The Bottom Line

Raiz is the superior micro-investing app over Spaceship due to the greater choices you have in investment portfolios. There is greater diversity in each portfolio and you can choose one that suits your risk tolerance. Some investment portfolios allow you to allocate a maximum of 5% of your funds into buying cryptocurrency.

One of the biggest advantages Raiz has over Spaceship is the round-up feature where small-change from your credit or debit card purchases are automatically transferred to your investment portfolio. This ‘set and forget’ approach makes Raiz an ideal choice for money-conscience Australians.

Winner: Raiz 🏆

Website: www.raizinvest.com.au

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website. Read our disclosure for more information.

Raiz vs Spaceship: Comparison Table

If you’re trying to decide between Raiz and Spaceship Voyager this quick comparison article will help you make a choice. These two micro-investing apps would have to be the most popular of a growing number of apps popping up lately.

|

| |

|---|---|---|

| Platform | Raiz | Spaceship |

| Trading Fees | $3.50 / month | $2.50 / month |

| Notable Features | Access to Bitcoin, round-up investing | Educational resources, solid portfolios |

| No. of Portfolios | 7 | 3 |

| Verdict |

Affiliate Disclaimer: We are reader supported and may earn a commission when clicking through the product links. This helps us grow the content and support the website.

Raiz Overview

Founded in 2016, Raiz is a mobile app built for Australians that lets people invest small amounts of money into various investments called portfolios. The app has low fees and is designed to be used by beginners who want to learn about investing without the risk of losing a lot of money.

Raiz creates a savings account for your money that pays dividends. In other words, it invests your pocket change, then pays you for the investment.

The app allows you to invest money in stocks, ETFs, and any other asset class that you desire. You can also borrow money from your account to invest in equities or other types of assets if you don’t have the funds currently available.

Raiz is one micro-investing app that has grown rapidly over the past year and has seen its users engage with it on a regular basis. Raiz is not only popular in Australia but it is also growing in popularity overseas in countries like Canada, UK, and Hong Kong.

Spaceship Overview

Spaceship Voyager is a micro-investing app that allows people to invest in the stocks of their choice. The app is user-friendly and easy to get started with. It offers a personalized experience for its users, which includes investment guidelines and support from experts. Spaceship Voyager provides an enjoyable, interactive experience that is hard to find in other apps on the market.

Spaceship Voyager is safe and a legit company that is regulated by ASIC. They have thousands of users across Australia and have also been in business since 2016.

Raiz vs Spaceship: How Do They Work?

Raiz and Spaceship offer mobile apps where you can easily start and grow an investment portfolio using your money. For a small fee, you can use the money that you deposit into your account to choose from one of several investment portfolio options depending on what your risk appetite is. Both Raiz and Spaceship focus on the automation of this process which is what makes them highly attractive to everyday people who want to be smarter with their cash.

To benefit from Raiz’s Round-up feature, you will need to link your preferred credit/debit card in addition to your Australian bank account.

Raiz vs Spaceship: Account Funding

Whilst they work in a similar fashion, Raiz provides greater flexibility in how you can allocate Australian Dollars (AUD) to your nominated investment portfolio. One of the best features that Raiz offers is the ability to round up your credit or debit card purchases with the small change sent straight into your portfolio where it can continue to grow. The benefit of this is that it automatically happens in the background which means it’s a great option for passively investing small amounts of cash at a time.

Of course, both Raiz and Spaceship allow you to link your Australian bank account to enable lump sum or recurring transfers of AUD into your accounts.

Winner: Raiz 🏆

The ability to round-up your credit/debit card purchases with the small-change automatically invested into your portfolio is a game changer. This means that you are contributing to your portfolio every time you make a purchase. This is a unique feature that will cater to the money-conscience Australian.

Raiz vs Spaceship: Choice Of Investment Portfolios

Raiz offers a wider variety of investment portfolios to choose from. There are a total of 8 portfolios to choose from depending on your risk appetite. These range from the Conversative portfolio to the Sapphire portfolio where 5% is invested into Bitcoin (BTC). The Sapphire portfolio is the only one where money is invested into US Large Cap Stocks. Part of the appeal of these pre-set portfolios is that you don’t need to be knowledgeable of the markets – Raiz will pick them for you.

But if you’re familiar with the markets then you create your own Raiz portfolio, a feature that isn’t offered by Spaceship. That is, you have a wide selection of Australian and global stocks and markets to choose from as well as setting their percentage allocations. When you tinker with the proportions, Raiz will present a summary of the risk profile. You can invest your money into Bitcoin, however, the maximum allocation that can be set is 5%.

On the other hand, Spaceship only offers 3 portfolios to choose from and there is no ability to create your own.

- Universe Portfolio: Made up of well-known companies that fit its ‘Where the world is going’ criteria, including Spotify, Microsoft, Apple, and Tesla.

- Earth Portfolio: Made up of companies that are considered to have a positive impact, including Starbucks, Shopify, and First Solar.

- Origin Portfolio: made up of some of the world’s largest companies, such as Apple, Amazon, and Johnson & Johnson.

Winner: Raiz 🏆

Not only does Raiz provide 8 investment portfolios to choose from over Spaceship’s 3, it also allows provides more control over your investments by letting you create your own. Beginners who are not privy to the world of investing and markets will benefit from Raiz’s risk profile feature. Another advantage with Raiz is that it also allows you to allocate a maximum of 5% of your cash to invest in Bitcoin.

Raiz vs Spaceship: Fees

The good thing about Spaceship and Raiz is that their fees are low and easy for beginners to get started.

At the time of writing, Raiz’s fees depend on the type of account you create. Fees range between $3.50 per month for Standard portfolios to $4.50 per month for Custom portfolios. On top of the low monthly fees, you will also be charged a flat 0.275% fee irrespective of the account type you hold. If you hold a Super Fund with Raiz then the weekly fee is $2 with a 0.34% annual fee.

In comparison, Spaceship’s monthly fees are slightly cheaper at $2.50 and only apply if your balance is greater than $100. Apart from having cheaper monthly fees than Raiz, there are no annual fees, even if you have multiple Spaceship accounts. There are also no withdrawal fees, no exit fees, and no sell spreads.

Overall, Spaceship provides slightly better value for money than Raiz, however, the advantages are minimal. Even though you pay slightly more for using Raiz, you have access to a wider range of portfolios including Bitcoin of which these benefits outweigh the extra cost.

Winner: Spaceship 🏆

Spaceship offers slightly lower monthly fees compared to Raiz. However, the real value for money lies in Spaceship’s lack of any annual fees. Raiz charges an annual fee of 0.275% of the balance of your account. These minor fees will add up over time but it may be worthwhile since Raiz provides access to more investment markets including Bitcoin.

Raiz vs Spaceship: Security

Raiz and Spaceship are both secure and highly reputable micro-investment apps to use. In Australia, they are licenced by the Australian Securities and Investment Commission (ASIC) to provide financial services.

In terms of their security features, Raiz and Spaceship are actually quite similar. Upon setting up a new account using a strong password and valid email address, you will need to enter your desired 4-digit PIN code. You can use your PIN to quickly log in on your mobile device. 2-Factor Authentication (2FA) can also be implemented, which is a popular method of safeguarding unauthorised access to your account.

Similar to most of the top mobile apps for cryptocurrencies in Australia, the Raiz and Spaceships apps also let you set up biometric log ins as an added layer of account security.

Winner: Tie

Raiz and Spaceship implement similar security features that are mostly there to protect your account. Additionally, both apps allow you to increase the level of security by setting up biometric log-ins.

Raiz vs Spaceship: Ease of Use

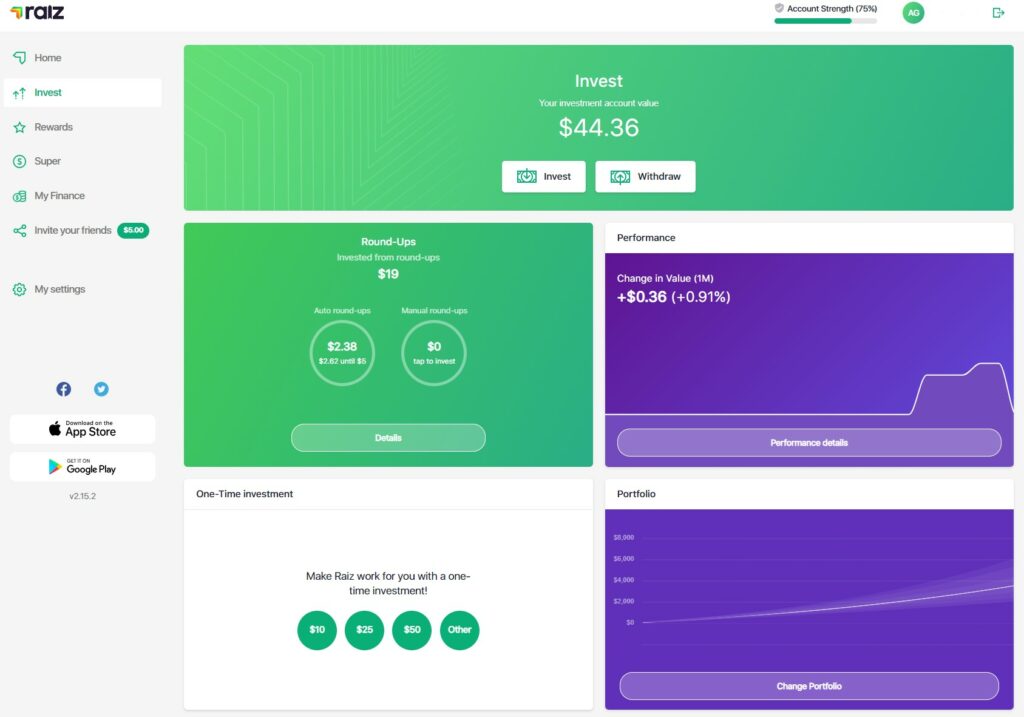

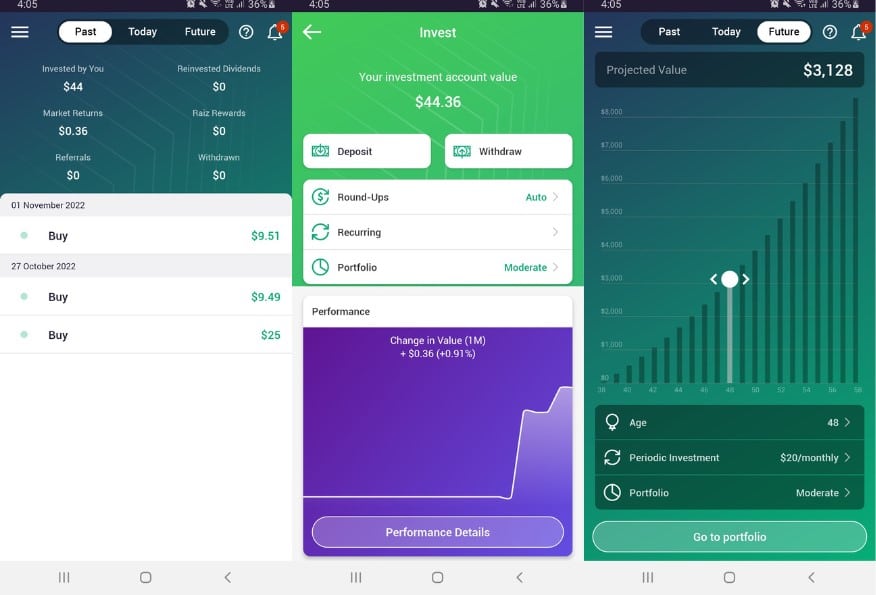

Raiz and Spaceship provide desktop and mobile apps that are clean, modern, and aesthetically pleasing to work with. Even if you haven’t used a micro-investing app before, you will quickly learn how these apps work given their simple designs.

All of the basic account features such as depositing AUD from an Australian bank account, linking a credit/debit card (in the case of Raiz), setting up recurring deposits, or investing bulk volumes of cash are easy to navigate and understand.

Winner: Tie

The simplistic but stylish designs of the Raiz and Spaceship interfaces allow for an easy and enjoyable investing experience that is suitable for a wide range of users, especially beginners. There are not too many differences between how the two are structured.

Raiz vs Spaceship: Mobile Apps

Raiz and Spaceship provide you with apps for iOS and Android mobile devices. In our opinion, the Raiz mobile felt easier to use over the Spaceship app as the design is clean, uncluttered and visually intuitive. There is clear direction of where things are. As shown in the images below, the Raiz app is largely split into three main sections – information about your past investment activities, current investment items, and a future projection of what your investment may look like.

In comparison, the Spaceship app is still easy to use but there is a bit more clutter which adds to the complexity and may distract the eye. However, one of the nice additions are the investment news articles which will keep you informed.

Winner: Raiz 🏆

Both the Raiz and Spaceship mobile apps are easy to use and are catered to the everyday Australian. However, we felt that the Raiz app was better designed due to its aesthetically pleasing and modern layout, yet still provides a high level of functionality.

Raiz vs Spaceship: Comparison Outcomes

Raiz and Spaceship are both reputable micro-investing apps that are trusted by thousands of everyday Australians. Whilst both apps provide a similar service, that is, allowing you to invest your cash into a range of preselected portfolios consisting of companies and funds, Raiz has diversified its offerings.

| Comparison Criteria | Winner | Reason |

|---|---|---|

| Account Funding | Raiz | Raiz’s round-up feature is unique as it provides a ‘set and forget’ way of adding to your portfolio. |

| Choice of Investment Portfolios | Raiz | Raiz provides four more portfolios to choose from. Some portfolios offer Bitcoin support. |

| Fees | Spaceship | Spaceship is slightly cheaper per month and doesn’t have an annual fee. |

| Security | Tie | Both Raiz and Spaceship offer similar security features including biometric log ins. |

| Ease of Use | Tie | Raiz and Sapceship are easy to get your head around. |

| Mobile Apps | Raiz | The Raiz mobile app is better designed, highly functional, and easy to use. |

In our opinion, we preferred the choice that Raiz provides in terms of investment portfolios. Even if you aren’t into cryptocurrencies such as Bitcoin, there is still plenty of investment portfolios to choose from depending on your level of risk tolerance. However, one of the downsides is that the maximum investment allocation for BTC is 5%. If you want to use your cash to invest in more Bitcoin or other digital currencies such as Ethereum (ETH), then you’re better off buying them from a top-tier Australia crypto exchange.

The standout service that Raiz offers is its ’round-up’ feature. Spaceship does not offer a similar service. This feature lets you passively increase your portfolio holdings by sending the small-change from credit/debit card purchases to your Raiz account.

All of Raiz’s features can be accessed on its elegantly designed mobile app that allows for a visually intuitive and enjoyable investing experience.

Other Micro-Trading Alternatives

Below is a list of some great Raiz and Spaceship alternatives…

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.