KuCoin Review For Australians: It’s Not What We Expected

Last Updated on December 24, 2023 by Kevin GrovesKuCoin is one of Australia’s best cryptocurrency exchanges. In fact, according to its website, 1 in every 4 crypto holders worldwide are registered on the platform. KuCoin is renowned for its competitive fees, huge list of supported digital currencies, and comprehensive trading hub – perfect for experienced investors. This review puts the microscope on KuCoin’s features, security, and fees to help Australians decide if it’s the right exchange for their crypto needs.

KuCoin

Trading fees:

0.1% (maker), 0.1% (taker)

Number of cryptos:

780+

Deposit methods:

Credit/debit card, bank transfer, SEPA

Supported countries:

Global (including Australia)

Promotion:

None

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Quick Overview

Here is a quick summary of the exchange information.

| Exchange name | KuCoin |

| Supported countries | Australia (and most other international countries) |

| Fiat currencies supported | AUD, USD, JPY, EUR, GBP, CNY and 30+ more |

| Deposit methods | Credit/debit card, bank transfer via third-party provider (Banxa), SEPA |

| Supported cryptocurrencies | BTC, ETH, USDT, SOL, ADA, XRP, APE +780 more |

| Deposit fee | 3.8% for card, free for crypto |

| Trading fee | 0.1% (maker) and 0.1% (taker) |

| Margin | Up to 100x leverage |

| Withdrawal fee | Fiat: None Crypto: Variable network fee that depends on cryptocurrency |

| Mobile app | Yes (iOS and Android) |

The Bottom Line

KuCoin is one of the most feature-rich exchanges on the market, boasting a massive list of altcoins, an earning hub, an advanced trading suite and much more. The platform is intended for both beginner and experienced crypto investors. However, we found that beginners can be quickly overwhelmed by the array of options and features. Additionally, Australians might find the inability to withdraw AUD and other fiat currencies a substantial barrier.

If you want an exchange with top-shelf features, DeFi integration and supported cryptocurrencies, KuCoin is a great choice. However, alternatives like Binance with superior support for AUD may be better for inexperienced investors.

What we liked:

- One of the biggest lists of trading pairs on the market.

- Advanced TradingView charting exchange that supports margin and derivatives.

- Very low trading fees (0.1%).

What we didn’t like:

- Poor integration with fiat currencies, notably AUD.

- Identity verification process can be annoying.

- Buying crypto with fiat can be expensive.

What is KuCoin (and is it available in Australia?)

KuCoin was released in the aftermath of 2017’s “DeFi Summer”, around the same time as competitor Binance. KuCoin is one of the most popular exchanges on the market, hosting over 20 million users across the globe. It regularly sees over 2 million weekly visits and USD $2 million daily trading volume.

KuCoin’s headquarters were originally located in China, however after the Chinese government cracked down on crypto regulations, they moved to a more favourable regulatory environment in Hong Kong. KuCoin is registered in the business haven Seychelles. They are yet to secure an Australian license and are not registered with AUSTRAC. This is a major reason the platform cannot offer AUD fiat withdrawals. However, there are other ways to withdraw from KuCoin to an Australian bank account.

The KuCoin exchange makes up for its regulatory limitations with one of the widest feature sets we’ve seen on any crypto platform. Users can trade over 780+ cryptocurrencies and 1350+ markets, including derivatives, with fees of 0.1% (or lower). The company has also partnered with NFT platform Windvane to offer tokenised assets to its customers.

Those interested in passively earning on their crypto holdings will find KuCoin more than capable of meeting most of their needs. Over 30 tokens can be earned on, with regular promotions offering an increased earning rate over a limited period.

Pros & Cons

Pros:

Cons:

Here’s Our Feedback on KuCoin’s Features

Derivatives and margin is powerful for advanced traders

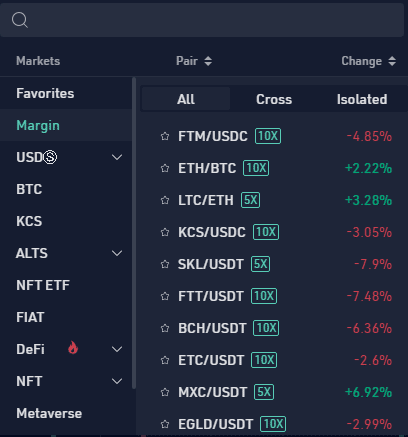

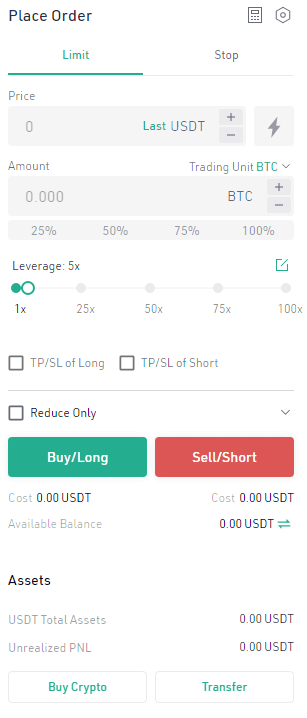

KuCoin is a crypto platform for trading with leverage. The margin trading interface is easily accessible and allows you to trade various cryptocurrencies with up to 10x leverage. Experienced investors can choose between Isolated Margins (10x leverage) or Cross Margins (5x leverage) on over 220 pairs. It’s worth noting that there aren’t any fiat trading pairs available on the KuCoin platform.

KuCoin also supports placing advanced orders such as Take-Profit and Stop-Loss to assist with the margin trading process. Considering that trading with leverage amplifies gains and losses, including these features can help investors mitigate some of the increased risks.

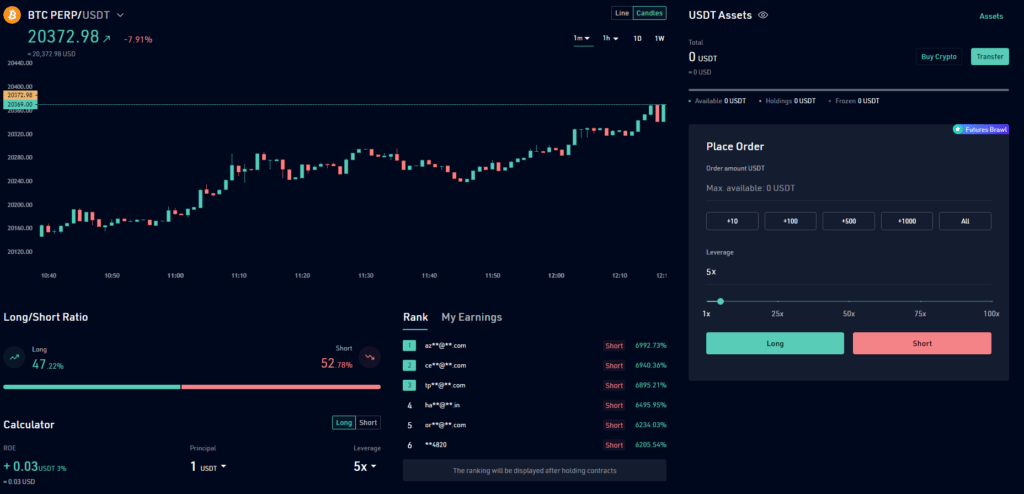

KuCoin also supports trading futures on over 100 coins with up to 100x leverage. More experienced traders can hold long or short positions on various popular cryptocurrencies, including BTC, ETH, ADA, APE and ATOM. The same advanced order options for margin trades can be used when buying and selling derivatives.

Interestingly, KuCoin also supports a “Futures lite” hub, a beginner-focussed trading interface for derivatives. The lite version removes many bells and whistles that might confuse inexperienced traders and offers a sleek interface with a customisable chart.

Although the lite version is designed for beginners, it is important to never trade derivatives without knowing what you’re doing. Trading futures contracts in a volatile market, especially with leverage, is one of the quickest ways for inexperienced traders to lose their hard-earned money.

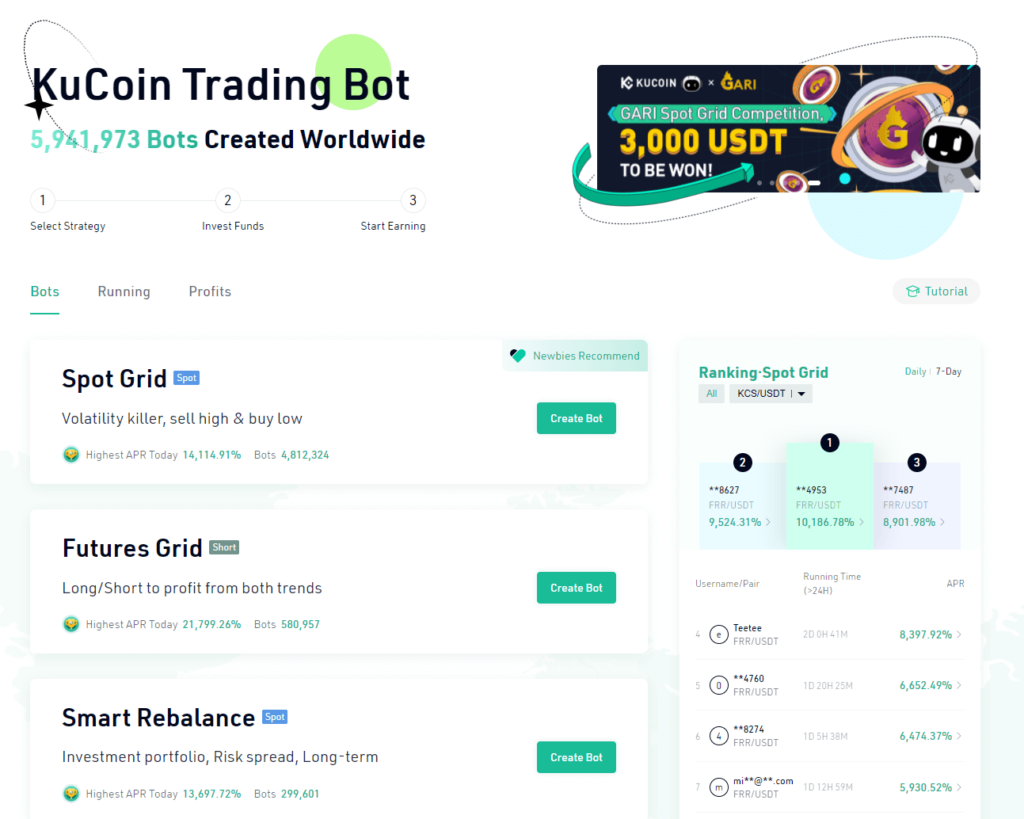

Trading bots are useful to automated your stratgegy

Many professional day traders use bots in both the traditional finance and crypto markets. KuCoin is a solid choice for those wanting to use crypto bots and automate their day-to-day trading experience. In fact, very few crypto exchanges even offer this service. KuCoin’s userbase has created nearly 10 million unique bots in its five years of running.

The bots generally work by automatically setting a price range (alternatively, you can set your own manual ranges). The bot will then attempt to buy low and sell high while operating within that price range.

Five different types of bots can be created:

- Spot Grid: A “Newbie-friendly” option that can buy cryptocurrencies in a custom low range and then sell them when they hit a higher range.

- Futures grid: Functions the same as the spot grid, however, trades derivatives with up to 100x leverage.

- Smart rebalance: A portfolio-focused bot that allows you to invest into a weighted basket of cryptocurrencies – much like an ETF. For example, the “DEX Flagships” bot will invest in UniSwap, Stellar, PancakeSwap, Synthetic, 1INCH and SushiSwap.

- Dollar-cost averaging: Another bot great for beginner (and experienced) traders. The DCA bot makes regular contributions to an asset over a set period of time while ignoring price fluctuations. This helps reduce volatility by gaining long-term exposure to the price of a coin.

- Infinity grid: The infinity grid works similarly to the Spot and Futures grid bots, with one key difference – there is no upper sell limit. Instead, the infinity grid will sell off portions of your assets depending on a preset profit rate.

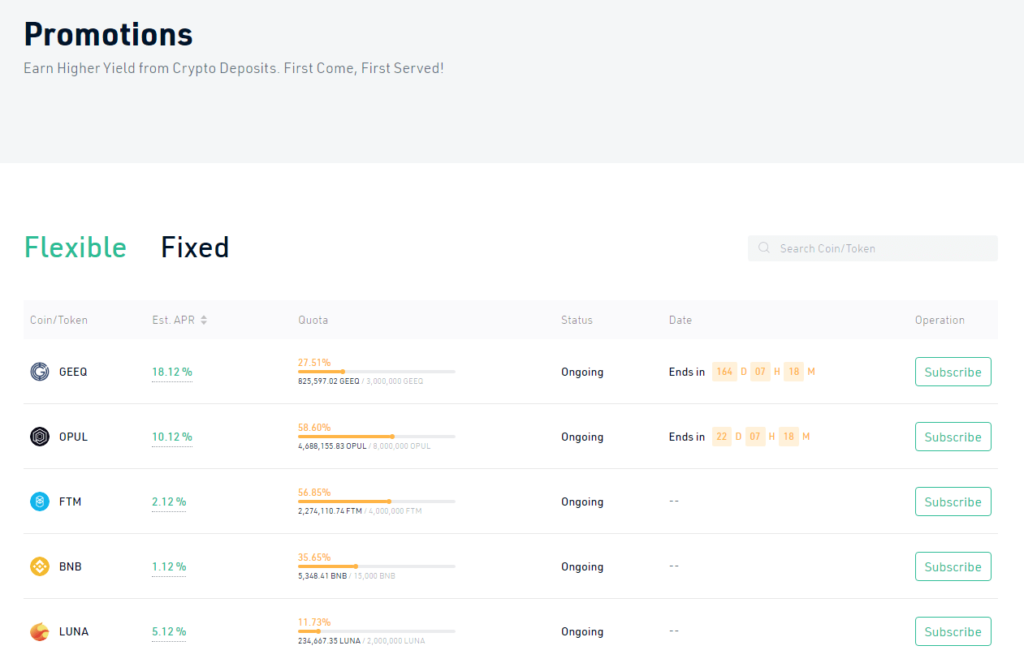

Earning hub has several ways to make a little more

KuCoin’s earning programs are one of the best places to earn interest and grow your investments. A huge range of earning mechanisms is available for you to cycle through, depending on your risk appetite and crypto holdings.

KuCoin’s flagship product, KuCoin Earn, allows you to accumulate income on various cryptocurrencies. Most prominent coins are supported, including Bitcoin, Ethereum, Polygon, Binance Coin, Solana, and Cardano, as well as a variety of stablecoins.

The yields on offer vary depending on the coin but are relatively competitive compared to other earning programs. Bitcoin’s current earn rate (0.27% APR) is quite feeble, however, popular coins like ATOM (15.25% APR), DOT (12.31%), and LUNA (14.25%) all boast solid returns. KuCoin also offers regular promotions that provide a boost in earnings over a short time. For example, for seven days, new users can get 100% APR on USDT deposits.

KuCoin also offers several other earning methods:

- Margin lending: You can lend crypto to margin traders using leverage, who will then pay you back with interest.

- KuCoin pool: You can mine Bitcoin by installing the appropriate mining software/hardware and connecting to the KuCoin pool

- Cloud mining: Through specific timeframes, you can purchase computing power on KuCoin to virtually mine BTC on your behalf.

- KuCoin win: KuCoin win is essentially a gambling/gaming hub where you can bet small amounts of crypto to try and win a variable jackpot.

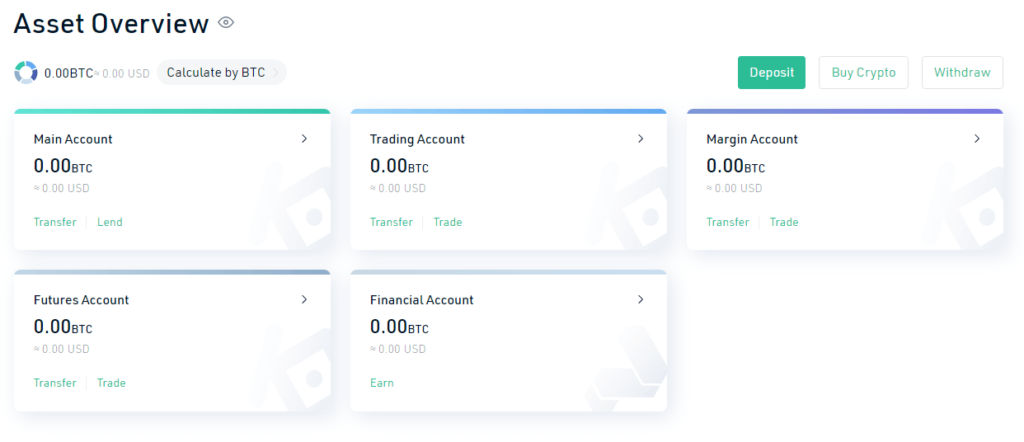

Multi-token wallet to store all your coins and tokens

The KuCoin platform comes with a native multi-token crypto wallet to store digital and fiat assets. The wallet is broken down into different sections depending on your investment goals. For example, if you’re an active margin trader, you can see how much leverage you’ve borrowed.

The KuCoin desktop wallet can store all of the coins supported by the platform, which is over 700. To actually trade crypto purchased on the platform, you must transfer digital currencies from your Main Account wallet to your Trading (or Margin/Futures) Account wallet.

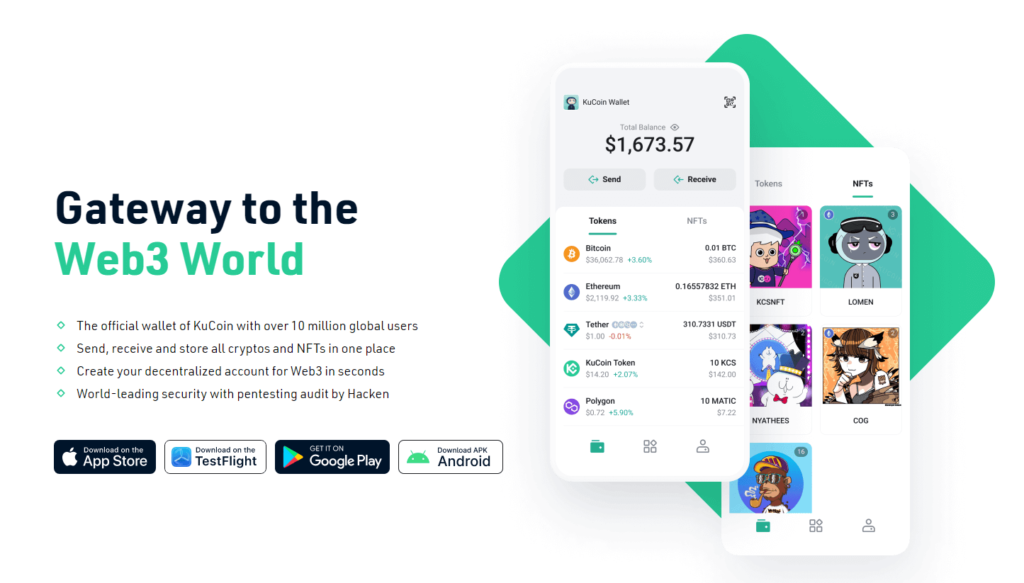

In conjunction with the desktop wallet, KuCoin has also developed an official smartphone application called the KuCoin Wallet. You can install this wallet on both iOS and Android devices. Though KuCoin’s wallets are relatively secure and functional, it’s always a good idea to consider a third-party wallet.

The KuCoin mobile wallet comes with several features attached. You can use it to store, send and receive hundreds of digital currencies. In addition, the app doubles up as an NFT marketplace where you can buy, trade and hold onto your digital tokens. The wallet address can also be linked with decentralized applications to easily engage with DeFi games and other Web 3.0 services.

Several rewards and promotions on offer (and regularly changing)

KuCoin is one of the richest cryptocurrency exchanges regarding rewards and promotions. There’s an array of different earning opportunities for users not wanting to stake/lend their cryptocurrencies.

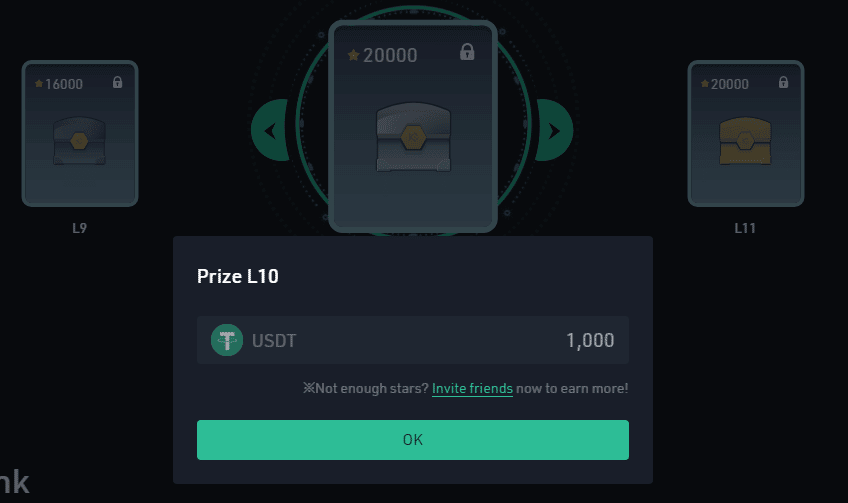

KuCoin’s referral program is rather unique. Whereas other platforms tend to offer a flat reward for new users signed up (e.g. 15% of their fees, or $10 in BTC), KuCoin rewards you with “stars”.

These stars can be accumulated whenever you register someone new with your referral link and whenever a referee makes a trade or completes certain tasks. Those who earn 20,000 stars can receive 1000 USDT as a reward.

KuCoin’s affiliate program, available to anybody with a strong social media following, is another earning opportunity. Affiliates will receive 40% of trading fees from anyone who signs up with their link.

The platform also offers regular promotions and trading competitions. For example, a September 2022 event pits users against each other for a cut of a 50,000 USDC prize pool. The lion’s share goes to the group with the highest trading volume among specific trading pairs.

One of the few exchanges with a marketplace to buy NFTs

KuCoin hosts an NFT platform that is broken down into three sections. The main NFT marketplace is a partnership between KuCoin and Windvane. Accessing Windvane requires you to leave the KuCoin exchange, where you can buy, sell and trade NFTs. You can also use your NFTs to participate in games and new NFT launches.

What really caught our eye was a newer feature developed by KuCoin called “Fractional NFTs”. As the NFT market exploded in the early 2020s, the price of the more popular digital artworks became out-of-reach for your average investor. However, these NFTs are also the most desirable, both in terms of status and growth.

To address, this, KuCoin launched a Fractional NFT marketplace that allows fractional investment into some of the top NFT collections. The way it works is simple – KuCoin (or another provider) will buy an expensive NFT outright and then sell fractional shares in the asset to its users.

For example, say KuCoin bought a Bored Ape NFT that cost $1 million. KuCoin could then offer 10,000 shares, each worth $100 and representing 0.01% ownership of the NFT. Then, if KuCoin sold the Bored Ape for $2 million, fractional owners would receive $200 per share. Although fractionalization of digital assets isn’t new, KuCoin is one of the only exchanges to offer this feature.

Mobile app to trade on the go

KuCoin has a top mobile app for crypto that offers the same services you can find on the desktop platform. The app is well-designed, clean and integrates a modern trading interface perfect for buying and selling digital assets on the go. The app is well-received, averaging a star rating of 4.5/5 across both the Google Play and iOS App stores.

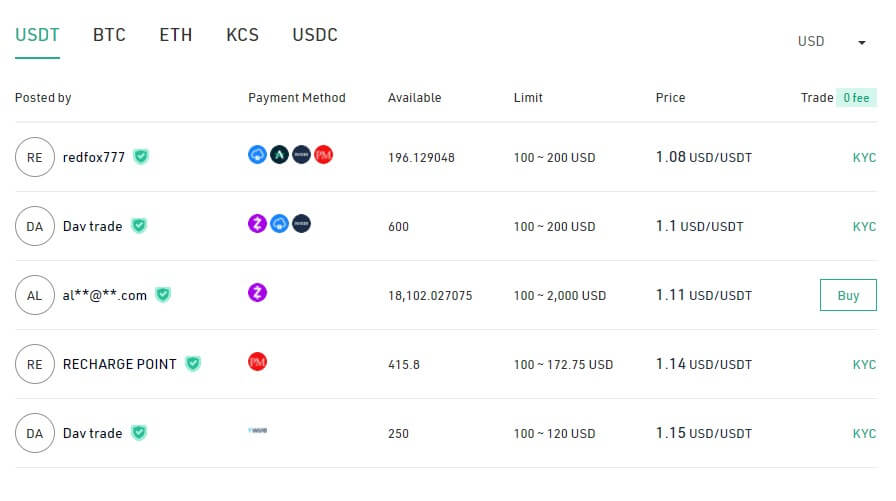

P2P exchange if you need more payment methods

The KuCoin platform supports a P2P exchange where you can buy and sell five crypto assets directly to other users. This is the only way Australians can purchase digital currencies using an AUD bank transfer. P2P trading supports trading USDT, BTC, ETH, KCS and USDC.

However, the P2P platform’s usability depends on how many sellers are active. While there are typically many options for USD and CNY currencies, the AUD offerings are rather barren. For example, as of September 15, 2022, only one seller is accepting AUD on the P2P exchange. A better alternative for those that want to trade on a P2P platform should consider Elbaite. Read our Elbaite review here.

How Many Supported Cryptos Are There?

KuCoin is one of the best crypto exchanges on the market in terms of supported digital currencies. Very few of KuCoin’s competitors can match the sheer volume of trading pairs and digital assets on the platform. KuCoin supports buying, selling and trading over 700 cryptocurrencies and 1,200 trading pairs. KuCoin is a solid choice to invest in Ethereum for Australians.

KuCoin is easily one of the top platforms for investors wanting to trade altcoins or more obscure digital currencies. It’s unlikely even the most experienced blockchain user will find many coins missing from KuCoin’s list. The number of pairs available for margin/derivatives trading is slightly less impressive but doesn’t lag too far behind advanced trading exchanges we’ve reviewed like Phemex and ByBit.

So, What Are KuCoin Fees?

Deposit fees

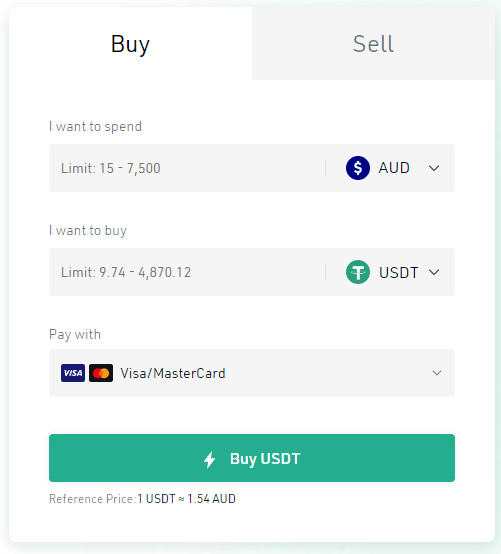

AUD cannot be directly deposited onto your KuCoin account, so there are no fees for these services. However, you can fund your account with AUD via a third-party payment gateway such as Banxa. This isn’t the best option for Australians, as these services can charge a fee of up to 1.99% per transaction.

It is recommended to fund your account with cryptocurrencies like BTC, ETH or USDT, if possible. This is a particularly cost-effective method when trading on KuCoin, as the platform does not charge deposit fees for cryptocurrency. Similarly, there are no deposit limits for cryptocurrency.

Withdrawal fees

Australians cannot withdraw AUD from KuCoin to an Australian bank account, so there are no possible fiat withdrawal fees. However, KuCoin does charge withdrawal fees for cryptocurrencies, which vary depending on the asset. You will need to find an alternative exchange such as Gemini that allows direct AUD deposits and withdrawals.

For example, withdrawing Bitcoin incurs up to a 0.0005 BTC fee (~15 AUD), while withdrawing Stellar only incurs a 0.02 XLM fee (currently less than a cent). The minimum/maximum withdrawal limits also depend on the specific digital currency being transferred. The maximum daily withdrawal is equivalent to 1 BTC for a basic level trading account.

Trading fees

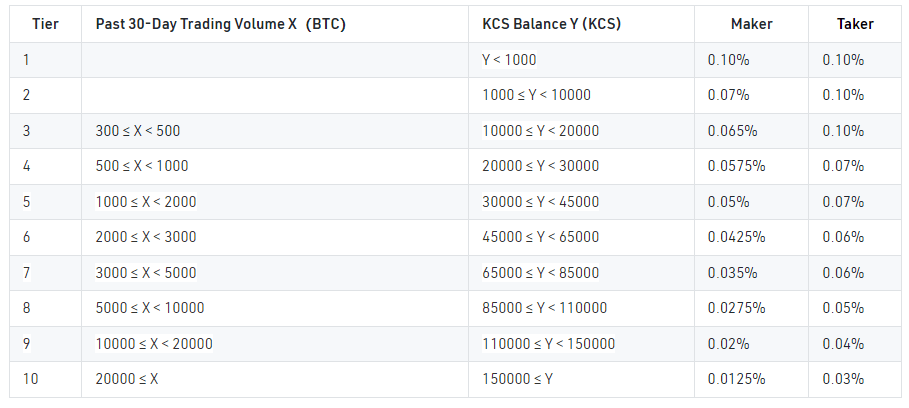

Like many other trading-focused platforms, KuCoin uses a tiered fee structure depending on trading volume and whether you’re a taker or a maker. However, even the highest fees for spot crypto trades are extremely competitive, starting at 0.1% for both makers and takers which is the as Huobi. This fee can be reduced to 0.0125%, either through paying fees with KuCoin’s native token (KCS) or having a monthly trading volume greater than 2000 BTC.

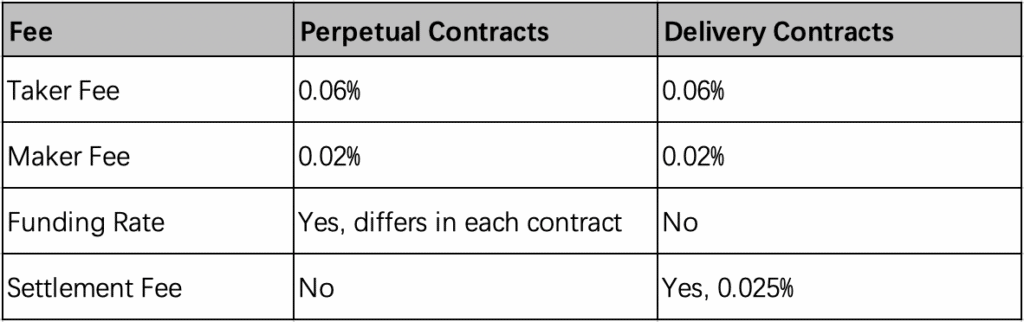

You will encounter a different fee structure when trading with leverage or derivatives on the KuCoin platform. The fees charged are 0.02% for makers and 0.06% for takers. These rates are relatively competitive, although other options in the market may offer better value for higher-volume traders.

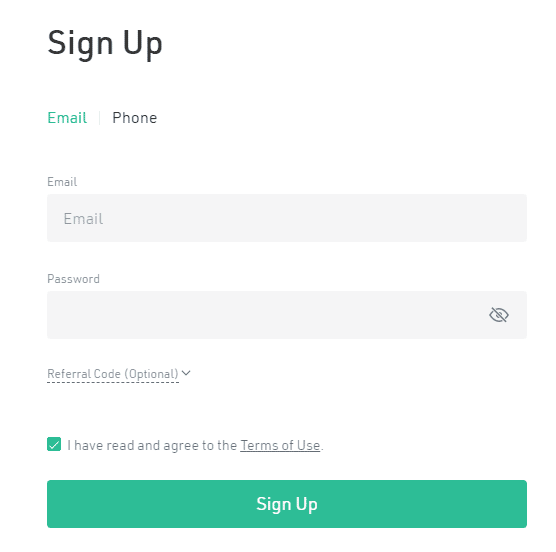

How To Get Started On KuCoin?

Like most modern cryptocurrency exchanges, signing up on KuCoin is relatively easy. They do not offer instant registering via Google Accounts or Facebook, however you can use either an email address or mobile phone number to open an account.

As KuCoin is not an AUSTRAC-registered exchange, once you’ve verified your email address/mobile number you can begin depositing and trading cryptocurrencies. However, you must complete the verification process to unlock certain features and expand your maximum trading/deposit/withdrawal limits.

KuCoin’s KYC system is a little clunky compared to the sleek and easy processes some other exchanges offer. To verify your account, you will need the standard images of a government-issued ID. However, KuCoin also requires a selfie of you holding a hand-written note depicting a signature, the current date and a random verification code. This process can take up to ten days to be reviewed and accepted.

Thankfully, an easier process for verification can be accessed when using the mobile application. Passing KYC this way will usually only take 10-15 minutes.

What Is Trading On KuCoin Like?

KuCoin has a trading centre aimed at beginners called “Fast Trade”. Using Fast Trade is incredibly simple – all you have to do is select your desired currency and put in the amount you wish to buy. You can settle the transaction using a debit/credit card or third-party payment provider. Although buying crypto this way is incredibly easy, it’s also expensive. The lowest fee on KuCoin for Fast Trades is 1.99% (Banxa). The fee for paying with a card is double (3.8%).

Experienced traders will feel comfortable using KuCoin’s main trading interface. It features all the basic elements you’d expect from a modern trading hub – customisable charts, market depth, an order book and your trade history.

On the other hand, novice investors may become quickly overwhelmed by KuCoin’s trading interface. That said, newer users can go on a virtual “Tour” which walks them through how each pane and feature work.

We Tested The Customer Support

Overall, KuCoin’s customer support services are exhaustive and aim to improve your experience using the exchange. The platform has an in-depth FAQ centre that provides guides on all the basics – trading, withdrawing, making deposits, and so on. Although these articles are quite comprehensive, we found them somewhat disorganized and difficult to navigate. However, most basic queries can be answered via this section.

Finding more intimate customer support can be difficult. A help icon is located in the bottom right of the webpage but occasionally disappears depending on where you are on the website. Once you find the support page, you can access a live chatbot 24/7. If you need support from a human, you can submit a ticket request from the same page.

Our Final Verdict

The KuCoin cryptocurrency exchange has a lot going right for it. It’s by far one of the most feature-laden platforms accessible to Australians, with a comprehensive earn hub, an impressive fractional NFT program and advanced trading options. Its low fees and comprehensive list of altcoins make it one of the best exchanges for more experienced crypto investors looking to dive head-first into the blockchain world.

However, the KuCoin desktop platform can be a little clunky to use. Beginners may be easily overwhelmed by the suite of options at their disposal, and Australians might find the inability to deposit and withdraw AUD a significant barrier. The lack of AUSTRAC regulation can also be a major put-off for some investors. However, if you’re comfortable with these limitations, the sheer weight of cryptocurrencies and features supported make KuCoin a suitable choice.

Frequently Asked Questions

Does KuCoin require KYC Australia?

No, Australians do not need to pass KYC to trade cryptocurrency on the KuCoin exchange. Partial verification of an email or mobile number is required to activate an account. However, identification documents only need to be provided to when increasing account withdrawal/deposit limits.

Has KuCoin been hacked?

Yes, KuCoin suffered a major attack in 2020 when hackers made off with approximately USD $281 million worth of cryptocurrency. Approximately 84% of the stolen funds were eventually recovered.

Can I withdraw AUD from KuCoin?

No, you cannot withdraw AUD or most other fiat currencies from KuCoin. This is largely because KuCoin is not regulated with Australian body AUSTRAC. Australian users can instead withdraw cryptocurrency, or use a third-party provider such as Banxa.

What country is KuCoin based in?

KuCoin was established in China, however, their headquarters are located in Seychelles.

Can I use KuCoin exchange in Australia?

Yes, you can use KuCoin in Australia to buy and trade cryptocurrencies. The popular global trading platform has recently attained registration with AUSTRALIA which means you will need to verify your identity and complete the KYC process before any AUD funds can be deposited. Australians can only deposit AUD via bank transfers or through their credit/debit card. After that, you have access to 780+ digital assets, derivatives and margin trading, trading bots, and an excellent earning hub where you can grow your portfolio.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.