Best Crypto Margin Exchanges In Australia (2024)

Last Updated on January 31, 2024 by Kevin GrovesTo cater to the rising number of margin traders in Australia, many crypto exchanges have expanded their reach in the region. All of them have unique features, and all of them provide unique tools for trading, but not all margin exchanges will be suitable for everyone. Additionally, there is also the matter of cryptocurrency laws in Australia.

While it is quite inclusive, giving ample flexibility to crypto traders, it also contains some strict rules that crypto margin trading platforms must adhere to. Therefore, in this guide, we will cover for you our list of the best crypto margin trading platforms.

Best Crypto Margin Exchanges Australia

We’ve carefully reviewed margin trading platforms available in Australia while considering factors such as ease of use, fees, beginner-friendly, security, and customer support. Our list of the best options for Australians are:

- Binance – Best margin exchange for traders

- Bybit – Best for high margin trading up to 100x

- Kucoin – Best margin exchange with trading bots

- Kraken – Reliable margin exchange with good security

- OKX – Alternate margin platform with a range of features

- Huobi – Long-standing crypto exchange with 125x leverage

- Margex – Margin trading platform with no KYC requirement

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Top Crypto Margin Platforms In Australia – Our Reviews

Due to the semi-lenient approach of Australian authorities towards cryptocurrencies, many flexible margin trading platforms are available. However, which one is the most suitable for all types of traders? In the section below, we have looked into the critical features of the margin trading platforms that make them ideal for Australia-based crypto traders.

1. Binance – Best Margin Platform For Traders

- Rating: ★★★★★

- Number of margin pairs: 231+

- Margin trading fees: 0.02% (maker) and 0.04% (taker)

- Acceptable deposit methods: PayID, credit card, debit card, bank transfers, Cryptocurrency, OSKO

- Allows AUD deposits and withdrawals: Yes

- Visit Website

Binance is one of Australia’s leading cryptocurrency exchanges offering a wide array of cryptocurrencies (more than 600) and has the largest derivatives 24-hour trading volume (58 billion USD). It is the margin trading utilities of this platform that make it a crypto margin trading exchange of choice within Australia.

Part of the reason for the popularity of this platform is the 0.02% and 0.04% trading fees for makers and takers, respectively. Also, if you want to reduce the fee, you can hold BNB to get a 10% discount on trading fees. It is Binance’s native crypto that’s used for multiple purposes.

Another reason it has met the official Aussie standards for trading is the number of margin trading pairs available, upwards of 231. Binance offers up to 10x leverage on margin trading and allows you to short positions on Bitcoin and other pairs to mint profits if the token’s value goes down.

You can also look into trading futures. These are futures contracts that you can invest in without the need to possess the asset. Crypto futures contracts are available round the clock and are tradeable on Binance futures. That said, Binance recommends that even though this feature is profitable, it comes with a large amount of risk. That is why invest wisely – being aware of your risk tolerance.

To access Binance Futures, you can directly go to the official website. If you are an existing user who wants to shift from beginner spot trading to margin, you can transfer the funds to the margin account. Here are the markets available on the platform.

- Binance Leveraged Tokens: These can give you a leveraged position on the underlying asset. Simply put, you can gain leveraged position on crypto while remaining safe from liquidation.

- Binance cryptocurrency Options: It allows users to transfer the assets from and to their Spot accounts.

- Perpetual or Quarterly Contracts settled in Stablecoins

- And perpetual or quarterly contracts that are settled in BTC

Another point to note is the platform’s charting software. It has Tradingview charting that will allow you to analyse the price charts using many indicators to make better investment decisions. The backend of this system is powerful, processing up to 100,000 orders per second. With only a minimal latency, margin traders on Binance are able to shift their positions quickly. In addition to these features, Binance also offers risk management tools such as limit and stop orders.

If you’re a trader on the move, then the Binance mobile app could be for you. Available on IOS and Android devices, this tool is intuitive, contains all the features of the web application, and will provide you with all that you need for margin trading.

Overall, Binance Futures is a great platform with all the tools you need to margin trade effectively. The trading terminal it provides is robust, offering multiple indicators. Those also come into play when you’re using automated investment strategies on the platform. The trading fee is a plus and can be reduced for those willing to invest in BNB. The mobile application is intuitive and has all that you’ll need to get ahead in margin trading in Australia.

Want to start trading? Claim 100 USDT with our Binance referral code.

Read our full Binance Review

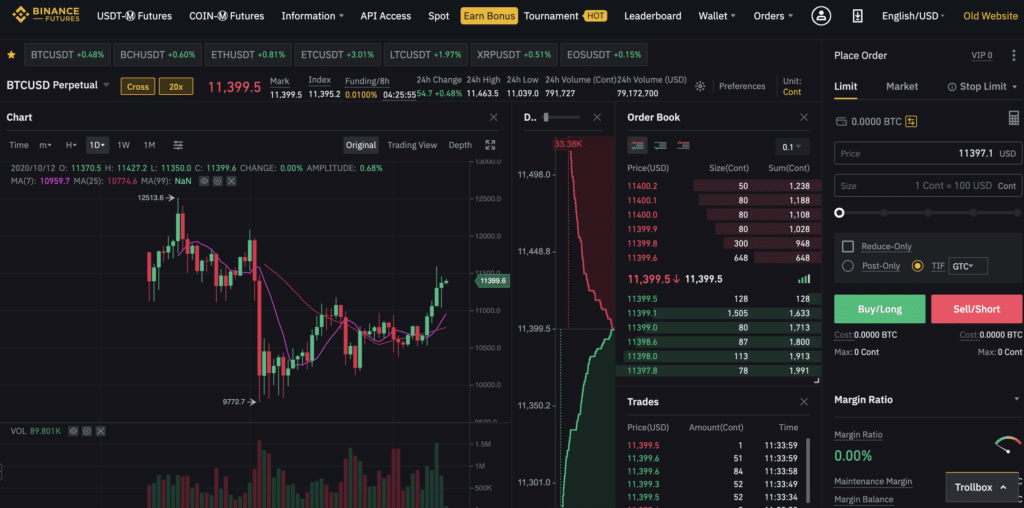

2. Bybit – Good Margin Exchange With High Leverage

- Rating: ★★★★★

- Number of margin pairs: 166+

- Margin trading fees: 0.01% (maker) and 0.06% (taker)

- Acceptable deposit methods: Crypto only

- Allows AUD deposits and withdrawals: No

- Visit Website

Bybit is another margin platform that will provide you with a seamless user experience. It offers margin traders on four cryptocurrencies, including Ethereum, EOS, and XRP, with up to 100x leverage. Better yet, you can access this feature all across Australia using your mobile because the smartphone app is designed to be as robust as the desktop app. It contains all the charting features you’d need to make better investment decisions.

Founded in 2018, Bybit quickly rose through the ranks and became one of the biggest trading platforms in Australia, with over 2 million users and over a $10 billion trading volume in 24 hours. The platform is known for having 99.99% uptime and handles 100,000 trades per second. The platform has four main markets: USDT, perpetual, inverse perpetual, inverse futures, and spot exchange.

Bybit also offers leverage of 100x on margin trading. It will allow increasing the amount you can borrow on small investments and maximise your profits even if the price fluctuations are small.

You can also get into Bybit’s learning program. You get demo coins to practice your trading. Once you have learned enough, you can move on to using real money. Simply put, it is a good platform to learn the ropes of margin trading before engaging.

Now comes the matter of fees. At Bybit, the taker fee is just 0.01%, and the maker fee is 0.06% – making it more competitive than the likes of OKX and Binance (0.1%) for placing limit orders. However, placing at market trades is slightly more expensive.

If you experience any hiccups during the trading process, you can directly contact Bybit’s customer support. The live chat team is extremely helpful and is always ready to help. Furthermore, in terms of security, this platform provides a wide array of tools, including two-factor authentication and a free insurance fund – protecting users from negative equity.

Overall, Bybit is a good choice for margin trade in Australia. The offering is 100x leverage, is great for day traders, and the learning program is a great way to learn the ropes. The fees are similar to other exchanges, and the platform has taken many great steps toward ensuring security for users. Moreover, there is a new copy-trading platform to replicate the margin trades of the most profitable crypto traders on the exchange.

Read our full Bybit Review

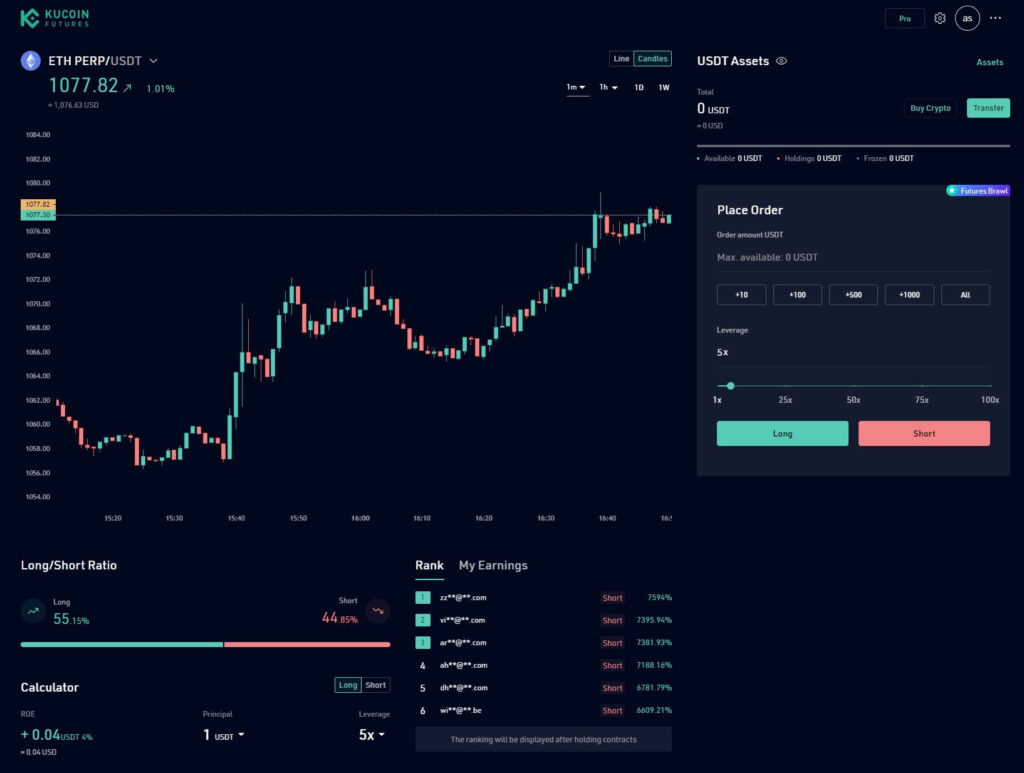

3. KuCoin – Good Crypto Margin Platform With Bots

In 2018, the leading cryptocurrency exchange in Asia expanded its operations to the Australian continent. As of now, Kucoin is one of the top crypto margin trading platforms in the oceanic region, and a top alternative to Bybit for no-KYC traders.

- Rating: ★★★★★

- Number of margin pairs: 110+

- Margin trading fees: 0.02% (maker) and 0.06% (taker)

- Acceptable deposit methods: Debit card, cryptocurrency

- Allows AUD deposits and withdrawals: No

- Visit Website

One strong reason KuCoin makes this list is the future’s platform. There are more than 110 coins that can be traded with leverage up to 100x which is similar to Bybit. Margin contracts can be settled in USD or USDT which makes it a viable choice for you to hedge positions against market volatility. There is also Futures Lite which is designed for margin traders that want a user-friendly experience. You can enter a long or short position on cryptocurrencies with up to 100x leverage with a clean-cut trading terminal.

In terms of the margin trading fees, we found them to be similar to the likes of OKX (0.02% and 0.05%) and Huobi, at 0.02% and 0.06% for maker and taker orders respectively.

Other than margin trading, you can also engage with crypto lending and borrowing, NFTs, spot trading, derivatives, and crypto staking on the platform. But that’s not all. We have added KuCoin to our list of leading crypto margin trading platforms in Australia because of the presence of free trading bots. In fact, we have rated KuCoin as one of the best crypto trading bot platforms for Australians.

The list of trading bots provided in Kucoin is comparable to exchanges such as OKX (see below) as it offers Spot Grid, Futures Grid, smart rebalancing, and DCA. This facility will allow you to manage your active trades while you’re away from the system so that you don’t always have to react to the market conditions actively – the software will do that for you.

Overall, Kucoin is a viable crypto margin platform for Australian traders who want a more affordable option to manage their trading strategies. The free trading bot feature stands out because of the absence of any monthly fee. And the fact that it offers up to 100x leverage is nothing to underestimate either. The platforms offer a seamless experience for Australian margin traders, and the availability of other features will help you diversify your investment.

Read our full review on KuCoin

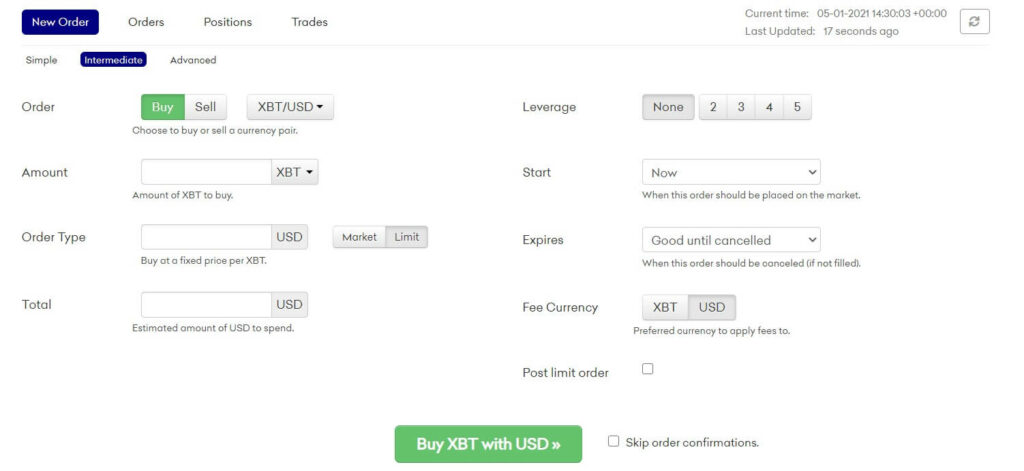

4. Kraken – Reliable and Trusted Margin Platform

- Rating: ★★★★★

- Number of margin pairs: 36

- Margin trading fees: 0.02% (maker) and 0.05 (taker)

- Acceptable deposit methods: Bank transfer, crypto

- Allows AUD deposits and withdrawals: Yes

- Visit Website

Kraken is one of the most popular cryptocurrency exchanges. Established in 2011, Kraken quickly accumulated more than 6 million traders. However, with time, and the expansion of this platform, Kraken also became a go-to crypto trading platform for Aussie traders. And the primary reason behind it is not the high leverage but the ease of use.

Unlike the other crypto trading platforms in the list, where it takes more than a few skills to understand and engage with margin trading, Kraken has made the entire process easier. But that doesn’t mean that it compromises the features.

At Kraken, veteran traders can use the easy-to-access UI to executive active and complex trading strategies to maximise their earnings. At heart, those tools lie in the advanced trading engine. The pro trading interface it provides is full of advanced order options. But the pros of this platform do not stop there. There is also advanced API access through which traders can manage their positions intuitively.

Another major reason that margin trading is so accessible on Kraken is the rollover fees. It is only up to 0.02% per four hours – making it suitable for most day traders. There is also the Kraken futures platform with fees that start from 0.02% and 0.05% for makers and takers. This is within the same pricing range as Binance, Bybit and KuCoin.

At the time of writing, Kraken offers margin trading for 36 cryptocurrencies, including Bitcoin Cash, Chainlink, and Ethereum, Aave, Bitcoin, Augur, Algorand, Monero, PAX Gold, Siacon, Solana, and more. The fee for opening a position on a cryptocurrency is the same as the rollover fee. And to eligible clients, Kraken also offers up to a $500,000 margin limit.

Overall, we consider Kraken as a reputable margin trading website in Australia. The simple-to-use interface, the low rollover, and opening position fees are definitely a plus. As a con, Kraken only allows investors to go long or sell short with up to 5x leverage. It is considerably lower than other trading platforms we have reviewed in this list.

Read our full Kraken Australia review

5. OKX – Great Features For Leverage Traders

- Rating: ★★★★★

- Number of margin pairs: 326+

- Margin trading fees: 0.02% (maker) and 0.05% (taker)

- Acceptable deposit methods: Crypto only

- Allows AUD deposits and withdrawals: No

- Visit Website

OKX is a crypto trading platform with a wide array of cryptocurrencies for margin and futures trading. It is supported in over 100 countries, including Australia. The platform has over 360 cryptocurrencies which gives lots of trading opportunities.

Also, it has multiple trading features, with crypto margin trading being one of its best features. It offers this facility for its spot and derivatives products – letting you short sell bitcoin and other assets. There are two types of margin options available, fixed and crossed margin. It offers up to 10x margin for spot exchange and up to 100x margin on the futures exchange that has 200+ trading pairs to choose from.

Thus, if you’re a trader looking to maximise your earnings by tapping into the small price movements of the market, margin trading on leverage with OKX is a sound choice. All you need to do is put down a fraction of the value of the crypto asset you want to trade and start trading. Similar to KuCoin, if you wish to automate your trading activities, you can benefit from the platform’s trading bot. It sports a wide variety of trading bots, such as spot grid, futures grid, recurring buy, smart portfolio, arbitrage, iceberg, and TWAP. This multi-faceted approach will allow you to tap into our trading potential and potentially maximise your earnings truly.

When it comes to fees, OKX is as slightly more expensive than Kraken. The futures and perpetual markets fees are 0.02% and 0.05% for makers and takers which is the same as Kraken. But if you want to reduce the prices, hold OKB tokens. OKB is the native crypto of OKX that allows traders to minimise fees and participate in the platform’s governance.

OKX is an efficient margin trading platform with many options for Australian traders. However, the user interface is complex. And while OKX has tried to circumvent this issue by providing guides, they are too complex as well. Despite these cons, OKX has a history of being one of the best exchanges for margin trading. Having up to 100x leverage (which used to be 125x) is definitely a pro for active traders looking to trade at a large scale. It also helps that the mobile application also allows margin trading facilities.

Read our full OKX review

6. Huobi – Long-Standing Crypto Exchange With 125x Margin

- Rating: ★★★★★

- Number of margin pairs: 163+

- Margin trading fees: 0.02% (maker) and 0.04% (taker)

- Acceptable deposit methods: Debit card, cryptocurrency

- Allows AUD deposits and withdrawals: No

- Visit Website

Huobi Global offers the largest leverage among all the margin platforms on this list. Launched in China, but now operating through Singapore, Huobi Global is one of the leading cryptocurrency exchanges in 195 countries, including Australia. It supports more than 348 cryptocurrencies and 163 margin trading pairs. It is our 6th best crypto margin platform in Australia, right behind Kraken and OKX.

If you want to access a wide array of cryptocurrency markets using a single account, Huobi provides. Among the options available are Margin Exchange, Spot Exchange, Futures Market, Options, and USDT-Swaps with leverage up to 125x. In the past, that leverage used to be up to 200x but has been reduced.

Through margin trading, you can hedge your position by short-selling Bitcoin and maximise your profits. Seeing as the crypto bear market punched Bitcoin below $20k levels, Australian investors could earn a lot of potential money on the platform because of their shorting success. However, the leverage on margin trading for Bitcoin, Ethereum, LTC, EOS, and XRP is only 3X.

If you’re in the market for a versatile cryptocurrency exchange with features beyond margin trading, Huobi is the right place. There are other features, products, and services on the platform that you can engage with, including staking and more. Transferring funds between wallets is also easy while you’re actively involved with margin trading.

When it comes to fees, Huobi charges a 0.02% maker and 0.04% taker fee – making it on par with Binance Futures and one of the cheapest options to use.

Overall, Huobi is a good crypto margin trading platform if you’re looking for high leverage. The platform’s user interface is great and is especially suitable for traders looking to sell Bitcoin short. The only con is that no AUD deposits or withdrawals are supported here.

Read our full Huobi review

7. Margex – Margin Platform With No KYC Requirement

- Rating: ★★★★★

- Number of margin pairs: 8

- Margin trading fees: 0.019% (maker) and 0.06% (taker)

- Acceptable deposit methods: Bank transfer, PayID/Osko, SWIFT, Xfers (Singapore)

- Allows AUD deposits and withdrawals: Yes

- Visit Website

Providing your user information to a crypto trading platform is not always conducive. Many users are apprehensive about it, and rightly so because the crypto regulations haven’t developed well enough to protect users’ identities. That is why Margex is such a great crypto margin trade platform in Australia. It’s also one of the best no KYC crypto exchanges and keeps the identity of the users safe.

If you’re still wary about an exchange that doesn’t require a verification document, know that Margex stores 100% of the user’s crypto assets inside cold storage equipped with bank-level security. Like most platforms on this list, Margex also offers up to 100x leverage trading. The fee of this platform is 0.019% (maker) and 0.060% (taker) making it one of the more expensive leverage exchanges on our list.

Another main feature that makes Margex stand out from the rest is the MP Shield. MP shield is a safety tool used by the platform to prevent price manipulation. It ensures that no unfair liquidation is triggered at any given time. MP Shield achieves this by merging the liquidity of 12 providers and using an AI-based algorithm and constant monitoring to watch over traders and keep an eye on their behaviour.

Margex also offers multi-collateral wallets through which you can deposit and trade almost any pair that is listed on the crypto exchange. Furthermore, Margex has gone to great lengths to ensure that it is always transparent to the user’s needs.

The only con of this platform is that because there is a lack of crypto regulations and KYC, there are only a few cryptocurrencies listed, including BTC, EOS, ETH, XRP, SOL, ADA, YFI, and LTC. While these cryptos have proven to have high liquidity, many emerging cryptos are being left out. Moreover, we found the user interface to be very basic and some traders may find it unusable. Another big limitation is that Margex does not offer a mobile app.

Overall, Margex is a viable cryptocurrency exchange for privacy-conscious users in Australia. You could gain 100x leverage for margin trades, and the fees will allow you to stick with Margex for longer. That said, the number of cryptocurrencies on the platform is limited, but the ones that are listed have proven liquidity. So, if you’re a trader looking to invest in cryptos that have established their mantel in the ecosystem, go with Margex.

Read our full review on Margex

Australian Crypto Margin Platforms Compared

The leverage offered varies depending upon the margin trading platforms. But you have to consider factors beyond that when selecting a cryptocurrency exchange. Points such as security, ease of use, and accessibility should take equal precedence for investors. With that in mind, here is the comparison chart to give you some critical features of the platforms discussed in this guide.

| Platform | Margin Offered | Trading Pairs | Trading Fees (maker/taker) |

|---|---|---|---|

| Binance | 10x | 231+ | 0.02% / 0.04% |

| Bybit | 100x | 166+ | 0.01% / 0.06% |

| Kucoin | 100x | 110+ | 0.02% / 0.06% |

| Kraken | 5x | 36 | 0.02% / 0.05% |

| OKX | 100x | 200+ | 0.02% / 0.05% |

| Huobi | 125x | 163+ | 0.02% / 0.04% |

| Margex | 100x | 8 | 0.019% / 0.06% |

What is Margin Trading?

Margin trading is your way to buy more assets than you can afford by borrowing money from other users on the platform. It is a way to leverage a small of crypto to borrow a higher amount and then either bet for (going long) or bet against (selling short) the cryptocurrency you have leveraged to utilize your funds.

In simpler terms, margin trading is how you put certain crypto as security to borrow cryptocurrencies. Normally, the number of tokens you can borrow is of a much higher amount – several times in most cases. For instance, if you put 1 TRX as collateral, borrow five TRX from the platform and use it for trading.

While there is an appeal to using leverage, it is not suitable for beginners. There are many small complexities involved with margin trading that only experienced traders can understand. However, if you want to try out margin trading for the first time, the above exchanges provide the opportunity to do so in Australia.

Conclusion

In this guide, we gave our opinion on the best margin trading platforms in Australia. These platforms offer up to 100x leverage. We have put Binance Australia as #1 due to the deep liquidity this platform provides – which is a major requirement to keep in mind when investing in any margin trading platform to avoid slippage.

That said, while margin trading will allow you to invest big while using only a little investment, it has many risks. Bearish market conditions can easily turn the circumstances bad, and you’d end up taking great losses. Therefore, you must first hold full conviction in the cryptocurrency that you want to long or short before investing. Furthermore, don’t forget to consider your risk tolerance before investing.

Frequently asked questions

Yes, you can margin trade crypto in Australia, and there is a wide array of options you can choose from. Among the listed, we believe Kraken is the best crypto margin trading platform in the country.

The “best” crypto trading platform is a subjective answer. You must choose the platform according to your needs. That said, if you’re looking for a crypto margin platform with simple-to-use tools and a wide array of facilities, go with Binance Australia.

No, Swyftx does not offer margin or futures trading on its platform. Swyftx operates as a broker and has a spot market only for buying and selling crypto.

Ben has a Master’s in Writing, Editing and Publishing from RMIT. He is passionate about crypto and has written about crypto topics for various publications.