Best Swyftx Alternatives For Australians

Last Updated on January 31, 2024 by Kevin GrovesSwyftx is a popular crypto exchange in Australia due to its ease of use, features that add value, and competitive trading fees. Although Swyftx ticks all the boxes for a local Australian crypto platform, more experienced investors and traders may seek sound alternatives that provide better value for money, financial growth tools, and innovative features.

With the Australian crypto consumer in mind, this article outlines the top crypto exchanges you could use instead of Swyftx.

Best Alternatives To Swyftx

These are the best alternatives to Swyftx to use:

- Binance Australia – Best alternative to Swyftx

- Bybit Australia – Best alternative for margin traders

- CoinSpot – Best alternative for HODLers

- eToro Australia – The best option for copy-trading

- Independent Reserve – Best alternative for SMSF investors

- Coinstash – The biggest range of supported crypto

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Crypto Exchanges Similar To Swyftx: Our Reviews

Here are our reviews of the best Australian crypto exchanges to use instead of Swyftx.

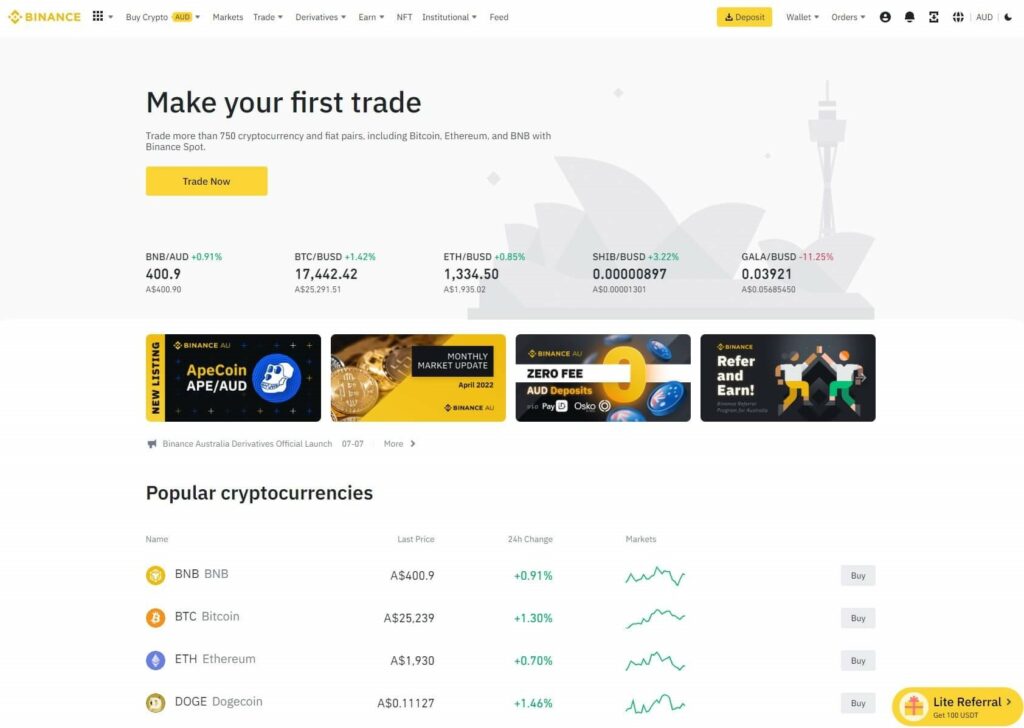

1. Binance Australia – Best alternative to Swyftx

Why we picked it: Binance Australia is renowned for its security and reliability as a provider of crypto trading services in Australia. The crypto exchange has just as good support for AUD deposits and withdrawals as Swyftx, but its trading markets and features are far superior, as you will see from our Binance vs Swyftx review. You can access 385 crypto assets across its 1,687 spot, margin, and derivatives trading markets, integrated TradingView charting, and robust financial management products. It’s also significantly cheaper than Swyftx where its spot maker and taker fees start at 0.1%.

- Rating: ★★★★★

- Supported Crypto: 385

- Deposit Fees: None for bank transfers and PayID, 2% for credit cards

- Trading Fees: 0.1% maker and 0.1% taker

- Beginner-friendly: Yes

- Allows AUD Deposits and Withdrawals: Yes

Binance Australia is a digital currency exchange that provides Australians with a platform to buy, sell, and store digital assets such as Bitcoin, Ethereum, and a wealth of other crypto assets. The exchange is a branch of the global cryptocurrency exchange Binance, and is headquartered in Melbourne, Australia.

Binance Australia is regulated by AUSTRAC and supports a variety of AUD-friendly deposit methods (bank transfer, PayID, and credit cards) as well as withdrawals to a bank account. The crypto exchange is best known for its standing as the world’s #1 ranked exchange in terms of liquidity and trading volume, but also for its ecosystem of cutting-edge spot and derivative trading markets, and innovative features to grow and build a crypto portfolio.

If you’ve been partaking in Swyftx’s spot-only trading markets and want to delve into margin and futures, then Binance is a good starting point. Binance Futures offers the following markets:

- USDS-M Futures: Perpetual or Quarterly Contracts that are settled in USDT or BUSD.

- Coin-M Futures: Perpetual or Quarterly Contracts settled in Cryptocurrency.

- Leveraged Tokens: Trade with leverage without the need to put up collateral, maintain and margin level, or worry about the risk of liquidation.

- Options: Cash-settled contracts where the options can be exercised before the time expires.

All of the usual order types are available on the modern trading interface including limit and market. But the list also includes One Cancels the Other (OCO) which is unique compared to crypto exchanges. if you need to balance out your altcoin portfolio then the free-to-use convert feature will let you instantly swap one digital asset for another.

Although you lose out on Swyftx’s Australian-specific features, there is a net benefit from switching over to Binance. Once you verify your account, you will have access to:

- A busy Peer-to-Peer (P2P) marketplace where you can trade directly with other users.

- tradBinance Earn, a financial management module that offers various features to passively grow your crypto asset holdings.

- Lower spreads due to the platform’s access to significant liquidity and trading volume.

- A popular marketplace to trade NFTs.

- ETH 2.0 staking.

- A modern and well-designed interface that is equipped with tools that cater to beginner and advanced traders.

Overall, Binance Australia is a natural stepping stone from user-friendly crypto exchanges like Swyftx. Unlike other global crypto exchanges which may overwhelm novices with their features and interfaces, Binance provides a high-quality environment whilst retaining a good degree of simplicity. You can find out more by reading our Binance Australia review.

Binance Australia Pros:

Binance Australia Cons:

2. Bybit – Best alternative for margin traders

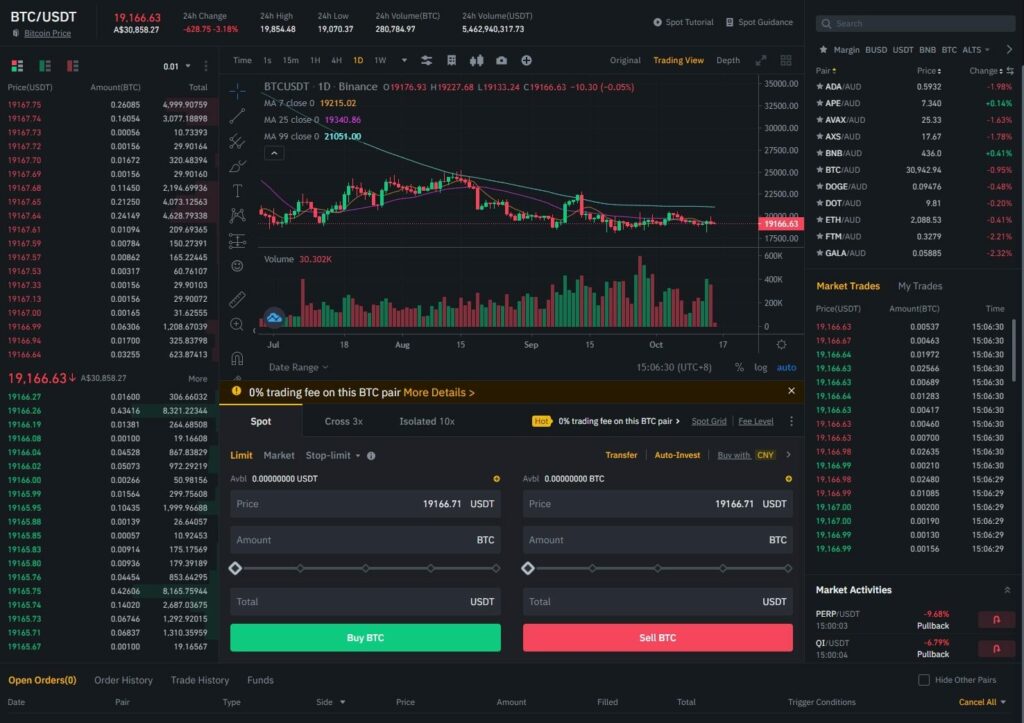

Why we picked it: Bybit is a reliable cryptocurrency exchange that delivers cost-effective margin trading for Australian traders. The crypto exchange offers hundreds of trading pairs where 5x leverage is common. However, up to 100x leverage can be applied to your long and short positions for Bitcoin and Ethereum. All trades are conducted on a state-of-the-art interface stocked with TradingView charting where transactions can be completed extremely fast due to its lightning-fast matching engine.

- Rating: ★★★★★

- Supported Crypto: 81

- Deposit Fees: None

- Trading Fees: Spot 0.1% maker and 0.1% taker, margin 0.06% maker and 0.01% taker

- Beginner-friendly: Yes

- Allows AUD Deposits and Withdrawals: No (crypto only)

Bybit is one of the few cryptocurrency exchanges currently offering margin and derivatives trading to Australian residents. The no-KYC crypto exchange separates itself from other margin trading platforms with its competitive fees, modern interface, and abundance of margin trading pairs where up to 100x leverage can be applied.

Traders can easily switch between perpetual contracts and benefit from up to 100x leverage on BTC and ETH trading pairs. Though sophisticated investors may find these features the most appealing, the user-friendly interface of the platform makes it accessible to novices as well.

The number of trading pairs with 5x leverage is not as much as other crypto trading platforms, however, the interface is incredibly advanced. It comes with a built-in TradingView API so you can customise the charts to your personal preference. As expected, limit, market, take-profit and stop-loss orders are available. If margin trading is not for you, then Bybit’s spot market is equally impressive with 390 trading pairs.

Both its spot and margin fees follow a maker and taker structure where discounts can be obtained depending on your trading volume.

As discussed in our Bybit Australia review, the other significant advantage over Swyftx is its features. These include its copy-trading feature, P2P marketplace, trading bots, NFT marketplace, crypto-backed loans, and Bybit Earn where you generate passive yields through its interest-earning wallets or via staking.

Bybit Pros:

Bybit Cons:

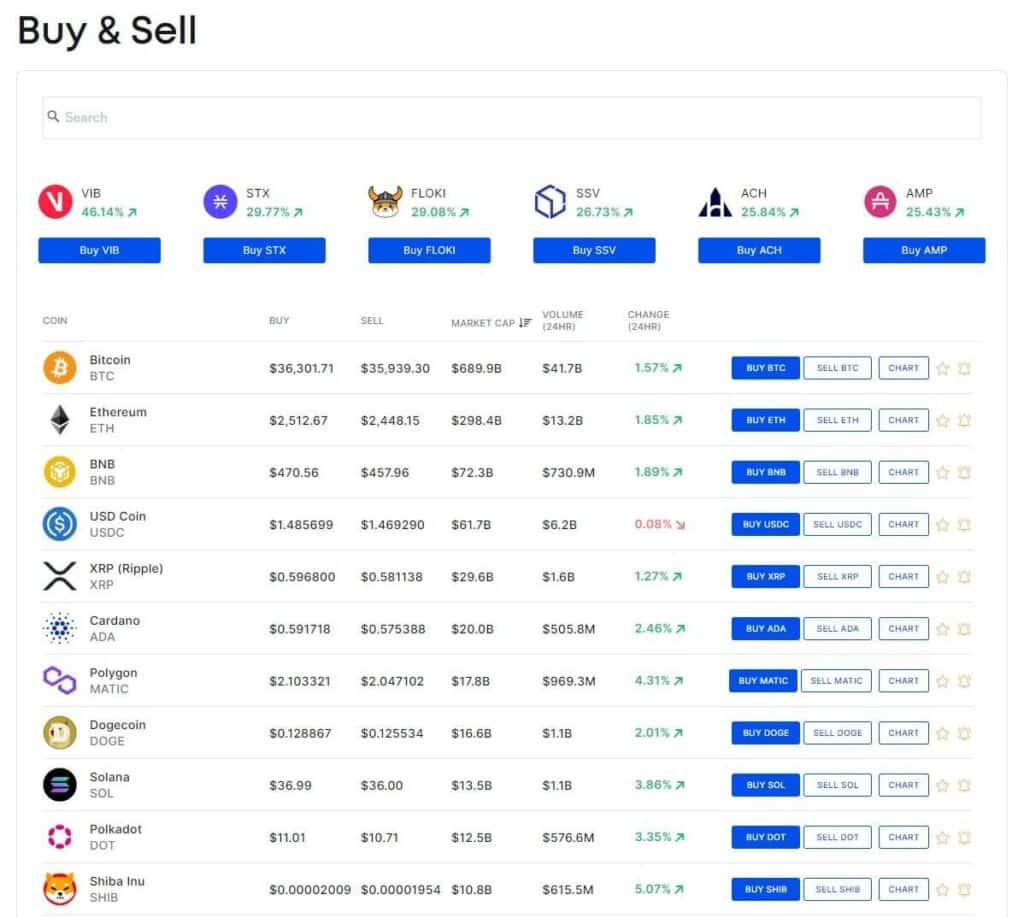

3. CoinSpot – Best alternative for HODLers

Why we picked it: CoinSpot is trusted as a provider of digital asset services by over 2.5 million Australians. In addition to the 380+ digital assets such as Bitcoin and Ethereum that can be easily bought using cash, CoinSpot offers a wealth of features that provide value. Every day Australians can easily exchange their cash for over 380 digital assets including Bitcoin, stablecoins, and numerous altcoins.

- Rating: ★★★★★

- Supported Crypto: 380+

- Deposit Fees: BPAY: 0.9%, cash deposits: 2.5%, credit card: 2.58%

- Trading Fees: Spot 1% for instant buy & sell, 0.1% for OTC/market orders

- Beginner-friendly: Yes

- Allows AUD Deposits and Withdrawals: Yes

CoinSpot has been a leader in the Australian crypto exchange market for nearly a decade, boasting a stellar reputation for providing beginners with a straightforward, and user-friendly platform. With an easy, fast transaction process and stringent security measures that have earned the ISO 27001 accreditation, CoinSpot is the go-to choice for everyday investors.

The appeal of CoinSpot as a reliable place to trade crypto stems from a few factors including its ease of use, the features it brings to the table, and its strong reputation. All the major deposit methods are supported including the convenience of credit cards. Most deposit methods result in your CoinSpot wallet being instantly funded so you can start trading any one of its 370 strong assets. Whether you choose to do this on a desktop or on your mobile device, the overall onboarding and setup process is streamlined and stress-free.

Once your account has been verified, you have access to all of CoinSpot’s features that are tailored to the Australian crypto market. If you want to expedite the growth of your portfolio then the crypto bundles feature will do just that as well as help save on trading fees. In addition, several cryptocurrencies can earn passive interest yields simply by depositing them into their respective Earn wallets.

But CoinSpot is more than just a place to HODL crypto. Similar to Swyftx, the popular cryptocurrency exchange has other features that will appeal to many users. These include the new CoinSpot Mastercard where you can spend your crypto at in-store or online retailers, a relatively well-stocked NFT marketplace, support for SMSF investors, and tax reporting tools. The availability of TradingView charting means that you are not missing out on a similar trading experience to Swyftx.

One of the differences between CoinSpot and Swyftx is the fees. If you prefer on buying crypto using the Instant Buy/Sell feature then CoinSpot will be too expensive due to the 1% fee (Swyftx is 0.6%). However, CoinSpot represents value for money if you know how to place market orders on the exchange. Here, the cheap 0.1% fees for buy and sell orders are on par with Binance Australia (0.1%).

If you need a like-for-like replacement for Swyftx then you will be well served using CoinSpot as you are getting similar stellar security and features. With over 2.5 million customers, CoinSpot is one of the best Swyftx alternatives and you can find out more in our CoinSpot review.

CoinSpot Pros:

CoinSpot Cons:

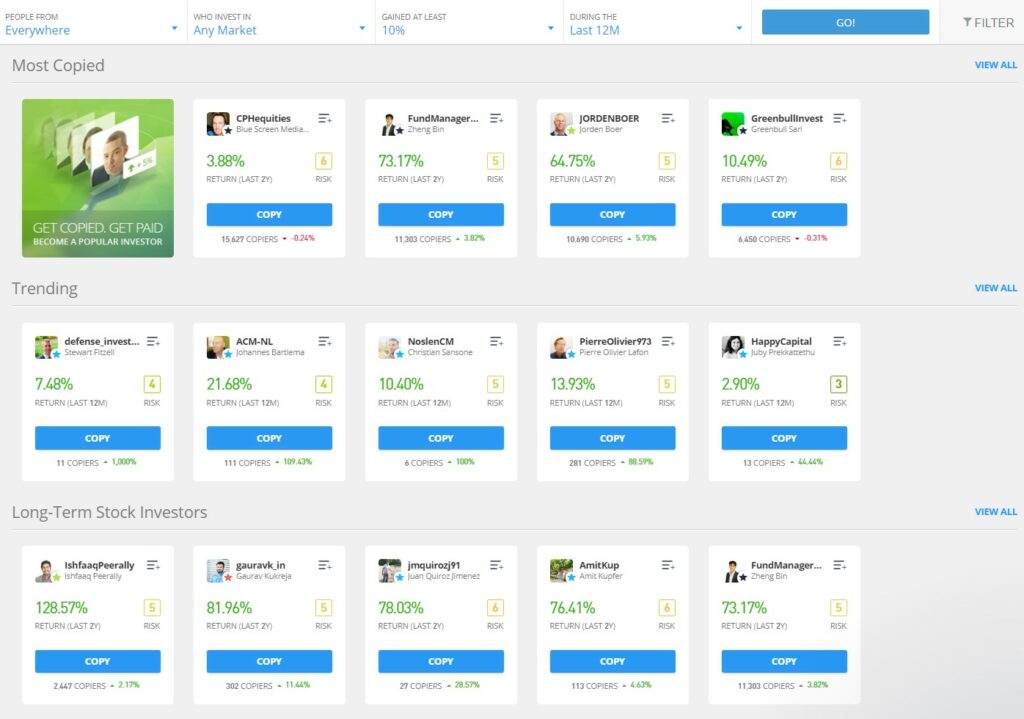

4. eToro Australia – The best option for copy-trading

Why we picked it: eToro Australia’s CopyTrader feature is renowned worldwide for its powerful, yet easy-to-use capacity to aid novice traders in replicating the trades of experienced and successful traders. Commonly called social trading, you can browse through the portfolios of other traders using various filters and categories, and find the perfect strategy for you by looking through eToro’s risk scores.

- Rating: ★★★★

- Supported Crypto: 90+

- Deposit Fees: None

- Trading Fees: None (spread only)

- Beginner-friendly: Yes

- Allows AUD Deposits and Withdrawals: Yes (converted to USD)

eToro is a social trading platform that offers investors a wide range of investment assets to buy and trade including Forex, cryptocurrencies, commodities, stocks, and Contract for Differences (CFDs). Founded in 2007, the Australian branch of the global platform is licenced by the Australian Securities and Investments Commission (ASIC) as a Digital Services Provider. As one of the leading Australian crypto exchanges for social trading, eToro continues to add new features and expand its services.

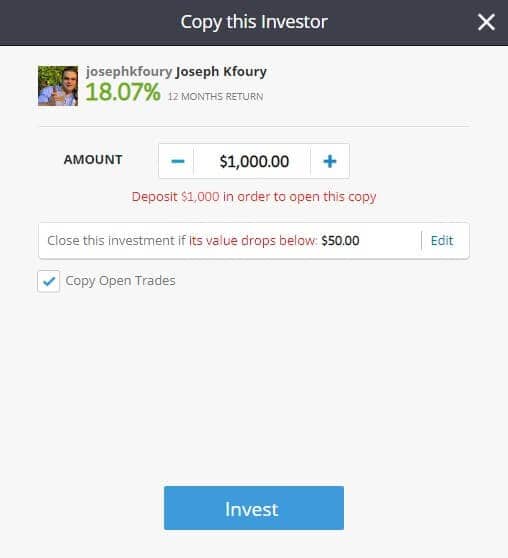

eToro Australia does not support the diverse range of digital currencies that Swyftx does but it more than makes up for it with its copy-trading features. Tailored for people who are more likely to want to trade the major coins and tokens, eToro makes copy-trading extremely accessible and straightforward to use than other platforms offering the same service.

The popularity of eToro has resulted in a massive library of over 273,000 multi-asset investment products that can be copied and incorporated into your own portfolio. There are excellent filtering options to sort results by performance, investment asset type, risk score, and number of copiers. Once you find an expert trader to copy, all you need to do is deposit funds to eToro and confirm the order. Another strength of eToro over other copy-trading platforms is its social trading community. This is a forum where you can connect with like-minded individuals to present and discuss investment trading opportunities and strategies.

If you are considering copy trading then eToro should be your first choice. But since eToro is not a traditional exchange like Swyftx, its crypto trading features are limited. A demo account with $100,000 USD is available to use for copy-trading but it doesn’t offer the paper-trading capabilities and trading tools of an advanced exchange. And although you can deposit fiat currencies into your wallet via bank transfer, POLI and credit/debit card, AUD is not supported (USD only).

In terms of value for money, eToro is a bit lacklustre. There are no fees to use its copy-trading features but a spread will apply for all cryptocurrency trades. The real con comes in the inability to deposit Australian money as eToro will automatically convert your AUD into USD and thereby incurring currency conversion losses. Learn more in our eToro Australia review.

eToro Australia Pros:

eToro Australia Cons:

5. Independent Reserve – Best alternative for SMSF investors

Why we picked it: Independent Reserve is renowned for its unparalleled Self-Managed Super Fund (SMSF) support, allowing you to invest a portion of your superannuation in crypto. While Swyftx also offers this service, Independent Reserve provides the highest degree of flexibility and control available in Australia.

- Rating: ★★★

- Supported Crypto: 30+

- Deposit Fees: $0.99 processing fee if under $100 AUD

- Trading Fees: 0.5%

- Beginner-friendly: Yes

- Allows AUD Deposits and Withdrawals: Yes

Independent Reserve is not as popular as Swyftx but it has been providing reliable and cost-effective cryptocurrency trading services since its establishment in 2013. After reading our Independent Reserve review, it is apparent that the ISO 27001 accredited company has not kept up with the innovative advances in the Australian crypto market.

But for long-term SMSF investors, Independent Reserve is a top option due to its long-standing reputation for delivering secure and reliable services. Independent Reserve is trusted by over 8,000 SMSF investors.

You have access to personalized advice on your investments, can utilize limit orders and Dollar-Cost-Averaging (DCA) to reduce your risk in volatile markets and enjoy the value from lower trading fees. Independent Reserve trading fees start from a very competitive 0.5% which is hard to pass up compared to Swyftx’s 0.6%. In addition, the availability of in-built tax reporting tools and an Over-The-Counter (OTC) desk further complements its SMSF service.

To give you peace of mind, Independent Reserve has one of the longest track records of not being hacked or suffering any other security breaches. This is due to the company’s focus on security knowing that Australians trust their investment funds with them.

The design of the Independent Reserve interface will feel a bit underwhelming compared to the more modern Swyftx exchange. However, it’s still as easy to use as Swyftx and the aesthetics of a user interface is not likely to be an important requirement for most Australian investors. Learn more in our Independent Reserve review.

Independent Reserve Pros:

Independent Reserve Cons:

6. Coinstash – The biggest range of supported crypto

Why we picked it: Coinstash comes in as the number crypto exchange in Australia for supported digital currencies. With over 1,000 crypto assets to buy and sell with AUD, this is vastly more than any local platform and global exchange.

- Rating: ★★★

- Supported Crypto: 1,000+

- Deposit Fees: None

- Trading Fees: 0.85%

- Beginner-friendly: Yes

- Allows AUD Deposits and Withdrawals: Yes

Founded in 2020, Coinstash is a new crypto brokerage that offers Australians the largest selection of digital assets on a platform tailored towards beginners. The AUSTRAC-registered digital services provider is ideal if you are getting started investing in crypto assets but don’t want to be bogged down with overly complicated interfaces and features.

If you’re interested in investing in cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA), you can purchase them with cash in minutes. Additionally, popular stablecoins like Tether (USDT) and Dai (DAI) are also available. Due to Coinstash’s DeFi connector, experienced traders will have access to over 1,000 crypto coins and tokens you might find on a decentralised exchange.

After you deposit fiat currency and buy digital currencies, Coinstash also gives you the ability steadily grow your portfolio through its Earn module. This is a significant advantage and perfect for HODlers since Swyftx ceased its interest-earning wallets in 2022.

There are no fees to deposit AUD into your Coinstash account using PayID or bank transfer. However, be prepared to pay slightly higher trading fees than Swyftx. Coinstash does not offer competitive trading fees (0.85%) and you can easily find a cheaper exchange in Australia to buy crypto.

If you enjoyed the trading tools and experience on Swyftx then Coinstash will feel similar. There are three ways to buy crypto:

- Use the Instant Buy/Sell feature.

- Buy crypto in bundles (multiple crypto assets in a single transaction).

- Placing an order on the exchange.

Coinstash offers both a basic and advanced trading interface, allowing you to switch between the two with a single click. The basic interface provides an overview of the market price of digital currencies, making it ideal for beginners to track price changes over time. The advanced interface, which uses the TradingView charting package, provides experienced traders with real-time prices and a variety of drawing tools and indicators to help them analyze price action more deeply.

All in all, Coinstash is a solid crypto trading platform. Best suited for beginners and people who want to buy their first digital currencies, it is also a good option to sell crypto back to AUD since it supports withdrawals to an Australian bank account.

CoinStash Pros:

CoinStash Cons:

Conclusion

Swyftx has been one of the top crypto exchanges in Australia due to its ease of use, an economical trading fee of 0.6%, free deposits and cash withdrawals. Although it provides a very strong starting point for Australians getting into crypto, you may want to consider alternatives to complement Swyftx. Of course, this depends on your crypto investment and trading needs.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.