Cryptocurrency Price and Usage Statistics

Last Updated on December 24, 2023 by Kevin GrovesFrom just seven cryptocurrencies at the start of 2013 to over 20,000 in 2023, the crypto world has exploded over the last decade and it doesn’t seem to be slowing down anytime soon.

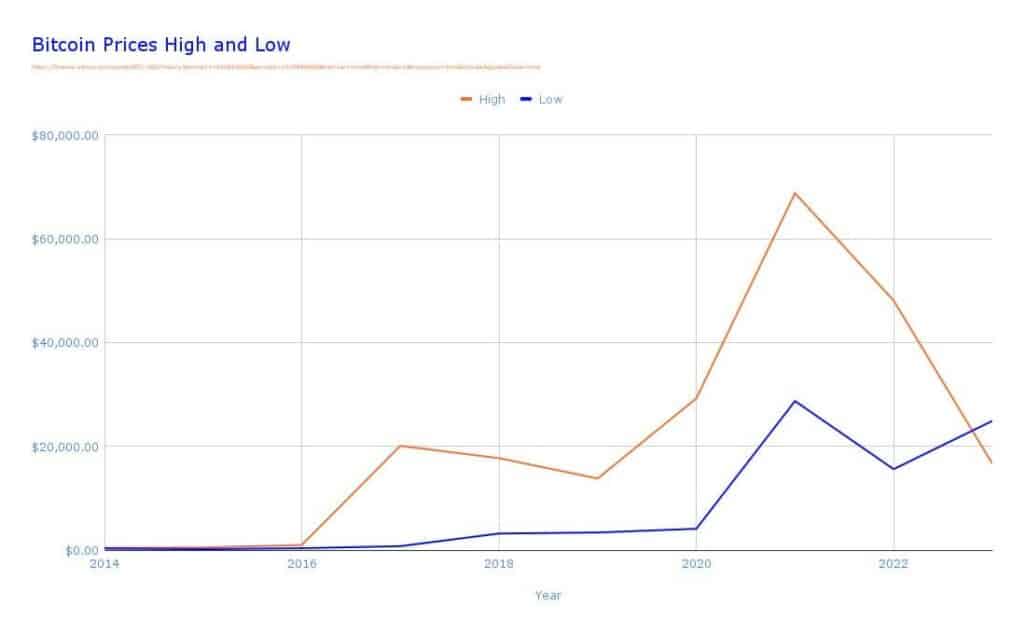

However, the cryptocurrency market can be unpredictable, as demonstrated by the dip in Bitcoin’s price from its all-time high of over $64,000 in 2021 to $18,000 in 2022. Other cryptocurrencies have also experienced similar price swings, highlighting their market cap volatility.

That’s why we’re here to give you the lowdown on the latest cryptocurrency statistics. Let’s break down the data and cryptocurrency trends shaping the world of crypto mining and take a look at some important cryptocurrency user statistics.

Top Cryptocurrency Statistics

Here are the top cryptocurrency statistics:

- Over 800 million people aged 16 to 64 have dabbled in crypto or virtual currency (Data Reportal).

- Crypto adoption reached more than 420 million in 2023, with Bitcoin (BTC) and Ethereum (ETH) being the most popular digital assets (Triple A)

- The top 10 cryptocurrencies have a market capitalization of over $800 million (Investing).

- Around 46 million Americans are cryptocurrency owners (Triple A).

- The global cryptocurrency market cap is over $1 trillion (Coin Gecko).

- From 2009 to 2021, Bitcoin (BTC) went from having a value of less than a penny to more than $69,000 (Coin Gecko).

- Out of the top 10 cryptocurrencies, only Bitcoin (BTC), Ethereum (ETH), and Wrapped Bitcoin have a price higher than $1,000.

- On January 4, 2018, Ethereum (ETH) hit 1.35 million cryptocurrency transactions (Y Charts).

- In 2010, Laszlo Hanyecz initiated Bitcoin payments by spending 10,000 BTCs, valued at $690 million (when the virtual currency was at an all-time high), on two pizzas.

- Around 36% of crypto owners have Bitcoins in their wallets (a cryptocurrency storage space) to make international blockchain transactions.

- Bitcoin (BTC) has a finite supply of 21 million crypto coins.

- Bitcoin tops the list of ATM-supported cryptocurrencies, with around 39,000 Bitcoin ATMs worldwide (Statista).

- The average price of Bitcoin cash reached its peak in 2017 when it hit $2537.08. Today, it stands at $121.83 (as of March 06, 2023) (Statista).

How Many People Own Cryptocurrency?

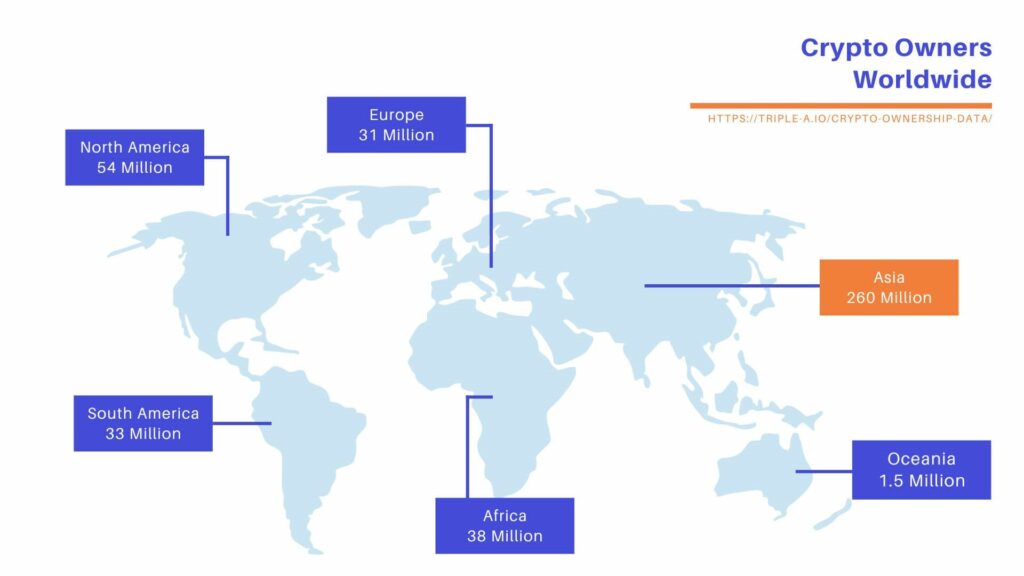

According to Triple A cryptocurrency statistics, there are more than 420 million crypto owners in the global cryptocurrency market. In 2016, the worldwide number of users of cryptocurrency amounted to five million; that’s an 8,300% increase in just 7 years. Asia is leading with 260 million owners. In fact, Asia has 306.25% more owners than the next top continent, North America, which has 64 million owners. Next, we have Africa with 38 million, South America with 33 million, Europe with 31 million, and Oceania with 1.5 million owners.

When we look at the top 10 countries for cryptocurrency owners, India is leading with 157 million owners followed by the United States with 44 million. However, Vietnam has the most owners per population. They have a population of 99 million and 25 million of them are cryptocurrency owners, meaning 26% of the population owns cryptocurrency. This is almost double the United States in which only 13.22% of the population owns crypto assets.

How Many People Use Bitcoin?

Bitcoin remains the most popular cryptocurrency and as of 2022, there are 219 million worldwide users of bitcoin. This calculates as 52% of all crypto owners have bitcoin in their crypto wallets.

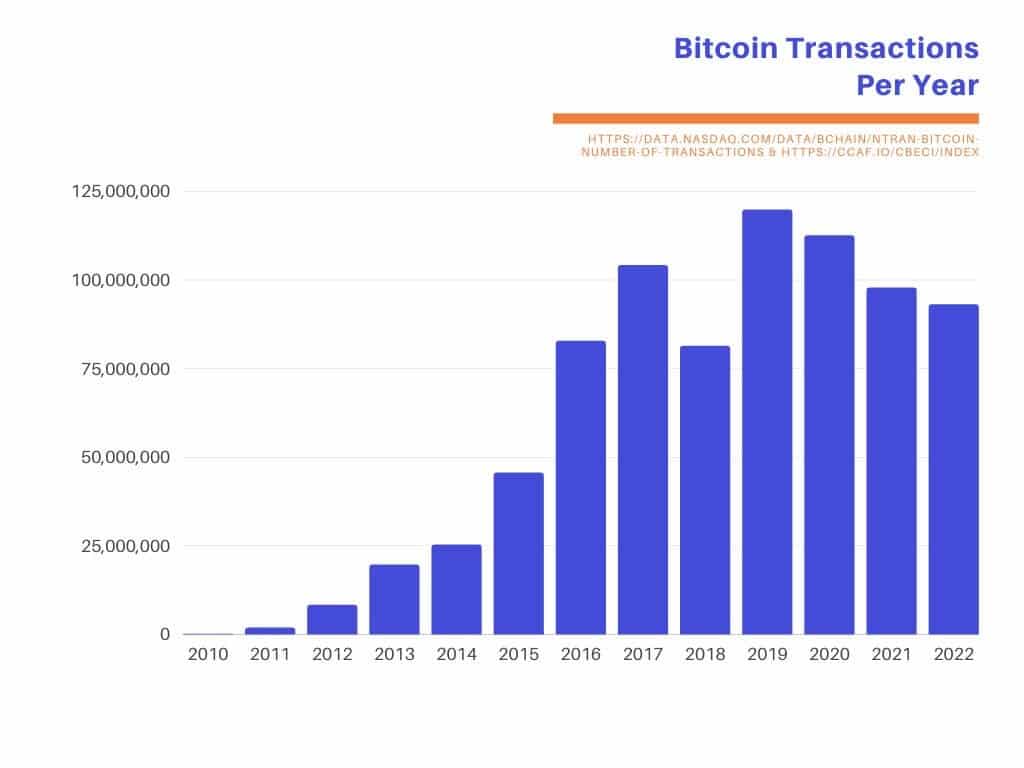

In 2022, there were 93,106,378 bitcoin transactions worldwide but in 2010 there were only 187,869. That’s an increase of 49,459% in bitcoin transactions over 13 years. The all-time high of bitcoin transactions worldwide in one year was in 2019 at 119,783,647.

Current statistics estimate there are around 1 million bitcoin miners globally, with the majority of the world’s bitcoin mining taking place in the United States. However, with a supply cap of 21 million and 19,279,325 bitcoins existing as of January 2023, bitcoin mining is almost at its limit.

How Many People Use Ethereum?

While Bitcoin (BTC) is edging closer to its maximum supply level, making it difficult to mine, Ethereum (ETH) has an infinite supply cap. It is only just beginning to become popular, hitting the 122.37 million supply mark as of February 2023 and there are:

- 510,135 active users worldwide (Statista).

- Over 1 million transactions of Ethereum (ETH) take place each day (Y Charts).

- 42% of American crypto owners have invested in Ethereum (Statista).

- 87 million own Ethereum eth, which is 20% of the global population (Crypto).

How Many Cryptocurrencies Are There?

According to CoinMarketCap cryptocurrency statistics, there are around 22,830 cryptocurrencies with a market cap of $1 billion as of March 2023, but only 9,000 are currently active.

However, data from CoinGecko indicates there may be 12,213 cryptocurrencies in circulation. That’s a massive disparity, so it’s safe to assume there are around 9,000 to 12,000 cryptocurrencies in circulation, depending on the source.

Regardless, the top 20 cryptocurrencies make up nearly 90 percent of the total cryptocurrency market value. And as of March 2023, the most popular cryptocurrencies are:

- Bitcoin

- Ethereum

- Tether

- BNB

- USD Coin

- XRP

- Cardano

- Dogecoin

- Polygon

- Solana

- Binance USD

- Polkadot

Other currencies include the Shiba Inu (SHIB), Litecoin (LTC), TRON (TRX), Dai (DAI), Avalanche (AVAX), Uniswap (UNI), Chainlink (LINK), and Wrapped Bitcoin (WBTC).

How Many Cryptocurrency Exchanges Are There?

According to CoinGecko, there are 681 centralised and decentralised cryptocurrency exchanges operating in the industry, with Coinbase Exchange, KuCoin, and Binance in the top ten.

A centralised crypto exchange is run by one company that sets the fees, and rules and oversees all transactions. Whereas a decentralised exchange is a program run on a network of computers and no single entity controls it.

Top centralised exchanges

The following are the top centralized cryptocurrency exchanges, according to traffic, liquidity, and trading volumes as per the latest data:

- Binance

- Coinbase Exchange

- Kraken

- KuCoin

- Binance.US

- Bitfinex

- Gemini

- Coincheck

- Bitstamp

- Bybit

Top decentralized exchanges

Below are the highest-ranked decentralized cryptocurrency exchanges, according to traffic, liquidity, and trading volumes according to the latest data:

- Uniswap (v3)

- dYdX

- Curve Finance

- Kine Protocol

- PancakeSwap (v2)

- DODO (Ethereum)

- Sun.io

- ApolloX DEX

- Uniswap (V2)

- Perpetual Protocol

Crypto Trading and Market Cap Statistics

As of 2023, the global cryptocurrency statistics show the market cap is $1 trillion. However, the total crypto market volume can rise or fall over time, and a cryptocurrency market share can rise and fall. On average, Bitcoin has the largest market share of 42% to this day when calculated at $1 trillion.

Bitcoin (BTC)

Market Cap: $426.9 billion

Market Share: 42.69%

Ethereum (ETH)

Market cap: $189.7 billion

Market Share: 18.97%

Tether (USDT)

Market cap: $69.2 billion

Market Share: 6.92%

Binance Coin (BNB)

Market cap: $46.9 billion

Market Share: 4.69%

U.S. Dollar Coin (USDC)

Market cap: $41.2 billion

Market Share: 4.12%

XRP (XRP)

Market cap: $19.1 billion

Market Share: 1.91%

Binance USD (BUSD)

Market cap: $15.6 billion

Market Share: 1.56%

Cardano (ADA)

Market cap: $13.3 billion

Market Share: 1.31%

Dogecoin (DOGE)

Market cap: $11.0 billion

Market Share: 1.1%

Polygon (MATIC)

Market cap: $10.8 billion

Market Share: 1.8%

These top 10 cryptocurrencies dominate a whopping 85.07% share, or 843.7 billion, of the total crypto market cap of $1 trillion.

Crypto Ownership by Country

Global cryptocurrency statistics show that adoption reached an all-time high in Q3 2021, according to a 2022 Chainalysis report.

And while most decentralised finance and crypto investments have risen and fallen since then, the total number of global cryptocurrency users is higher than ever at 425 million.

If looked at it in terms of ownership percentage, the United Arab Emirates (UAE) takes the top spot on the cryptocurrency ownership list, with 27.67% of the population owning crypto as of 2023. In another study by HedgewithCrypto, the UAE was ranked 4th in overall crypto adoption.

Let’s take a look at the top ten contenders by crypto ownership percentage:

However, when seen under the lens of absolute crypto ownership, India wins the top spot with 159.6 million cryptocurrency users. We follow it at 45 million, then Vietnam with 25.9 million, China with 19.9 million, and Brazil with 17.8 million.

Historical Bitcoin Prices

The starting price of Bitcoin when it was created in 2009 was $0.0008 and since then, it has inflated exponentially to a titan digital asset. Taking a look at the historic prices, the best year was 2021 when it reached an all-time high of $68,789 USD.

2015

High: $495.56

Low: $171.51

In 2015, Bitcoin started the year at $314 and remained relatively stable with little volatility compared to the previous year. However, Ethereum was launched on July 30, leading to the creation of thousands of new cryptocurrencies competing with Bitcoin.

In September, the US CFTC defined Bitcoin as a commodity, while the EU decided not to impose VAT on cryptocurrency transactions, effectively defining Bitcoin as a currency.

2016

High: $979.40

Low: $354.91

The second Bitcoin halving occurred on July 9, 2016, leading to relatively stable Bitcoin prices trading between $350 and $700 in the summer months. The year ended with Bitcoin hitting $979.4

However, 2016 was marked by the hack of the Bitcoin exchange Bitfinex, which resulted in nearly a crypto theft of 120,000 BTC from cryptocurrency users.

2017

High: $20,089

Low: $755,76

This was the year everyone took notice of Bitcoin, from institutional and retail investors to governments and economists.

Bitcoin reached historic heights, with the price hovering around $1,000 at the beginning of the year, hitting a high of $20,089.

2018

High: $17,712.40

Low: $3,191.30

Bitcoin hit the $6,000 and $8,000 range, falling to $3,250 in December. It closed the year at just over $3,700, down 73% from the beginning of the year.

2019

High: $13,796.459

Low: $3,391.02

Bitcoin mainly moved sideways during 2019, with a significant spike in June when positive news about institutional investors and wider cryptocurrency adoption converged, triggering a rise.

However, the Bitcoin price hovered around the $7,000 mark for the rest of the year, ending 2019 at just over $7,200.

2020

High: $29,244.88

Low: $4,106.98

When COVID was declared a pandemic in March 2020, global cryptocurrency markets went into turmoil. Bitcoin crashed to a low of $4k on March 17. In May, the third halving in Bitcoin’s history occurred, and the price slowly recovered, pushing up to over $10,000 again.

However, by the end of the year, Bitcoin’s price was back to its previous all-time high (ATH) of $20,000 and surpassed it, closing on December 31 at $28,949.

2021

High: $68,789.63

Low: $28,722.76

Bitcoin began 2021 with optimism and had a bullish first quarter that ended at an all-time high of $68k in mid-April. This was triggered by continuous liquidity injection in the cryptocurrency markets by the Federal Reserve and news that companies like Tesla were allocating Bitcoin in their treasuries.

However, in May, a new China restriction on cryptocurrencies hit Bitcoin, leading to a crash in its price. The ban also had repercussions on the Bitcoin mining industry.

2022

High: $48,086.84

Low: $15,599.05

Like other cryptocurrency prices, Bitcoin dropped to $35,000 in January over the surging threat of an imminent Russia-Ukraine war, which erupted at the end of February, and the Bitcoin mining market crash.

By March, it had recovered to $47,459, but the global economic and financial crisis caused it to crash down to the $20,000 range, where it stayed for a few months until high-profile blow-ups like FTX smashed traders’ confidence and caused Bitcoin to drop below $16,000.

Bitcoin closed the year at $16,537, down 64% from 12 months earlier.

Kevin is a cryptocurrency writer that has published hundreds of articles, guides, and reviews. He has been in the crypto space since 2016 and is passionate about sharing his expertise and knowledge with others.