges to have achieved the internationally recognised ISO 27001 certification.

On the other hand, Binance is one of the most trusted cryptocurrency exchanges in Australia (and the world) and features multiple layers of security, such as 2FA, anti-phishing codes, and Google authentication. They make use of cryptocurrency security standards to safeguard user accounts, and also have an emergency fund to protect investors in the case of a breach. Although, it is important to note that Binance has been hacked before, resulting in a loss of around $40 million.

Winner: Tie

Even though Binance has been hacked in the past for a small amount, there is no material difference between the security framework of Binance and CoinSpot. Both are trusted and secure trading platforms that implement industry-leading security measures.

Binance vs CoinSpot: Comparison Outcomes

Based on our comparison of Binance Australia and CoinSpot, the latter is really suited for Australians who want a no-fuss way of buying and investing in popular digital currencies. CoinSpot provides a simple fiat gateway where you can quickly exchange your money for Bitcoin, Ethereum and a whole host of altcoins. Although its Earn wallets don’t provide the yields that Binance does, the interest rates on offer are still viable and are a good option to passively grow your crypto. CoinSpot has great customer service but the only way of cheaply buying crypto is by placing market orders on the exchange.

Experienced traders and investors who want more options will choose Binance. By doing so, you’re not losing out on the ability to trade altcoins since Binance and CoinSpot have similar lists of supported assets. But you gain in its diverse trading markets which CoinSpot doesn’t offer. You can trade on its spot, margin, leveraged token, futures, or options markets with more fiat/crypto and crypto/crypto trading pairs at your disposal. The Simple Earn module is far stronger than CoinSpot’s equivalent with more options and greater yields.

Binance Australia also has lower fees in almost all areas. While CoinSpot charges minor fees for some deposit methods (BPAY, cash deposits), you can deposit AUD into your Binance wallet for free. Its maker and taker fees are also very economical in the Australian market. If you’re an existing CoinSpot customer then you easily transfer your crypto to Binance Australia.

| Comparison Criteria | Winner | Reason |

|---|---|---|

| Deposit Methods | CoinSpot | CoinSpot supports more payment methods – bank transfer, POLi, PayID, BPAY, cash deposits, and credit/debit cards. |

| Products & Services | Binance Australia | Better-developed features that heighten the trading experience. Superior ROI on interest-earning wallets. More trading pairs. |

| Ease of Use | Binance Australia | Both are easy-to-use platforms but the CoinSpot interface is outdated. |

| Fees | Binance Australia | Binance Australia offers free deposit methods and vastly cheaper trading fees. |

| Markets & Trading | Binance Australia | CoinSpot is limited to AUD trading. Binance offers spot, margin, leveraged token, futures, and options markets. |

| Mobile Apps | Tie | Both platforms provide easy-to-use and functional apps for iOS and Android mobile devices. |

| Customer Service | CoinSpot | The local CoinSpot support team is more responsive than Binance. |

| Security | Tie | Both platforms implement industry-leading security protocols. |

Warren is the co-founder of CoinCryption. He has a passion for cryptocurrency and has been involved in this space for more than 7 years. His other love is digital marketing and has over 15 years of experience.